10 Best Forex Robot Traders

The 10 Best Forex Robot Traders revealed. Robot Traders have revolutionized the trading landscape by providing accuracy, effectiveness, and seamless trading activities. We have explored the realm of automated trading to discover the top 10 Forex Robot Traders.

In this in-depth guide, you’ll learn:

- Forex Robot Traders and Why They Are Important.

- What are the 10 Best Forex Robot Traders?

- How Forex Robot Traders Work.

- What To Consider Choosing a Robot Trader.

- Conclusion

- FAQs

And lots more…

So, if you’re ready to go “all in” with the 10 Best Forex Robot Traders…

Let’s dive right in…

10 Best Forex Robot Traders (2024*)

- ☑️ForexVPS – a Strong emphasis on safety and dependability.

- ☑️Waka Waka EA – Record of maintaining high profits.

- ☑️EA Builder – This is a robust and intuitive tool.

- ☑️Odin – a Sophisticated grid trading strategy.

- ☑️Flex EA – Innovative automated trading strategy.

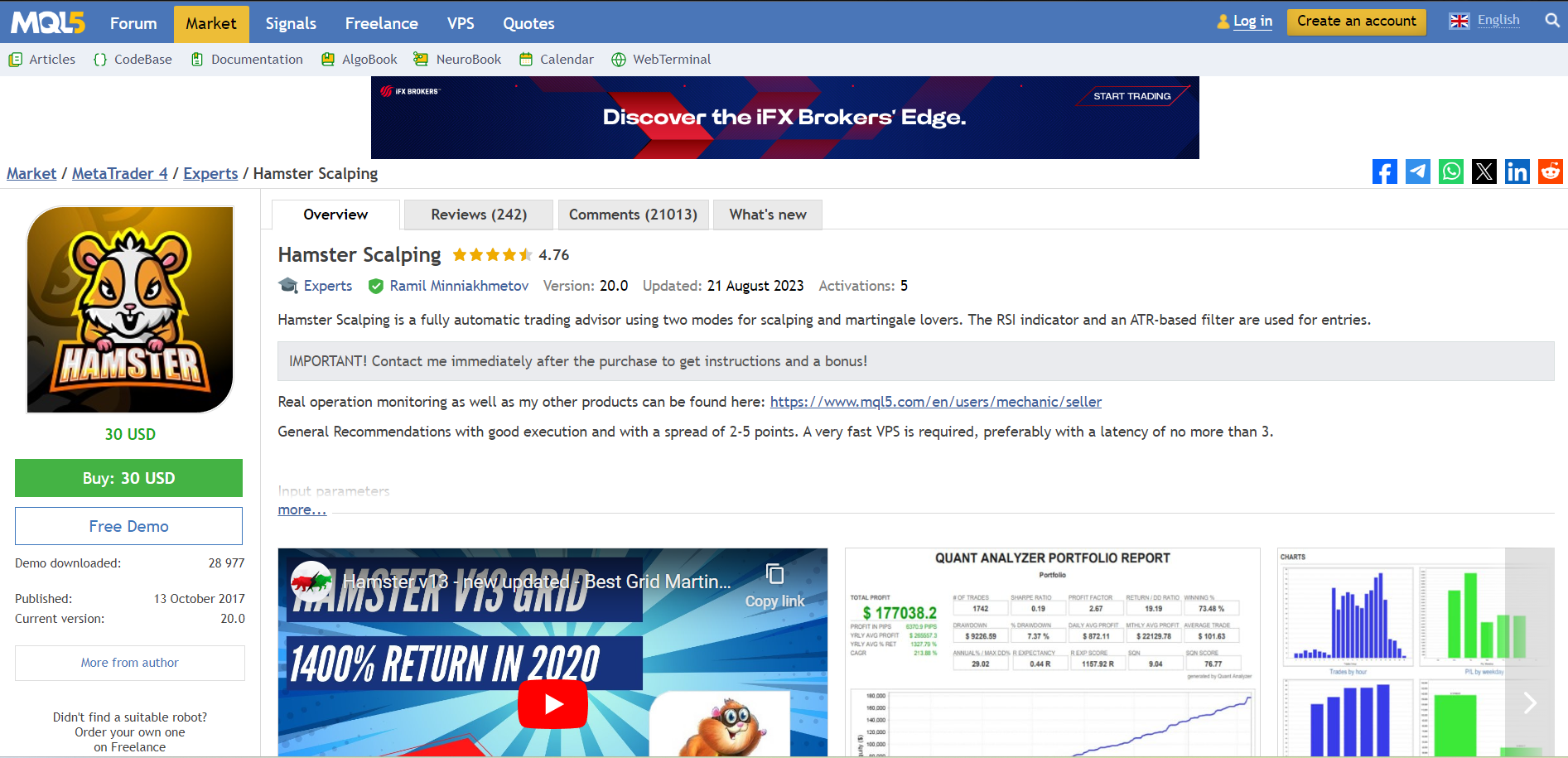

- ☑️Hamster Scalping – Completely automated trading advisor.

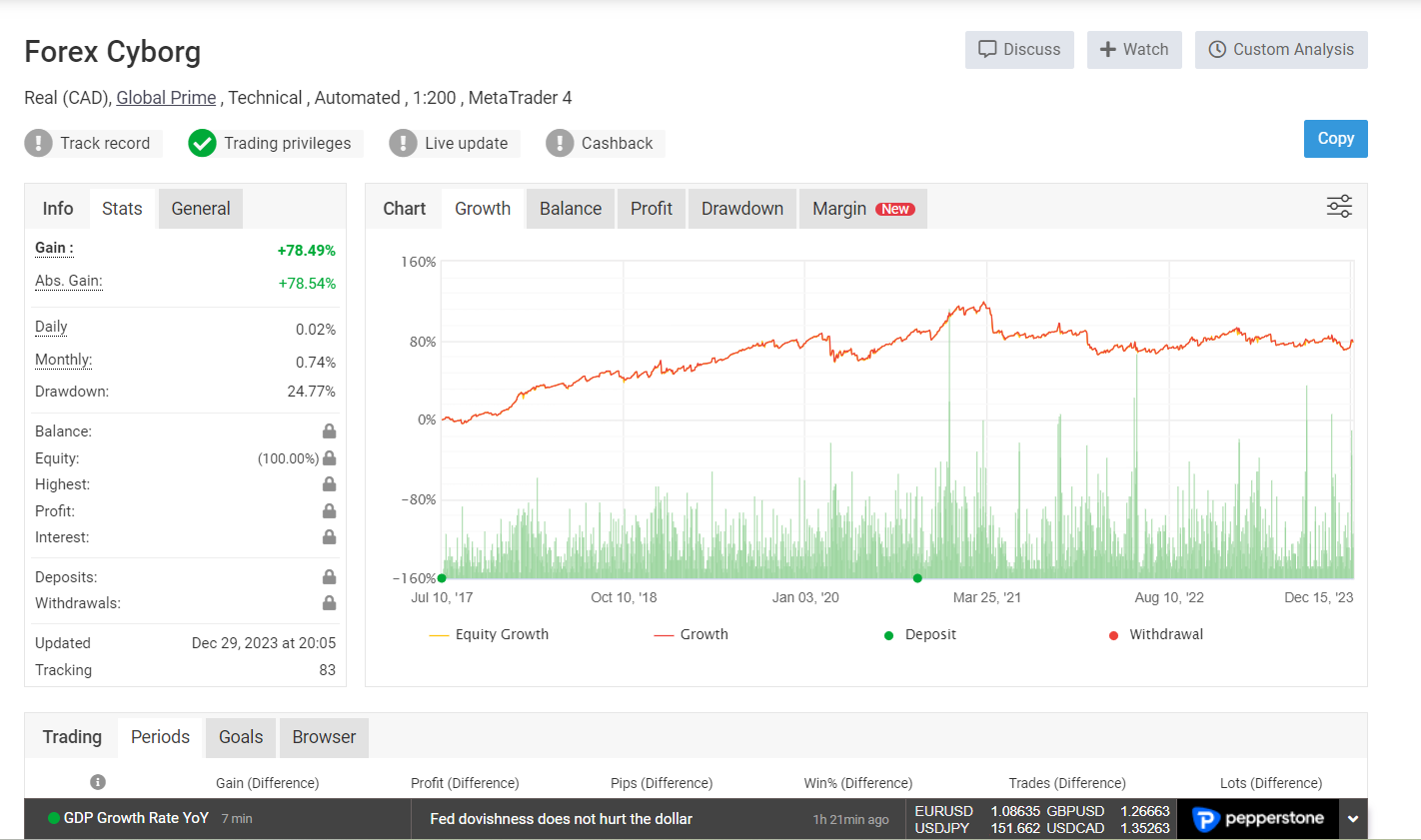

- ☑️Forex Cyborg – Cutting-edge forex-trading robot.

- ☑️Perceptrader AI – Trading tool designed for MetaTrader 4/5.

- ☑️Fortnite EA – Comes with customizable risk settings.

- ☑️Learn2Trade – Comprehensive educational platform.

What Are Forex Robot Traders?

Forex Robots, or Expert Advisors (EAs), are advanced trading automation tools that use predefined algorithms to execute trades in dynamic Forex markets. They analyze market trends and make 24/7 trades without emotional influence.

These robots are the pinnacle of quantitative trading, combining scalping and long-term position trading with unmatched accuracy.

Furthermore, they provide valuable insights from extensive datasets, transforming the strategic dynamics of the Forex market and pushing the boundaries of digital trading platforms.

The 10 Best Forex Robot Traders?

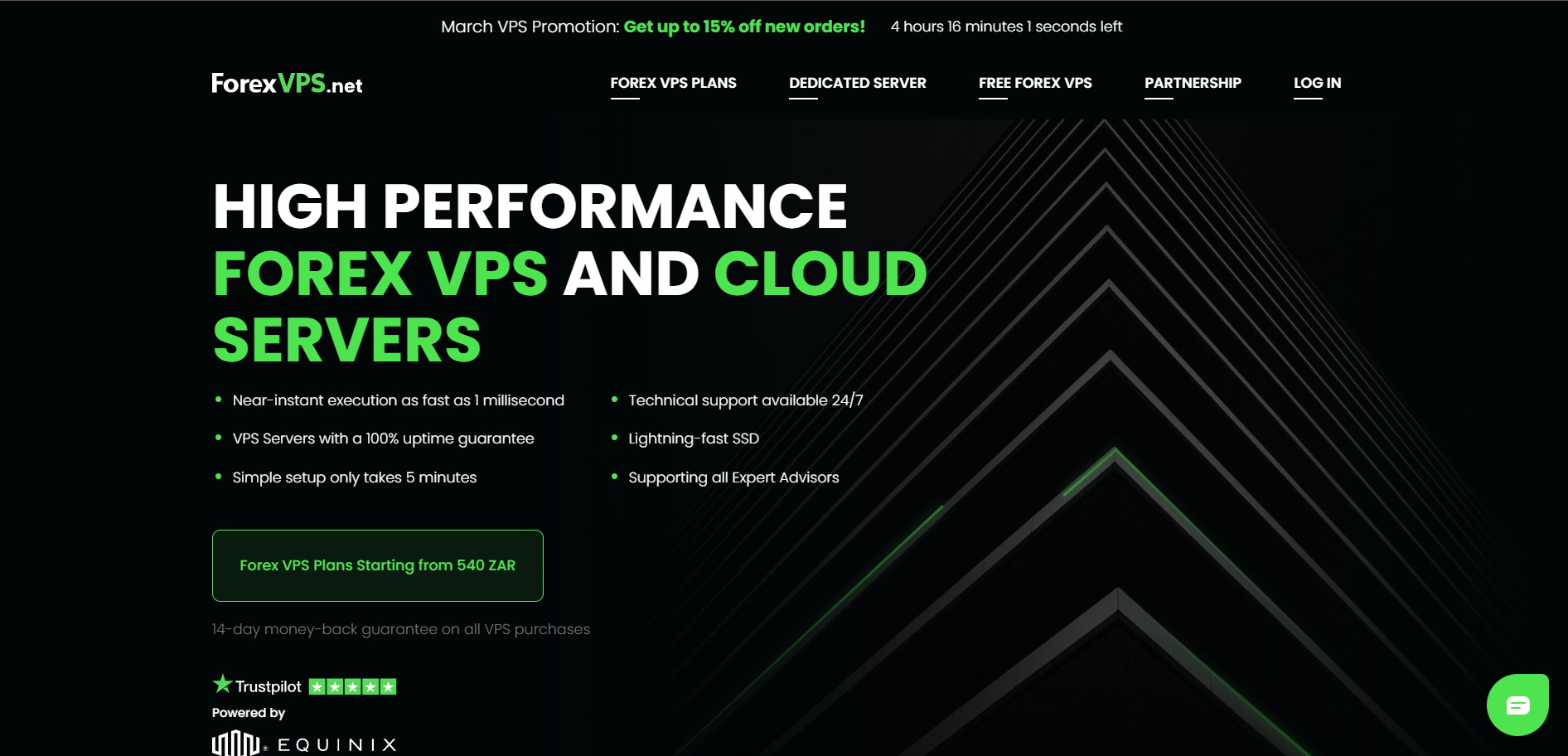

ForexVPS

Specializing in offering high-performance VPS (Virtual Private Server) services customized for forex trading, ForexVPS stands out in the market.

Operating from servers in key financial data centers globally, ForexVPS provides ultra-fast execution speeds of up to 1 millisecond and ensures a 100% uptime. The service caters to all Expert Advisors and offers a high-speed SSD, a dedicated IP address, and a choice of different Windows versions.

Performance History

ForexVPS is well-known for its reliability and performance in the forex trading community. However, it does not provide specific performance metrics like latency improvements for various brokers. Customer testimonials and reviews emphasize their satisfaction with the service’s stability and speed as a reliable Forex VPS provider.

ForexVPS Pros and Cons

| ✅ Pros | ❌ Cons |

| Quick VPS provisioning enables rapid setup and deployment. | Familiarity with VPS and trading platforms could be necessary for the best setup and utilization. |

| They provide assistance for all Expert Advisors and trading platforms. | The pricing may seem slightly elevated compared to regular VPS services that are not tailored for forex trading. |

| Around-the-clock technical support is available for any problems or help with setup. | Restricted to Windows operating systems, which may not align with all traders' preferences. |

| Having server locations worldwide guarantees minimal latency to top forex brokers. | |

| Ensuring uninterrupted online presence with a 100% uptime guarantee for trading platforms. |

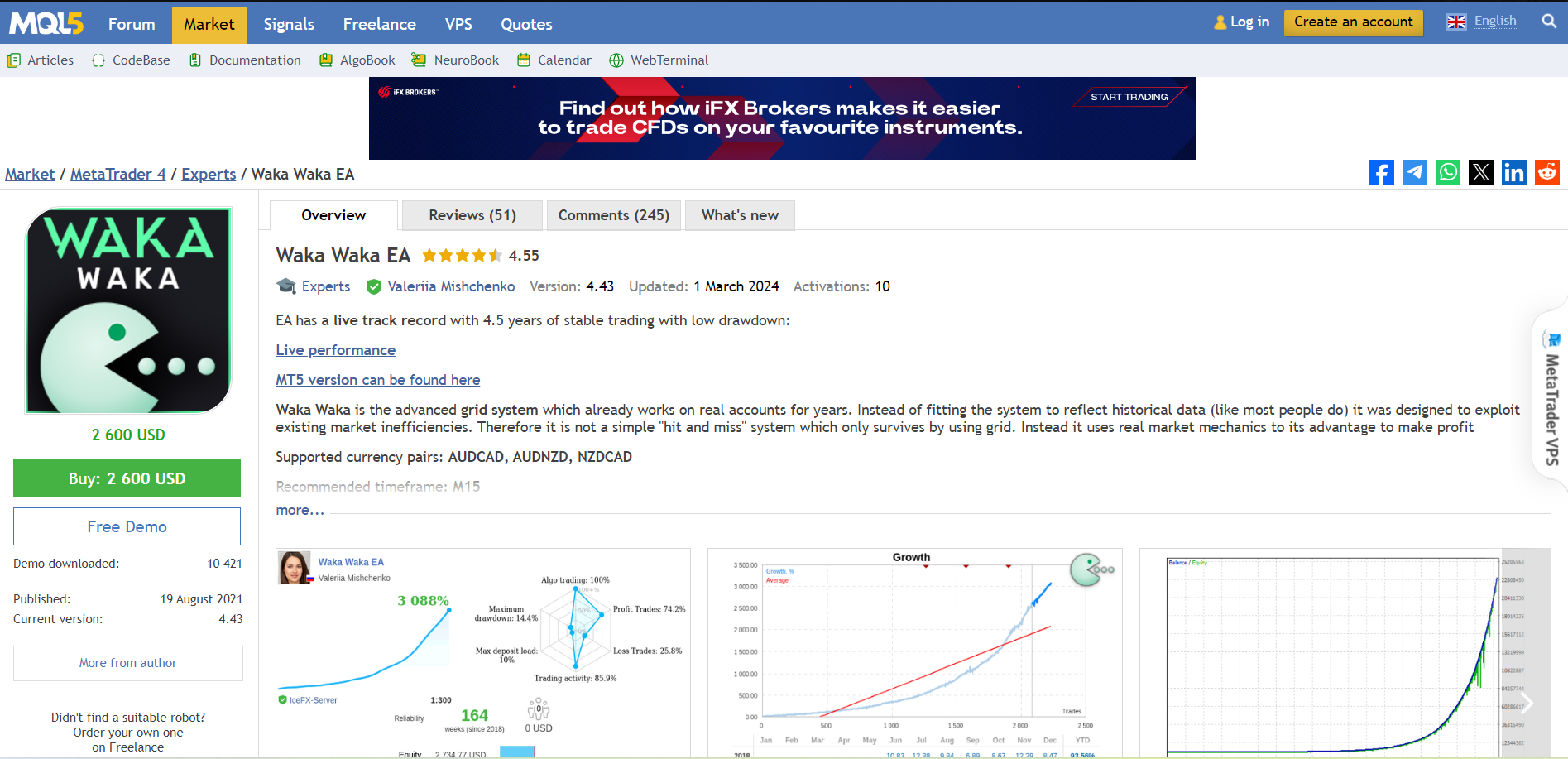

Waka Waka EA

Waka Waka EA is crafted for forex trading with a strong emphasis on safety and dependability. Operating on a single chart setup enables traders to efficiently manage all symbols from one place, streamlining the trading process. With its support for various currency pairs, the EA becomes more versatile for forex trading. Its strong history of steady trading performance over 4.5 years highlights its reliability and low drawdowns.

Performance History

Waka Waka EA has a remarkable record of maintaining high profits and minimal drawdowns. This has a proven track record of consistent performance over an extended period, making it a dependable option for traders seeking stability in their trading activities.

Waka Waka EA Pros and Cons

| ✅ Pros | ❌ Cons |

| Enjoy a streamlined trading experience with just one chart setup. | Results may fluctuate based on market conditions. |

| Reducing drawdowns is crucial for protecting capital. | Experience in trading may be necessary to fine-tune the settings. |

| Various risk management setups to accommodate different trading styles. | There is a lack of details regarding customization options. |

| Provides a range of currency pairs for added flexibility. | |

| Demonstrated a history of steady profits and limited losses. |

EA Builder

EA Builder is a robust and intuitive tool that allows traders to easily develop personalized indicators and strategies, even without programming expertise.

It is compatible with MetaTrader 4 & 5 and TradeStation platforms. Users can generate unlimited indicators at no cost and access strategies with a single upgrade.

This web-based application can be accessed without the hassle of downloading or installing any software. EA Builder provides diverse functionalities, such as personalized arrows and notifications, automated trading strategies, and support for trading multiple financial assets.

Performance History

The effectiveness of the strategies created using EA Builder depends on their unique characteristics. Since users can design a vast array of indicators and tactics, performance may fluctuate depending on trading conditions, financial instruments used, and user-defined parameters.

To help optimize results, EA Builder provides tools to test and refine these strategies to deliver optimal outcomes for the creators.

EA Builder Pros and Cons

| ✅ Pros | ❌ Cons |

| Compatible with both MetaTrader and TradeStation platforms. | Some users might find the upfront cost of strategy creation a hindrance. |

| Provides a complimentary option for generating indicators and the choice to make a single payment for access to all features. | The effectiveness of strategies relies significantly on user design and market conditions. |

| Allows for the development of personalized indicators and strategies even without coding expertise. | There might be a learning curve to make the most of all the features. |

| Offers video tutorials and a user-friendly interface for simple learning and usage. | |

| Comes with tools for financial management and notifications to improve trading tactics. |

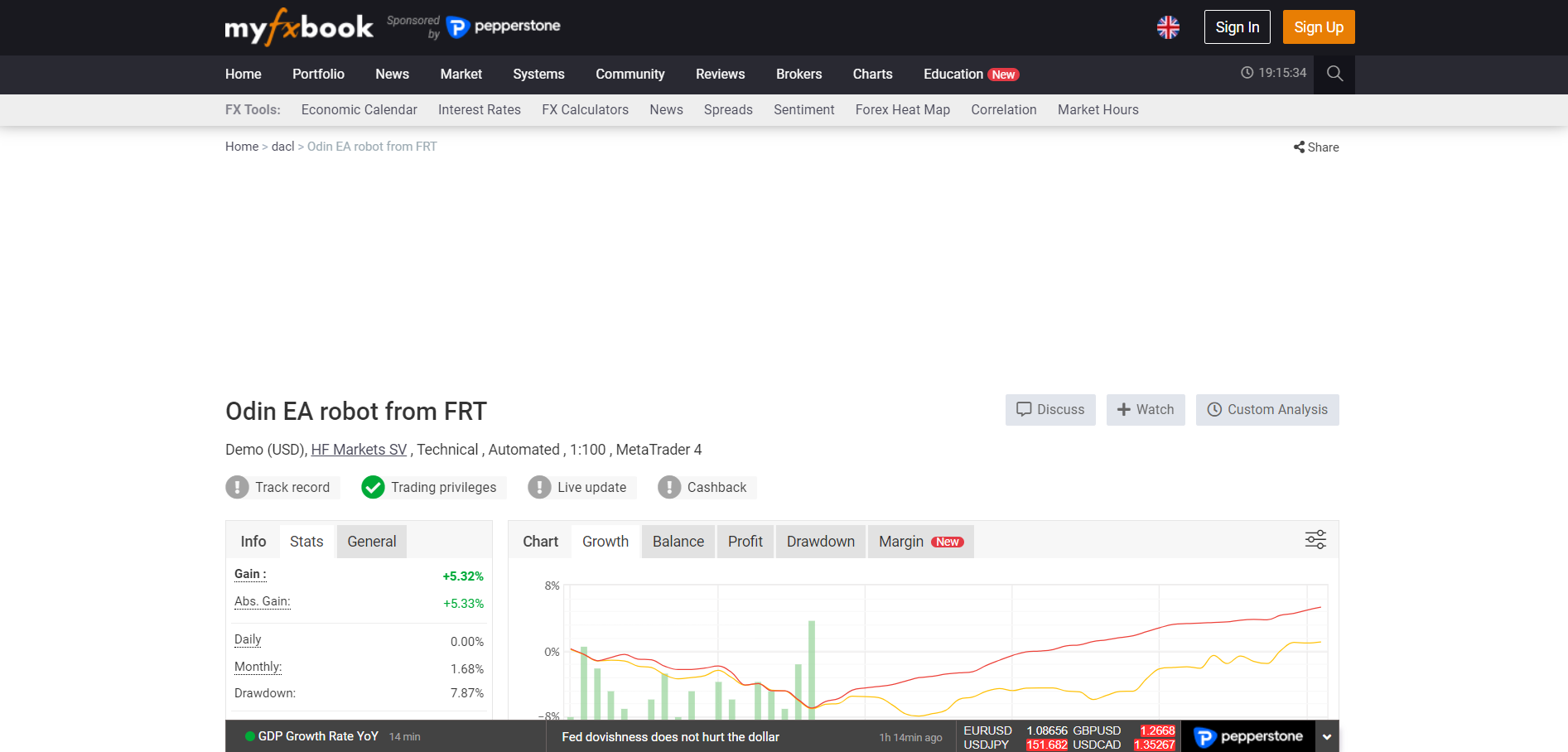

Odin

Odin Robot utilizes a sophisticated grid trading strategy to maneuver through the forex market. Implementing this approach includes setting buy and sell orders at specific intervals above and below a designated price point, resulting in a grid of orders at progressively higher and lower prices.

Odin is crafted to identify ideal entry and exit points, using precise stop loss and take profit strategies to secure profits as the price fluctuates. This strategy enables numerous trading chances within a specific price range, aiming to take advantage of market fluctuations.

Performance History

The Odin Robot’s performance stands out for its chart-dominating grid trading strategy. Although detailed performance metrics are not provided, the robot is highlighted for its ability to efficiently execute trades in different market conditions.

Yet, the efficiency of grid trading strategies can fluctuate greatly with market volatility and might not consistently meet user expectations.

Odin Pros and Cons

| ✅ Pros | ❌ Cons |

| An advanced trading strategy is optimized for market volatility. | Performance is closely tied to market conditions. |

| Skilled at navigating various market environments. | A grid trading strategy can result in higher risk if not carefully controlled. |

| Crafted to identify ideal moments to enter and exit trades. | It may necessitate close monitoring to fine-tune strategy parameters in unpredictable markets. |

| Implements precise stop loss and take profit strategies to safeguard profits. |

Flex EA

Features Flex EA uses an innovative automated trading strategy that uses “virtual trades” to identify optimal entry points before initiating real trading. Compatible with MT4 and MT5, it provides a variety of optimized settings and strategies, such as a news filter and money management features.

This automated system is crafted to avoid significant news announcements and can be tailored extensively to suit different trading approaches and preferences, accommodating all currency pairs.

Performance History

Flex EA showcases verified real account trading results with ADR Dynamic, BBANDS 300 EMA, and RSI 90 CROSS strategies. These live accounts showcase the adaptability and strong performance of Flex EA under various market conditions.

The website highlights its achievements through verified customer accounts that have demonstrated substantial returns, including accounts that tripled in value within six months.

Flex EA Pros and Cons

| ✅ Pros | ❌ Cons |

| Comes equipped with a news filter and sophisticated money management features to reduce risk. | Relying on virtual trades for entry points may not always match with rapid or unpredictable market changes. |

| Extensive compatibility with MT4 and MT5, making it ideal for various types of traders. | The cost might be too high for some traders due to the one-time payment required for full access to all features and updates. |

| Various strategy choices with adjustable settings to suit various trading preferences. | For those new to this, the intricacy of settings and strategies can feel quite daunting. |

| Automated updates guarantee that the EA stays optimized for current market conditions. | Achieving good performance hinges on choosing the appropriate settings and strategies for the prevailing market conditions, necessitating a grasp of the market. |

| A vibrant community forum and strong customer support enhance user experience and encourage knowledge exchange. |

Hamster Scalping

Hamster Scalping is a completely automated trading advisor employing scalping and martingale strategies. It utilizes the RSI indicator with an ATR-based filter to identify optimal entry and exit points.

The EA offers two operational modes: scalping mode for swift gains and martingale mode for traders desiring a more aggressive approach. Hamster Scalping is ideal for those who seek minimal interference once configured since it is a fully automatic forex trading solution.

Performance History

While we do not have precise performance data, Hamster Scalping employs scalping and martingale tactics. The goal is to make gains from minor price shifts and to try to bounce back from losses by increasing trade volumes. However, the success of these methods can vary greatly depending on market circumstances, which means that Hamster Scalping’s performance may also fluctuate.

Hamster Scalping Pros and Cons

| ✅ Pros | ❌ Cons |

| Uses the RSI indicator and ATR-based filter to make decisions. | Results can fluctuate significantly based on market conditions. |

| Ideal for traders seeking rapid profits through scalping. | This may necessitate close monitoring and fine-tuning of parameters to enhance performance. |

| Trading is fully automated and requires minimal intervention once it is set up. | The Martingale strategy carries a higher level of risk, which could result in substantial losses. |

| Provides options for both scalping and martingale strategies to accommodate various trading preferences. |

Forex Cyborg

Forex Cyborg is a sophisticated, cutting-edge forex-trading robot programmed to independently execute trades and establish stop-loss and take-profit levels.

This system is fully automated and operates with a high level of sophistication that can handle multicurrency trading across 14 currency pairs simultaneously. Forex Cyborg seeks to take advantage of the market’s volatility during pre-Asian hours, setting it apart in the world of forex trading robots.

Performance History

Forex Cyborg is skilled at efficiently trading different currency pairs using scalping techniques during quieter trading times.

While specific performance data is unavailable, the robot’s ability to handle multiple currencies suggests a broad approach to engaging with the market. This could offer more chances for profit but also highlights the importance of careful risk management.

Forex Cyborg Pros and Cons

| ✅ Pros | ❌ Cons |

| Created to function efficiently during the Asian trading session, focusing on particular market conditions. | Engaging in multicurrency trading heightens susceptibility to market fluctuations and potential hazards. |

| An automated trading system that operates with minimal user involvement. | Performance can vary greatly depending on market conditions and the choice of currency pairs. |

| Utilizing a sophisticated and cutting-edge algorithm to autonomously establish stop loss and take profit levels. | Understanding and optimizing settings in the system may be challenging due to its complexity, requiring users to invest time in learning. |

| Able to trade 14 currency pairs simultaneously, providing extensive market coverage. |

Perceptrader AI

Perceptrader AI is an advanced trading tool designed for MetaTrader 4/5. It uses Artificial Intelligence, specifically deep learning algorithms, to enhance its trading strategy.

This cutting-edge system focuses on grid trading and is designed to identify hidden patterns and trends in the forex market by analyzing large amounts of historical data.

By employing machine learning, Perceptrader AI can adapt to changing market conditions, aiming to maintain consistent profitability over time.

Performance History

While not offering specific performance metrics, Perceptrader AI focuses on its capacity to deliver steady profits by leveraging AI and machine learning in forex trading.

The system’s ability to analyze and learn from historical data indicates a possibility for strong performance. However, market volatility and the accuracy of its predictive models can impact its success, as with any trading system.

Perceptrader AI Pros and Cons

| ✅ Pros | ❌ Cons |

| Skilled at uncovering concealed patterns and trends by conducting thorough data analysis. | Relying solely on past data analysis may not consistently forecast future market trends. |

| Compatible with both MetaTrader 4 and MetaTrader 5 platforms. | Understanding AI and machine learning models can be challenging for some users due to their complexity. |

| Utilizes cutting-edge Artificial Intelligence and deep learning algorithms for market analysis. | The grid trading strategy's effectiveness can fluctuate depending on market conditions. |

| Crafted to adjust to evolving market conditions to ensure steady profitability. |

FX Fortnite EA

Fortnite EA is an advanced forex trading robot that caters to different trading preferences and risk levels. It comes with customizable risk settings, allowing users to adjust their risk levels according to their comfort level.

The system incorporates a robust profit-taking strategy, which functions automatically, ensuring trades are executed at opportune moments without manual input.

Specifically optimized for the EURCHF pair on the H1 timeframe, it employs a combination of trend-following and hedging techniques to capitalize on potential profits. Traders can select from various package options tailored to their unique trading styles and objectives.

Performance History

The FX Fortnite EA’s performance shines through its real-money performance tests, showcasing its profitability across various market conditions. By blending trend analysis with hedging techniques, the EA can adjust to market shifts to maintain steady returns.

Backtest results demonstrate substantial profits from a small starting deposit, suggesting the EA’s potential for impressive returns compared to the risk involved.

Fortnite EA Pros and Cons

| ✅ Pros | ❌ Cons |

| An automated trading system designed for efficient and timely trade execution. | The success of the hedging strategy may fluctuate depending on market volatility. |

| Demonstrated effectiveness through proven results in real money performance tests. | Adjustments must be made carefully to match individual risk preferences. |

| Customizable risk settings enable tailored trading strategies. | Designed mainly for one currency pair, potentially restricting diversification opportunities. |

| Designed for the EURCHF pair on the H1 timeframe, using a mix of trend-following and hedging tactics. |

Learn2Trade

Learn2Trade is renowned for its comprehensive educational platform and signals for forex and cryptocurrency trading. Offering a wide array of services including free forex, VIP trading, and crypto signals. This platform is designed to cater to the requirements of traders at all levels, providing access to over 60 analytical tools and indicators.

Traders can receive news alerts and signals and explore the MetaTrader market to buy additional indicators and tools to enhance their trading strategy and decision-making.

Performance History

Learn2Trade is a top-notch forex trading school known for its excellent education and reliable trading signals. They offer real-time signals for commodities, indices, cryptocurrencies, and forex, aiming to provide valuable insights for profitable trading opportunities.

Learn2Trade Pros and Cons

| ✅ Pros | ❌ Cons |

| The educational material is suitable for individuals at all levels of trading experience. | For some traders, the subscription fees for VIP signals might be too high. |

| Providing timely trading signals to offer practical insights across different asset classes. | Users need to possess or acquire a specific level of trading knowledge to make the most of the platform's features. |

| One of the advantages is the wide range of trading signals available for forex and cryptocurrencies. | Trading signals' effectiveness can fluctuate depending on market conditions and how quickly traders can respond to them. |

| Access more than 60 analytical tools and indicators to improve market analysis. |

How Do Forex Robot Traders Work?

Robots are like automated assistants that handle buying and selling in the forex market. They follow pre-set plans using different types of analysis to make decisions without getting influenced by emotions. This helps them work non-stop and catch opportunities from around the world. Furthermore, these robots’ success depends on their basic to advanced strategies, which need a lot of computing power to process data quickly.

Understanding Algorithmic Trading

Algorithmic trading involves using computer programs to execute trades faster and more frequently than humans can. It is all about automated trading strategies based on specific criteria like technical indicators, statistical arbitrage, or market conditions.

These strategies are thoroughly tested on historical data to ensure they work before being used in real markets. The aim is to generate consistent returns by minimizing human error and avoiding emotional trading decisions. Thanks to algorithmic trading, individual traders can now access advanced strategies that were once only available to institutional investors, opening up financial markets to a wider audience.

The Role of Artificial Intelligence and Machine Learning

AI and ML are crucial in boosting the capabilities of forex robot traders. Artificial intelligence allows robots to swiftly analyze market data and adapt their trading strategies, improving their predictive abilities. Machine learning algorithms excel at detecting hidden patterns and trends within vast datasets, enabling forex robots to make informed decisions by analyzing market sentiment, economic indicators, and price fluctuations. Incorporating AI and ML into forex trading enhances the effectiveness of trading strategies, resulting in the development of autonomous systems capable of self-optimization over time.

What To Consider When Choosing an Ideal Robot Forex Trader

Reliability and Performance History

To choose a forex robot trader, prioritize reliability and a proven track record. Ensure robots have undergone backtesting, shown steady returns, and maintained minimal drawdown to avoid risk.

Verify performance history through independent platforms like Myfxbook or FX Blue for transparency and confidence.

Compatibility with Various Trading Platforms

Additionally, the Forex robot must seamlessly integrate with popular trading platforms such as MetaTrader 4 and MT5. These platforms serve as vital infrastructures for efficient trade execution and enjoy widespread adoption among brokers globally. By ensuring compatibility with these platforms, users can experience uninterrupted usage without encountering technical obstacles.

Cost and Subscription Models

Forex robots and their subscription models come with a wide range of costs.

Traders should evaluate their budget and the robot’s value, considering the potential returns on investment. Moreover, numerous developers provide a money-back guarantee, enabling traders to evaluate the robot’s performance without risk.

Customer Support and Community Feedback

Good customer support and positive community feedback show that a robot is reliable and its developers are dedicated to their product. Support channels should quickly help set up, adjust, and fix any issues.

Community feedback on forums and review sites gives useful info on how well the robot works and what users think, which helps traders choose wisely. An active online community can also give tips and tricks to improve trading.

Conclusion

While searching for the best forex robot traders, we found that the landscape appears intricate and diverse, full of opportunities yet accompanied by numerous factors to consider.

With the introduction of these automated systems, individuals of all skill levels can now participate in the forex market.

We found that these robots provide continuous trading, rational decision-making, and the capacity to analyze extensive data for enhanced trading strategies.

Nevertheless, the challenges are significant. Ensuring the dependability of these systems may require extensive research and testing. Moreover, their efficiency relies heavily on market conditions without ensuring future results.

Overall, we can conclude that although Forex Robot Traders show great potential, they are not a cure-all. Therefore, traders need to stay alert, informed, and ready to handle the risks of automated trading.

Faq

Professional traders incorporate forex robots into their extensive trading arsenal. Robots enhance execution speed and backtesting strategies; they are not a substitute for market knowledge and experience.

Stay cautious of robots that promise exaggerated profits or lack verified performance records. Conduct a comprehensive investigation into the seller’s reputation and seek trustworthy user reviews.

Currency pairings, risk tolerance, trading style (scalping, swing trading, etc.), and the robot’s history to be checked. Seek clarity in the robot’s trading logic and backtesting outcomes.

Utilizing forex robots can be beneficial for automating strategies and maximizing efficiency. Yet, they do not replace a deep comprehension of the market and do not ensure profits.

Forex robots do not provide a miraculous path to riches. Mastering forex trading involves a blend of solid strategy, effective risk management, and acknowledging that even top-performing robots can face losses.