10 Best Forex Brokers with Minimum $10 Deposit

10 Best Forex Brokers with Minimum $10 Deposit This article lists the ten top Forex brokers that permit traders to sign up with a nominal minimum deposit.

In this in-depth guide, you’ll learn:

- What is a Minimum Deposit?

- Can I open a Forex account with $10?

- Who is the best forex broker with a ten-dollar minimum deposit?

- Which forex brokers have a 10-dollar minimum deposit?

- Can $10 minimum deposit accounts access diverse trading platforms?

So, if you’re ready to go “all in” with the best minimum deposit forex brokers…

Let’s dive right in…

10 Best Forex Brokers with Minimum $10 Deposit (2024*)

- ☑️FXTM – Overall Best $10 minimum deposit Forex Broker.

- ☑️Axiory – Best Broker for Beginners.

- ☑️Exness– Well-known for its immediate Withdrawal Services.

- ☑️OANDA – Strong Regulatory Structure.

- ☑️RoboForex – Features a Loyalty Program.

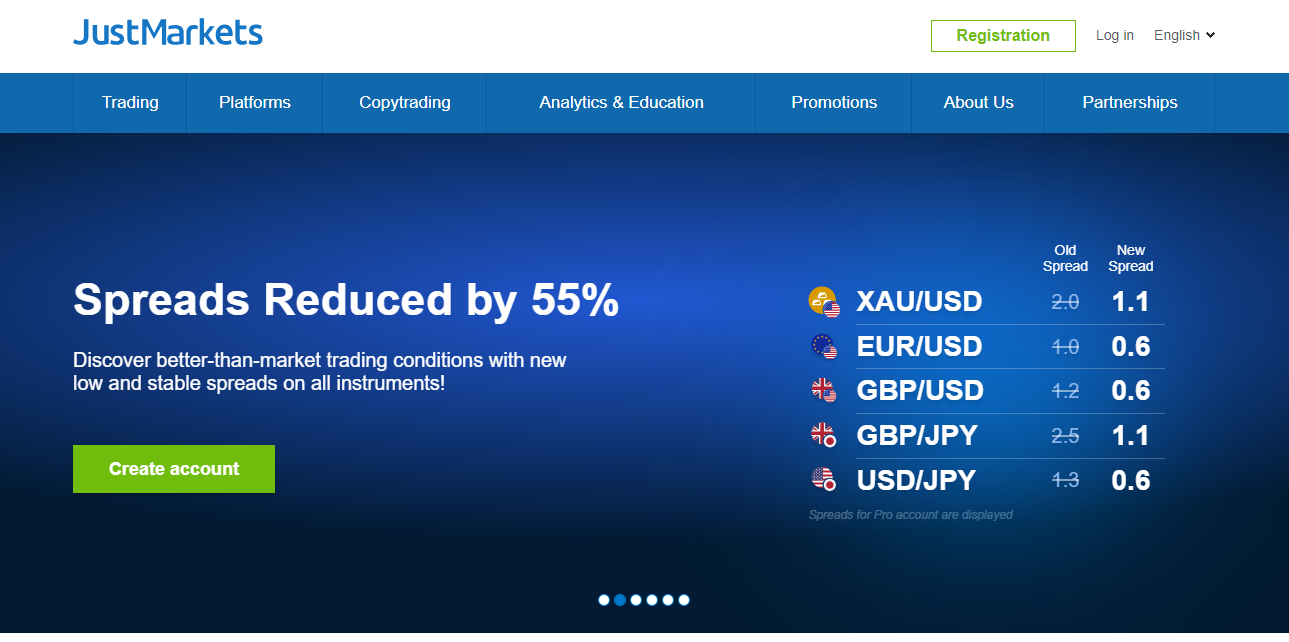

- ☑️JustMarkets – Offers no Commissions.

- ☑️LiteFinance – Offers beginner-friendly CENT Account.

- ☑️IQ Option – Best to explore Various Markets.

- ☑️IFX Brokers – Well-known for a wide selection of ZAR accounts.

- ☑️Libertex – Offers Exceptional Market experience.

What is a Minimum Deposit?

The term “minimum deposit” denotes the bare minimum quantity of capital necessary to establish a trading account with a broker in Forex trading. This deposit is utilized as trading capital on the foreign exchange market. Commencing with a $10 deposit presents distinct ramifications and prospects.

A minimum deposit requirement of $10 enables greater accessibility to the Forex market. This platform allows novices to explore authentic trading environments while avoiding substantial financial hazards.

This feature is especially attractive to novice Forex traders or those exercising caution when investing their funds.

In addition, using a humble deposit of $10 for trading grants essential hands-on experience that aids in understanding market dynamics, testing out strategies, and building confidence without the possibility of significant financial losses.

Although it limits earning potential, one must understand that this method may not yield the same expertise as investing with larger deposits, especially when dealing with leverage management and diversification strategies.

10 Best Forex Brokers with a $10 Minimum Deposit

| 🔎Broker Name | 👉 Open Account | 💻Account Types | 💰Minimum Deposit | 💻Demo Account |

| FXTM | 👉 Open Account | Micro, Advantage, Advantage Plus | 10 USD | ✅ |

| Axiory | 👉 Open Account | Nano, Standard, Max, Tera, Alpha | 10 USD | ✅ |

| Exness | 👉 Open Account | Standard, Standard Cent, Raw Spread, Zero, Pro | 10 USD | ✅ |

| OANDA | 👉 Open Account | Standard, Core, Swap-Free, Premium, Premium Core | From 0 USD (can deposit $10) | ✅ |

| RoboForex | 👉 Open Account | Prime, ECN, R StocksTrader, ProCent, Pro | 10 USD | ✅ |

| JustMarkets | 👉 Open Account | MT4 Standard Cent, MT4 Standard, MT4 Pro, MT4 Raw Spread, MT5 Standard, MT5 Pro, MT5 Raw Spread | 10 USD | ✅ |

| LiteFinance | 👉 Open Account | CENT, CLASSIC, ECN | 10 USD | ✅ |

| IQ Option | 👉 Open Account | Retail, Professional | 10 USD | ✅ |

| IFX Brokers | 👉 Open Account | IFX Standard, IFX Premium, IFX VIP, IFX Islamic, IFX Cent | 10 USD | ✅ |

| Libertex | 👉 Open Account | Libertex Portfolio, Libertex CFD | 10 USD | ✅ |

FXTM

Minimum Deposit

FXTM’s Micro Account allows traders to start with just $10, giving them access to major markets like currency and commodities.

With floating spreads starting at 1.5 pips on EUR/USD and no commissions, this account is great for beginner or experienced traders looking to test new strategies with quick execution on the MT4 and FXTM Trader platforms.

Unique Features

| 🔎Regulators | CySEC, FSCA, FCA, CMA, FSC Mauritius |

| 💻Account Types | Micro, Advantage, Advantage Plus |

| 📊Leverage | 1:2000 |

| 💰Minimum Deposit | 10 USD |

| 👉 Open Account | 👉 Open Account |

FXTM Pros and Cons

| ✅Pros | ❌Cons |

| Traders can access a variety of markets, including Forex, commodities, and indices | Forex markets can be turbulent, and starting with modest cash may not provide adequate protection against market swings |

| FXTM provides substantial teaching materials to help new traders learn about the Forex market | High leverage increases the chance of losses, especially for inexperienced traders |

| The $10 minimum deposit makes it accessible to a wide spectrum of traders | While a $10 investment is low-risk, lower position sizes may limit earnings possibilities |

| The broker is known for providing prompt and friendly client support | Certain withdrawal methods may have limitations or costs that affect the overall trading experience |

| FXTM provides high leverage options, allowing traders to maximize market exposure with less cash |

Axiory

Minimum Deposit

Axiory’s Nano Account, with a $10 minimum deposit, provides ultra-low average spreads of 0.3 pips on major Forex pairs.

The account, available on MetaTrader 4 and cTrader, permits trading in micro-lots and charges a $6 commission per lot, making it ideal for beginners and those experimenting with different trading strategies.

Unique Features

| 🔎Regulators | IFSC Belize, FSC Mauritius, FCA |

| 💻Account Types | Nano, Standard, Max, Tera, Alpha |

| 📊Leverage | 1:1000 |

| 💰Minimum Deposit | 10 USD |

| 👉 Open Account | 👉 Open Account |

Axiory Pros and Cons

| ✅Pros | ❌Cons |

| Axiory is noted for its transparent trading conditions, which include clear information on spreads, commissions, and leverage | Axiory's product selection is fairly limited compared to larger brokers |

| The broker provides a Nano Account with extremely low spreads | |

| Axiory offers MetaTrader 4, 5, and cTrader, two of the industry's most popular and advanced trading platforms. | |

| The broker's commitment to customer service is clear, as evidenced by a reputation for prompt and helpful assistance | |

| Axiory's educational content and market research are continuously updated |

Exness

Minimum Deposit

Exness’ Standard Account is praised for its user-friendliness and flexibility, with no minimum deposit and trades starting at $10.

This account offers changeable spreads starting at 0.3 pips, unlimited leverage, and no commissions, catering to various trading styles and skill levels using a market execution mechanism.

Unique Features

| 🔎Regulators | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA |

| 💻Account Types | Standard, Standard Cent, Raw Spread, Zero, Pro |

| 📊Leverage | 1:Unlimited |

| 💰Minimum Deposit | 10 USD |

| 👉 Open Account | 👉 Open Account |

Exness Pros and Cons

| ✅Pros | ❌Cons |

| High Earning Potential: Exness offers a combination of competitive commission structures, including CPA (cost per acquisition) tiers that can be as high as $1,000 and lifetime revenue sharing up to 40%. This means you can earn a significant amount for each client you refer and continue to benefit as long as they remain active. | Performance-Based Income: Your earnings depend entirely on client activity. If you don't attract a steady stream of referrals who trade actively, your income may be inconsistent. |

| Flexible Commission Plans: You can choose between revenue sharing and CPA models, allowing you to tailor your earnings strategy to your audience and traffic source. | Limited Transparency: Exness doesn't readily disclose information on conversion rates or the size of their existing affiliate base, making it difficult to gauge the program's overall effectiveness. |

| Potentially High Conversion Rate: While Exness doesn't explicitly advertise conversion rates, the focus on competitive commissions and lifetime earnings suggests they might be attractive to potential clients, leading to a higher conversion rate. | Minimum Requirements: There might be minimum traffic or activity requirements to participate in the program, which could be a hurdle for new affiliates. |

| Established Program: The program's well-established nature suggests it might have a large existing affiliate base, potentially indicating its success and trustworthiness. | Regulatory Considerations: Forex and CFD trading are heavily regulated in many regions. You'll need to ensure your marketing practices comply with relevant regulations and target the appropriate audience. |

| Marketing and Support: Exness provides a range of marketing materials and creatives to help you promote their services. Additionally, you'll have access to a dedicated affiliate support team for any questions or assistance you may need. | Complex Products: Forex and CFDs are complex financial instruments. You'll need a good understanding of these products to responsibly promote them and avoid attracting unsuitable clients. |

| The broker offers infinite leverage for certain account types, providing a distinct advantage for experienced traders who understand the dangers and rewards of high-leverage | While Exness is regulated, some of its jurisdictions are less stringent than top-tier authorities such as the FCA or ASIC |

| Exness is well-known for its immediate withdrawal services, which provide traders with quick and efficient access to their assets | Exness' teaching tools are somewhat restricted, especially for advanced traders who require complete learning materials |

| The platform covers a diverse set of trading instruments, including Forex pairings, commodities, cryptocurrencies, energy, and indices |

OANDA

Minimum Deposit

OANDA’s Standard Account allows for easy trading with no verification required for deposits under $9,000 and a starting balance of $0, allowing traders to start trading with $10.

Traders benefit from competitive spreads starting at 0.6 pips, no commissions, and variable leverage, which suits traders of all levels.

Unique Features

| 🔎Regulators | IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, BVI FSC |

| 💻Account Types | Standard, Core, Swap-Free, Premium, Premium Core |

| 📊Leverage | 1:888 |

| 💰Minimum Deposit | 0 USD |

| 👉 Open Account | 👉 Open Account |

OANDA Pros and Cons

| ✅Pros | ❌Cons |

| OANDA is known for its strong regulatory structure, which is overseen by top-tier entities like as the FCA and CFTC, enhancing its credibility and dependability | OANDA has a restricted product selection, principally focused on Forex and CFDs |

| The platform has an advanced trading interface, extensive charting capabilities, and a user-friendly design that is appropriate for both novice and expert traders | The broker's account structure and price tiers can be complex and perplexing to inexperienced traders |

| OANDA offers a wide range of research tools and resources, such as market analysis and economic calendars | While OANDA offers complex tools, beginners may struggle to master these functions |

| There is no minimum deposit requirement, making it accessible to traders of all levels, and its spreads are competitive. | Some users have noticed slippage and latency concerns during periods of strong market volatility |

| OANDA's customer service is well-regarded, with helpful and experienced support staff |

RoboForex

Minimum Deposit

RoboForex’s Prime Account offers optimal trading conditions, including a $10 minimum deposit, floating spreads from 0 pips, and a $10 commission per million transacted.

Available on many platforms, including MT4 and MT5, it provides a wide range of tradable instruments with a high leverage ratio of 1:300, making it appealing to traders of all skill levels.

Unique Features

| 🔎Regulators | 💻Account Types | 📊Leverage | 💰Minimum Deposit |

| CySEC, IFSC, Labuan FSA | Prime, ECN, R StocksTrader, ProCent, Pro | 1:2000 | 10 USD |

| 💻Account Types | Prime, ECN, R StocksTrader, ProCent, Pro | ||

| 📊Leverage | 1:2000 | ||

| 💰Minimum Deposit | 10 USD | ||

| 👉 Open Account | 👉 Open Account |

RoboForex Pros and Cons

| ✅Pros | ❌Cons |

| RoboForex provides several account types, including cent accounts | Some traders have complained about customer service's responsiveness and efficacy |

| The broker offers CopyFX, a tool for copy trading that is useful for both beginners and experienced traders searching for diversity | RoboForex's bonus programs might be complex and difficult to grasp, particularly for inexperienced traders. |

| RoboForex features a loyalty program that offers cashback and other advantages to active users | |

| The broker accepts a variety of payment options, including cryptocurrency, for deposits and withdrawals | |

| RoboForex offers MetaTrader 4 and 5, which provide traders with freedom and superior capabilities |

JustMarkets

Minimum Deposit

JustMarkets provides the MT4 Standard Cent Account with a $10 minimum deposit, ideal for South African traders starting their Forex career.

This account allows for micro-lot trading and provides generous leverage of up to 1:3000, making it ideal for those exploring low-risk methods.

Furthermore, it is a fantastic starting place for market beginners because it has no commissions and allows you to trade various instruments, including 33 Forex pairs and 4 commodities.

Unique Features

| 🔎Regulators | FSA, CySEC, FSCA, FSC |

| 💻Account Types | MT4 Standard Cent, MT4 Standard, MT4 Pro, MT4 Raw Spread, MT5 Standard, MT5 Pro, MT5 Raw Spread |

| 📊Leverage | 1:3000 |

| 💰Minimum Deposit | 10 USD |

| 👉 Open Account | 👉 Open Account |

JustMarkets Pros and Cons

| ✅Pros | ❌Cons |

| JustMarkets provides tight spreads and cheap commission rates | Concerns have been raised about execution speed and slippage during instances of extreme volatility |

| Offers an Islamic account option, which appeals to a wider spectrum of traders | While there are a variety of educational tools available, their quality may not match the expectations of more experienced traders |

| JustMarkets provides high leverage options | Traders from some areas, notably the United States, are prohibited from utilizing JustMarkets |

| Accepts a variety of payment options |

LiteFinance

Minimum Deposit

LiteFinance offers a beginner-friendly CENT account with a minimum deposit of $10. It supports micro-lot trading and leverage of up to 1:200, offering a safe environment for traders to study and execute low-volume trades.

With no commissions and a floating spread starting at 1.8 pips, the account is available on numerous platforms, including MetaTrader 4 and 5. It allows for limitless open orders, promoting a comprehensive trading experience.

Unique Features

| 🔎Regulators | CySEC |

| 💻Account Types | CENT, CLASSIC, ECN |

| 📊Leverage | 1:1000 |

| 💰Minimum Deposit | 10 USD |

| 👉 Open Account | 👉 Open Account |

LiteFinance Pros and Cons

| ✅Pros | ❌Cons |

| LiteFinance includes a social trading function that allows traders to replicate the transactions of experienced investors | Some customers have experienced concerns with the platform's stability and execution speed during moments of extreme volatility |

| Offers a diverse selection of trading instruments, such as forex pairings, commodities, oil, and cryptocurrencies | Educational resources are sparse |

| LiteFinance is noted for its competitive spreads and cheap transaction fees | |

| Trading platforms are easy to use and include extensive capabilities for both novices and professionals | |

| LiteFinance provides several account types, including ECN accounts, to suit various trading methods |

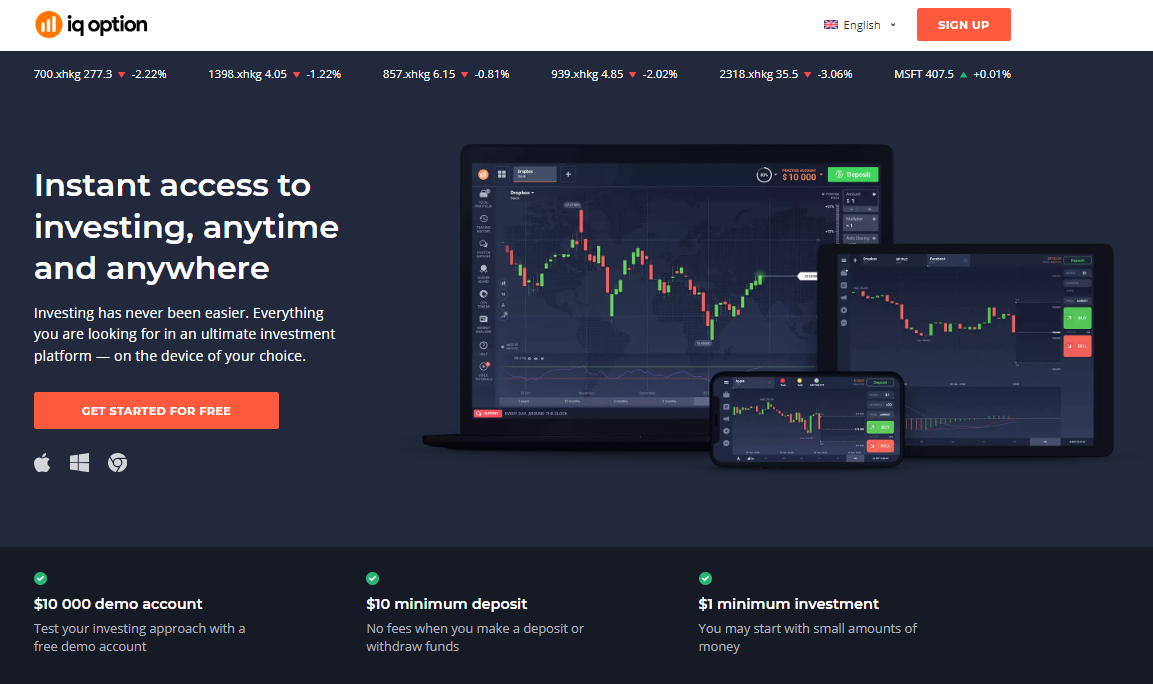

IQ Option

Minimum Deposit

IQ Option offers a $10 minimum deposit, commission-free trading, and tight spreads starting at 0.6 pips for EUR/USD.

Traders can explore various markets, including equities, options, and cryptocurrencies, using the broker’s award-winning interface on desktop and mobile devices.

The platform’s architecture and toolset cater to various trading techniques, putting the user experience first.

Unique Features

| 🔎Regulators | CySEC |

| 💻Account Types | Retail, Professional |

| 📊Leverage | 1:30 |

| 💰Minimum Deposit | 10 USD |

| 👉 Open Account | 👉 Open Account |

IQ Option Pros and Cons

| ✅Pros | ❌Cons |

| IQ Option is well-known for its creative and user-friendly trading interface | IQ Option's emphasis on binary and digital options may not appeal to traditional Forex and stock traders |

| Provides a unique variety of tradable products, such as binary options, digital options, and cryptocurrency | Regulated by CySEC, which is respected but less severe than regulators such as the FCA |

| IQ Option offers a free demo account with virtual funds | |

| The interface is well-designed, with good charting tools and technical indicators to aid trading analysis | |

| IQ Option places a major emphasis on trader education, including several learning resources and courses |

IFX Brokers

Minimum Deposit

IFX Brokers offers a $10 minimum deposit on its MT4 and MT5 platforms, catering to a diverse range of traders since its launch in 2018. Traders can select from various currency pairings and enjoy competitive trading conditions.

The broker stands out for its wide selection of ZAR account options, which cater to South African traders while emphasizing transparency and fairness.

Unique Features

| 🔎Regulators | FSCA |

| 💻Account Types | IFX Standard, IFX Premium, IFX VIP, IFX Islamic, IFX Cent |

| 📊Leverage | 1:500 |

| 💰Minimum Deposit | 10 USD |

| 👉 Open Account | 👉 Open Account |

IFX Pros and Cons

| ✅Pros | ❌Cons |

| IFX Brokers provides MetaTrader 4 and 5 platforms | IFX Brokers is primarily regulated by the Financial Sector Conduct Authority of South Africa, which may not be as well-known internationally as other agencies such as the FCA or CySEC |

| The broker offers several account types, including Islamic accounts, to meet the different trading demands and preferences | The Account structure might be confusing and overwhelming for beginners |

| IFX Brokers offers competitive spreads, which are very useful for traders trying to reduce their trading costs | Traders can still lose their invested capital because of high leverage despite negative balance protection |

| Has a local presence in South Africa and provides personalized services to South African traders | The platform's research and analytical tools may not be adequate for sophisticated technical analysis |

| IFX Brokers offers a variety of educational materials that are appropriate for both new and seasoned traders |

Libertex

Minimum Deposit

Libertex, with over 25 years of experience, provides a streamlined trading experience for CFDs and commission-free stock investment. The Alpha Account offers MetaTrader 5 access and tailored trading conditions for skilled traders, with no minimum deposit and leverage of up to 1:1.

The platform distinguishes itself with its bespoke user-friendly design, affordable pricing, and fast execution rates, making it suited for novice and experienced traders.

Unique Features

| 🔎Regulators | CySEC |

| 💻Account Types | Libertex Portfolio, Libertex CFD |

| 📊Leverage | 1:999 |

| 💰Minimum Deposit | 10 USD |

| 👉 Open Account | 👉 Open Account |

Libertex Pros and Cons

| ✅Pros | ❌Cons |

| Libertex is well-known for its user-friendly interface | Libertex has a smaller selection of tradable assets than other brokers |

| Provides commission-free stock trading | Libertex does not offer MetaTrader 5 |

| Libertex offers unique risk management capabilities, such as Stop Loss and Take Profit functionalities | Libertex's educational resources are limited |

| The platform provides a demo account with virtual funds | |

| Libertex has over 20 years of market experience, creating a solid reputation |

Conclusion

Entering the realm of Forex trading does not necessarily entail a significant financial risk. Start small, prioritize education, and choose a broker that aligns with your financial goals and risk tolerance.

Faq

Yes, traders can use leverage with a $10 minimum deposit account, increasing possible profit and danger of loss.

Trading with a $10 deposit exposes traders to the same market risks as larger accounts but with less financial exposure; nonetheless, diversification and plan execution may be constrained.

With a $10 deposit, traders can often access currency pairs, metals, and, in some cases, indices and commodities, depending on the broker’s offerings.

Brokers such as Exness, JustMarkets, LiteFinance, and others allow traders to open accounts with as little as a $10 investment, making them accessible to beginner and experienced traders.

Many forex brokers allow you to start an account with a $10 minimum deposit, which is ideal for new traders or those wishing to test the market with minimal financial commitment.