What are Tokenized Bonds?

Last Update: November 28th, 2024

A bond is a fixed-interest financial instrument representing a debt agreement between an investor and a borrower.

It includes details like interest rates and a repayment schedule. Tokenized bonds, on the other hand, are digital representations of bonds on a blockchain.

These bonds automate terms through smart contracts, offering benefits such as increased liquidity, 24/7 accessibility, and the elimination of intermediaries. The tokenization process secures data by converting it into cryptographic characters, making tokenized bonds transferable and storable on blockchain networks.

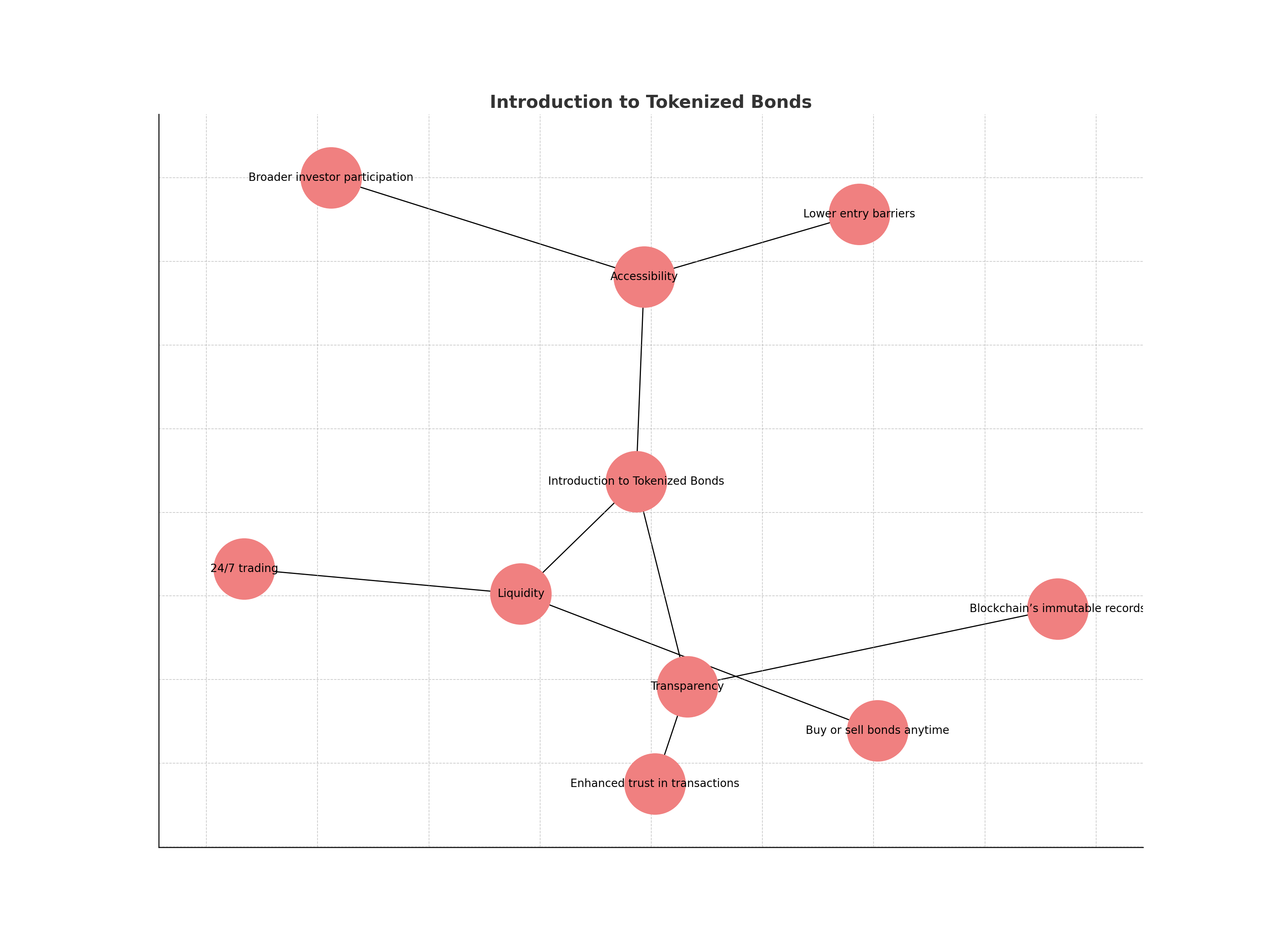

Introduction to Tokenized Bonds

Tokenized bonds bring innovation to the traditional bond market by combining fixed-income securities with blockchain technology. This process involves digitizing and fractionalizing bonds, enabling smaller investors to own fractions of high-value bonds.

Key advantages include:

- Accessibility: Broader investor participation by lowering entry barriers.

- Transparency: Blockchain’s immutable records enhance trust in transactions.

- Liquidity: 24/7 trading allows bonds to be bought or sold anytime.

For instance, a previously illiquid $10,000 bond could now be fractionalized into smaller, affordable units, making it accessible to a larger audience. This evolution is reshaping the bond market into an inclusive and efficient ecosystem.

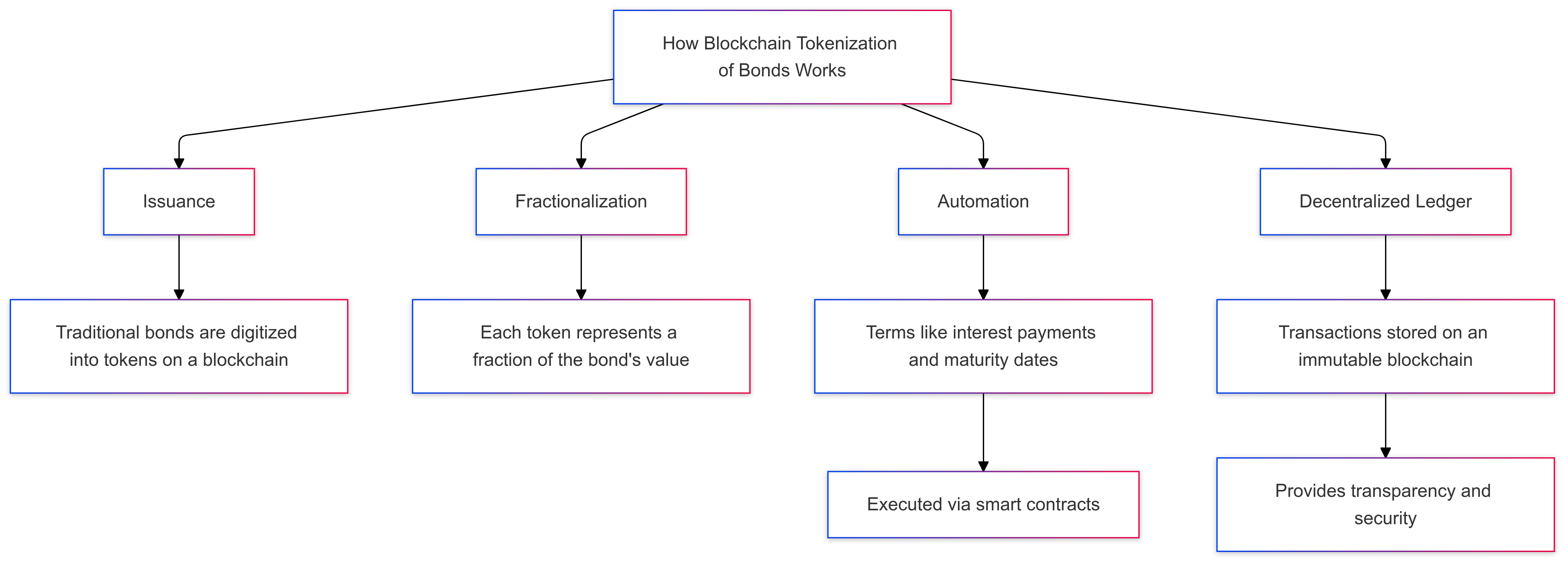

How Blockchain Tokenization of Bonds Works

Tokenized bonds represent ownership through blockchain-hosted tokens.

Here’s how it works:

- Issuance: Traditional bonds are digitized into tokens on a blockchain.

- Fractionalization: Each token represents a fraction of the bond’s value.

- Automation: Terms like interest payments and maturity dates are executed via smart contracts.

- Decentralized Ledger: Transactions are stored on an immutable, transparent blockchain.

Example: A $1,000 bond can be divided into 100 tokens worth $10 each. Smart contracts automatically execute interest payments and handle transfers. This eliminates the need for middlemen while improving transparency and security.

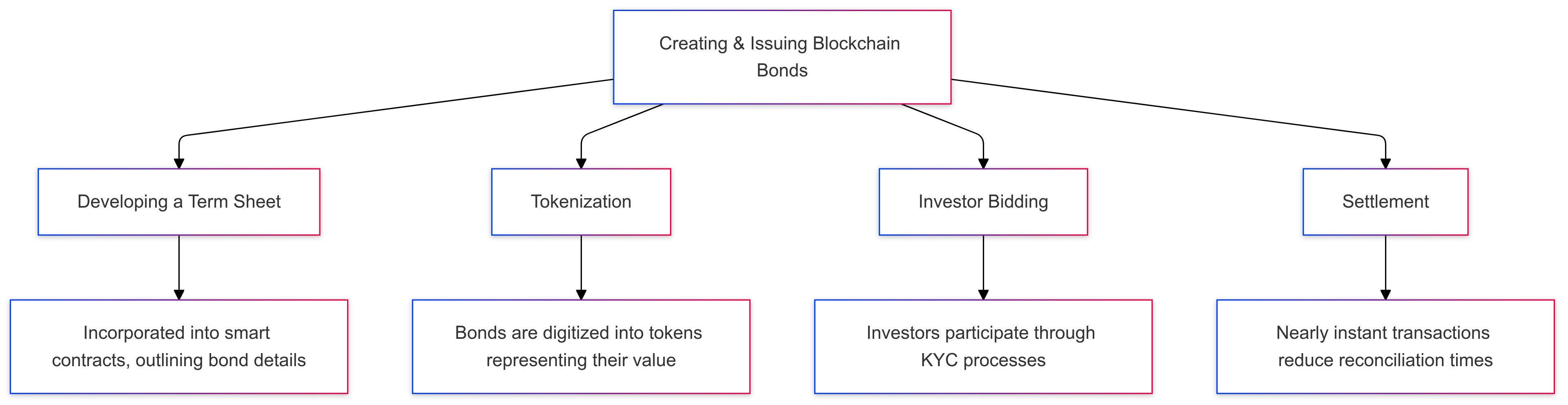

Creating & Issuing Blockchain Bonds

The creation and issuance of blockchain bonds involve leveraging blockchain technology to digitize and automate traditional bond processes. Here’s a breakdown of the steps:

Steps to Create and Issue Blockchain Bonds

Developing a Term Sheet:

- The issuer drafts a detailed term sheet that outlines the bond’s features, including maturity, coupon rate, and repayment schedule.

- Example: A company issuing a $10 million bond with a 5% annual coupon rate incorporates these terms into a smart contract to ensure automation.

Tokenization:

- The bond is digitized into tokens that represent fractional ownership.

- Example: A $1,000 bond can be tokenized into 1,000 tokens, each worth $1, allowing smaller investors to participate.

Investor Bidding:

- Investors bid for tokens through platforms requiring Know-Your-Customer (KYC) verification to ensure compliance with anti-money laundering (AML) regulations.

- Example: An institutional investor bids for 50% of the bond tokens, while retail investors bid for smaller fractions.

Settlement:

- Transactions are executed almost instantly through blockchain, reducing reconciliation times to minutes instead of days.

- Example: Once tokens are purchased, they are directly deposited into the investors’ digital wallets, and funds are transferred to the issuer.

Features of Blockchain Bonds:

Real-Time Settlement:

- Smart contracts automate coupon payments and maturity payouts.

- Example: Quarterly coupon payments of $25 for a $1,000 bond are automatically credited to investors’ wallets without manual intervention.

Accessibility:

- Bonds can be traded 24/7 on decentralized exchanges or OTC platforms.

- Example: An investor needing liquidity can sell part of their bond tokens on a decentralized exchange at any time.

Cost Efficiency:

- Blockchain eliminates traditional intermediaries like custodians and clearinghouses, significantly reducing costs.

- Example: A bond issuance saves up to 30% in administrative fees by cutting out intermediaries.

Challenges in Blockchain Bond Issuance

- Regulatory Hurdles:

- The lack of standardized regulations for tokenized bonds in many jurisdictions creates uncertainty.

- Example: In countries like the U.S., tokenized bonds must comply with SEC guidelines, but similar frameworks are absent in emerging markets.

- Adoption Barriers:

- Significant investment in technology and infrastructure is required to scale blockchain-based bond issuance.

- Example: Smaller financial institutions may struggle to adopt blockchain systems due to high initial costs and lack of expertise.

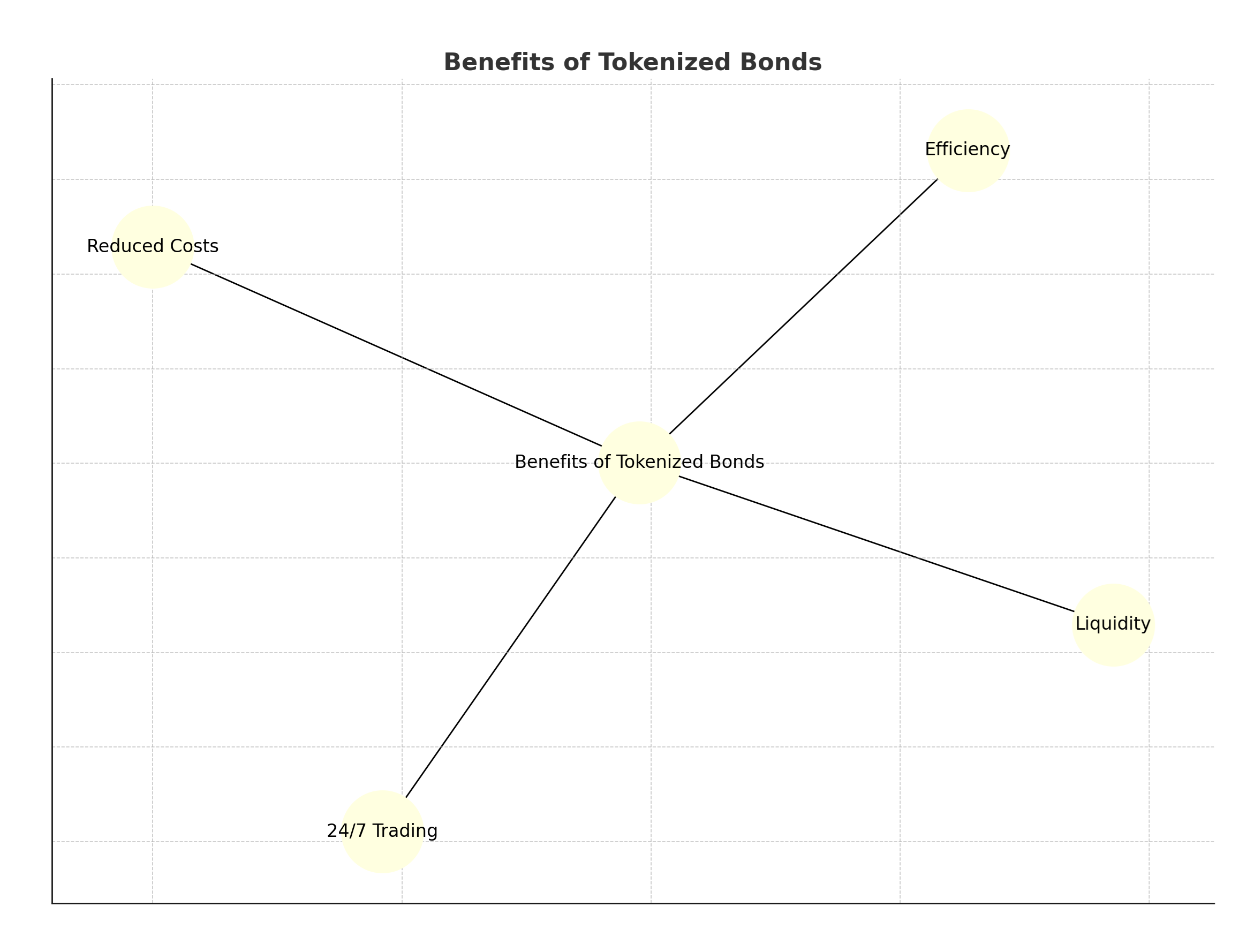

Benefits of Tokenized Bonds

Tokenized bonds offer several benefits over traditional bonds. Tokenized bonds offer transformative benefits that address many limitations of traditional bonds, making them more accessible and efficient for a wider range of investors.

- Increased Liquidity

- Fractional Ownership: Tokenized bonds enable investors to buy or sell smaller portions of bonds, lowering the capital barrier to entry.

- Example: An investor holding $500 worth of a tokenized bond can sell $50 worth of tokens instantly, ensuring liquidity without waiting for lengthy settlement processes.

- 24/7 Trading

- Unlike traditional bonds, which are limited to specific market hours, tokenized bonds can be traded anytime, ensuring greater flexibility for global investors.

- Real-World Scenario: An investor in Asia can trade tokenized bonds during hours when traditional U.S. bond markets are closed, leveraging time zone differences.

- Cost Reduction

- Smart Contracts: Automation of processes like interest payments and bond redemption eliminates the need for intermediaries, significantly reducing administrative costs.

- Comparison: Traditional bonds require custodial services and manual reconciliations, adding layers of fees that tokenized bonds avoid.

- Operational Efficiency

- Blockchain streamlines operations by ensuring real-time settlement and transparency in transactions.

- Example: A quarterly coupon payment is executed automatically via a smart contract, directly crediting the investor’s wallet without delays or manual intervention.

Example: An investor holding $500 worth of a tokenized bond can sell a fraction of it for $50 without waiting for traditional settlement periods, ensuring quick liquidity.

Blockchain Bonds vs. Traditional Bonds

| Feature | Blockchain Bonds | Traditional Bonds |

|---|---|---|

| Issuance Process | Quick and automated | Lengthy and manual |

| Intermediaries | Eliminated | Required |

| Transparency | Immutable ledger | Prone to asymmetry |

| Settlement Time | Real-time | Several days |

| Trading Hours | 24/7 | Limited to market hours |

The decentralized nature of blockchain bonds reduces inefficiencies and enhances investor savings, making them a disruptive force in the financial industry.

Bitcoin Bonds

Bitcoin bonds are tokenized bonds issued on a blockchain network. These bonds are automated, offering low transaction costs and simplified coupon management. Although still experimental, Bitcoin bonds demonstrate the potential for integrating cryptocurrencies into traditional financial instruments.

Example: A Bitcoin bond issuer automates interest payments through smart contracts, enabling seamless transactions without third-party involvement.

Ethereum Bonds

Ethereum bonds leverage Ethereum’s blockchain and smart contract capabilities. Notable examples include:

- European Investment Bank: Issued a €100 million two-year blockchain bond in 2021.

- World Bank’s Bond-i: A blockchain-based bond developed using Ethereum.

Ethereum’s growing role in decentralized finance (DeFi) is expected to further influence the bond market, enabling direct transactions and lower costs.

The Future of the Bond Market

The adoption of tokenized bonds signals a transformative shift in the bond market:

- Integration with DeFi Platforms: Enabling lending, borrowing, and trading within decentralized networks.

- Smart Contract Automation: Reducing paperwork and ensuring real-time settlements.

- Broader Investor Participation: Democratizing access to high-value bonds.

As regulatory frameworks evolve and blockchain technology matures, tokenized bonds are likely to become a mainstream investment option.

Market Risks and Challenges

Despite their benefits, tokenized bonds face notable challenges:

- Market Volatility: Fluctuating prices can impact bond stability.

- Regulatory Ambiguity: Slow adoption of blockchain policies creates uncertainty.

- Security Risks: Vulnerability to hacking and fraud remains a concern.

Mitigation Strategies:

- Conduct thorough due diligence before investing.

- Stay updated on regulatory developments.

- Work with secure, compliant platforms.

Regulatory Environment

A clear regulatory framework is crucial for the growth of tokenized bonds. Current efforts focus on:

- Defining standards for issuance and trading.

- Ensuring compliance with anti-money laundering (AML) and KYC requirements.

Example: Regulatory advancements in countries like Switzerland and Singapore are paving the way for tokenized financial instruments, fostering trust and stability in the market.

FAQs: Tokenized Bonds

1. What are tokenized bonds?

Tokenized bonds are digital representations of traditional bonds hosted on a blockchain. They utilize smart contracts to automate terms, improve liquidity, provide 24/7 accessibility, and eliminate intermediaries, making the bond market more efficient and inclusive.

2. How does tokenization of bonds work?

Tokenization involves converting traditional bonds into digital tokens hosted on a blockchain. These tokens represent fractional ownership and are governed by smart contracts that automate processes like interest payments, record-keeping, and compliance, ensuring transparency and security.

3. What are the benefits of tokenized bonds?

- Increased Liquidity: Fractional ownership enables easier trading and portfolio diversification.

- 24/7 Accessibility: Investors can trade anytime without restrictions.

- Reduced Costs: Smart contracts minimize administrative and intermediary fees.

- Enhanced Transparency: Blockchain provides a secure, immutable ledger of transactions.

4. How do tokenized bonds differ from traditional bonds?

- Traditional Bonds: Require intermediaries, involve lengthy settlement processes, and have limited trading hours.

- Tokenized Bonds: Eliminate intermediaries, offer near-instant settlements, and operate on a blockchain for 24/7 trading.

5. What are Bitcoin and Ethereum bonds?

- Bitcoin Bonds: Tokenized bonds issued on a blockchain, automated for low-cost transactions.

- Ethereum Bonds: Tokenized bonds leveraging Ethereum’s smart contracts, allowing payments in cryptocurrencies and supporting decentralized applications.

6. What challenges do tokenized bonds face?

- Regulatory Uncertainty: Laws governing tokenized bonds are still evolving.

- Market Risks: Volatility and liquidity fluctuations can impact value.

- Security Concerns: Potential vulnerabilities to hacking and fraud.

7. What is the future of tokenized bonds?

Tokenized bonds are expected to revolutionize the bond market by integrating with decentralized finance (DeFi) platforms. Smart contracts will streamline financial processes, making bond trading more efficient and accessible to a wider range of investors.

8. Are tokenized bonds safe investments?

While they offer transparency and efficiency, tokenized bonds carry risks like market volatility and cybersecurity threats. Investors should conduct thorough research, assess risks, and stay updated on regulatory developments to make informed decisions.

9. Can tokenized bonds be traded on exchanges?

Yes, tokenized bonds can be traded on digital asset exchanges and decentralized platforms, enhancing liquidity and market access compared to traditional bonds.

10. How do regulatory frameworks affect tokenized bonds?

Clear regulatory guidelines are essential for fostering trust and widespread adoption of tokenized bonds. Investors should work with platforms that comply with emerging regulations to ensure secure and legitimate transactions.

Sidebar rates

HFM

wgt-lc-defi

- DeFi Lending

- DeFi Yield Farming

- AMM (Automated Market Maker)

- DEX

- Cross Chain Bridges

- Crypto Options

- Tokenized Bonds

- Crypto Derivatives

- On-chain synthetic Assets

- Cryptocurrency Perpetuals

- Cryptocurrency Staking

- Cryptocurrency Total Locked Value (TVL)

- Impermanent loss

- Rebase Token

- Decentralized Autonomous Organization

- Decentralized Application

- Gas Fees

- Liquidity Pools

- Cryptocurrency Tokenomics

- Pegged Stablecoins