What are Cross Chain Bridges?

Last Update: October 9th, 2024

Cross chain bridges are technologies that enable the transfer of digital assets and information between different blockchain networks. They are essential for achieving cross chain interoperability, allowing blockchain ecosystems to communicate and share value.

Typically, blockchains operate independently, making it difficult for assets or data to move between them. Cross-chain bridges solve this problem by acting as a secure link between a source chain (where the assets originate) and a destination chain (where the assets are transferred).

What Are Cross Chain Bridges?

Cross chain bridges enable the transfer of digital assets and data between different blockchain networks. They provide a solution for the lack of interoperability between blockchains, allowing users to move tokens and information seamlessly across multiple chains. This functionality helps solve a critical problem in the blockchain space, where most networks operate independently, leading to fragmentation and limited cross chain transactions.

The main difference between cross chain bridges and blockchain bridges is scope. While a blockchain bridge typically connects only two specific blockchains, a cross chain bridge facilitates interactions between several networks, making it a more versatile solution for the blockchain ecosystem.

By connecting separate blockchains like Ethereum, Binance Smart Chain, and Solana, cross chain bridges enable cross chain functionality that opens up new possibilities for decentralized finance (DeFi), cross chain decentralized exchanges, and liquidity provision. Additionally, programmable token bridges enhance cross-chain capabilities by allowing for more complex cross-chain functionality post-bridging. This includes swapping, lending, staking, and depositing tokens into smart contracts simultaneously, thus expanding the utility and applications of cross-chain bridges.

They use cross chain messaging protocols to ensure that data and assets are transferred securely, maintaining the value and utility of the underlying tokens. This cross chain interoperability allows developers to create more complex applications that can leverage multiple blockchain ecosystems, increasing the overall utility and accessibility of digital assets.

Key Takeaways

- Cross chain bridges connect multiple blockchain networks to enable smooth and secure transfers of digital assets.

- They use cross chain messaging protocols to ensure compatibility and facilitate communication between different blockchain networks.

- Cross chain bridges enable the movement of wrapped tokens, provide cross chain liquidity, and support cross chain decentralized exchanges.

- They operate using a lock-mint, burn-release model, maintaining the total supply of tokens across chains.

- Despite their benefits, cross chain bridges carry potential risks, such as bridge hacks and security vulnerabilities, which can result in loss of funds.

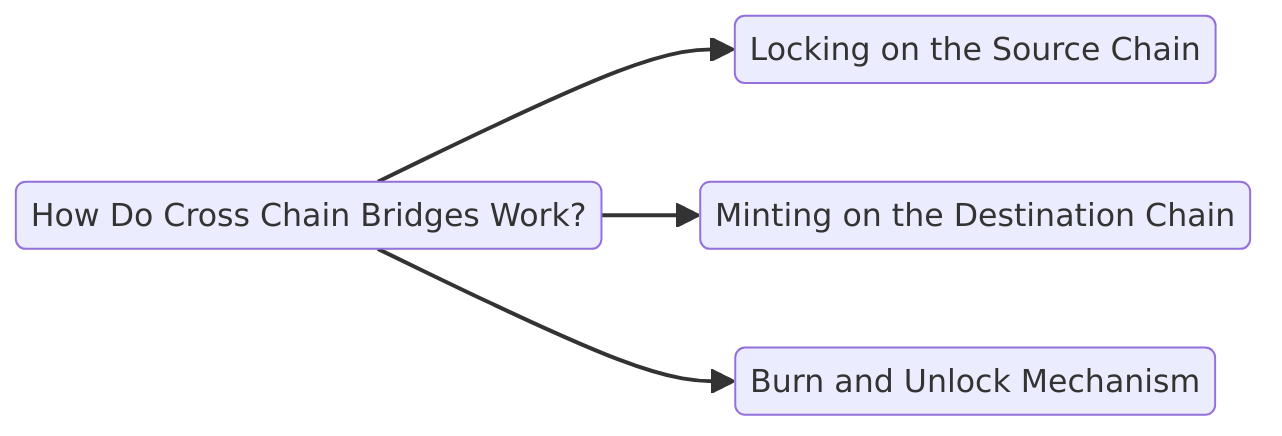

How Do Cross Chain Bridges Work?

Cross chain bridges operate by facilitating the movement of tokens and data between two or more blockchains. They use a combination of smart contracts and a cross chain messaging protocol to ensure smooth asset transfers. The cross chain messaging protocol serves as a foundational technology within these bridges, enabling the transfer of tokens between different blockchain networks, enhancing interoperability and enabling various applications such as decentralized exchanges and money markets.

The process typically involves two main components: the source chain (where the assets are initially locked) and the destination chain (where new tokens are minted).

Here’s how a typical cross chain transaction works:

- Locking on the Source Chain: When a user wants to transfer tokens from Chain A (e.g., Ethereum) to Chain B (e.g., Binance Smart Chain), the cross chain bridge locks the equivalent amount of tokens on the source chain using a smart contract.

- Minting on the Destination Chain: The bridge then mints new tokens on Chain B, representing the locked assets on Chain A. This ensures that the total supply of tokens remains balanced between the chains.

- Burn and Unlock Mechanism: To reverse the process, the user must burn the tokens on Chain B. Once the tokens are burned, the bridge unlocks the equivalent amount of tokens on Chain A.

Example: The Polygon Bridge allows users to move assets between Ethereum and the Polygon network by locking ETH on Ethereum and minting equivalent tokens (MATIC) on Polygon. Similarly, the Rainbow Bridge facilitates transfers between Ethereum and NEAR Protocol, enabling the movement of assets without a central authority.

This lock-mint and burn-release model ensures security and maintains the value of tokens across chains, making cross chain bridges a critical component of blockchain ecosystems.

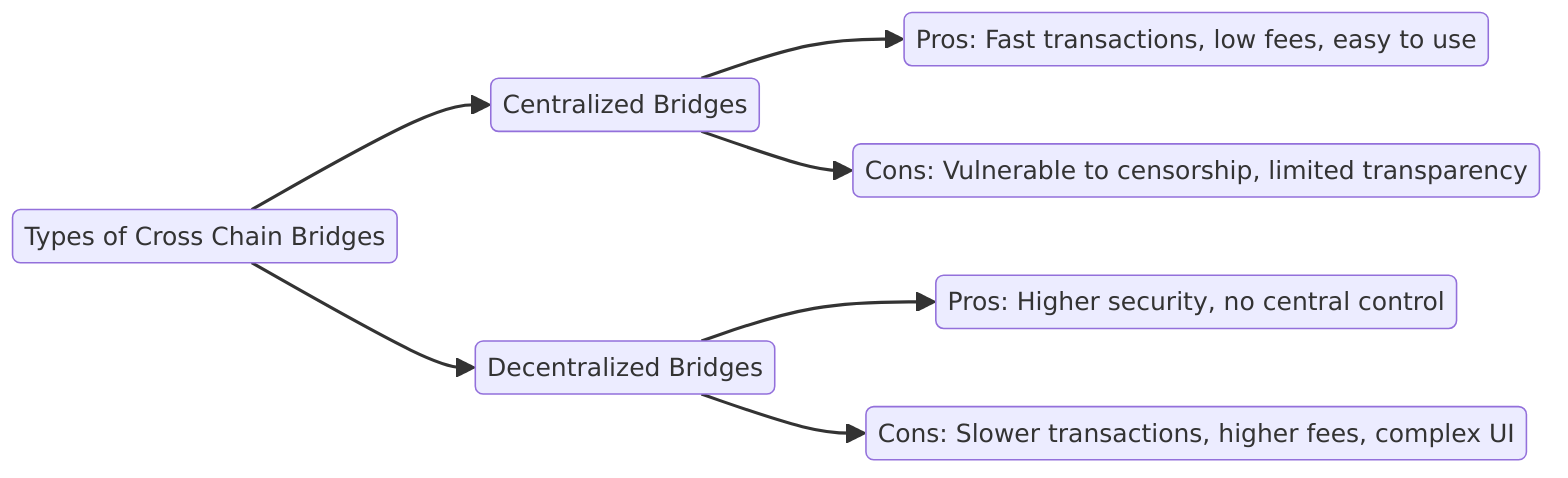

Types of Cross Chain Bridges: Centralized vs. Decentralized

Centralized Bridges rely on a central authority or organization to manage the transfer of assets between blockchains. For example, the Binance Smart Chain Bridge is controlled by Binance, which ensures the security and functionality of the bridge. This type of bridge typically offers faster transaction times and lower fees due to centralized control, making it user-friendly for beginners.

However, centralized bridges pose a higher risk of censorship and single-point-of-failure vulnerabilities, where a hack or internal mismanagement can lead to loss of funds.

Decentralized Bridges, also known as trustless bridges, operate without a central entity, relying on smart contracts and decentralized protocols to facilitate transactions. These bridges, such as the Thorchain and Anyswap, offer higher security and transparency since they don’t depend on any single entity to validate transactions.

However, decentralized bridges often have lower transaction speeds and higher fees compared to their centralized counterparts due to the distributed nature of their operations.

Pros and Cons:

- Centralized Bridges:

- Pros: Fast transactions, low fees, easy to use.

- Cons: Vulnerable to censorship and hacking, limited transparency.

- Decentralized Bridges:

- Pros: Higher security, no central control, more transparency.

- Cons: Slower transactions, higher fees, complex user interface.

In summary, centralized bridges are ideal for quick and simple transfers, while decentralized bridges are better for users prioritizing security and transparency.

Cross Chain Messaging Protocols: Enabling Interoperability

Cross chain messaging protocols are communication mechanisms that allow different blockchains to interact and share data seamlessly. These protocols enable cross chain communication for transferring assets, executing smart contracts, and maintaining interoperability between independent blockchains.

One popular example is the Inter-Blockchain Communication (IBC) protocol used by the Cosmos network. IBC allows multiple blockchains to exchange tokens and data, making it a powerful tool for cross chain interoperability. Similarly, Chainlink’s Cross Chain Protocol facilitates secure data transfer between blockchains, enabling the development of complex decentralized applications (dApps) that operate across multiple networks.

By enabling communication between blockchains, cross chain messaging protocols support a wide range of use cases, from DeFi applications to cross chain decentralized exchanges, improving the overall efficiency and utility of blockchain ecosystems.

Use Cases of Cross Chain Bridges

Cross chain bridges have a variety of use cases, particularly in the DeFi space. They enable seamless transfer of assets between different blockchains, making them essential for liquidity pool transfers and cross chain decentralized exchanges.

For example, users can leverage the Polygon Bridge to move tokens from Ethereum to Polygon, taking advantage of lower transaction fees for yield farming. Similarly, the Binance Smart Chain Bridge allows users to convert their Ethereum-based tokens into BSC-compatible tokens, enabling participation in DeFi applications on the BSC network.

Another common use case is cross chain liquidity provision. Bridges like Thorchain enable the swapping of assets across blockchains, which helps in maintaining liquidity across various blockchain ecosystems. These bridges allow users to access a broader range of assets and liquidity options, enhancing the overall efficiency and utility of the DeFi market.

Benefits of Cross Chain Transactions

Cross chain transactions offer a multitude of benefits that significantly enhance the blockchain ecosystem. One of the primary advantages is increased liquidity. By enabling the transfer of assets between different blockchain networks, cross chain transactions allow users to access a broader range of liquidity pools. This interconnectedness ensures that assets are not confined to a single blockchain, promoting a more fluid and dynamic market.

Improved scalability is another key benefit. Different blockchain networks have varying capabilities and limitations. Cross chain transactions enable users to leverage the strengths of multiple networks, optimizing performance and scalability. For instance, a user can transfer assets from a congested network like Ethereum to a more scalable one like Binance Smart Chain, benefiting from faster transaction speeds and lower fees.

Enhanced user experience is also a significant advantage. Cross chain transactions simplify the process of moving assets across different blockchain networks, making it more convenient for users to participate in various decentralized applications (dApps) and services. This seamless interoperability fosters a more inclusive and user-friendly crypto landscape, encouraging broader adoption and innovation.

Why is it Important to Create a Bridge Between Different Blockchains?

Creating cross chain bridges is crucial for ensuring cross chain interoperability and connectivity between different blockchain networks. Blockchains like Ethereum, Binance Smart Chain, and Solana are typically isolated, making it difficult for assets and data to flow between them. Cross chain bridges solve this issue by enabling seamless asset transfers and cross chain communication.

With these bridges, decentralized applications (dApps) can interact with multiple chains, expanding their reach and functionality. For instance, a DeFi protocol built on Ethereum can leverage liquidity from Binance Smart Chain through a cross chain bridge, improving liquidity and attracting a broader user base. Additionally, cross chain functionality promotes economic growth, fosters innovation, and opens up new opportunities for decentralized finance (DeFi) and other blockchain-based services by eliminating the barriers between separate blockchain ecosystems.

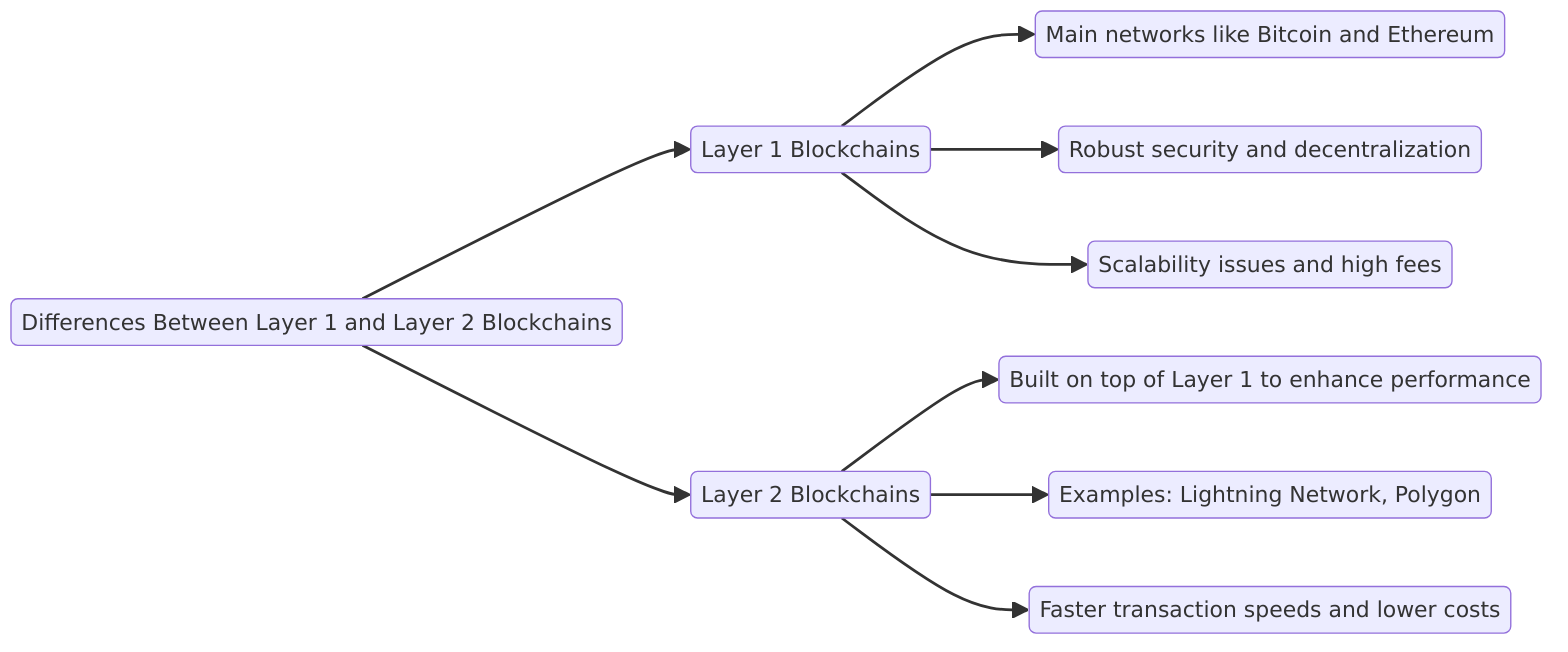

Differences Between Layer 1 and Layer 2 Blockchains

- Layer 1 Blockchains: The main networks like Bitcoin and Ethereum that process all on-chain transactions. These networks offer robust security and decentralization but often face scalability issues and high fees due to network congestion.

- Layer 2 Blockchains: Solutions built on top of Layer 1 to enhance performance. For example, the Lightning Network (Bitcoin) and Polygon (Ethereum) handle transactions off-chain, reducing congestion and fees. Layer 2 networks allow faster transaction speeds and lower costs without altering the core Layer 1 network.

Layer 2 solutions are essential for scaling popular Layer 1 blockchains, enabling them to handle a higher number of transactions per second while maintaining decentralization and security.

Ethereum’s High Gas Fees

Ethereum’s high gas fees are a direct consequence of its popularity as the go-to network for building decentralized applications and non-fungible tokens (NFTs). Gas fees represent the computational power needed to process a transaction and are denominated in gwei (a unit of ETH). During periods of high demand, gas prices can spike, making it costly to execute transactions on the network.

These high fees have pushed users and developers to explore alternative chains that offer lower costs and faster transactions while maintaining compatibility with Ethereum’s ecosystem.

Best Alternatives to Ethereum

Cosmos

- Overview: Cosmos is designed as an “internet of blockchains” that aims to solve Layer 1 scalability issues by enabling parallel blockchain development.

- Key Features: Utilizes the Tendermint consensus algorithm, and its native token, ATOM, is used for staking and governance.

- Use Case: Ideal for cross chain applications that require inter-chain communication and scalability.

Cardano

- Overview: An open-source blockchain designed to support decentralized applications and smart contracts. Founded by Charles Hoskinson, Cardano offers high scalability and low energy consumption through its proof-of-stake consensus mechanism.

- Key Features: ADA is the network’s utility and governance token, and it powers dApps and staking.

- Use Case: Suitable for dApps seeking a sustainable, scalable blockchain network.

Binance Smart Chain (BSC)

- Overview: BSC runs parallel to Binance Chain and is built for high-performance smart contract execution.

- Key Features: Lower transaction fees and faster processing times compared to Ethereum. Uses a proof-of-stake authority model.

- Use Case: Frequently used for DeFi applications and NFT projects due to its compatibility with the Ethereum Virtual Machine (EVM).

Polygon (Layer 2)

- Overview: An Ethereum Layer 2 solution that enhances transaction speed and reduces fees through its hybrid proof-of-stake and Plasma framework.

- Key Features: Capable of handling up to 65,000 transactions per second (TPS) with a block time of just 2 seconds.

- Use Case: Ideal for developers looking to build scalable dApps that can easily integrate with Ethereum’s ecosystem.

These alternatives provide viable options for projects seeking lower fees and faster transactions while maintaining the security and compatibility of established networks.

Available Cross-Chain Platforms

- Solana Wormhole Bridge

The Wormhole Bridge connects Solana to several other decentralized financial networks, including Ethereum, Binance Smart Chain (BSC), Terra, and Polygon. This bridge leverages Solana’s high transaction speed and low fees, enabling users to transfer assets quickly and cost-effectively. For example, users can move SOL tokens to Ethereum as wrapped assets, making them usable in Ethereum-based DeFi protocols like Uniswap and Aave. - Binance Bridge

The Binance Bridge facilitates interoperability between the Binance Chain and Binance Smart Chain (BSC) with other major blockchains, such as Ethereum and Bitcoin. Users can convert their assets into wrapped tokens compatible with BSC, allowing them to participate in BSC-based DeFi projects. This bridge also enables Bitcoin holders to earn staking rewards and utilize their assets in BSC’s DeFi ecosystem. - Avalanche Cross-Chain Bridge

The Avalanche Bridge enables seamless transfers between Avalanche and the Ethereum network. Users can transfer AVAX tokens to Ethereum or vice-versa through the Avalanche Wallet, which charges a small fee for cross-chain transfers. The bridge utilizes Intel SGX technology for enhanced security and supports popular wallets like MetaMask and WalletConnect, making it a secure and user-friendly option. - Polkadot

Polkadot enables independent blockchains, known as parachains, to be interoperable through its Relay Chain. This architecture supports interactions between Ethereum, Bitcoin, and other networks, providing a robust cross-chain environment. Polkadot’s parachains can be customized for different use cases, making the platform suitable for both public and private blockchain implementations. - Anyswap

Anyswap is a decentralized cross-chain protocol that allows the swapping of tokens between various blockchains, such as Ethereum and Binance Smart Chain. The platform uses Fusion’s Decentralized Control Rights Management (DCRM) technology, which enhances security for cross-chain transactions. Its open-source smart contracts have undergone independent audits to ensure security, making it a reliable choice for asset transfers across multiple blockchain ecosystems.

These cross chain bridge examples demonstrate how various platforms can support interoperability and seamless asset transfers, each with unique features that cater to different blockchain ecosystems.

Examples of Cross Chain Bridges

Several cross chain bridges have gained prominence in the crypto community, each offering unique features and capabilities. Here are some notable examples:

- Cosmos: Known as the “Internet of Blockchains,” Cosmos is a decentralized network of independent, parallel blockchains, each powered by the Cosmos-SDK framework. It uses the Inter-Blockchain Communication (IBC) protocol to enable seamless cross chain transactions and interoperability.

- Polkadot: Polkadot is a decentralized platform that facilitates interoperability between different blockchain networks through its unique relay chain and parachain architecture. This design allows for secure and scalable cross chain communication, making it a robust solution for various blockchain applications.

- Solana: Solana is a high-performance blockchain network that supports the creation of decentralized applications. Its Wormhole Bridge connects Solana to other major networks like Ethereum and Binance Smart Chain, enabling fast and cost-effective cross chain transactions.

- Binance Smart Chain (BSC): BSC is a fast and low-cost blockchain network that supports the creation of decentralized applications. The Binance Bridge allows users to convert their assets into BSC-compatible tokens, facilitating cross chain transactions and participation in BSC-based DeFi projects.

- Ethereum: As a leading decentralized platform, Ethereum supports the creation of decentralized applications and enables cross chain transactions through various bridges like the Polygon Bridge and the Rainbow Bridge. These bridges connect Ethereum to other networks, enhancing its interoperability and utility.

Common Risks and Challenges of Cross Chain Bridges

Cross chain bridges face several security challenges, making them attractive targets for malicious actors. One of the primary risks is bridge hacks, where vulnerabilities in the bridge’s security protocols allow hackers to exploit weaknesses and siphon off funds. For instance, in 2022, the Wormhole Bridge suffered a hack that resulted in the loss of over $320 million in assets due to a flaw in the bridge’s smart contract logic.

Another risk is related to arbitrary data messaging capabilities, where malicious transactions can be injected into the bridge, leading to unauthorized minting or burning of tokens. This vulnerability can disrupt the lock-mint and burn-release mechanisms, causing the total supply of tokens across chains to become unbalanced.

The impact of these attacks can be severe, affecting the overall market sentiment and causing users to lose confidence in the reliability of cross chain bridges. A prominent example is the Poly Network hack, where over $600 million in assets were stolen, highlighting the need for robust security protocols and continuous audits. Addressing these challenges is crucial for the long-term success of cross chain interoperability solutions.

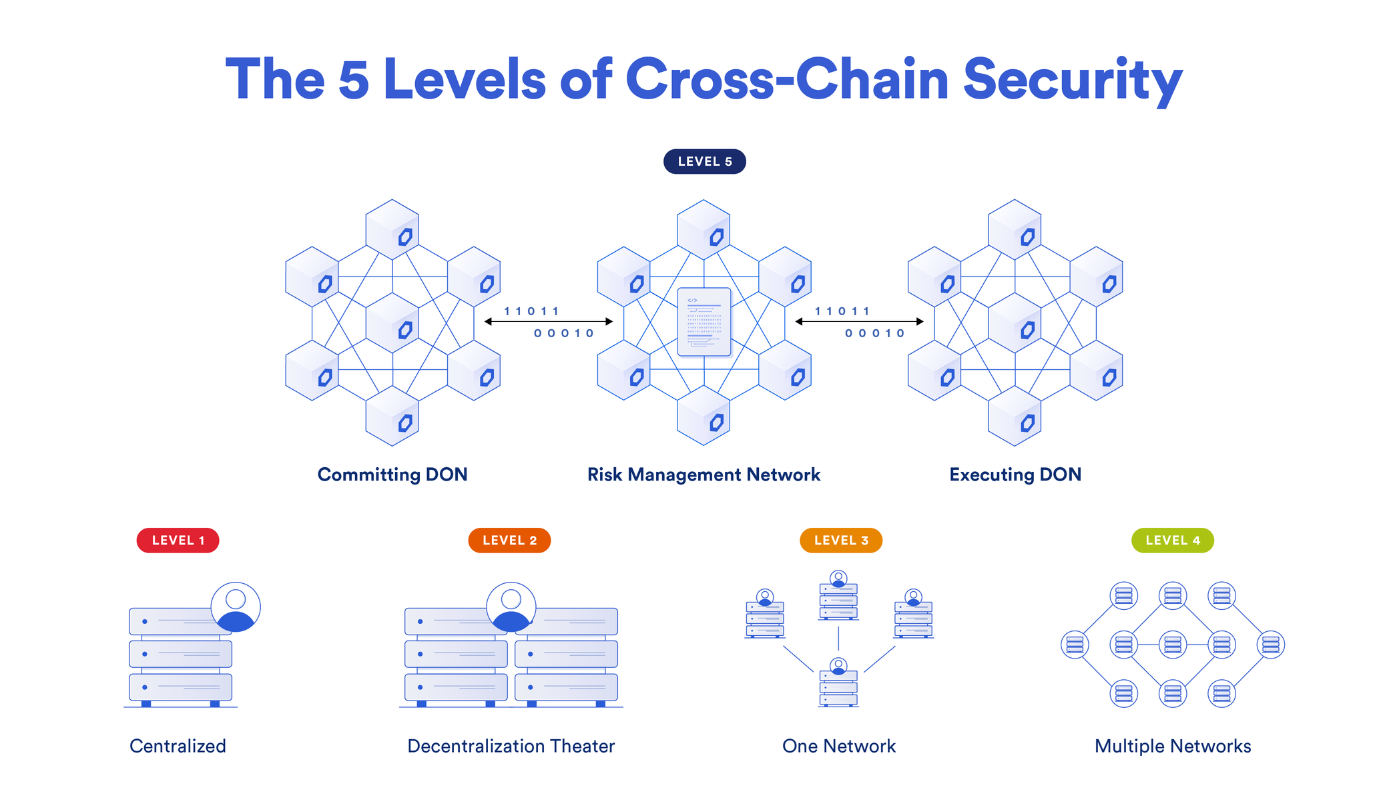

Security Considerations for Cross Chain Bridges

While cross chain bridges offer numerous benefits, they also come with significant security risks. One of the primary concerns is smart contract vulnerabilities. Since smart contracts are the backbone of cross chain bridges, any flaws or bugs in the contract code can be exploited by attackers, leading to potential loss of funds.

Centralization risks are another critical consideration. Centralized bridges, while efficient, pose significant security risks, including the possibility of hacking and theft. A single point of failure in a centralized system can lead to catastrophic losses, making it essential to balance efficiency with security.

Regulatory risks also play a crucial role. Cross chain bridges may be subject to various regulatory requirements, including anti-money laundering (AML) and know-your-customer (KYC) regulations. Non-compliance with these regulations can result in legal challenges and potential shutdowns, highlighting the need for regulatory awareness and compliance.

Ensuring Security with Cross Chain Bridges

To ensure the security of cross chain bridges, it is essential to implement robust security measures. One effective approach is conducting regular smart contract audits. These audits help identify and rectify vulnerabilities in the contract code, preventing potential exploits and attacks.

Utilizing multi-signature wallets is another crucial security measure. Multi-signature wallets require multiple approvals for transactions, reducing the risk of unauthorized transfers and enhancing overall security.

Implementing rate limits on token transfers can also help mitigate risks. By capping the amount of tokens that can be transferred within a specific period, rate limits prevent large-scale attacks and reduce the potential impact of theft.

External verification with additional security measures can further enhance trust and security. By incorporating third-party verification and additional layers of security, cross chain bridges can minimize risks and ensure safer transactions.

In conclusion, while cross chain bridges offer significant benefits and opportunities, it is crucial to address their security challenges. By implementing robust security measures and best practices, developers and users can ensure the safe and efficient operation of cross chain bridges, fostering a more secure and interconnected blockchain ecosystem.

The Role of Cross Chain Bridges in DeFi

Cross chain bridges play a vital role in the DeFi ecosystem by facilitating cross chain liquidity and enabling users to participate in cross chain decentralized exchanges.

With the help of cross chain bridges, users can move assets from one blockchain to another to take advantage of better liquidity pools, lending rates, and yield farming opportunities.

For instance, a user can transfer Ethereum-based tokens through the Polygon Bridge to access lower fees and faster transactions on the Polygon network.

Similarly, using the Binance Bridge, users can convert their assets into Binance Smart Chain tokens and participate in BSC-based DeFi projects with reduced costs compared to Ethereum.

Cross chain bridges also enable cross chain decentralized exchanges like THORChain and SushiSwap to support trading of assets across different blockchains. This capability allows users to trade and swap tokens across chains without relying on centralized exchanges, ensuring greater transparency and reducing the risk of single points of failure.

In essence, cross chain bridges are critical for optimizing asset allocation, liquidity provision, and accessibility in the rapidly growing DeFi market, making them a cornerstone of the decentralized finance space.

Future Trends in Cross Chain Bridges

The future of cross chain bridges is set to evolve with the introduction of programmable token bridges and generalized cross chain functionality. Programmable token bridges will enable developers to build more complex functionalities directly into the bridge, such as automated lending and borrowing, cross chain staking, and yield aggregation.

Emerging cross chain messaging protocols will further enhance the ability of different blockchains to communicate and execute smart contracts, leading to a more interconnected and efficient multi chain ecosystem. These advancements will allow dApps to operate seamlessly across multiple chains, breaking down the barriers between isolated blockchain networks.

Another trend is the rise of generalized cross chain functionality, which will support not just asset transfers but also the movement of arbitrary data and smart contract interactions. This will enable the creation of cross chain dApps that can access and utilize resources from multiple chains, expanding the possibilities for developers and users alike.

As the demand for cross chain interoperability grows, we can expect to see more sophisticated cross chain solutions that prioritize security, scalability, and ease of use, paving the way for a more integrated and robust blockchain ecosystem.

FAQs Section

What Are Cross Chain Bridges?

Cross chain bridges are tools designed to connect different blockchain networks, allowing the seamless transfer of digital assets and data between them. They enable blockchains like Ethereum, Binance Smart Chain, and Solana to communicate and exchange value, solving the problem of network isolation.

How Do Cross Chain Bridges Work?

Cross chain bridges utilize smart contracts and cross chain messaging protocols to securely transfer assets from a source chain (e.g., Ethereum) to a destination chain (e.g., Binance Smart Chain). The bridge locks the tokens on the source chain and mints equivalent tokens on the destination chain, ensuring the total supply remains balanced across networks.

What Are the Risks of Using Cross Chain Bridges?

The main risks include bridge hacks, where attackers exploit security loopholes to steal funds, and vulnerabilities in security protocols that can lead to loss of assets. Technical failures or errors in arbitrary data messaging capabilities can also disrupt the transfer process, resulting in asset imbalance or loss.

Sidebar rates

HFM

wgt-lc-defi

- DeFi Lending

- DeFi Yield Farming

- AMM (Automated Market Maker)

- DEX

- Cross Chain Bridges

- Crypto Options

- Tokenized Bonds

- Crypto Derivatives

- On-chain synthetic Assets

- Cryptocurrency Perpetuals

- Cryptocurrency Staking

- Cryptocurrency Total Locked Value (TVL)

- Impermanent loss

- Rebase Token

- Decentralized Autonomous Organization

- Decentralized Application

- Gas Fees

- Liquidity Pools

- Cryptocurrency Tokenomics

- Pegged Stablecoins