Keeping a Trading Journal

Last Update: July 15th, 2019

Why do you need a trading journal?

A trading journal enables you to look back at your trading history and see what you did wrong and what you did right, highlighting the trading mistakes. By keeping a journal, you can see if you have a tendency to enter or exit trades too early or too late, if you overtrade, if your position sizes are too big etc. This allows you to change the things you haven´t done right. This way you can improve your discipline – and we know that this is a great virtue. As a trader, you shouldn´t let your emotions take over.

You may ask why it is important to keep a journal when you have all your trades in the account history section of your platform. This is because a trading journal is much more than the pairs you trade and the prices you entered and exited. By the way, the journal section that the MT4 and the MT5 have recently added is not a journal of your trades; it is a journal of the platform actions.

Improving your strategy

When I keep a trading journal I also register the strategy that I use for every trade. Personally, I use several strategies because one strategy cannot work in every scenario or trade setup. I use the news trading strategies when there are important news releases – such as the knee jerk reaction when the price makes an initial move based on headline numbers or the fade strategy when the initial move fades and the price pulls back. There are times when the headline really does move the price so the knee jerk reaction strategy works well. One occasion was the ECB QE announcement in February 2015 which sent the Euro about 400 pips down in a few hours. But there are also times when the headline doesn´t move the price and a currency declines after a small gain even though the data was great.

Learn more about Trading the News – Forex Trading Strategies

In September 2015 the USD kept declining even though most of the data posted positive numbers. On this occasion, it´s better to use the fade strategy. After looking at the trading journal at the end of the first week in September to review my strategy, I saw that the price was ignoring the numbers. The USD declined 70-80 pips after making small gains when the US data was positive, so I decided to use the fading strategy and the results improved, ending September with a 386 profit. Had I not looked at my trading journal and kept using the same knee-jerk strategy, I would have been in red by the end of the month.

Overtrading

Knowing whether you are overtrading is not as simple as it seems. As we said above, a trader can use different strategies such as short-term trading or scalping. When you are scalping, 15 trades a day doesn´t necessarily mean you are overtrading. You open and close the position for several pips within minutes, so a scalping strategy might even produce 30-40 signals a day. The problem is when you use normal strategies, keeping the positions open for hours and days, and still have a high number of trades.

If your trading journal shows that the trades are daily, midterm and long term and you still have 10-15 trades a day then you are definitely overtrading because you are keeping at least 8-10 positions open at the same time. When you are doing that you cannot concentrate and properly evaluate the market. As we know, the market changes constantly and we need to analyze it often in order to manage the open positions. A trading journal shows how long your trades last, which strategy they´re based on and the number of daily trades. If you are overtrading, it will definitely be noted in the journal.

Account history functions

Apart from helping you improve the aspects of your trading, you can use the journal as a performance statistic. The account history registers all your trades, the pairs you have traded, the opening and closing times, and the trade size. You can use this information to see your performance. You can check it to see which pairs you are more successful with and which ones you keep having losing trades in.

Some pairs such as GBP/JPY and EUR/AUD are more volatile than others and some are less volatile, such as USD/JPY and CHF/USD. Some traders perform better when they trade the less volatile pairs while others have a higher winning rate in the more volatile ones. In the trading journal, you can see if you are a volatility trader or not. You can avoid trading the less volatile pairs if your journal shows that you perform better with the less volatile pairs. You can check which session or time of day has the highest number of winning trades and stick to trading only on that session. Some traders only trade on the London session until 14:00 GMT when the US opens because they find it is easier to read the price action with only one market open.

Notes

I often write notes in addition to the trades on the journal when I think that I did something wrong or when I don´t stick to the trading plan and the strategy. For instance, I write a small note when I exit from a trade too early and I didn’t wait for the price to reach the take profit or the stop loss target according to the strategy. Sometimes it´s wise to exit early with a small profit when you think the market is reversing, or get out with a small loss if you think the market is headed towards your stop loss target. But you should also stick to your strategy and analysis.

In a trading journal you can register the amount of pips you win and lose and the pips that you would have won/lost if you stuck to the strategy. If you see that you would have made more pips at the end of the week/month with a strict strategy then you should avoid premature exits. If not, then maybe you should exit early more often or review your strategy.

You can register the missed opportunities as well. Sometimes I hesitate too long and miss trades which would have resulted in a nice profit, as well as other trades which would have ended up in a loss. You can check at the end of the week/month to see if you would have made a bigger profit had you taken these trades. If you would, then you should not hesitate too long and jump the trigger.

As you can see, keeping a trading journal is pretty simple and it helps you improve a lot as a trader. All your failures and successes are recorded, so you can check them and do a regular appraisal of yourself. It´s better to look at your failures in the face and manage to avoid them next time than to ignore and repeat them time after time. According to the trading journal you can improve or change your trading strategy, stop overtrading and avoid all sorts of mistakes. This way you can become a disciplined trader which is the only way to make it in the long run in this business.

There are several rules which a forex trader must follow in order to be successful. We have covered most of these rules in our forex strategies section and they include: creating a trading plan, money management, how to read and trade the price action etc. But there is another very important rule that helps you evolve and become a professional trader. That is keeping your trading journal.

A trading journal is just like a diary; you record all trades and their specifics. You must make it your habit to keep one because it helps you identify your weaknesses, mistakes, and strengths. This way you can eliminate or at least minimize these. In my first year of trading, I didn´t keep a journal of my trades even though I was new and trading was hard, obviously. I guess I didn´t want to acknowledge my weaknesses and mistakes and, therefore, kept making them. I only got rid of them when I started registering all my trades and their details. Since then, my trading has only gotten better. But how do you keep a trading journal and why exactly do you need it?

How to keep a trading journal

Keeping a trading journal is not complicated; you register each and every trade statistic. You can do this in an excel sheet. Place the date of the trade, (in order to see which days you are most successful), and the opening and closing time (to see if you have a favorite session). Then you record the entry price, the take profit price, the stop loss price and the closing price to see if your targets are too narrow or too wide, the position size and the profit/loss. These are the basics.

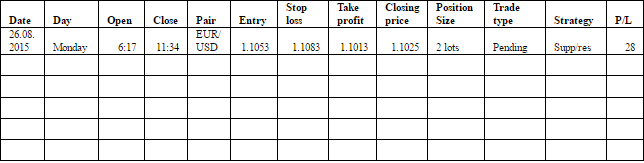

I choose to add other sections such as strategy (the strategy the trade is based on) and notes (small notes about trade specifics). I also add the trade type, to see whether I am most successful with pending orders or market execution orders. Below, you have an example of a trading journal (empty and filled).

Trading Journal Template

Date: ____________

Day: ____________

Time the trade open: ____________ and closed: ____________

Currency pair: _____________

Entry price: _____________

Stop loss price: _____________

Take profit price: _____________

Closing price: _____________

Position Size: _____________

Strategy: _____________

Trade type: _____________

P/L: _____________

Notes: _____________

Trading Journal Example

Date: 26.08.2015

Day: Monday

Time of the trade Open: 06:17 Close: 11:34

Currency pair: EUR/USD

Entry price: 1.1053

Stop loss price: 1.1083

Take profit price: 1.1013

Closing price: 1.1025

Position Size: 2 lots

Trade type: Pending

Strategy: Support/resistance

P/L: +28

Notes: Closed manually prematurely