NAGA Review

- NAGA Review – 13 key points quick overview:

- Overview

- At a Glance

- NAGA Account Types

- How To Open a NAGA Account

- NAGA Deposit & Withdrawal Options

- Trading Instruments & Products

- NAGA Trading Platforms and Software

- NAGA Spreads and Fees

- Leverage and Margin

- Educational Resources

- Pros & Cons

- Security Measures

- Conclusion

Overall NAGA is considered a low risk, with an overall Trust Score of 95 out of 100. They are licensed by two Tier-1 Regulators (highly trusted), zero Tier-2 Regulators (trusted), zero Tier-3 Regulators (average risk), and zero Tier-4 Regulators (high risk). The broker offers six different retail trading accounts: an Iron, Bronze, Silver, Gold, Diamond, and Crystal Account.

NAGA Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️NAGA Account Types

- ☑️How To Open a NAGA Account

- ☑️NAGA Deposit & Withdrawal Options

- ☑️Trading Instruments & Products

- ☑️NAGA Trading Platforms and Software

- ☑️NAGA Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️NAGA Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

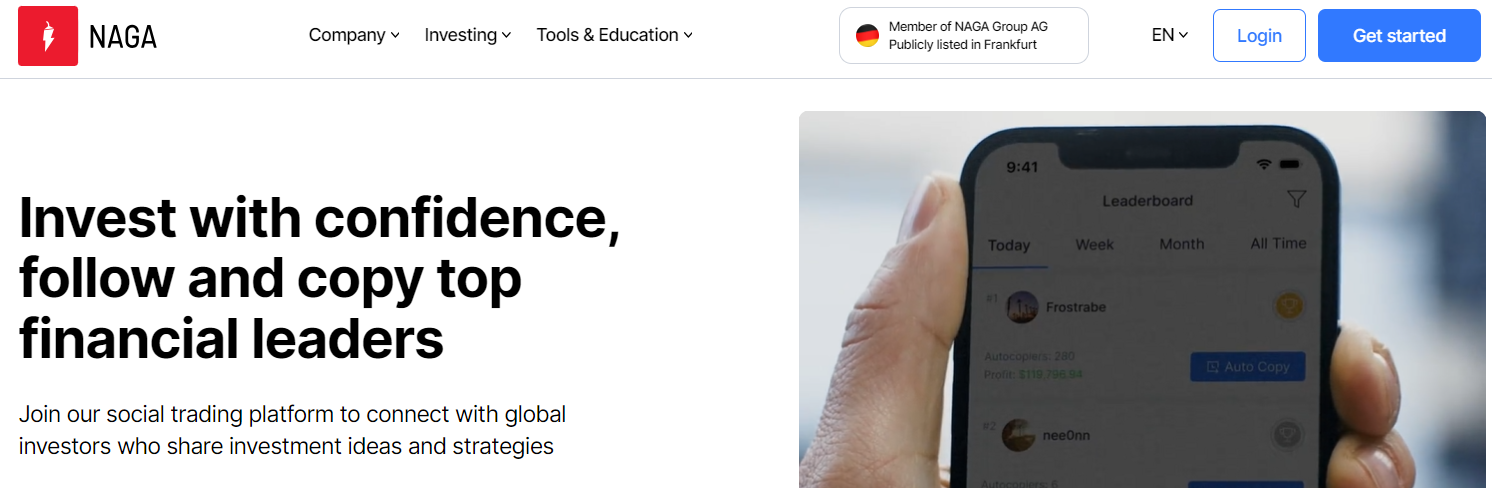

NAGA, founded in 2015, has become a leading player in the finance industry, revolutionizing social trading. In doing so, the company aims to democratize financial markets by offering a simple platform and tools for traders of all levels of expertise.

NAGA’s commitment to transparency ensures clients are aware of expenses and risks. This fee-free framework, in turn, fosters a platform focused on community, cooperation, and knowledge exchange. Moreover, this allows experienced and inexperienced traders to interact and learn from professional tactics.

Additionally, the broker is publicly traded on the Frankfurt Stock Exchange, demonstrating its commitment to innovation and expansion.

Furthermore, its focus on client-centricity makes it an appealing option for those seeking a socially involved trading environment.

What is the origin of NAGA’s regulation and licensing?

They are regulated and licensed by CySEC and BaFin, with CySEC licence number 204/13 and BaFin-ID 10135203.

What proprietary trading software does NAGA offer?

The broker provides its unique Trading Platform, enabling market execution and social trading capabilities.

At a Glance

| 🗓 Established Year | 2015 |

| ⚖️ Regulation and Licenses | CySEC, BaFin |

| 🪪 Ease of Use Rating | 4/5 |

| 📞 Support Hours | 24/5 |

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5, NAGA |

| 🛍 Account Types | Iron, Bronze, Silver, Gold, Diamond, Crystal |

| 🤝 Base Currencies | EUR, USD, GBP, PLN, NGC, BTC, ETH, BNB |

| 📊 Spreads | From 0.7 pips |

| 📈 Leverage | Up to 1:1000 |

| 💸 Currency Pairs | 29; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 250 USD |

| 🚫 Inactivity Fee | Yes, 20 USD after three months of inactivity |

| 🗣 Website Languages | English, Spanish, Portuguese, Chinese, Indonesian, Arabic |

| 💰 Fees and Commissions | Spreads from 0.7 pips, commissions from 0.1% |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | The United States, Canada, United Kingdom, Israel, Islamic Republic of Iran |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Forex, stock CFDs, indices, commodities, Futures, ETFs, cryptocurrencies |

| 🎖 Open an Account | Open Account |

NAGA Account Types

Iron Bronze Silver Gold Diamond Crystal ✅ Availability All; ideal for beginners All; ideal for casual traders All; ideal for more experienced traders All; ideal for casual traders and high-volume traders All; ideal for scalpers and experienced traders All; ideal for institutional traders and professionals 🛍 Markets All All All All All All 💸 Commissions Yes Yes Yes Yes Yes Yes 💻 Platforms All All All All All All 📊 Trade Size From 0.01 lots From 0.01 lots From 0.01 lots From 0.01 lots From 0.01 lots From 0.01 lots 📈 Leverage Up to 1:1000 Up to 1:1000 Up to 1:1000 Up to 1:1000 Up to 1:1000 Up to 1:1000 💰 Minimum Deposit 250 USD 2,500 USD 5,000 USD 25,000 USD 50,000 USD 100,000 USD 🎖 Open an Account Open Account Open Account Open Account Open Account Open Account Open Account

Iron Account

Overall, the Iron Account is a first tier for inexperienced traders, offering variable spreads on forex majors, up to four trading signals, and a $5 withdrawal fee. It offers base currencies, cryptocurrency alternatives, webinars, and training materials, with trading notifications but limited advanced tools.

Bronze Account

Overall, the Bronze Account is higher for traders with expertise, requiring a $2,500 minimum deposit. It offers 1.7 pips spreads on key forex pairings, up to four trading signals, and a lowered withdrawal charge. It also includes the PI Dashboard.

Silver Account

The Silver Account, designed for experienced traders, requires a $5,000 minimum deposit. In return, it offers tight 1.7 pip spreads on major forex pairs, four trading signals per day, and low $3 withdrawal costs. Additionally, clients receive one-on-one coaching for a customized trading experience.

Gold Account

Overall, the Gold Account, designed for expert traders, requires a minimum investment of $25,000. Additionally, it offers competitive spreads, 15 trade signals, reduced withdrawal costs, improved coaching sessions, and cheaper stock CFD commissions, making it a cost-effective trading environment.

Diamond Account

The Diamond Account is a high-tier trading platform designed for experienced traders. With a minimum deposit of $50,000, it offers several benefits, including reduced spreads on forex majors, up to 20 trading signals, and limited withdrawal costs. Additionally, it retains all the features of the Gold Account, plus it provides additional trading signals and reduced fees on stock CFDs.

Crystal Account

Moreover, the Crystal Account is a top tier and requires a $100,000 deposit. It offers narrow spreads, 20 trading signals, no withdrawal fees, unlimited coaching sessions, and the lowest stock CFD commissions, making it ideal for experienced traders.

Demo Account

The Demo Account provides a risk-free platform with virtual funds for inexperienced traders to test market conditions without financial risk. It teaches trading environment and techniques but does not allow fund withdrawals, necessitating a live account for real trading.

Islamic Account

Overall, the Islamic Account, a Sharia-compliant option, eliminates overnight costs for Muslim traders by allowing up to 10 days of position retention without swap costs, except for gold, silver, and oil trades, which are taxed as normal.

How many retail investor accounts does NAGA offer?

The broker provides six separate retail investor accounts, each with unique features designed to suit different degrees of trading experience.

Can traders benefit from reduced commissions on specific accounts?

Yes, the broker provides lower commissions on stock CFDs, varying percentages based on the account type.

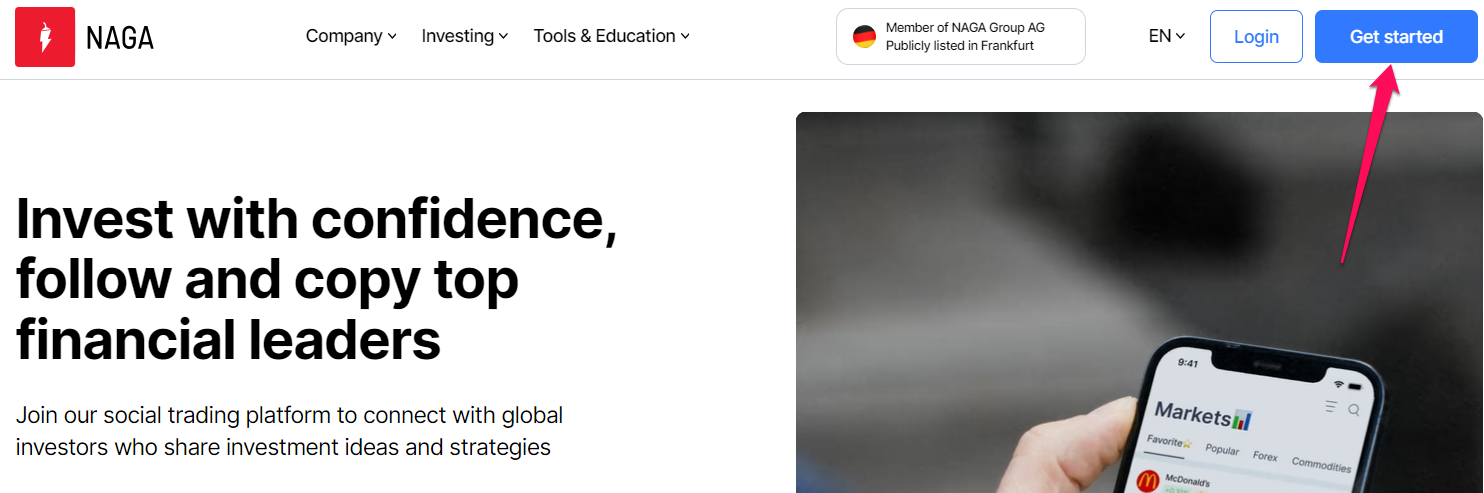

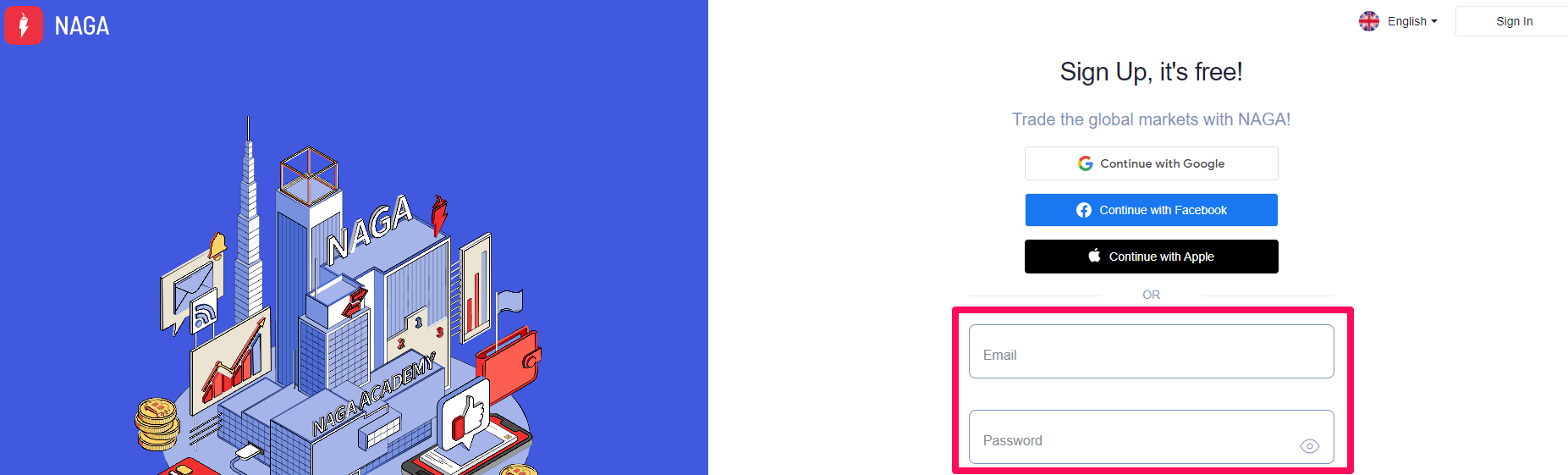

How To Open a NAGA Account

To register an account, follow these steps:

Step 1 – Click on the Register button.

Begin by going to the official NAGA website and clicking on the “Register” button, normally in the homepage’s upper right corner.

Step 2 – Complete the form.

Complete the registration form with your personal information, such as your full name, email address, and phone number, and then establish a strong password for your account.

NAGA Deposit & Withdrawal Options

💳 Payment Method 🏛 Country ⚖️ Currencies Accepted ⏰ Processing Time Credit Cards All USD, EUR, GBP, PLN 10 Minutes Debit Cards All USD, EUR, GBP, PLN 10 Minutes Bank Transfers All Multi-currency Up to 5 working days Crypto Wallets All BTC, ETH, DASH, LTC, BCH, NGC Instant Electronic Gateways All Multi-currency Instant

Deposit Methods:

Bank Wire

✅Navigate to your account’s “Deposit” or “Funding” section.

✅Select “Bank Wire Transfer” as your desired deposit option.

✅You will be given NAGA’s bank account information (account number, IBAN, etc.).

✅Make a wire transfer from your bank account to the account using the information supplied.

✅Add appropriate reference numbers or your account ID to the transfer notes.

Credit or Debit Card

✅Go to your account’s “Deposit” or “Funding” section.

✅Select “Credit/Debit Card” as your preferred deposit method.

✅Enter your card information (number, expiration date, and CVV code).

✅Specify the amount you intend to deposit.

✅To complete the transaction, follow the on-screen instructions, which may involve additional verification processes.

Cryptocurrency Wallets

✅Access your account’s “Deposit” or “Funding” section.

✅Choose the coin you wish to deposit.

✅The broker will generate a unique wallet address for the coin.

✅Copy the supplied wallet address.

✅Go to your cryptocurrency wallet and transfer to the copied wallet address.

e-Wallets or Payment Gateways

✅Choose your favourite e-wallet or payment mechanism under your account’s “Deposit” or “Funding” section.

✅You will most likely be sent to the e-wallet/gateway’s website to log in to your account.

✅Enter the amount you want to deposit and then confirm the transfer. Once finished, the funds should appear in your account promptly.

Withdrawal Methods:

Bank Wire

✅Within your account, go to the “Withdrawal” area.

✅Select “Bank Wire Transfer” as your chosen choice.

✅Enter your bank details (account number, IBAN, SWIFT/BIC code, etc.).

✅Please specify the amount you wish to withdraw.

✅Submit your withdrawal request and wait for the broker to process it, which can take several business days.

Credit or Debit Cards

✅Locate the “Withdrawal” area on your account.

✅Select “Credit/Debit Card” as your withdrawal method.

✅Be advised that NAGA normally prioritizes withdrawals to the card used to make the deposit.

✅Enter the amount you want to withdraw, then confirm your request.

✅Processing timeframes might vary depending on your card issuer.

Cryptocurrency Wallets

✅Enter the “Withdrawal” section of your account.

✅Choose the coin you wish to withdraw.

✅Enter the wallet address for your external cryptocurrency wallet.

✅Enter the amount to withdraw and submit your request.

✅NAGA will conduct the transaction, and the withdrawn crypto should be in your wallet soon after.

e-Wallets or Payment Gateways

✅Navigate to the “Withdrawal” area of your account.

✅Select the e-wallet or payment gateway you want to use.

✅Enter your e-wallet account details.

✅Indicate the amount you wish to withdraw and confirm the transaction.

✅Your funds should be sent to your e-wallet account within the timeframe specified by the payment provider.

What are some of the deposit options available?

The broker accepts various deposit methods, including credit and debit cards, bank wire transfers, cryptocurrency wallets, and electronic payment portals.

Can a trader deposit cryptocurrencies directly into their account?

Yes, the broker accepts deposits in several cryptocurrencies, including Bitcoin and Ethereum.

Trading Instruments & Products

The broker offers the following trading instruments and products:

➡️Forex – Overall, they give traders access to a large forex market, with several currency pairs accessible for trading, including major, minor, and exotic pairings, allowing for a wide range of trading tactics, from day trading to swing trading and beyond.

➡️Stock CFDs – Additionally, traders can interact with stock CFDs from numerous worldwide firms, allowing them to trade on price changes without holding the underlying equities. This benefits individuals wishing to profit from both rising and declining markets.

➡️Indices – Moreover, the broker offers a variety of global indices that reflect baskets of leading shares from certain exchanges, making it perfect for traders wishing to gain exposure to financial market segments without having to research individual securities.

➡️Commodities – Overall, the broker offers a variety of commodities, including precious metals like gold and silver, energy commodities like oil, and soft commodities like agricultural products, allowing for portfolio diversification and hedging.

➡️Futures – In addition, futures contracts are offered as a derivative product, allowing traders to bet on the future price of assets such as indices and commodities while benefiting from leverage and the opportunity to trade long or short.

➡️ETFs – Moreover, various ETFs (Exchange-Traded Funds) are available, allowing traders to trade a collection of assets or an index in a single transaction, which may be used to diversify or invest in a certain industry or area.

➡️Cryptocurrencies – They offer trading in various cryptocurrencies, allowing traders to engage in the digital currency market, recognized for its extreme volatility and potential for large price swings.

How many forex pairs does the broker offer for trading?

They offer 29 forex pairings, including major, minor, and exotic, to appeal to various trading techniques.

What types of commodities can be traded?

The broker provides for the trade of various commodities, including precious metals such as gold and silver, and energy commodities like oil.

NAGA Trading Platforms and Software

Trading Platform

The NAGA Trading Platform is a social trading platform that allows trade execution and community engagement. Therefore, it offers access to over 950 financial products, including forex, CFDs, and cryptocurrencies.

The platform’s user-friendly design and integration with NAGA’s services provide a smooth trading experience. Its emphasis on instructional tools appeals to both new and experienced traders.

MetaTrader 4

Overall, MT4 offers powerful technical analysis tools, indicators, and charting features, appealing to traders using technical techniques.

Additionally, MT4’s one-click trading function is useful for scalping. In combination with this, its interoperability with the account types ensures a smooth trading experience.

MetaTrader 5

Overall, MetaTrader 5 offers more advanced capabilities for financial products. It offers more periods, graphical elements, and technical indicators for market research.

Furthermore, MT5 offers more order types, processing more data and execution with lower latency, which enhances NAGA’s high leverage and large deal size capabilities. In addition, its economic calendar and financial news integration align perfectly with NAGA’s educational and research services.

Which versions of MetaTrader does NAGA support?

The broker supports MetaTrader 4 and MetaTrader 5, providing traders with powerful charting, analytical tools, and automated trading capabilities.

Are there any unique features in the proprietary trading platform?

The broker’s unique trading platform supports social trading, allowing traders to mimic the trades of more experienced traders easily.

NAGA Spreads and Fees

Spreads

Overall, the Spreads cater to various trading methods, offering changeable spreads as low as 0.7 pips for key forex pairs. This competitive structure is popular among scalpers and day traders. Premium accounts have smaller spreads due to higher minimum deposit requirements.

Commissions

Commissions charge traders for specific actions, maintaining a clear fee structure. Additionally, equity and ETF trades have a competitive 0.1% fee rate, allowing traders to control costs and be aware of potential costs.

Overnight Fees

Overnight fees are charges for open positions, varying by asset class and direction. These fees are crucial for traders holding positions for over a day. The broker provides comprehensive information on overnight fees, assisting traders in planning deals while being aware of the charges involved.

Deposit and Withdrawal Fees

Overall, the Deposit and Withdrawal Fees facilitate easy account funding and retrieval for traders. Fees vary based on account type and payment mode, with withdrawal costs graded based on account level.

Inactivity Fees

In order to encourage consistent trading activity on the platform, we implement an inactivity fee structure. After three consecutive months of no trading activity, an account will be considered inactive and a $20 monthly fee will be incurred.

Currency Conversion Fees

The currency conversion fees are charged for transactions involving currencies other than the account’s base currency, covering the cost of currency conversion using current rates.

How competitive are the spreads on major forex pairs?

The broker provides competitive spreads on key forex pairs beginning at 0.7 pips, depending on account type.

Are there any commission fees for trading stock CFDs with NAGA?

Yes, the broker levies a commission fee of 0.1% on equities and ETF trades, with details changing by account type.

Leverage and Margin

Overall, NAGA’s leverage and margin services allow traders to increase their trading capacity, leading to higher profits with a lower initial outlay. Leverage multiplies a trader’s money, allowing them to handle larger positions.

However, it also increases risk, as a 1% price change in the underlying asset can significantly influence the trader’s return. Leverage offers flexibility, potentially larger earnings, and access to more expensive or prestigious markets but also increases the risk of losing money.

What is the process for changing leverage on an account?

To modify leverage on an account, traders must contact customer service via email, with approval based on an evaluation of trading expertise and risk awareness.

Are there leverage restrictions for traders based in Europe?

Yes, traders in Europe suffer leverage limits under ESMA rules, with maximum leverage restricted at lower levels than Global customers.

Educational Resources

The broker offers the following educational resources:

➡️Blog – Overall, NAGA’s blog is likely a resource for traders seeking to remain up to speed on market trends, trading methods, and platform upgrades.

➡️Daily Hot News – Additionally, this feature most likely provides daily market updates, news, and analysis. Traders must be informed of market movements and economic developments affecting their trading decisions.

➡️NAGA Learn – Moreover, NAGA Learn is an educational portal within the broker that offers structured learning resources.

➡️Glossary – The glossary is useful for new and experienced traders to become acquainted with trading terms.

➡️Currencies Encyclopedia – In addition, this site offers thorough information on several currencies globally. It is useful for forex traders who want to learn the subtleties of different currency pairings.

➡️Currency Converter – As a practical tool, the currency converter allows traders to immediately convert values between different currencies, which is critical for making educated judgments regarding multi-currency trading.

➡️eBooks – Overall, NAGA’s eBooks are comprehensive guides to numerous trade themes. These vary from forex trading basics to more advanced topics such as technical analysis or risk management.

➡️Webinars – The Webinars are interactive meetings where traders may learn from and chat with experienced traders and market analysts.

How can traders access the trading glossary?

Traders can access the trading dictionary directly from the website or trading platform, which includes descriptions of major trading words and concepts.

Are NAGA’s educational resources available to all account types?

NAGA’s instructional tools are available to all account types, guaranteeing that all traders can access useful learning materials to help them improve their trading abilities.

Pros & Cons

✅ Pros ❌ Cons NAGA lets users purchase fractional shares of US equities, making it more inexpensive to invest in pricey firms NAGA imposes fees for several deposit and withdrawal methods Every NAGA client is allocated a personal account manager who can provide assistance and direction After six months of inactivity, NAGA imposes a €10 monthly inactivity fee CySEC, a reputable financial regulator, oversees NAGA The NAGA platform may be difficult for novices to navigate NAGA's Autocopy function enables users to replicate the trades of other successful traders, which may be beneficial to novices Some traders have reported having difficulty reaching NAGA's customer support personnel NAGA provides a wide variety of asset types, including equities, ETFs, indexes, FX, and cryptocurrencies NAGA provides a user-friendly platform with several features, including social trading, educational materials, and an integrated messaging NAGA charges no fees for stock and ETF trading, and its spreads are often competitive

Security Measures

NAGA, a trusted European Union broker, adheres to strict regulatory requirements and MiFID II. In addition, its clients’ assets and personal information are protected through segregated accounts with top-tier banks and Investor Compensation Fund membership.

The broker uses strong encryption technology and data protection measures because they prioritize security. This commitment to keeping your information safe makes them a trustworthy broker.

Does NAGA offer any compensation scheme to its traders?

Yes, the broker is a member of the Investor Compensation Fund (ICF), which may compensate eligible clients if NAGA fails to meet its financial responsibilities.

What should traders do if they suspect unauthorized access to their accounts?

If traders suspect unlawful access to their accounts, they should immediately contact customer assistance to take the appropriate precautions.

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $0 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

Conclusion

Overall NAGA is a robust Forex and CFD brokerage platform with a range of financial products and smart trading solutions. Its regulatory compliance, commitment to transparent trading methods, and diverse account types appeal to different expertise levels.

For more information on FXLeaders.

Faq

The broker charges a varied price structure. Some trades, such as equities and ETFs, may be commission-free, while others may incur spreads or extra fees.

Yes, due to using leverage in some forms of trading, losses can exceed your initial investment. Before engaging in leveraged trading, you must first grasp the dangers involved.

Withdrawals are normally processed instantly or within five business days, depending on the method and account type.

The minimum deposit to start an account is $250, which grants access to a wide range of trading products and platforms.

NAGA’s Autocopy tool automatically allows you to repeat the platform’s top-performing traders’ trades. This can be an effective technique for learning from expert traders or making passive revenue.

Yes, they are regarded as a secure broker, licensed by respected financial regulators such as CySEC and BaFin, and offering extra safeguards like segregated customer accounts and ICF membership.

The broker allows traders to trade forex, stock CFDs, indices, commodities, futures, ETFs, and cryptocurrencies over a wide range of tradable assets.

They are based in Cyprus and operate under the Cyprus Securities and Exchange Commission (CySEC) supervision.

Yes, the broker provides a free demo account, including virtual dollars. This lets you practice trading and become acquainted with the platform without risking real money.

Gold has always been my favourite, since the times I just strated trading. I have blown maybe like 10 accs on gold, but finally I was able to tame this beast😆 So those who are struggling with it, DONT give up! Spreads that NAGA offers on gold are tight enough, lets me to open many positions at once not loosing much money.

Thanks for sharing your thoughts.

best place to daily trade stocks, even if they don’t teach you much about them.

Your review is greatly appreciated—thank you

a good review; I think even more could be said about the social trading aspect, as its suuch a huge feature on the platform right now. I used to 90% trade, 10% copy trades, but now its 50%-50%, and kind of going the way of becoming 30% trading, 70% just copying. Its simply easier and brings more profit in the long run. I think actually quite a lot of people with this broker are going the same way, the core traders, signal providers, are just waay too strong.