The 8 Worst Scam Forex brokers

The 8 worst scam Forex brokers revealed on our list. We have explored and tested several brokers to identify the 8 worst Forex brokers that are fraudulent and deceive traders.

In this in-depth guide, you’ll learn:

- What is a fraudulent Forex broker?

- Who are the worst scam forex brokers?

- Identify red flags for each broker on our list.

- Popular FAQs about scam Forex brokers.

And lots more…

So, if you’re ready to learn about the 8 worst fraudulent Forex brokers…

Let’s dive right in…

The 8 worst scam Forex brokers (2024*)

- ☑️DDFuture’s – dangled enticing investment plans with high returns.

- ☑️Canabis Trader –lures traders into stock CFD investments.

- ☑️️Calloway Software –pledging swift wealth.

- ☑️️Prime Trading – presents itself as a licensed investment firm.

- ☑️NAS Broker – Dubious FSA regulation claim.

- ☑️CBFInvest – Lack of transparency in ownership and management.

- ☑️Tradorax – multiple complaints with blacklisted status.

- ☑️Panamoney’s – Too good to be true, regulator warning.

What is a scam Forex broker?

Additionally, a scam Forex broker is an illegitimate entity that deceives investors by offering fraudulent or unreliable trading services. They often lure clients with promises of unrealistic returns, manipulate prices, withhold withdrawals, or engage in other unethical practices. Therefore, investors should exercise caution and conduct thorough research to avoid falling victim to such schemes.

Worst Scam Forex Brokers

| 🔎Broker Name | 🟥 Red Flags | Why they might be a scam? |

| DDFuture's | Enticing investment plans with high returns | Promises of unrealistic returns are a classic sign of a scam. They may lure you in with the idea of getting rich quick, but it's highly unlikely. |

| Canabis Trader | Lures traders into stock CFD investments | While Cannabis stocks can be volatile, some brokers might use this to target inexperienced investors with risky CFDs (Contracts for Difference) without proper explanation of the risks. |

| Calloway Software | Pledging swift wealth | Similar to DDFuture's, promising quick wealth is a major red flag. Legitimate investment strategies require time and effort. |

| Prime Trading | Presents itself as a licensed investment firm | False claims of legitimacy are a common tactic. Always verify a broker's licensing with the relevant regulatory body. |

| NAS Broker | Dubious FSA regulation claim | Lying about regulation is a serious offense. Verify a broker's regulatory status with the official source (e.g., FSA in the UK). |

| CBFInvest | Lack of transparency in ownership and management | An honest broker will be upfront about their ownership and management team. Hidden ownership can be a red flag. |

| Tradorax | Multiple complaints with blacklisted status | If a broker has a history of complaints and appears on blacklists from regulators, avoid them at all costs. |

| Panamoney's | Too good to be true, regulator warning | Promises that seem too good to be true often are. If a regulator has issued a warning, it's a strong sign of a scam. |

Below, we have listed the worst scam Forex brokers that traders should avoid when dealing with them. We will also point to red flags for each scam broker that will help you identify other scam brokers in the future.

DDFutures

DDFutures, masquerading as a dual Forex and cryptocurrency investment platform with dangled enticing investment plans promising remarkable returns.

Boasting up to 1555% profits within a mere 25 days, the website fails to elucidate the strategies behind such astronomical gains or the operational mechanics of the broker. With scant details provided, investors are left in the dark about DDFutures’ modus operandi beyond its vague assertion of being a UK-based private company engaged in high-yield product development.

Alerts

| ❌Red flags |

| Unrealistic Returns: Promising returns of up to 1555% within 25 days is highly unrealistic and often indicative of a scam. |

| Lack of Explanation: The absence of clear explanations regarding the investment strategies and operational procedures raises suspicion about the legitimacy of the broker. |

| Vague Company Information: DDFutures provides limited information about its background, operations, or regulatory status, making it challenging to verify its authenticity. |

| Lack of Transparency: The website lacks transparency regarding how profits are generated and how the broker functions, leaving investors uninformed and vulnerable. |

| Ambiguity in Operations: DDFutures claims to be involved in high-yield product development without providing specific details, further obscuring its activities and intentions. |

Cannabis Trader

Cannabis Trader lures traders into cannabis stock CFD investments with enticing promises. Requiring an initial deposit of 250 US Dollars upon registration, traders are propelled into a world where automated software executes trades based on live market signals.

The broker supplements this with trading tips, advocating investment in cannabis stock CFDs while the market thrives.

Despite these offerings, red flags abound, signaling potential deceit akin to typical scam brokers. Traders must remain vigilant amidst the allure of quick gains and carefully scrutinize such platforms to safeguard their investments.

Alerts

| ❌Red flags |

| High-pressure tactics: Urging traders to invest in cannabis stock CFDs while emphasizing the urgency of the opportunity is a classic red flag often used by scam brokers. |

| Automated trading software: Relying solely on automated software to execute trades without any human oversight can lead to significant losses and suggests a lack of transparency or control over trading activities. |

| Lack of transparency: Failing to provide clear information about how the trading software operates, how trades are executed, or the broker's background raises suspicions about their legitimacy. |

| Minimal investment required: Requiring a relatively low initial deposit of US Dollar 250 may indicate that the broker is more interested in collecting deposits than providing genuine investment opportunities. |

| Absence of regulatory information: A reputable broker would typically provide details about their regulatory status, which is conspicuously missing in the case of Cannabis Trader, further heightening concerns about their legitimacy. |

Calloway Software

Calloway Software emerges as another enticing scheme, pledging swift wealth regardless of traders’ expertise.

The broker dangles the prospect of earning thousands of dollars within hours, relying on popular indicators like Fibonacci and Bollinger to generate foolproof trading signals. However, traders must exercise extreme caution, recognizing the peril of succumbing to such deceptive brokers and their false promises of guaranteed profits.

Alerts

| ❌Red flags |

| Warning Issued by FINRA: The fact that the Financial Industry Regulatory Authority (FINRA) issued a warning about Panamoney being con artists is a significant red flag, indicating fraudulent or unethical practices. |

| Sudden Closure: Panamoney abruptly closed down without warning, leaving traders unable to access their funds or the broker's website, which is a common tactic employed by scam brokers to abscond with investors' money. |

| Unwarranted Deductions and Confiscation of Profits: Panamoney was known to deduct funds from trading accounts and forfeit profits under fabricated "early fund withdrawal requests," suggesting dishonest practices aimed at depriving traders of their rightful earnings. |

| Significant Losses Reported: Traders claimed to have lost substantial amounts of money, such as US Dollar 160,000, while trading through Panamoney, indicating widespread financial harm inflicted by the broker. |

| Arbitrary Blocking of Trading Accounts: Panamoney reserved the right to block trading accounts at any time without warning, clearing them of all funds, which is a clear indicator of a scam operation designed to deprive traders of access to their investments. |

Prime Trading

Prime Trading presents itself as a licensed investment firm offering an array of services, including investment strategies and products. Allegedly, over 135 investment teams across 30 countries collaborate to impart knowledge for traders’ benefit.

However, the Malta Financial Services Authority (MFSA) has issued a warning, branding Prime Trading a scam. Despite promises of guaranteed success, trading inherently carries risks, and profitability isn’t assured.

Successful trading demands dedication, research, and consistent effort—qualities no broker or software can substitute. Traders must realize that sustainable profits stem from their diligence and adherence to proven strategies rather than relying on external entities for financial gains.

Alerts

| ❌Red flags |

| False claims of licensing: Prime Trading purportedly presents itself as a licensed investment company, yet the warning from the Malta Financial Services Authority (MFSA) indicates otherwise, suggesting deceptive practices. |

| Dubious collaboration claims: Claiming to have over 135 investment teams in 30 countries sharing knowledge and experiences raises suspicions, especially considering the lack of verifiable evidence or transparency regarding these collaborations. |

| Guarantee of success: Promising traders a guarantee of success contradicts the reality of trading, where profits are not assured and risks are inherent, suggesting Prime Trading may be employing deceptive tactics to lure unsuspecting traders. |

| Lack of transparency: Prime Trading fails to provide transparent information about its operations, regulatory status, or the team behind the platform, which is often indicative of a lack of legitimacy. |

| Overemphasis on profitability: While trading can be profitable, the emphasis on profits without acknowledging the associated risks and the need for traders' effort and dedication is a common red flag in scam schemes. |

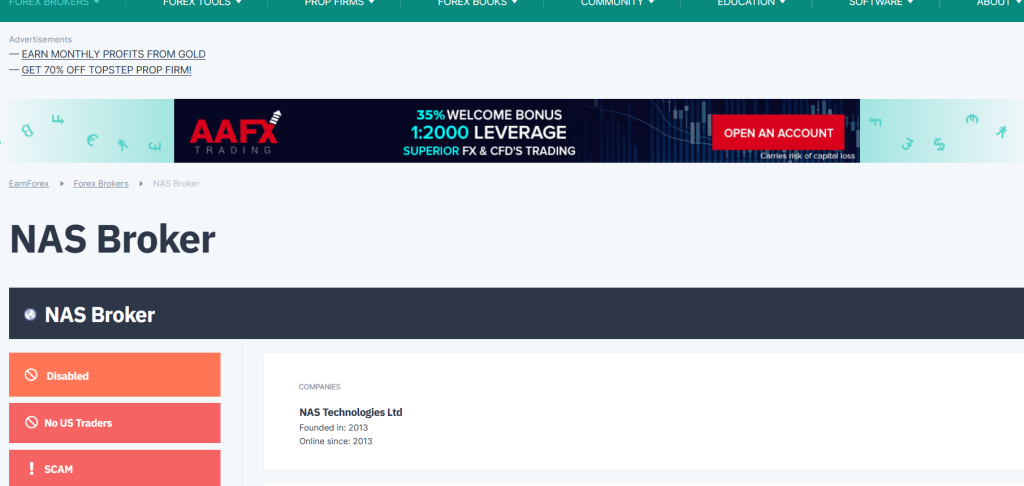

NAS Broker

NAS Broker asserts its establishment in 2012, allegedly providing traders access to a diverse range of financial instruments. Operating under the claim of being headquartered in Saint Vincent and the Grenadines and regulated by the FSA, NAS Broker has attracted numerous traders.

Offering a live account sans minimum deposit alongside a US Dollar 50 no-deposit bonus promotes accessibility. Moreover, NAS Broker boasts mobile trading capabilities, various account options, and PAMM and MAM accounts, enhancing its appeal to prospective traders.

Alerts

| ❌Red flags |

| Dubious Regulation Claim: NAS Broker claims regulation through the FSA (presumably the Financial Services Authority). However, Saint Vincent and the Grenadines is known for being a popular location for offshore brokers due to lax regulatory oversight, raising doubts about the legitimacy of the claimed regulation. |

| Unrealistic Promotions: Offering a live account with a US Dollar 0 minimum deposit requirement and a US Dollar 50 no-deposit bonus can be seen as unrealistic and potentially indicative of a scheme to attract traders without genuine intention to provide reliable services. |

| Lack of Transparency: Despite claiming to have been founded in 2012 and providing various account options and services, NAS Broker lacks transparency regarding its operations, regulatory status, and the team behind the platform, which raises concerns about its legitimacy. |

| Offshore Headquarters: Being headquartered in Saint Vincent and the Grenadines, a common offshore location for Forex brokers, may suggest an attempt to evade stricter regulatory scrutiny in more reputable financial jurisdictions. |

| Common Location for Scam Brokers: Saint Vincent and the Grenadines has gained a reputation for hosting numerous scam brokers due to its lenient regulatory environment, further casting doubt on NAS Broker's legitimacy. |

CBFInvest

However, traders should exercise caution and conduct thorough research, given the prevalence of scam brokers in the industry.

CBFInvest asserts itself as a Cyprus-based NDD broker established in 2013, facilitating the trading of multiple financial instruments.

With a multilingual website available in English, Hungarian, Spanish, German, and Romanian, it targets a diverse clientele. Traders encounter a modest US Dollar 10 minimum deposit requirement and various account options.

While CBF Invest purports regulation and authorization by CySEC, backed by a provided license number, its utilization of a web-based trading platform and mobile trading compatibility for Android and iOS devices emphasizes accessibility.

Customer support is available in English, and traders can opt for trading accounts denominated in USD, EUR, or GBP. Supported payment methods encompass Skrill, Neteller, Debit/Credit Cards, and Wire Transfer.

Alerts

| ❌Red flags |

| Dubious Regulation Claim: CBFInvest claims to be regulated and authorized by CySEC (Cyprus Securities and Exchange Commission), but the legitimacy of this claim should be verified independently as false regulatory claims are common among scam brokers. |

| Minimal Deposit Requirement: Requiring a mere US Dollar 10 minimum deposit could indicate an attempt to attract traders with low barriers to entry without providing substantial services, which is often a tactic used by scam brokers. |

| Lack of Transparency: While CBFInvest claims to have been founded in 2013 and provides information about its trading platform, accounts, and supported languages, it lacks transparency regarding its ownership, management team, and regulatory compliance beyond the mentioned license number. |

| Multilingual Website: While offering a multilingual website may seem beneficial for reaching a wider audience, scam brokers sometimes use this tactic to appear more legitimate and attract traders from various regions without providing genuine services. |

| Offshore Location: Cyprus is known for hosting numerous Forex brokers, but its regulatory environment is not as strict as in some other jurisdictions, making it a popular location for scam brokers to operate from. |

| Limited Payment Methods: While CBFInvest supports common payment methods like Skrill, Neteller, Debit/Credit Cards, and Wire Transfer, the absence of more reputable and secure options could raise concerns about the safety of funds and legitimacy of the broker. |

Tradorax

Tradorax has garnered many complaints, with 4 guilty verdicts from the FPA Trader’s Court branding it a scam. Its name now graces the blacklists of numerous websites. Notorious for freezing trading accounts and withholding withdrawals, Tradorax has left victims like a 60-year-old pensioner, who lost £60,000 when denied access to funds.

Traders recount similar tales of payout refusals and fund misappropriation. Reports also allege unauthorized deals and fraudulent credit card charges by Tradorax.

The broker’s modus operandi involves enticing traders to deposit more funds, only to freeze accounts and abscond with the money. Traders must exercise utmost vigilance and steer clear of such deceptive practices.

Alerts

| ❌Red flags |

| Multiple Complaints and Guilty Votes: Tradorax has accumulated numerous complaints and received four guilty votes in the FPA Trader’s Court, indicating widespread dissatisfaction and potentially fraudulent practices. |

| Blacklisted Status: Being listed on numerous websites as a blacklisted broker is a significant red flag, suggesting that Tradorax's activities are widely recognized as fraudulent or unethical. |

| Account Freezing and Withdrawal Issues: Tradorax is infamous for freezing trading accounts and blocking traders from withdrawing their funds, a tactic commonly associated with scam brokers aiming to withhold investors' money. |

| Reports of Fund Theft: Victims, including a pensioner who lost a substantial amount, have reported instances of Tradorax unlawfully withholding funds, indicating a pattern of theft or financial misconduct. |

| Unauthorized Trading and Fraudulent Charges: There are reports of Tradorax engaging in trades without prior permission from traders and charging registered credit cards fraudulently, further underscoring the broker's lack of integrity. |

| Encouragement to Deposit More Funds: Tradorax's practice of encouraging traders to deposit additional funds, only to freeze accounts and seize the funds, is a classic scam tactic aimed at extracting more money from unsuspecting investors. |

Panamoney

In the realm of brokerage evaluation, the adage “if it seems too good to be true, it probably is” rings especially true, as evidenced by the cautionary tale of this broker. The Financial Industry Regulatory Authority (FINRA) issued a warning in 2010, exposing Panamoney as a fraudulent operators.

Despite initially providing some returns, Panamoney abruptly shuttered, vanishing without a trace. Traders found themselves stranded, unable to access their funds as the broker’s website evaporated alongside their investments.

Panamoney’s nefarious tactics included unwarranted deductions from trading accounts and the confiscation of profits under fabricated “early fund withdrawal requests.” Some traders recount staggering losses upwards of US Dollar 160,000.

They wielded the power to arbitrarily block trading accounts without notice, leaving traders blindsided until their futile attempts to access them revealed the grim reality.

Alerts

| ❌Red flags |

| Warning Issued by FINRA: The fact that the Financial Industry Regulatory Authority (FINRA) issued a warning about Panamoney being con artists is a significant red flag, indicating fraudulent or unethical practices. |

| Sudden Closure: Panamoney abruptly closed down without warning, leaving traders unable to access their funds or the broker's website, which is a common tactic employed by scam brokers to abscond with investors' money. |

| Unwarranted Deductions and Confiscation of Profits: Panamoney was known to deduct funds from trading accounts and forfeit profits under fabricated "early fund withdrawal requests," suggesting dishonest practices aimed at depriving traders of their rightful earnings. |

| Significant Losses Reported: Traders claimed to have lost substantial amounts of money, such as US Dollar 160,000, while trading through Panamoney, indicating widespread financial harm inflicted by the broker. |

| Arbitrary Blocking of Trading Accounts: Panamoney reserved the right to block trading accounts at any time without warning, clearing them of all funds, which is a clear indicator of a scam operation designed to deprive traders of access to their investments. |

Conclusion

Our Final Thoughts on the 8 Worst Scam Forex Brokers. By scrutinizing brokers for red flags like unrealistic promises, regulatory warnings, sudden closures, and unexplained deductions, traders can evade the clutches of deceitful entities. Therefore, diligence and research are the keys to safeguarding investments and avoiding the pitfalls of the worst scam Forex brokers.

Frequently Asked Questions

What are the warning signs of a scam Forex broker?

Furthermore, look out for brokers promising unrealistic returns, lacking regulatory oversight, engaging in deceptive practices like account freezing or fund confiscation, and receiving warnings or negative reviews from reputable financial authorities.

How can I verify the legitimacy of a Forex broker?

Verify their registration status and review their regulatory history. Check for clear disclosures of company information and client reviews.

What should I do if I suspect I’m dealing with a scam Forex broker?

Immediately cease all transactions with the broker and attempt to withdraw any remaining funds. Furthermore, report your suspicions to the relevant regulatory authorities, such as SEC or FCA, and consider seeking legal advice if necessary.

Are there common tactics used by scam Forex brokers to lure investors?

Moreover, bonuses or incentives with hidden terms and conditions can be offered, and high-pressure sales tactics can be employed to rush investors into depositing funds without due diligence.

How can I protect myself from falling victim to a scam Forex broker?

Please avoid brokers with a history of regulatory violations or suspicious practices. Always use caution and trust your own instincts.

Do your research before investing with any broker; thoroughly research their reputation, fees, and regulatory status.

Beware of unrealistic promises: Guarantees of high returns or quick wealth are red flags. Additionally, always confirm a broker’s licensing with the relevant regulatory body. If it sounds too good to be true, it probably is.

A Reliable Forex broker review of Exness will ensure safe trading. You can stay up to date by linking to our Twitter account.

Faq

Look out for brokers promising unrealistic returns, lacking regulatory oversight, engaging in deceptive practices like account freezing or fund confiscation, and receiving warnings or negative reviews from reputable financial authorities.

Ensure the broker is regulated by a reputable authority, such as the SEC, FCA, or ASIC. Verify their registration status and review their regulatory history. Additionally, check for transparent disclosures of company information and client reviews

Immediately cease all transactions with the broker and attempt to withdraw any remaining funds. Report your suspicions to the relevant regulatory authorities, such as the SEC or FCA, and consider seeking legal advice if necessary.

Yes, scam brokers often use tactics like promising guaranteed profits, offering bonuses or incentives with hidden terms and conditions, and employing high-pressure sales tactics to rush investors into depositing funds without due diligence.

Conduct thorough research before engaging with any broker, including verifying their regulatory status, reading client reviews and warnings from financial authorities, and avoiding brokers with a history of regulatory violations or suspicious practices. Always use caution and trust your instincts.