VT Markets Review

- VT Markets Review - Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Advantages Over Competitors

- Rating of VT Markets

- Safety and Security

- Bonus Offers and Promotions

- Partnership Options and Features

- Account Types

- Account Opening and Trader Dashboard

- Trading Platforms and Solutions

- Social (Copy) Trading

- Trading and Non-Trading Fees

- Tradable Asset Classes and Instruments

- Leverage and Margin

- Deposit and Withdrawals

- Academy and Trading Tools for Traders

- Customer Support and Resources

- Corporate Activity

- Pros and Cons

- In Conclusion

- Our Insights

VT Markets is a global forex and CFD broker known for offering competitive spreads, fast execution, and a range of tradable assets.

| 🔎 Broker | 🥇 VT Markets |

| 📌 Regulations | ASIC, FSCA, FSC |

| 💴 Min. Deposit | 50 USD |

| 📊 Leverage (up to) | 500:1 |

| ☪️ Swap-Free Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| 📌 Live Trading Accounts | Cent ECN, Cent STP, Standard STP, Raw ECN |

| 📈 MetaTrader 4 | ✅Yes |

| 📉 MetaTrader 5 | ✅Yes |

| 💹 Proprietary Trading Platforms | VT WebTrader+, VT Markets App |

| 🪙 Crypto Deposits | ✅Yes |

| 💶 Commission Fee | ECN Accounts |

| 💵 Withdrawal Fee | ✅Yes |

| 💷 Inactivity Fee | ✅Yes |

| ⭐ Education | Learning Centre |

| 🥰 Live Chat | 24/7 |

| 🤝 Partnership Options | IBs and CPA Affiliates |

| 🚨 Restricted Countries | The United States, Singapore, Russia |

| ⚙️ Trading instruments | Indices, Forex, Energies, Precious Metals, Soft Commodities, ETFs, CFD Bonds |

| 🚀Open an Account | 👉 Click Here |

VT Markets Review – Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Advantages Over Competitors

- ☑️ Rating of VT Markets

- ☑️ Safety and Security

- ☑️ Bonus Offers and Promotions

- ☑️ Partnership Options and Features

- ☑️ Account Types

- ☑️ Account Opening and Trader Dashboard

- ☑️ Trading Platforms and Solutions

- ☑️ Trading and Non-Trading Fees

- ☑️ Tradable Asset Classes and Instruments

- ☑️ Leverage and Margin

- ☑️ Deposit and Withdrawals

- ☑️ Academy and Trading Tools for Traders

- ☑️ Customer Support and Resources

- ☑️ Corporate Activity

- ☑️ Pros and Cons

- ☑️ In Conclusion

- ☑️ Our Insights

Overview

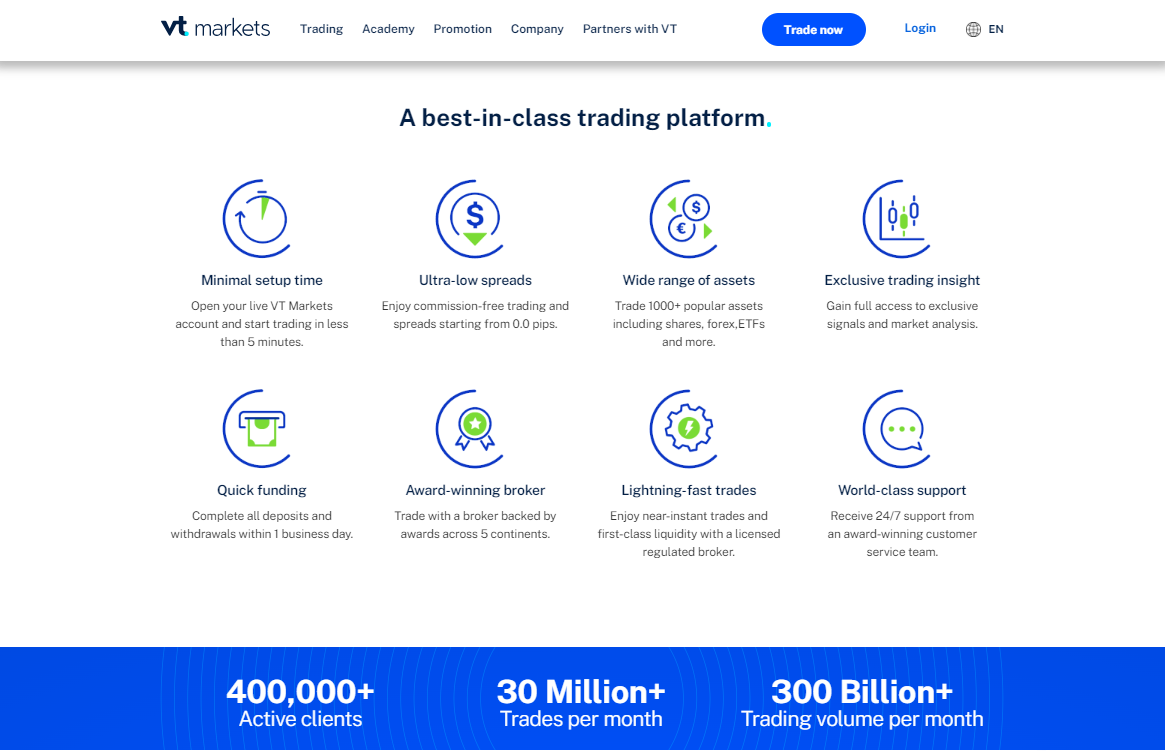

VT Markets is fairly new to online trading compared to brokers operating for decades. However, it’s quickly building a name for itself. VT Markets positions itself as a comprehensive trading platform, catering to all trader levels with over 1,000 instruments.

They are also not shy to indicate that (since their establishment in 2015), they’ve already gained 400,000+ active clients. VT Markets boasts over 30 million monthly trades and a $300 billion trading volume, despite operating for less than a decade.

Our Insights

VT Markets is a global online broker offering forex, CFDs, and other financial instruments. Known for its competitive spreads, fast execution, and user-friendly platforms, VT Markets caters to a wide range of traders. Multiple authorities regulate the broker, ensuring a degree of investor protection.

Detailed Summary

| 🔎 Broker | 🥇 VT Markets |

| 📌 Regulations | ASIC, FSCA, FSC |

| 💴 Min. Deposit | 50 USD |

| 📊 Leverage (up to) | 500:1 |

| ☪️ Swap-Free Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| 📌 Live Trading Accounts | Cent ECN, Cent STP, Standard STP, Raw ECN |

| 📈 MetaTrader 4 | ✅Yes |

| 📉 MetaTrader 5 | ✅Yes |

| 💹 Proprietary Trading Platforms | VT WebTrader+, VT Markets App |

| 🪙 Crypto Deposits | ✅Yes |

| 💶 Commission Fee | ECN Accounts |

| 💵 Withdrawal Fee | ✅Yes |

| 💷 Inactivity Fee | ✅Yes |

| ⭐ Education | Learning Centre |

| 🥰 Live Chat | 24/7 |

| 🤝 Partnership Options | IBs and CPA Affiliates |

| 🚨 Restricted Countries | The United States, Singapore, Russia |

| ⚙️ Trading instruments | Indices, Forex, Energies, Precious Metals, Soft Commodities, ETFs, CFD Bonds |

| 🚀Open an Account | 👉 Click Here |

Our Insights

VT Markets aims to simplify trading for a global audience. With a focus on accessibility, the broker offers a range of accounts and instruments. Backed by multiple regulations, including ASIC, FSCA, and FSC, VT Markets prioritizes client security and transparency. While lacking in detailed financial information, the platform’s emphasis on user experience is evident.

Advantages Over Competitors

VT Markets provides true ECN accounts with raw spreads obtained straight from top-tier liquidity providers. In addition:

- Beyond the industry-standard MetaTrader 4 and 5, VT Markets provides WebTrader+ powered by TradingView, a cutting-edge platform that combines MT4/5 functionality with TradingView’s outstanding charting and analytical features.

- The Broker offers a diverse range of products across asset classes, including Forex, indices, energy, precious metals, soft commodities, ETFs, and CFD bonds.

- The Cent Account, with its modest minimum investment of $50 (5000 US dollars), lets traders access the market with minimal risk.

- VT Markets provides Muslim traders a swap-free accounts in both Standard STP and Raw ECN versions.

- The VT Markets ClubBleu Loyalty Program goes beyond standard reward systems, allowing traders to earn points depending on their trading behavior and redeem them for a range of incentives such as cash, vouchers, and trading equipment.

Finally, the VT Markets app provides a full trading experience on mobile devices, including over 1,000 assets, advanced trading tools, real-time notifications, and unique discounts.

Rating of VT Markets

| 🔎 Feature | 🔟 Rating (Out of 10) |

| 🔏 Fund Safety and Security | 6 |

| 📈 Account Types | 7 |

| 📉 Trading Platforms | 9 |

| 💴 Trading Conditions (Fees) | 6 |

| 📊 Leverage and Margin | 8 |

| 💹 Range of Markets | 7 |

| 🤓 Education | 8 |

| 📒 Trading Tools and Research | 5 |

| 🎁 Bonuses and Promotions | 8 |

| 🥰 Customer Support | 6 |

| 🤝 Partnership Program | 6 |

| 📌 Website Navigation | 8 |

| 📍 Trader Dashboard UI | 9 |

| ▶️ Account Opening Process | 7 |

| 🚀Open an Account | 👉 Click Here |

Safety and Security

We visited the registers of each regulatory entity that VT Markets lists on the website to confirm the licenses. We’ve included links to allow traders to view these licenses.

When a trader resides in a specific country, they are automatically directed to the appropriate VT Markets entity’s website upon signing up.

| 🔎 Entity Name | 📌 Regulatory Authority | 📍 License Number | 📊 Jurisdiction | 📉 Notes |

| 1️⃣ VT Global Pty Ltd | Australian Securities & Investments Commission (ASIC) | AFSL 516246 | Australia | Current – can only provide services to wholesale clients under ASIC |

| 2️⃣ VT Markets (Pty) Ltd | Financial Sector Conduct Authority (FSCA) | FSP 50865 | South Africa | Authorized as a Category 1 Company that offers derivative instruments under “Advice Non-Automated” and “Intermediary Offer” and Forex Investment under “Intermediary Offer” |

| 3️⃣ VT Markets Limited | Mauritius Financial Services Commission (FSC) | GB23202269 | Mauritius | Authorized as a Sec-2.1B Investment Dealer |

In addition to its regulations, VTMarkets Ltd., the Cypriot entity, is registered in Cyprus under HE436466 but doesn’t currently hold a license from the Cyprus Securities and Exchange Commission (CySEC). This means that traders from this region will be onboarded through other entities.

VT Markets offers trading solutions to traders from around the world. The following countries are restricted:

- The United States

- Singapore

- Russia

- Jurisdictions listed on the FATF and Global Sanctions List

VT Markets does not disclose the identities of its banking partners on its website, despite being well-regulated having confirmed licenses, and implementing several security measures to ensure fund safety.

Our Insights

We contacted their live chat customer support line to find out more but could not confirm the exact details surrounding their banking partners.

This could be due to privacy issues but might concern some traders. Brokers like VT Markets must disclose where they hold customer funds, while agents are prohibited from disclosing certain details over unsecured channels. Moreover:

- Regulatory Status and confirmation thereof (please see our table below)

- Client Fund Segregation per the requirements of regulatory entities.

- VT Markets only uses reputable banking partners to store funds.

- Negative balance protection is applied to all retail accounts.

- SSL encryption is used to protect transactions and personal information.

Investor protection is available through VT Markets’ membership with the Financial Commission. If there are unresolved disputes, EU-based traders could be eligible for up to 20,000 EUR (subject to terms and conditions).

Bonus Offers and Promotions

Bonuses and Promotions are extremely lucrative and aim to draw in new traders while providing existing clients with ongoing benefits, increasing client retention. VT Markets offers a few bonuses that caught our attention.

ClubBleu Loyalty Program

ClubBleu is VT Markets’ reward program that extends beyond the traditional points-for-purchase approach.

You gain Trade Points by actively trading and depositing funds. These points grant access to a treasure trove of prizes, including cash, trade vouchers, gift cards, special webinar access, and even a spin-the-wheel game with additional rewards.

Key Features

- Earn points for more than 1,000 trading instruments.

- Redemption options include cash, coupons, trade tools, and more.

- Multiple membership tiers with increasing advantages.

How to qualify

- Register and verify a VT Markets trading account.

- Trade actively to earn Trade Points.

- Exchange your Trade Points for prizes.

Terms and Conditions

- Rewards are not transferable and cannot be redeemed for cash (save for cash rewards).

- VT Markets maintains the right to modify or stop the program at any time.

- The program is invalid and banned by law.

- Membership is available to all VT Markets clients who have funded accounts.

- Points are awarded based on the trading volume and deposit amount assessed by VT Markets.

- The rewards are subject to change and availability.

- Abuse of the program may lead to membership revocation.

- Terms and conditions for certain awards within the program apply.

- The decision by VT Markets on point allocation and reward redemption is final.

- ClubBleu points have no monetary value outside of the program.

Refer a Friend

This is a standard referral bonus that rewards VT Markets clients and any traders that they refer. The approach is simple: share your unique referral link, and when your referral registers an account, funds it, and trades at least 5 lots within 60 days, you will both earn the bonus.

Key Features

- Both referrers and their referrals will get a $200 cash incentive.

- Easy distribution of referral links via numerous platforms.

- After the trading volume has been reached, the bonus will be credited to your trading account.

How to qualify

- Have an existing VT Markets account.

- Your referral must be a new customer.

- The referral must fulfill the deposit and trading volume criteria within 60 days.

Terms and Conditions

- The referral cannot be linked to VT Markets’ IBs or affiliates.

- VT Markets’ decision on qualifying and incentive payment is final.

- Only closed trades on specified instruments (Forex, Gold, Silver, and Crude Oil) are eligible.

- The referral must be a new VT Markets customer.

- Both the referrer and the referral must meet the qualifying criteria.

- The bonus is paid in USD, which could be subject to exchange rate fluctuations.

- The referral cannot be a current VT Markets affiliate.

- In suspected misuse, VT Markets can reject participation or suspend the offer.

- The incentive is subject to verification and could take up to 60 days to process.

Welcome Bonus

All new traders registering with VT Markets can start trading using a 50% welcome bonus according to their initial minimum deposit. This bonus only offers trading credit that can be used for trading, allowing you to gain more market exposure.

Key Features

- Get a 50% bonus on your initial deposit, up to $500.

- The bonus is credited to your account within one business day.

How to qualify

- Create a new active account with VT Markets.

- Make a minimum first deposit of $500 (USD equivalent).

Terms and Conditions

- The bonus cannot be withdrawn, but the earnings from it can.

- The VT Markets website lists eligible countries.

- The offer is only accessible to new clients and is at the discretion of VT Markets.

- The bonus could be partially or completely withdrawn if the initial deposit is withdrawn.

- Internal transfers, balance changes, and refunds are not treated as new deposits.

- If clients make deposits using e-wallets or cryptocurrencies, VT Markets maintains can prevent them from claiming bonuses.

- To qualify, you must make a first-time deposit of at least $500 (USD equivalent).

- The highest bonus amount is $500 (USD equivalent).

- The incentive can’t be transferred across accounts.

Deposit Bonus

According to VT Markets, this bonus is open to all VT Markets clients and provides a 20% bonus on deposits greater than $1,000. This is an excellent strategy to boost your trading money while potentially increasing your profits.

Key Features

- All deposits above $1,000 are eligible for a 20% bonus.

- The bonus is credited to your account within one business day.

- The maximum bonus amount is $10,000 (USD equivalent).

How to qualify

- Make a minimum deposit of $1,000 (USD equivalent) into your current VT Markets account.

Terms and Conditions

- If the initial deposit is withdrawn, the bonus could be withdrawn by VT Markets – either fully or partially.

- Internal transfers, balance changes, and refunds are not considered new deposits.

- If clients make deposits using e-wallets or cryptocurrencies, VT Markets can prevent them from claiming bonuses.

- Only certain regions and countries are eligible, with a full list on the VT Markets website.

- The bonus cannot be withdrawn, but profits made using the bonus can.

- The incentive is non-transferrable between trading accounts.

- The offer is offered to both new and current clients at the discretion of VT Markets.

- The bonus applies to future deposits (after the first) or any percentage of the original deposit that exceeds $1,000 (USD equivalent).

- The maximum total bonus is $10,000 (USD equivalent).

Active Trader Program

This unique program offers all qualifying traders interest of up to 13% yearly on eligible funds in their active trading accounts.

Key Features

- Earn 0.25 percent interest every week on qualified funds.

- Interest is credited once every four weeks.

- Multiple accounts can participate, but each must meet the requirements independently.

How to qualify

- Enroll in the program via the Client Portal.

- Maintain a daily Eligible Fund of at least $5,000.

- Complete at least one standard lot for every $5,000 in qualified funds during settlement week.

Terms and Conditions

- Only Standard STP and RAW ECN accounts are accepted.

- Every week, a minimum daily Eligible Fund of $5,000 and a minimum trading volume of one standard lot per $5,000 in eligible funds are needed.

- The Eligible Fund is calculated as account equity less any credit benefits.

- VT Markets can withhold or revoke awards under certain circumstances.

- The trade volume utilized for this offer cannot be used for other promotions.

- VT Markets maintains the right to modify or stop the program at any time.

- Only closed trades in Forex, Gold, Silver, and Crude Oil (that lasted more than 5 minutes) are considered eligible for the program.

- Withdrawals or internal transfers during the settlement week prohibit the member from obtaining the weekly award.

- Participants must opt in through the Client Portal; enrollment is not automatic.

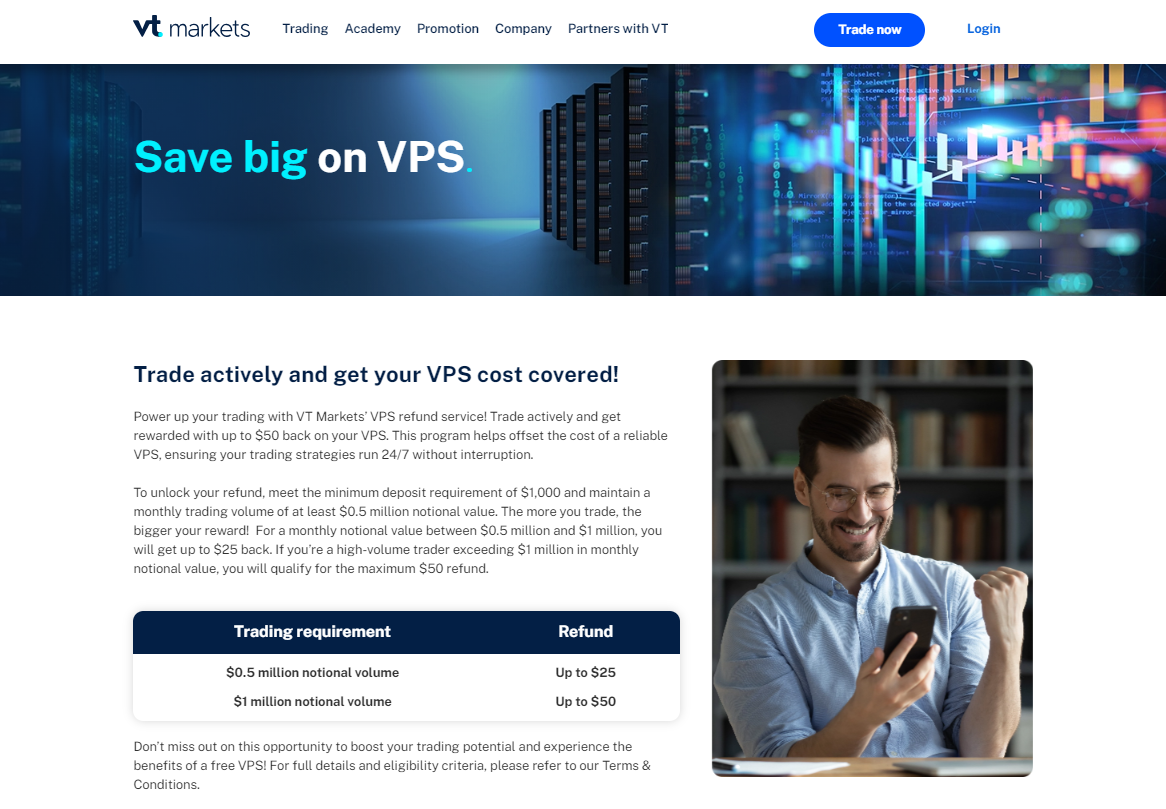

VPS Refund

VT Markets provides a refund scheme for traders who use VPS hosting for automated trading techniques. You can save up to $50 on your VPS charges by reaching specific trading volume requirements.

Key Features

- There’s a refund of up to $50 on VPS costs.

- A trading volume requirement is a $0.5 million notional value for a $25 refund.

- There are higher refunds available for higher trading volumes.

How to qualify

- Deposit at least $1,000 into your trading account.

- Maintain a monthly trading volume of at least $500,000 in notional value (up to a $25 return).

- Maintain a monthly trading volume of at least $1 million in notional value (up to a $50 refund).

Terms and Conditions

- Only closed trades are eligible.

- VT Markets can cancel the program at any moment.

- The VPS invoice must be posted through the Client Portal and meet certain requirements.

- If there’s a terms and conditions breach, VT Markets maintains the right to suspend or reject participation and deduct claimed amounts.

- Available to new and current clients in eligible countries/regions.

- PAMM/MAM master accounts are ineligible.

- There’s a $1,000 deposit (or equivalent) is required.

- Trading volume criteria must be met throughout the VPS billing cycle.

- The maximum claim amount is $25 for $500,000-$999,999 in notional value and $50 for $1 million or more.

Rebates for Clients

VT Markets doesn’t currently have a rebate program that’s aimed at paying trading rebates to retail clients. Based on our experience, partners can earn commissions or rebates when they sign up for the Introducing Broker program.

However, apart from stating that IBs can benefit from competitive commissions and that there are flexible rebates and incentives, VT Markets does not provide comprehensive information.

Partnership Options and Features

VT Markets offers three unique partnership options: Introducing Broker and CPA Affiliates. They also cover MAM/PAMM Investor under their “Partners with VT,” which we’ll explore.

Introducing Broker

The VT Markets IB program is designed for individuals or firms with a strong network within the trading community. This model offers flexibility for IBs to tailor their commission structures to align with their clients’ trading volume and deposit size.

How does VT Markets IB work?

- Register as an IB on the VT Markets website.

- Use your unique referral link to introduce new customers to VT Markets.

- Receive commissions based on your clients’ trading volume and deposit size. The commission structure is adaptable and may be customized to match your needs.

Key Benefits of Becoming a VT Markets IB

These are the benefits that the IB program offers, as per the VT Markets website:

- Customize your commission structure to maximize your revenue.

- Expand your network by introducing other independent business owners and earning commissions on their recommendations.

- Use copy trading, MAM, and PAMM to expand your company offers.

- You will get marketing materials and direct assistance in effectively promoting Vermont Markets.

- Receive individualized support in your choice language anytime you need it.

- The user-friendly partner site lets you easily manage your partners and track your revenue.

CPA Affiliates

The CPA Affiliate program is tailored for individuals with a solid online presence, such as website owners, influencers, bloggers, or educators. This model is less complex when compared to the IB program, as it provides a set commission for every qualified referral.

How does VT Markets CPA Affiliate Program work?

- Register as a CPA Affiliate on the VT Markets website.

- Share your unique referral link with your target audience.

- Receive a set CPA (Cost Per Acquisition) payout for every customer that signs up and satisfies specified requirements.

Key Benefits of Becoming a VT Markets CPA Affiliate

- Affiliates can earn up to $900 for each eligible referral.

- CPA Affiliates receive payment swiftly.

- Affiliates can use VT Markets’ reputation and specialized marketing help to increase their conversions.

- VT Markets offers the CellXpert Platform to affiliates to monitor their referrals and profits in real time.

- All affiliates receive individualized support from a professional affiliate manager around the clock.

Account Types

We have conducted a thorough analysis of VT Markets’ wide range of account options to offer an impartial and informative evaluation for prospective traders. VT Markets offers a variety of account types that will likely suit different experience levels and trading strategies.

However, before we explore each account type that VT Markets offers, here’s a comprehensive overview and comparison of all account types.

| 🔎 Feature | 🥇 Cent Account ECN | 🥈 Cent Account STP | 🥉 Standard STP | 🏅 Raw ECN | 🎖️ Swap-Free (STP/ECN) | 🏆 Demo Account |

| 💴 Minimum Deposit | 50 USD | 50 USD | 100 USD | 100 USD | 100 USD | N/A |

| 💶 Minimum Withdrawal | 40 USD | 40 USD | N/A | N/A | N/A | N/A |

| 📈 Minimum Trading Size | 0.01 lot | 0.01 lot | 0.01 lot | 0.01 lot | 0.01 lot | N/A |

| 📉 Platform | MT4/MT5 | MT4/MT5 | MT4/MT5 | MT4/MT5 | MT4/MT5 | MT4/MT5 |

| 📊 Execution Type | ECN | STP | STP | ECN | STP/ECN | N/A |

| 💹 Spread from | 0.0 pips | 1.1 pips | 1.2 pips | 0.0 pips | 1.2 pips | N/A |

| 💵 Commission | $6 | $0 | $0 | $6 | $0 | N/A |

| ☪️ Swap Free | ✅Yes | ✅Yes | None | None | ✅Yes | N/A |

| 💷 Base Currencies | $ USC | $ USC | Various | Various | Various | USD |

| 📌 Applicable Product Types | Forex, Gold, Silver, Oil | Forex, Gold, Silver, Oil | Various | Various | Various | Various |

| 🚀Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here |

Cent Account

The Cent Account provides a distinctive opportunity for individuals interested in trading but reluctant to invest a large amount of money.

The Cent Account is an excellent resource for traders looking to gain valuable experience in the market. Its low minimum deposit and micro-lot trading make it an ideal learning tool, enabling traders to understand market dynamics and platform functionality without taking on significant risks.

Although the range of available instruments is restricted to major forex pairs, gold, silver, and oil, this platform offers abundant opportunities for beginner traders to acquire hands-on experience and develop their confidence

However, we must mention that the Cent Account operates with a unique currency unit (USC) for transactions. This could require some adaptation for individuals accustomed to standard account denominations.

Standard Account

Most retail traders’ needs are met by the Standard STP Account, which offers cost-effectiveness and practicality. Frequent traders can benefit from the absence of commissions and competitive spreads, which provide a cost-effective solution.

In addition, a much wider range of tradable assets, including Forex, commodities, indices, and share CFDs, can offer opportunities for diversifying your portfolio and making strategic decisions.

The speed of execution, which we found is made possible by the Equinix fiber optic network, is a significant advantage, especially for traders who depend on quick order fulfillment.

However, while this account is comprehensive, we must mention that it might not offer all the advanced features and tools that most experienced traders want.

Raw ECN

The Raw ECN Account is a top-tier option tailored for experienced traders who value quick execution, accuracy, and direct access to the market. High-frequency traders and scalpers gain a competitive advantage with tight spreads that can start as low as 0.0 pips.

In addition, the account also offers traders access to high-quality liquidity, which means that orders are executed efficiently and with minimal slippage.

However, one snag with this account is that there’s a commission fee per trade, which can discourage individuals with lower trading volumes. Before you select this account, ensure that it aligns with your unique strategy and that you can afford the commission fees.

Demo Account

VT Markets provides a demo account for traders to explore the platform and test their strategies in a risk-free environment where they’re not required to deposit or use funds for trading. Here’s what we learned about the demo account from VT Markets’ website:

- The demo account offers a generous 90-day trial period, allowing traders to acquaint themselves with the platform, test different tools and features, and fine-tune their trading techniques before investing real cash.

- VT Markets lets users set up several demo accounts, which is useful for testing alternative strategies or comparing account kinds.

- The demo account gives you full access to all the features and tools available on the live platform, including charting tools, technical indicators, and real-time market data.

- Traders receive $100,000 in virtual currency to practice trading, allowing them to gain market experience without risking any funds.

This is an extremely valuable tool, but please remember that even though it mimics a live trading environment, prices might not be as accurate. Using a demo account for too long can desensitize you to the real risks you can face in online trading.

Swap Free

We’ve reviewed many brokers and have seen that more are including a Swap Free or Islamic Account in their offerings, and VT Markets isn’t an exception.

However, what impresses us is that VT Markets gives in-depth information on their Swap Free Account instead of merely mentioning that a Swap Free option is available.

Furthermore, this account is offered in both Standard STP and Raw ECN variants, allowing traders to select the optimum execution mechanism for their requirements. Here are some key features of the Swap Free Account:

- As the name implies, this account waives swap costs for overnight holdings.

- Traders can select between the Standard STP model, which has spreads beginning at 1.2 pips, and the Raw ECN model, which starts at 0.0 pips but requires a $6 commission every round turn.

- The Swap-Free account provides access to various assets, including FX, indexes, energy, precious metals, soft commodities, and CFD shares.

- The account follows Islamic trading rules, which ensures Sharia compliance.

Some transactions may still incur a modest admin cost despite the removal of swap fees. It is worth mentioning that VT Markets provides Swap-Free accounts with no administrative costs in some countries and areas.

Swap Free Accounts – Compared

| 🔎 Feature | 🅰️ Swap-Free (STP) | 🅱️ Swap-Free (ECN) |

| ⚙️ Execution Type | STP | ECN |

| ☪️ Swap-Free | ✅Yes | ✅Yes |

| 📈 Platform | MT4/MT5 | MT4/MT5 |

| 💴 Minimum Deposit | $100 | $100 |

| 📉 Leverage | 500:1 | 500:1 |

| 📊 Spread from | 1.2 pips | 0.0 pips |

| 💶 Commission | $0 | $6 (per round turn) |

| 🎁 Trading Bonus | Available | Available |

| 💵 Base Currencies | $ AUD, $ USD, £ GBP, € EUR, $ CAD | $ AUD, $ USD, £ GBP, € EUR, $ CAD |

| 🚀Open an Account | 👉 Click Here | 👉 Click Here |

Our Insights

VT Markets offers a decent number of account types, allowing traders to choose one that aligns with their strategies, preferences, financial goals, and risk tolerance. While some brokers offer more accounts, VT Markets’ approach gives traders a choice without overcomplicating things.

Account Opening and Trader Dashboard

Here’s the process that you can follow to register an account with VT Markets:

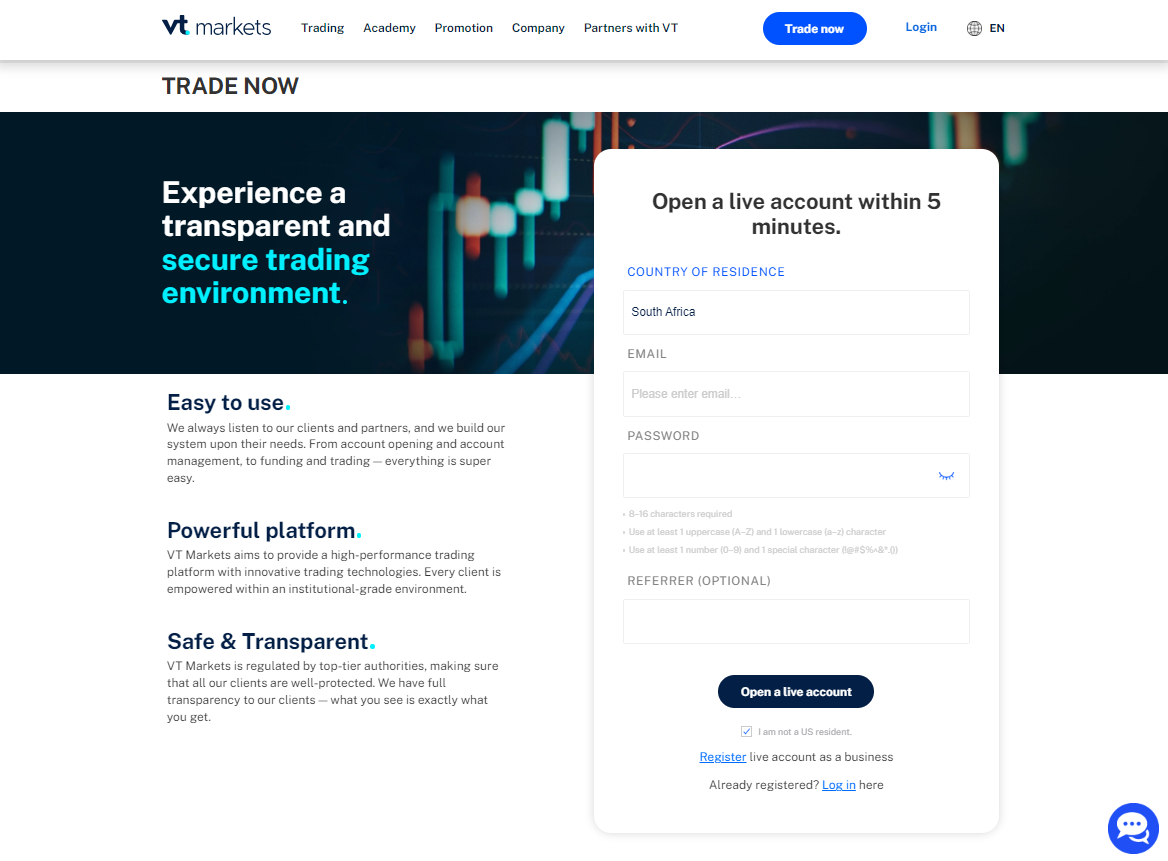

Step 1: Click “Trade Now to Start the Registration Process

On the VT Markets webpage, click the blue “Trade Now” banner in the top right corner of the main menu and wait for the page to load.

The application form has a few fields that you must complete:

- Type in the name of your country and select the appropriate option.

- Enter a valid email address.

- Choose a password (8 – 16 characters long, must have 1 uppercase and 1 lowercase character, and use at least 1 number and 1 special character).

- If you’ve been referred by someone else, you can provide their information.

Before clicking the “Open a live account” banner, make sure the box below it is unchecked if you are a US resident.

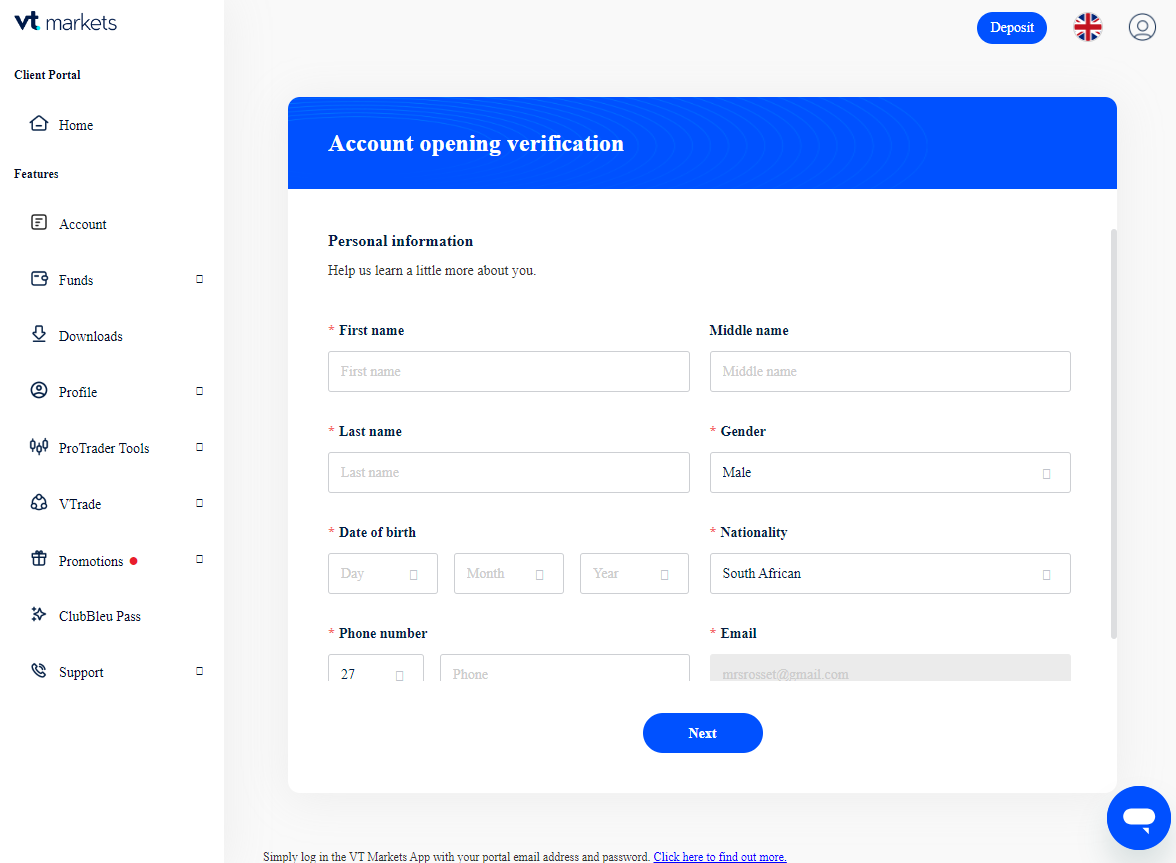

Step 2: Complete the Comprehensive Online Form

You are required to provide information in all fields marked with a red asterisk (*). Next, a more comprehensive form will load. Here’s what the form requires:

- First Name

- Last Name

- Gender (unfortunately, there isn’t an option for those who would rather not say)

- Date of Birth

- Nationality

- Phone Number (if the country code doesn’t automatically update according to your location or IP, you can scroll through the drop-down list).

After completing and verifying the information in the fields, you click “Next.”

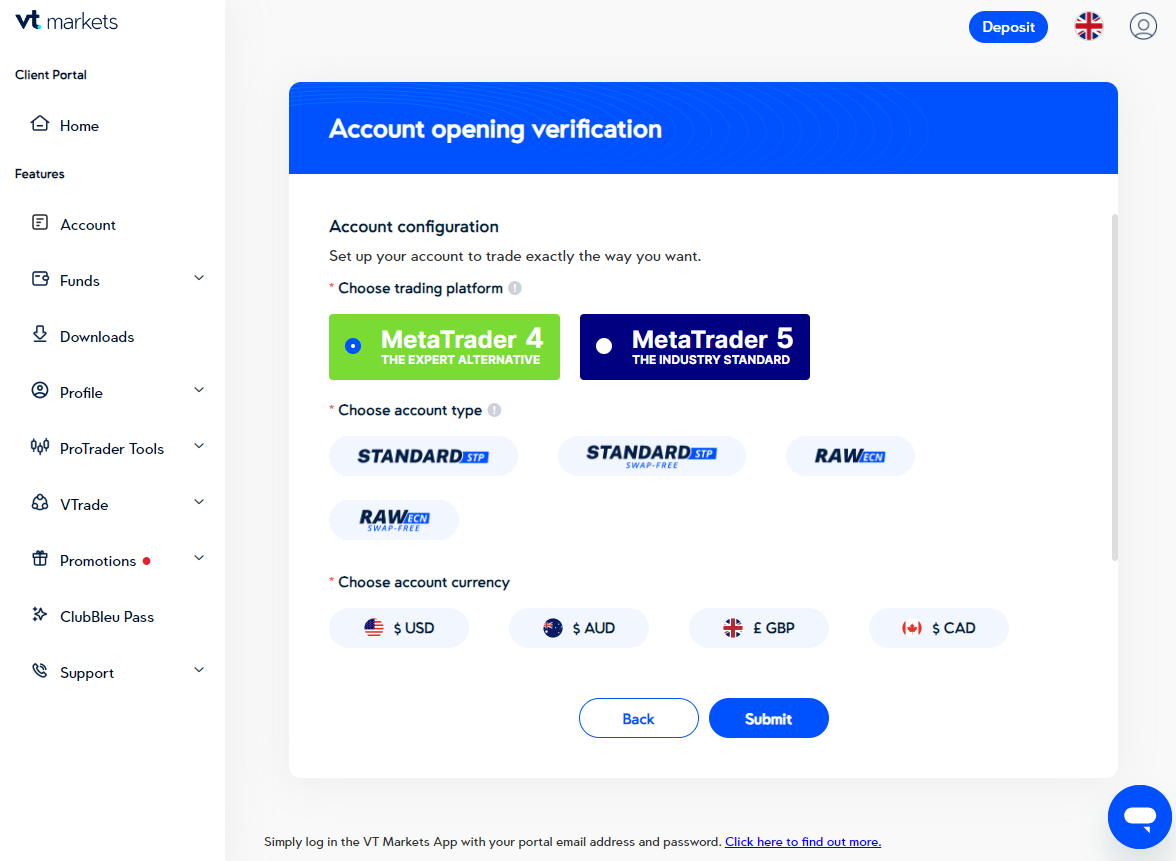

Step 3: Account Opening Verification

The next part is the “Account Opening Verification,” and here, you must:

- Choose your trading platform (only MetaTrader 4 and MetaTrader 5 were available on our application).

- Standard, Standard Swap-Free, Raw ECN, and Raw ECN Swap-Free (these were the options available on our application).

- Choose your account currency.

- There’s a section with a check box (“By ticking this box, you hereby agree to the following) and a drop-down list with what you’re agreeing to by signing up. Take the time to read through the documents before you sign up!

- Click “Submit.”

The next screen will state, “Congratulations, you are almost ready to trade.” In this section, you are required to confirm your identity. Click the option, and the identity verification page will load. Provide your ID number and then click “Next.”

Final Steps: Provide an Identity Document and Wair for Approval

The next page allows you to upload a copy of your identity document. There are instructions for all types of identity docs, so ensure you understand what VT Markets considers acceptable.

- Once uploaded, click “Next” to submit the uploads.

- A new page will load, stating “Your document is under review.” We completed ID verification in an hour, exceeding our expectations of a 12-hour process

- We completed ID verification in an hour, exceeding our expectations of a 12-hour process

Once approved, you can sign in and start trading using your deposited funds.

Trading Platforms and Solutions

| 🔎 Feature | 4️⃣ MT4 | 5️⃣ MT5 | 🖱️ WebTrader | 💻 VT WebTrader+ | 📲 VT Markets App |

| 📈 Platform Type | Desktop/Mobile | Desktop/Mobile | Browser-based | Browser-based | Mobile |

| 📉 Interface | User-friendly | User-friendly | MT4-like | TradingView-based | User-friendly |

| 📊 Charting & Indicators | Customizable | Advanced | Limited | 100+ indicators | Limited |

| 💹 Algorithmic Trading | Expert Advisors | MQL5 | None | None | None |

| 💱 TradingView Integration | None | None | None | ✅Yes | None |

| 📱 Mobile App | ✅Yes | ✅Yes | N/A | N/A | ✅Yes |

| 📌 Additional Features | Fast execution | Fast execution | No download | Live market updates | 1000+ assets |

MetaTrader 4 (MT4)

The reputation of MT4 as a reliable and versatile platform is well-deserved. While conducting our review, we discovered that the platform (combined with VT Markets’ accounts) is incredibly user-friendly and offers a diverse selection of assets for trading.

The option to fully customize charts and indicators is a significant advantage, as it enables traders of any skill level to personalize their trading experience.

In our experience, MT4 boasts lightning-fast order execution and highly competitive spreads, catering perfectly to the needs of traders who prioritize swift and efficient execution.

VT Markets’ decision to integrate with the official MetaQuotes trading ecosystem demonstrates their strategic thinking, guaranteeing MT4 users a seamless experience characterized by dependability and efficiency.

Most traders will be grateful for including WebTrader, a user-friendly browser-based version of MT4 that provides effortless access from any device connected to the internet. The iOS and Android MT4 app also keeps traders connected to their trading anywhere in the world.

MetaTrader 5 (MT5)

MT5 brings forth a range of enhanced features that cater to traders looking for more advanced capabilities. Serious traders are drawn to this option due to its wide range of trading assets and enhanced trade management and strategy testing features.

MT5’s support for algorithmic trading via the MQL5 language is a notable advantage, especially when combining this with the VT Markets Raw ECN Account.

In addition, traders can leverage advanced charting tools and custom indicators to gain a more precise analysis of market trends. The platform’s impressive flexibility, offering unlimited charts on watchlists, 21 timeframes to choose from, and a wealth of historical data, only adds to its appeal.

VT WebTrader+

VT WebTrader+ is a one-of-a-kind platform that combines the powerful features of MetaTrader 4 and the top-notch technical tools of TradingView.

The platform’s browser-based nature provides a high level of convenience by eliminating the need for downloads or installation.

Furthermore, we must emphasize the exceptional charting and market analysis tools, including a wide range of customizable technical indicators and intelligent drawing tools.

VT Markets App

Unlike most brokers’ native apps (which are just an overview of the trader dashboard and nothing more), the VT Markets App offers an extensive range of features.

The app’s extensive support for a wide range of trading assets, its ability to provide real-time alerts and signals, and its advanced trading tools make it an invaluable tool for traders of all levels of experience.

Traders will appreciate the effort put into providing informative guides and videos, which shows a dedication to educating traders. Special promotions, such as welcome and deposit bonuses, enhance the app’s attractiveness.

You can also access VT Markets’ live chat right from the app, allowing you to address queries and issues immediately.

Social (Copy) Trading

While a separate service on its own, we decided to include VT Markets’ copy trading solutions under platforms because it is another avenue for trading. Simply defined, copy trading is a technique that allows traders to replicate the trades of seasoned investors, commonly known as “providers.”

We examined the details on VT Markets’ website to find out how VTrade accommodates both followers and providers and the potential advantages and inherent risks it presents.

VTrade for Followers

VTrade’s simplicity for followers is one of its most compelling aspects. The platform offers a wide range of more than 100 providers, each with its distinct strategies, risk profiles, and performance track records.

This feature will allow followers to choose providers aligned with their investment objectives and risk tolerance.

Once Followers select a Provider, their strategies and trades are automatically copied to the Follower’s profile, which cancels out any manual trading and allows Followers to profit from the successful trades and strategies of more experienced traders.

While we couldn’t identify a minimum deposit or initial investment amount, traders must verify whether Providers charge fees or a percentage of the profit made on their trades – these could be hidden fees to look out for.

VTrade for Providers

Experienced traders can become Providers with VTrade and capitalize on their expertise and abilities. By joining VTrade as a provider, traders can expand their reach and monetize their strategies by earning commissions from their followers’ profits.

According to VT Markets, providers have a fee-free structure, allowing them to develop different strategy offerings and tailor their commission structures and strategies to a broader audience.

Copy Trading – Advantages, Risks, and Considerations

This is an extremely simple and popular trading solution offered by many other brokers (brokers typically give their copy trading solutions different names, but it comes down to the same principle).

VTrade offers a range of impressive advantages, such as automated trading options, 24/7 market access, a user-friendly platform, and a wide selection of providers. VT Markets strongly emphasizes transparency, offering a leaderboard that evaluates providers based on their performance and profitability.

Nevertheless, like any investment strategy, copy trading comes with inherent risks. Always remember that historical performance won’t guarantee future outcomes, and there is always a possibility that a provider’s strategy won’t meet your expectations.

As mentioned before, verify any fees that the Provider might charge to ensure that you can calculate your trading costs and possible profits.

Overall, we consider VTrade a valuable asset within VT Markets’ ecosystem. It provides a distinctive opportunity for both new and seasoned traders to participate in the markets. However, do your research before you start copy trading and ensure that it aligns with your strategy and risk tolerance.

Trading and Non-Trading Fees

Trading and Non-Trading fees are standard in online trading, and we like how VT Markets has structured its schedule. You can find the “Trading Conditions” page under “Trading” and “Support” in the main menu.

VT Markets Forex Live Spreads

According to the website, VT Markets’ spreads are competitive and depend on the traded instrument and the account type used. The charged spreads are floating, which means they fluctuate according to market conditions and other factors.

VT Markets provides in-depth information on all spreads and instruments that can be viewed on the website and the trading platforms, allowing traders to calculate their trading fees.

Check Live Spreads

Here’s how traders can view live spreads charged by VT Markets:

- Log into your platform using your VT Markets account credentials.

- Open “Market Watch” from your dashboard.

- Rick-click inside Market Watch and then click “Spreads.”

- A new column will load, and you’ll see the spreads for each instrument.

Normal Spreads on STP and ECN Accounts

VT Markets’ typical spreads across the STP and ECN Accounts (subject to change according to market conditions) are as follows:

| 🔎 Account Type | 🪙 Currency Pair | 📊 Typical Spread (pips) |

| 1️⃣ Standard STP | EUR/USD | From 1.3 |

| 2️⃣ Standard STP | GBP/USD | From 1.8 |

| 3️⃣ Standard STP | AUD/USD | From 1.6 |

| 4️⃣ Standard STP | USD/JPY | From 1.5 |

| 5️⃣ Raw ECN | EUR/USD | From 0.0 |

| 6️⃣ Raw ECN | GBP/USD | From 0.6 |

| 7️⃣ Raw ECN | AUD/USD | From 0.4 |

| 8️⃣ Raw ECN | USD/JPY | From 0.5 |

ECN Commission Charges

STP Accounts already have VT Markets’ broker fee worked into the spread, which is why these spreads tend to be wider than those on ECN Accounts. Because ECN accounts feature narrow spreads, there’s a flat rate (commission fee) applied as follows:

| 🔎 Trading Account Currency | 📈 Commission per 0.01 LOTS (1,000 base currency) | 📉 Commission per 1 LOT (100,000 base currency) |

| 💴 AUD (Australian Dollar) | AUD 0.03 (round turn $0.06) | AUD 3 (round turn $6) |

| 💶 USD (US Dollar) | USD 0.03 (round turn $0.06) | USD 3 (round turn $6) |

| 💵 GBP (Pound Sterling) | GBP 0.02 (round turn £0.04) | GBP 2 (round turn £4) |

| 💷 EUR (Euro) | EUR 0.025 (round turn €0.05) | EUR 2.5 (round turn €5) |

| 💴 CAD (Canadian Dollar) | CAD 0.03 (round turn $0.06) | CAD 3 (round turn $6) |

Swap Rate

Because swaps and overnight fees are a typical and integral part of forex trading, we had to gain insight into VT Markets’ approach to managing overnight positions in the forex market.

Overall, forex trades typically settle two business days after the trade date. VT Markets, like other brokers, doesn’t physically deliver currencies.

Therefore, any open positions at the end of the day are automatically rolled over to the next value date. During this rollover, there is a possibility of incurring a swap charge or receiving a credit, which is determined by several factors.

Decoding VT Markets’ Forex Swap Rates

VT Markets’ swap rates are not fixed. Instead, they fluctuate in response to market conditions and the countries’ interest rates associated with a currency pair.

The swap rates are calculated daily using risk-management analysis conducted by VT Markets’ financial partners. Traders must note that each currency pair has its unique swap charge. Therefore, the interest payment or receipt will vary depending on whether you buy or sell a particular currency.

Traders can easily view the most recent swap rates by going to the “Market Watch” window in their platform, clicking on “Symbol,” and then choosing the asset class they want to view to display the swap rates for both long (buy) and short (sell) positions.

Oil Rollover

Traders who trade oil using futures contracts on the MT4 platform must note that each contract has a specific expiration date. Therefore, traders planning to hold onto their positions beyond the monthly contract expiration must undergo a rollover process.

When the current contract is about to expire, VT Markets will automatically close out the existing position.

Simultaneously, a new position is initiated in the next month’s futures contract. This guarantees the seamless continuation of the trading position, albeit with a transition to a new contract that has its unique price dynamics.

Slippage Policy

Slippage is typical in online trading, especially in markets that move quickly. VT Markets is extremely transparent about this, and they feature a dedicated section that explains what you can expect.

When you use VT Markets’ market execution model, your orders will be filled at the next available price if your initial requested price becomes unavailable due to market fluctuations or execution speed.

Therefore, slippage can occur in your favor (positive slippage) or against you (negative slippage), impacting your position.

We also found that slippage can impact various order types at VT Markets, including Stop Loss, Take Profit, Buy/Sell Stops, and Limit Orders.

Although VT Markets cannot provide a guarantee against slippage caused by its market execution policy, we urge traders to ensure that they understand slippage and the consequences thereof and how it affects their trading.

VT Markets Non-Trading Fees

These are the trading fees that VT Markets indicates on the website. There are also non-trading fees and other conditions that traders must consider when they trade with the broker, including the following Withdrawal Fees:

- Bank Wire Transfers – there’s one free monthly withdrawal, after which a $20 fee applies.

- Fasapay – 0.5% handling fee

- Skrill – 1% handling fee

- Neteller – 2% fee

VT Markets archives inactive accounts after a certain time, according to their Help Centre, which does not explicitly mention an inactivity fee.

Tradable Asset Classes and Instruments

Based on the information on VT Markets’ website, we’ve created a table that’ll give you an idea of what you can trade with this broker.

| 🔎 Instrument Class | ⭐ Examples | 🗝️ Key Features | 📒 Additional Notes |

| 📈 Indices | S&P 500, Dow Jones, DAX 40 | Lightning-fast execution, transparent pricing, diverse offering, advanced tech infrastructure, leverage up to 500:1 | Reflect real-time stock market prices, allowing for hedging currency risk |

| 📉 Forex | 40+ major pairs (e.g., EUR/USD, GBP/JPY) | Access to major pairs, leverage up to 500:1, spreads from 0.0 pips | 24-hour global access, educational resources for mastering strategies |

| 💡 Energies | Crude Oil, Natural Gas, Gasoline, Gasoil | Diverse portfolio, flexible trading sizes, leverage options, competitive spreads, market symbol variety | Spot contracts against USD, connected to Nymex/CME market for swift execution |

| 💎 Precious Metals | Gold, Silver, Platinum, Palladium, Copper | Store of value, insights into economic health, safe-haven asset, predictable price movements, diverse opportunities | Traded via MetaTrader 4 platforms |

| 🍊 Soft Commodities | Cocoa, Coffee, Cotton, Orange Juice, Raw Sugar | Diversification, historical significance, risk mitigation for farmers, essential role in production, speculation | Grown commodities, foundation of food and clothing, persistent demand |

| 📊 ETFs | AGG, ARKB, ARKW, BITB, BITO | Diversify your portfolio with ETF trading, cost-effective trading, leverage options up to 33:1, cutting-edge technology | Trade diverse sectors such as technology, energy, and mining with super-low costs, leveraging up to 33:1 |

| 💹 CFD Bonds | EURIBOR Futures, Euro-Bund Futures, Euro-BOBL Futures | Long and short positions, leverage up to 100:1, a curated selection of bonds, versatile and cost-effective trading | Take advantage of expected price movements by taking long or short positions, ultra-low spreads with commission starting from $0 per trade |

Leverage and Margin

VT Markets impressed us with their approach to leverage in forex trading while examining their Trading Conditions. It seems to have a deep understanding of the pros and cons of leverage, namely the potential for increased profits and the likelihood of substantial losses.

The Broke provides a significant maximum leverage of 500:1, which can be attractive to traders to optimize their market exposure.

Nevertheless, their focus on responsible trading is extremely noteworthy. Traders are reminded consistently of the potential dangers of high leverage and are urged to understand the risks fully before making any adjustments.

Deposit and Withdrawals

We explored how traders can manage their funds with VT Markets, leading us to the website’s deposit and withdrawals section.

Firstly, we couldn’t find a dedicated link to the deposits and withdrawals page on any of the main menu options, which led us to believe that the only way to view in-depth information on deposits and withdrawals requires account registration – which might be a tedious process for traders who are merely reviewing and comparing brokers.

Even when entering “VT Markets Deposits and Withdrawals” into our search engine, we were led to the VT Markets Help Centre. This features questions and answers relating to deposits and withdrawals, including:

- How to deposit/withdraw

- Deposit/withdrawal methods

- Deposit/withdrawal processing times

- Deposit/withdrawal tracking

- Deposit/withdrawal notes and limits, etc.

To make it easier for traders to see what they can expect from deposits and withdrawals, here’s a table that shows the payment methods, average processing time, fees, etc.

| 🔎 Payment Method | ⏰ Deposit Time | 💴 Deposit Fee | ⏲️ Withdrawal Time | 💶 Withdrawal Fee |

| 💳 Visa | Instant | 0 USD | 3 – 7 days | 0 USD |

| 💱 International Bank Transfer | 1 day | 0 USD | 3 – 7 days | One free withdrawal, $20 after that |

| 🪙 Crypto | Instant | Blockchain Fees | Instant | Blockchain Fees |

| 💴 Fasapay | Instant | 0 USD | 1 – 3 days | 0.5% |

| 💶 Perfect Money | Instant | 0 USD | 1 – 3 days | 0 USD |

| 💵 Neteller | Instant | 0 USD | 1 – 3 days | 0% |

| 💷 Skrill | Instant | 0 USD | 1 – 3 days | 1% |

| 💰 AIRTM | Instant | 0 USD | 1 – 3 days | 0% |

How to Deposit Funds into a VT Markets Account

The process involved with depositing funds with VT Markets is simple and each payment method has its verification and requirements. However, VT Markets’ Help Centre offers the necessary steps for each payment option. Here’s a general guide:

- You must log into your client portal using your email and password.

- On the left-hand side of the screen, under “Features,” select “Funds” to expand the list, and click on “Deposit Funds.”

- The payment options will load, and you can click on your preferred method to load the relevant page.

- You’ll receive the steps involved with your payment method, followed by a few required fields that must be completed, including:

- Trading Account Number

- Deposit Amount

- Any Important notes that must be added

- Read the deposit notes carefully to ensure you understand any terms, conditions, or limitations.

Once you’ve provided the information required by the deposit method and double-checked this, you can click “Submit.”

How to Withdraw Funds from a VT Markets Account

Withdrawals with VT Markets is easy, and there’s a detailed step-by-step process on the Help Centre under “How do I submit a withdrawal request?”. There are even screenshots to guide you through it, which is extremely helpful. Here are the steps:

- Log into your Client Portal using your email and password

- On the left sidebar, you can click on “Funds” and then select “Withdraw Funds.:

- Select your trading account

- Enter your withdrawal amount

- Click “Continue”

There’s a drop-down menu with the available withdrawal methods. Choose your preferred option and then click “Submit.”

Our Insights

The process involved with depositing, managing, and withdrawing funds is simple. While there is no dedicated Deposit and Withdrawal section in the main menu on the website, we found that the comprehensive FAQ section on the Help Centre should address most queries that traders might have.

We picked up that the deposit and withdrawal methods could differ according to the trader’s region, and there might be local options available.

Academy and Trading Tools for Traders

The “Academy” Section on the VT Markets website is divided into three sections, namely:

- Learning Centre

- Analysis

- Tools

Join us as we explore these sections to see what they offer traders!

Learning Centre

Based on the name, we expected a section filled with resources aimed at beginners who are still learning and more experienced traders who like brushing up on the basics. Here’s what you can expect from the VT Markets Learning Centre:

- An A-Z Trading Glossary that lists a plethora of terms along with their definitions. There’s a user-friendly search bar where you can enter the term without having to go through the entire glossary, and you can also apply filters according to topics like “General Finance,” “Manual Trading,” “Markets,” “Strategies,” etc.

- Learn Forex features many articles and trading guides that cover all the basics of Forex trading (as the name suggests). This could be extremely useful for newbies.

- Learn MetaTrader focuses on MetaTrader 4 download, installation, upgrades, tips and tricks, and all other information on using the platform.

Podcast is an extremely valuable resource covering Education, Market Analysis, and Market Talk. The podcasts can be streamed on the Apple Podcasts app, Spotify, iHeart, and Amazon Music.

Analysis

VT Markets offers traders access to the following analysis resources:

- Daily Analysis – which offers daily information across all instruments. This is updated daily, and traders can access the full history by clicking the page numbers at the bottom of the section.

- Daily Market Overview is presented in the same format as the analysis and provides information on the “Week Ahead” every Monday.

Finally, the VT Markets Blog. This option redirects you to various topics under Education, Research, and Latest News.

Tools

VT Markets’ Tools consist of the following:

- Economic Calendar – This is standard with most brokers and platforms, providing traders with information on important market events that could lead to significant market movements.

- Trading Signals – VT Markets is partnered with Trading Central and MetaQuotes to offer traders access to identify trading opportunities.

- Trading Central MT4 Tools include various analytical tools like Alpha Generation, Economic Insight, Forex Featured Ideas, etc.

- ProTrader Tools include Market Buzz, Featured Ideas, Economic Calendar, and Analyst Views. This service requires a trading account funded with at least 50 USD.

VT Markets offers traders access to thousands of EAs through MetaTrader 4, allowing them to use automated trading strategies.

Our Insights

Firstly, the resources are comprehensive, and we were extremely impressed by the massive amount of information along with how it’s presented, especially in the Learning Centre.

However, we noticed that VT Markets currently only has “Learn MetaTrader” for MetaTrader 4 and not for the other platforms supported, like MetaTrader 5 or the native WebTrader and app.

Not all brokers offer the podcast section, and it can be useful for all types of traders. However, this section is limited and could be expanded by adding more topics and podcasts.

Customer Support and Resources

Customer support is vital when reviewing any broker, and before we get to our first-hand experience with VT Markets’ support, let’s explore the support options they offer traders.

- Trading Conditions delves into VT Markets’ spreads, commissions, trading hours, etc.

- Trading Notifications are divided into Important Notifications related to VT Markets’ website updates, conditions, etc.

The Help Centre is a comprehensive FAQ section that covers everything you might want to know about VT Markets. Moreover, Customer Support is offered 24/7 via Live Chat and Email.

- The Help Centre

- Live Chat (instant assistance 24/7)

- Email (Replies can take 1 – 3 business days)

Overall, VT Markets’ customer support section is comprehensive, and the Help Centre is one of the most comprehensive that we’ve seen.

Corporate Activity

Now that we’ve seen what VT Markets offers its clients and partners, we look at what they’re all about beyond trading conditions. The “Corporate Activity” section on the VT Markets website features Sponsorships and ESG; let’s take a look.

Sponsorships

A Strategic Alliance: Finance Meets Motorsports

Overall, VT Markets’ collaboration with Maserati MSG Racing is fascinating and piqued our interest as reviewers.

At first glance, combining a financial broker and a Formula E racing team appears unusual, and we couldn’t quite wrap our minds around this. Still, a deeper examination revealed a strategic alignment that might benefit both sides.

The relationship provides VT Markets a unique chance to boost its brand image and reach a larger audience while aligning with motorsports’ high-performance and inventive attitude.

A Broker with Growing Ambition

From what we’ve seen and discovered, since its inception in the financial sector, VT Markets has received widespread attention for its attempts to simplify and streamline the trading process – and this is also visible in how they’ve structured their trading ecosystem.

By emphasizing accessibility and ease of use, VT Markets has garnered a global clientele looking for a user-friendly platform.

The way we see it, this partnership with Maserati MSG Racing (a team that has quickly established itself in the tough Formula E circuit) can be seen as a mirror of VT Markets’ rapid expansion and ambition to be a leader in the brokerage sector.

What This Means for Traders

How exactly can this partnership benefit traders, exactly? Well, for one, it symbolizes VT Markets’ commitment to offering a trading platform that reflects the speed, dependability, and technical developments witnessed in Formula E racing.

Furthermore, if VT Markets can apply the ideas of high performance and cutting-edge technology from the racetrack to its trading platform, it can provide traders with a more dynamic and efficient trading experience.

Our Insights

As reviewers, we believe this partnership can help VT Markets build its brand identification and attract traders who prioritize innovation and solid performance. However, in our opinion, VT Markets can also explore other partnerships to build its name, as this is currently the only collaboration.

Many brokers have several partnership and sponsorship programs globally in various sectors, which boosts their name and significantly benefits the business and their clients.

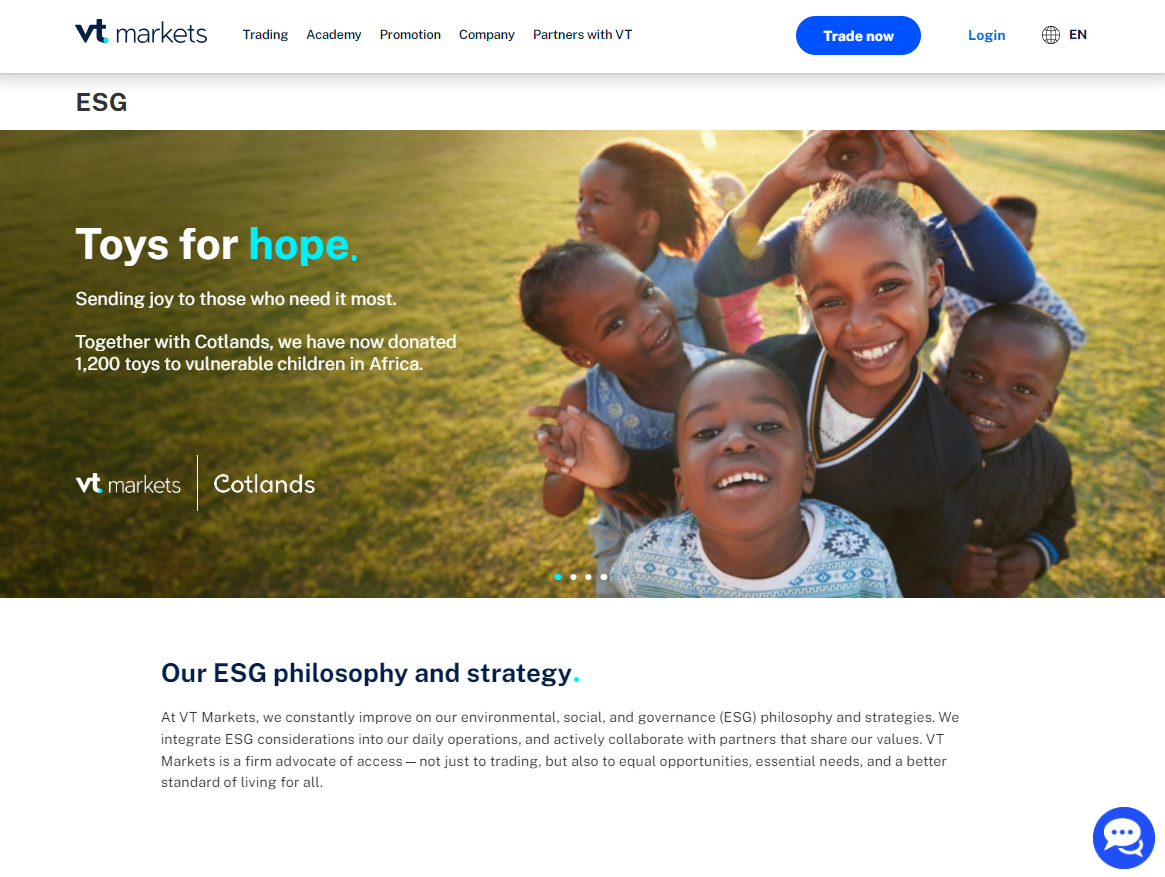

VT Markets ESG

The VT Markets website has a long list of ESG initiatives and commitments. Here are a few that stood out, especially because they are programs in which VT Markets actively participates.

Social Responsibility at VT Markets

The VT Markets website emphasizes its dedication to social responsibility, notably through its connection with the UN’s ShareTheMeal initiative. In 2023, this collaboration resulted in the distribution of 2,000 meals, indicating a proactive approach to combating world hunger.

Empowering Communities and Building Resilience

The VT Markets website displays a commitment to community participation and resilience, notably through their support of the UNESCO disaster and climate resilience workshop.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Top-tier financial regulators oversee the trading environment | Lacks transparency in its banking partnerships and doesn’t indicate where funds are kept |

| Client funds are kept separate from operational funds | The blog and news sections are out of date, restricting access to current market information |

| Provides negative balance protection on all retail accounts | There are no trading calculators on the website |

| Uses SSL encryption to secure sensitive data and transactions | The live chatbot can become annoying |

| Offers a demo account for risk-free practicing and strategy testing | Limited sponsorships and CSR projects and initiatives |

| Provides a choice of account types to accommodate different trading strategies and experience levels | There are withdrawal fees charged across payment methods |

| Supports common trading platforms, including MT4 and MT5, as well as their own WebTrader+ platform and app | Swap rates are not set and change depending on market conditions |

| Integrates with TradingView and Trading Central | Slippage can occur |

| VTrade offers copy trading, which allows customers to duplicate successful traders | There is no information on the features of the MAM or PAMM solutions |

| Provides access to a glossary, articles, guides, courses, and podcasts | Only offers platform guides for MetaTrader 4 |

In Conclusion

VT Markets excels in various areas. Their dedication to technology is obvious in their numerous platform offerings, notably incorporating TradingView into their WebTrader+ platform, which provides a substantial edge for traders who rely on complex charting and analytical tools.

the wide range of account types and their trading conditions that suit different strategies and risk tolerances prove VT Markets’ universality. They offer powerful trading platforms and various guides, articles, etc., to guide and support traders.

Furthermore, while they offer several bonuses and rewards, the distinctive ClubBleu reward program stood out to us with its significant incentives and appealing benefits.

Our Insights

The lack of transparency with their financial partners creates legitimate worries about fund security. The outdated news section and the lack of trading calculators and seminars represent wasted chances to equip traders with relevant information and instructional tools.

In addition, while customer assistance is provided 24 hours a day, the dependence on a restricted chatbot and occasional discrepancies in agent answers must be improved to improve the user experience.

Overall, despite the drawbacks, our experience with this broker was positive and they have many unique features that paint them as an attractive option for all types of traders and prospective partners.

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $0 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

Faq

Yes, VT Markets is overseen by top-tier financial regulators such as the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Financial Services Commission (FSC) in Mauritius.

From $5. The minimum deposit for a VT Markets account varies by account type but starts from $5 for a Cent account.

Yes, VT Markets provides a VPS refund program to qualifying clients who satisfy certain trading volume requirements.

You can contact VT Markets via live chat and email. They also offer a FAQ area in the Help Centre on their website.

Yes, VT Markets’ VTrade platform supports copy trading, allowing traders to mimic the trades of successful traders.

Yes, VT Markets provides swap-free accounts to clients that follow Islamic values.

No, VT Markets isn’t a scam. It is overseen by respectable financial agencies, which ensures a safe trading environment.