What are Liquidity Pools?

Last Update: January 1st, 2025

Liquidity pools are the backbone of decentralized finance (DeFi), enabling seamless trading, lending, and other financial activities on blockchain networks without the need for intermediaries.

These pools consist of funds provided by users, known as liquidity providers (LPs), and are managed by smart contracts that automate trading and ensure market efficiency.

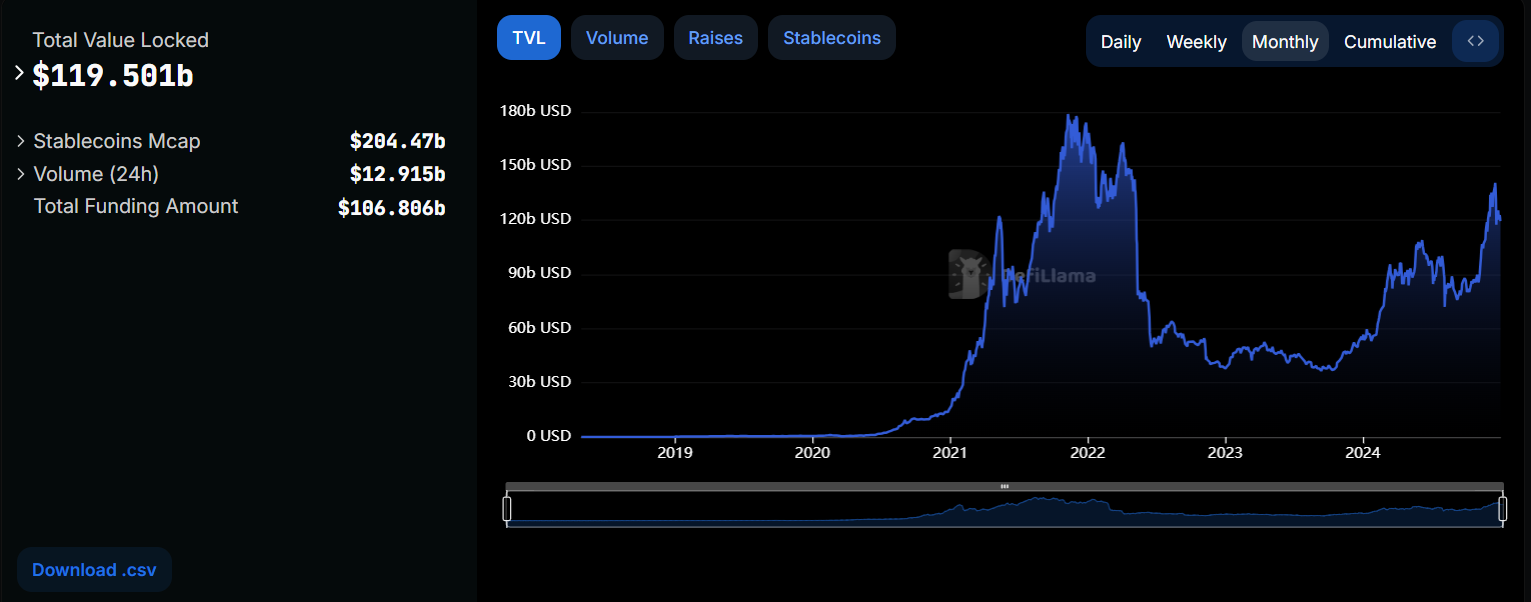

Liquidity Pools in DeFi: A $119 Billion Backbone

As of 2025, the total value locked (TVL) in decentralized finance (DeFi) liquidity pools has reached an impressive $119.5 billion, highlighting their critical role in the evolving blockchain ecosystem.

These pools, powered by smart contracts, not only facilitate seamless trading and lending but also underpin the explosive growth of DeFi, offering traders and investors access to a transparent, decentralized financial network.

How Do Liquidity Pools Work?

- Paired Assets: Liquidity pools typically consist of two paired assets, similar to traditional Forex pairs. For instance, an ETH/USDT pool contains Ethereum (ETH) and USDT (a stablecoin), allowing users to trade between the two seamlessly.

- Smart Contracts and Automation: These pools are governed by smart contracts, self-executing pieces of code that determine the price of assets using algorithms like the Constant Product Formula (X×Y=KX times Y = KX×Y=K). This ensures a balanced ratio of assets in the pool, regardless of fluctuations in market demand.

- Efficient Market Functionality: Unlike traditional exchanges that rely on live buyers and sellers, liquidity pools facilitate trades even when no direct counterparties are available. This ensures continuous liquidity, making the trading process smoother and faster.

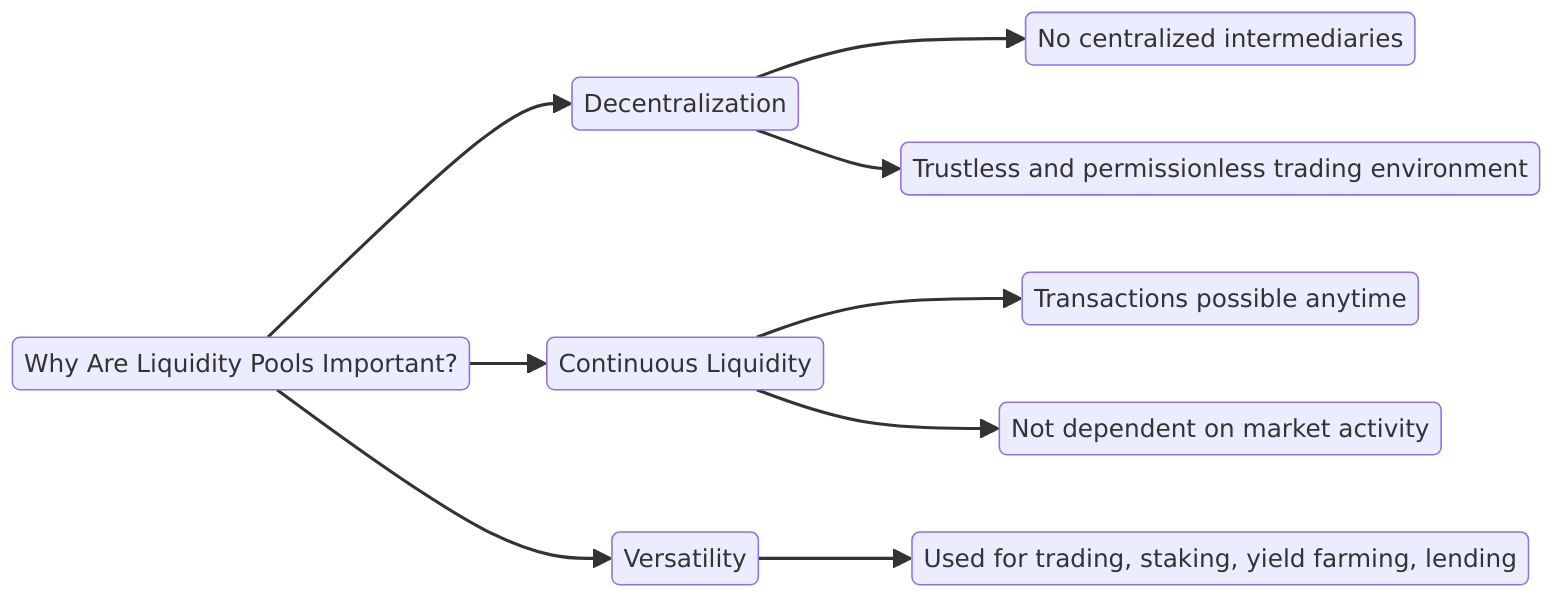

Why Are Liquidity Pools Important?

- Decentralization: Operate without centralized intermediaries, ensuring a trustless and permissionless trading environment.

- Continuous Liquidity: Traders can execute transactions at any time, regardless of market activity.

- Versatility: Used not only for trading but also for staking, yield farming, and collateral in lending protocols.

Example: ETH/USDT Liquidity Pool

In an ETH/USDT pool:

- Users deposit equal dollar values of ETH and USDT to the pool.

- Traders can swap ETH for USDT (or vice versa), with the AMM adjusting the price dynamically based on the pool’s asset ratio.

- Liquidity providers earn a portion of the transaction fees, incentivizing them to contribute to the pool.

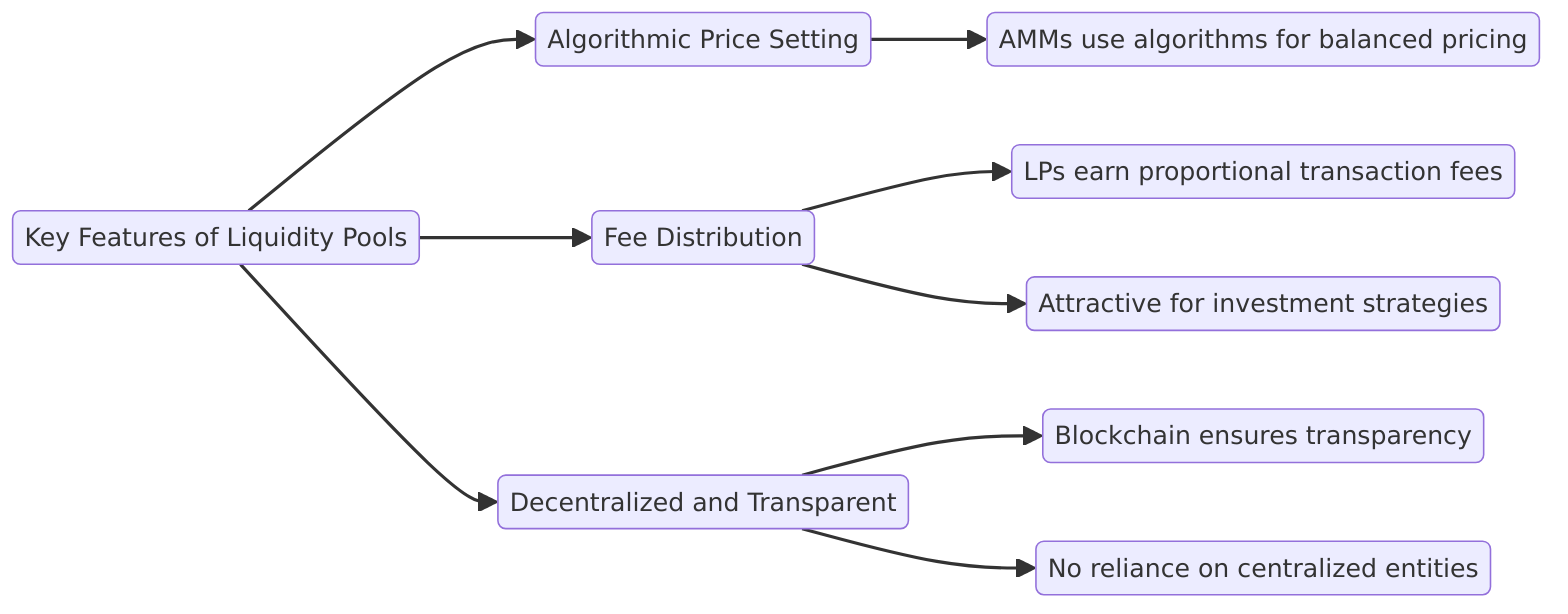

Key Features of Liquidity Pools

- Algorithmic Price Setting: Automated Market Makers (AMMs) determine prices using algorithms, ensuring a balanced and efficient market.

- Fee Distribution: Liquidity providers earn a share of transaction fees, proportional to their contribution to the pool, making it an attractive investment strategy.

- Decentralized and Transparent: All transactions and operations within a liquidity pool are recorded on the blockchain, offering complete transparency and eliminating the need for trust in a centralized entity.

How Are Liquidity Pools Created?

Liquidity pools are a core innovation in decentralized finance (DeFi), designed to address the challenges of illiquid markets often encountered in traditional trading models like the Order Book Model.

By encouraging users to supply liquidity, these pools ensure smoother trading conditions and improved market efficiency.

Here’s a breakdown of the process and mechanics:

Understanding the Order Book Model

The Order Book Model is a system used in traditional finance and centralized exchanges to match buyers and sellers based on price and quantity.

- Bid Side: Represents buyers, listing their preferred purchase prices and quantities.

- Offer Side: Represents sellers, listing their desired selling prices and quantities.

- Market Price: Determined by the last executed trade when a buyer’s bid meets a seller’s offer.

This model is prevalent in equity markets and centralized crypto exchanges like Coinbase and Binance.

Challenges with the Order Book Model:

- Thin Trading Markets: In low-activity markets, there are few buyers and sellers, leading to illiquidity.

- Dependence on Market Makers: To address illiquidity, exchanges rely on market makers—institutions or individuals who consistently provide buy and sell orders, ensuring continuous trading activity.

How Liquidity Pools Work

Liquidity pools eliminate the need for traditional order books and market makers by automating liquidity provision through smart contracts.

Role of Liquidity Providers (LPs):

- Contribution of Token Pairs:

- LPs deposit two token pairs, such as ETH/USDT or DAI/ETH, into a smart contract.

- The value of these tokens must be equal at the time of deposit (e.g., $1,000 worth of ETH and $1,000 worth of USDT).

- Earning Incentives:

- LPs earn trading fees whenever the pool facilitates a trade.

- Fees are distributed proportionally based on the LP’s share in the pool.

Example: If a pool generates $1,000 in fees in a day and an LP holds 10% of the pool’s liquidity, they earn $100 in fees.

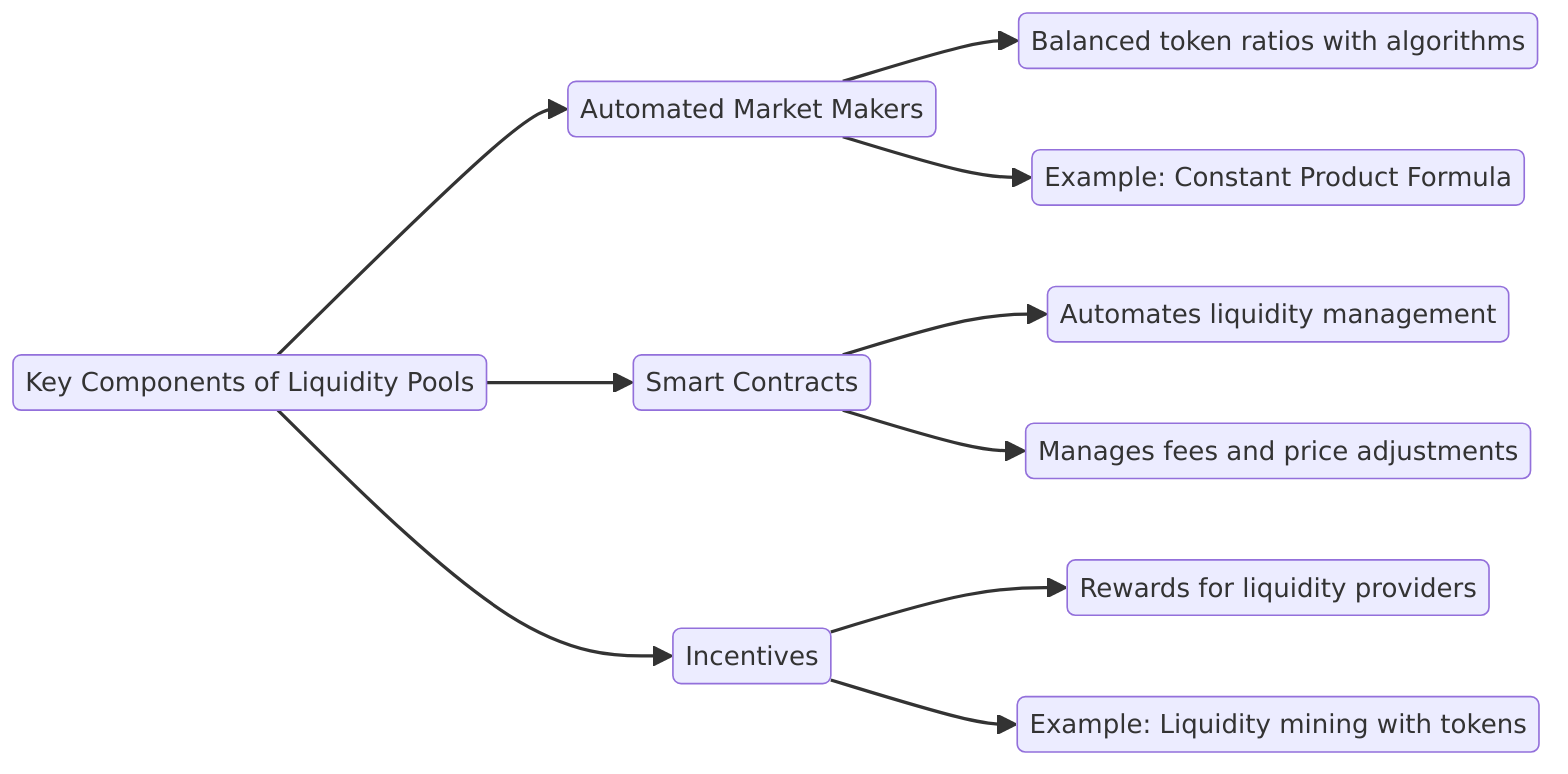

Key Components of Liquidity Pools

- Automated Market Makers (AMMs): Governed by algorithms like the Constant Product Formula (X×Y=KX times Y = KX×Y=K), AMMs ensure balanced token ratios regardless of market activity.

- Smart Contracts: Automate liquidity management, fee distribution, and price adjustments without requiring intermediaries.

- Incentives: Platforms like Uniswap and Balancer offer additional rewards (e.g., native tokens) to incentivize liquidity provision, a practice known as liquidity mining.

Advantages of Liquidity Pools

- Continuous Liquidity: Traders can buy or sell assets without needing a direct counterparty, ensuring faster transactions.

- Decentralization: Liquidity pools operate without intermediaries, enhancing trust and accessibility.

- Incentives for LPs: Providers earn fees and sometimes platform-native tokens, making it financially rewarding to participate.

Example: Creating an ETH/USDT Liquidity Pool

- Setup: An LP deposits 10 ETH (worth $15,000) and 15,000 USDT into the pool.

- Trading: A trader swaps 1 ETH for USDT. The AMM algorithm adjusts the pool’s token ratio and price dynamically.

- Earnings: The LP earns a share of the trading fees from the transaction.

How Automated Market Makers Changed the Game

Remember that for the Order Book Model to work, they need an automated market maker to help facilitate trading and provide liquidity. In the cryptocurrency world, these market makers are called “AMM” or “Automated Market Makers.” They are automated, using an algorithm, and coded into the blockchain via smart contracts.

This innovative technology fundamentally makes the order book model obsolete. The inherent process of bidding and offering is still there, but through the AMM, there is no more need for external market makers to create liquidity in the markets.

AMMs are connected to the liquidity pools, which then automate the process of market-making. This changed the game because trading in almost any cryptocurrency, be it a small or large token, can be done seamlessly, as long as there is an AMM and a liquidity pool backing it.

Traders do not have to take on high slippage or wait for long periods of time just to get matched – everything is automated with AMMs.

Benefits of Liquidity Pools for Liquidity Providers

Liquidity providers are incentivized to participate in liquidity pools by earning trading fees and rewards in the form of liquidity pool tokens (LP tokens).

These tokens represent a liquidity provider’s share of the pool and can be redeemed to reclaim their share of the assets in the pool.

Additionally, LP tokens can be staked or farmed to earn additional rewards in many DeFi protocols. By providing liquidity, liquidity providers can earn passive income and participate in the growth of the DeFi ecosystem.

The Impermanent Loss factor and trading fees

When investing in a Liquidity Pool, it is important to understand the concept of “Impermanent loss” as this can greatly affect an LP’s profits. Impermanent Loss is a temporary loss of value of the funds you supply in a liquidity pool.

This happens when an LP provides two assets in equal ratios, but one is a lot more volatile than the other. For example, an LP supplies the DAI/ETH in equal parts. If the ETH price appreciates, the liquidity pool would rely on arbitrage entities to balance it out again, in order to balance the ratios. As such, your ETH profits, due to price appreciation, will be taken away to balance it out with the DAI.

In this situation, if you withdrew your assets from the liquidity pool, your ETH would be worth less than the initial deposit.

On the other hand, if the price of ETH then depreciates to the level that you initially provided liquidity in, arbitrage entities would also balance this out. In this situation, if you withdrew your assets from the liquidity pool, you would come out with the same amount of ETH and DAI that you deposited initially.

Risks and Security Considerations for Liquidity Pools

While liquidity pools offer numerous benefits, they also come with significant risks and security considerations. One of the primary risks is impermanent loss, which occurs when the price of tokens in the pool deviates significantly from the market price.

Additionally, liquidity pools are exposed to smart contract risks, as they are based on complex smart contracts that can be vulnerable to bugs and hacking. Furthermore, liquidity pools can be subject to market volatility, regulatory risks, and liquidity pool manipulation.

To mitigate these risks, it is essential for liquidity providers to carefully evaluate the reputation of the DEX and liquidity pool, verify the security of the smart contract, and use a secure wallet and keep their private keys safe.

The Role of a Liquidity Provider in a Liquidity Pool

A liquidity provider plays a crucial role in a liquidity pool by depositing assets into the pool and providing liquidity for traders to buy and sell. In return, liquidity providers earn trading fees and rewards in the form of LP tokens. By providing liquidity, liquidity providers help to facilitate price discovery and efficient trading on the DEX.

Additionally, liquidity providers can participate in yield farming by staking their LP tokens to earn additional rewards. To become a liquidity provider, users must select a DEX and liquidity pool, deposit assets into the pool, and receive LP tokens in return.

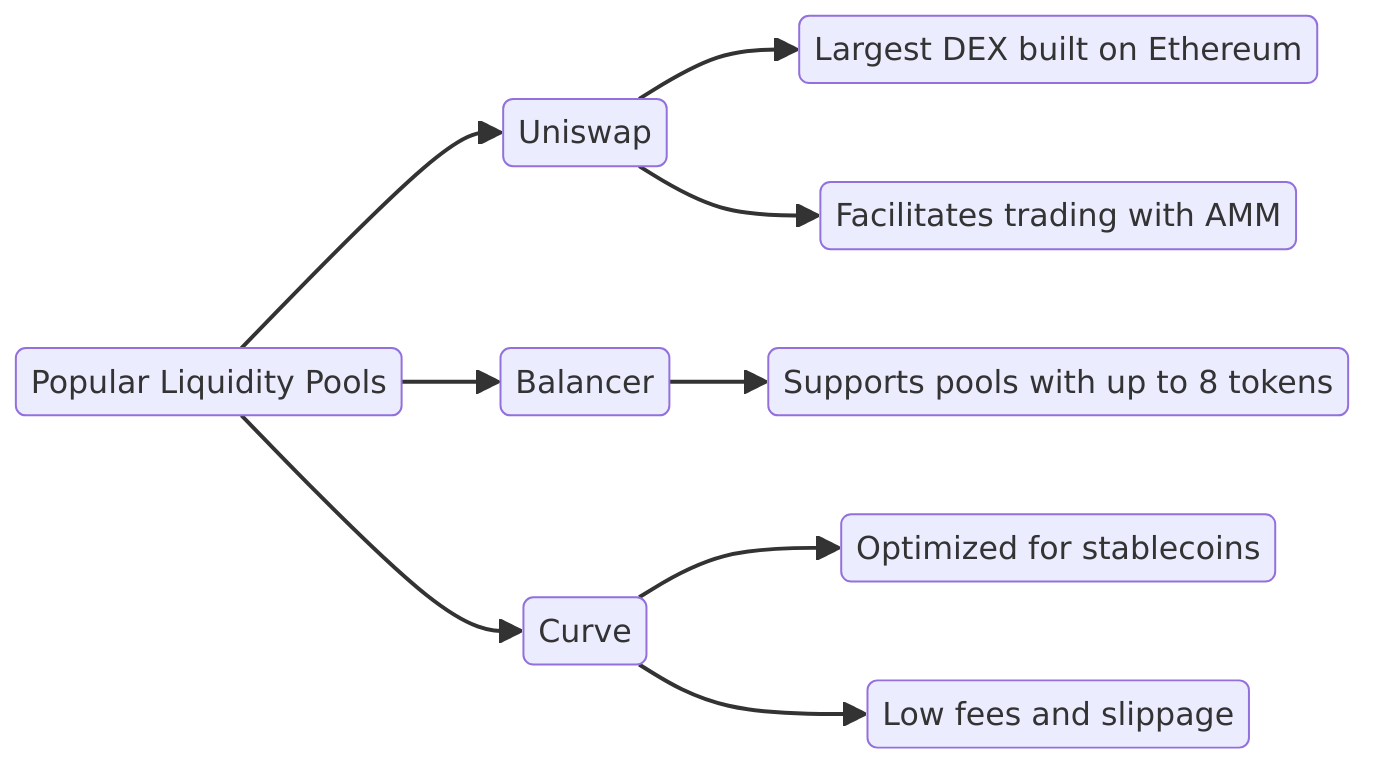

List of Popular Liquidity Pools

- Uniswap (UNI): One of the largest DEXs built on the Ethereum blockchain. It facilitates trading with AMM in the financial marketplace

- Balancer (BAL): A DEX that can supply liquidity pools with more than the usual two tokens. It can provide as many as 8 tokens in a single liquidity pool

- Curve (CRV): A DEX realizes that the AMM mechanism does not work well for assets with similar prices, like stable coins. As a result, they were able to efficiently facilitate the trading of stablecoins with lower fees and lower slippage.

In conclusion, liquidity pools serve as fundamental components of the DeFi space, facilitating decentralized trading and yield opportunities. Understanding the associated risks and security measures is crucial for users engaging with these financial tools.

FAQ Section: Liquidity Pools in DeFi

What Are Liquidity Pools?

Liquidity pools are collections of funds provided by users, called liquidity providers (LPs), that facilitate trading and other financial activities in decentralized finance (DeFi) ecosystems. These pools use smart contracts to automate processes, eliminating the need for traditional intermediaries like banks or brokers.

How Do Liquidity Pools Work?

Liquidity pools operate by pairing two assets, such as ETH/USDT, and maintaining a balanced ratio between them. Automated Market Makers (AMMs) manage these pools using algorithms like the Constant Product Formula (X × Y = K) to adjust asset prices dynamically based on supply and demand.

Why Are Liquidity Pools Important?

Liquidity pools ensure continuous trading even in illiquid markets, reduce dependency on centralized intermediaries, and enable additional DeFi activities like staking and yield farming. As of 2025, they hold $119.5 billion in total value locked (TVL), underscoring their importance in the DeFi ecosystem.

What Is the Role of an LP (Liquidity Provider)?

LPs deposit equal values of paired assets into a pool to facilitate trading. In return, they earn a share of transaction fees and sometimes platform-native tokens. For example, an LP providing liquidity to an ETH/USDT pool would earn fees proportional to their share in the pool.

What Are the Risks of Liquidity Pools?

Liquidity pools carry risks such as impermanent loss (when asset prices fluctuate significantly), smart contract vulnerabilities, and market manipulation. LPs should carefully evaluate pools, use secure wallets, and monitor market conditions to mitigate these risks.

What Is Impermanent Loss?

Impermanent loss occurs when the value of assets in a pool deviates from their original deposit value due to market price changes. This is more likely in pools with volatile assets. Stablecoin pools (e.g., USDC/USDT) can minimize this risk.

How Are Trading Fees Distributed in Liquidity Pools?

Trading fees, typically around 0.3% of each transaction, are distributed to LPs based on their contribution to the pool. For example, an LP with 10% of the pool’s total liquidity would earn 10% of the fees collected.

What Are Some Popular Liquidity Pools?

- Uniswap (UNI): Known for its AMM-based trading on Ethereum.

- Balancer (BAL): Allows multi-asset pools with up to 8 tokens.

- Curve (CRV): Specializes in stablecoin pools, offering lower slippage and fees.

Can Impermanent Loss Be Avoided?

While it cannot be completely avoided, impermanent loss can be mitigated by:

- Using stablecoin pairs (e.g., USDC/USDT).

- Earning trading fees to offset potential losses.

- Timing liquidity provision during high trading activity.

- Leveraging AMM protocols with impermanent loss protection, like Bancor.

How Have AMMs Revolutionized Liquidity Pools?

Automated Market Makers (AMMs) use algorithms to automate trading and pricing, eliminating the need for traditional market makers. This innovation ensures continuous liquidity and fast transactions, even in low-activity markets.

How Do Smart Contracts Ensure Security in Liquidity Pools?

Smart contracts automate the management of liquidity pools, including fund distribution and price adjustments. They operate transparently on blockchain networks, though they can still be vulnerable to bugs or hacking. Always use audited protocols for added security.

Sidebar rates

HFM

wgt-lc-defi

- DeFi Lending

- DeFi Yield Farming

- AMM (Automated Market Maker)

- DEX

- Cross Chain Bridges

- Crypto Options

- Tokenized Bonds

- Crypto Derivatives

- On-chain synthetic Assets

- Cryptocurrency Perpetuals

- Cryptocurrency Staking

- Cryptocurrency Total Locked Value (TVL)

- Impermanent loss

- Rebase Token

- Decentralized Autonomous Organization

- Decentralized Application

- Gas Fees

- Liquidity Pools

- Cryptocurrency Tokenomics

- Pegged Stablecoins