Plus500 Futures Review

Plus500’s user-friendly platform and diversified market offerings make it an appealing alternative for futures traders. This full review will review the intricacies of Plus500’s futures products, helping you decide whether it fits your trading ambitions well.

| 🔎 Broker | 🥇 Plus500 |

| 📌 Year Founded | 2008 |

| 👤 Amount of staff | 1,000+ |

| 👥 Amount of active traders | Over 400,000 active traders (as of the latest reports) |

| 📍 Publicly Traded | Yes, listed on the London Stock Exchange (LSE: PLUS) |

| 🛡️ Regulation and Security | Very High |

| ⭐ Regulation | FCA CySEC ASIC MAS FSA EFSA DFSA CFTC |

| 🌎 Country of regulation | UK Australia Cyprus New Zealand |

| 1️⃣ Suited to Professionals | ✅Yes |

| 2️⃣ Suited to Active Traders | ✅Yes |

| 3️⃣ Suited to Beginners | ✅Yes |

| 🥰 Most notable Benefit | Wide range of tradable instruments (CFDs on forex, stocks, commodities, indices, etc.), competitive spreads, user-friendly platform |

| 🥺 Most Notable Disadvantage | Limited educational resources for beginners, lack of fundamental analysis tools |

| 🔃 Account Segregation | Client funds are kept in segregated accounts |

| 🔋 Investor Protection Schemes | Client funds are protected under the Financial Services Compensation Scheme (FSCS) in the UK, and other local protection schemes |

| ⚙️ Account Types and Features | Real Account Demo Account |

| 💴 Minor account currencies | USD, EUR, GBP, and other major currencies available for trading; minor currencies not as widespread |

| 💶 Minimum Deposit | $100 (or equivalent in other currencies) |

| ⏰ Average deposit processing time | Instant (depending on payment method) |

| ⏲️ Average withdrawal processing time | 1-3 business days |

| 💵 Fund Withdrawal Fee | No withdrawal fees for most methods |

| 💷 Spreads from | 0.8 pips (depending on the market conditions) |

| 💳 Commissions | No commissions spreads only |

| 🪙 Number of base currencies | 7 (USD, EUR, GBP, AUD, JPY, CHF, and CAD) |

| 💰 Swap Fees | Applicable swap fees/overnight financing |

| ↪️ Leverage | varies by instrument (Trading with leverage comes with a high risk and may not be suitable for everyone.) |

| ➡️ Margin requirements | Varies by asset class typically between 2% to 5% |

| ☪️ Islamic account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⌚ Order Execution Time | 1-2 seconds |

| 📈 Total CFDs Offered | Over 2,000+ |

| 📉 CFD Stock Indices | ✅Yes |

| 🌽 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💹 Deposit Options | Credit/debit cards bank transfer PayPal Skrill Neteller e-wallets |

| 💱 Withdrawal Options | Credit/debit cards bank transfer PayPal Skrill Neteller e-wallets |

| 🖥️ Trading Platforms | Plus500 WebTrader, Plus500 Mobile App +INSIGHTS |

| 💻 OS Compatibility | WebTrader (browser based), iOS, Android |

| 🖱️ Forex trading tools | Basic charting tools, risk management tools (stop-loss, take profit), no advanced trading tools like MetaTrader4/5 |

| 🩷 Customer Support | Responsive |

| 🐦 Social Media Platforms | Facebook YouTube |

| 🗯️ Languages supported | English, Spanish, German, French, Italian, Portuguese, Dutch, Chinese, and other languages |

| 🎓 Forex course | No comprehensive course; limited resources |

| ✏️ Webinars | Limited availability |

| 📔 Educational Resources | Basic tutorials and guides |

| 🫰🏻 Affiliate program | ✅Yes |

| 🫶 Amount of partners | Hundreds of affiliate partners globally |

| 🤝 IB Program | ✅Yes |

| 🎉 Sponsor | Legia Warsaw Chicago Bulls BSC Young Boys |

| 🚀Open an Account | 👉 Click Here |

Futures Overview – Key Point Quick Overview

- ☑️ Overview

- ☑️ Safety and Security

- ☑️ Futures Markets

- ☑️ Trading Platforms

- ☑️ Account Types

- ☑️ Trading Conditions

- ☑️ Education and Research

- ☑️ Customer Support

- ☑️ Pros and Cons

- ☑️ Broker Comparison

- ☑️ In Conclusion

- ☑️ Our Insights

Overview

Having extensively delved into online trading platforms, our team has discovered that Plus500 is an intriguing subject for analysis.

This global fintech firm, based in Haifa but with a strong global presence, has established a reputation for providing diverse financial instruments, including Futures spread across crypto, agriculture, metals, forex, Interest Rates, energies, and Equity Index.

An intriguing feature that immediately captured our interest is their exclusive trading platform. With an impressive range of 32 languages, this tool is easily accessible to traders worldwide.

Their dedication to inclusivity is evident in their extensive reach across diverse markets such as Australia, the EEA, and the Middle East. This demonstrates their strong commitment to engaging a wide range of audiences.

Plus500’s expansion into the U.S. market, highlighted by their sponsorship of the Chicago Bulls, is a fascinating aspect. It shows a strong commitment to investing in brand awareness and expanding its reach into various global territories where other brokers haven’t ventured.

In our assessment, Plus500 emerges as a dynamic contender in the online trading industry. This company’s extensive global presence, wide range of products, and cutting-edge platform position it as a company that demands attention.

If you have experience in trading or are just starting in the world of online investing, Plus500 is worth considering. It offers a range of features that make it an attractive choice. However, please note that Futures trading is only available in the United States.

Safety and Security

Plus500 stands out as one of the most well-regulated forex and CFD brokers globally, with their licenses and regulations indicated in the table below:

| 🔎 Registered Entity | 🌎 Country of Registration | 📌 Registration Number | 📍 Regulatory Entity | 📊 Tier | 📈 License Number/Ref |

| 1️⃣ Plus500AU Pty Ltd | Australia | CAN 153301681 | ASIC | 1 | AFSL417727 |

| 2️⃣ Plus500UK Ltd | United Kingdom | 07024970 | FCA | 1 | FRN 509909 |

| 3️⃣ Plus500CY Ltd | Cyprus | N/A | CySEC | 1 | 250/14 |

| 4️⃣ Plus500SEY Ltd | Seychelles | N/A | FSA | 3 | SD039 |

| 5️⃣ Plus500EE AS | Estonia | N/A | EFSA | 3 | 4.1-1/18 |

| 6️⃣ Plus500SG Pte Ltd | Singapore | N/A | MAS | 1 | UEN 201422211Z |

| 7️⃣ Plus500AE Ltd | Dubai | N/A | DFSA | 2 | F005651 |

| 8️⃣ Plus500AU Pty Ltd | South Africa | 153301681 | FSCA | 2 | FSP 47546 |

| 9️⃣ Plus500US Financial Services LLC | United States | NFA ID number 0001398 | NFA, CFTC | N/A | NFA ID number 0001398 |

Furthermore, Plus500 stresses customer safety and fund security with a multi-layered approach that includes regulatory compliance, financial precautions, and technical measures as follows:

- Operates under top-tier financial regulators like FCA, CySEC, and ASIC.

- Adheres to stringent financial standards and best practices.

- Client funds are held in separate bank accounts.

- Protects client assets in case of insolvency.

- Plus500US Financial Services LLC will hold your funds in a segregated bank account, which separates customer funds from the company’s funds.

- Uses SSL encryption for website communication and data encryption for stored information.

- Two-factor authentication (2FA)

- Provides stop-loss and take-profit orders.

In addition, Plus500 is publicly traded on the London Stock Exchange.

Futures Markets Overview

Plus500 provides a wide range of futures markets, giving traders exposure to a variety of asset classes and global economic trends. Let’s investigate each market in detail.

Agriculture

After thoroughly examining Plus500’s agricultural offerings, we have discovered a platform that allows traders to take advantage of the fluctuations in commodity prices, regardless of whether they are rising or falling.

| 🔎 Symbol | 📌 Name | 📍 Intraday |

| 1️⃣ ZWU4 | Wheat | $250 |

| 2️⃣ LEQ4 | Live Cattle | $300 |

| 3️⃣ ZLZ4 | Soybean Oil | $550 |

| 4️⃣ HEQ4 | Lean Hogs | $250 |

| 5️⃣ GFQ4 | Feeder Cattle | $500 |

| 6️⃣ ZMZ4 | Soybean Meal | $715 |

| 7️⃣ ZCZ4 | Corn | $250 |

| 8️⃣ ZSX4 | Soybean | $910 |

Cryptocurrencies

The world of cryptocurrencies is known for its inherent volatility. Plus500 offers leveraged trading on crypto futures, which can potentially increase profits but also comes with the risk of amplified losses.

In our experience, this market is known for its potential for both high risks and high rewards, making it deserving of careful consideration.

| 🔎 Symbol | 📌 Name | 📍 Intraday |

| 🅰️ MBTN4 | Micro Bitcoin | $100 |

| 🅱️ METN4 | Micro Ether | $20 |

Forex

With Plus500’s forex futures offerings, traders gain access to the vast global currency market, allowing them to make informed speculations on exchange rate fluctuations.

| 🔎 Symbol | 📌 Name | 📍 Intraday |

| 📈 M6BU4 | Micro GBP/USD | $50 |

| 📉 M6EU4 | Micro EUR/USD | $50 |

| 📊 MCDU4 | Micro CAD/USD | $40 |

| 💹 6JU4 | Japanese Yen | $250 |

| 💱 6SU4 | Swiss Franc | $400 |

| 🔢 6NU4 | New Zealand Dollar | $250 |

| 📈 6EU4 | Euro FX | $300 |

| 📉 E7U4 | E-mini Euro FX | $150 |

| 📊 M6AU4 | Micro AUD/USD | $40 |

| 💹 6AU4 | Australian Dollar | $300 |

| 💱 6BU4 | British Pound | $400 |

| 🔢 6CU4 | Canadian Dollar | $250 |

| 📈 6MU4 | Mexican Peso | $385 |

Equity Indices

Traders looking to expand their investment portfolio may find Plus500’s equity index futures as a valuable tool to diversify into specific sectors or regions of the stock market. We believe that this nuanced approach can potentially complement broader investment strategies.

| 🔎 Symbol | 📌 Name | 📍 Intraday |

| 📔 NQU4 | E-mini Nasdaq-100 | $1,000 |

| 📚 EMDU4 | E-mini S&P Midcap 400 | $1,000 |

| 📒 YMU4 | E-mini Dow Jones | $500 |

| 📑 MYMU4 | Micro E-mini Dow Jones | $50 |

| 🗃️ NKDU4 | Nikkei | $1,500 |

| 🗄️ MNQU4 | Micro E-mini Nasdaq-100 | $100 |

| 📇 M2KU4 | Micro E-mini Russell 2000 | $50 |

| 📏 RTYU4 | E-mini Russell 2000 | $500 |

| 📐 MESU4 | Micro E-mini S&P 500 | $50 |

| 🧾 ESU4 | E-mini S&P 500 | $500 |

Precious Metals

During economic uncertainty, precious metals are popular among investors seeking a haven. Exploring Plus500’s competitive spreads and leverage options for precious metals futures could be a strategic choice for those looking for stability.

| 🔎 Symbol | 📌 Name | 📍 Intraday |

| 🥇 QOQ4 | E-mini Gold | $250 |

| 🥈 SILU4 | Micro Silver | $200 |

| 🥉 HGU4 | Copper | $1,375 |

| 🏅 MGCQ4 | Micro Gold | $50 |

| 🎖️ MHGU4 | Micro Copper | $100 |

| 💎 GCQ4 | Gold | $500 |

| 🪙 PLV4 | Platinum | $1,000 |

| 💰 SIU4 | Silver | $1,000 |

Interest Rates

Interest rates are a crucial factor in finance, and Plus500 offers the opportunity to trade interest-rate futures. This could be a valuable tool for traders seeking to enhance the diversification of their portfolios.

| 🔎 Symbol | 📌 Name | 📍 Intraday |

| ↘️ ZQQ4 | 30 Day FedFund | $190 |

| ➡️ 10YN4 | Micro 10-Year Yield | $45 |

Energies

The energy market is known for its constant fluctuations, influenced by global supply and demand factors. Engaging with the diverse energy futures contracts offered by Plus500 requires careful analysis due to the market’s volatility.

| 🔎 Symbol | 📌 Name | 📍 Intraday |

| 📈 HOQ4 | Heating Oil | $1,500 |

| 📉 NGQ4 | Natural Gas | $1,000 |

| 📊 RBQ4 | RBOB Gasoline | $1,000 |

| 💹 QMQ4 | E-mini Crude Oil | $400 |

| 📈 MNGQ4 | Micro Natural Gas | $100 |

| 📉 CLU4 | Crude Oil | $800 |

| 📊 MCLQ4 | Micro WTI Crude Oil | $80 |

| 💹 BZU4 | Brent Crude Oil | $1,000 |

| 📈 QGQ4 | E-mini Natural Gas | $250 |

| 📊 CLQ4 | Crude Oil | $800 |

What does “Intraday” Mean?

Plus500 offers intraday prices for futures contracts. The prices on the platform are continuously updated throughout the trading day to reflect real-time market movements.

In our experience, traders heavily rely on intraday prices to make well-informed trading decisions due to their high accuracy.

Trading Platforms

Web-Based Platform

The Plus500 web-based platform is a seamless and user-friendly interface accessed directly from your web browser.

We greatly appreciate the convenience of not needing to download or install anything, which is ideal for making swift trading decisions. We found the platform fully equipped with all the necessary features, including charting tools, technical indicators, and real-time price updates.

This platform is an excellent option for traders who value the convenience and versatility of web-based platforms, particularly those who frequently need to trade while on the move.

Mobile App

Traders who are constantly on the go can now enjoy the complete trading experience on their smartphones or tablets with Plus500’s mobile app, which is compatible with iOS and Android.

The app’s design is incredibly intuitive, reflecting the key functionalities of the web platform. This app offers a range of convenient features, including push notifications for price alerts and the ability to manage your positions from anywhere.

The mobile app is an excellent choice for traders who value the flexibility and ease of trading on their mobile devices.

Notable Platform Features and Tools

Plus500 offers a variety of tools to enhance the trading experience for futures traders. These are some of the standout features:

- The platform provides users with interactive charts that offer a range of timeframes and technical indicators. These tools have proven highly valuable for analyzing price trends and patterns.

- You can use risk management tools that offer stop-loss and take-profit orders to manage your risk tolerance effectively. These tools allow you to close positions automatically when your desired price levels are reached.

- The platform’s integrated economic calendar provides timely updates on upcoming market events, offering valuable insights to support your decision-making process.

- You can stay informed about market conditions is essential, and Plus500 provides real-time market news and analysis to assist you in comprehending potential price drivers.

In addition, you can ensure additional risk management on specific instruments by utilizing guaranteed stop orders. These orders assure that your positions will be closed at the price you designate, regardless of market gaps.

Account Types

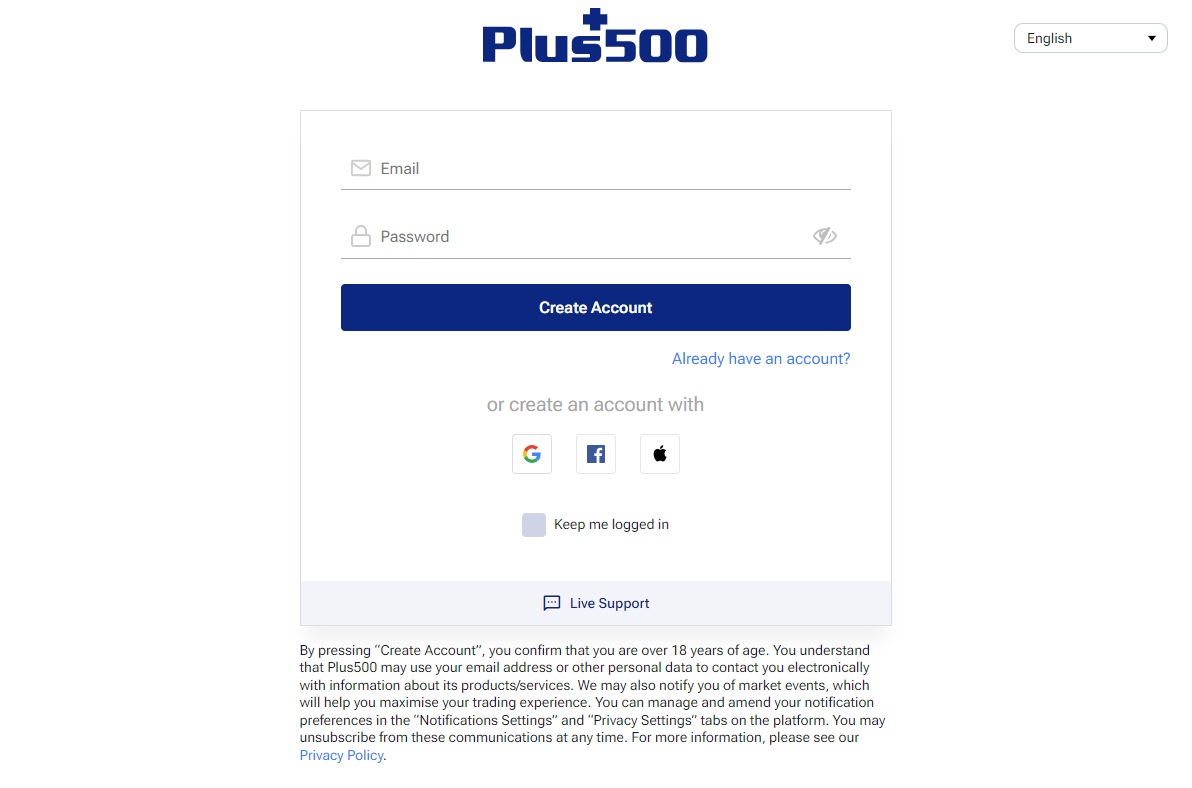

It is worth noting that Plus500 provides a convenient range of account options, including a standard retail account that caters to various trading requirements, including futures. This simple approach streamlines the process for both novice and experienced traders.

Registering an account was incredibly easy. We decided to explore the Plus500 website and proceeded to initiate the trading process by clicking on the “Start Trading Now” button.

Next, we entered our details, such as name, email, and country. Once we established a strong password and accepted the terms, we were just about ready to engage in trading.

Minimum Deposit Overview

As part of the account setup process, a minimum deposit is necessary. According to the Plus500 website, the amount can differ based on the payment method you select. However, according to the Plus500 website, traders can start trading futures with a 100 USD minimum deposit.

How to Verify A Plus500 Account

Before engaging in futures trading, Plus500 mandates the completion of identity and address verification. This standard procedure, widely used in the financial industry, helps ensure compliance with regulations and prevent fraud.

We provided copies of our identification and proof of address. The verification process was conducted with utmost efficiency and effectiveness.

After setting up our verified account, we were eager to explore the platform’s future offerings. We were impressed with the user-friendly platform and the extensive range of educational resources provided.

Whether you have years of experience in trading or are just starting, Plus500 offers a nurturing environment for learning and trading futures.

Trading Conditions for Futures Trading

Having extensively examined Plus500’s future offerings, we have acquired valuable insights that we are excited to share. One aspect that stood out to us about Plus500 was their commitment to providing clear and transparent information about their fees.

Many services, such as deposits, real-time quotes, and charting tools, are free. This removes any concerns about undisclosed expenses and enables you to focus on refining your trading strategies.

Here is a comprehensive analysis of what you can anticipate when trading futures on this platform.

Leverage

Plus500 provides leverage options for traders, although the amount offered may differ based on the asset being traded. Remember, trading with leverage comes with a high risk and may not be suitable for everyone.

Spreads

Plus500 generates revenue primarily through the buy/sell (bid/ask) spread. The spread, included in the quoted rates, represents the expense of initiating a position.

The spreads on Plus500’s futures contracts are generally competitive, although they may fluctuate depending on market conditions.

For example, the E-mini S&P 500 futures may have a spread of approximately 0.4 points, whereas gold futures could be around 0.3. Given the dynamic nature of these fluctuations, it is prudent to consult the platform for up-to-date quotes before initiating any trades.

To view the spread for any instrument, simply log into your demo or live account and navigate to the details section. It will provide you with all the necessary information.

Fees and Commissions

While Plus500 doesn’t charge commissions on most forex and CFD instruments, Futures attract the following commission fees:

| 💴 Standard and E-Mini contract commission | 0.89 USD per side, not including Exchange Commissions or NFA Fees |

| 💶 Micro contract commission | 0.49 USD per side, not including Exchange Commissions or NFA Fees |

| 💵 Liquidation fee per contract | 10 USD |

| 💷 Withdrawal wire transfer | 0 USD |

| 💴 Data fee | 0 USD |

| 💶 Platform fee | 0 USD |

| 💵 Deposit and withdrawal | 0 USD |

| 💷 Inactivity Fee | 0 USD |

| 💴 Routing fee | 0 USD |

Here are some additional fees that could be incurred based on your trading activity:

- Overnight Funding is a fee that is applied to your account if you keep a position open overnight, increasing or decreasing your balance. The specific amount will differ based on the terms of the agreement and the current interest rates.

- When trading futures in a currency different from your account currency, you will be subject to a currency conversion fee. This fee is visible in real-time within an open position’s unrealized profit and loss.

- When using a guaranteed stop order to manage risk effectively, it’s important to note that a wider spread will be applied. This wider spread ensures that the execution of the order will be guaranteed at the price you have specified.

Be aware that failing to log into your account for three months or longer could result in a monthly inactivity fee of up to USD 10 being charged.

Deposit and Withdrawal Fees

Plus500 takes care of most payment processing fees for deposits and withdrawals, underscoring their dedication to offering advantageous trading conditions. Occasionally, your bank or payment issuer may charge fees, but Plus500 does not impose deposit or withdrawal fees.

Futures Education and Research

We’ve discovered that Plus500 deeply understands the needs of traders, particularly those new to the market.

The “Trader’s Guide” goes beyond a simple overview and delves into the essential aspects of futures trading, such as margin and leverage. It presents complex concepts in an easily understandable way.

What about their FAQ section? This list of questions goes beyond the ordinary; it provides comprehensive answers to the inquiries that traders truly ponder.

Furthermore, we found that the platform’s video tutorials are impressive, offering concise and visually engaging guides on efficiently using the trading tools.

Futures Market Analysis

Plus500 excels in providing exceptional market analysis tools. An interesting feature was the economic calendar, providing traders with valuable information about upcoming events that may impact the market.

The platform also offers a continuous flow of up-to-the-minute news updates and technical analysis tools, such as charts and indicators. Based on our extensive experience, these tools are highly valuable in identifying potential trading opportunities.

Risk Management Tools

Risk management is vital in futures trading, and it’s evident that Plus500 understands this concept very well. We were thoroughly impressed by the wide array of risk management tools they provide.

Traders can automatically use features such as stop-loss and take-profit orders to close positions at pre-set levels.

This allows for effective management of potential losses and the opportunity to secure profits. We discovered that the “Close at Profit” and “Close at Loss” features are valuable additions, offering additional control over your trades.

Customer Support

| ⏰ Operating Hours | 24/7 |

| 📌 Support Languages | English, German, Spanish, French, Italian, Danish, Czech, Romanian, Polish, Bulgarian, Norwegian, Swedish, Greek, Finnish, Russian, Slovak |

| 🥰 Live Chat | ✅ Yes |

| 💌 Email Address | [email protected] |

| ☎️ Telephonic Support | +44 203 808 9577 (UK) +1 212 444 0548 (US) +61 283 110 459 (Australia) |

Response Time Overview

To determine how quickly Plus500 responds to client queries, we reviewed websites to find information from real clients, and this is what we discovered:

| 🔎 Contact Methods | ⏰ Response Time | 🥰 Customer Comment |

| ☎️ Phone | 1-2 minutes | I was connected to a person within a minute, and they were quite helpful in fixing my problem. |

| 1-2 hours | I sent an email and received a thorough response within an hour. I was delighted with the level of help. | |

| 🔊 Live Chat | 1-2 minutes | The live chat help was fast and effective. My query was answered within minutes. |

| ⭐ Social Media | 1-2 hours | I contacted Plus500 via X (Twitter), and they answered within an hour with the information I required. |

| 🤝 Affiliate | 24-48 hours | As an affiliate, I had a query concerning my commission. The crew responded within a day with a detailed explanation. |

FAQ and Help Center

Plus500 provides a comprehensive FAQ and Help Center on their website and various direct contact methods. This resource proved highly valuable for answering frequently asked questions regarding their platform, trading conditions, and account management.

The FAQ section is meticulously structured and effortlessly navigable, rendering it a convenient self-help resource for traders.

Plus500 vs AvaFutures vs HFM – a Comparison

| 🔎 Feature | 🥇 Plus500 | 🥈 AvaFutures | 🥉 HFM |

| 📊 Regulation | FCA (UK), CySEC, ASIC | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📈 Trading Platforms | Web, Mobile App | AvaTrade WebTrader, AvaOptions, AvaTradeGO, MetaTrader 4, MetaTrader 5, AvaSocial, DupliTrade, ZuluTrade | MetaTrader 4, MetaTrader 5, HFM App, HFCopy |

| 📉 Futures Markets | Wide variety, including agricultural commodities, indices, cryptocurrencies, forex, equities, metals, interest rates, and energies | Wide variety, including Indices, commodities, forex, treasuries, cryptocurrencies, metals, soft commodities | Limited variety, including energies, indices |

| 💹 Spreads | Variable, generally competitive | Variable, can be lower than Plus500 | Variable, competitive for major instruments |

| 💴 Commissions | Charged per contract, varies by instrument | Charged per contract, varies per instrument, includes NFA and Exchange fees in the pricing structure | No commissions on most futures contracts |

| 📌 Leverage * | Varies by instrument | Varies by instrument and account type, up to 1:400 for professional clients | Varies by instrument and account type, up to 1:200 for futures |

| 💶 Fees | Overnight financing, inactivity fee, currency conversion fee (rare) | Overnight financing, inactivity fee, currency conversion fee | Overnight financing, inactivity fee, currency conversion fees |

| 🎓 Educational Resources | Trader's Guide, video tutorials, FAQ | Educational videos, webinars, articles, economic calendar | Educational videos, webinars, articles, economic calendar, podcasts, trading classes, online courses, platform tutorials |

| ❤️ Customer Support | 24/7 email and live chat | 24/5 phone, email, and live chat support in multiple languages | 24/5 phone, email, and live chat support |

| 🚀Open an Account | 👉 Click Here | 👉 Click Here

| 👉 Click Here |

*Trading with leverage comes with a high risk and may not be suitable for everyone

Pros and Cons

| ✅ Pros | ❌ Cons |

| Plus500 strives to offer competitive spreads on futures contracts | Futures can only be traded in the US |

| There is a large futures portfolio that covers various sectors and asset classes | The spreads are variable and could widen significantly during volatile market conditions |

| There are competitive futures commissions charged | Commissions apply per contract and do not include the Exchange Commissions or NFA fees |

| There are various educational resources available for futures trading | Currency conversion and inactivity fees apply |

In Conclusion

Our examination of Plus500’s futures trading products yielded mixed results. The platform’s broad range of futures contracts across various asset classes is undeniably appealing, catering to a wide range of trading interests.

Furthermore, the platform’s user-friendly design, along with excellent instructional tools, makes it accessible to both new and experienced traders.

However, while the pricing structure is straightforward, we found it might not suit everyone. Commissions on each trade and potential overnight financing charges can quickly accumulate, particularly for active traders.

While the spreads are normally competitive, they might vary depending on market conditions, thereby affecting profitability. In addition, futures trading is currently not offered globally and is limited to the United States.

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $0 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

Our Insights

We believe that Plus500 is an attractive alternative for futures trading, especially for individuals who value a wide market selection and an easy-to-use interface.

Traders should, however, carefully analyze the cost structure and other disadvantages, such as restricted customer service channels and unpredictable spreads, before making any final decisions.

Faq

Plus500 offers a comprehensive range of futures contracts, including commodities (such as agriculture, metals, and energies), indices (such as the S&P 500), Interest Rates, Forex, and cryptocurrencies.

Yes, Plus500 is regulated by the CFTC and NFA in the United States for futures trading purposes.

Futures contracts on Plus500 typically begin trading on Sunday at 6 pm ET (Eastern Time) and close on Friday between 4:30 and 5 pm.

They normally open at 5 pm ET each day and close at 4 pm ET the next day. However, specific trading hours differ based on the type of futures contract and the underlying instrument. The Plus500 platform’s information section contains the trading hours for each contract.

Plus500 principally charges a fee for each futures contract traded, starting from 0.49 USD on Micro Contracts (this excludes exchange and NFA fees). Additional expenses include overnight financing and currency conversion fees.

Yes, Plus500 offers a demo account that allows you to practice futures trading with virtual funds before investing real money.