Interactive Brokers Review

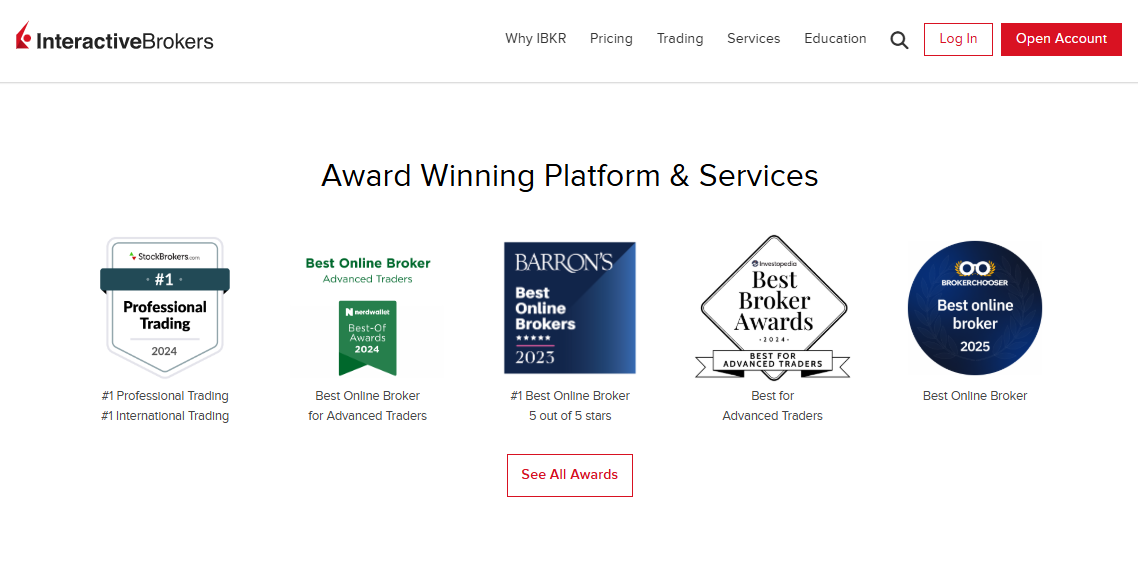

Overall, Interactive Brokers stands out as a reliable broker offering access to global markets in over 200 countries and territories. Commissions begin at 0 USD, and all client funds are held in segregated accounts for added security. The platform holds an impressive trust score of 98 out of 99.

🛡️Regulated and trusted by FCA, ASIC, NYSE, SEC, FINRA, and, IIROC.

🛡️2179 new traders chose this broker in the last 90 days.

🛡️Available for global Traders.

| 🔎 Broker | 🥇 Interactive Brokers |

| 📌 Year Founded | 1978 |

| 👤 Amount of Staff | Approximately 2,700 |

| 👥 Amount of Active Traders | Over 2 million active traders |

| 📍 Publicly Traded | NASDAQ - IBKR |

| 🧾 Regulation | Multiple |

| 🌎 Country of Regulation | USA (SEC, FINRA), UK (FCA), Australia (ASIC) |

| ↪️ Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| 🛡️ Investor Protection Schemes | SIPC |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | ✅Yes |

| 💴 Minor Account Currencies | 15+ |

| 💶 Minimum Deposit | None |

| ⚡ Average Deposit/Withdrawal Processing Time | 1-3 business days |

| 💵 Fund Withdrawal Fee | Typically free |

| 📈 Spreads From | Variable |

| 📉 Commissions | Variable |

| 📊 Number of Base Currencies Supported | 20+ |

| 💹 Swap Fees | ✅Yes |

| 💱 Leverage | Up to 1:40 (Retail Clients) |

| 📐 Margin Requirements | Varies |

| ☪️ Islamic Account | None |

| 🆓 Demo Account | ✅Yes |

| ⏰ Order Execution Time | Milliseconds |

| 🖱️ VPS Hosting | Free |

| 📈 CFDs - Total Offered | Thousands |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💴 Deposit Options | Bank wire, ACH, credit/debit |

| 💶 Withdrawal Options | Bank wire, ACH, credit/debit |

| 🖥️ Trading Platforms | Trader Workstation (TWS), IBKR Mobile, WebTrader |

| 💻 OS Compatibility | Windows, macOS, iOS, Android |

| 🖱️ Forex Trading Tools | Advanced charting, market scanners, etc. |

| 🥰 Live Chat Availability | ✅Yes |

| 💌 Customer Support Email Address | [email protected] |

| ☎️ Customer Support Contact Number | +1-877-442-2757 |

| 💙 Social Media Platforms | Facebook, Twitter, |

| 🔊 Languages Supported | English, Spanish, Chinese, Japanese |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | ✅Yes |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 Amount of Partners | Numerous |

| 🫰🏻 IB Program | ✅Yes |

| 📌 Do They Sponsor Any Notable Events or Teams | ✅Yes |

| 📍 Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Overview

Interactive Brokers (IBKR) serves as a premier gateway for professional traders to access global financial markets. Offering clients in over 200 countries the ability to trade on 150 global markets, IBKR provides a unified platform for stocks, options, futures, currencies, bonds, and funds.

With industry-leading professional pricing, low commissions, and no added fees like ticket charges or account minimums, IBKR allows investors to maximize returns. The platform boasts advanced trading tools, cutting-edge technology, and access to a wealth of educational resources, ensuring clients at all levels can make informed trading decisions.

IBKR’s strong financial position and robust security features make it a trusted partner for traders worldwide.

Frequently Asked Questions

What markets can I access with IBKR?

IBKR provides access to over 150 global markets, allowing clients to trade a wide range of assets such as stocks, options, futures, currencies, bonds, and funds in over 200 countries.

What are the commission rates for trading with IBKR?

IBKR offers professional pricing, with commissions starting at USD 0 for US-listed stocks and ETFs. There are no added ticket charges, spreads, or account minimums, ensuring low-cost trading.

How can I fund my IBKR account?

IBKR allows clients to fund accounts in 28 different currencies, making it easy to deposit and trade across global markets.

What educational resources does IBKR offer?

IBKR provides a range of educational resources through its Traders’ Academy, including webinars, on-demand courses, podcasts, and blogs to help traders of all levels improve their skills and knowledge.

Our Insights

Interactive Brokers is an excellent choice for professional traders and investors seeking a powerful, cost-effective platform with access to global markets. Its low-cost trading model, comprehensive educational tools, and robust security measures make it a top contender in the online brokerage space.

Detailed Summary

| 🔎 Broker | 🥇 Interactive Brokers |

| 📌 Year Founded | 1978 |

| 👤 Amount of Staff | Approximately 2,700 |

| 👥 Amount of Active Traders | Over 2 million active traders |

| 📍 Publicly Traded | NASDAQ - IBKR |

| 🧾 Regulation | Multiple |

| 🌎 Country of Regulation | USA (SEC, FINRA), UK (FCA), Australia (ASIC) |

| ↪️ Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| 🛡️ Investor Protection Schemes | SIPC |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | ✅Yes |

| 💴 Minor Account Currencies | 15+ |

| 💶 Minimum Deposit | None |

| ⚡ Average Deposit/Withdrawal Processing Time | 1-3 business days |

| 💵 Fund Withdrawal Fee | Typically free |

| 📈 Spreads From | Variable |

| 📉 Commissions | Variable |

| 📊 Number of Base Currencies Supported | 20+ |

| 💹 Swap Fees | ✅Yes |

| 💱 Leverage | Up to 1:40 (Retail Clients) |

| 📐 Margin Requirements | Varies |

| ☪️ Islamic Account | None |

| 🆓 Demo Account | ✅Yes |

| ⏰ Order Execution Time | Milliseconds |

| 🖱️ VPS Hosting | Free |

| 📈 CFDs - Total Offered | Thousands |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💴 Deposit Options | Bank wire, ACH, credit/debit |

| 💶 Withdrawal Options | Bank wire, ACH, credit/debit |

| 🖥️ Trading Platforms | Trader Workstation (TWS), IBKR Mobile, WebTrader |

| 💻 OS Compatibility | Windows, macOS, iOS, Android |

| 🖱️ Forex Trading Tools | Advanced charting, market scanners, etc. |

| 🥰 Live Chat Availability | ✅Yes |

| 💌 Customer Support Email Address | [email protected] |

| ☎️ Customer Support Contact Number | +1-877-442-2757 |

| 💙 Social Media Platforms | Facebook, Twitter, |

| 🔊 Languages Supported | English, Spanish, Chinese, Japanese |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | ✅Yes |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 Amount of Partners | Numerous |

| 🫰🏻 IB Program | ✅Yes |

| 📌 Do They Sponsor Any Notable Events or Teams | ✅Yes |

| 📍 Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Frequently Asked Questions

What markets can I trade on with IBKR?

IBKR gives you access to over 150 global markets, including stocks, options, futures, currencies, bonds, and funds in over 200 countries.

What are IBKR’s commission rates?

Commissions for US-listed stocks and ETFs start at USD 0, with no added ticket charges, spreads, or account minimums. Rates for other products are also low.

How can I fund my IBKR account?

You can fund your account in 28 different currencies, making it easy to deposit and trade across multiple global markets.

Does IBKR offer margin trading?

Yes, IBKR provides margin trading with margin rates up to 53% lower than the industry average, allowing for more leverage and potentially higher returns.

Our Insights

Interactive Brokers is a top-tier platform for professional traders, offering unrivaled global market access, low-cost pricing, and cutting-edge technology. With its strong security features, comprehensive educational resources, and advanced trading tools, IBKR is well-suited for both seasoned investors and those looking to advance their trading skills.

Safety and Security

Interactive Brokers (IBKR) takes security seriously, providing a robust infrastructure to protect client funds and data. With a strong capital position and a conservative balance sheet, IBKR ensures that it can withstand market fluctuations and safeguard client assets.

The platform’s automated risk controls, advanced security protocols, and commitment to compliance with regulatory standards further enhance the protection of investors.

IBKR’s solid financial standing and client-focused approach make it a trusted choice for professional traders and investors worldwide.

Frequently Asked Questions

How does IBKR ensure the security of my funds?

IBKR maintains a strong capital position and a conservative balance sheet, ensuring that it can endure market fluctuations. Automated risk controls further safeguard clients from large trading losses.

What measures does IBKR have in place to protect my data?

IBKR uses advanced security protocols and complies with industry standards to ensure the protection of sensitive client information.

Is IBKR financially stable?

Yes, IBKR has a solid financial foundation, with $16.1 billion in equity capital and $11.7 billion in excess regulatory capital, ensuring stability and long-term security for clients.

What happens if IBKR faces financial difficulties?

IBKR’s strong balance sheet and risk management strategies are designed to protect client assets even in challenging market conditions. The firm is also regulated and adheres to stringent financial and operational standards.

Our Insights

IBKR offers a high level of safety and security, backed by strong financial capital, risk management systems, and advanced security protocols. These measures, coupled with its regulatory compliance, make IBKR a reliable and secure platform for traders and investors looking for peace of mind while managing their assets.

Minimum Deposit and Account Types

Interactive Brokers (IBKR) offers a wide range of account types to cater to different investors’ needs, from individual traders to institutions. The platform’s minimum deposit requirements and available account options are designed to provide flexibility and accommodate diverse trading strategies.

Account types include individual, joint, trust, IRA, and specialized accounts for advisors, family offices, and institutions. IBKR also offers a variety of margin options and account management features to suit different investor needs, ensuring that clients have the tools they need to succeed in the global markets.

Frequently Asked Questions

What is the minimum deposit required to open an account with IBKR?

The minimum deposit varies depending on the account type. IBKR typically requires a minimum of $10,000 for individual accounts, but this amount may differ based on specific account features and the investor’s location.

What account types does IBKR offer?

IBKR offers a wide range of account types, including individual, joint, trust, IRA, UGMA/UTMA, advisor, money manager, family office, institutional accounts, and more, each designed to cater to different trading needs and investment strategies.

Can I trade with margin on all IBKR account types?

Most IBKR account types, including individual, joint, and institutional accounts, offer margin trading, including Cash, Reg T, and Portfolio Margin options. However, some accounts, such as UGMA/UTMA, are cash accounts and do not allow margin trading.

What features are available for IBKR advisor accounts?

IBKR offers a range of features for advisor accounts, including master accounts linked to client accounts, fee collection, and trade allocations, multiple tiers for managing client funds, and the ability to offer various margin types and pre-trade allocations.

Our Insights

Interactive Brokers provides a broad selection of account types, each tailored to different investor needs, from individual traders to large institutions. With flexible deposit requirements, comprehensive margin options, and robust account management features, IBKR ensures that its clients have the tools to succeed in global markets.

How to Open an IBKR Account

To open an Interactive Brokers (IBKR) account, follow these steps:

1. Step 1: Visit the IBKR Website

Go to the official Interactive Brokers website at www.ibkr.com.

2. Step 2: Select ‘Open an Account’

On the homepage, click the “Open an Account” button to start the registration process.

3. Step 3: Choose Account Type

IBKR offers a variety of account types (individual, joint, trust, advisor, business, etc.). Choose the one that suits your needs. Each account type has different features and requirements.

4. Step 4: Complete the Online Application

Fill out the online application form with your details. Depending on your location, you may need to provide additional documents such as proof of identity and address (e.g., a government-issued ID and a utility bill).

5. Step 5: Fund Your Account

Once your application is approved, you’ll be asked to fund your account. IBKR supports various funding methods, including bank transfers and wire transfers.

You can fund your account in multiple currencies, depending on your location and the account type.

6. Step 6: Agree to Terms and Conditions

Review and accept the terms, conditions, and any applicable agreements, such as the margin agreement if you plan to trade on margin.

7. Step 7: Submit and Verify

After submitting your application, IBKR may verify your identity and other information. This process may take some time, especially for accounts that require additional documentation.

8. Step 8: Access Your Account

Once your account is approved and funded, you will receive access to IBKR’s trading platforms, such as the IBKR WebTrader, IBKR Mobile, or IBKR Trader Workstation (TWS).

You can then start trading, managing your portfolio, and exploring the platform’s various tools and features. If you need assistance during the application process, IBKR provides customer support to help you through the steps.

Trading Platforms and Tools

Interactive Brokers (IBKR) offers a range of powerful, award-winning trading platforms designed to cater to traders of all levels. Whether you’re a beginner, intermediate, or advanced trader, IBKR’s platforms—including IBKR GlobalTrader, Trader Workstation (TWS), and IBKR Mobile—provide the tools and features you need to trade a variety of assets such as stocks, options, futures, currencies, bonds, and more.

With no platform fees and a range of advanced trading tools, IBKR ensures an optimized experience for each trader’s unique style and strategy.

Frequently Asked Questions

Which IBKR trading platform is best for beginners?

Beginners can benefit from the IBKR GlobalTrader, which is available on mobile and web. It’s designed for ease of use and includes features for stock and ETF trading.

What features are available on IBKR’s advanced platforms?

Advanced traders can use platforms like Trader Workstation (TWS) and IBKR APIs. These platforms offer advanced tools such as complex order types, algorithmic trading, and detailed technical analysis.

Can I use IBKR platforms on mobile?

Yes, IBKR offers several mobile platforms, including IBKR Mobile and IBKR GlobalTrader. Both provide a seamless trading experience on the go with access to market data, portfolio management, and order execution.

Are there any fees for using IBKR’s platforms?

No, IBKR charges no platform fees. All of its trading platforms, including mobile and desktop versions, are free to use for clients.

Our Insights

IBKR’s suite of trading platforms is tailored to meet the needs of traders at all experience levels. From the easy-to-use IBKR GlobalTrader for beginners to the advanced capabilities of Trader Workstation (TWS) for professional traders, IBKR provides robust tools to suit various trading strategies.

With no platform fees and access to powerful research and data, IBKR offers a flexible, feature-rich trading environment for anyone looking to succeed in the financial markets.

Markets Available for Trade

Interactive Brokers offers a wide range of tradable assets, including stocks, options, futures, currencies, bonds, ETFs, and more. With access to over 150 global markets, IBKR accommodates a variety of investment strategies and preferences, ensuring traders can find opportunities across multiple asset classes.

Frequently Asked Questions

What types of assets can I trade on IBKR?

You can trade a diverse range of assets, including stocks, options, futures, currencies, bonds, ETFs, and various funds, across over 150 global markets.

Can I trade fractional shares?

Yes, IBKR allows trading in fractional shares, starting from as little as $1, making it easier to build a diversified portfolio, especially with high-priced stocks.

Are there tools available to assist with trading?

IBKR offers a suite of advanced trading platforms and tools for both desktop and mobile. These tools are designed to enhance your trading experience, offering everything from real-time market data to complex order types.

Is there access to international markets?

Yes, IBKR provides seamless access to international markets, allowing you to trade a wide range of global assets across different regions.

Our Insights

Interactive Brokers offers a comprehensive range of tradable assets and access to over 150 international markets, providing traders with the flexibility to explore diverse investment opportunities. Whether you’re looking to invest in stocks, bonds, or other asset classes, IBKR equips you with the tools and resources needed to navigate today’s dynamic trading landscape successfully.

Fees, Spreads, and Commissions

Interactive Brokers (IBKR) is renowned for its competitive pricing structure, offering traders an affordable way to engage in the markets. With low spreads and commissions across various asset classes, IBKR delivers value to traders of all experience levels.

The broker’s transparent pricing model includes commission-free trading options on select assets and low fees on others, enabling clients to maximize their investment potential while keeping costs down.

Frequently Asked Questions

What are the typical commissions on trades?

Commissions vary depending on the asset class and trade volume. Many products come with low-cost or even commission-free trading options.

Are there any account maintenance fees?

IBKR generally does not charge maintenance fees. However, it is recommended to review your specific account type for any applicable fees.

How are spreads determined?

Spreads can vary based on market conditions and the specific asset being traded. IBKR aims to offer tight spreads for optimal trading conditions.

Is there a minimum deposit required to open an account?

Most IBKR account types do not require a minimum deposit, although certain accounts may have specific deposit requirements. It’s best to check the details of your chosen account type.

Our Verdict

IBKR’s competitive and transparent fee structure makes it an attractive choice for traders seeking to minimize costs while accessing a broad range of assets. With no maintenance fees and the option for commission-free trading, IBKR offers a cost-effective solution for both casual and active traders to manage their investment strategies effectively.

Deposits and Withdrawals

Interactive Brokers (IBKR) offers a variety of deposit options, with bank transfers available across all countries. However, the availability of certain deposit methods may vary depending on the country of residence.

The processing time for withdrawals will depend on the chosen method, with bank transfers generally taking longer.

Frequently Asked Questions

What deposit options are available with Interactive Brokers?

IBKR offers several deposit methods, including bank transfers, wire transfers, and other methods. Availability may vary depending on the country.

Are all deposit methods available in every country?

No, not all deposit options are available in every country. It’s important to check the available options specific to your country.

How long does it take to process a withdrawal?

Withdrawal processing times vary depending on the method selected. Bank transfers typically take longer than other withdrawal options.

Is there a minimum deposit requirement?

Minimum deposit requirements can differ based on the account type. It is recommended to review the terms and conditions of your specific account.

Our Insights

Interactive Brokers offers a wide range of deposit methods, with bank transfers being universally available. While this flexibility is beneficial, users should be mindful that not all deposit options are available in every country, and withdrawal processing times may vary depending on the chosen method.

Education and Research

Interactive Brokers offers an extensive range of educational resources through the IBKR Online Campus. These resources are ideal for traders at all levels, particularly beginners looking to enhance their skills and knowledge. The IBKR Campus includes:

- Traders Academy

- IBKR Webinars

- Traders Insights

- IBKR Podcasts

- IBKR Quant

- Student Trading Lab

Additionally, Interactive Brokers provides access to short educational videos and a comprehensive Traders Glossary.

Frequently Asked Questions

What resources are available through the IBKR Online Campus?

The IBKR Online Campus provides a variety of resources, including the Traders Academy, webinars, Traders Insights, podcasts, IBKR Quant, and the Student Trading Lab.

Are there any short video tutorials available?

Yes, IBKR offers short video tutorials covering various trading topics, allowing for quick and easy learning.

Is there a glossary for trading terms?

Yes, the IBKR Campus features a Traders Glossary, which helps users understand key trading terminology.

Are these educational resources suitable for beginners?

Yes, the resources are designed for traders of all levels, with a special focus on helping beginners build their knowledge and skills.

Our Insights

Interactive Brokers offers a comprehensive suite of educational resources through the IBKR Online Campus, making it an invaluable platform for traders at all skill levels. With accessible tools like webinars, podcasts, and a glossary, beginners can easily enhance their trading knowledge and expertise.

Customer Reviews

🥇 Exceptional Trading Platform!

I’ve been using Interactive Brokers for over a year now, and I couldn’t be more impressed with the platform. The variety of assets available to trade, coupled with their competitive fees, makes it a top choice for me. The educational resources on the IBKR Campus have been invaluable in improving my trading skills. Whether you’re a beginner or a seasoned trader, IBKR offers everything you need to succeed! – John

🥈 Great Experience and Low Fees!

Interactive Brokers has truly exceeded my expectations. The platform is user-friendly, and I love how low the commissions are, especially when compared to other brokers. I was able to start trading with a small deposit, and their educational resources helped me get up to speed quickly. IBKR’s international market access has also opened up great opportunities for me. – Sarah

🥉 Best Broker for Active Traders!

As an active trader, I need a platform that offers powerful tools and low fees, and Interactive Brokers delivers on both fronts. The Trader Workstation (TWS) is packed with advanced features that make complex trades easier to manage. Plus, the customer support team is always available to assist when needed. I’ve been consistently impressed with their reliable service and competitive pricing. IBKR is my go-to for all my trading needs! – Michael

Pros and Cons

| ✅ Pros | ❌ Cons |

| Interactive Brokers offers a wide range of marketable assets and markets | A challenging platform with a steep learning curve |

| The Advanced Trader Workstation (TWS) platform is available to traders | During peak periods of activity, customer service may be less accessible |

| Competitive commission and margin rates | Low-balance accounts incur monthly inactivity penalties |

References:

In Conclusion

Interactive Brokers (IBKR) stands out as a leading platform for professional traders and investors. With access to over 150 global markets, low-cost pricing, and advanced technology, IBKR is a comprehensive solution for traders at all levels. Its robust security measures, strong capital position, and educational resources ensure that clients are well-supported in their trading journey.

Faq

IBKR gives you access to over 150 global markets, including stocks, options, futures, currencies, bonds, and funds in over 200 countries.

Commissions for US-listed stocks and ETFs start at USD 0, with no added ticket charges, spreads, or account minimums. Rates for other products are also low.

You can fund your account in 28 different currencies, making it easy to deposit and trade across multiple global markets.

Yes, IBKR provides margin trading with margin rates up to 53% lower than the industry average, allowing for more leverage and potentially higher returns.

IBKR offers interest rates up to USD 3.83% on instantly available cash in your account, providing additional earning potential.