LCG Review

- LCG Review - Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Safety and Security

- Account Types

- How To Open an Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Leverage and Margin

- Trading Instruments and Products

- LCG Deposit and Withdrawal Options

- Educational Resources

- LCG Pros and Cons

- In Conclusion

Overall, LCG can be summarised as a reputable Forex Broker with over two decades of experience in the financial markets. It prioritizes technical innovation and offers access to comprehensive charting tools and trusted customer support. LCG has a trust score of 90 out of 99.

| 🔎 Broker | 🥇 LCG |

| 📈 Established Year | 1996 |

| 📉 Regulation and Licenses | FCA, CIMA, CySEC, SCB |

| 3️⃣ Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | MetaTrader 4, LCG Trader |

| 📊 Account Types | Classic, ECN |

| 🪙 Base Currencies | USD, EUR, GBP, CHF |

| 💹 Spreads | 0.0 pips |

| 💱 Leverage | 1:200 |

| 💷 Currency Pairs | 67; major, minor, and exotic |

| 💶 Minimum Deposit | 100 USD |

| 💵 Inactivity Fee | Yes, 15 GBP after 6 months of inactivity |

| 🔊 Website Languages | English, Chinese, Spanish, Russian, French, Italian, Polish, Malay, Indonesian, Arabic, Thai, Japanese, Turkish, Vietnamese, Portuguese, Swedish, Norwegian |

| 💴 Fees and Commissions | Spreads from 0.0 pips, commissions of $45 per 1 million USD traded on LCG Trader, 10 USD per standard lot on MetaTrader 4 |

| 🥰 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States, Australia, Belgium, Canada, New Zealand, Singapore |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, metals, indices, shares, commodities, bonds, interest rates, vanilla options, EFTs |

| 🚀 Open an Account | 👉 Click Here |

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $200 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

LCG Review – Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Safety and Security

- ☑️ Account Types

- ☑️ How To Open an LCG Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and, Commissions

- ☑️ Leverage and Margin

- ☑️ Trading Instruments and Products

- ☑️ Deposit and Withdrawal Options

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

Overview

London Capital Group (LCG) is a reputable and trustworthy internet trading broker established in 1996. With over two decades of experience, LCG is regulated by the UK’s Financial Conduct Authority (FCA).

The company prioritizes technical innovation, offering a unique trading platform called LCG Trader with comprehensive charting tools, complex order types, and seamless interaction with TradingView. LCG also offers clients the industry-standard MetaTrader 4 platform.

As a worldwide broker, LCG offers access to over 7,000 financial instruments across various asset classes, including Forex, indices, commodities, and stocks.

Traders can benefit from competitive spreads, clear pricing, and quick order execution. LCG’s emphasis on exceptional customer service further strengthens its reputation.

Can I trust LCG with my funds and personal information?

Yes, LCG stresses client security and compliance with tough rules imposed by respected authorities, protecting the protection of payments and personal information.

What distinguishes LCG from other brokerage businesses in terms of its history?

LCG has a lengthy history stretching back to 1996, exhibiting stability, dependability, and adaptation in the ever-changing financial industry.

Detailed Summary

| 🔎 Broker | 🥇 LCG |

| 📈 Established Year | 1996 |

| 📉 Regulation and Licenses | FCA, CIMA, CySEC, SCB |

| 3️⃣ Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | MetaTrader 4, LCG Trader |

| 📊 Account Types | Classic, ECN |

| 🪙 Base Currencies | USD, EUR, GBP, CHF |

| 💹 Spreads | 0.0 pips |

| 💱 Leverage | 1:200 |

| 💷 Currency Pairs | 67; major, minor, and exotic |

| 💶 Minimum Deposit | 100 USD |

| 💵 Inactivity Fee | Yes, 15 GBP after 6 months of inactivity |

| 🔊 Website Languages | English, Chinese, Spanish, Russian, French, Italian, Polish, Malay, Indonesian, Arabic, Thai, Japanese, Turkish, Vietnamese, Portuguese, Swedish, Norwegian |

| 💴 Fees and Commissions | Spreads from 0.0 pips, commissions of $45 per 1 million USD traded on LCG Trader, 10 USD per standard lot on MetaTrader 4 |

| 🥰 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States, Australia, Belgium, Canada, New Zealand, Singapore |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, metals, indices, shares, commodities, bonds, interest rates, vanilla options, EFTs |

| 🚀 Open an Account | 👉 Click Here |

Safety and Security

London Capital Group (LCG) employs various security measures to protect customer data and ensure a secure trading environment.

Their cybersecurity solutions aim to enhance the security of federal IT enterprises. LCG’s methodology involves developing and deploying sophisticated security solutions to ensure data transmission and security, particularly in cloud settings.

Their Data Protection and Privacy Policy outlines their commitment to protecting personal information through physical, electronic, and administrative methods.

Furthermore, clients are encouraged to protect their personal information, demonstrating LCG’s dedication to safety and compliance in online trading.

How does LCG ensure compliance with regulatory requirements regarding client protection?

LCG maintains strict compliance with regulatory requirements regarding client protection by adhering to guidelines set forth by regulatory authorities such as the FCA, CySEC, CIMA, and SCB, prioritizing client interests and security.

How does LCG safeguard client data and transactions from cyber threats?

LCG employs advanced cybersecurity solutions and encryption protocols to protect client data and transactions from unauthorized access and cyber threats.

Account Types

| 🔎 Account Type | 🥇 Classic | 🥈 ECN |

| 🩷 Availability | Ideal for beginners and casual traders | Ideal for scalpers, day traders, and algorithmic traders |

| 📈 Markets | All | All |

| 💴 Commissions | None. Only the spread is charged | $10 per lot traded on MT4, $45 per 1 million USD traded on LCG Traded |

| 📉 Platforms | MetaTrader 4, LCG Trader | MetaTrader 4, LCG Trader |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots |

| 💹 Leverage | 1:200 | 1:200 |

| 💷 Minimum Deposit | 0 USD | 10,000 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here |

Classic Account

LCG’s Classic account provides a commission-free trading experience. Instead, LCG takes its broker fee from wider spreads than the ECN account.

Designed for traders who appreciate simplicity, this account type often has a low minimum deposit and flexible trading amounts. Leverage choices may be extensive, making the Classic account suitable for novices.

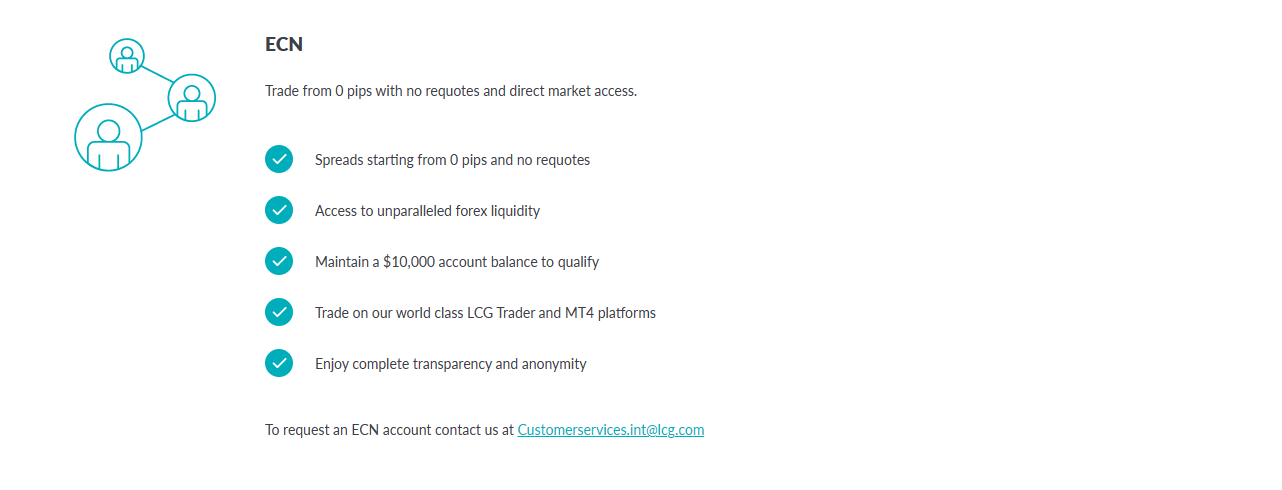

ECN Account

The ECN account is designed for highly active, high-volume traders. It entails a direct fee for each transaction, typically approximately $45 for every $1 million exchanged.

The upside is substantially narrower spreads, which might reduce total trading expenses. However, the ECN account often has a greater minimum deposit of $10,000.

Demo Account

The LCG (London Capital Group) demo account is a valuable tool for new and experienced traders, offering a risk-free environment to practice trading methods across various asset classes like forex, CFDs, and spread betting.

Available on both LCG Trader and MetaTrader 4, the account mimics the features and user experience of LCG’s real trading account, providing free access to premium tools and options.

This lets traders get acquainted with the trading environment, learn new trading skills, and try various strategies in real-time market conditions.

The LCG demo account is accessible without registration or use fees, making it a smooth transition for traders transitioning from practice to real-world trading.

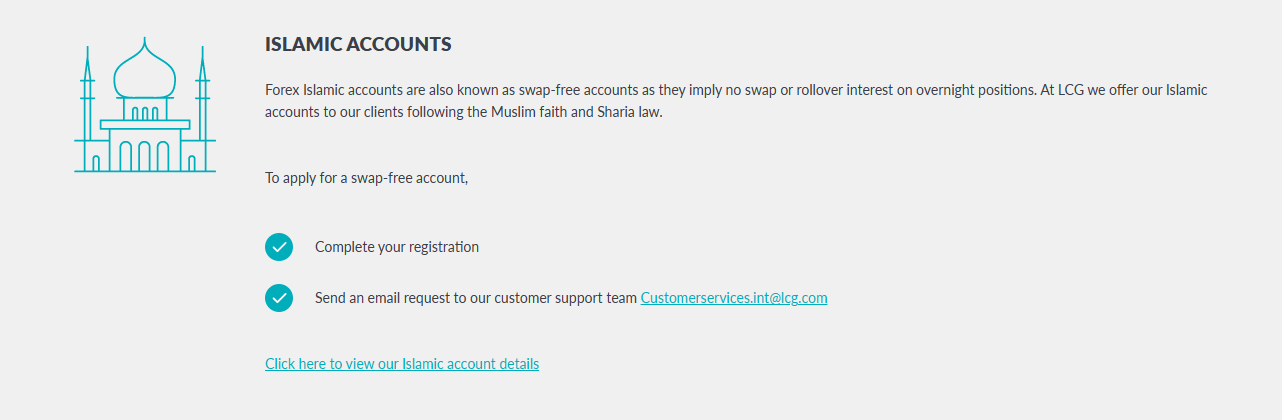

Islamic Account

LCG provides Islamic or swap-free accounts for customers adhering to Sharia law and Islamic financial norms. These accounts do not charge interest on overnight holdings, allowing traders to participate in Forex and CFD markets on terms that align with their religious beliefs.

Customers must register and agree to the LCG Swap-Free Account Additional Terms and Conditions to use these accounts. The accounts use holding costs instead of swap fees, applied to different currency pairings and instruments after a certain number of days.

Furthermore, the holding price for energy spot markets is $30 per lot after one day.

How do I know which LCG account type is best for my trading style?

Consider trading frequency, volume, and preferred trading instruments while deciding between LCG’s Classic and ECN account types.

Can I switch between LCG account types once I establish an account?

Yes, traders can switch between LCG account types according to their changing trading requirements and preferences.

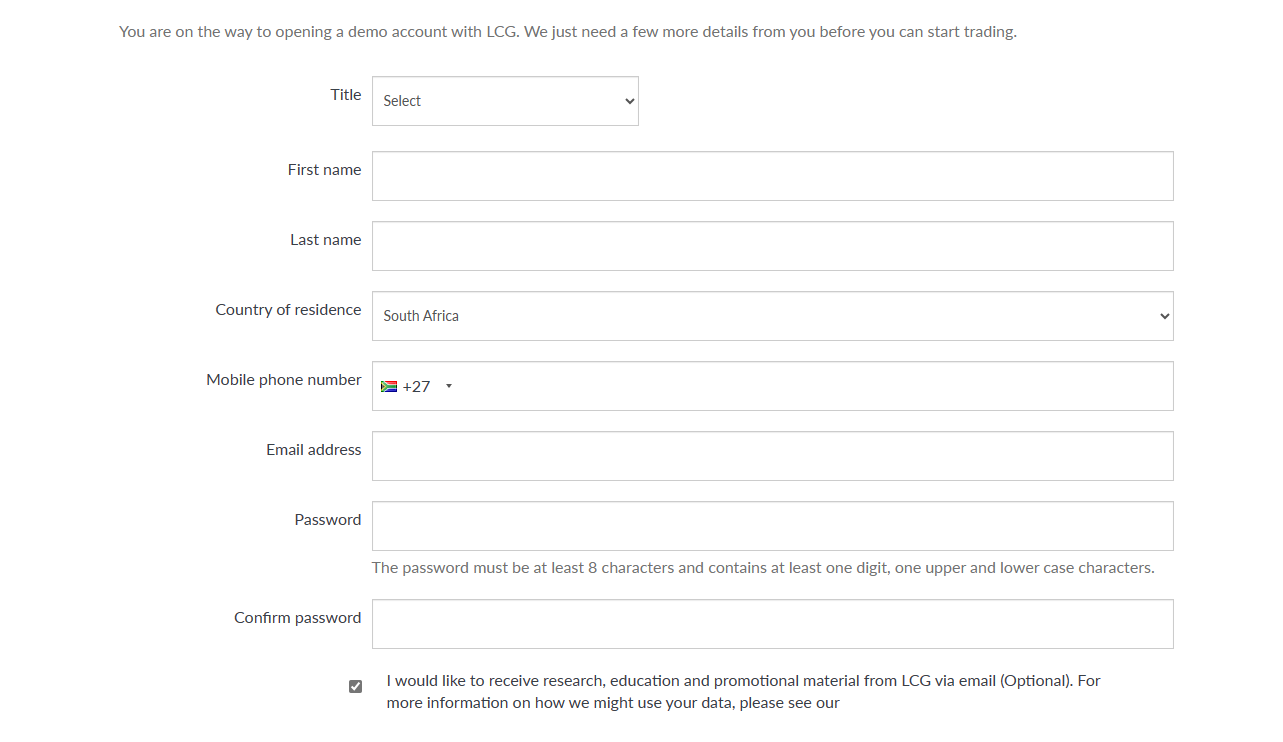

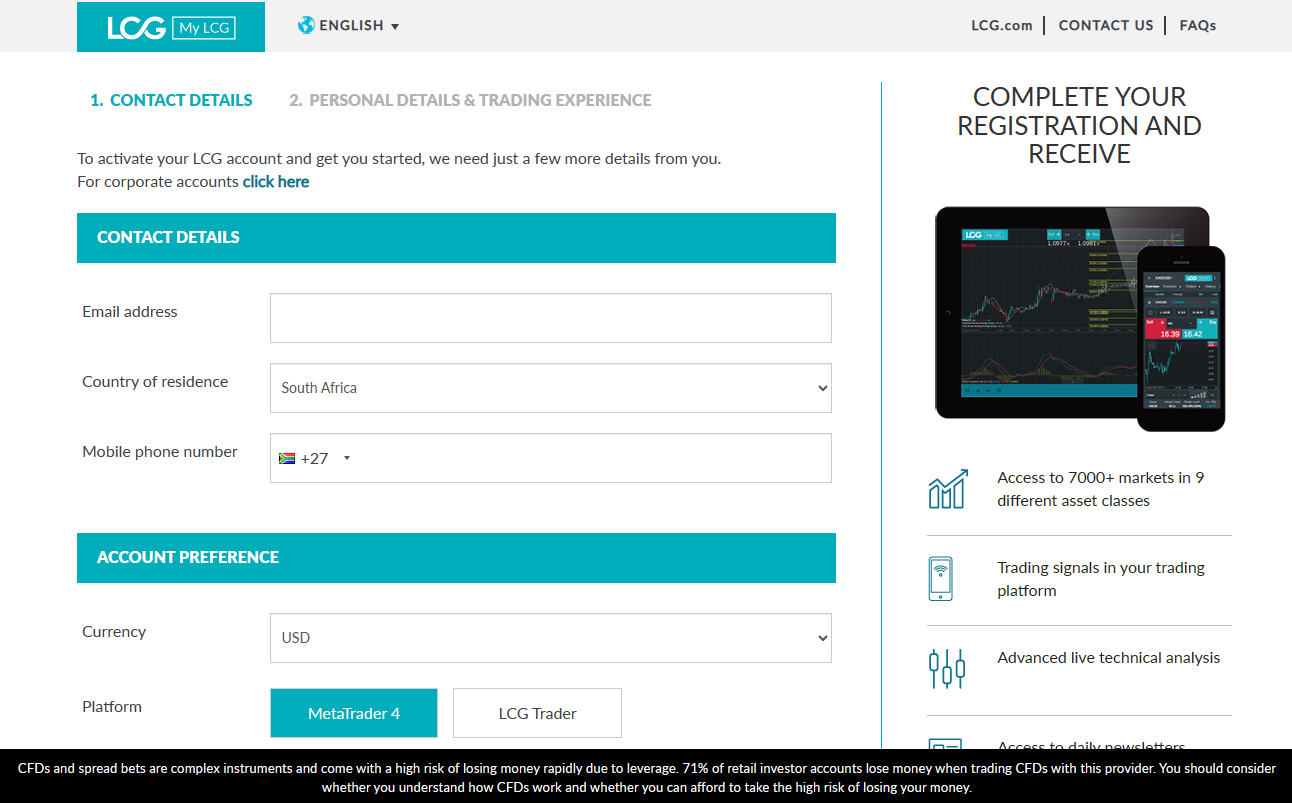

How To Open an Account

To register an account with LCG, follow these steps:

Go to the LCG website and start your application process.

- Click the “Open Live Account” button to begin the account creation procedure.

- The online form will ask for your name, address, contact information, and financial history.

- Ensure that all information is correct and up to date.

- To comply with the rules, LCG must verify your identity and residence.

- LCG provides a user-friendly LCG Trader interface and the well-known MetaTrader 4 (MT4) platform.

- Once accepted, you can fund your new LCG account using various methods.

After financing, download and install the platform selected (LCG Trader or MT4) on your smartphone, laptop, or PC.

What documents will be needed to verify my identity and residence throughout the account opening process?

You will normally be required to produce scanned copies of identifying documents, such as a passport or driver’s license, and evidence of residency, such as a utility bill or bank statement.

Can I start trading right after I register an LCG account?

Once your account application has been authorized and financed, you may begin trading immediately utilizing the LCG trading platforms.

Trading Platforms and Software

Trader

LCG Trader is a cutting-edge trading platform with a user-friendly web-based interface, offering access to over 7,000 instruments across nine asset classes. Its minimal latency and fast execution ensure traders do not miss opportunities.

LCG’s pricing enhancement technologies enhance trading efficiency, and its user-friendly interface is designed for various devices.

MetaTrader 4

MetaTrader 4 is a key player in the online trading industry, known for its exceptional charting skills, extensive indicator library, and advanced algorithmic tools.

Its user-friendly design and robust security measures make it a popular choice for novice and experienced traders, allowing them to evaluate markets and execute trades on various devices confidently.

Does LCG offer a web-based trading platform for convenient access from any internet-enabled device?

Yes, LCG Trader is a web-based trading platform that provides traders convenient access to their accounts from any device with internet access and a web browser.

Are there any differences in features or functionality between LCG Trader and MetaTrader 4?

While both platforms offer robust trading capabilities, LCG Trader is known for its intuitive user interface and seamless integration with TradingView. At the same time, MetaTrader 4 is renowned for its extensive charting tools and algorithmic trading capabilities.

Fees, Spreads, and, Commissions

Spreads

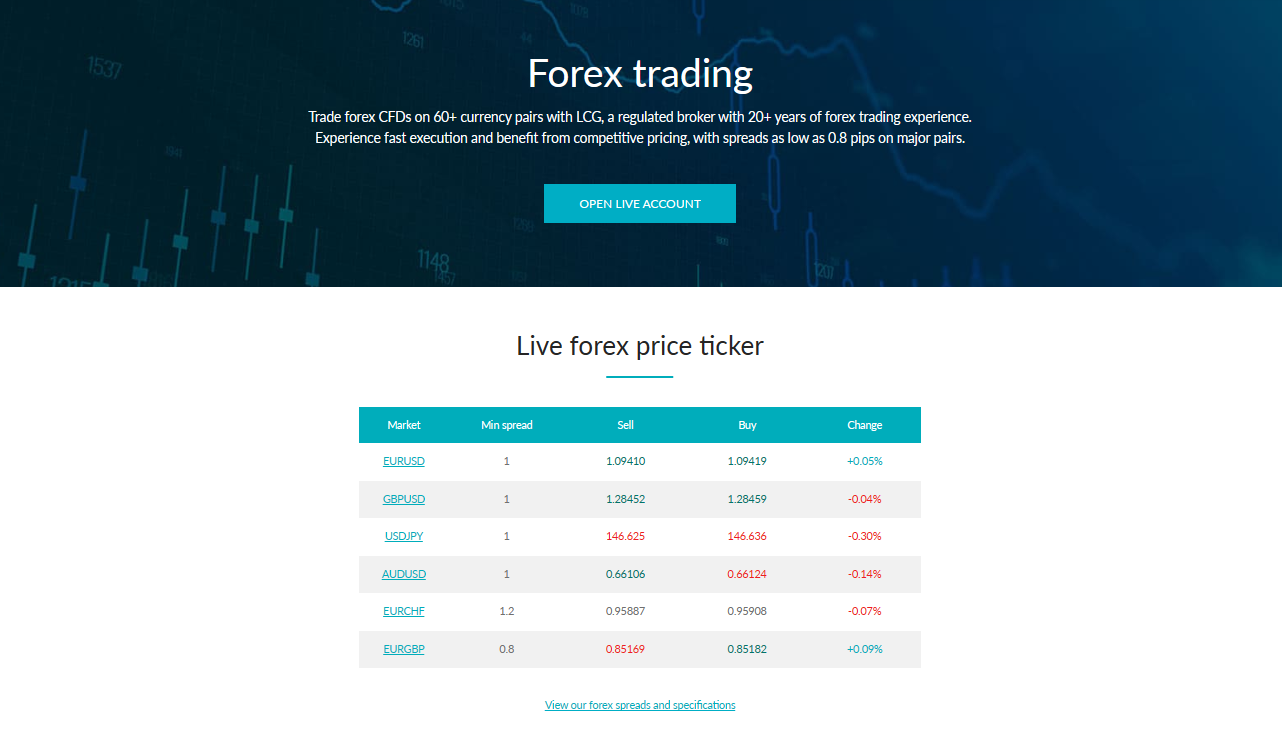

LCG offers competitive spreads for various trading styles and account types, starting at 0.0 pips on ECN accounts and 0.8 pips on Classic accounts for key currency pairings like EUR/USD, enhancing potential earnings.

Commissions

The Broker offers open commissions for its traders, with Classic accounts having no extra charges. MT4 accounts on ECN pay a $10 fee per lot traded, while LCG Trader accounts are charged $45 per million moved, ensuring fair compensation for their services.

Overnight Fees

For overnight holdings, LCG charges a financing cost of 0.04% daily at 22:00 (UK time). Holdings maintained after Friday’s cut-off will require three days of financing, which reflects the cost of keeping holdings overnight.

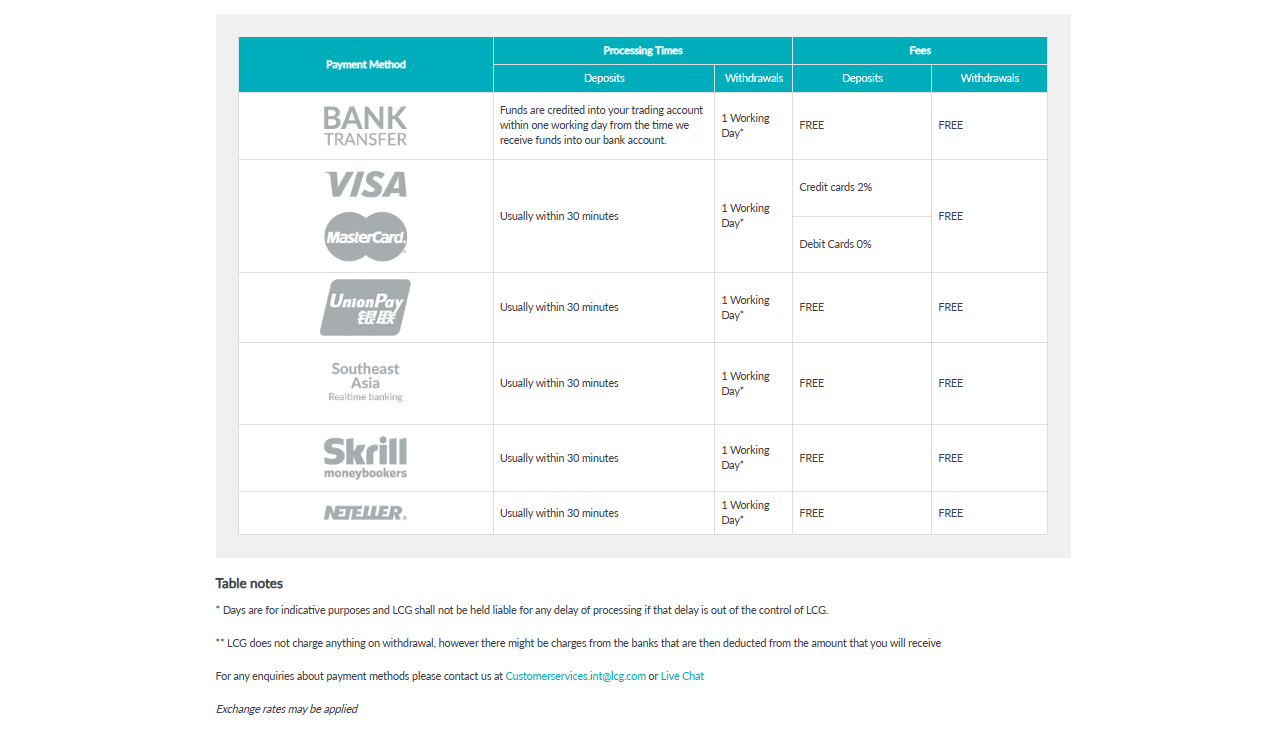

Deposit and Withdrawal Fees

LCG charges a 2% withdrawal fee for credit card transactions, but deposits are free, offering transparency and flexibility for traders managing account funds.

Inactivity Fees

LCG charges a modest cost of £15 after 6 months of inactivity, urging traders to stay involved in the markets or actively maintain their accounts.

Currency Conversion Fees

LCG simplifies currency conversion by translating holding costs into the account’s base currency, despite incurring conversion fees, and fairly determining the exchange rate, reducing traders’ risk of losses.

Does LCG offer fixed spreads or variable spreads on its trading accounts?

LCG primarily offers variable spreads on its trading accounts, which may vary depending on market conditions and liquidity.

Are there any additional fees or charges for holding positions overnight with LCG?

Yes, LCG charges overnight financing fees for positions held overnight, which are calculated based on the size of the position and prevailing interest rates.

Leverage and Margin

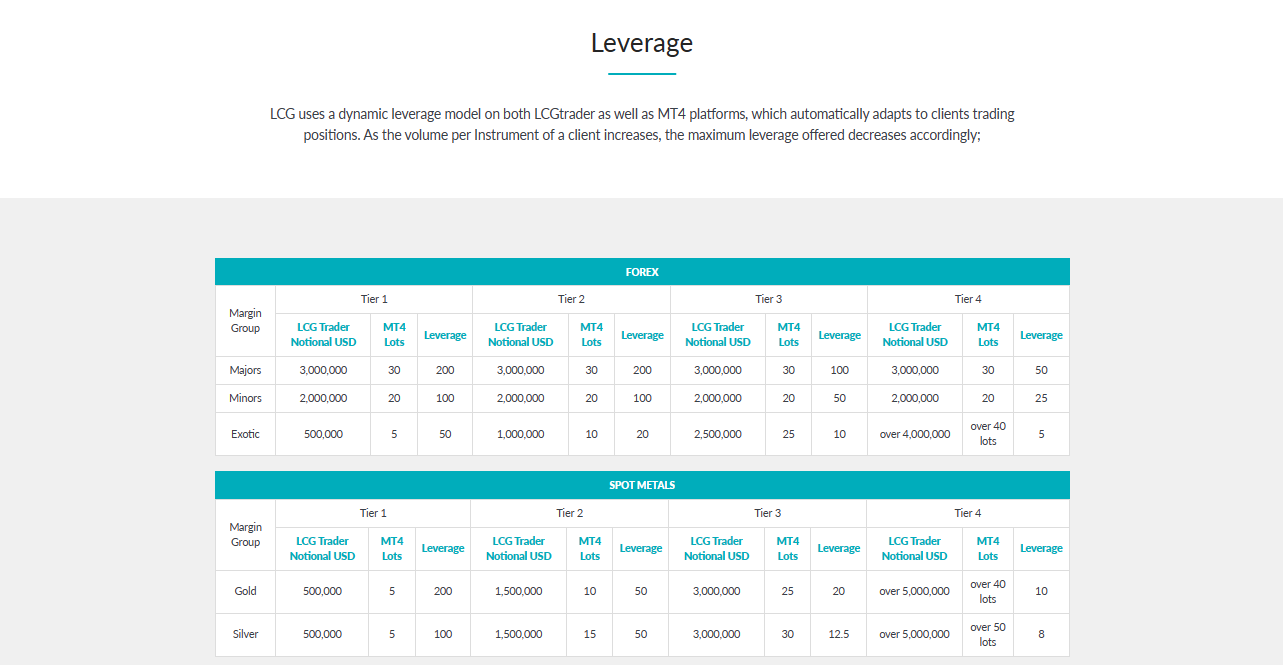

LCG employs a dynamic leverage mechanism in its trading platforms, including LCG Trader and MT4, to manage risk and adjust leverage based on a client’s trading positions.

Leverage tiers are determined by the notional USD volume traded in LCG Trader and open lots in MT4, with each instrument assigned a separate margin group.

This structure is similar to major, minor, and exotic currency pairings, with leverage lowering as notional USD volume or MT4 lots grow. The leverage levels are computed independently for each symbol or instrument, ensuring margin needs are specific to each trading position.

How does LCG calculate margin requirements for traders’ positions?

LCG calculates margin requirements based on the leverage level, position size, and prevailing market conditions, ensuring traders maintain sufficient funds to cover potential losses.

Are there any restrictions on margin trading with LCG?

Yes, there are. While LCG allows margin trading, traders should be aware of the associated risks and ensure they understand and comply with margin requirements and risk management strategies to safeguard their capital.

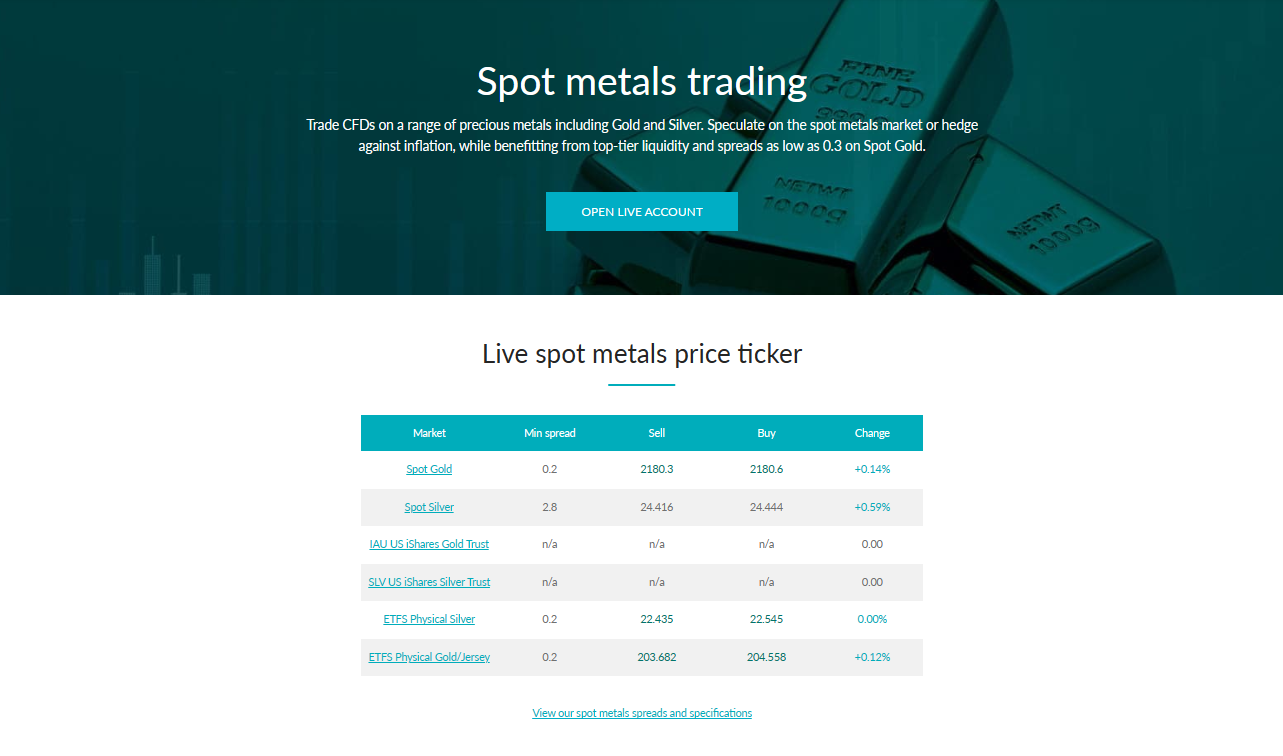

Trading Instruments and Products

LCG offers the following trading instruments and products:

- Over 60 currency pairs

- CFDs on precious metals such as gold and silver.

- Spot Gold offers top-tier liquidity with spreads as low as 0.3 pips.

- Prominent spot and futures indexes include the UK 100 (FTSE), Wall Street (DJI), and Germany 30 (DAX). Furthermore, traders can enjoy narrow spreads and minimal margin requirements.

- Over 4,000 global stocks, including Amazon, Facebook, and Google.

- A diverse selection of metal, energy, and agricultural commodities, including gold, silver, US crude (WTI), Brent, coffee, and sugar.

- Bond and interest rate markets such as BOBL, Schatz, Euribor, Bund, Gilt, and US 10-Year.

- Vanilla options on various global currencies, indexes, and stocks.

- More than 500 exchange-traded funds (ETFs).

Can I trade cryptocurrencies like Bitcoin and Ethereum using LCG?

No, LCG does not currently offer cryptocurrency trading as part of its range of financial instruments and products.

Does LCG provide access to options trading for traders looking for derivative products?

Yes, LCG provides vanilla options trading on a range of global currencies, indices, and equities, allowing traders to hedge and speculate.

LCG Deposit and Withdrawal Options

| 🔎 Payment Method | 🌎 Country | 🪙 Currencies Accepted | ⏰ Processing Time |

| 💴 Bank Wire Transfer | All | Multi-currency | 1 day |

| 💵 Credit/Debit Card | All | Multi-currency | 30 minutes – 1 day |

| 💶 UnionPay | China | Multi-currency | 30 minutes – 1 day |

| 💷 Southeast Asia Real-time Banking | Asian Countries | Multi-currency | 30 minutes – 1 day |

| 💴 Skrill | All | Multi-currency | 30 minutes – 1 day |

| 💵 Neteller | All | Multi-currency | 30 minutes – 1 day |

Deposit Methods

Bank Wire

- Start the transfer from your bank account using LCG’s bank information (available on their website).

- Include the LCG account number or unique reference code in the transfer description.

- Funds may take a few business days to clear.

Credit or Debit Card

- Navigate to the deposit area of your LCG account site.

- Select “Credit/Debit Card” and enter the appropriate deposit amount.

- Enter your card details, including the number, expiration date, and CVC/CVV.

- Funds are normally credited immediately or within a short span.

e-wallets or Payment Gateways

- Select your chosen e-wallet/gateway from the LCG-approved alternatives.

- Enter your deposit amount and go to the e-wallet/gateway’s website.

- Log into your e-wallet/gateway account and approve the transfer of funds.

Withdrawal Methods

Bank Wire

- Access the withdrawals area of your LCG account.

- Provide your bank account information (IBAN, SWIFT/BIC).

- Enter the withdrawal amount and submit your request.

- Processing normally takes a few business days.

Credit or Debit Cards

- Withdrawals are often routed to the same card used for deposits.

- Go to the withdrawals area of your LCG account.

- Enter the amount and submit your request.

- Processing periods vary, but they are typically faster than bank wires.

e-wallets or Payment Gateways

- Choose the e-wallet or gateway where you wish to receive funds.

- Log into your connected account and finish the withdrawal procedure.

Can I use several payment methods to finance my LCG trading account?

Yes, LCG accepts various payment methods to fund trading accounts, including bank wire transfers, credit/debit cards, and e-wallets.

Is there a limit to the amount I can deposit or withdraw using LCG?

No, LCG does not set specified deposit and withdrawal restrictions. However, each payment method may have its own.

Educational Resources

LCG’s Trading Guides are comprehensive instructional products intended to assist traders of all skill levels grasp the complexities of the financial markets. Moreover, the Broker offers resources to give visual and practical insights into trading tactics, market analysis, and platform navigation.

In addition, a Glossary is a valuable resource for new and seasoned traders, clearly describing trading words and unclear terms.

Does LCG offer personalized coaching or mentoring services for traders?

No, they do not. However, while LCG does not provide personalized coaching or mentoring services, traders can benefit from the wealth of educational resources and support available to independently enhance their trading skills and knowledge.

Can beginners with no previous trading experience benefit from LCG’s educational resources?

Yes, LCG’s educational resources cater to traders of all skill levels, including beginners, providing them with the necessary knowledge, tools, and support to kickstart their trading journey effectively.

LCG Pros and Cons

| ✔️ Pros | ❌ Cons |

| Active operation of over two decades in the market demonstrates dependability and consistency | The minimum deposit for the ECN account is high ($10,000) |

| LCG provides negative balance protection, which protects traders from losses that exceed their account balances | Classic account spreads are wider than those offered by rivals |

| LCG provides services throughout several geographies | If your account is idle for 6 months, an inactivity fee of 15 GBP applies |

| Both the LCG Trader and MT4 platforms are accessible | Some users claim poor website performance during peak trading hours |

| Provides market research and trading recommendations to help traders | The variety of platforms and products could be perplexing for inexperienced traders |

In Conclusion

According to our research, London Capital Group (LCG) is a seasoned FX and CFD brokerage with over two decades of experience and a strong regulatory framework. It offers a wide selection of over 7,000 financial products, reasonable spreads, and dependable customer service.

However, we found LCG has disadvantages like a high minimum deposit requirement and periodic website performance issues.

Faq

LCG operates as both a market maker and an ECN broker.

Withdrawals from LCG normally take a few business days to complete, depending on the withdrawal method used and any extra verification required.

No, LCG does not accept customers from the United States.

Yes, LCG is regarded as a safe broker since it is regulated by recognized institutions such as the FCA, CySEC, CIMA, and SCB, ensuring stringent financial compliance and enhanced customer safety.