Live Forex Signals

Full access to Signal Reports

FOREX SIGNALS HIGHLIGHTS 2025

In early 2025, the U.S. dollar (USD) has experienced a notable decline, reaching a five-month low against major currencies. This depreciation is largely attributed to President Donald Trump's economic and trade policies, which have diminished the dollar's traditional safe-haven appeal. In contrast, currencies like the euro (EUR) and the Japanese yen (JPY) have strengthened. The euro's rise is supported by increased defense and infrastructure spending in Europe, while the yen benefits from higher Japanese interest rates and its status as a safe-haven currency.

Analysts anticipate that the EUR/USD pair will fluctuate between 1.05 and 1.12 in early 2025, with a potential year-end target of 1.12. Investors focusing on income may find opportunities in selling the risk of EUR/USD and GBP/USD declines or USD/CHF gains, though it's essential to remain mindful of the inherent risks associated with options trading.

Cryptocurrency Market Trends

The cryptocurrency market has continued its bullish trajectory into 2025. Bitcoin (BTC) has surpassed the $100,000 mark, with projections suggesting it could reach $185,000 by the end of the year. This surge is driven by increased institutional adoption, favorable regulatory developments, and the approval of spot Bitcoin ETFs in the United States.

Ethereum (ETH) has also shown significant growth, with staking rates expected to exceed 50% by the end of 2025. The broader cryptocurrency market is projected to reach a valuation of $5 billion by 2030, reflecting a compound annual growth rate (CAGR) of 15.4% from 2024 to 2030.

Commodity Markets

Gold prices have reached unprecedented levels, surpassing $3,000 per ounce for the first time. This surge is attributed to rising geopolitical tensions, economic uncertainty, and a weakening USD, prompting investors to seek safe-haven assets.

Stock Markets and Indices

Global stock markets have experienced mixed performance in early 2025. While some indices have rallied due to increased government spending and infrastructure projects, others have faced headwinds from geopolitical tensions and trade uncertainties. Investors are advised to monitor fiscal policies and geopolitical developments closely, as these factors are expected to influence market dynamics throughout the year.

Conclusion

The financial landscape in 2025 is characterized by significant shifts across forex, cryptocurrency, commodity, and stock markets. Traders and investors should remain vigilant, adapting their strategies to navigate the evolving economic environment effectively.

Ethiopia’s Stock Exchange Raises $26.6M, Doubles Capital Target

IMF Cuts U.S. GDP by 0.9% for 2025—Trump Tariffs to Blame?

OUTsurance Share Price Eyes ZAR 7,674—ROE at 32%, But What’s Next?

Aspen Pharmacare Shares Crashes 33% on R2.77B Shock—Here’s What Happened

JSE Up 0.45%—Shares Rally as Capitec Delivers, Rand Firms

Pepe Coin Breakout—7,220% Surge Ahead?

AMZN Rebounds: Bull Run Resuming for Amazon Stock?

Long/Short Term Signals

Non-fx Signals

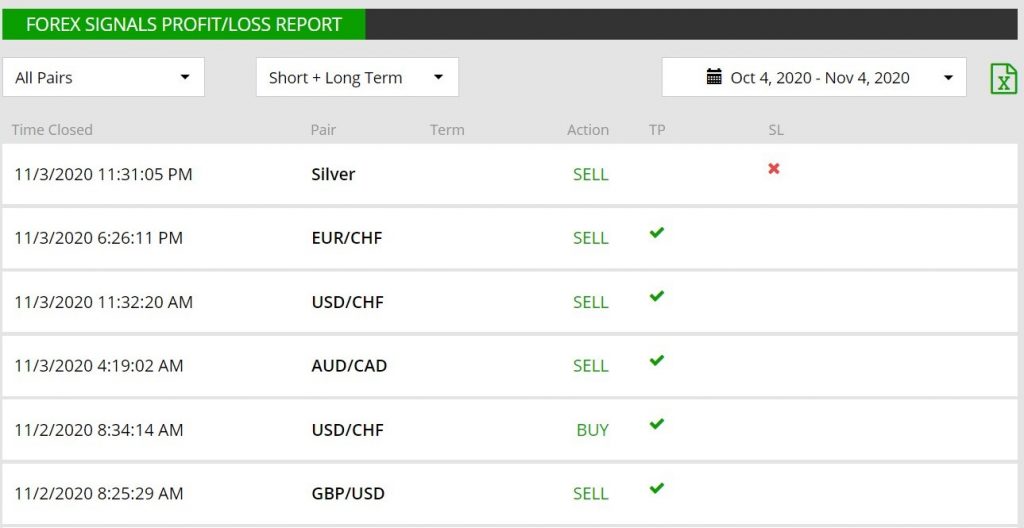

Forex Signals Profit/Loss Report

Trading Alerts

Signals News and Analysis

Forex Economic Calendar

What Are Forex Signals?

How to Use Our Forex Signals?

How to Make the Most of Forex Signals?

Automated vs. Manual Forex Signals

Our signals are managed manually since they are created by our experienced analysts who apply different manual trading strategies to the markets. This is opposed to other signal providers whose signals are generated automatically.

There are pros and cons for both services which we explain in our “Forex Signals - Auto vs. Manual” article. We prefer manual signals as we see more value in human intelligence than in artificial intelligence. Automated vs. Manual Forex Signals

Our signals are managed manually since they are created by our experienced analysts who apply different manual trading strategies to the markets. This is opposed to other signal providers whose signals are generated automatically.

There are pros and cons for both services which we explain in our “Forex Signals - Auto vs. Manual” article. We prefer manual signals as we see more value in human intelligence than in artificial intelligence. Automated vs. Manual Forex SignalsHow to Choose the Best Forex Signals Provider?

Forex Signals for Technical Traders

Forex Signals for Scalping

"Great work guys and I can confirm that I rode at least 300 of those 800 pips of profits which your trading signals spotted over the last 2 days. It was great for my account. I just need to know how on earth you guys manage it?"Frank Carlini , Canada

"I've traded with your free Forex signals for almost a month now and so far so good. It is the first time that i copy forex signals, and honestly, it is so much better than trading by myself. I am actually enjoying it. I could not believe that someone was giving away free signals that actually worked! I thought there had to be a catch, but to my amazement they do work and for the first time I will more than likely open up a real account because of you. Keep up the good work"Siddhart Mohan , South Africa

"I came across fxleaders.com and started following your trading signals. I could not believe that such great performing signals were totally free! I am thankful for this service & support. Services as yours are really helpful for newbies like me. Highly recommended!"Silvio Bucheli , Italy

"Looks like there are some great minds behind your fx signals watching closly those candlesticks, always getting the job done. thank you!"Eliud, Kenya

"Great work guys, I am going to get a premium account... Thanks for the best signal."Kawsar Ahamed, Bangladesh

Faq

As a trade recommendation, the information and details such as the Buy/Sell action, the Opening Price, the Take Profit and Stop Loss targets and the Opening Time are specified well, which you can follow very easily when trading. But, you are not obligated to follow the instructions precisely as received. Signal receivers are also traders themselves and when there’s potential for more profit, they can also move the take profit target further to maximize profits.They can also move the stop loss, to nurse their trades, close their trades whenever they want or even not follow the signal at all, if markets have changed too fast.

A signals service is a provider who offers forex signals, issued either by professional forex traders and analysts or by an automated trading software. Some forex signal services provide free signals, while others offer them for a fee.

The best depends mostly on performance, so the providers with the most profit are usually preferred. But, always after testing their performance, to see if it meets the results they claim. FX Leaders is one of the most popular analysis and forex signals provider, empowered by a team of experienced analysts who utilize a variety of skills and strategies and are worth following for trade recommendations. In addition, different other factors also take their weight in the total score card for a good signal provider. The option and the time you receive the message after the trade is open are important. The risk factor as well, because some signal providers open too many signals and place quite large stops. This increases the risk. Automated trading signals might be good at certain times, but they can’t read fundamentals, epidemics, OPEC decisions, politics, etc, when the potential for profit is immense. So, you have to combine all these factors to see what signal providers are best.

GET ALERTS

GET ALERTS