What are Crypto Derivatives?

Last Update: November 30th, 2024

Crypto derivatives are financial contracts whose value is derived from underlying cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Similar to traditional derivatives in commodities or stocks, they allow traders to speculate on price movements or manage risks without directly owning the digital asset.

The crypto derivatives market has seen explosive growth, providing traders with various financial products such as options and futures contracts, which are crucial for managing risk and speculating on cryptocurrency price movements.

These derivatives include futures, options, perpetual swaps, and contracts for differences (CFDs). For instance, a Bitcoin futures contract derives its value from Bitcoin’s market price at a future date, providing a mechanism for traders to hedge risks or capitalize on price trends.

Key Roles in the Market:

- Risk Management: Mitigate losses by hedging against adverse price movements.

- Speculation: Profit from upward or downward price trends without holding the asset.

- Liquidity Enhancement: Increase trading volumes, stabilizing the broader market.

- Price Discovery: Reflect fair market value, even during volatile conditions.

Crypto derivatives are pivotal in financial markets, attracting both retail and institutional investors. By offering tools for portfolio protection and advanced strategies like arbitrage, they facilitate efficient trading and foster a mature cryptocurrency ecosystem. These instruments have become essential for navigating the complexities of the rapidly evolving crypto landscape.

How Do Crypto Derivatives Work?

Crypto derivatives are financial contracts that derive their value from an underlying cryptocurrency asset, such as Bitcoin (BTC) or Ethereum (ETH). These contracts allow traders to engage in crypto derivatives trading, where they can speculate on price movements, manage risk, or gain exposure to the cryptocurrency market without owning the actual digital asset. The mechanics of crypto derivatives make them a versatile tool for participants in volatile crypto markets.

Underlying Asset

The value of a crypto derivative is tied directly to the performance of its underlying crypto asset. For example:

- A Bitcoin futures contract derives its value from Bitcoin’s current market price and anticipated future price movements.

- The underlying asset’s volatility makes these derivatives appealing for traders seeking to profit from short-term price changes or hedge against potential losses.

Ownership Dynamics

Owning a crypto derivative does not mean owning the underlying cryptocurrency. Instead, the derivative represents a contractual agreement tied to the asset price of the underlying cryptocurrency.

- Example: A trader holding a Bitcoin futures contract is speculating on Bitcoin’s asset price but does not directly hold any BTC. This distinction eliminates the need for custody or wallet management, simplifying access to crypto markets.

Types of Crypto Derivatives

1. Futures Contracts

- Agreement to buy or sell a cryptocurrency at a predetermined price on a future date.

- Commonly used to hedge risks or speculate on market trends.

- Example: A trader agrees to buy Bitcoin at $40,000 in three months, regardless of its actual price then.

2. Options Contracts

- Provide the right, but not the obligation, to buy (call) or sell (put) a cryptocurrency at a specific price before a set expiration date.

- Useful for hedging against unfavorable price movements.

- Example: Buying an Ethereum call option at $1,800 allows the holder to purchase ETH at that price, even if it rises to $2,000.

3. Perpetual Swaps

- Similar to futures but without an expiration date, allowing positions to be held indefinitely.

- Prices remain closely aligned with the spot market due to funding rates.

- Popular among active traders for speculative purposes.

4. Contracts for Differences (CFDs)

- Allow traders to speculate on the price difference of a cryptocurrency between the opening and closing of a trade.

- No actual ownership of the asset is involved.

Example: Trading Bitcoin Futures on Binance:

- A trader anticipates Bitcoin’s price will rise from $30,000 to $35,000.

- The trader enters a long position in a Bitcoin futures contract with 10x leverage.

- If Bitcoin reaches $35,000, the trader realizes a significant profit. However, if Bitcoin’s price falls, the leveraged position could amplify losses.

Smart Contract Derivatives

Smart contract derivatives use blockchain technology to create automated financial agreements that execute when predefined conditions are met. By eliminating intermediaries, they streamline trading processes and enhance market efficiency, particularly in decentralized finance (DeFi).

How Smart Contract Derivatives Work

- Automated Execution: When specific conditions, such as a price crossing a threshold, are met, the smart contract executes the terms autonomously.

- Blockchain Infrastructure: Smart contracts are deployed on platforms like Ethereum, ensuring transparency and immutability. For instance, if a trader sets a condition to sell Bitcoin at $30,000, the contract will execute automatically when this price is reached.

- DeFi Integration: Platforms like Synthetix allow traders to create synthetic assets representing real-world or crypto assets, enabling advanced trading strategies.

Advantages of Smart Contract Derivatives

- Permissionless Transactions: No need for central authorities or intermediaries, reducing operational costs.

- Immutable Records: Transactions are secure and tamper-proof, ensuring trust among participants.

- Efficient Settlements: Processes like margin calls or contract closures are completed instantly without manual intervention.

Example: A DeFi user can trade synthetic gold (sXAU) through Synthetix, with smart contracts handling price updates and settlements seamlessly.

Comparison with Traditional Derivatives

| Feature | Smart Contracts | Traditional Derivatives |

|---|---|---|

| Execution Speed | Instantaneous | Days or weeks |

| Intermediaries Needed | None | Brokers and clearinghouses |

| Costs | Low (gas fees) | High |

| Flexibility | Predefined but rigid | Negotiable terms |

Challenges

- Regulatory Compliance: Smart contracts must navigate diverse legal frameworks, complicating global adoption.

- Adaptability: Immutable contracts struggle to adapt to changing laws or unforeseen conditions.

- Technical Risks: Bugs or vulnerabilities in contract code can lead to significant losses.

Example: The 2020 “DeFi Hack” of $25M in smart contracts highlighted the need for robust code audits.

Popular Crypto Derivatives: Bitcoin and Ethereum

Bitcoin Derivatives

Bitcoin derivatives are financial contracts based on the price of Bitcoin, enabling traders to speculate, hedge, or gain exposure without owning the cryptocurrency itself.

Advantages:

- Hedging: Traders can manage risks associated with Bitcoin’s high price volatility.

- Liquidity: High trading volumes in Bitcoin futures and options benefit frequent traders by reducing slippage.

Risks:

- Counterparty Risk: The issuing company or exchange might face insolvency, leading to potential losses for traders.

- Lack of Ownership: Derivative holders do not own Bitcoin, forfeiting its sovereignty and utility.

Example: CME Bitcoin futures have played a significant role in institutional adoption, allowing large investors to access Bitcoin price movements within a regulated framework.

Ethereum Derivatives

Ethereum derivatives are contracts that use Ether (ETH) as the underlying asset, offering exposure to Ethereum without holding the token.

Advantages:

- Institutional Interest: Ethereum’s versatile infrastructure and DeFi applications attract institutional investors.

- Growing Popularity: The rise in open interest for Ethereum futures highlights its increasing demand.

Example: Ethereum futures on Binance allow traders to speculate on ETH price movements. For instance, if ETH is expected to rise, a trader might take a long position in futures, profiting from the price increase.

These derivatives cater to diverse trading strategies, making them indispensable in the evolving cryptocurrency landscape.

How to Trade Crypto Derivatives

Trading crypto derivatives involves navigating exchanges, understanding leverage and margin, and managing contracts effectively. Here’s a step-by-step guide:

1. Opening an Account

To start trading crypto derivatives:

- Choose a Reliable Platform: Reputable exchanges like Binance, Bybit, or CME Group offer a range of derivatives products, including futures, options, and perpetual swaps.

- Account Setup: Complete the registration process, including Know-Your-Customer (KYC) verification, which is mandatory on most regulated platforms.

- Deposit Funds: Fund your account with fiat currency or cryptocurrencies to begin trading.

2. Leverage and Margin Requirements

- Leverage: Derivatives allow traders to control larger positions using smaller initial investments, amplifying both potential profits and losses. For instance, a 10x leverage means a $1,000 margin can control a $10,000 position.

- Margin Requirements: Margins vary based on trade size and volatility. Exchanges often allow the use of cryptocurrencies like Bitcoin or USDT as collateral.

Example: A trader on Binance opens a $50,000 Bitcoin futures position with $5,000 as initial margin, using 10x leverage.

3. Trading Process

- Placing a Trade: Select the derivative type (e.g., Bitcoin futures), choose your leverage, and enter the position size.

- Monitor Position: Use stop-loss and take-profit orders to manage risk.

Example: A trader places a long position in Bitcoin futures, betting the price will rise from $30,000 to $35,000. If the price increases, the profit is amplified due to leverage.

4. Settlement

- Cash Settlement: Most crypto derivatives settle in cash, where the difference between the contract price and the market price is credited or debited.

- Rolling Over Contracts: For futures with expiration dates, traders can extend their position by rolling over into a new contract.

Real-World Scenario: During a volatile Bitcoin market, a trader rolls over their futures contract to the next month to avoid forced liquidation due to sharp price fluctuations.

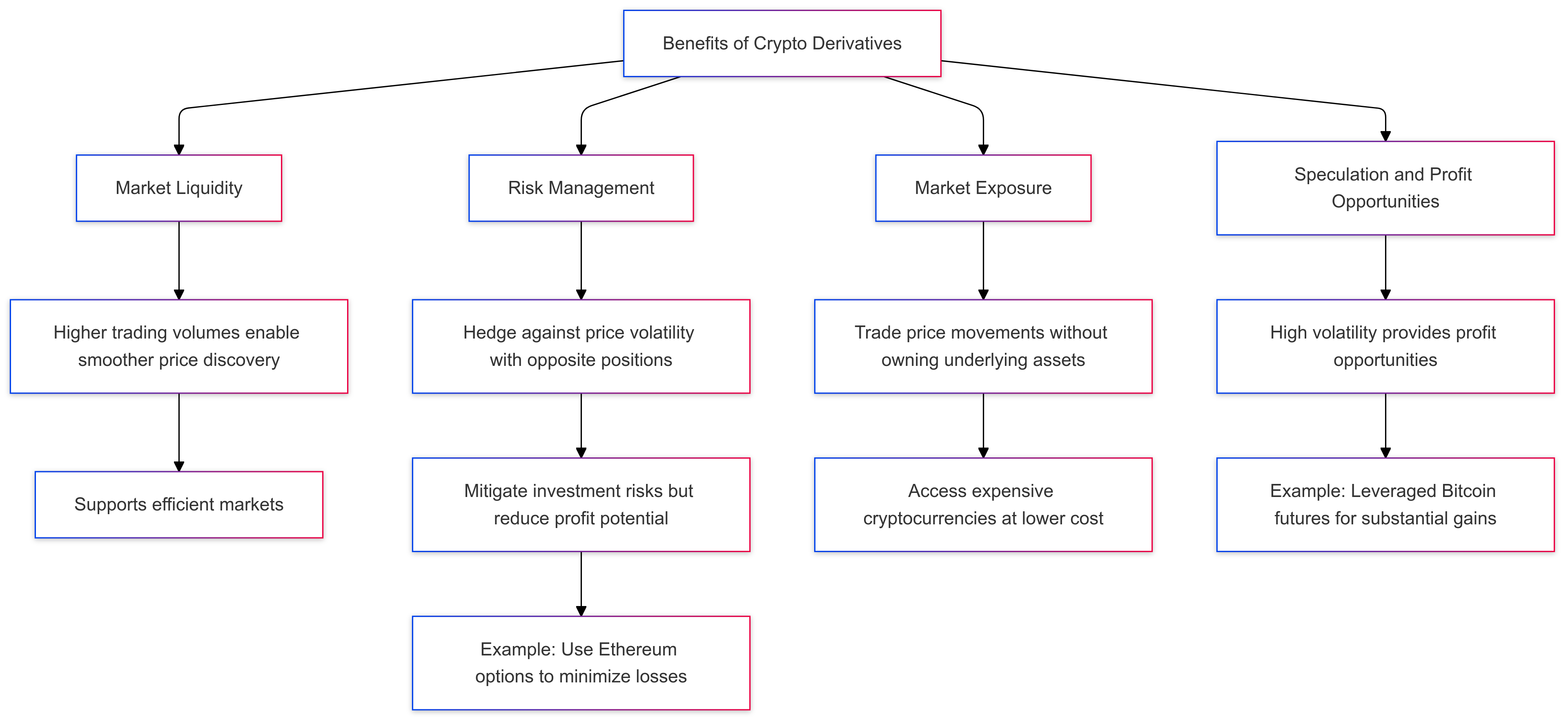

Benefits of Crypto Derivatives

- Market Liquidity: Crypto derivatives enhance liquidity by enabling higher trading volumes, which supports smoother price discovery and efficient markets.

- Risk Management: Traders can hedge against price volatility by employing a risk management strategy. This involves taking opposite positions in trading to offset potential losses, which can help mitigate investment risks while also noting the possibility of reduced profit potential.

- Example: A portfolio holding Ethereum can use Ethereum options to protect against sudden price drops, minimizing losses while retaining upside potential.

- Market Exposure: Derivatives allow traders to benefit from price movements without owning the underlying asset, offering access to expensive cryptocurrencies like Bitcoin at a fraction of the cost.

- Speculation and Profit Opportunities: High volatility in crypto markets provides opportunities for traders to capitalize on significant price swings.

- Example: Leveraged Bitcoin futures contracts can yield substantial profits if the market moves favorably.

Risks of Crypto Derivatives

- Volatility Risks: Crypto markets are highly volatile. Rapid price changes can lead to amplified losses for traders.

- Leverage Risks: Using leverage increases exposure but can also magnify losses beyond the initial margin.

- Example: A 10x leveraged position can result in total loss if the price moves by just 10% against the trader.

- Counterparty Risks: The insolvency of an exchange or broker can lead to loss of funds, especially on less-regulated platforms.

- Regulatory Uncertainty: Different countries have varying rules, creating complexities for traders.

- Example: The U.S. imposes stricter derivatives regulations compared to Asia, affecting market access and compliance requirements.

The Future of Crypto Derivatives

- Growing Market Demand: Institutional investors increasingly use derivatives like Bitcoin and Ethereum futures for portfolio diversification and hedging.

- Integration with DeFi: Platforms like Synthetix enable decentralized derivatives trading, expanding access while maintaining transparency and control.

- Example: Synthetix allows users to trade synthetic assets pegged to real-world prices.

- Regulatory Developments: Major markets are working toward standardizing regulations, which could increase trust and adoption globally.

- Innovation in Products: New instruments tailored to retail and institutional needs, such as tokenized derivatives and perpetual swaps, are expected to emerge, further diversifying trading options.

FAQs on Crypto Derivatives

- What Are Crypto Derivatives?

Crypto derivatives are financial contracts whose value is derived from underlying cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH). They allow traders to speculate on price movements, hedge risks, or gain market exposure without owning the actual cryptocurrency. - What Types of Crypto Derivatives Are Available?

- Futures Contracts: Agreement to buy or sell a cryptocurrency at a set price on a future date.

- Options Contracts: Provides the right, but not the obligation, to buy (call) or sell (put) at a specific price.

- Perpetual Swaps: Derivatives without an expiration date.

- Contracts for Differences (CFDs): Speculate on price movements without owning the asset.

- How Do Crypto Derivatives Work?

Crypto derivatives derive their value from the price of an underlying cryptocurrency. For example, a Bitcoin futures contract tracks Bitcoin’s market price, enabling traders to profit from price changes without owning Bitcoin itself. Settlement can occur through cash or cryptocurrency, depending on the contract. - What Are the Benefits of Trading Crypto Derivatives?

- Risk Management: Hedge against price fluctuations.

- Market Liquidity: Enhance overall market activity.

- Speculation Opportunities: Leverage price movements for potential profits.

- Market Exposure: Gain access to expensive cryptocurrencies without direct ownership.

- What Are the Risks of Crypto Derivatives?

- Volatility Risks: Rapid price movements can lead to significant losses.

- Leverage Risks: Amplifies both gains and losses.

- Counterparty Risks: Risk of insolvency from exchanges or brokers.

- Regulatory Uncertainty: Varying rules across jurisdictions can create complexities for traders.

Sidebar rates

HFM

wgt-lc-defi

- DeFi Lending

- DeFi Yield Farming

- AMM (Automated Market Maker)

- DEX

- Cross Chain Bridges

- Crypto Options

- Tokenized Bonds

- Crypto Derivatives

- On-chain synthetic Assets

- Cryptocurrency Perpetuals

- Cryptocurrency Staking

- Cryptocurrency Total Locked Value (TVL)

- Impermanent loss

- Rebase Token

- Decentralized Autonomous Organization

- Decentralized Application

- Gas Fees

- Liquidity Pools

- Cryptocurrency Tokenomics

- Pegged Stablecoins