OANDA Review

Oanda is a reliable broker known for offering competitive spreads on Contracts for Difference (CFDs). With over 100 trading instruments available, it boasts a 98 out of 100 trust score. Additionally, Oanda is fully regulated by three tier-1 authorities, the industry’s highest regulatory standards.

🛡️Regulated and trusted by ASIC, BVI, CFTC, FCA, FFAJ, etc.

🛡️3002 new traders chose this broker in the last 90 days.

🛡️Available for global Traders.

| 🔎 Broker | 🥇 Oanda |

| 📌 Year Founded | 1996 |

| 👤 Amount of staff | Approximately 500 |

| 👥 Amount of active traders | Over 100,000 |

| 📍 Regulation and Security | Very High |

| 🛡️ Regulation | ASIC BVI CFTC FCA FFAJ FSC IIROC MAS NFA |

| 1️⃣ Suited to Professionals | ✅Yes |

| 2️⃣ Suited to Active Traders | ✅Yes |

| 3️⃣ Suited to Beginners | ✅Yes |

| 🥰 Most Notable Benefit | Transparent pricing |

| 🥺 Most Notable Disadvantage | Limited research tools |

| ♒ Account Segregation | ✅Yes |

| ⭐ Negative Balance Protection | ✅Yes |

| 🚨 Investor Protection Schemes | ✅Yes |

| ↪️ Account Types and Features | Standard Premium Premium Plus |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | None |

| 🪙 Minor account currencies | ✅Yes |

| 💰 Minimum Deposit | None |

| 💴 Trading Conditions | Variable spreads, competitive commissions |

| ⏰ Average deposit processing time | Instant |

| ⏱️ Average withdrawal processing time | 1-3 business days |

| 💶 Fund Withdrawal Fee | None |

| 💵 Spreads from | 1.0 pips |

| 💷 Commissions | Low commissions on certain accounts |

| 💳 Number of base currencies | 80+ |

| 💸 Swap Fees | ✅Yes |

| 🏧 Leverage | Up to 50:1 for Forex, varies for other instruments |

| 🏦 Margin requirements | Varies by instrument |

| ☪️ Islamic account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⌛ Order Execution Time | Instant execution |

| 🖱️ VPS Hosting | Available for premium accounts |

| 🤖 Trading Instruments | Forex CFDs commodities indices |

| 📈 Total CFDs Offered | 200+ |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💹 Deposit Options | Bank transfer credit/debit cards PayPal |

| 💱 Withdrawal Options | Bank transfer credit/debit cards |

| ↘️ Trading Platforms | MT5 OANDA Mobile TradingView |

| 🖥️ OS Compatibility | Windows Mac iOS Android |

| 💻 Forex trading tools | Trading calculators, economic calendar |

| 💌 Support Email | Contact Request |

| 🐦 Social Media | Twitter, Facebook, LinkedIn |

| 🗯️ Languages | Multiple |

| 🎓 Forex course | ✅Yes |

| ✏️ Webinars | ✅Yes |

| 📔 Educational Resources | Articles tutorials |

| 📚 Affiliate program | ✅Yes |

| 📒 Amount of partners | Varies |

| 📑 IB Program | ✅Yes |

| 🗃️ Sponsor events or teams | ✅Yes |

| 🗄️ Rebate program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Overview

OANDA has built a trusted reputation as an online trading platform with over 25 years of experience, offering a wide range of global financial instruments such as forex, commodities, cryptocurrencies, indices, and shares. Known for exceptional customer service, transparent pricing, and top-tier platforms, OANDA ensures traders experience fast and secure withdrawals and deposits. As a regulated broker across eight jurisdictions, OANDA guarantees a reliable trading environment.

OANDA enhances the trading experience with powerful tools like MetaTrader, TradingView, and mobile apps. The platform also offers competitive spreads on key instruments and a variety of account types, making it ideal for both beginner and professional traders.

Frequently Asked Questions

What instruments can I trade on OANDA?

OANDA offers various trading instruments, including forex, commodities, cryptocurrencies, shares, indices, and metals. This enables you to diversify your portfolio and access global markets.

How can I trade directly from TradingView with OANDA?

You can link your OANDA account with TradingView and place trades directly from the TradingView platform. Just create or log in to your TradingView account and choose OANDA as your preferred broker.

What tools does OANDA provide for traders?

OANDA offers advanced tools such as AutoChartist for technical analysis, premium MetaTrader features, and risk management solutions. There are also in-built charting capabilities in the mobile app, along with custom indicators and VPS services for premium traders.

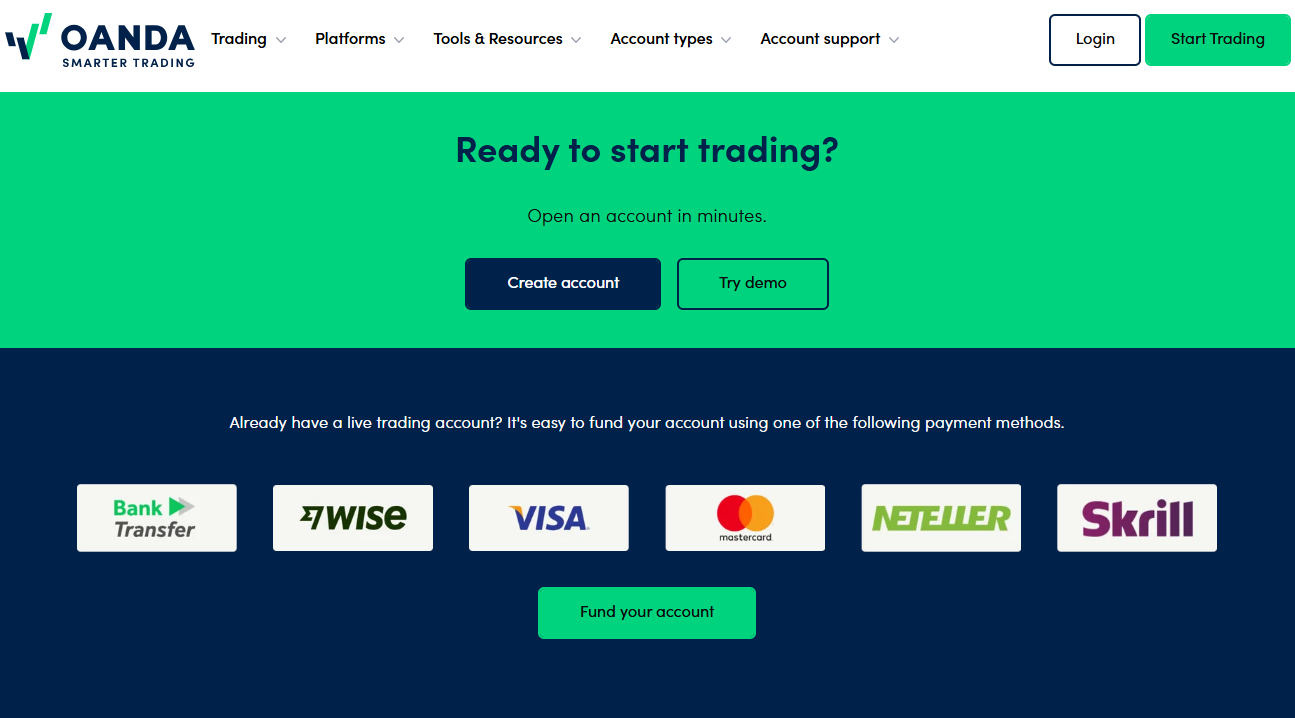

How can I get started with OANDA?

Getting started with OANDA is simple—just create an account in minutes. You can also try a demo account first to familiarize yourself with the platform before trading with real funds.

Our Insights

OANDA stands out as a top choice for both novice and experienced traders by offering advanced tools, competitive spreads, and strong account support. With its long-standing reputation, a wide range of instruments, and regulatory oversight, OANDA provides a trustworthy environment for anyone looking to trade smarter and safer. The integration with TradingView and top-tier platforms like MetaTrader enhances the trading experience, while attractive offers make it easy to get started.

Detailed Summary

| 🔎 Broker | 🥇 Oanda |

| 📌 Year Founded | 1996 |

| 👤 Amount of staff | Approximately 500 |

| 👥 Amount of active traders | Over 100,000 |

| 📍 Regulation and Security | Very High |

| 🛡️ Regulation | ASIC BVI CFTC FCA FFAJ FSC IIROC MAS NFA |

| 1️⃣ Suited to Professionals | ✅Yes |

| 2️⃣ Suited to Active Traders | ✅Yes |

| 3️⃣ Suited to Beginners | ✅Yes |

| 🥰 Most Notable Benefit | Transparent pricing |

| 🥺 Most Notable Disadvantage | Limited research tools |

| ♒ Account Segregation | ✅Yes |

| ⭐ Negative Balance Protection | ✅Yes |

| 🚨 Investor Protection Schemes | ✅Yes |

| ↪️ Account Types and Features | Standard Premium Premium Plus |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | None |

| 🪙 Minor account currencies | ✅Yes |

| 💰 Minimum Deposit | None |

| 💴 Trading Conditions | Variable spreads, competitive commissions |

| ⏰ Average deposit processing time | Instant |

| ⏱️ Average withdrawal processing time | 1-3 business days |

| 💶 Fund Withdrawal Fee | None |

| 💵 Spreads from | 1.0 pips |

| 💷 Commissions | Low commissions on certain accounts |

| 💳 Number of base currencies | 80+ |

| 💸 Swap Fees | ✅Yes |

| 🏧 Leverage | Up to 50:1 for Forex, varies for other instruments |

| 🏦 Margin requirements | Varies by instrument |

| ☪️ Islamic account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⌛ Order Execution Time | Instant execution |

| 🖱️ VPS Hosting | Available for premium accounts |

| 🤖 Trading Instruments | Forex CFDs commodities indices |

| 📈 Total CFDs Offered | 200+ |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💹 Deposit Options | Bank transfer credit/debit cards PayPal |

| 💱 Withdrawal Options | Bank transfer credit/debit cards |

| ↘️ Trading Platforms | MT5 OANDA Mobile TradingView |

| 🖥️ OS Compatibility | Windows Mac iOS Android |

| 💻 Forex trading tools | Trading calculators, economic calendar |

| 💌 Support Email | Contact Request |

| 🐦 Social Media | Twitter, Facebook, LinkedIn |

| 🗯️ Languages | Multiple |

| 🎓 Forex course | ✅Yes |

| ✏️ Webinars | ✅Yes |

| 📔 Educational Resources | Articles tutorials |

| 📚 Affiliate program | ✅Yes |

| 📒 Amount of partners | Varies |

| 📑 IB Program | ✅Yes |

| 🗃️ Sponsor events or teams | ✅Yes |

| 🗄️ Rebate program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Frequently Asked Questions

Is OANDA regulated?

Yes, OANDA is regulated in eight jurisdictions, including the British Virgin Islands, ensuring a safe and secure trading environment. This regulation provides traders with peace of mind when executing trades on the platform.

What is the minimum deposit required to open an account with OANDA?

OANDA does not specify a strict minimum deposit amount to open a standard account. However, it’s important to check the account funding requirements when you register, as these may vary depending on the type of account you choose.

Can I use OANDA’s mobile app for trading?

Yes, OANDA offers a mobile app for both iOS and Android devices, allowing you to trade on the go with fast execution and integrated charting tools. This gives you the flexibility to trade anywhere, anytime.

What account types does OANDA offer?

OANDA offers a range of account types, including spread-only accounts and core spread + commission accounts. There is also a Premium Trader account, specifically designed for high-volume traders, with added benefits such as dedicated support and premium spreads.

Our Insights

OANDA offers a comprehensive and user-friendly trading platform with extensive tools and features designed for traders of all levels. The integration with TradingView, competitive spreads, and access to powerful platforms like MetaTrader ensure a seamless trading experience. With strong regulation, excellent customer service, and a commitment to innovation, OANDA provides a solid choice for anyone looking to navigate global markets with confidence. Whether you’re a beginner or an elite trader, OANDA gives you the flexibility and support needed to succeed.

Advantages Over Competitors

OANDA has earned its reputation as a trusted and innovative broker by providing a range of advantages over competitors. With over 25 years of experience in the industry, OANDA stands out for its exceptional customer support, competitive spreads, and powerful trading tools.

The integration with TradingView and access to platforms like MetaTrader offer traders unparalleled flexibility, while its regulatory compliance across multiple jurisdictions ensures a secure trading environment. By offering a variety of account types and diverse instruments such as forex, commodities, and cryptocurrencies, OANDA caters to traders of all levels, making it an ideal choice for those seeking a reliable and feature-rich platform.

Frequently Asked Questions

How does OANDA’s integration with TradingView benefit traders?

OANDA’s seamless integration with TradingView allows traders to execute trades directly from the TradingView platform, making it easier to analyze the market and place trades from a single interface. This integration is a major advantage over competitors that may not offer such streamlined access.

What sets OANDA’s mobile app apart from competitors?

OANDA’s mobile app offers superfast execution, access to in-built TradingView charting, and a user-friendly interface. Compared to competitors, OANDA’s app is recognized for its high client satisfaction and offers a more intuitive and smooth trading experience on both iOS and Android devices.

How does OANDA’s pricing compare to other brokers?

OANDA provides ultra-competitive spreads on major instruments like EUR/USD, GBP/USD, and gold. The broker also offers spread-only and core spread + commission accounts, giving traders flexibility and cost-effective pricing options compared to many competitors who may have higher or less transparent pricing structures.

How is OANDA’s customer support superior to that of competitors?

OANDA offers exceptional customer support with 24/5 availability, and it is particularly known for its responsiveness and professionalism. With dedicated account managers and priority support for premium accounts, OANDA’s customer service stands out against competitors, ensuring traders receive assistance when needed.

Our Insights

OANDA’s combination of robust trading tools, competitive pricing, and top-tier customer service gives it a clear edge over many competitors in the market. Its integration with TradingView and access to powerful platforms like MetaTrader makes trading more efficient, while its transparent pricing and regulatory compliance provide confidence to traders.

Safety and Security

OANDA operates as a highly trusted broker with significant regulatory oversight from seven Tier-1 regulators, including reputable financial authorities such as the Australian Securities & Investment Commission (ASIC), the Financial Conduct Authority (FCA), and the Commodity Futures Trading Commission (CFTC). OANDA commits to transparency and regulatory compliance across various jurisdictions, ensuring a secure trading environment for its clients. Although it is not publicly traded and does not operate as a bank, OANDA’s regulatory measures make it a highly secure choice for traders.

Frequently Asked Questions

What is OANDA’s Trust Score?

OANDA holds a Trust Score of 98 out of 99, which signifies its high level of trustworthiness and reliability. This score is based on the broker’s regulatory compliance, transparency, and operational practices, positioning OANDA as one of the most secure brokers in the industry.

Which regulatory bodies oversee OANDA’s operations?

OANDA is regulated by seven Tier-1 regulators, including the Australian Securities & Investment Commission (ASIC), the Financial Conduct Authority (FCA), and the Commodity Futures Trading Commission (CFTC). These regulators are known for their stringent oversight, ensuring OANDA’s commitment to maintaining high standards of security.

How does OANDA’s regulation impact my trading experience?

OANDA’s regulation by reputable Tier-1 authorities ensures that your funds are protected and that the broker adheres to strict standards of conduct. This means that OANDA is required to follow transparent pricing, fair trading practices, and secure client funds, providing you with a safe trading environment.

Is OANDA at risk of financial instability?

OANDA’s regulation by Tier-1 financial authorities minimizes the risk of financial instability. While the broker is not publicly traded and does not operate a bank, its regulatory framework is designed to safeguard clients’ interests. The absence of Tier-2 or Tier-3 regulators further reinforces OANDA’s high trust and low risk compared to brokers regulated by lower-tier authorities.

Our Insights

With oversight from seven Tier-1 regulators, including the FCA, ASIC, and CFTC, OANDA ensures that traders can trust its platform for secure and transparent trading. The absence of Tier-2 or Tier-3 regulation further strengthens its position as a low-risk broker. For those prioritizing safety and security in their trading experience, OANDA stands out as a top choice.

Minimum Deposit and Account Types

OANDA offers a range of account types to meet the needs of different traders, whether they are beginners or high-volume professionals. These accounts vary in spreads, commissions, and additional benefits.

OANDA provides Standard, Premium, and Premium Plus accounts, each with unique features to suit different trading styles and volumes. Premium accounts typically require a minimum deposit of USD 10,000, while the standard account remains accessible to all traders.

OANDA also supports traders with one-click trading and offers a variety of instruments, including forex, commodities, and indices.

Frequently Asked Questions

What is the minimum deposit required to open an account with OANDA?

For the Standard account, there is no specific minimum deposit mentioned. For the Premium account, the minimum deposit is USD 10,000, while the Premium Plus account is suited for high-volume traders and requires significantly higher trading volumes, with more stringent criteria for qualification.

How many account types does OANDA offer?

OANDA offers three main account types: Standard, Premium, and Premium Plus. These account types differ in terms of spreads, commissions, available tools, and benefits, allowing traders to select the account that best suits their trading style.

What features are available with the Premium and Premium Plus accounts?

Both the Premium and Premium Plus accounts provide additional benefits such as a dedicated relationship manager, free withdrawals, exclusive trading resources, and event invitations. The Premium Plus account offers further benefits, including spread discounts, a VPN, VPS, and seasonal gifts.

Are there any rebates available for high-volume traders?

Yes, OANDA offers volume-based rebates for high-volume traders with the Premium and Premium Plus accounts. Premium account holders can earn USD 4 per million in volume, while Premium Plus account holders can earn USD 6 per million in volume, with minimum monthly volume requirements for both.

Our Insights

OANDA provides a flexible range of accounts suitable for both beginners and experienced traders. While the Standard account is accessible to all, the Premium and Premium Plus accounts cater to more advanced traders with added benefits like rebates, dedicated support, and lower spreads. The variety of account types ensures that OANDA can meet the needs of traders at all levels, offering excellent value for high-volume traders and comprehensive tools and resources for everyone.

How to open an Oanda Account

The first step to opening an Oanda account is to click on the “Open trading account” button located on the webpage.

2. Step 2: Confirm Country of Residence

The applicant will be asked to confirm their country of residence to proceed.

3. Step 3: Complete the Registration

The applicant will be required to complete a registration form on the following sub-categories:

- Personal Details

- Citizenship

- Home Adress

- Employment

- Identity Verification

Once these fields have been completed, the account holder can make a first deposit and start to trade.

Trading Platforms

OANDA offers a diverse set of trading platforms and tools to enhance the trader’s experience across various asset classes like forex, CFDs, and cryptocurrencies. It provides the highly customizable MetaTrader 5 (MT5), the popular TradingView, and its own OANDA Mobile App, each catering to different trading preferences.

With powerful charting features, one-click trading, and advanced risk management tools, these platforms allow traders seamless integration and access to all necessary resources for efficient trading. Whether you trade on the go, use advanced algorithms, or leverage detailed charting, OANDA meets all your needs with robust, professional tools.

Frequently Asked Questions

Which platforms are available for trading with OANDA?

OANDA offers several platforms including the OANDA Mobile App, MetaTrader 5 (MT5), and TradingView. Each platform offers its unique features, such as advanced charting, customizable user interfaces, and various trading tools to enhance the trading experience.

What are the key features of the OANDA Mobile App?

The OANDA Mobile App is highly intuitive and responsive, designed for both professional and retail traders. It offers customizable order tickets, charting layouts, and account details, with one-click trading and access to a broad range of CFD instruments such as forex, shares, commodities, and crypto. It’s available on both iOS and Android.

Can I trade on TradingView with OANDA?

Yes, you can trade directly from TradingView with your OANDA account. This platform is known for its exceptional charting tools, financial community, and all-around analytics. It supports desktop, browser, and mobile versions, allowing traders to access a comprehensive trading suite and a community of over 50 million active investors.

Does OANDA support automated trading strategies?

Yes, OANDA supports automated trading through MetaTrader 5 (MT5), which allows traders to develop expert advisors (EAs) using MQL5 programming. This platform provides tools for backtesting and implementing automated strategies, ideal for traders looking for more advanced trading techniques and optimization.

Our Insights

OANDA offers a comprehensive suite of platforms designed to cater to all types of traders. Whether you’re a beginner using the OANDA Mobile App or an advanced trader seeking the power of MetaTrader 5 or TradingView, OANDA’s platforms provide flexibility, superior charting tools, and efficient trade execution. The addition of automated trading features and advanced charting tools ensures that traders at every level can access professional-grade resources, making OANDA one of the most versatile brokers for a wide range of trading styles.

Fees, Spreads, and Commissions

OANDA’s fee structure is transparent, and the broker is committed to providing competitive pricing with tight spreads, especially on major instruments like forex pairs and commodities. OANDA offers zero commissions on all accounts, making it an attractive option for traders looking to minimize their overall trading costs.

For the Standard account, spreads start from 0.6 pips on major instruments, while Premium and Premium Plus accounts offer even tighter spreads. The fee structure also includes volume-based rebates for high-volume traders, which further enhances the trading experience.

Frequently Asked Questions

Are there any commissions on OANDA accounts?

No, OANDA does not charge any commissions on any of its accounts, including the Standard, Premium, and Premium Plus accounts. This makes OANDA an attractive option for traders who want to avoid additional fees beyond the spread.

What are the spreads like on OANDA accounts?

Spreads on OANDA accounts are highly competitive. On the Standard account, spreads start from 0.6 pips on major instruments. Premium accounts offer spreads from 0.7 pips, while Premium Plus accounts can access even tighter spreads, with starting points as low as 0.1 pips.

How does OANDA’s fee structure compare to other brokers?

OANDA’s zero-commission policy and competitive spreads place it ahead of many competitors. With transparent pricing and no hidden fees, traders can enjoy a more straightforward and cost-effective trading experience.

Are there any additional charges for high-volume traders?

For high-volume traders, OANDA offers volume-based rebates. Premium account holders can earn USD 4 per million traded with a minimum monthly volume of USD 20 million, while Premium Plus account holders can earn USD 6 per million with a minimum monthly volume of USD 50 million.

Our Insights

OANDA offers highly competitive spreads and zero commissions on all account types, making it an excellent choice for traders who want to keep their costs low. With transparent pricing and volume-based rebates for high-volume traders, OANDA ensures that both retail and professional traders can benefit from cost-effective trading conditions. Whether you’re a beginner or a high-volume trader, OANDA’s pricing structure remains one of the most competitive in the industry.

Deposit and Withdrawal

OANDA is a globally trusted online trading platform that offers forex, commodities, indices, metals, and other CFD products. With over 25 years of experience, OANDA is committed to providing powerful platforms, advanced trading tools, and transparent pricing to traders worldwide. The platform supports easy deposits and withdrawals, with a wide range of payment methods, including credit/debit cards, bank transfers, Skrill, and Neteller. OANDA also offers alternative payment methods in specific regions like Southeast Asia, Latin America, and Africa. Whether you’re a seasoned trader or a beginner, OANDA’s demo account and educational resources are available to guide you through your trading journey.

Frequently Asked Questions

What deposit methods are available on OANDA?

OANDA supports a variety of deposit methods, including credit and debit cards (MasterCard, Visa), bank transfers, WISE, Skrill, and Neteller. Clients in specific regions also have access to local online/mobile bank transfers and e-wallet options.

How do I withdraw funds from my OANDA account?

Withdrawals from your OANDA account are processed back to the original deposit method. For example, if you funded your account using a credit card, the withdrawal must go back to the same card. If multiple deposit methods were used, withdrawals are processed in a specific order: first debit cards, then credit cards, and finally bank transfers.

Are there any fees associated with trading on OANDA?

OANDA provides transparent pricing and trading costs. While market volatility and liquidity can influence spreads, OANDA ensures that traders are well-informed about the costs they will incur. They offer tools such as a pricing policy and financing cost calculators to help you understand the potential fees.

How long does it take for deposits and withdrawals to be processed?

Deposits made via credit and debit cards are typically processed within one business day. Bank and WISE transfers may take longer, depending on the transfer method. Withdrawal processing times may vary depending on the payment method used.

Our Insights

OANDA offers a reliable and user-friendly trading experience with over 25 years of expertise in the market. Its extensive range of deposit and withdrawal options, including local payment methods in certain regions, makes it accessible for global traders. With transparent pricing, powerful trading platforms, and educational resources, OANDA is an excellent choice for both beginners and experienced traders alike.

Customer Reviews

🥇 Excellent!

As someone new to trading, I was looking for a platform that was easy to use and offered plenty of educational resources. The Broker has been a game-changer for me. The fxTrade mobile app is so intuitive, and I love that I can start trading without worrying about a minimum deposit. The educational content is top-notch, and I feel confident in my trades now. Highly recommend for beginners! – Sarah

🥈 They have earned my trust!

I’ve been trading for over 5 years and have used many brokers, but OANDA stands out in terms of both pricing and platform quality. The spreads are competitive, and I love the no-commission Core account. The MetaTrader 5 integration is seamless, and the tools are excellent for advanced traders. Customer support is always responsive, and I never have issues with deposits or withdrawals. – David

🥉 Great Support!

OANDA’s transparency and customer service have made them my go-to broker. The platform is fast and reliable, and I appreciate the fact that there are no hidden fees when I withdraw funds. I also love how easy it is to manage multiple accounts with one login on their app. It’s clear that OANDA prioritizes security and customer satisfaction, and that’s why I keep coming back. – Estie

Pros and Cons

| ✅ Pros | ❌ Cons |

| Great trading platforms | Only FX and CFD available for most clients |

| Outstanding research tools | Lacking Customer Support |

| Low trading fees | Inactivity fee |

In Conclusion

OANDA is a well-established and reliable online trading broker with over 25 years in the industry. They offer competitive spreads on a variety of financial instruments, including forex, commodities, cryptocurrencies, indices, and shares.

References:

Faq

OANDA is a highly reputable online trading broker that offers a variety of global financial instruments including forex, commodities, cryptocurrencies, indices, and shares. They are known for competitive spreads, no commissions, and providing access to advanced trading platforms like MetaTrader, TradingView, and their own mobile app.

OANDA is regulated by several Tier-1 authorities, including ASIC, FCA, and CFTC. This ensures that the platform adheres to high standards of security and operational practices, making it a trustworthy and safe choice for traders.

OANDA provides three main account types: Standard, Premium, and Premium Plus. These accounts vary in terms of spreads, commissions, and additional benefits to cater to both beginner and high-volume traders.

To get started simply create an account online, complete the registration process, and make a deposit. You can also try a demo account to familiarize yourself with the platform before trading with real funds.