What is Impermanent Loss?

Last Update: January 1st, 2025

Impermanent loss happens when automated market makers’ (AMM) algorithmically-determined formula in DeFi liquidity pools shows a divergence between the price of an asset in and the price changes from outside a liquidity pool.

The AMM eliminates intermediary parties in decentralized exchanges and trade assets from a liquidity pool of tokens supplied by liquidity providers.

The liquidity pool is maintained by a constant algorithm formula that balances the ratio of tokens crypto assets in the pool. Depreciation leads to a loss in the asset outside of the pool since the AMM calculator prioritizes the ratio.

Definition and Explanation

Impermanent loss is a temporary reduction in value that can occur when providing liquidity to a decentralized exchange (DEX) or a liquidity pool.

This phenomenon happens when the price of the deposited assets in the pool changes, resulting in a temporary loss of value compared to simply holding the assets separately.

Essentially, impermanent loss is a risk associated with providing liquidity, and it is crucial for liquidity providers to understand how liquidity pools work and the factors that contribute to impermanent loss to mitigate this risk effectively.

How Liquidity Pools Work

Liquidity pools are a cornerstone of decentralized finance (DeFi), enabling users to provide liquidity to a market without relying on a centralized third party. A liquidity pool is essentially a collection of funds locked in a smart contract, which facilitates trading on a DEX.

Liquidity providers contribute a trading pair to the pool, such as ETH and USDT, and in return, they earn a share of the trading fees generated by the pool.

The price of assets within a liquidity provider’ pool is determined by the ratio of assets in the pool and is continuously adjusted in real-time based on market demand. This dynamic pricing mechanism ensures that the pool remains balanced and can accommodate trades efficiently.

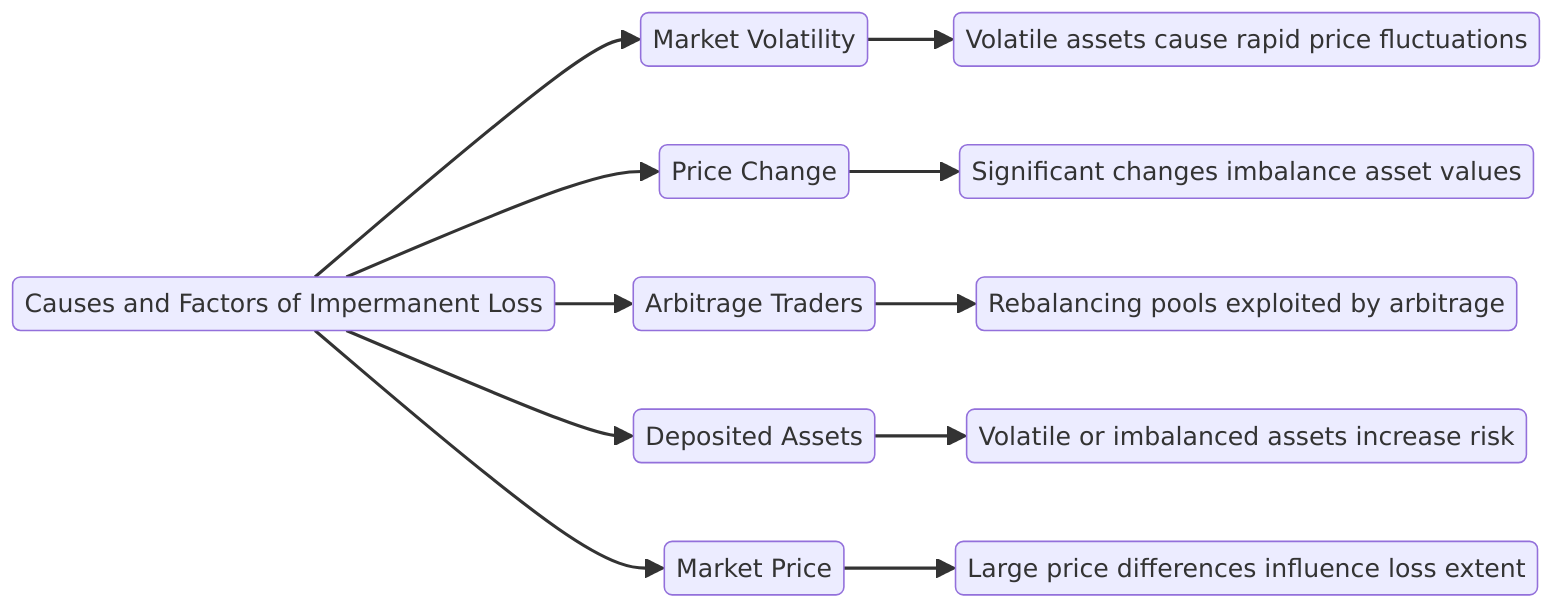

Causes and Factors of Impermanent Loss

Impermanent loss occurs when the price ratio of assets in a liquidity pool changes, leading to a temporary dip in value compared to holding the assets separately. Several factors contribute to how impermanent loss is, including:

- Market Volatility: Impermanent loss is more likely to occur in pools with volatile assets, as the prices of these assets can fluctuate rapidly.

- Price Change: A significant price change in one of the assets in the pool can cause impermanent loss, as the value of the pool’s assets becomes imbalanced.

- Arbitrage Traders: Arbitrage traders can exploit price differences in liquidity pools, leading to impermanent loss for liquidity providers as they rebalance the pool.

- Deposited Assets: The type and amount of assets deposited into the pool can affect the likelihood of impermanent loss. Pools with highly volatile or imbalanced assets are more susceptible.

- Market Price: The overall market price of the assets in the pool can influence the extent of impermanent loss, especially if there is a considerable price difference between the assets.

By understanding these factors, liquidity providers can take proactive steps to mitigate impermanent loss and maximize their returns.

This includes choosing less volatile asset pairs, monitoring market conditions, and leveraging strategies such as earning trading fees to offset potential losses.

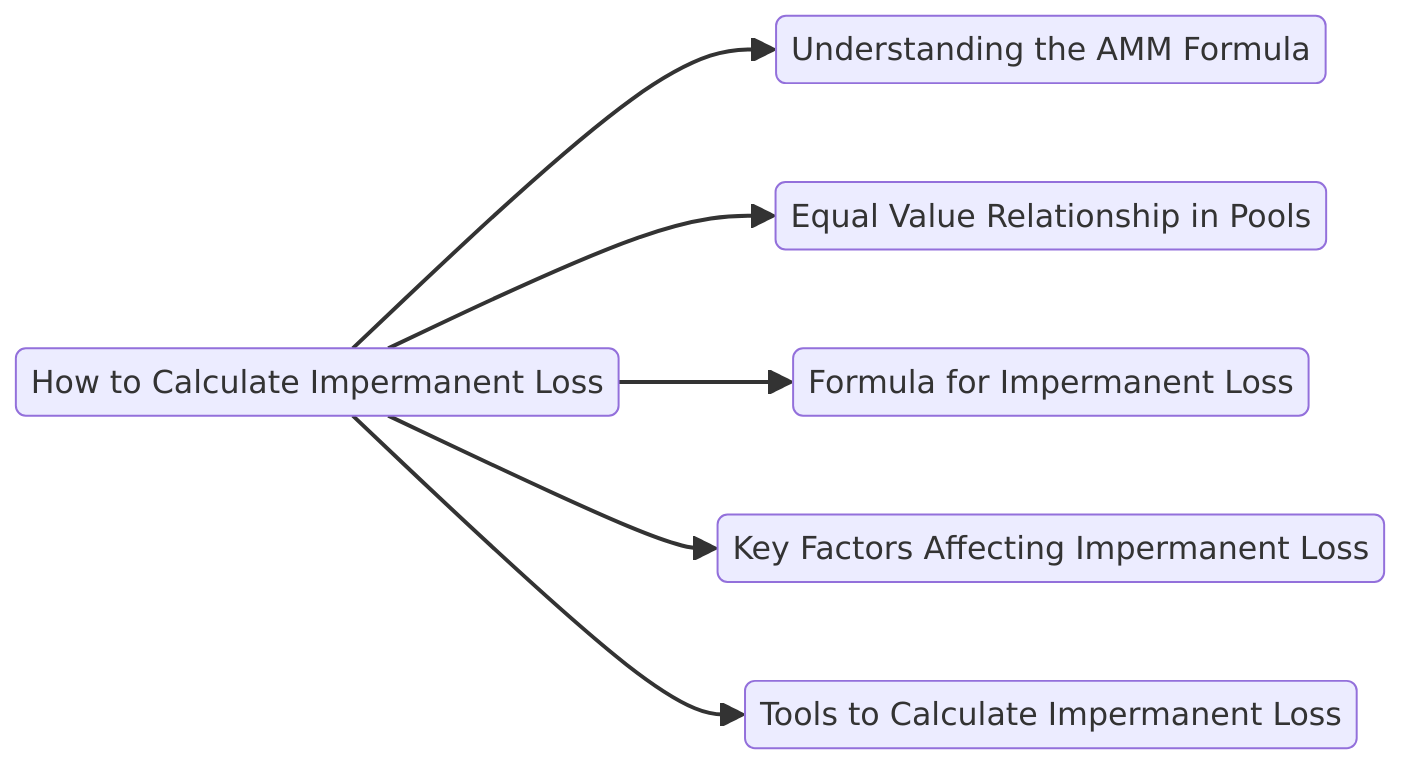

How to Calculate Impermanent Loss?

Impermanent loss occurs when you provide liquidity to a pool and the dollar value of your assets changes due to price fluctuations in the tokens. This change is compared to simply holding the tokens instead of participating in the pool.

Here’s a simplified explanation and steps to calculate it:

1. Understanding the AMM Formula:

X * Y = K

Automated Market Makers (AMMs) like Uniswap maintain liquidity pools using the constant product formula:

X×Y=KX times Y = KX×Y=K

where:

- X = Quantity of Token A

- Y = Quantity of Token B

- K = Constant

This ensures that the total value of the pool remains balanced as traders swap tokens.

2. Equal Value Relationship in Pools

- In a 50/50 liquidity pool (e.g., 50% Token A, 50% Token B), the dollar value of each token pair must be equal.

- For example:

- If Token A is worth $100 and Token B is worth $100, the pool holds an equal $200 value.

- If Token A increases in value to $200, the AMM adjusts the quantity of Token B to maintain the balance, causing impermanent loss.

3. Formula for Impermanent Loss

The impermanent loss can be calculated using the formula:

Where:

- Price Ratio = New Price of Token A / Initial Price of Token A

Example:

- Initial Price of Token A = $100

- New Price of Token A = $150

- Price Ratio = $150 / $100 = 1.5

Substitute into the formula:

This means a 2.05% loss compared to simply holding the tokens.

4. Key Factors Affecting Impermanent Loss

- Price Divergence: The greater the difference between token prices, the higher the impermanent loss.

- Volatility: Pools with highly volatile assets face greater impermanent loss.

- Low Volatility Pools: Pools with similar assets (e.g., stablecoin pairs like USDC/DAI) minimize impermanent loss.

5. Tools to Calculate Impermanent Loss

- DeFiPulse and DeFiLlama: Track protocol statistics, including liquidity data.

- vFat: Provides yield farming calculators to estimate earnings and losses.

- LiquidityFolio: Manages liquidity investments, especially on platforms like Uniswap.

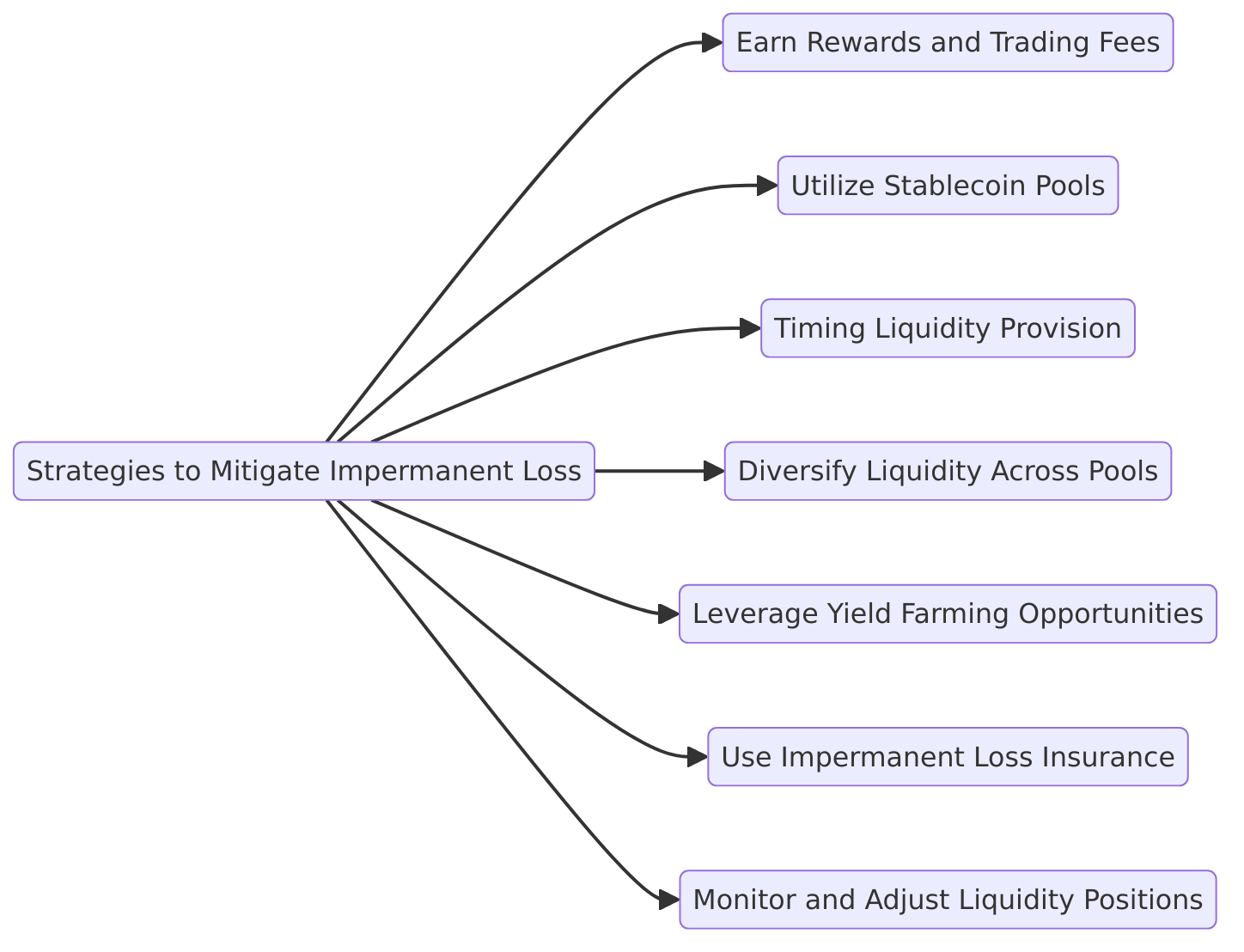

Strategies to Mitigate Impermanent Loss for Liquidity Providers

Impermanent loss, a common challenge for liquidity providers (LPs) in AMM (Automated Market Maker) platforms, can be mitigated through various strategies and incentive mechanisms.

These approaches aim to offset potential losses while maximizing earnings from liquidity provision.

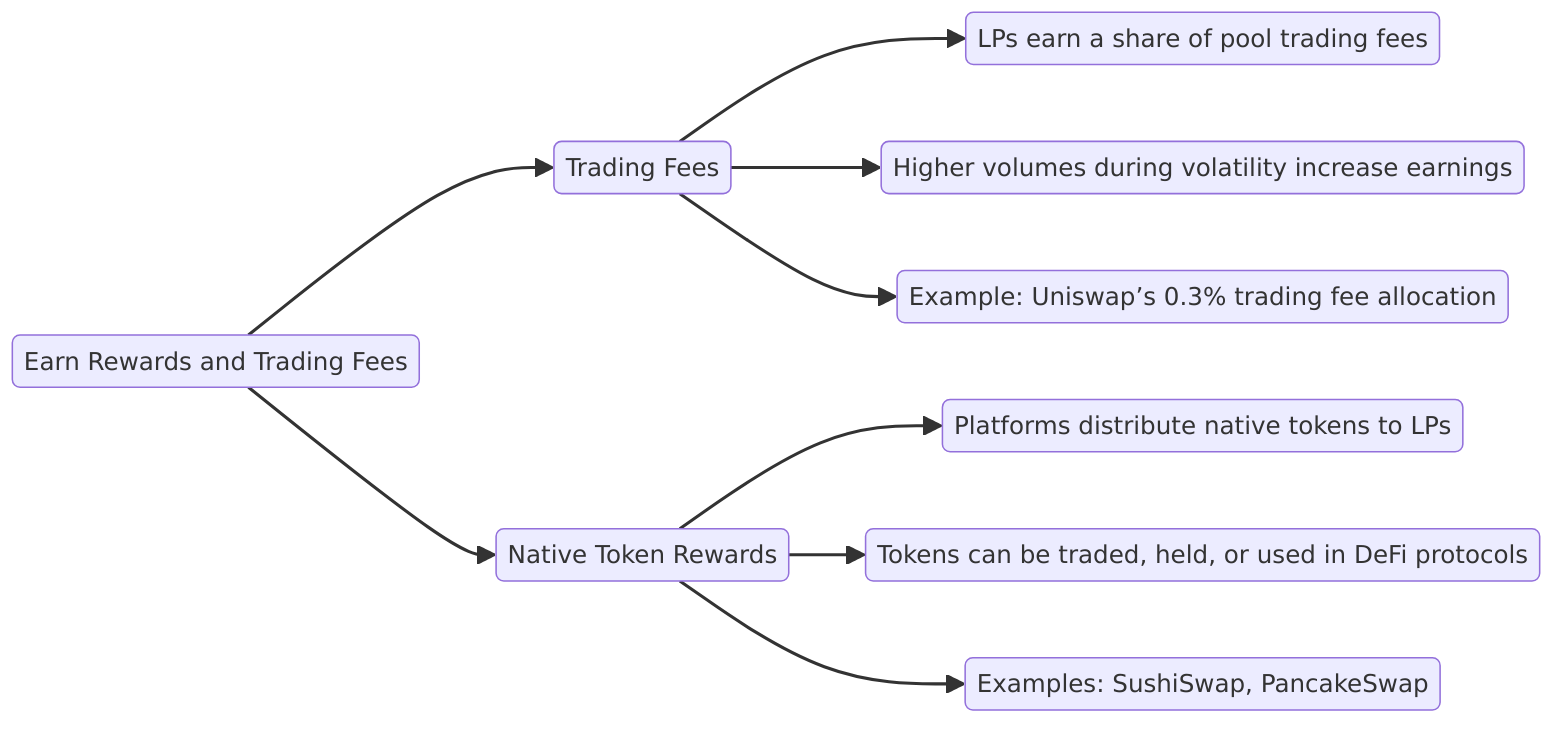

1. Earn Rewards and Trading Fees

Many DeFi protocols incentivize LPs with trading fees and rewards:

- Trading Fees:

- LPs earn a portion of the trading fees generated within the pool. For example, Uniswap allocates 0.3% of trading volume as fees distributed proportionally to LPs.

- Higher trading volumes during periods of volatility increase fee earnings, which can offset impermanent loss.

- Native Token Rewards:

- Some platforms reward LPs with native tokens. For instance, platforms like SushiSwap or PancakeSwap distribute tokens that derive their value from network activity.

- These tokens can be traded, held for appreciation, or used in other DeFi protocols for additional yield.

2. Utilize Stablecoin Pools

- Pools consisting of stable assets (e.g., USDC/DAI) are less volatile, minimizing impermanent loss.

- Stablecoin pairs have predictable price movements, making them ideal for conservative LPs.

3. Timing Liquidity Provision

- Providing liquidity during high trading activity seasons (e.g., market volatility or new token launches) allows LPs to earn higher trading fees.

- Conversely, avoiding periods of low activity reduces the chance of losses outweighing rewards.

4. Diversify Liquidity Across Pools

- Distributing funds across multiple pools reduces exposure to a single pool’s impermanent loss.

- For example, allocating liquidity between stablecoin pairs and more volatile pairs spreads risk and balances earnings.

5. Leverage Yield Farming Opportunities

- Pairing liquidity provision with yield farming boosts returns.

- Platforms like Uniswap and Balancer provide reward tokens that can be staked or reinvested into the protocol to generate additional yield.

6. Use Impermanent Loss Insurance

- Emerging DeFi protocols now offer insurance against impermanent loss.

- Example: Bancor’s impermanent loss protection covers up to 100% of losses for LPs who remain in the pool for a minimum duration (e.g., 100 days).

7. Monitor and Adjust Liquidity Positions

- Regularly reviewing the performance of your liquidity pools ensures timely adjustments.

- Tools like DeFiPulse, Zapper.fi, and LiquidityFolio help LPs track performance and manage impermanent loss effectively.

Can Impermanent Loss Be Avoided?

While impermanent loss is an inherent risk in providing liquidity to AMM (Automated Market Maker) pools, certain strategies and configurations can significantly reduce or, in some cases, almost eliminate its impact.

Here’s how:

1. Use of Stablecoin Pairs

- How It Helps:

- Providing liquidity using stablecoin pairs like USDC/USDT minimizes price fluctuations since these assets are pegged to fiat currencies (usually USD).

- Stablecoin pools are ideal for reducing impermanent loss because both assets maintain similar value, avoiding significant price divergence.

- Drawback:

- In bullish markets, LPs in stablecoin pools miss out on potential gains from price appreciation of volatile tokens.

- For example, a USDC/USDT pool won’t benefit from ETH or BTC price rallies.

- When to Use:

- Stablecoin pools are suitable during periods of low market volatility or for risk-averse liquidity providers.

2. Trading Fees

- How It Helps:

- Trading fees charged on transactions within the pool can offset or completely counterbalance impermanent loss.

- High trading volume pools generate more fees, making them less susceptible to impermanent loss.

- Example: A pool with 0.3% trading fees and high daily volumes can generate sufficient income to cover potential losses.

- Consideration:

- Ensure the trading pair has significant activity and volume to maximize fee earnings.

3. Managing Volatility

- How It Helps:

- Pairing relatively stable assets, such as ETH/DAI or BTC/WBTC, reduces the risk of significant price divergence.

- Avoid highly volatile pairs unless you anticipate a quick price reversion.

- Drawback:

- Pairs with inherently high volatility (e.g., new tokens) are more prone to impermanent loss, even with high fees.

4. Adjusting Liquidity Provider (LP) Ratios

- AMM Ratios:

- Many AMMs use a 50/50 ratio for liquidity pools, which increases exposure to impermanent loss. However, platforms like Balancer allow customizable ratios (e.g., 80/20), reducing impermanent loss risk for one asset.

- Multi-Asset Pools:

- Some AMMs support pools with more than two tokens, diversifying risk and mitigating impermanent loss.

5. Managing Price Deviation

- How It Helps:

- Impermanent loss becomes negligible if the price of tokens in the pair returns to their original ratio at the time of deposit.

- Example: If a token pair starts at 1:1 and eventually reverts to this ratio, impermanent loss is effectively zero.

- One-Sided Liquidity Pools:

- Some protocols, such as Bancor, offer one-sided liquidity provision, allowing LPs to avoid price deviation risks associated with two-token pools.

Key Takeaway

While impermanent loss cannot be entirely avoided in volatile markets, strategic approaches such as using stablecoin pairs, optimizing fee earnings, leveraging innovative AMM ratios, and understanding price dynamics can significantly mitigate its impact.

Choosing the right liquidity pool and timing your participation wisely are essential steps in minimizing this risk.

FAQ: Impermanent Loss in DeFi

1. What is Impermanent Loss?

Impermanent loss occurs when the price of assets in a liquidity pool changes compared to their price outside the pool. The loss arises because Automated Market Makers (AMMs) adjust the asset ratio within the pool to maintain balance, potentially leading to less favorable outcomes than simply holding the assets.

2. How Do Liquidity Pools Work?

Liquidity pools are collections of funds locked in smart contracts, facilitating decentralized trading without intermediaries. Providers contribute equal-value token pairs (e.g., ETH/USDT) and earn a portion of trading fees. The AMM algorithm balances the token ratio, ensuring smooth trading but exposing providers to impermanent loss.

3. What Causes Impermanent Loss?

- Market Volatility: Rapid price fluctuations increase the risk of impermanent loss.

- Price Divergence: Significant differences in token prices disrupt pool balance.

- Arbitrage Trading: Exploitation of price discrepancies by traders leads to pool rebalancing.

- Liquidity Pair Choices: Pools with volatile token pairs are more susceptible to loss.

4. How Can Impermanent Loss Be Calculated?

Using the AMM formula X×Y=KX times Y = KX×Y=K, you can assess how changes in token price ratios affect pool balance. Specialized tools like DeFiPulse, LiquidityFolio, and vFat simplify these calculations.

Example:

- Initial Token A Price: $100

- New Token A Price: $150

- Impermanent Loss: Approx. 2.05%, compared to holding tokens individually.

5. Can Impermanent Loss Be Avoided?

Complete avoidance is challenging, but strategies to mitigate include:

- Stablecoin Pairs: Use pairs like USDC/USDT to reduce price volatility risk.

- Trading Fees: High trading volumes offset potential losses with earned fees.

- One-Sided Pools: Bancor’s one-sided pools minimize price deviation risks.

6. How Can Liquidity Providers Mitigate Impermanent Loss?

- Timing Liquidity Provision: Join pools during high trading activity.

- Diversify Pools: Spread risk across multiple pools or assets.

- Leverage Insurance: Use protocols offering impermanent loss coverage, like Bancor.

- Utilize Yield Farming: Pair liquidity with farming incentives to boost returns.

7. Why Are Stablecoin Pairs Popular for Reducing Impermanent Loss?

Stablecoins like USDC and USDT maintain consistent value, minimizing price divergence. While they don’t benefit from bullish markets, they offer a secure option for risk-averse liquidity providers.

8. Are Trading Fees Enough to Offset Impermanent Loss?

In high-volume pools with significant trading fees (e.g., Uniswap’s 0.3%), earnings often outweigh potential losses. However, success depends on consistent pool activity and market conditions.

9. Is Impermanent Loss Permanent?

No, impermanent loss is “impermanent” as long as token prices revert to their original ratios when liquidity is withdrawn. However, if prices remain divergent, the loss becomes permanent upon withdrawal.

10. What Tools Can Help Manage Impermanent Loss?

- DeFiPulse & DeFiLlama: Track liquidity and protocol stats.

- LiquidityFolio: Manage investments on platforms like Uniswap.

- vFat Tools: Calculate yield farming earnings and impermanent loss.

Sidebar rates

HFM

wgt-lc-defi

- DeFi Lending

- DeFi Yield Farming

- AMM (Automated Market Maker)

- DEX

- Cross Chain Bridges

- Crypto Options

- Tokenized Bonds

- Crypto Derivatives

- On-chain synthetic Assets

- Cryptocurrency Perpetuals

- Cryptocurrency Staking

- Cryptocurrency Total Locked Value (TVL)

- Impermanent loss

- Rebase Token

- Decentralized Autonomous Organization

- Decentralized Application

- Gas Fees

- Liquidity Pools

- Cryptocurrency Tokenomics

- Pegged Stablecoins