10 Best Skrill Forex Brokers

The 10 Best Skrill Forex Brokers revealed. Skrill is a payment method that has become a staple for most forex traders and brokers due to its speed, convenience, and security.

With so many brokers offering this payment method for deposits and withdrawals, choosing the right option can be tricky.

In this in-depth guide, you’ll learn:

✅What is Skrill, and Why is It so Popular?

✅Who are the 10 Best Skrill Forex Brokers?

✅What are the Advantages of Using Skrill with Forex Brokers?

✅Our Conclusion on The 10 Best Skrill Forex Brokers

✅Popular FAQs about The 10 Best Skrill Forex Brokers

And much, MUCH more!

10 Best Skrill Forex Brokers – a Comparison

| 🔍 Broker | 🚀 Open an Account | 💵 Minimum Deposit | 🫴🏻 Offers Skrill |

| 🥇 FxPro | 👉 Click Here | 100 USD | ✅ Yes |

| 🥈 Exness | 👉 Click Here | Depending on Payment System | ✅ Yes |

| 🥉 AvaTrade | 👉 Click Here | 100 USD | ✅ Yes |

| 🏅 HFM | 👉 Click Here | 0 USD to open Account. 5 USD on Skrill | ✅ Yes |

| 🎖️ Axiory | 👉 Click Here | 10 USD | ✅ Yes |

| 🏆 FXTM | 👉 Click Here | 10 USD | ✅ Yes |

| 🥇 IC Markets | 👉 Click Here | 200 USD | ✅ Yes |

| 🥈 XM | 👉 Click Here | 5 USD | ✅ Yes |

| 🥉 Vantage Markets | 👉 Click Here | 50 USD | ✅ Yes |

| 🏅 FXCM | 👉 Click Here | 50 USD | ✅ Yes |

10 Best Skrill Forex Brokers (2024)

- ☑️FxPro – Overall, The Best Skrill Forex Broker

- ☑️Exness – Best CFD Broker

- ☑️AvaTrade – Excellent Customer Fund Security

- ☑️HFM – Offers a Quick, Safe, and Flexible Payment Option

- ☑️Axiory – Most Secure Broker

- ☑️FXTM – Excellent Low Spreads

- ☑️IC Markets – Standard and Raw Spread accounts

- ☑️XM – Popular Forex and CFD Broker

- ☑️Vantage Markets – Best Professional Trading App

- ☑️FXCM – Best Forex Trading Platform

What is Skrill, and Why is It so Popular?

Skrill is a market leader in digital payments, providing a user-friendly experience distinguished by simplicity, security, and fast transactions.

Unlike conventional banking systems, Skrill provides investors with a digital wallet that makes online transactions easier.

Furthermore, Skrill’s appeal comes from its powerful infrastructure, which supports various major currencies and allows for smooth, frictionless global transactions between traders and brokers, deposits, and withdrawals.

Skrill’s popularity also stems from its user-friendly interface and minimal deposit and withdrawal fees, making it a popular option among online traders, investors, freelancers, and enterprises worldwide.

Furthermore, this payment provider prioritizes security using powerful encryption technologies that protect user payments and personal data.

Overall, this unique and robust combination of simplicity, speed, and security differentiates Skrill from other online payment methods, ushering in a new age of financial transactions for the investment world.

FxPro

FxPro stands out in the forex brokerage market by partnering with Skrill as a deposit and withdrawal option for traders. This partnership simplifies financial transactions, demonstrating FxPro‘s commitment to creating user-friendly platforms.

By allowing traders to deposit and withdraw money quickly, FxPro capitalizes on market movements and ensures security through modern encryption and methods.

Furthermore, the FxPro and Skrill partnership appeals to traders globally, offering support for multiple currencies and a simpler approach for foreign traders to manage their FxPro trading accounts and funds.

| 💵Minimum Deposit | 100 USD |

| ⌛Regulation | FCA, CySEC, SCB, FSCA, FSC |

| ⏱️Starting spread | None |

| 💴Minimum Commission per Trade | $7 Round turn on Forex |

| 💷Decimal Pricing | 5th decimal after the comma |

| ➡️Margin Call | 100% |

| 🛑Stop-Out | 50% |

| 👉Are funds kept in segregated accounts? | ✅ Yes |

| 🫴🏻Offers Investor Protection/Insurance? | ✅ Yes, up to 20,000 EUR |

| 🚀 Open an Account | 👉 Click Here |

Deposit and Withdrawal Information

| 💳Deposit and Withdrawal Options | Bank Transfers Credit/Debit Cards Neteller PayPal Skrill UnionPay |

| ⏰Minimum Deposit Time on Skrill | Instant |

| ⏱️Maximum Deposit Time on Skrill | Instant |

| ⏰Minimum Withdrawal Time On Skrill | 1 day |

| ⏱️Maximum Withdrawal Time on Skrill | 1 day |

| 💵Skrill Deposit Currencies | USD, EUR, GBP, CHF, PLN, AUD, JPY, ZAR |

| 💷Skrill Deposit Fees | No internal fees from FxPro |

| 💶Skrill Withdrawal Fees | No internal fees from FxPro |

Pros and Cons FxPro

| ✅ Pros | ❌ Cons |

| Skrill deposits with FxPro are instant | Withdrawal limits might apply |

| FxPro does not charge internal fees on Skrill deposits or withdrawals | Skrill might apply processing fees |

| FxPro offers several security measures on deposits and withdrawals | Traders have to undergo strict KYC processes before they can deposit or withdraw funds with FxPro |

Exness

Exness is a world-renowned forex and CFD broker that offers quick and secure deposits and withdrawals through Skrill. Skrill’s integration with Exness ensures traders can transfer funds securely with minimal processing times.

Furthermore, Exness is committed to protecting client funds by keeping all deposits in segregated accounts with top-tier banks. By integrating Skrill, Exness shows traders it is committed to ensuring they can easily manage their trading accounts and funds.

| 💵Minimum Deposit | Depending on the payment system, typically, low |

| ⌛Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA |

| ⏱️Starting spread | 0.0 pips EUR/USD |

| 💴Minimum Commission per Trade | From $0.1 per side, per lot |

| 💷Decimal Pricing | 5th decimal pricing after the comma |

| ➡️Margin Call | 60% |

| 🛑Stop-Out | 0% |

| 👉Are funds kept in segregated accounts? | ✅ Yes |

| 🫴🏻Offers Investor Protection/Insurance? | ✅ Yes, 20,000 EUR per eligible client |

| 🚀 Open an Account | 👉 Click Here |

Deposit and Withdrawal Information

| 💳Deposit and Withdrawal Options | Capitec Pay Bank Cards Internet Banking (EFT) Skrill Neteller Perfect Money SticPay OZOW |

| ⏰Minimum Deposit Time on Skrill | 30 minutes |

| ⏱️Maximum Deposit Time on Skrill | 30 minutes |

| ⏰Minimum Withdrawal Time On Skrill | 24 hours |

| ⏱️Maximum Withdrawal Time on Skrill | 24 hours |

| 💵Skrill Deposit Currencies | Multi-currency |

| 💷Skrill Deposit Fees | None charged by Exness |

| 💶Skrill Withdrawal Fees | None charged by Exness |

Pros and Cons Exness

| ✅ Pros | ❌ Cons |

| Skrill deposits are processed within 30 minutes, and withdrawals are within 24 hours | Not all traders have access to Skrill deposits and withdrawals |

| Exness offers multi-currency deposits and withdrawals | There might be caps on transactions |

| Exness offers investor protection of up to 20,000 EUR to eligible traders | There are tedious and stringent verification processes |

AvaTrade

AvaTrade is dedicated to providing a seamless and efficient trading experience. Furthermore, this is bolstered by its collaboration with Skrill, which streamlines deposit and withdrawal procedures.

By partnering with payment gateways like Skrill, AvaTrade shows its commitment to supporting fast and flexible financial transactions, allowing traders to engage in global markets effortlessly.

Furthermore, AvaTrade is well-known for its customer fund security and assets by following rigorous regulatory rules and using modern encryption technology to secure investments and personal information.

| 💵Minimum Deposit | 100 USD |

| ⌛Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| ⏱️Starting spread | 0.9 pips EUR/USD |

| 💴Minimum Commission per Trade | None; only the spread is charged |

| 💷Decimal Pricing | 5th Decimal after the comma |

| ➡️Margin Call | 50% on Retail |

| 25% on AvaOptions Accounts | |

| 🛑Stop-Out | 10% |

| 👉Are funds kept in segregated accounts? | ✅ Yes |

| 🫴🏻Offers Investor Protection/Insurance? | ✅ Yes, 20,000 EUR |

| 🚀 Open an Account | 👉 Click Here |

Deposit and Withdrawal Information

| 💳Deposit and Withdrawal Options | Bank Wire Transfer Credit/Debit Card PayPal WebMoney Neteller Skrill |

| ⏰Minimum Deposit Time on Skrill | 24 hours |

| ⏱️Maximum Deposit Time on Skrill | 48 hours |

| ⏰Minimum Withdrawal Time On Skrill | 24 hours |

| ⏱️Maximum Withdrawal Time on Skrill | 48 hours |

| 💵Skrill Deposit Currencies | USD, EUR, GBP, AUD |

| 💷Skrill Deposit Fees | None charged by AvaTrade |

| 💶Skrill Withdrawal Fees | None charged by AvaTrade |

Pros and Cons AvaTrade

| ✅ Pros | ❌ Cons |

| Skrill offers secure deposits and withdrawals | AvaTrade has limited deposit currencies |

| AvaTrade has a robust regulatory framework and long track record as a trusted broker | Skrill deposits and withdrawals are not instant with AvaTrade |

HFM

With HFM, traders can expect seamless integration with Skrill for fast and reliable transfer of funds. Skrill’s integration with this popular Forex and CFD broker demonstrates HFM’s commitment to offering a seamless trading experience.

This allows all retail and institutional traders to manage their assets effectively and react quickly to market opportunities.

Furthermore, beyond streamlined fund transfers, HFM emphasizes the security of its customers’ assets by adhering to high regulatory requirements and using modern encryption technology that safeguards personal information and client funds.

Overall, by adding Skrill, HFM increases its desirability by offering a quick, safe, and flexible payment option that accepts a variety of currencies, minimizing the chances of currency conversion fees.

| 💵Minimum Deposit | 0 USD to open an account, 5 USD on Skrill |

| ⌛Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| ⏱️Starting spread | 0.0 pips |

| 💴Minimum Commission per Trade | From $6 per round turn on Forex |

| 💷Decimal Pricing | 5th Decimal after the comma |

| ➡️Margin Call | Between 40% to 50% |

| 🛑Stop-Out | Between 10% and 20% |

| 👉Are funds kept in segregated accounts? | ✅ Yes |

| 🫴🏻Offers Investor Protection/Insurance? | ✅ Yes, 5 million EUR |

| 🚀 Open an Account | 👉 Click Here |

Deposit and Withdrawal Information

| 💳Deposit and Withdrawal Options | Bank Wire Transfer Electronic Transfer Credit Card Debit Card Skrill |

| ⏰Minimum Deposit Time on Skrill | Up to 10 minutes |

| ⏱️Maximum Deposit Time on Skrill | Up to 10 minutes |

| ⏰Minimum Withdrawal Time On Skrill | Up to 10 minutes |

| ⏱️Maximum Withdrawal Time on Skrill | Up to 10 minutes |

| 💵Skrill Deposit Currencies | Multi-currency according to region |

| 💷Skrill Deposit Fees | None applied by HFM |

| 💶Skrill Withdrawal Fees | None applied by HFM |

Pros and Cons HFM

| ✅ Pros | ❌ Cons |

| Deposits and withdrawals with HFM on Skrill are completed in 10 minutes | Skrill might impose processing fees |

| HFM has a low 5 USD minimum deposit on Skrill | Skrill might not be available to HFM traders in all regions |

| HFM does not apply any fees to Skrill deposits and withdrawals | Skrill relies on the internet connection, which could be a problem for traders in regions without a reliable connection |

Axiory

Axiory is an international offshore broker regulated by the IFSC in Belize, the FSC in Mauritius, and the reputable FCA in the United Kingdom. Axiory may offer limited deposit and withdrawal options but is integrated with Skrill.

This integration ensures that Axiory clients can easily manage and transfer funds between their bank and trading accounts. Furthermore, because of its FCA regulation, Axiory is held to the highest standards in terms of client fund security.

| 💵Minimum Deposit | 10 USD |

| ⌛Regulation | IFSC Belize, FSC Mauritius, FCA |

| ⏱️Starting spread | 0.13 pips |

| 💴Minimum Commission per Trade | $0.04 |

| 💷Decimal Pricing | 5th decimal pricing after the comma |

| 👉Margin Call | 50% |

| 🛑Stop-Out | 20% |

| ➡️Are funds kept in segregated accounts? | ✅ Yes |

| 🫴🏻Offers Investor Protection/Insurance? | ✅ Yes, 20,000 USD |

| 🚀 Open an Account | 👉 Click Here |

Deposit and Withdrawal Information

| 💳Deposit and Withdrawal Options | Credit Cards Debit Cards Bank Transfer Sticpay Neteller Skrill Vload Thunderxpay PayRedeem |

| ⏰Minimum Deposit Time on Skrill | Instant |

| ⏱️Maximum Deposit Time on Skrill | Instant |

| ⏰Minimum Withdrawal Time On Skrill | Instant |

| ⏱️Maximum Withdrawal Time on Skrill | Instant |

| 💵Skrill Deposit Currencies | EUR, USD |

| 💷Skrill Deposit Fees | None imposed by Axiory |

| 💶 ✅Skrill Withdrawal Fees | Axiory might charge fees |

Pros and Cons Axiory

| ✅Pros | ❌ Cons |

| Axiory allows for instant deposits and withdrawals using Skrill | There are limited deposit and withdrawal currencies with Axiory’s Skrill |

| Axiory imposes no deposit fees on Skrill | Axiory might apply fees to Skrill withdrawals |

FXTM

FXTM has partnered with Skrill to enhance its financial transactions system. The partnership demonstrates FXTM‘s commitment to providing user-friendly deposit and withdrawal procedures, ensuring customer money protection, and adhering to international regulations.

Furthermore, by integrating Skrill as a payment method for deposits and withdrawals, FXTM proves its commitment to providing a versatile, secure, and cost-effective option for fund transfers.

| 💵Minimum Deposit | 10 USD |

| ⌛Regulation | CySEC, FSCA, FCA, CMA, FSC Mauritius |

| ⏱️Starting spread | 0.0 pips, variable |

| 💴Minimum Commission per Trade | $0.40 to $2, depending on the trading volume |

| 💷Decimal Pricing | Forex – 5 decimals (3 on JPY pairs) Metals – 2 decimals for XAU/USD and 3 decimals for XAG/USD |

| ➡️Margin Call | 60% to 80% |

| 🛑Stop-Out | 40% to 50% |

| 👉Are funds kept in segregated accounts? | ✅ Yes |

| 🫴🏻Offers Investor Protection/Insurance? | ✅ Yes, 20,000 EUR |

| 🚀 Open an Account | 👉 Click Here |

Deposit and Withdrawal Information

| 💳Deposit and Withdrawal Options | Bank Wire Transfer GlobePay Skrill PayRedeem Perfect Money Neteller Visa MasterCard Maestro Google Pay Local Indian Payment Methods Local Nigerian Instant Bank Transfers Equity Bank Transfer Ghanaian Local Transfer Africa Local Solutions M-Pesa FasaPay TC Pay Wallet |

| ⏰Minimum Deposit Time on Skrill | Instant |

| ⏱️Maximum Deposit Time on Skrill | Instant |

| ⏰Minimum Withdrawal Time On Skrill | 1 day |

| ⏱️Maximum Withdrawal Time on Skrill | 1 day |

| 💵Skrill Deposit Currencies | EUR, USD, GBP, PLN, CZK |

| 💷Skrill Deposit Fees | None charged by FXTM |

| 💶Skrill Withdrawal Fees | None charged by FXTM |

Pros and Cons FXTM

| ✅ Pros | ❌ Cons |

| Traders can expect fast, fee-free deposits and withdrawals | Skrill might charge fees |

| There are several currencies for deposits and withdrawals | Skrill might not be available in all regions to FXTM clients |

| FXTM keeps all deposits safely in segregated accounts | Withdrawals with Skrill can take up to 1 day, which is slower compared to other brokers |

IC Markets

IC Markets is a top-tier forex broker, attributable to its excellent trading conditions, True ECN Nature, and provision of Skrill for fast and easy deposits and withdrawals.

Besides ensuring traders receive the best trading conditions, IC Markets ensures that deposits and withdrawals are simplified and processed quickly using Skrill.

Furthermore, quick access to funds ensures traders respond quickly to trading opportunities across several markets using IC Markets’ robust trading platforms.

| 💵Minimum Deposit | 200 USD |

| ⌛Regulation | ASIC, CySEC, FSA, SCB |

| ⏱️Starting spread | From 0.0 pips |

| 💴Minimum Commission per Trade | From $3 to $3.5 |

| 💷Decimal Pricing | 5th decimal pricing after the comma |

| ➡️Margin Call | 100% |

| 🛑Stop-Out | 50% |

| 👉Are funds kept in segregated accounts? | ✅ Yes |

| 🫴🏻Offers Investor Protection/Insurance? | ✅ Yes, 1 million USD |

| 🚀 Open an Account | 👉 Click Here |

Deposit and Withdrawal Information

| 💳Deposit and Withdrawal Options | Credit Card Debit Card PayPal Neteller Neteller VIP Skrill UnionPay Bank Wire Transfer Bpay FasaPay Broker to Broker POLi Thai Internet Banking Vietnamese Internet Banking Rapidpay Klarna |

| ⏰Minimum Deposit Time on Skrill | Instant |

| ⏱️Maximum Deposit Time on Skrill | Instant |

| ⏰Minimum Withdrawal Time On Skrill | Instant |

| ⏱️Maximum Withdrawal Time on Skrill | Instant |

| 💵Skrill Deposit Currencies | AUD, USD, JPY, EUR, SGD, GBP |

| 💷Skrill Deposit Fees | None charged by IC Markets |

| 💶Skrill Withdrawal Fees | None charged by IC Markets |

Pros and Cons IC Markets

| ✅ Pros | ❌ Cons |

| IC Markets’ Skrill deposits and withdrawals are instant | There may be certain transaction limits |

| There are no deposit or withdrawal fees | Skrill might impose fees for processing transactions |

| IC Markets is reputable and offers in-house investor protection | Verification can take a few days before traders can deposit funds to start trading |

XM

XM is a popular forex and CFD broker operating for decades. XM prioritizes offering traders the best trading conditions while ensuring client fund security.

Several reputable regulatory entities oversee XM’s operations, ensuring the broker offers a safe, fair trading environment.

Among its many deposit and withdrawal options, XM offers Skrill. This partnership ensures that traders can safely and quickly deposit and withdraw funds with zero fees charged by XM.

| 💵Minimum Deposit | 5 USD |

| ⌛Regulation | FSCA, IFSC, ASIC, CySEC, DFSA, FCA |

| ⏱️Starting spread | From 0.7 pips |

| 💴Minimum Commission per Trade | From $1 per share |

| 💷Decimal Pricing | 5th Decimal after the comma |

| ➡️Margin Call | 50% to 100% (EU) |

| 🛑Stop-Out | 20% to 50% (EU) |

| 👉Are funds kept in segregated accounts? | ✅ Yes |

| 🫴🏻Offers Investor Protection/Insurance? | ✅ Yes, 20,000 EUR or 90% of the eligible trader’s claim (whichever is lower) |

| 🚀 Open an Account | 👉 Click Here |

Deposit and Withdrawal Information

| 💳Deposit and Withdrawal Options | Credit Card Debit Card Bank Wire Transfer Local Bank Transfer Skrill Neteller WebMoney |

| ⏰Minimum Deposit Time on Skrill | Instant |

| ⏱️Maximum Deposit Time on Skrill | Instant |

| ⏰Minimum Withdrawal Time On Skrill | 1 day |

| ⏱️Maximum Withdrawal Time on Skrill | 1 day |

| 💵Skrill Deposit Currencies | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR |

| 💷Skrill Deposit Fees | None charged by XM |

| 💶Skrill Withdrawal Fees | None charged by XM |

Pros and Cons XM

| ✅ Pros | ❌ Cons |

| Deposits to an XM account are instant using Skrill | XM can impose limits on transactions |

| XM does not charge any internal fees on Skrill deposits or withdrawals | Skrill might not be available to all XM clients |

| XM offers substantial investment protection | Deposit and withdrawal processes can be delayed by slow internet |

Vantage Markets

Vantage Markets has built a strong reputation in the Forex and CFD industry. This reputation is further boosted by offering modern, instant payment gateways like Skrill.

Furthermore, traders can rely on Vantage Markets to keep their deposits safe and in segregated accounts.

The partnership between Vantage Markets and Skrill offers fast, reliable, cost-effective deposits and withdrawals, aligning with Vantage Markets’ standards. Furthermore, with Skrill, traders know their deposits and withdrawals are securely processed in the shortest time.

| 💵Minimum Deposit | 50 USD |

| ⌛Regulation | CIMA, VFSC, FSCA, ASIC |

| ⏱️Starting spread | 0.0 pips |

| 💴Minimum Commission per Trade | $3 round turn |

| 💷Decimal Pricing | 5th Decimal after the comma |

| ➡️Margin Call | 80% |

| 🛑Stop-Out | 50% |

| 👉Are funds kept in segregated accounts? | ✅ Yes |

| 🫴🏻Offers Investor Protection/Insurance? | ✅ Yes, 20,000 EUR |

| 🚀 Open an Account | 👉 Click Here |

Deposit and Withdrawal Information

| 💳Deposit and Withdrawal Options | Domestic EFT Domestic Fast Transfer (Australia) International EFT Credit/Debit Card JCB China UnionPay Neteller Skrill AstroPay Broker-to-Broker Transfer FasaPay Thailand Instant Bank Wire Transfer |

| ⏰Minimum Deposit Time on Skrill | 24 hours |

| ⏱️Maximum Deposit Time on Skrill | 24 hours |

| ⏰Minimum Withdrawal Time On Skrill | A few hours |

| ⏱️Maximum Withdrawal Time on Skrill | A few hours |

| 💵Skrill Deposit Currencies | USD, EUR, GBP, AUD |

| 💷Skrill Deposit Fees | None charged by Vantage Markets |

| 💶Skrill Withdrawal Fees | ✅ Yes, 1% |

Pros and Cons Vantage Markets

| ✅ Pros | ❌ Cons |

| Traders can access their funds within 24 hours when depositing to Vantage Markets using Skrill | Vantage Markets charges a withdrawal fee of 1% on Skrill |

| Vantage Markets offers multi-currency support | There are limited deposit and withdrawal currencies |

| There are robust security features offered to protect traders and their funds | Skrill deposits with Vantage Markets take up to 24 hours |

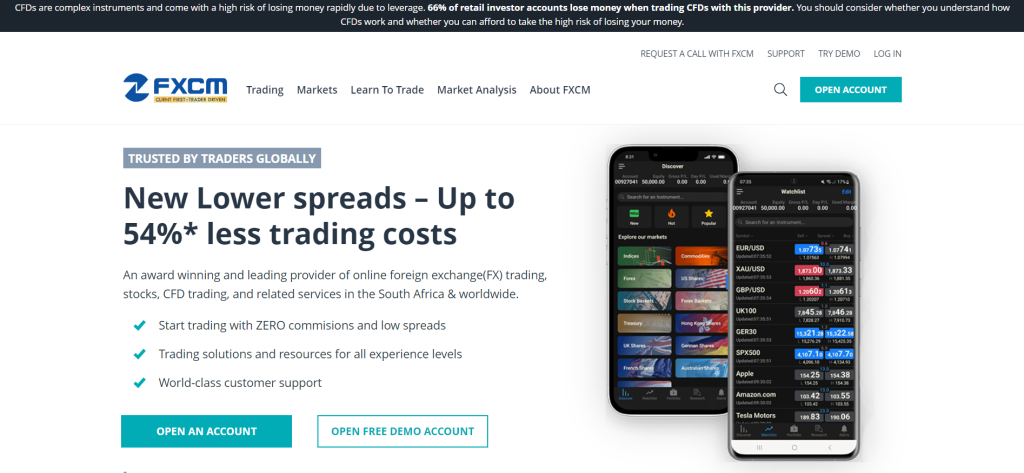

FXCM

FXCM is a well-regulated and multi-asset forex and CFD broker regulated by FSCA, FCA, ASIC, and CySEC. FXCM partners with Skrill to offer secure and fast deposit and withdrawal options as part of its offer to traders.

Furthermore, FXCM stands out from other brokers by not imposing deposit or withdrawal fees on this modern, popular payment method. FXCM allows for multi-currency deposits and withdrawals in minimal time.

| 💵Minimum Deposit | 50 USD |

| ⌛Regulation | FCA, ASIC, CySEC, FSCA |

| ⏱️Starting spread | 0.2 pips on EUR/USD, Variable |

| 💴Minimum Commission per Trade | None; only the spread is charged |

| 💷Decimal Pricing | 5th Decimal after the comma |

| ➡️Margin Call | 100% |

| 🛑Stop-Out | 50% |

| 👉Are funds kept in segregated accounts? | ✅ Yes |

| 🫴🏻Offers Investor Protection/Insurance? | ✅ Yes, 85,000 GBP |

| 🚀 Open an Account | 👉 Click Here |

Deposit and Withdrawal Information

| 💳Deposit and Withdrawal Options | Credit Card Debit Card CreditPay Bank Wire Transfer Skrill Neteller Klarna. Rapid Transfer Local Bank Transfer Philippines Local Bank Transfer Local Bank Transfer LATAM Local Bank Transfer Malaysia Local Bank Transfer Indonesia |

| ⏰Minimum Deposit Time on Skrill | Instant |

| ⏱️Maximum Deposit Time on Skrill | Instant |

| ⏰Minimum Withdrawal Time On Skrill | Instant |

| ⏱️Maximum Withdrawal Time on Skrill | 2 days |

| 💵Skrill Deposit Currencies | EUR, USD, GBP |

| 💷Skrill Deposit Fees | None applied by FXCM |

| 💶Skrill Withdrawal Fees | None applied by FXCM |

Pros and Cons FXCM

| ✅ Pros | ❌ Cons |

| FXCM offers instant deposits with Skrill | There are no instant withdrawals with Skrill on FXCM |

| There are no internal fees charged on Skrill deposits or withdrawals with FCXM and Skrill | Skrill might apply processing fees, which are the responsibility of the trader |

What are the Advantages of Using Skrill with Forex Brokers?

Skrill‘s connection with forex brokers provides benefits that appeal to various trading demands. This integration of financial services and trading platforms usher in a new age of ease and efficiency in Forex trading.

✅Skrill‘s platform is straightforward, boosting the trading experience. Furthermore, Skrill’s simple navigation lets traders of all experience levels easily handle transactions, allowing them to concentrate on market analysis rather than financial activities.

✅Skrill allows traders to complete transactions rapidly, which is important in the fast-paced trading industry. It allows traders to capitalize on market opportunities without delay.

✅Skrill supports several currencies, making international transactions easier for traders. Furthermore, this removes the need for several currency accounts or translation costs, making managing money in a complex trading environment simpler.

✅Skrill provides a more cost-effective option for financial transactions than conventional banking methods like ETFs, SEPA, and Bank Wire Transfer. Its competitive pricing structure and reduced transaction costs result in considerable savings for traders, especially active traders who deposit and withdraw multiple times.

✅Skrill prioritizes digital security, using modern encryption and two-factor authentication to protect traders’ financial and personal data. This degree of protection instills trust and confidence in traders, enabling them to concentrate on trading without fear of data breaches or fraud.

In Conclusion

While exploring Skrill and evaluating brokers for this guide, we discovered something unique about Skrill’s place in the trading world: a mix of efficiency and flexibility.

Moreover, Skrill plays an important part in this dynamic by allowing traders to access forex markets quickly and securely. Its seamless connection with leading brokers improves the trading experience by providing a dependable and secure platform for handling money.

However, we also found various restrictions, such as geographical constraints and certain transaction limits imposed by brokers and Skrill, that can influence some traders’ strategies and overall fund management.

Despite these problems, we can conclude that Skrill‘s general ease of use, minimal fees, and robust security features make it a very appealing deposit and withdrawal option in forex trading.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all South African investors.

Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Faq

Skrill forex brokers provide benefits such as faster transaction processing, more security, and even lower deposit and withdrawal costs than certain conventional banking options.

When evaluating Skrill Forex Brokers, you must consider regulation by searching for credible regulatory agencies, trading costs like spreads, supported currency pairings, platform availability, and customer service quality.

A Skrill forex broker is a firm that accepts Skrill as a payment method for forex trading deposits and withdrawals.

Yes, Skrill is a reputable e-wallet service with strong security features.

Deposit processing times with Skrill are often near-instant, while withdrawal processing times vary per broker.

There might be. Some brokers charge a processing fee on deposits and withdrawals with Skrill. Furthermore, Skrill has its price structure for deposits, withdrawals, and currency conversions.