10 Best Share CDF Brokers

The 10 Best Share CFD Brokers revealed. Share CFDs are popular among traders due to their potential for significant gains with minimal initial investment. With most brokers offering share CFDs, it can be difficult to choose the right broker. Therefore, to help traders make informed decisions, we have comprehensively evaluated these brokers to identify the 10 best.

In this in-depth guide, you’ll learn:

✅What is Share CFD Trading?

✅The 10 Best Share CFD Brokers

✅Advanced Tools for Share CFD Traders – Revealed

✅Fees in Share CFD Trading

✅Our Conclusion on The 10 Best Share CFD Brokers

✅Popular FAQs about The 10 Best Share CFD Brokers

And much, MUCH more!

10 Best Share CFD Brokers – a Comparison

| 🔍 Broker | 🚀 Open an Account | 💵 Minimum Deposit | 🫴🏻 Share CFD |

| 🥇 IG | 👉 Click Here | 250 USD | ✅ Yes |

| 🥈 AvaTrade | 👉 Click Here | 100 USD | ✅ Yes |

| 🥉 Pepperstone | 👉 Click Here | 200 AUD | ✅ Yes |

| 🏅 Tickmill | 👉 Click Here | 100 USD | ✅ Yes |

| 🎖️ XTB | 👉 Click Here | 0 USD | ✅ Yes |

| 🏆 HFM | 👉 Click Here | 0 USD | ✅ Yes |

| 🥇 BDSwiss | 👉 Click Here | 10 USD | ✅ Yes |

| 🥈 Exness | 👉 Click Here | Depends on Payment System | ✅ Yes |

| 🥉 OANDA | 👉 Click Here | 0 USD | ✅ Yes |

| 🏅 FP Markets | 👉 Click Here | 100 AUD | ✅ Yes |

10 Best Share CFD Brokers (2024)

- ☑️IG – Overall, the Best Share CFD Broker

- ☑️AvaTrade – Low Forex Fee CFD Broker

- ☑️Pepperstone – CFD Broker with MetaTrader4

- ☑️Tickmill – The Best Forex Spreads

- ☑️XTB – Best MetaTrader Trading Platforms

- ☑️HFM – The Best Forex Trading Accounts

- ☑️BDSWiss – Best Broker in Education and Research

- ☑️Exness – Best Multi-Asset Broker

- ☑️OANDA – Best Low-Cost Broker

- ☑️FP Markets – Best Forex Partnership Program

What is Share CFD Trading?

CFD (Contract for Difference) trading is a sophisticated financial approach that lets investors predict stock price movements without owning the stocks.

Using leverage magnifies the potential gains or losses with only a small initial investment required. However, this increased leverage also comes with heightened risks.

Unlike traditional stock trading, CFDs enable traders to profit from upward and downward movements, making them suitable for volatile market conditions.

Furthermore, CFD trading primarily focuses on predicting price movements, offering a straightforward and flexible alternative to traditional equity investments, particularly in market instability.

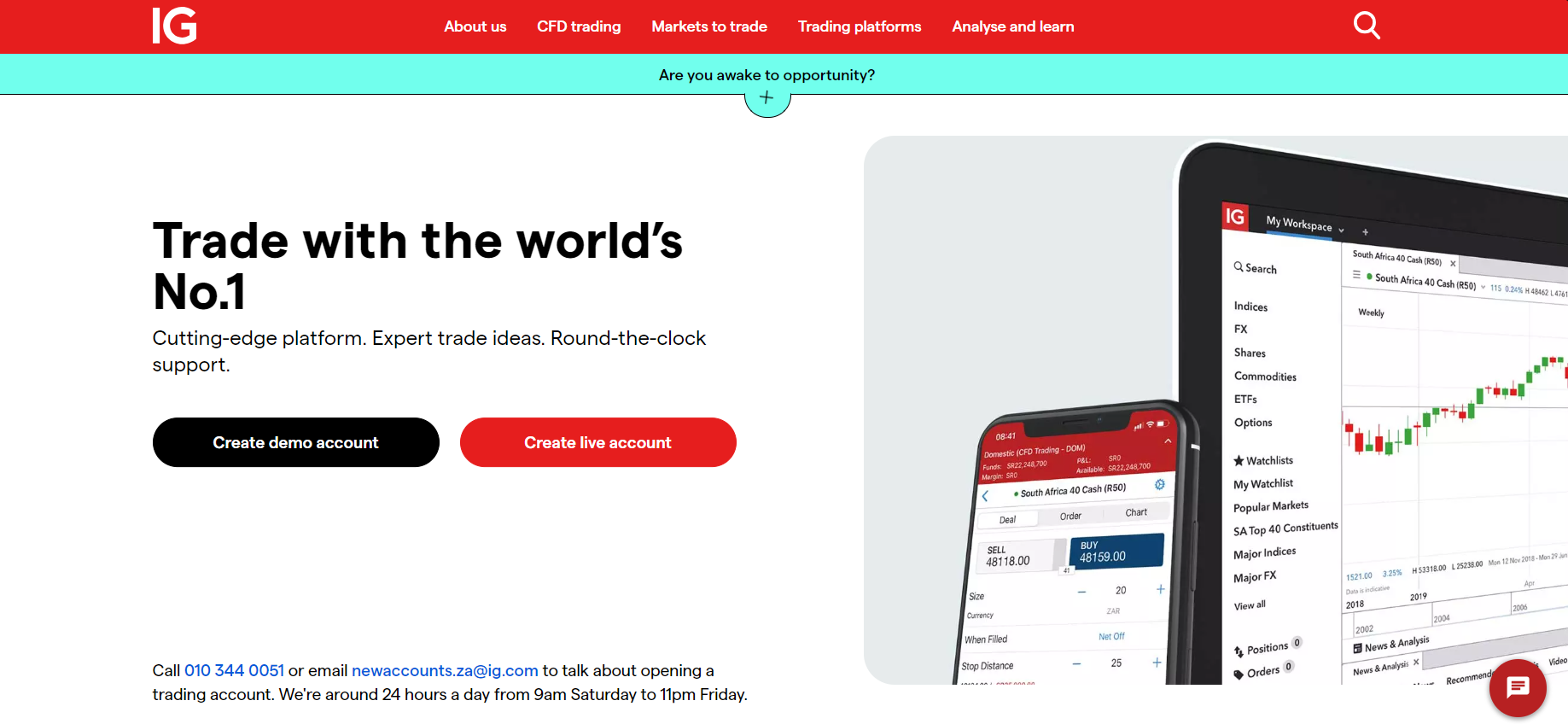

IG

IG is a comprehensive platform for trading share CFDs, offering over 10,500 stock CFDs and financial products like ETFs, indices, and commodities. It offers spread betting, Turbo24, options trading, and share dealing, catering to new and experienced traders.

This broker is known for its low forex costs, but its stock CFD fees are higher. It also offers tax-efficient investment options like Share Dealing ISA and Smart Portfolio ISA for UK investors and a SIPP for retirement savings.

| 💵Minimum Deposit | $250 |

| 🧑⚖️Order Execution | Market |

| ➡️OCO Orders | None |

| 👉One-Click Trading | ✅ Yes |

| ✏️Scalping Allowed? | ✅ Yes |

| 📌Hedging Allowed? | ✅ Yes |

| 🗞️News Trading Allowed? | ✅ Yes |

| 👤Expert Advisors (EAs) Allowed? | ✅ Yes |

| ⬆️Maximum Leverage | 1:30 (Retail, EU, UK) 1:222 (Professional) |

| 🛢️Tradable Assets | Forex Indices Share CFDs Commodities Cryptocurrencies Futures Options Bonds ETFs Digital 100s Interest Rates |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons IG

| ✅ Pros | ❌ Cons |

| IG offers over 17,000 instruments that can be traded | Stock CFD fees can be expensive compared to other brokers |

| IG’s platforms are robust and reliable | The platform can be confusing to navigate for beginners |

| There are comprehensive educational materials offered on IG’s website for Share CFD trading | Beyond CFDs and Options, there is a limited product portfolio |

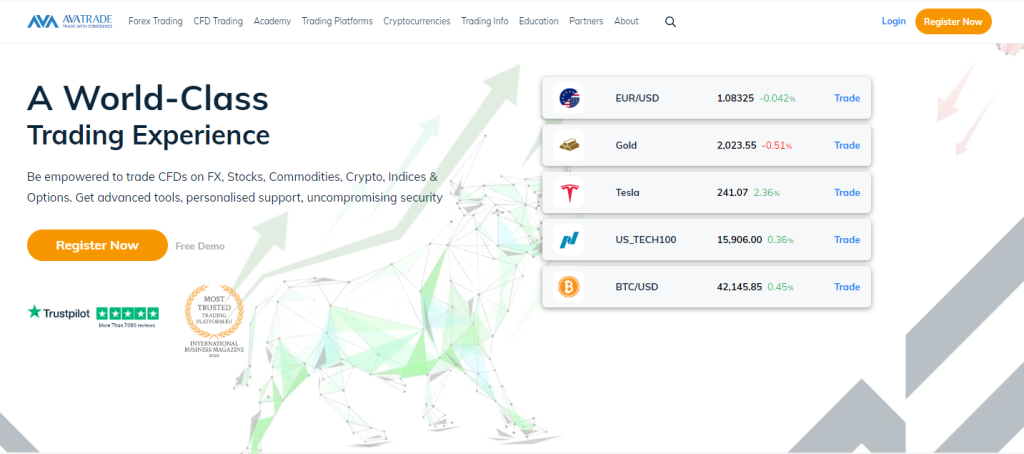

AvaTrade

AvaTrade stands out in the share CFD industry due to its extensive selection of options such as stocks, indices, commodities, currencies, ETFs, and cryptocurrencies. This breadth offers traders the versatility to explore different markets using CFDs.

The broker is known for offering competitive spreads while executing fast trades that can be traded in over 1,000 stock CFDs available with leverage. The award-winning support and global regulation make it a popular option among traders looking for reliability and flexibility.

| 💵Minimum Deposit | 100 USD |

| 🧑⚖️Order Execution | Instant |

| ➡️OCO Orders | None |

| 👉One-Click Trading | ✅ Yes |

| ✏️Scalping Allowed? | ✅ Yes |

| 📌Hedging Allowed? | ✅ Yes |

| 🗞️News Trading Allowed? | ✅ Yes |

| 👤Expert Advisors (EAs) Allowed? | ✅ Yes |

| ⬆️Maximum Leverage | 1:30 (Retail) 1:400 (Pro) |

| 🛢️Tradable Assets | Forex Stocks Commodities Cryptocurrencies Treasuries Bonds Indices Exchange-traded funds (ETFs) Options Contracts for Difference (CFDs) Precious Metals |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons AvaTrade

| ✅ Pros | ❌ Cons |

| AvaTrade offers a balance of proprietary and third-party platforms for CFD trading | Spreads can be wider than that of rivals |

| Traders can participate in social trading | The web platform can be slow at times |

| AvaTrade is well-regulated in several regions | AvaTrade charges inactivity fees |

Pepperstone

Pepperstone provides a competitive landscape for share CFD trading, offering access to over 600 CFDs solely from US markets. The platform is lauded for its speedy and reliable execution, boasting an execution time of around 30ms and a fill rate of 99.90%, ensuring minimal slippage and no requotes.

Traders can engage in share CFDs on the MetaTrader 5 platform, leveraging features like margin trading to amplify their trading potential. It is crucial to note the additional risks associated with margin trading.

The broker charges $0.02 per share for share CFD trading, with a minimum of $0.2, a fee structure deemed reasonable compared to other brokers.

| 💵Minimum Deposit | 200 AUD |

| 🧑⚖️Order Execution | Market |

| ➡️OCO Orders | ✅ Yes |

| 👉One-Click Trading | ✅ Yes |

| ✏️Scalping Allowed? | ✅ Yes |

| 📌Hedging Allowed? | ✅ Yes |

| 🗞️News Trading Allowed? | ✅ Yes |

| 👤Expert Advisors (EAs) Allowed? | ✅ Yes |

| ⬆️Maximum Leverage | 1:500 (Professional) 1:200 (Retail) – Depending on the jurisdiction |

| 🛢️Tradable Assets | Forex Commodities Indices Currency Indices Cryptocurrency Shares ETFs |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons Pepperstone

| ✅ Pros | ❌ Cons |

| Pepperstone’s spreads are tight, especially for active traders trading large volumes | Customer support is not offered 24/7 |

| There are fast and reliable execution speeds | The minimum deposit is higher than that expected by competitors |

Tickmill

Tickmill has over 100 CFD Stocks, including popular FAANG stocks and diverse companies, allowing traders to participate in the stock market with lower capital. The platform offers no commission costs for trading CFDs, facilitating portfolio diversification across industries.

In addition, Tickmill is known for its low forex costs and offers no fees for deposits, withdrawals, or inactivity. Operating on the MetaTrader 4 and 5 platforms, Tickmill offers trading in forex, stock indexes, bonds, and commodities.

| 💵Minimum Deposit | 100 USD |

| 🧑⚖️Order Execution | Market |

| ➡️OCO Orders | None |

| 👉One-Click Trading | ✅ Yes |

| ✏️Scalping Allowed? | ✅ Yes |

| 📌Hedging Allowed? | ✅ Yes |

| 🗞️News Trading Allowed? | ✅ Yes |

| 👤Expert Advisors (EAs) Allowed? | ✅ Yes |

| ⬆️Maximum Leverage | 1:500 |

| 🛢️Tradable Assets | Forex Stock Indices Energy Indices Precious Metals Bonds Cryptocurrencies Stocks ETFs |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons Tickmill

| ✅ Pros | ❌ Cons |

| Tickmill is known for its competitive trading conditions across accounts and assets | The research offering is less comprehensive compared to other brokers |

| There is a good selection of CFDs offered | The educational materials are limited |

| Tickmill offers MetaTrader 4 and 5 across devices | Customer support quality can vary, especially during busy market hours |

XTB

XTB offers a competitive environment for share CFD trading, emphasized by its commission-free offer on stock and ETF trading for transactions. Up to €100,000 monthly volume, which is especially appealing to those trading US shares.

With its award-winning xStation 5 platform, XTB provides various analytical tools and real-time market data for beginner and expert traders.

XTB’s regulatory framework provides a secure trading environment reinforced by educational materials and customer assistance. In addition, XTB guarantees to provide transparent and cost-effective trading alternatives for share CFDs.

| 💵Minimum Deposit | 0 USD |

| 🧑⚖️Order Execution | Market |

| ➡️OCO Orders | ✅ Yes |

| 👉One-Click Trading | ✅ Yes |

| ✏️Scalping Allowed? | ✅ Yes |

| 📌Hedging Allowed? | ✅ Yes |

| ✏️News Trading Allowed? | ✅ Yes |

| 👤Expert Advisors (EAs) Allowed? | ✅ Yes |

| ⬆️Maximum Leverage | 1:500 |

| 🛢️Tradable Assets | Forex Indices Commodities Stock CFDs ETF CFDs Cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons XTB

| ✅ Pros | ❌ Cons |

| XTB offers its award-winning platform for share CFD trading | XTB does not offer MetaTrader or any other third-party platforms |

| XTB offers comprehensive educational materials | There are several trading and non-trading fees charged |

| There is a decent selection of CFDs that can be traded | Spreads can widen significantly outside active market hours |

HFM

HFM provides a complete platform for trading CFDs and individual stocks, including commission-free trading on over 2,000 equities using the MetaTrader 5 platform. However, transactions over 1,000 monthly shares incur a small cost of $0.10 per share.

The broker also allows for the purchase of fractional shares, which enables investors to access significant company shares and diversify their portfolios with a little starting commitment.

| 💵Minimum Deposit | 0 USD |

| 🧑⚖️Order Execution | Market |

| ➡️OCO Orders | None |

| 👉One-Click Trading | ✅ Yes |

| ✏️Scalping Allowed? | ✅ Yes |

| 📌Hedging Allowed? | ✅ Yes |

| 🗞️News Trading Allowed? | ✅ Yes |

| 👤Expert Advisors (EAs) Allowed? | ✅ Yes |

| ⬆️Maximum Leverage | 1:2000 |

| 🛢️Tradable Assets | Forex Precious Metals Energies Indices Shares Commodities Cryptocurrencies Bonds ETFs |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons HFM

| ✅ Pros | ❌ Cons |

| Traders can choose from flexible account types to trade share CFDs | The share CFD selection is less comprehensive than that of rivals |

BDSwiss

BDSwiss is a leading player in the share CFD market, offering traders access to top stocks from major global exchanges. The platform caters to beginners and seasoned traders with an average quarterly trading volume exceeding $98 billion and over 1.7 million registered accounts.

With over 250 CFD products, including currency pairs, commodities, cryptocurrencies, indices, share CFDs, and ETFs, BDSwiss provides a secure and well-regulated trading environment suitable for beginners and seasoned traders.

This comprehensive offering reflects BDSwiss’ commitment to providing comprehensive trading opportunities.

| 💵Minimum Deposit | 10 USD |

| 🧑⚖️Order Execution | Instant, Market |

| ➡️OCO Orders | None |

| 👉One-Click Trading | ✅ Yes |

| ✏️Scalping Allowed? | ✅ Yes |

| 📌Hedging Allowed? | ✅ Yes |

| 🗞️News Trading Allowed? | ✅ Yes |

| 👤Expert Advisors (EAs) Allowed? | ✅ Yes |

| ⬆️Maximum Leverage | 1:2000 |

| 🛢️Tradable Assets | Forex Commodities Shares Indices Cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons BDSwiss

| ✅ Pros | ❌ Cons |

| There are user-friendly platforms offered for sharing CFD trading | The share CFD offering is limited compared to other brokers |

| There are comprehensive guides and educational materials | Several non-trading fees apply, including inactivity fees |

Exness

Exness offers CFD trading on major global stocks such as AAPL and AMZN. Furthermore, Exness allows traders to connect with the stock market using CFDs.

This provides leverage of up to 1:20 with a minimum investment of only $1, making stock market volatility more accessible and rewarding.

Their coverage of over 200 products across several financial markets and asset classes reflects its dedication to offering traders a broad and varied trading environment.

| 💵Minimum Deposit | Depends on the payment system |

| 🧑⚖️Order Execution | Market |

| ➡️OCO Orders | None |

| 👉One-Click Trading | ✅ Yes |

| ✏️Scalping Allowed? | ✅ Yes |

| 📌Hedging Allowed? | ✅ Yes |

| 🗞️News Trading Allowed? | ✅ Yes |

| 👤Expert Advisors (EAs) Allowed? | ✅ Yes |

| ⬆️Maximum Leverage | Unlimited |

| 🛢️Tradable Assets | Forex Commodities Stocks Indices Cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons Exness

| ✅ Pros | ❌ Cons |

| Exness is well-regulated in several regions | There are limited financial instruments compared to other brokers |

OANDA

OANDA’s share CFD services enable traders to leverage their stock market positions without paying the full price for shares up front. Giving them more exposure to market movements while they remain budget-conscious.

As a fully licensed broker with over 25 years of expertise, OANDA offers various CFDs, such as indices, forex, commodities, shares, metals, and bonds. With cheap spreads and an easy-to-use trading environment, the platform appeals to new and seasoned traders.

| 💵Minimum Deposit | 0 USD |

| 🧑⚖️Order Execution | Market |

| ➡️OCO Orders | ✅ Yes |

| 👉One-Click Trading | ✅ Yes |

| ✏️Scalping Allowed? | ✅ Yes |

| 📌Hedging Allowed? | ✅ Yes |

| 🗞️News Trading Allowed? | ✅ Yes |

| 👤Expert Advisors (EAs) Allowed? | ✅ Yes |

| ⬆️Maximum Leverage | 1:888 |

| 🛢️Tradable Assets | Forex Indices Metals Shares Commodities Cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

OANDA

| ✅ Pros | ❌ Cons |

| OANDA is known for its robust research tools and market analysis | The platforms can have a steep learning curve for beginners |

FP Markets

FP Markets stands out in the share CFD field by providing traders transparent access to over 10,000 stocks across four continents. The platform’s wide offering includes equities, indices, metals, commodities, and cryptocurrencies, with over 10,000 trading CFD products.

This broker offers traders numerous platforms for a consistent trading experience. It emphasizes transparency, extensive market access, and the flexibility to demand higher position sizes via leverage.

| 💵Minimum Deposit | 100 AUD |

| 🧑⚖️Order Execution | Market |

| ➡️OCO Orders | None |

| 👉One-Click Trading | ✅ Yes |

| ✏️Scalping Allowed? | ✅ Yes |

| 📌Hedging Allowed? | ✅ Yes |

| 🗞️News Trading Allowed? | ✅ Yes |

| 👤Expert Advisors (EAs) Allowed? | ✅ Yes |

| ⬆️Maximum Leverage | 1:500 |

| 🛢️Tradable Assets | Forex Shares Metals Commodities Indices Cryptocurrencies Bonds ETFs |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons FP Markets

| ✅ Pros | ❌ Cons |

| FP Markets has tight spreads and low commission fees on Share CFDs | Limited share CFD portfolio outside Australian shares |

Advanced Tools for Share CFD Traders – Revealed

Sophisticated tools can significantly enhance a trader’s ability to analyze markets, execute trades, and effectively manage risks in the rapidly evolving world of share CFD trading.

Designed with both inexperienced and seasoned traders in mind, the following tools provide a solid basis for making sound decisions and devising strategic plans.

Technical Analysis

A vital tool in Share CFD trading is Technical Analysis Software, which provides traders with a thorough understanding of market trends and patterns via indicators and charts.

Furthermore, this program helps traders detect probable buy or sell signals and estimate future price changes using previous data.

Automated Trading Systems

The Automated Trading System is another valuable weapon in a trader’s armory.

This method enables traders to specify specified criteria for trade entry and exits, which, when fulfilled, automatically execute deals.

This feature is important for capitalizing on opportunities that emerge after trading hours or managing holdings when direct market access is unavailable.

Risk Management Tools

Share CFD trading also relies heavily on risk management tools. These tools, like stop-loss orders and position size calculators, assist traders in reducing losses and protecting their profits by limiting the amount of money at risk.

Economic Calendars

Economic calendars are similar to personal market forecasts and vital for traders who want to keep ahead of market trends. These calendars serve as your road map, outlining impending economic data and events that may impact market conditions. With this knowledge, traders can fine-tune their methods and alter their positions ahead of market volatility, ensuring they are in step with overall market movements.

Mobile Trading Platforms

Mobile trading platforms have revolutionized contemporary trading, providing traders with unparalleled freedom and flexibility. These systems function as your trading cockpit, providing access to real-time market data and enabling you to monitor your positions while on the go.

Push alerts, for example, notify you of any market fluctuations in real time, ensuring you are constantly connected to the market’s pulse, no matter where you are.

Fees in Share CFD Trading

Spreads

A fundamental trading cost is the Spread, which refers to the variance between a share CFD‘s buy and sell prices. It relies on brokers’ discretion and depends upon underlying asset liquidity.

Opting for a broker with lower spreads could decrease trade expenses, rendering it an imperative consideration when choosing one.

Commissions

Some brokers charge a set fee per transaction or a percentage of trading volume. While some brokers provide commission-free trading, they may compensate by imposing larger spreads.

To properly control their trading expenditures, traders must first understand the structure and effects of these fees.

Overnight Fees

Overnight financing costs, or swaps, apply to positions kept open overnight. These costs are based on the leverage and size of the position and may build over time, reducing the profitability of long-term transactions.

The Overnight fees are a large consideration for Share CFD traders who use long-term trading strategies.

Inactivity Fees

Some brokers charge inactivity fees on accounts not traded in a specific period. These costs can progressively drain an account’s balance and are essential for traders who intend to trade infrequently, especially those with long-term strategies in Share CFD trading.

Currency Conversion Fees

Conversion Fees apply when a trader’s account currency changes from the underlying asset’s. These costs involve changing earnings and losses back into the account’s base currency and fluctuate depending on the broker’s exchange rate.

Traders should know these fees to manage their currency exposure and avoid excessive expenses

In Conclusion

In our experience, although using leverage is useful, it also increases hazards. Therefore, each broker’s offering must be thoroughly evaluated according to individual trading methods and risk tolerance to make the best decision.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all South African investors.

Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Faq

Yes, you can. Most reputable brokers provide demo accounts.

Consider share selection, costs, regulation, platforms, customer service, research tools, and other relevant aspects of your trading style.

Yes, it is. You need funds to start trading share CFDs. Brokers have different minimum deposit requirements. Some might not have a set minimum deposit requirement, allowing you to invest any amount with which you can start trading.

Reputable brokers are regulated by entities like the FCA, ASIC, and CySEC, among others. This provides a safe and transparent environment where share CFDs can be traded.

No, not all CFD brokers offer educational materials. Furthermore, the quality and scope of educational opportunities vary substantially in terms of those that do.

Yes, losses can outweigh your deposit owing to leverage. Before you begin trading CFDs, be sure you understand the dangers involved.