Markets.com Review

- Markets.com – 13 key points quick overview:

- Overview

- At a Glance

- Markets.com Account Types

- How To Open a Markets.com Account

- Markets.com Deposit & Withdrawal Options

- Trading Instruments & Products

- Markets.com Trading Platforms and Software

- Markets.com Spreads and Fees

- Leverage and Margin

- Educational Resources

- Markets.com Pros & Cons

- Security Measures

- Conclusion

Overall Markets.com is considered a low risk, with an overall Trust Score of 98 out of 100. They are licensed by three Tier-1 Regulators (highly trusted), one Tier-2 Regulator (trusted), zero Tier-3 Regulators (average risk), and one Tier-4 Regulator (high risk). The broker offers a single live trading account.

Markets.com – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️Markets.com Account Types

- ☑️How To Open a Markets.com Account

- ☑️Markets.com Deposit & Withdrawal Options

- ☑️Trading Instruments & Products

- ☑️Markets.com Trading Platforms and Software

- ☑️Markets.com Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️Markets.com Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

Markets.com, a global brokerage firm, began operations in 2008 in the British Virgin Islands. It expanded globally, opening offices in major financial centers like the UK, South Africa, Cyprus, and Australia.

The company capitalized on the growing interest in Forex and CFD trading during a revolution in online trading. Further, this broker has a strong regulatory framework, obtaining tier-1 and tier-2 licenses from the Financial Conduct Authority, ASIC, CySEC, and the Financial Sector Conduct Authority.

The platform emphasizes innovation and trader empowerment, offering account versatility with fixed or variable spreads, advanced trading tools, and extensive instructional resources. The broker has served over 4.3 million active clients, showcasing its global reach and efficient client engagement methods.

Furthermore, the broker’s success is a testament to its trader-centric strategy, strong regulatory processes, and commitment to a secure and comprehensive trading environment.

What sets them apart from other brokers?

The broker offers various trading assets, including forex, stocks, commodities, indices, cryptocurrencies, ETFs, bonds, and IPOs.

How many active customers does Markets.com have?

The broker has over 4.3 million active clients, suggesting a robust and trustworthy position in the financial markets.

At a Glance

| 🗓 Established Year | 2008 |

| ⚖️ Regulation and Licenses | ASIC, CySEC, FSCA, FCA, BVI FSC |

| 🪪 Ease of Use Rating | 4/5 |

| 📞 Support Hours | 24/5 |

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5, Markets.com |

| 🛍 Account Types | Live Trading Account |

| 🤝 Base Currencies | USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, and AED |

| 📊 Spreads | From 0.6 pips |

| 📈 Leverage | Up to 1:300 (Pro), 1:30 (Retail) |

| 💸 Currency Pairs | 56+; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 100 USD |

| 🚫 Inactivity Fee | Yes, 10 USD after 90 days |

| 🗣 Website Languages | English, Spanish, Thai, Vietnamese |

| 💰 Fees and Commissions | Spreads from 0.6 pips; only the spread is charged |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | The United States, Japan, Canada, Belgium, Israel, New Zealand, Russia, Hong Kong, and several other regions |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Forex, shares, commodities, indices, cryptocurrencies, ETFs, Bonds, IPO |

| 🎖 Open an Account | Open Account |

Markets.com Account Types

Live trading account ✅ Availability All 🛍 Markets All 💸 Commissions None; only the spread is charged 💻 Platforms MetaTrader 4, MetaTrader 5; Markets.com 📊 Trade Size From 0.01 lots 📈 Leverage 1:300 (Pro), 1:30 (Retail) 💰 Minimum Deposit 100 USD 🎖 Open an Account Open Account

Markets.com Live Trading Account

The Live Trading Account offers traders a range of features, including daily research, trading platforms, video lessons, webinars, chat customer assistance, negative balance protection, fee conversions, one-click trading, and analyst recommendations.

Furthermore, with a 50% stop-out, it caters to serious traders with accessible features.

Markets.com Demo Account

The Demo Account is a teaching platform with $10,000 virtual money, ideal for novices and experienced traders.

It simulates market conditions for 30 days, can be extended, and supports desktop and mobile trading. Additionally, It demonstrates Markets.com’s commitment to trader education and risk management.

Markets.com Islamic Account

The Islamic Account, based on Sharia law, ensures no interest in trades and prompts transactions. With spreads starting at 0.6 pips for EUR/USD and access to over 8,000 products, it particularly appeals to traders seeking a balance between religious principles and modern trading requirements.

Markets.com Professional Account

The Professional Account is for experienced traders with specific criteria, offering more leverage and premium services. Eligibility is based on financial experience and transaction volume.

Lastly, it allows smaller spread profiles, sophisticated analysis reports, and more trading instruments. Professional traders enjoy a personalized service and a trading environment tailored for high-volume market players.

Are there any eligibility criteria for the Professional account on Markets.com?

To be eligible for a Professional account, traders must fulfill at least two of the stipulated requirements, which include financial portfolio size, trading experience, and transaction frequency.

Can traders switch between account types on Markets.com?

Yes, Traders can change account types based on their trading demands and eligibility requirements.

How To Open a Markets.com Account

To register an account, follow these steps:

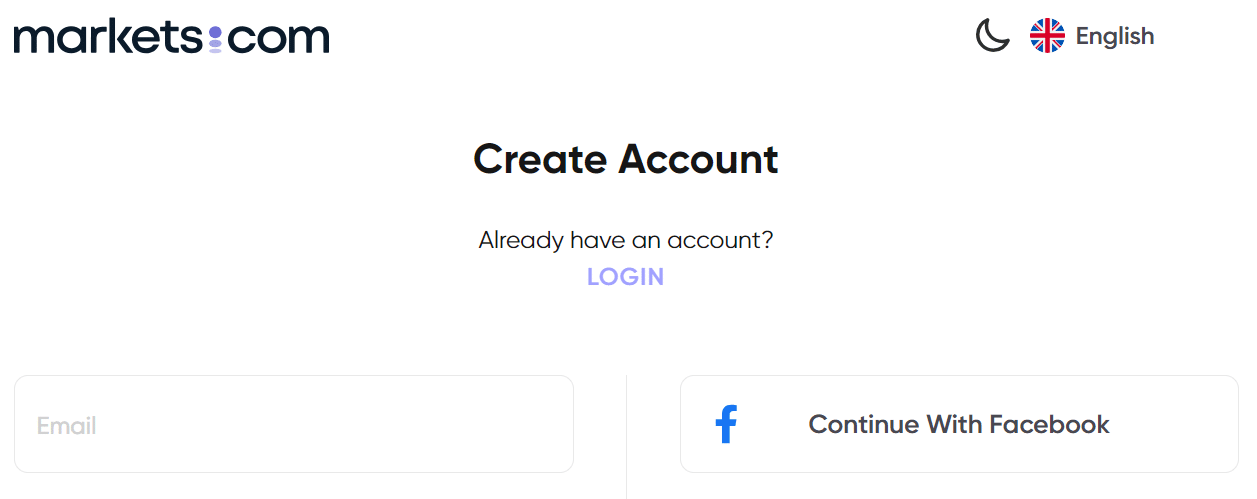

Step 1 – Click on the Register button.

To begin the account opening procedure with Markets.com, go to their official website and find the “Create Account” or “Sign Up” option, usually in the homepage’s upper right corner.

Step 2 – Complete the form.

After choosing this, you will be requested to input basic personal information such as your full name, email address, phone number, and country of residence and create a secure username and password for your account.

Markets.com Deposit & Withdrawal Options

💳 Payment Method 🏛 Country ⚖️ Currencies Accepted ⏰ Processing Time Bank Wire Transfer Europe, Australia, UK, BVI USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, AED 1 – 5 days Credit Card Europe, Australia, UK, BVI USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, AED 24 hours – 7 days Debit Card Europe, Australia, UK, BVI USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, AED 24 hours – 7 days Skrill Europe, Australia, BVI USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, AED Up to 24 hours Neteller Europe, Australia, BVI USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, AED Up to 24 hours PayPal Europe USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, AED Up to 24 hours Local Bank Transfer Europe, Australia, BVI USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, AED 2 – 5 days Ideal Europe USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, AED Up to 24 hours Sofort Europe USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, AED Up to 24 hours

Deposit Methods:

Bank Wire

✅Firstly log in to your trading account and go to the ‘Deposit’ area.

✅Choose ‘Bank Wire Transfer’ as your deposit option.

✅Obtain the banking information supplied by Markets.com, including the bank name, account number, and SWIFT code.

✅Use these data to begin a wire transfer from your bank account, which may be done online using your banking app or in person at a branch.

✅On the deposit page, enter the deposit amount in the necessary space and complete the transaction.

✅Keep your bank’s receipt or transaction reference number as proof of transfer; Markets.com may request it for verification. The funds will normally appear in your trading account within 1 to 2 days of the transfer.

Credit or Debit Card

✅Access your trading account and select the ‘Deposit’ option.

✅Select ‘Credit/Debit Card’ from the list of deposit options.

✅Enter your card information, including the card number, expiration date, and CVV code.

✅Specify your deposit amount and ensure it matches the minimum deposit criteria.

✅Confirm the information and submit your deposit. The funds should appear in your trading account immediately, allowing you to begin trading immediately.

e-Wallets or Payment Gateways

✅Sign in to your trading account and select the ‘Deposit’ option.

✅Choose your e-wallet or payment gateway provider from the deposit choices, including Skrill, Neteller, and PayPal.

✅Enter the amount you want to deposit while staying under minimum requirements.

✅You will be sent to the e-Wallet or payment gateway’s login page, where you must enter your credentials to log in.

✅Review the payment information and confirm the transaction. The funds should be credited to your account soon after.

Withdrawal Methods:

Bank Wire

✅Log in to your account and pick the ‘Withdrawal’ option from the account dashboard.

✅Select ‘Bank Wire Transfer’ as your withdrawal option.

✅Provide your bank account information, including the account number, name, and SWIFT/BIC code.

✅Enter the withdrawal amount, ensuring it matches any minimum withdrawal requirements.

✅Submit your withdrawal request, and Markets.com will process it and send the funds to your bank account within 2 to 5 days.

Credit or Debit Cards

✅Access your account and go to the ‘Withdrawal’ area.

✅To withdraw, select the ‘Credit/Debit Card’ option.

✅Select the card you used to deposit funds as the destination for your withdrawal.

✅Input the amount you intend to withdraw, keeping the minimum amount in mind.

✅Submit a withdrawal request. Processing timeframes vary, but money usually takes 2 to 7 days to appear on your card.

e-Wallets or Payment Gateways

✅Log into your trading account and navigate the ‘Withdrawal’ area.

✅Choose your favourite e-wallet or payment channel, such as Skrill, Neteller, or PayPal.

✅If you have previously deposited funds via the e-Wallet, it should appear as an option; pick it.

✅Please enter the amount you intend to withdraw, ensuring it complies with Markets.com’s minimum withdrawal requirements.

✅Confirm the withdrawal. The money is normally available in your e-wallet within 24 hours, subject to Markets.com’s internal processing processes.

Is there a minimum deposit requirement for Markets.com accounts?

Indeed, the minimum deposit amount for accounts is $100, making it accessible to traders of all budgets.

Can traders withdraw funds from Markets.com using the same method they used for deposit?

Typically, traders must withdraw funds using the method they used to deposit them, ensuring transaction simplicity and efficiency.

Trading Instruments & Products

The broker offers the following trading instruments and products:

➡️Forex – The broker provides 56 currency pairs for trading, including major, minor, and exotic pairings, giving a full forex trading experience with leverage of up to 1:300 for professional clients and 1:30 for retail clients.

➡️Shares – Additionally, Markets.com traders have access to 829 share CFDs, which include some of the world’s most well-known companies, allowing them to speculate on the price movements of individual companies without having to own the underlying shares.

➡️Commodities – There are 23 commodities accessible for trading, including precious metals, energy, and agricultural items, allowing traders to diversify their portfolios and hedge against inflation or currency risks.

➡️Indices – Moreover, Markets.com offers 31 worldwide indices, allowing traders to obtain exposure to whole sectors or economies in a single transaction.

➡️Cryptocurrency – The platform includes 25 cryptocurrency CFDs, allowing traders to engage with the volatile crypto markets without needing a digital wallet. Moreover, it provides a simple way to speculate on cryptocurrency price movements.

➡️ETFs – There are 77 ETFs available, allowing traders to access a basket of assets through a single unit.

➡️Bonds – Additionally, clients can speculate on the future movements of government debt instruments using four bond CFDs, making them a more reliable investment alternative and a method to diversify a trading strategy based on long-term interest rate fluctuations

➡️IPO – Furthermore, the broker allows traders to join in the thrill of initial public offers by allowing them to bet on the market performance of newly listed firms’ shares.

How many assets are available for trading on Markets.com?

The broker offers over 2,200 products in eight categories, Again, allowing traders to diversify their portfolios and explore new markets.

Can traders access leveraged trading on Markets.com?

They provide leveraged trading possibilities, with maximum leverage ratios ranging by financial instrument and trader classification.

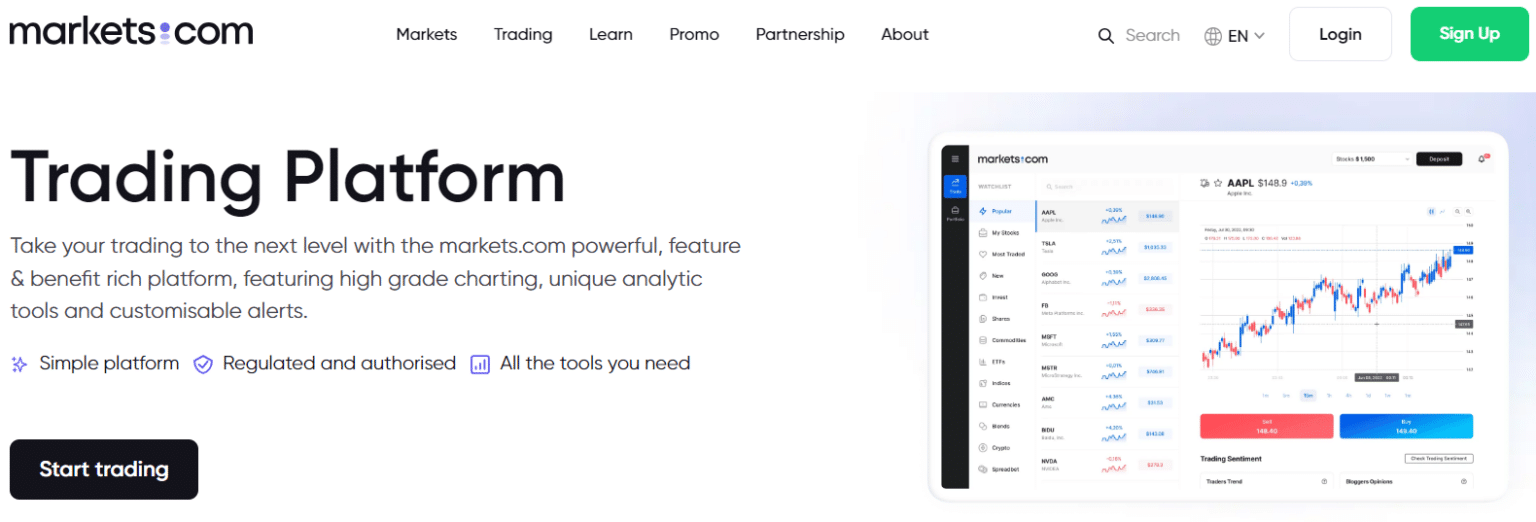

Markets.com Trading Platforms and Software

Markets.com

The broker has developed a trading platform for clients. Therefore, offering various portfolio management and trading tools. Additionally, a user-friendly platform is suitable for traders of all skill levels.

It includes in-app financial analysis and market mood indicators and interacts with financial experts for valuable market information. They also ensure strict regulatory compliance for a secure trading environment.

MetaTrader 4

Markets.com’s MetaTrader 4 (MT4) is a popular platform due to its superior charting capabilities, algorithmic trading via Expert Advisors (EAs), and micro-lot trading.

MT4 supports various trading methods and offers competitive pricing and execution speeds. Its accessibility and instructional tools make it an excellent choice for both beginners and experienced traders.

MetaTrader 5

MetaTrader 5 (MT5) is a more advanced version of MT4, offering more periods, graphical tools, and hedge positions. Consequently, Markets.com offers MT5 for traders seeking a more advanced trading experience.

Secondly, it supports algorithmic trading through the MQL5 programming language, allowing for complex trading robots and bespoke technical indicators. Moreover, MT5 is an excellent choice for strict security measures and extensive client services.

Can traders access copy trading or social trading features on Markets.com?

No, Markets.com does not currently offer copy trading or social trading capabilities. However, it does offer other sophisticated trading tools and research resources to help traders.

Does Markets.com offer mobile trading options?

Yes, Markets.com prioritizes accessibility by offering mobile terminals and a web platform that allows traders to manage their portfolios while on the go.

Markets.com Spreads and Fees

Spreads

Markets.com employs a dynamic spread model that adjusts to market conditions, financial instruments, and trading periods. Consequently, it offers tight spreads as low as 0.6 pips for major currency pairings like EUR/USD.

This strategy caters to traders seeking cost-conscious deals and accommodates various trading styles. Consequently, it enhances Markets.com’s position as a trader-centric platform.

Commissions

Firstly, Markets.com offers a zero-commission trading policy, allowing traders to avoid additional commission costs on every trade.

This strategy benefits large-volume traders by ensuring predictable trading costs within the spread. Additionally, it aligns with Markets.com’s goal of providing a clear price structure and fairness in trading fees.

Overnight Fees

Markets.com charges overnight fees, or swaps, for open positions after the market closes. These costs are industry standard and vary per instrument. Moreover, Markets.com ensures traders are fully informed about these costs, promoting a transparent trading environment and allowing them to make informed decisions.

Deposit and Withdrawal Fees

Markets.com offers a cost-effective trading experience with no fees for deposits and withdrawals, allowing traders to manage their money and trading expenditures effectively. This policy applies to various payment methods, enhancing the overall appeal of its services.

Inactivity Fees

Markets.com charges an inactivity fee of $10 per account for over 90 days of inactivity to promote consistent trading and efficient resource allocation. However, this fee can be avoided by regular trading or regular logins for active traders.

Currency Conversion Fees

Markets.com charges a 0.6% conversion fee for international trading deals involving different currencies. This reasonable fee is included in the broker’s fee structure, allowing traders to participate in global markets while understanding associated expenses.

What types of fees does Markets.com charge for trading?

Markets.com primarily charges spreads for trading with no commission costs. Additionally, traders could be charged overnight costs for holding trades overnight.

Does Markets.com offer fee-free deposits and withdrawals?

Indeed, Markets.com normally does not impose fees for deposits or withdrawals, which promotes openness and efficiency in fund transactions.

Leverage and Margin

Markets.com offers leveraged trading for retail traders in the UK and Europe, with levels up to 1:30. Professional traders can also arrange for larger leverage.

Furthermore, leverage allows traders to take larger positions, increasing rewards and risk. Markets.com alerts traders when margins fall below 70% and maintains the right to close trades.

How is leverage determined for traders on Markets.com?

Leverage on Markets.com is controlled by regulatory rules and trader categorization, with larger leverage ratios accessible to experienced traders who meet the prerequisites.

What margin requirements does Markets.com enforce?

Markets.com normally sets margin call levels at 50% and stop-out levels at 30%. What’s more, This ensures traders have sufficient margin to fund their holdings.

Educational Resources

Markets.com offers the following educational resources:

➡️Glossary – Firstly, their Glossary is a valuable resource for understanding trade terminology.

➡️Education Centre – The Education Centre provides various learning resources, In addition, including articles and e-books.

➡️Trading Basics – Trading Basics is great for novices, as it breaks down trading principles.

➡️Video Library – Furthermore, the Video Library has a plethora of visual information to improve learning, covering subjects ranging from market research to trading tactics.

Are the educational resources on Markets.com free for traders?

Indeed, Markets.com’s instructional products are often free for traders, Furthermore, increasing accessibility and encouraging ongoing learning in financial trading.

Does Markets.com offer personalized educational support?

Markets.com may provide personalized educational help to traders via specialized account managers or customer care personnel, Furthermore, aiding them with unique learning requirements or questions.

Markets.com Pros & Cons

✔️ Pros ❌ Cons The platform provides versatility through browser-based choices, smartphone apps, and the popular MetaTrader 4 and 5 platforms Markets.com's services are not completely available to traders in the United States due to regulatory restrictions Several handy tools improve the trading experience, including technical indicators, economic calendars, and other trade notifications Spreads for some assets may be greater than those offered by other brokers. It is critical to compare their spreads to other platforms you are considering Markets.com operates under various respectable regulatory authorities Experienced traders will gain the most from sophisticated features. The plethora of alternatives might be intimidating for new traders A risk-free trial account allows new traders to practice their trading methods and become comfortable with the platform Inactivity penalties apply to accounts that have been idle for a prolonged length of time The "XRay" function provides traders with professional market analysis, breaking news, market sentiment tools, and analyst recommendations Markets.com allows you to trade thousands of different assets, including forex, equities, indices, commodities, cryptocurrencies, and more Markets.com provides customer service via live chat, phone, and email

Security Measures

Markets.com has implemented a robust security system to safeguard its traders’ interests. Furthermore, client funds are stored separately to prevent personal finances from overlapping with the company’s working funds.

The broker also invests in compensation funds for additional investor protection. Online security measures include SSL encryption for data transfer and two-factor authentication (2FA) for account access and transactions. Additionally, it measures to ensure the safety of personal and financial information.

Is Markets.com compliant with data protection regulations?

Indeed, this broker follows strict data protection rules, including the General Data Protection Regulation (GDPR). This ensures the safe management and processing of client data.

Can traders report security concerns or incidents to Markets.com?

Indeed, traders can report security concerns or occurrences to Markets.com’s dedicated support staff, who will investigate and take necessary action to resolve any issues mentioned.

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $0 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

Conclusion

Overall, Markets.com is a leading forex and CFD broker with extensive regulatory compliance and diverse trading products. in addition, competitive spreads, comprehensive training tools, and a robust platform range appeal to novice and experienced traders.

Faq

Markets.com has its trading platform including the popular MetaTrader 4 and MetaTrader 5 platforms.

Withdrawals at Markets.com are completed quickly, with e-wallets showing money within 24 hours and bank transfers taking two to five days.

Indeed, Markets.com supports trading over 25 cryptocurrencies, including Bitcoin and Ethereum.

Markets.com’s minimum deposit is $100, making it accessible to traders with diverse financial availability.

Yes, Markets.com offers an Islamic account that adheres to the norms of Sharia law for interest-free trading.

Yes, Markets.com is regarded as a safe broker, licensed by top-tier agencies such as the FCA, ASIC, and CySEC.

Retail clients can gain up to 1:30 leverage at Markets.com, with more leverage available to professional clients based on qualifying.

Markets.com allows traders to trade forex, equities, commodities, indices, cryptocurrencies, ETFs, and bonds and participate in IPO trading.

Markets.com offers various instructional materials, including a dictionary, an education centre, trading basics, and a video library for traders of all skill levels.

Markets.com is based in the British Virgin Islands and has global offices in the United Kingdom, South Africa, Cyprus, and Australia.