XLibre Review

Overall, XLibre can be summarised as a trustworthy and Popular Broker choice that offers access to a full range of financial instruments. It is ideal for both beginners and professional traders, and it has a trust score of 70 out of 99.

🛡️Regulated and trusted by FCA and FSC.

🛡️1607 new traders chose this broker in the last 90 days.

🛡️Available for global Traders.

| 🔎 Broker | 🥇 XLibre |

| 🗓 Established Year | 2024 |

| ⚖️ Regulation and Licenses | FCA, FSC |

| 🪪 Ease of Use Rating | 4.5/5 |

| 📞 Support Hours | 24/5 live support |

| 💻 Trading Platforms | MetaTrader 5 (MT5), Web-based platform |

| 🛍 Account Types | Cent Account, Standard Account, Raw Account and Pro Account |

| 🤝 Base Currencies | USD, EUR, GBP, ZAR |

| 📊 Spreads | From 0 pips |

| 📈 Leverage | 1:2000 |

| 💸 Currency Pairs | 50+ currency pairs |

| 💳 Minimum Deposit | $0 |

| 🎁 Bonus Offer | 100% Welcome Bonus |

| 🌟 Copy/Social Trading | ✅Yes |

| 🚫 Inactivity Fee | Yes, after 6 months of inactivity |

| 🗣 Website Languages | English, French, Spanish, Arabic, and more |

| 💰 Fees and Commissions | Commission-free on most accounts, with competitive spreads |

| ✅ Affiliate Program | Yes, with competitive commission structures |

| 🏦 Banned Countries | None |

| ✔️ Scalping | Allowed |

| 📉 Hedging | Allowed |

| 📈 CFD Commodities | 15+ |

| 📊 CFDs-Total Offered | 1000+ |

| 💹 CFD Stock Indices | 20+ |

| ⭐ CFD Shares | 500+ |

| 🚀Open an Account | 👉 Open Account |

Overview

XLibre’s dual licensing in Mauritius and South Africa highlights its commitment to a secure regulatory environment. The platform emphasizes user security, transparency, and innovation, with advanced protocols to protect client funds and provide market insights.

Their 24/5 support and diverse account options cater to various traders. As a Market Maker broker, XLibre is transparent about potential conflicts of interest and trading conditions. Our goal is to offer a balanced assessment of XLibre by examining its regulations, customer service, account types, and execution policies.

Detailed Summary

| 🔎 Broker | 🥇 XLibre |

| 🗓 Established Year | 2024 |

| ⚖️ Regulation and Licenses | FCA, FSC |

| 🪪 Ease of Use Rating | 4.5/5 |

| 📞 Support Hours | 24/5 live support |

| 💻 Trading Platforms | MetaTrader 5 (MT5), Web-based platform |

| 🛍 Account Types | Cent Account, Standard Account, Raw Account and Pro Account |

| 🤝 Base Currencies | USD, EUR, GBP, ZAR |

| 📊 Spreads | From 0 pips |

| 📈 Leverage | 1:2000 |

| 💸 Currency Pairs | 50+ currency pairs |

| 💳 Minimum Deposit | $0 |

| 🎁 Bonus Offer | 100% Welcome Bonus |

| 🌟 Copy/Social Trading | ✅Yes |

| 🚫 Inactivity Fee | Yes, after 6 months of inactivity |

| 🗣 Website Languages | English, French, Spanish, Arabic, and more |

| 💰 Fees and Commissions | Commission-free on most accounts, with competitive spreads |

| ✅ Affiliate Program | Yes, with competitive commission structures |

| 🏦 Banned Countries | None |

| ✔️ Scalping | Allowed |

| 📉 Hedging | Allowed |

| 📈 CFD Commodities | 15+ |

| 📊 CFDs-Total Offered | 1000+ |

| 💹 CFD Stock Indices | 20+ |

| ⭐ CFD Shares | 500+ |

| 🚀Open an Account | 👉 Open Account |

Safety and Security

Client Fund Management and Security Protocols

XLibre states that they prioritize keeping client funds secure. Here’s what we’ve discovered about their approach:

- Segregated Accounts: Your funds are kept separate from XLibre’s operational funds. This means that your investments are protected even if the company faces financial difficulties.

- Regular Audits: XLibre undergoes regular audits to demonstrate compliance with financial regulations and maintain transparency.

These audits are designed to verify that client funds are being handled correctly.

XLibre’s Advanced Security Technologies

From what we can tell, XLibre uses modern security technologies to protect client data and transactions. These include SSL encryption for secure data transmission, two-factor authentication for account access, and regular security audits to identify and address potential vulnerabilities.

While these measures are positive, they are also the standard practice among reputable brokers. Some competitors offer additional security features like biometric authentication and real-time transaction monitoring, which XLibre currently doesn’t provide.

Regulatory Compliance and Oversight

We appreciate that XLibre is regulated, and they have implemented measures like segregated accounts and negative balance protection to safeguard client funds.

| 🛡️Regulatory Body | 🔎Region | 📑License Number |

| 🅰️ Financial Services Commission (FSC) | Republic of Mauritius | GB21026537 |

| 🅱️ Financial Sector Conduct Authority | South Africa | FSP No. 47159 |

- FSC (Mauritius): Ensures compliance with financial regulations in Mauritius.

- FSCA (South Africa): Offers an additional layer of regulatory oversight, particularly for clients in South Africa.

Negative Balance Protection

XLibre offers Negative Balance Protection, a vital safety measure for traders.

- How It Works: If the market moves significantly against your position, XLibre automatically resets your account balance to zero if it goes negative. This prevents you from losing more money than you’ve deposited.

- Industry Standard: Many reputable brokers offer this feature, and it’s good to see XLibre also providing it.

However, it’s important to remember that while this protection is beneficial, it shouldn’t replace proper risk management practices.

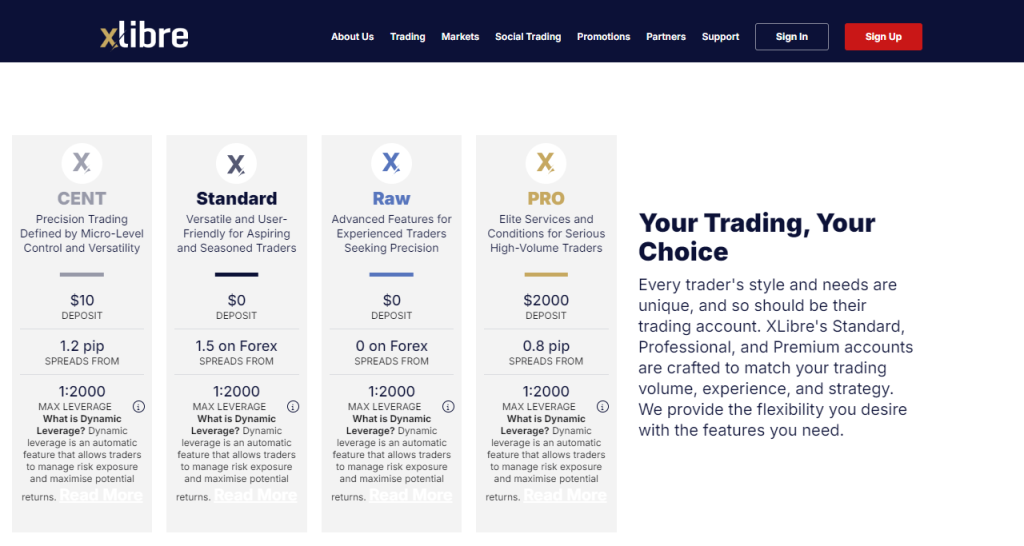

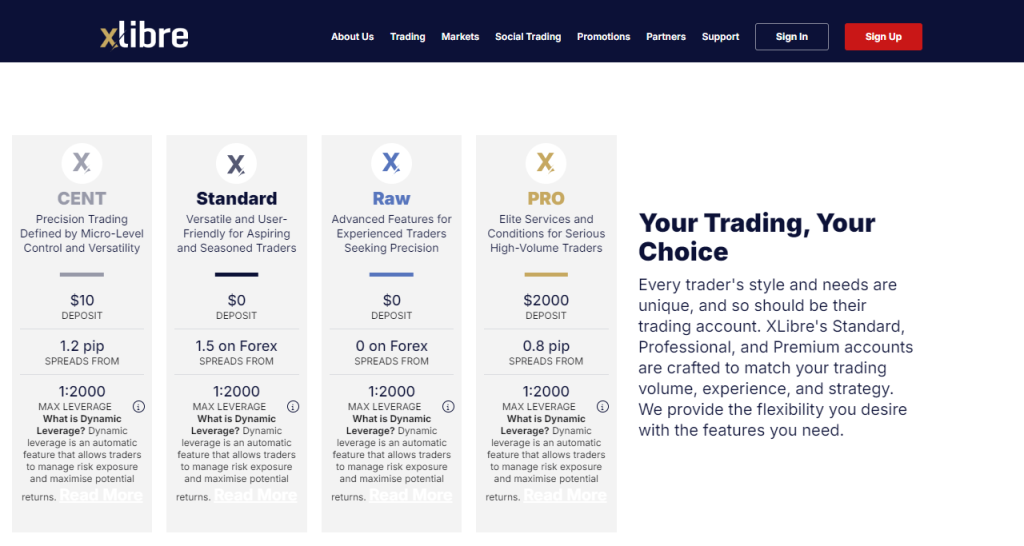

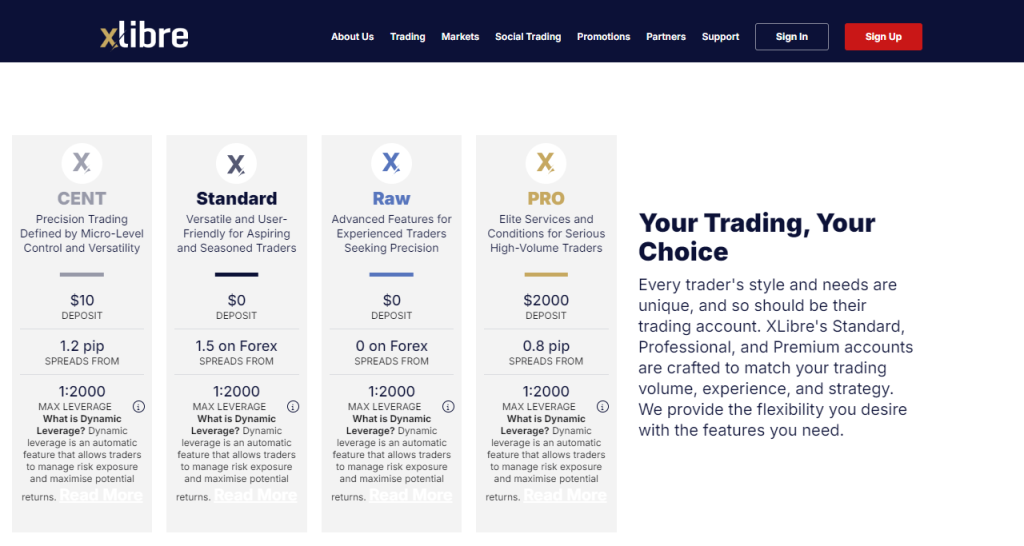

XLibre Account Types

| 🔖Feature | 🥇Cent Account | 🥈Standard Account | 🏅Raw Account | 🏆Pro Account |

| ✅ Availability | All; ideal for casual and professional traders | All; ideal for algorithmic traders | All; ideal for traders and investors who want a personalized approach to investing | Ideal for Professional Traders |

| 🛍 Trading Instruments | Forex Gold | Forex, Metals, Commodities, Indices, Cryptos, Shares | Forex, Metals, Commodities, Indices, Cryptos, Shares | Forex, Metals, Commodities, Indices, Cryptos, Shares |

| 💸 Commissions | Forex: $0.05 per lot per side Commodities: $0.05 per lot per side | Shares: 1% Crypto: 1% | Forex: $5 per lot per side Commodities: $5 per lot per side Shares: 1% Indices: $5 | Shares: 1% Crypto: 1% |

| 💻 Platforms | All | All | All | All |

| 📊 Trade Size | Variable according to market | Variable according to market | Variable according to market | Variable according to market |

| 📈 Leverage | 1:2000 | 1:2000 | 1:2000 | 1:2000 |

| 💰 Minimum Deposit | $10 | $0 | $0 | $2,000 |

| 🎁Bonus Eligibility | None | ✅Yes | None | None |

| ☪️Swap-Free Option | Available | Available | Available | Available |

| 🎖 Open an Account | 👉 Open Account | 👉 Open Account | 👉 Open Account | 👉 Open Account |

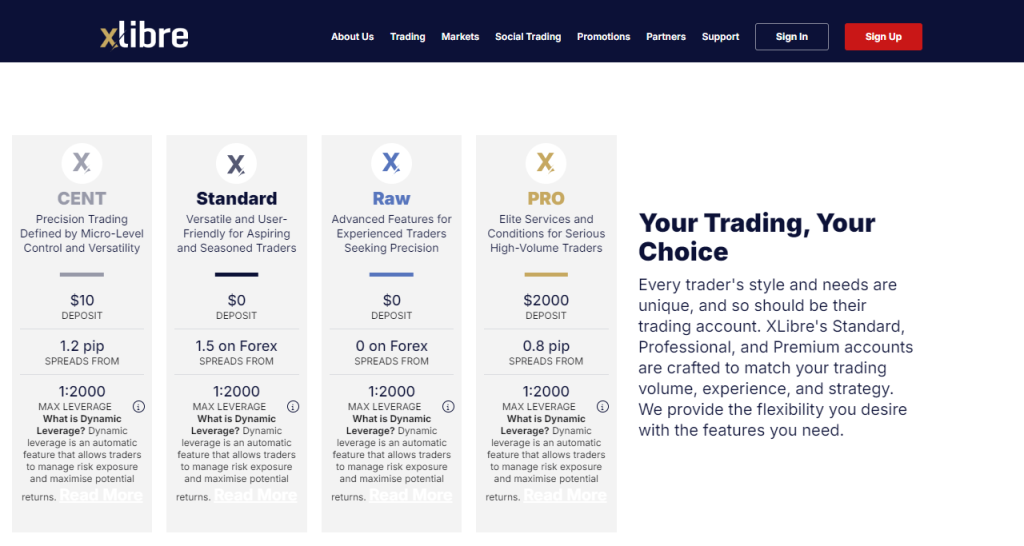

Cent Account

The Cent Account prioritizes control—the ability to manage trades down to the cent level. With a minimal deposit of $10, it’s ideal for anyone new to trading.

Spreads start from 1.2 pips and the substantial leverage of up to 1:2000 allows trading larger positions with less capital.

Features:

- Minimum Deposit: $10

- Spreads From: 1.2 pips

- Maximum Leverage: 1:2000

- Dynamic Leverage: Automatically adjusts based on position size and market conditions.

The Cent Account is great for testing strategies like grid or martingale trading with micro-lots and tight risk management. However, the slightly higher spreads might add up with numerous trades, potentially affecting cost-efficiency as you scale your trading activity.

Standard Account

The Standard Account is versatile for traders seeking freedom without minimum deposit concerns. With no upfront deposit required, spreads from 1.5 pips on Forex pairs, and leverage up to 1:2000, it’s flexible enough for various trading strategies.

Features:

- Minimum Deposit: $0

- Spreads From: 1.5 pips on Forex

- Maximum Leverage: 1:2000

- Dynamic Leverage: Automatically adjusts to manage risk.

- Bonus Eligibility: The only account eligible for promotional bonuses.

The Standard Account offers flexibility for swing or position traders with no minimum deposit and bonus eligibility, benefiting long-term market trends. However, the slightly wider spreads may affect profits for frequent traders or large positions, and bonuses often come with conditions that might impact trading flexibility.

Raw Account

The Raw Account is where things get serious. With spreads from 0 pips on Forex pairs and a commission per trade, it caters to traders requiring precision and minimal costs. The high leverage of 1:2000 and no minimum deposit are a rare combination for an account offering such tight spreads.

Features:

- Minimum Deposit: $0

- Spreads From: 0 pips on Forex

- Maximum Leverage: 1:2000

- Dynamic Leverage: Adapts to market conditions and position sizes.

The Raw Account is ideal for scalping or day trading with its near-zero spreads and minimal slippage, benefiting high-frequency traders. However, the per-trade commission can add up for less active traders, potentially outweighing the advantage of low spreads. Balancing the cost and precision with your trading volume and frequency is essential.

Pro Account

The Pro Account caters to those trading in large volumes and needs an account that supports this. With a minimum deposit of $2000, spreads from 0.8 pips, and leverage up to 1:2000, it’s designed for serious traders demanding the best trading conditions.

Features:

- Minimum Deposit: $2000

- Spreads From: 0.8 pips

- Maximum Leverage: 1:2000

- Dynamic Leverage: Provides risk management tailored to your trading volume.

The Pro Account suits high-frequency and VWAP trading with its lower spreads and efficient order execution. Its $2,000 minimum deposit filters serious traders, creating a stable environment. However, this higher deposit may be a barrier for newer or less frequent traders. While the dynamic leverage system is advantageous, it requires careful management to prevent unexpected liquidations in volatile markets.

How to Open an XLibre Account

Setting up an account with XLibre is generally simple, but there are some key aspects to be aware of, particularly around client categorization and how the trader’s menu functions. Here’s what we discovered while exploring their platform.

Creating an account with XLibre involves a series of steps that are mostly easy to navigate. Here’s the breakdown:

1. Step 1: Click on the Sign Up Page

Click on Start Trading or Sign Up to begin the process of Signing Up.

2. Step 2: Complete Application

The journey begins with completing an online application form on XLibre’s website. This form requests basic personal details.

3. Step 3: Send Documents

XLibre requires identification documents for FSCA compliance and anti-money laundering laws, including a South African ID or passport and proof of address. Verification usually takes about 24 hours. The account isn’t activated until all documents are complete and verified, highlighting XLibre’s commitment to regulatory compliance.

While the process is standard and user-friendly, delays can occur, so ensure your documents are current and clear to avoid any inconvenience.

XLibre Deposit and Withdrawal

Efficient fund management is the lifeblood of any successful trading strategy. XLibre offers a selection of deposit and withdrawal methods to help you manage your funds. Their processes are designed to be user-friendly, with options catering to various needs.

Exploring Deposit and Withdrawal Options

XLibre provides a few different methods for both deposits and withdrawals, but the variety feels a bit limited when you weigh it up against other brokers who might offer a wider selection, including more region-specific options or even the ability to deposit via cryptocurrency.

XLibre Deposits

| 💳 Method | ⏰Deposit Time | 💰Fees | 💳Minimum Deposit |

| 💴VISA | Up to 10 minutes | 0% | Depends on account type |

| 💵Mastercard | Up to 10 minutes | 0% | Depends on account type |

| 💶SWIFT | 2-7 business days | No fees for deposits over $100 | Depends on account type |

| 💷Online Bank Transfer | Instant | 0% | Depends on account type |

| 💴QR Code | Instant | 0% | Depends on account type |

| 💵Local Bank Transfer | Instant | 0% | Depends on account type |

| 🪙 Crypto | Instant | 0% | Depends on account type |

Minimum Deposits by Account Type:

- Cent Account: $10

- Standard Account: $0

- Raw Account: $0

- Pro Account: $2000

Overall, the deposit methods at XLibre cover the essentials and the instant deposit options are convenient.

Furthermore, the Standard and Raw Accounts don’t have a set minimum deposit requirement, allowing you to start with any amount (just remember to deposit enough to cover the margin requirement, fees, and potential losses).

XLibre Withdrawals

Like deposits, XLibre’s withdrawal options are adequate. Here’s what’s available:

| 💳 Method | ⏰Withdrawal Time | 💰Fees |

| 💴VISA | 2-7 business days | 0% |

| 💵Mastercard | 2-7 business days | 0% |

| 💶SWIFT | 2-7 business days | 0% |

| 💷Online Bank Transfer | 1-3 business days | 0% |

| 💴QR Code | 1-3 business days | 0% |

Overall, the withdrawal process at XLibre is clear and straightforward, but again, the limited options may not suit all traders. For example, the lack of same-day withdrawal services or alternative methods like e-wallets could be a drawback for those prioritizing speed and flexibility in accessing their funds.

Despite this, XLibre has a transparent system and they offer reliable and secure withdrawal methods. Refund and Cancellation Policies

XLibre has strict policies in place regarding refunds and cancellations:

- Accuracy of Withdrawal Information: Double-check all your withdrawal details. Any errors could lead to delays or even cancellations.

- Prohibited Trading Practices: XLibre keeps a close eye on activities like arbitrage, and any suspicious behavior could result in your trades being canceled.

- Market Conditions: Your trades might be canceled in certain situations like extreme market volatility or technical glitches.

Overall, these policies are fairly standard across the industry and designed to protect both you and the platform.

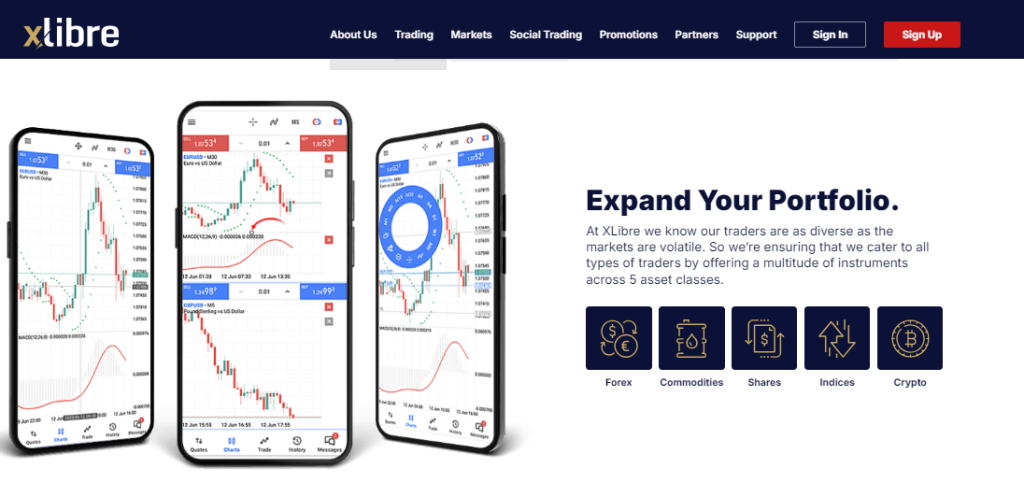

Trading Instruments and Products

XLibre offers more than 1,000 financial instruments to “expand your portfolio with ease” and this seems to cater to traders of all types and experience levels.

However, the question remains: does this variety translate to a valuable trading experience, or is it only a superficial collection? Let’s delve deeper and assess the true quality of XLibre’s offerings.

Forex Trading

Forex trading is a central feature of XLibre’s platform, providing access to a diverse range of currency pairs. Whether you’re interested in major, minor, or exotic pairs, they cover all bases.

- Major Pairs: All the major currency pairs like EUR/USD, GBP/USD, and USD/JPY are offered. These pairs are inherently known for their high liquidity and narrower spreads.

- Minor Pairs: Beyond the majors, XLibre also offers minor pairs, including EUR/GBP and AUD/JPY. Depending on your strategies, these offer more volatility that could lead to more opportunities.

- Exotic Pairs: Exotic pairs like USD/TRY and EUR/ZAR are available if you want more speculative opportunities. While the potential for higher returns exists, these pairs also have higher risks and costs because they’re less liquid and more expensive.

Overall, XLibre’s forex offerings are extensive, and the range of exotic pairs is noteworthy.

Trading Commodities with Confidence

XLibre also has several commodities for trading, providing exposure to markets like metals and energy.

- Precious Metals: Trading in gold and silver is available through XLibre. Gold, in particular, is often considered a safe-haven asset during economic uncertainty.

- Energy Commodities: Instruments like crude oil and natural gas are included in XLibre’s offerings. These markets are known for their volatility, presenting both opportunities and risks.

The selection of commodities at XLibre seems adequate for most traders, and the trading conditions are generally reasonable. We noted, however, that the availability of some lesser-known commodities is limited, which could be a drawback for anyone who wants to trade more niche markets.

Shares and Index Trading

XLibre offers a decent selection of shares and indices for traders interested in equities.

- Shares: XLibre provides access to a variety of global shares, including those from major markets.

- Indices: Trading on popular indices like the S&P 500, NASDAQ, and FTSE 100.

The diversity of shares and indices offered at XLibre is appreciable.

Cryptocurrency Trading on XLibre’s Platform

XLibre also offers various cryptocurrencies that can be traded, including the following:

- Major Cryptos: Trading is available on popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) through XLibre’s platform.

- Minor Cryptos: In addition to the major ones, XLibre provides access to a few lesser-known options like OmiseGO, Qtum, etc.

XLibre’s cryptocurrency offerings are extensive, covering well-established and emerging digital assets.

Trading Hours and Market Access

The trading world operates around the clock, and your trading opportunities should, too. XLibre acknowledges this by offering a range of instruments with trading hours that reflect the activity of global markets.

Whether you want to capitalize on the Asian session or benefit from the New York close, understanding these hours is necessary for optimizing your trading strategy.

Trading Hours for Various Instruments

XLibre’s trading hours align with global markets, offering 24/5 access to Forex, metals, and energy commodities. The market opens at 00:05 GMT on Monday, but initial liquidity can be lower, leading to wider spreads and potential slippage.

Daily breaks for commodities between 23:59 GMT and 01:00 GMT (or 02:00 GMT for crude oil) may disrupt continuous trading but are necessary for system maintenance. Cryptocurrency trading is available 24/7, offering flexibility but requiring discipline due to rapid market changes.

Overall, XLibre’s trading hours are competitive but include breaks for stability and accurate pricing.

XLibre Trading Platforms and Software

Regarding trading platforms, having the right tools can make all the difference. At XLibre, they’ve opted to exclusively offer the MetaTrader 5 (MT5) platform across desktop, mobile, and web versions.

MT5 is well-regarded in the industry, but traders looking for a wider selection of platforms might find XLibre’s single-platform approach somewhat limiting.

Desktop Platform

MetaTrader 5 on the desktop is the heart of XLibre’s trading ecosystem. It comes packed with features designed for in-depth analysis, automated trading, and flexible order execution. Here are some standout features:

- Advanced Charting Tools: MT5 offers a wide range of technical indicators, chart types, and analytical tools, making it ideal for thorough market analysis. With 21 timeframes and the capacity to view up to 100 charts simultaneously, it caters to both short-term and long-term traders.

- Algorithmic Trading: Thanks to MT5’s support for Expert Advisors (EAs), traders can automate their strategies. This is useful for optimizing your trading and managing positions 24/7 – just take note of XLibre’s restrictions on using EAs before you get started.

- Depth of Market (DOM) provides real-time insights into market liquidity and the volume of buy and sell orders at various price levels.

Overall, while MT5 on the desktop is undoubtedly powerful and feature-rich, XLibre’s sole reliance on this platform might be a significant constraint. Traders who are used to or interested in exploring other platforms, such as MetaTrader 4 (MT4) or cTrader, might find XLibre’s offering restrictive.

Furthermore, although MT5 is fantastic for experienced traders, its complexity could be daunting for beginners or those who prefer a simpler trading interface.

MT5 Mobile Platform

XLibre extends its trading capabilities to smartphones and tablets through the MT5 Mobile platform, allowing traders to manage their accounts and execute trades on the go.

- Full Trading Functionality: The mobile platform mirrors its desktop counterpart, offering access to account management, trade execution, and real-time market data. Traders can open and close positions set stop-loss and take-profit orders, and stay updated on market movements.

- Customizable Interface: The platform offers a degree of customization, enabling traders to personalize chart settings and indicators.

- Push Notifications: The platform supports push notifications for price alerts, news, and other critical updates, ensuring traders don’t miss important market events.

The MT5 Mobile platform is a valuable asset for traders who need to stay connected to the markets throughout the day.

Furthermore, while the mobile app does a commendable job of replicating the desktop experience, the smaller screen size inherently limits the depth of analysis and the ability to manage multiple positions with the same level of precision.

MT5 WebTrader

XLibre offers MT5 WebTrader, a browser-based solution that provides most of the same features as the desktop version.

- No Download Required: WebTrader functions directly in your browser, eliminating the need for software installation. This convenience is ideal for traders who frequently switch devices or prefer a lighter, more accessible platform.

- Real-Time Data and Execution: Like its desktop counterpart, WebTrader supports multiple order types and provides real-time data, ensuring effective strategy execution.

- Cross-Device Synchronization: WebTrader syncs with the MT5 desktop and mobile versions, ensuring consistency across all devices.

MT5 WebTrader offers a flexible alternative for traders needing quick access to their accounts without the hassle of software downloads.

However, the platform’s reliance on a stable internet connection could be a drawback in areas with unreliable connectivity. Moreover, the exclusive use of MT5 means that traders who prefer browser-based platforms with different interfaces or functionalities won’t find those options at XLibre.

| 🔎Feature | 💻MT5 Desktop | 💻MT5 WebTrader | 📱MT5 Mobile | 📱XLibre MT5 (Desktop, Web, Mobile) |

| 📌Multiple Chart Types | ✅Yes | ✅Yes | ✅Yes | ✅Yes |

| 📍Technical Indicators | 80+ | 80+ | 30+ | 80+ (Desktop/Web), 30+ (Mobile) |

| ⚙️Analytical Objects | ✅Yes | ✅Yes | Limited | ✅Yes |

| 🖱One-Click Trading | ✅Yes | ✅Yes | ✅Yes | ✅Yes |

| 📝Order Types | All | All | Limited | All (Desktop/Web), Limited (Mobile) |

| 📊Depth of Market (DOM) | ✅Yes | ✅Yes | None | ✅Yes |

| ℹ️Automated Trading (EAs) | ✅Yes | ✅Yes | ✅Yes | ✅Yes |

Spreads and Fees

When it comes to trading, fees can significantly eat into your profits. We’ve taken a deep dive into XLibre’s fee structure and uncovered a mix of industry-standard practices and some areas worth considering.

Commissions

XLibre’s commission structure is tiered, depending on your account type and your trading assets. Let’s break it down:

- Cent Account: A commission of $0.05 per lot is charged on Forex and commodities. This is relatively low, making it suitable for anyone entering micro-level trading.

- Standard Account: A 1% commission applies to Share and Crypto trades. While this seems reasonable initially, it can quickly add up for high-volume traders.

- Raw Account: This account has a $5 commission per lot on Forex, commodities, and indices.

- Pro Account: Like the Standard Account, a 1% commission is levied on shares and cryptocurrencies.

The higher minimum deposit requirement of $2,000 might be justifiable for premium services, but the commission structure is a point for high and larger volume traders.

Spreads

Spreads are a key factor in determining trading costs. XLibre’s spreads vary depending on the account type:

- Cent Account: Spreads start from 1.2 pips, but Forex and commodities trading also includes a commission fee of $0.05 per trade, which means that trading costs are expensive on this entry-level account.

- Standard Account: Forex trades have spreads starting at 1.5 pips. This is average and not the most competitive option, especially with the 1% commission on shares and cryptos.

- Raw Account: With spreads from 0 pips, the Raw Account is designed for cost-conscious traders. However, the $5 commission per lot must be factored into your overall cost analysis.

- Pro Account: Spreads from 0.8 pips offer a middle ground between cost and service.

However, compared to other brokers, some traders can find more favorable spread conditions elsewhere, especially if they’re trading high volumes.

Currency Conversion Fees

Currency conversion fees can increase, especially if you’re trading in multiple currencies. XLibre applies a markup to the exchange rate during conversions, which is common practice in the industry.

Inactivity Fees and their Implications

Inactivity fees can be a burden for traders who don’t trade regularly. XLibre considers an account dormant if there’s no financial or trading activity for six months. The fees escalate the longer the account remains inactive:

- 6 months – 1 year: $5 per month

- 1 – 2 years: $10 per month

- 2 – 3 years: $20 per month

- 3+ years: Previous year’s fee plus $10 per month

Additionally, the account may be terminated if the account balance falls below the inactivity fee. We appreciate that XLibre is extremely transparent about these fees.

Rollover Policies and Calculations

Rollover fees, or swaps, are charged for holding positions overnight. XLibre calculates these fees based on specific security and market conditions.

For example, a long position on USA100 (Nasdaq) with a position size of 1 lot and a swap value of -470 would result in a rollover fee of -4.31 EUR (calculated as 11-470*0.01 = -4.70 USD, then converted to EUR at -4.70/1.09).

Swap-Free Trading Conditions

XLibre offers swap-free accounts to traders who adhere to Sharia law, allowing them to trade without incurring or paying interest on overnight positions.

However, the swap-free status only lasts for seven days. After that, carry charges might not be interest-based but still represent a significant cost that must be considered.

Shares and Corporate Actions

Trading shares on XLibre involves additional costs, particularly overnight financing and corporate actions like dividends.

The overnight financing fee for share CFDs is 10% per year based on the opening price.

Dividend Adjustments

When you’re trading share CFDs, dividends can directly impact your account. Let’s break down how these adjustments typically work:

- Long Positions: If you’re holding a long position (speculating that the share price will go up) and the share goes ex-dividend (meaning the buyer won’t receive the next dividend payout), you’ll see a positive adjustment to your balance equivalent to the dividend amount.

On the other hand, if you’re in a short position (anticipating the share price will drop) and the share goes ex-dividend, you’ll see a negative adjustment to your balance, reflecting the dividend amount.

Leverage and Margin

When it comes to trading with leverage and margin, you have to find the right balance between potential profits and the heightened risks that come with it.

From our perspective, adjusting based on your traded instruments and position sizes, the dynamic leverage system adds a layer of flexibility. Let’s delve deeper into how leverage and margin work in practice.

Understanding Leverage Across Different Instruments

Leverage acts as a multiplier, but its availability varies significantly depending on what you’re trading.

The leverage offered across different instruments caters to diverse trading approaches. For instance, the high leverage on FX Majors offers the potential for significant market exposure with a smaller initial investment. However, leverage amplifies both profits and losses.

On the other hand, the more conservative leverage on shares reflects the inherent volatility of the equity market.

The gradual decrease in leverage as position sizes grow is a risk management measure we appreciate. However, it underscores the need for traders to be constantly mindful of their margin utilization.

Margin Requirements and Their Implications

- Margin Call Level: 50% across all account types

- Stop Out Level: 20% across all account types

The consistent margin call and stop-out levels across all account types streamline the margin management process. The 50% margin call level provides a buffer, but the automated nature of margin calls means traders must proactively monitor their account equity.

The 20% stop-out level is fairly standard but emphasizes the need for swift action if a margin call occurs. Traders should consider using stop-loss orders and actively managing their leverage to mitigate risks rather than relying solely on margin as a safety net.

Managing Margin Calls and Stop-Outs

Here are our key takeaways:

- Vigilance is Key: Regularly review your account balance and margin level, especially when trading with high leverage.

- Utilize Stop-Loss Orders: These orders can help manage risk by automatically closing positions before they trigger a margin call.

Finally, Position Sizing Matters. Adjust your position sizes based on market volatility to avoid overextending your margin.

Educational Resources

Unfortunately, XLibre doesn’t offer educational content that could empower traders to enhance their understanding of financial instruments, market dynamics, or risk management.

However, there is a wealth of information available across platforms and internet sources that can help South Africans increase their knowledge and boost their skills. Furthermore, XLibre often posts updates across its social media accounts that can guide traders.

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $200 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Dual regulation in Mauritius and South Africa | Lacks Tier-1 regulatory oversight |

| Wide range of financial instruments (over 1,000) | Wider spreads on minor cryptocurrencies and exotic currency pairs |

| Competitive spreads on major currency pairs | High commissions on shares and cryptocurrencies in Standard and Pro accounts |

| MetaTrader 5 platform is available across desktop, web, and mobile | No support for MetaTrader 4 or other platforms |

Conclusion

When we take a closer look at XLibre’s place in the brokerage industry, we can see they’re trying to strike a balance between accessibility and a diversified product offering.

Their dual regulation in Mauritius and South Africa shows a commitment to establishing credibility and trust, especially in regions where regulatory frameworks are less stringent than in major financial centers.

Faq

The broker only provides the MetaTrader 5 (MT5) platform, accessible on desktop, online, and mobile.

The Cent Account has a minimum deposit of $10, whereas the Standard and Raw Accounts don’t have a minimum deposit requirement. The Pro Account has a higher minimum deposit of $2,000.

Yes. However, the broker has certain limits on scalping and other strategies.

The broker accepts deposits and withdrawals using VISA, MasterCard, SWIFT, online bank transfers, QR codes, and local transfers.

Yes, the Cent Account charges a $0.05 commission each lot on Forex and commodities, while the Standard and Pro Accounts charge a 1% commission on stocks and cryptocurrency. The Raw Account charges a $5 fee per lot for Forex, commodities, and indices.

XLibre is a market maker, serving as the counterparty in your transactions. While this can offer liquidity and competitive spreads, it could also result in conflicts of interest. However, XLibre is transparent about how it operates and what traders can expect.