ICM Capital Review

- ICM Capital Review - Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Safety and Security

- Account Types

- How To Open an Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Trading Instruments and Products

- Deposit and Withdrawal Options

- Educational Resources

- Pros and Cons

- In Conclusion

Overall, ICM Capital is a trustworthy global internet trading broker with a well-established global presence. ICM Capital is committed to customer service and has a trust score of 90 out of 99.

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $0 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

ICM Capital Review – Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Safety and Security

- ☑️ Account Types

- ☑️ How To Open an Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and, Commissions

- ☑️ Trading Instruments and Products

- ☑️ Leverage and Margin

- ☑️ Deposit and Withdrawal Options

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

Overview

ICM Capital, established in 2009, is a global internet trading broker with a global presence serving customers in Europe, Asia, the Middle East, Latin America, and Africa. ICM Capital is regulated by the UK’s Financial Conduct Authority (FCA), ensuring a secure trading environment for customers.

It is known for its commitment to customer service and technical innovation, investing in improving its trading platforms for a smooth experience across desktop and mobile devices.

Detailed Summary

| 🔎 Broker | 🥇 ICM Capital |

| 📈 Established Year | 2009 |

| 📉 Regulation and Licenses | FCA, ADGM, FSC Mauritius, FSA Labuan, FSA Saint Vincent and the Grenadines, FSCA, ARIF, Stockholm County Administrative Board, QFCQ |

| 📊 Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | MetaTrader 4 |

| 📌 Account Types | ICM Direct, ICM Zero |

| 💴 Base Currencies | USD, GBP, EUR, PLN |

| 📍 Spreads | From 0.0 on ICM Zero |

| 🚩 Leverage | 1:200 |

| 💵 Currency Pairs | 32; major, minor, and exotic pairs |

| 💶 Minimum Deposit | 200 USD |

| 💷 Inactivity Fee | 50 USD after 12 months of inactivity |

| 🔊 Website Languages | English, Arabic, Spanish, Portuguese, Thai |

| 💳 Fees and Commissions | Spreads from 0.0 pips, commissions from $7 per round turn |

| 🤝 Affiliate Program | ✅Yes |

| ❎ Banned Countries | United States and other sanctioned regions |

| ⏩ Scalping | ✅Yes |

| ▶️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, metals, US shares, energy futures, index futures, cash CFDs |

| 🚀 Open an Account | 👉 Click Here |

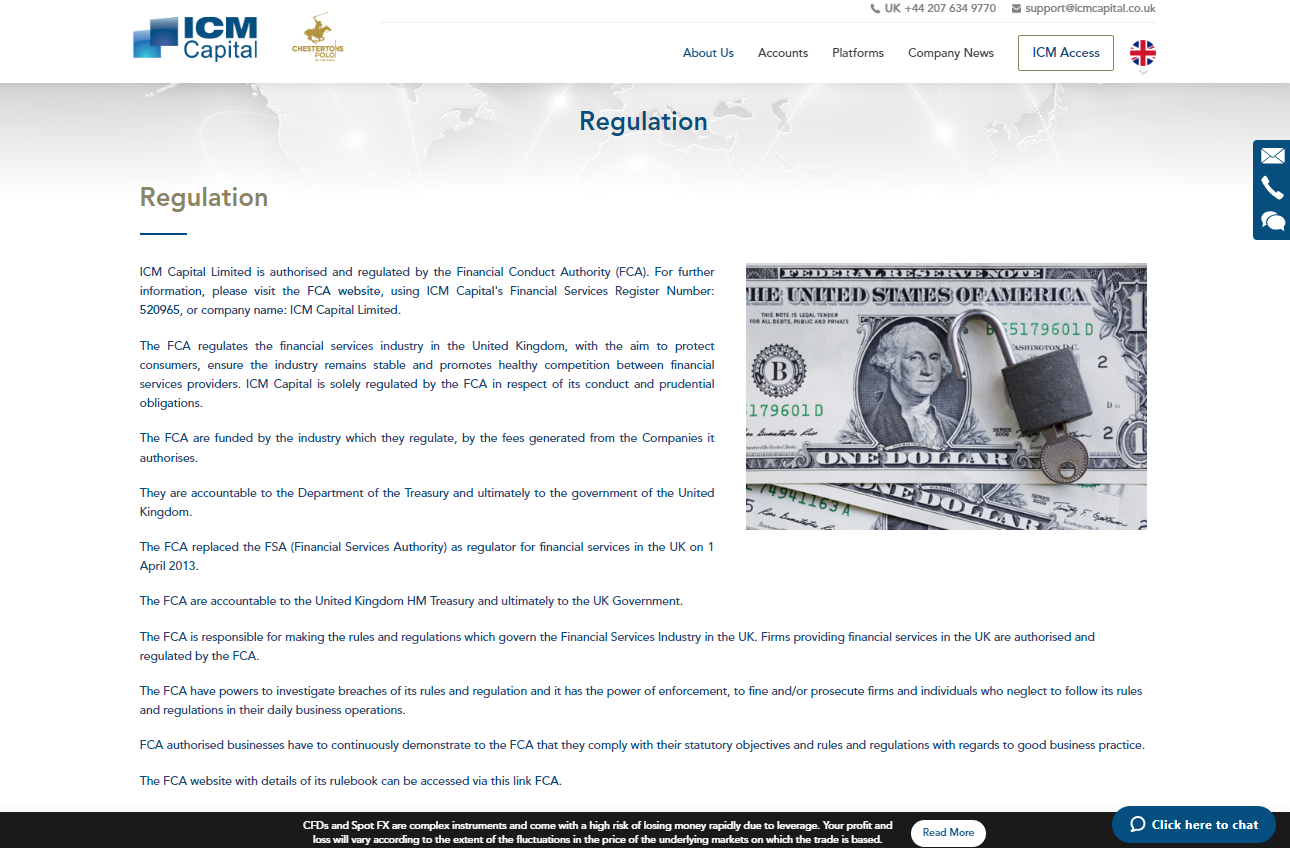

Safety and Security

ICM Capital is committed to ensuring the security of its customers’ funds and personal information. They use cold storage wallets, particularly in cryptocurrency trading, to protect digital assets from hacking and loss.

Additionally, it maintains stringent security processes to protect personal information against loss, theft, duplication, and unauthorized disclosure.

The privacy policies emphasize preserving customer information and providing a secure trading environment.

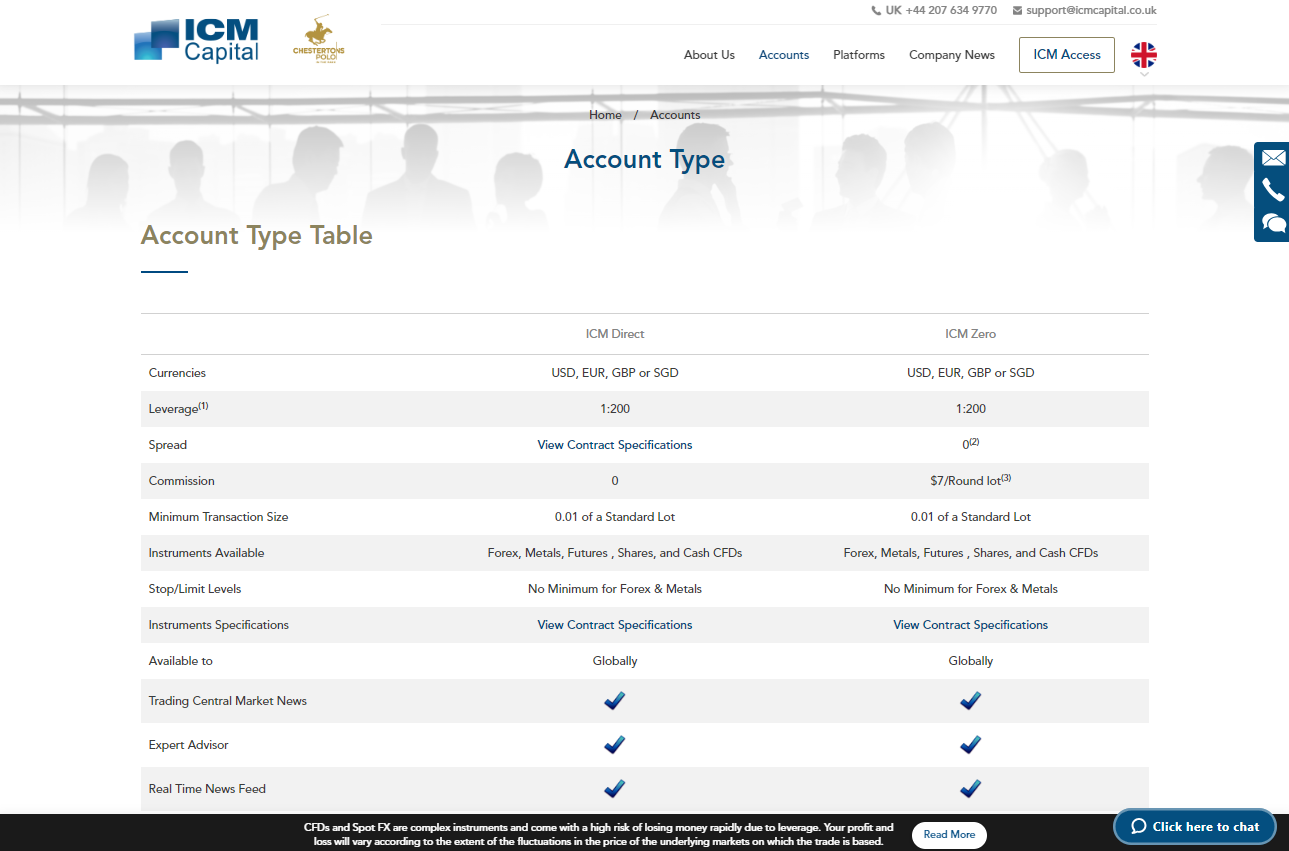

Account Types

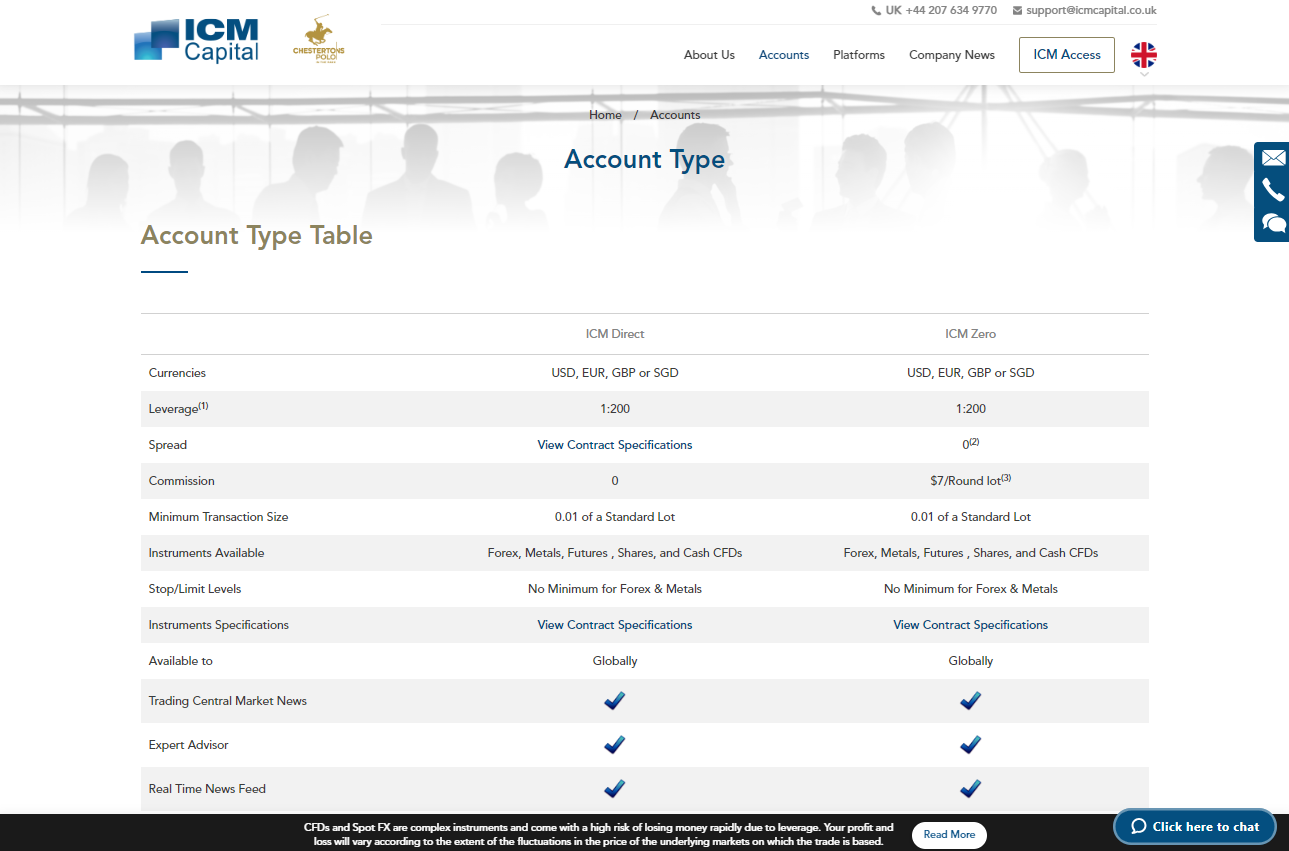

| 🔎 Account Type | 🥇 ICM Direct | 🥈 ICM Zero |

| 🩷 Best Suited | Ideal for beginners and casual traders | Ideal for scalpers, day traders, and professionals |

| 📈 Markets Available | All | All |

| 💷 Commissions | None. Only the spread is charged | $7 per round lot traded |

| 📉 Platforms | All | All |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots |

| 💹 Leverage | 1:200 | 1:200 |

| 💴 Minimum Deposit | 200 USD | 200 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here |

Direct Account

This account has greater spreads than the Zero account, but there are no commission costs. It is ideal for traders who desire a commission-free structure and are not focused on ultra-tight spreads.

Zero Account

This account provides raw spreads on key currency pairings beginning at 0.0 pips. However, a $7 commission per round turn lot applies. It is ideal for high-volume traders who want the narrowest spreads possible and are satisfied with the fee structure.

Demo Account

Demo accounts are a standard feature of most brokers, enabling inexperienced traders to test trading methods in a risk-free environment with virtual money.

The ICM Demo account most likely mirrors genuine market conditions without the financial risk, giving an educational platform for traders to get acquainted with the broker’s trading platforms and tools.

Islamic Account

Islamic accounts, also called swap-free accounts, adhere to Sharia law by not charging or accepting interest. Furthermore, this account type is intended for Muslim traders who want their trading activity to comply with Islamic financial norms.

Typically, Islamic accounts substitute swap costs with daily administrative fees for positions held overnight, guaranteeing that the trading process is interest-free.

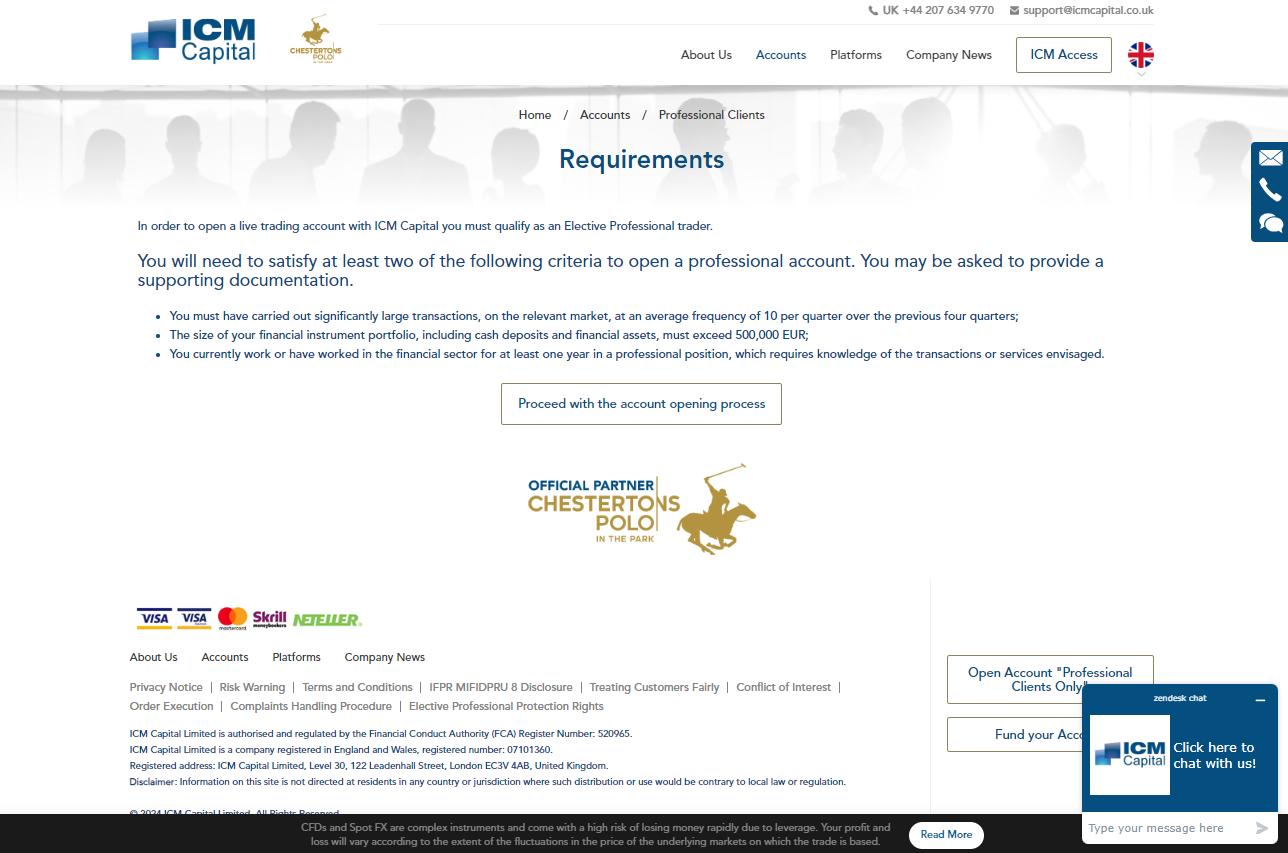

How To Open an Account

- To register an account, follow these steps:

- Go to the ICM Capital website.

- Next, click on the “Register” button.

- Complete the online registration form.

- Confirm your identity and your address.

- Finally, Fund your account.

- After your account has been funded, you can begin trading.

Trading Platforms and Software

MetaTrader 4 (MT4) is offered as its primary trading platform, catering to various trading requirements. The platform has a straightforward interface, excellent charting capabilities, and Expert Advisors for automated trading methods.

Furthermore, the Broker enhances the MT4 experience by adding smooth execution speeds and access to large liquidity pools, ensuring competitive pricing and minimal slippage.

The platform also includes bespoke indicators and analytical tools for beginner and experienced traders, promoting informed decision-making and strategy optimization.

Fees, Spreads, and, Commissions

Spreads

It offers two account types with varying spread possibilities. The ICM Direct account charges 1.3 pips on EUR/USD, offering beginners a competitive but larger spread. The Zero Account provides raw spreads on key currency pairings starting at 0.0 pips.

Commissions

The ICM Zero Account charges traders a $7 fee per round lot transacted, which is crucial for high-frequency traders or those executing large deals. This commission provides transparency in trading expenses and is allocated to each round-turn lot.

Overnight Fees

The Broker charges overnight fees for Forex and CFD trading, incurred when positions are kept open overnight.

The Broker aims to offer affordable fees, allowing traders to maintain long-term holdings without excessive charges. These fees are determined by interest rate differentials between currencies, ensuring fairness and transparency for traders.

Deposit and Withdrawal Fees

The Broker provides various deposit and withdrawal options, each with associated costs. Deposits include Moneybookers, Neteller, PayPal, and Visa/Mastercard, while withdrawals have a predetermined fee, such as 15 GBP.

Inactivity Fees

The Broker charges $50 after 12 months of account dormancy, a low fee to remind customers to stay active on the platform, but traders should maintain consistent activity to avoid excessive charges.

Currency Conversion Fees

The Broker charges a currency conversion fee for trades where traders trade instruments in a different currency than their account-based currency. This fee covers converting gains or losses into the account’s base currency, ensuring fair rates and transaction transparency.

Trading Instruments and Products

The following trading instruments and products are on offer:

- (OTC) Spot Foreign Exchange for key currency pairings.

- (OTC) Spot Precious Metals

- Key US stocks

- (OTC) Energy Futures

Additionally, ICM Capital enhances its portfolio with Cash CFDs, giving customers additional trading options and variety.

Deposit and Withdrawal Options

| 🔎 Payment Method | 🌎 Country | 🪙 Currencies Accepted | ⏰ Processing Time |

| 📈 Bank Transfer | All | Multi-currency | 2 – 5 days |

| 💳 Debit/Credit Cards | All | Multi-currency | 1 – 10 days |

| 📉 Skrill | All | Multi-currency | Instant – a few days |

| 📊 Neteller | All | Multi-currency | 1 day |

Deposit Options:

Bank Wire

- To wire funds from your account, go to the “Deposit” section.

- Next, Select Bank Wire and acquire ICM’s bank account information.

- Finally, instruct your bank to conduct a wire transfer using the funds and use your ICM account number as the reference.

Credit or Debit Card

- First, go to the “Deposit” area and pick your card type

- Next, enter your card’s number, expiration date, CVV, and deposit amount.

- Finally, follow any further authentication procedures

Withdrawal Options:

Bank Wire

- Go to your account’s “Withdraw” section to withdraw funds by bank wire.

- Next, select Bank Wire and enter your bank account information

- Finally, enter your desired withdrawal amount and submit the request.

Credit or Debit Cards

- Typically, you may only withdraw to the card you used to make the transaction.

- Next, enter your withdrawal amount in the “Withdraw” area.

- Finally, submit the withdrawal request.

Educational Resources

ICM Capital provides a comprehensive teaching platform through its ICM Capital Academy, offering tools for traders of all skill levels. The academy provides insights into market dynamics and economic data through online courses, weekly market update films, and educational webinars.

The “Trading for Beginners” course teaches fundamentals of online trading, while the “Path to Professional Trading” course focuses on improving trading abilities.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Highly Regulated | Customer Support not around the clock |

| Negative Balance Protection | Website not User Friendly |

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $0 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

In Conclusion

According to our findings, ICM Capital is a reputable Forex and CFD broker with over a decade of experience in the financial markets. It adheres to regulatory compliance, offering a safe trading environment.

Additionally, they offer a variety of account types and trading instruments and provide training tools through the ICM Academy.

Faq

Withdrawal processing timeframes with ICM Capital vary depending on the withdrawal option used. However, they normally range from a few days to a week.

ICM Capital principally provides the industry-standard MetaTrader 4 (MT4) platform, with additional choices for web-based trading and mobile trading applications.

ICM Capital demands a minimum deposit of $200 to register an account.