FXPRIMUS Review

- FXPRIMUS Review – Analysis of Brokers’ Main Features

- Overview

- Detailed Summary

- At a Glance

- Security Measures

- Account Types

- How To Open an FXPRIMUS Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Which Markets Can You Trade with FXPRIMUS?

- Leverage and Margin

- Deposit & Withdrawal Options

- Educational Resources

- Pros & Cons

- Conclusion

Overall, FXPRIMUS Review can be summarised as a trustworthy and well-regarded entity within the online financial trading arena. They have a global presence in crucial financial hubs like Australia and Belgium. They have a trust score of 69 out of 99

| 🔍 Broker | 🥇 FXPRIMUS |

| 💵 Minimun Deposit | 15 USD |

| 4️⃣ Ease of use Rating | 4/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

FXPRIMUS Review – Analysis of Brokers’ Main Features

- ☑️Overview

- ☑️Detailed Summary

- ☑️Security Measures

- ☑️Account Types

- ☑️How to Open an FXPRIMUS Account

- ☑️Trading Platforms and Software

- ☑️Fees, Spreads and Commissions

- ☑️Which Markets Can You Trade with FXPRIMUS

- ☑️Leverage and Margin

- ☑️Deposits and Withdrawals

- ☑️Educational Resources

- ☑️Pros and Cons

- ☑️In Conclusion

- ☑️Frequently Asked Questions

Overview

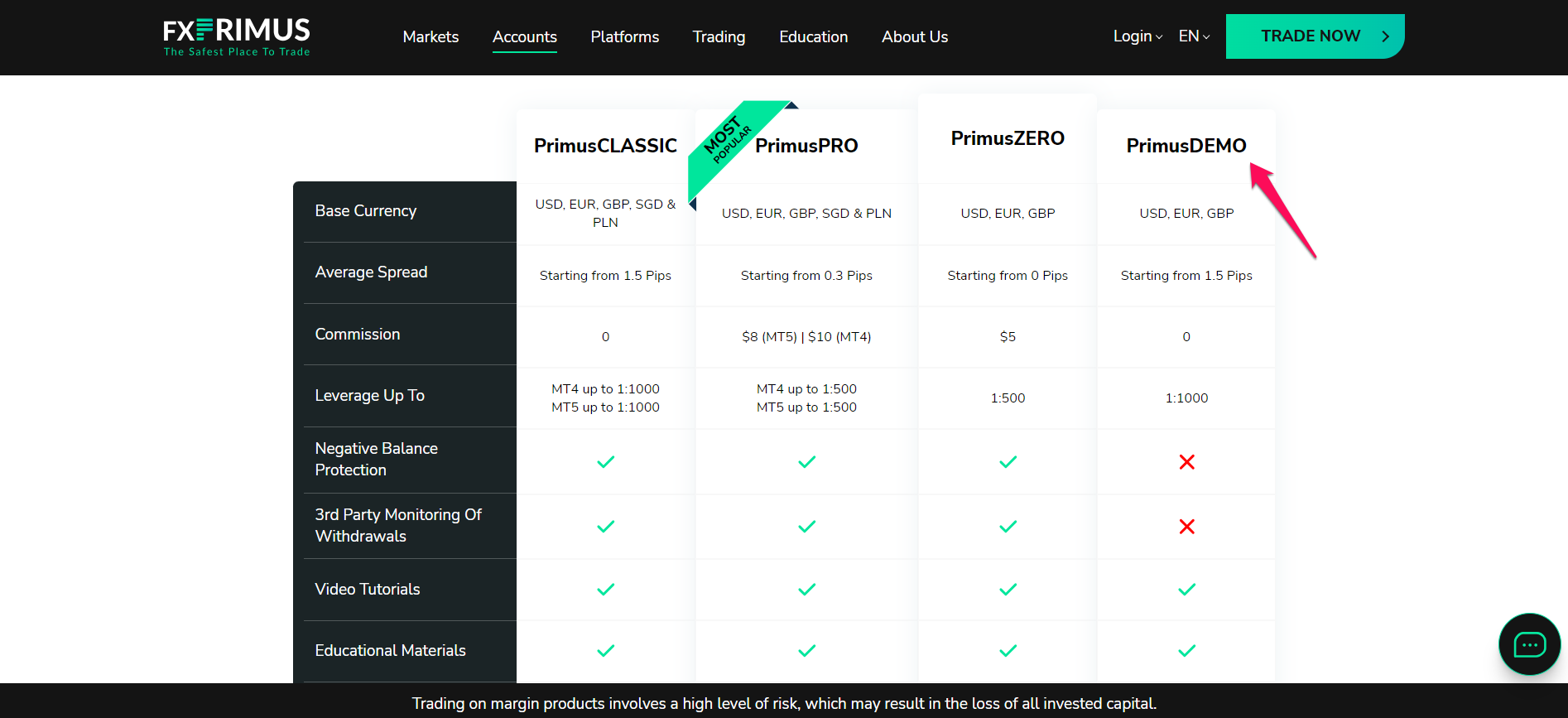

FXPRIMUS is considered high-risk, with an overall Trust Score of 69 out of 100. FXPRIMUS is licensed by zero Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and one Tier-3 Regulator (low trust). They offer three retail trading accounts: PrimusCLASSIC, PrimusZERO, and PrimusPRO.

Detailed Summary

FXPRIMUS, founded in 2009, began its journey as an online broker with offices in Vanuatu and Cyprus. This strategic posture created the groundwork for the company’s global footprint, which now provides a comprehensive variety of financial products to traders worldwide.

This comprehensive range of services allows customers to quickly diversify their portfolios across several asset classes on a single platform, hence improving their trading experience.

This broker prioritizes the safety and security of its clients’ cash, as seen by its robust insurance coverage, which covers up to 5 million euros.

Furthermore, the adoption of negative balance protection gives customers further comfort by prohibiting them from exceeding their deposits, efficiently controlling risk, and encouraging trust in their trading operations.

In addition, the company’s commitment to offering a safe and efficient trading environment is evident in the use of modern encryption technology and access to high-speed cloud services.

Their trading platforms, which include MetaTrader 4, MetaTrader 5, and cTrader, are well-known for their dependability and extensive functionality.

These user-friendly platforms offer a variety of trading activities, including hedging, scalping, and the usage of Expert Advisors (EAs), meeting the varying demands of traders throughout the world.

As a member of the PRIME Group, they have grown over the years to become a global supplier of trading solutions, providing a diverse range of products and services to meet the requirements of traders worldwide.

At a Glance

| 🔍 Broker | 🥇 FXPRIMUS |

| 🔢Established Year | 2009 |

| ⌛Regulation and Licenses | VFSC, CySEC |

| 4️⃣ Ease of Use Rating | 4/5 |

| 🎁Bonuses | None |

| 🕰️Support Hours | 24/5 |

| 📊Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| 🗂️Account Types | PrimusCLASSIC, PrimusZERO, PrimusPRO |

| 💴Base Currencies | USD, EUR, GBP, SGD, PLN |

| 📝Spreads | From 0.0 pips |

| 📈Leverage | 1:1000 |

| 💷Currency Pairs | 43; minor, major, exotic pairs |

| 💵Minimum Deposit | 15 USD |

| 💶Inactivity Fee | None |

| 🗣️Website Languages | English, Thai, Spanish, Portuguese, Czech, Chinese, Arabic, Indonesian, Somali, Vietnamese |

| 💸Fees and Commissions | Spreads from 0.0 pips, commissions from $5 |

| 🤝Affiliate Program | ✅ Yes |

| ❌Banned Countries | Australia, Belgium, Iran, Japan, North Korea, United States |

| ➡️Scalping | ✅ Yes |

| 👉Hedging | ✅ Yes |

| 🛢️Trading Instruments | Forex, shares, energies, precious metals, indices, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

What sets FXPRIMUS apart in terms of client fund security?

They insure clients’ money up to 5 million euros, providing traders with unrivaled protection and peace of mind.

Can traders access social trading on FXPRIMUS?

Yes, they enable social and copy trading, which allows traders to replicate the techniques of more experienced traders.

Security Measures

At FXPRIMUS, the safety of its clients’ assets and trading activities takes precedence.

An extensive approach is employed to achieve a secure operating environment with strict adherence to regulations set by esteemed financial watchdogs such as the Cyprus Securities Exchange Commission (CySEC) and Vanuatu Financial Services Commission (VFSC).

Such vigilance ensures that compliance standards are always met, making them a dependable trader’s choice for upholding superior fiscal practices.

To enhance the safety of customer funds, they partner with leading financial institutions to offer liquidity solutions. HSBC is one such custodian that plays a crucial role in this collaboration.

This association with reputed organizations ensures client investments are managed with utmost security and ethics.

Moreover, this broker offers negative balance protection as an essential feature for preventing customers from accruing debt beyond their account balances during unforeseen market changes.

Such practices form part of a holistic approach toward risk management aimed at shielding traders against excessive fluctuation risks prevailing in markets today.

Moreover, through its investment in technology, the broker enhances the safety of trading practices.

By collaborating with renowned industry professionals and utilizing state-of-the-art tools, FXPRIMUS delivers rapid execution rates and minimal delays, culminating in a flawless atmosphere for traders to operate.

The platform’s technical architecture caters equally to novice and experienced traders while wholeheartedly demonstrating their commitment to dispensing an effective yet secure trading infrastructure.

How does FXPRIMUS manage risk for its clients?

They implement extensive risk management measures like leverage limitations and margin requirements to safeguard its clients.

Does FXPRIMUS securely process withdrawals and deposits?

Yes, they secure withdrawals and deposits with SSL encryption and verification processes.

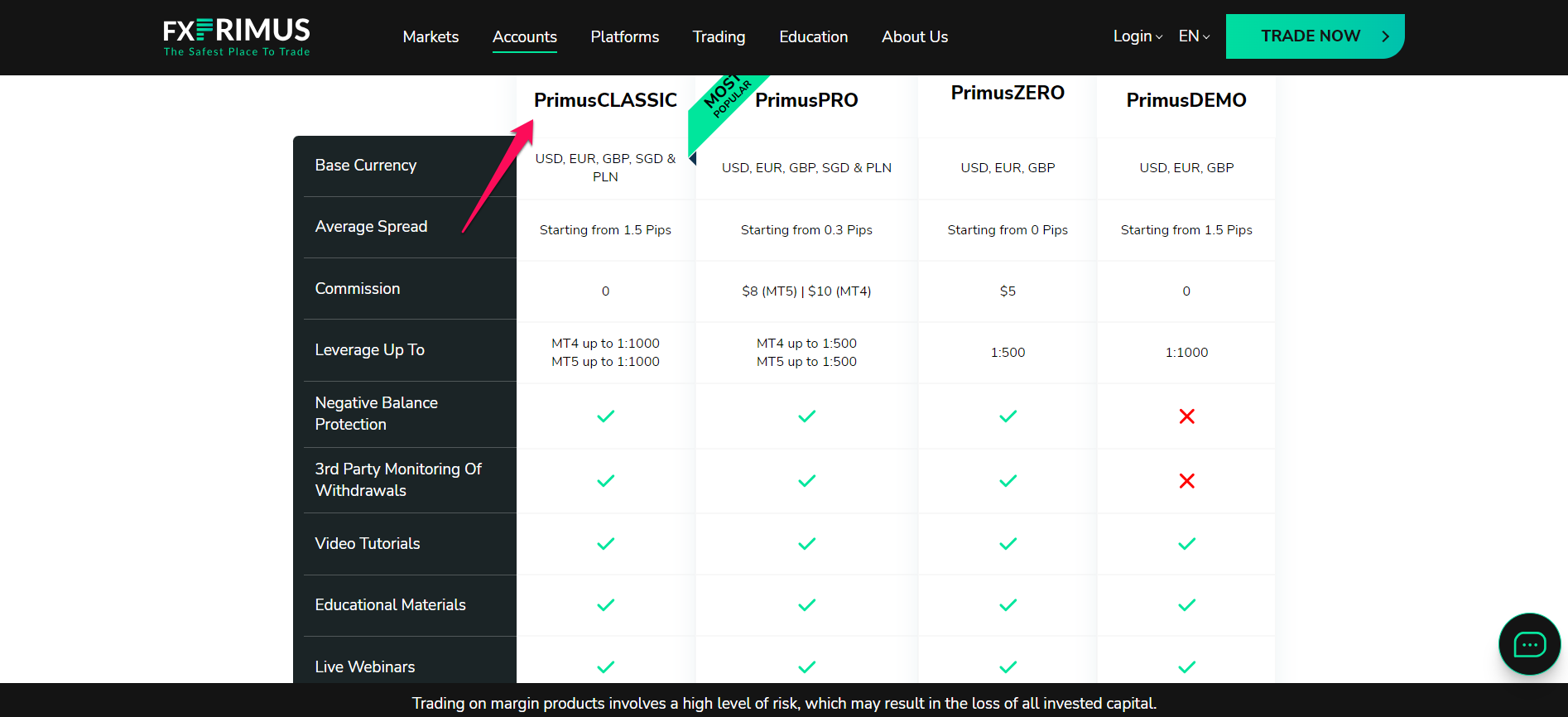

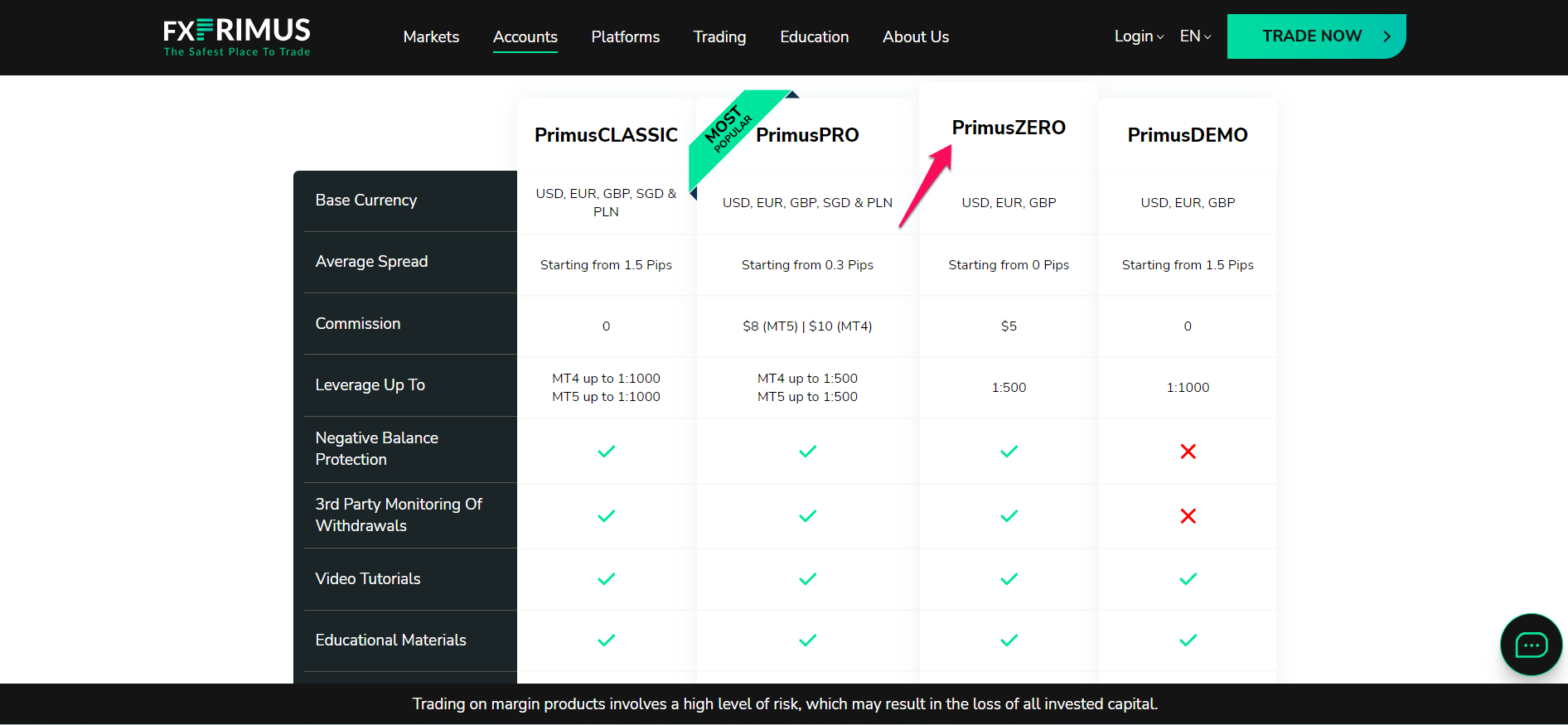

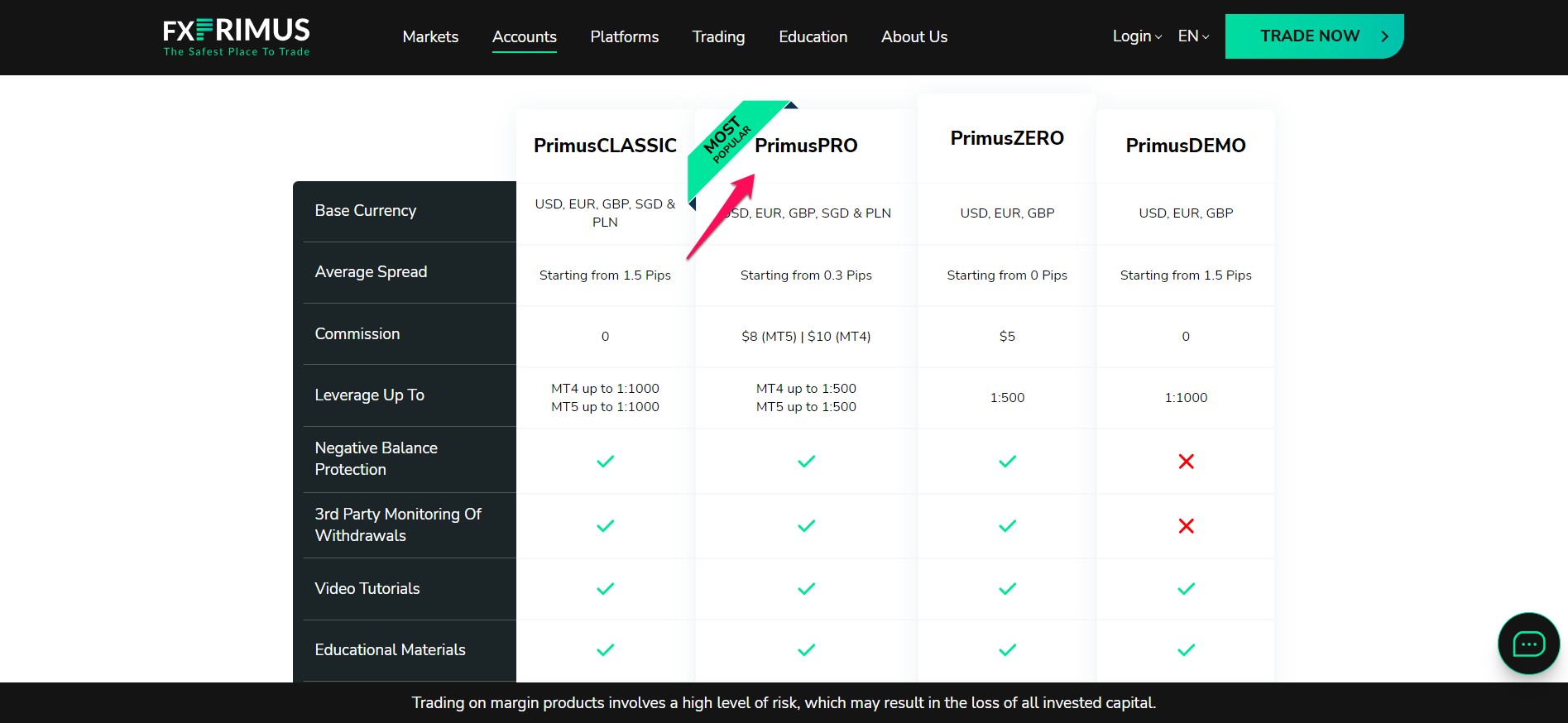

Account Types

| 🔍Account Type | 🥇PrimusCLASSIC | 🥈PrimusZERO | 🥉PrimusPRO |

| ⌚Availability | All; suitable for casual traders | All; suitable for scalpers, day, and algorithmic traders | All; suitable for experienced traders |

| 📊Markets | All | All | All |

| 💴Commissions | None; only the spread is charged | $5 | $8 on MT5, $10 on MT4 |

| 📊Platforms | MT4 and 5 | MetaTrader 4 | MT4 and 5 |

| ⬆️Trade Size | 0.01 – 300 lots | 0.01 – 300 lots | 0.01 – 300 lots |

| 📈Leverage | 1:1000 (MT4 and 5) | 1:500 (MT4) | 1:500 (MT4), 1:1000 (MT5) |

| 💵Minimum Deposit | 15 USD | 15 USD | 15 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here |

PrimusCLASSIC Account

For individuals in pursuit of a hassle-free trading experience devoid of additional charges, they introduce the PrimusCLASSIC account.

This offering is tailored for retail traders and provides variable spreads at a competitive 1.5 pips for major currency pairs. It necessitates a minimal deposit of just $15 and does not entail any supplementary commissions.

With the added advantage of leverage of up to 1:1000 and the absence of commission costs, this option is particularly accessible to beginners or those with more limited budgets.

Including educational resources and safeguard measures against negative balances further enrich its appeal, positioning it as a comprehensive and welcoming entry point into the world of forex market participation.

PrimusZERO Account

The PrimusZERO account caters to proficient traders who desire superior trading conditions with reduced spreads.

This option features a nominal spread of 0.0 pips for eminent currency pairs and a round lot fee of $5. It requires an initial deposit of at least $1,000, which suggests its orientation towards committed traders.

The MetaTrader 4 platform offers leverage up to 1:500 to appeal more effectively to those seeking execution time and pricing exactitude in their transactions.

PrimusPRO Account

PrimusPRO account caters to a diverse group of traders, encompassing retail and professional individuals seeking ECN-like trading conditions. This account commences with spreads as low as 0.3 pips on major currency pairs and incurs a cost of $8 to $10 per round lot traded.

A minimum deposit of $500 is required to open such an account. It boasts leverage options of up to 1:500 on the MT4 platform or even higher, reaching 1:1000 when using the MT5 platform. This enables traders to magnify their positions swiftly.

Moreover, the PrimusPRO account grants access to advanced trading techniques and provides a comprehensive and feature-rich trading environment that facilitates seamless trade executions.

This, in turn, empowers traders with the tools and strategies they need to achieve their trading objectives effectively.

Demo Account

Traders who wish to acquaint themselves with this broker’s offerings without incurring financial risk will find the Demo Account a valuable resource.

Mimicking real market conditions, this account furnishes traders with simulated funds to formulate strategies and familiarize themselves with the trading platform.

Whether new to trading or an experienced professional seeking fresh approaches, this tool offers excellent support for gaining expertise as it never expires, allowing all customers ample time to explore every aspect of their trading environment at their own pace.

Islamic Account

An Islamic Account is available, adhering to the principles of Islamic financing. This interest-free option enables Muslim traders to engage in trading activities while avoiding any associated costs that conflict with Sharia law.

The account boasts similar exceptional trading conditions as other accounts including competitive leverage and spreads.

However, no swap fees are accumulated on overnight positions due to ethical business practices upheld by the broker’s comprehensive trading expertise for a complete experience.

Does FXPRIMUS offer accounts for professional traders?

Yes, the PrimusPRO account is designed for professional traders with special trading requirements.

What are the benefits of opening a PrimusZERO account with FXPRIMUS?

PrimusZERO accounts have spread as low as 0.0 pips and cost $5 per lot, making them suitable for high-volume traders.

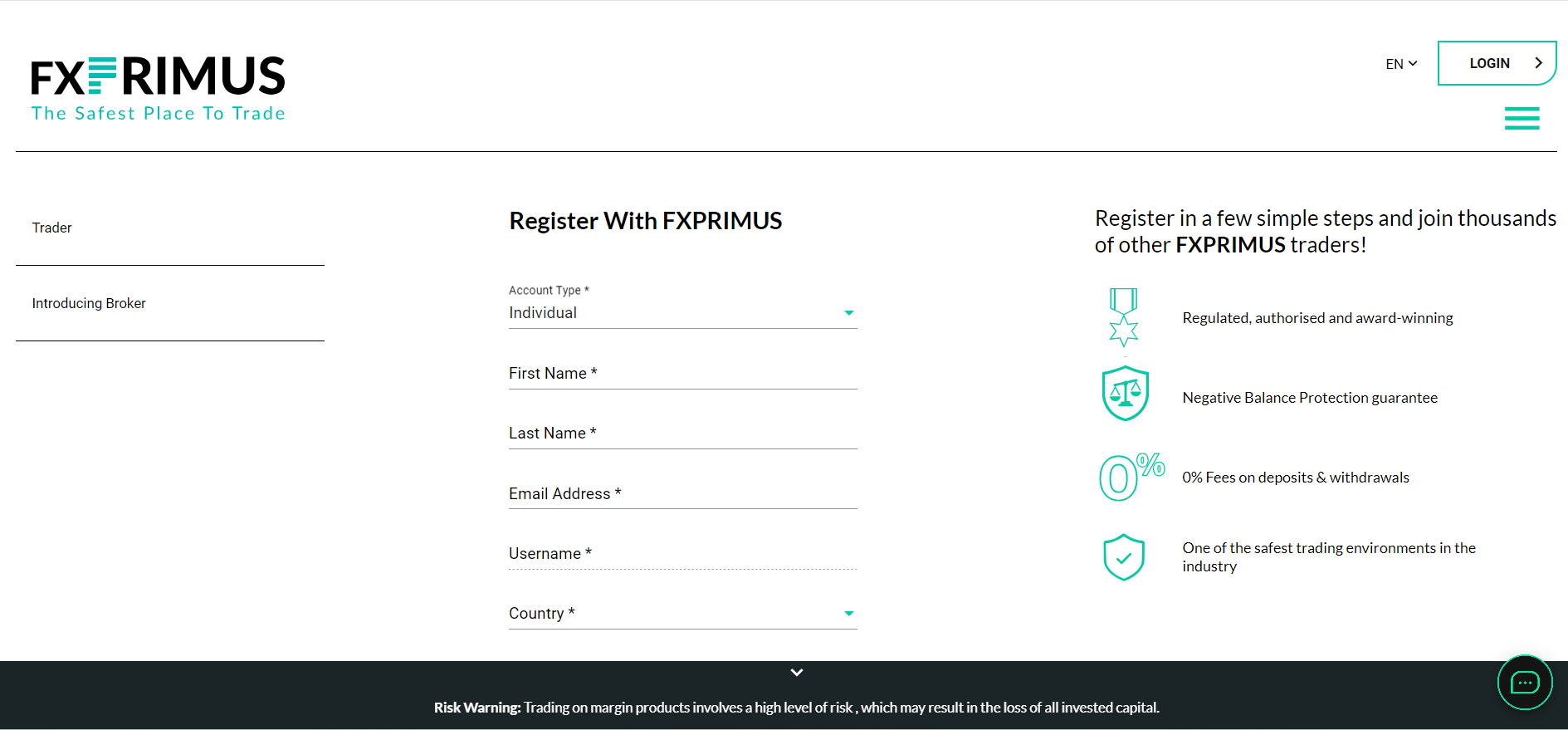

How To Open an FXPRIMUS Account

✅Go to https://fxprimus.com/ and then click the “Start Trading” option.

✅Choose the account that best meets your trading goals and skill level. Consider the minimum deposit, spreads, commissions, and available platforms.

✅Click the “Open Account” button, then fill out the online form with your personal information. This contains your full name, email address, phone number, and country of residence.

✅Select a secure username and password for account access.

✅To comply with requirements, upload the needed papers, which include a government-issued ID and proof of address.

✅ Choose your desired deposit method and send the minimum amount specified for your account type. They provide various payment choices, including credit/debit cards, bank transfers, and e-wallets.

✅Choose your favorite platform (MT4, MT5, or cTrader) and download it onto your smartphone.

✅Once your account has been financed and validated, you may log in to your platform and start trading.

How quickly can I start trading after opening an account with FXPRIMUS?

After account verification, you can begin trading immediately after funding your account.

Is there a minimum age requirement to open an account with FXPRIMUS?

The minimum age for opening an account is 18 years.

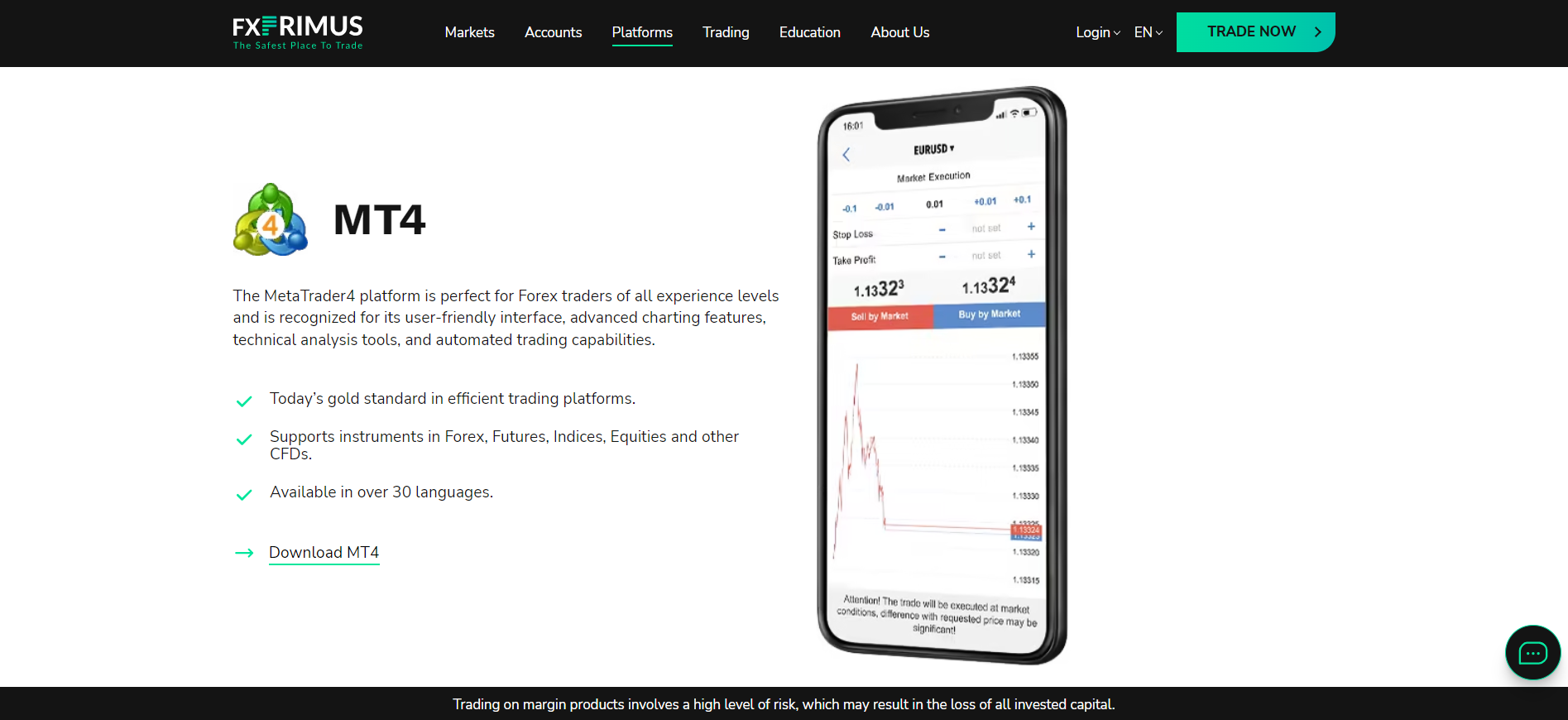

Trading Platforms and Software

MetaTrader 4

MT4’s status as a top-tier trading platform is evident in its long-standing track record of excellence. They have built upon this rich history by offering clients a user-friendly MT4 experience packed with robust features.

One major selling point of the platform lies in its customizability – traders can tailor their setups to suit their preferences using an array of technical indicators and charting tools.

Furthermore, it excels at automated trading through Expert Advisors (EAs), making it particularly attractive for those seeking efficiency and precision in today’s fast-paced market environment.

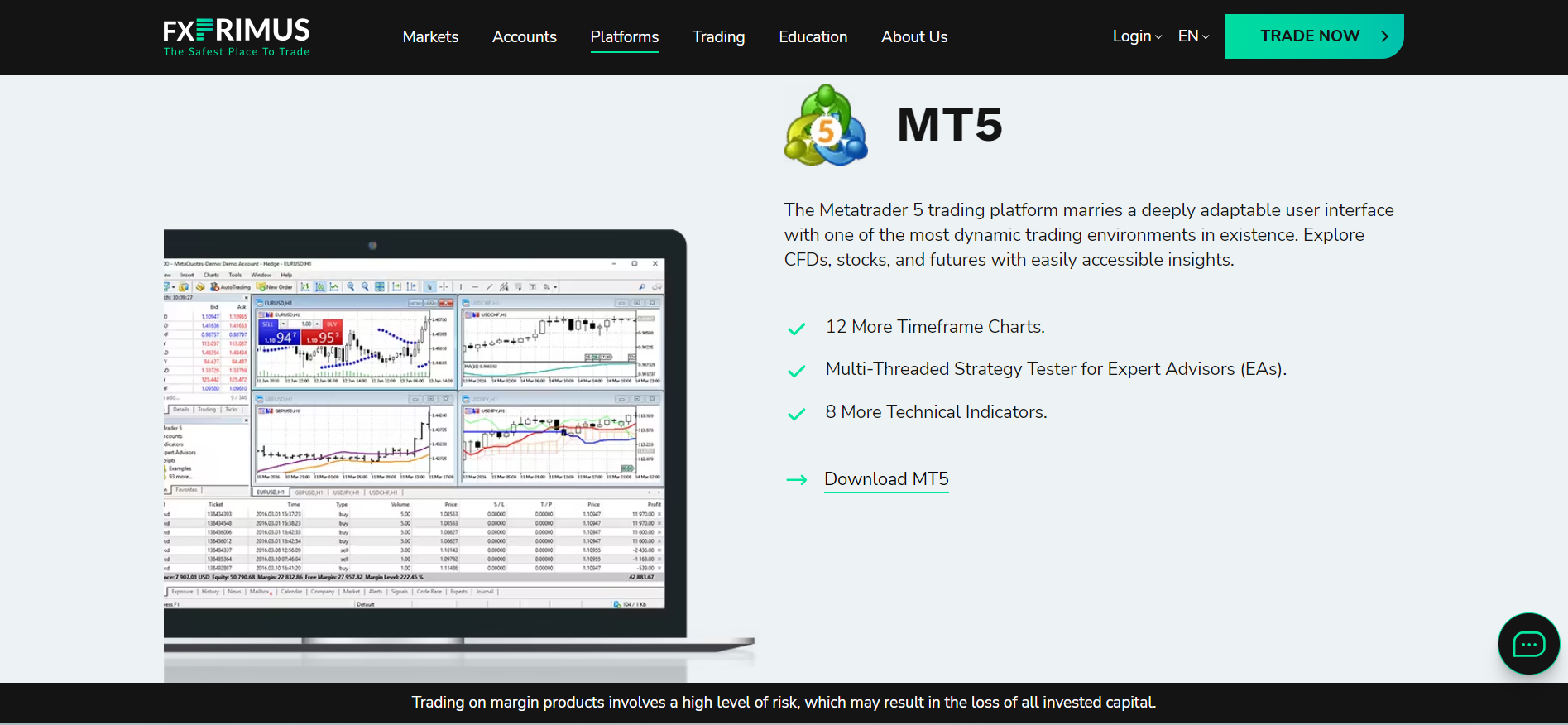

MetaTrader 5

They have embraced the MetaTrader 5 (MT5) platform to meet the ever-changing requirements of modern traders.

MT5 preserves the fundamental elements that contributed to the success of MT4 while augmenting its capabilities with advanced charting tools, diverse pending order types, expanded timeframes, and an integrated economic calendar.

Furthermore, it provides access to a broader spectrum of markets, including commodities, indices, and equities, thus establishing itself as a versatile multi-asset solution.

The forward-looking design of MT5 incorporates innovations in algorithmic trading, attracting clients who seek a high degree of flexibility and performance from their trading software.

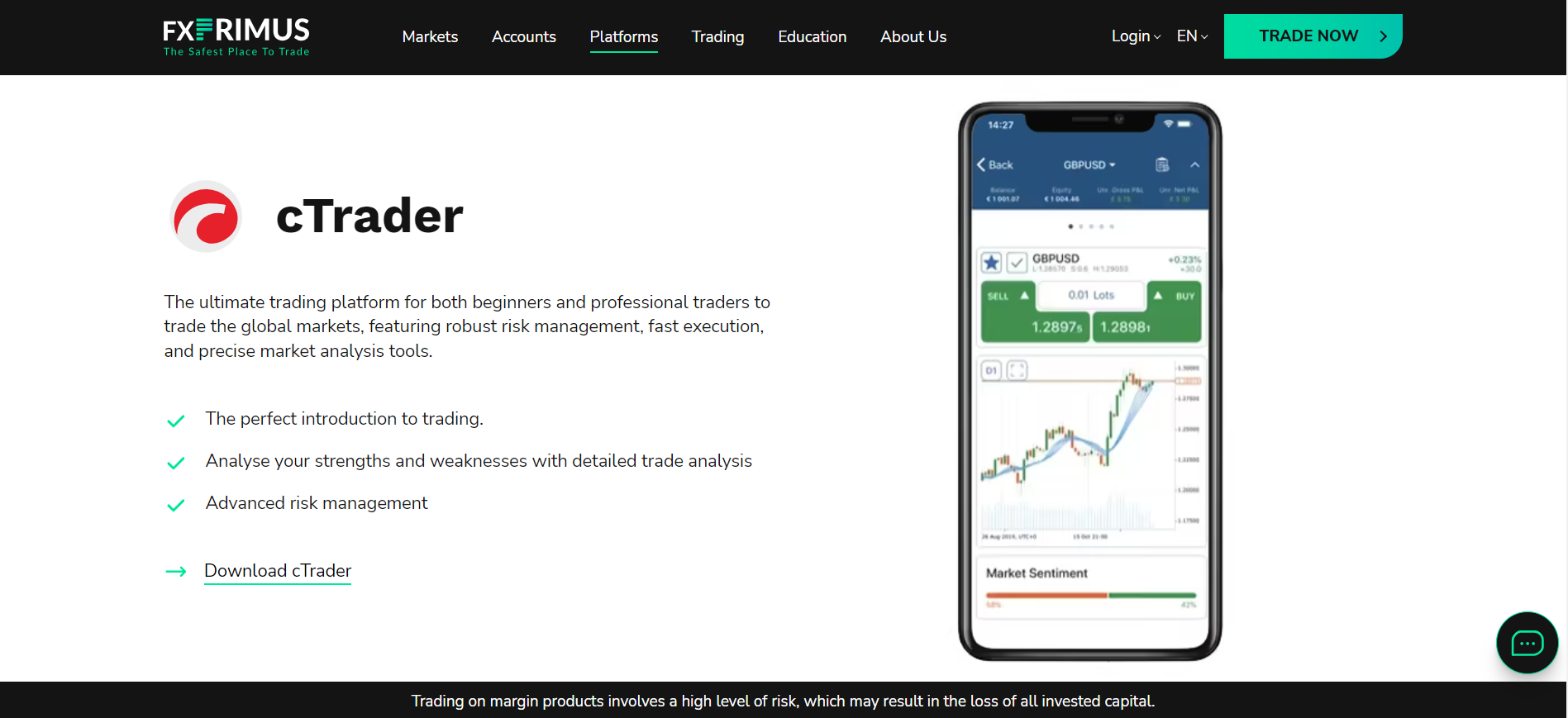

cTrader

Traders seeking a seamless and direct trading experience prefer cTrader, thanks to its clean design and user-friendly interface.

The broker acknowledges the platform’s popularity as an alternative to the MetaTrader suite due to improved order execution capabilities and comprehensive risk management features.

With level II pricing displaying executable prices from liquidity sources, traders are relying on accuracy and benefit greatly from this openness.

Additionally, cTrader offers a customizable algorithmic trading environment with cutting-edge infrastructure – making it attractive for those looking to test their algorithms seamlessly.

What are the main features of the cTrader platform provided by FXPRIMUS?

The cTrader platform provides advanced trading features such as level II pricing, one-click trading, and rich charting tools.

Can I access one-click trading with FXPRIMUS?

Yes, one-click trading is available on their platforms, streamlining the trading procedure for faster execution.

Fees, Spreads, and, Commissions

Spreads

This broker is renowned for its competitively low spreads, demonstrating the broker’s unwavering commitment to providing economical trading options.

On selected accounts, these spreads start at an incredibly narrow 0.0 pips – a major advantage to traders actively participating in market entry and exit strategies such as scalping.

In markets with ample liquidity, narrower spreads are vital to lessen transactional expenses and drive higher potential profits.

Account types may vary regarding spread structures offered by this broker, enabling traders to choose account types that align with their unique volume requirements while maintaining optimal cost-efficiency across all transactions executed.

Commissions

This broker offers a transparent commission system dependent on the user’s choice of account type. For instance, the PrimusZERO plan charges $5 per round turn lot, making it an attractive option for traders who prefer tighter spreads and higher volume trading at a reasonable cost.

On the other hand, with ECN-like conditions and prices ranging from $8 to $10 per round turn lot, PrimusPRO caters to those seeking even lower spread expenses but are willing to pay transaction fees in return.

Overnight Fees

The broker implements a charge for overnight trading, commonly known as swap fees. The aim is to account for the trader’s leverage utilized during the night shift.

Although they do not display the rates of these swap charges conspicuously on their website, they can be easily accessed through their available trading platforms.

Traders must take note of such costs since it could affect the profitability of any trades left open beyond one day, especially those extended over an extended period.

Awareness of this overhead fee helps strategize potential transactions better while considering long-term positions’ outcomes.

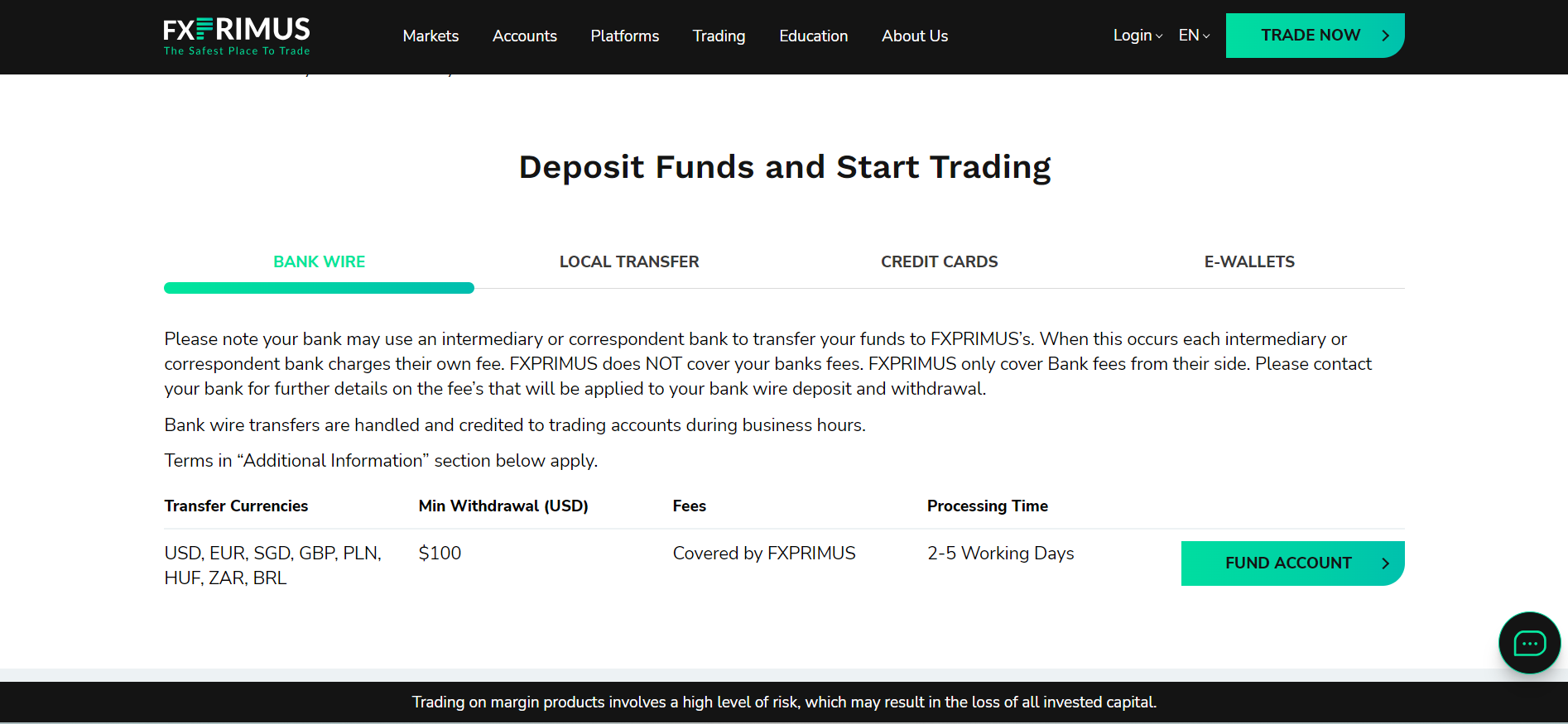

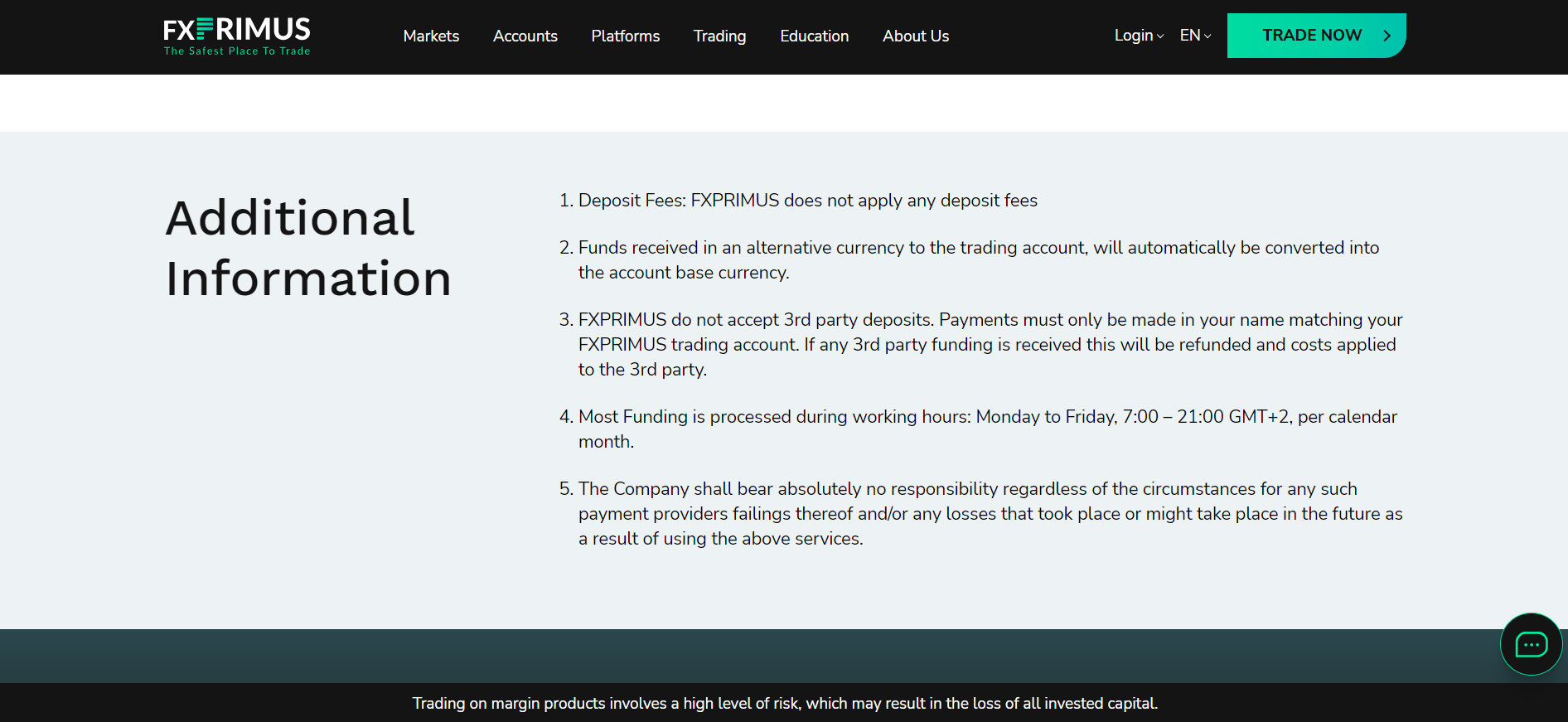

Deposit and Withdrawal Fees

FXPRIMUS aims to simplify the funding process by eliminating deposit and withdrawal fees.

This approach enhances traders’ overall trading experience they can manage their funds more efficiently without incurring extra charges whenever they transfer money into or out of their accounts.

They adhere to a client-focused strategy that empowers traders with control over their finances, manifested through this fee-free system for deposits and withdrawals.

Inactivity Fees

For traders who are not constantly engaged in trading, the issue of inactivity fees is significant. Nevertheless, this broker does not punish its clients for being inactive. Hence, their accounts will remain untouched if they do not execute trades during a specific period.

This absence of charges for inactivity is an advantage to those traders who adopt a more passive approach or wish to take time off from trading without apprehension about losing their account balance due to penalties imposed on them because of their non-transactional status.

Currency Conversion Fees

When traders use a currency other than their account’s base currency, currency conversion charges may apply.

They follow market practice by imposing conversion fees in such cases to cover expenses incurred during the exchange process.

Traders should consider this fee when making deposits or withdrawals in non-base currencies, as it can affect available trading funds and withdrawal amounts received.

What are the typical spreads for major forex pairs at FXPRIMUS?

They charge competitive spreads for key forex pairs starting at 0.0 pips on selected account types.

Which Markets Can You Trade with FXPRIMUS?

They offer the following trading instruments and products:

✅Forex – Provides a wide choice of 43 currency pairs for trading, including major, minor, and exotic pairings, giving traders plenty of possibilities to bet on the movements of various global economies and execute diverse forex trading techniques.

✅Shares – A total of 110 share CFDs are available, allowing traders to track top firms’ performance without holding the underlying asset, making it perfect for individuals wishing to profit from stock market volatility through a derivative form.

✅Energies – Traders have access to four distinct energy instruments, including prominent commodities such as oil and natural gas, allowing them to profit from market patterns impacted by geopolitical, environmental, and economic considerations.

✅Precious Metals – With five precious metal products available, traders may invest in valuable commodities like gold and silver, which are generally considered safe havens during market instability or inflationary pressures.

✅Indices – There are 15 accessible indices, allowing traders to speculate on the overall performance of market sectors and top-performing corporations across many worldwide exchanges.

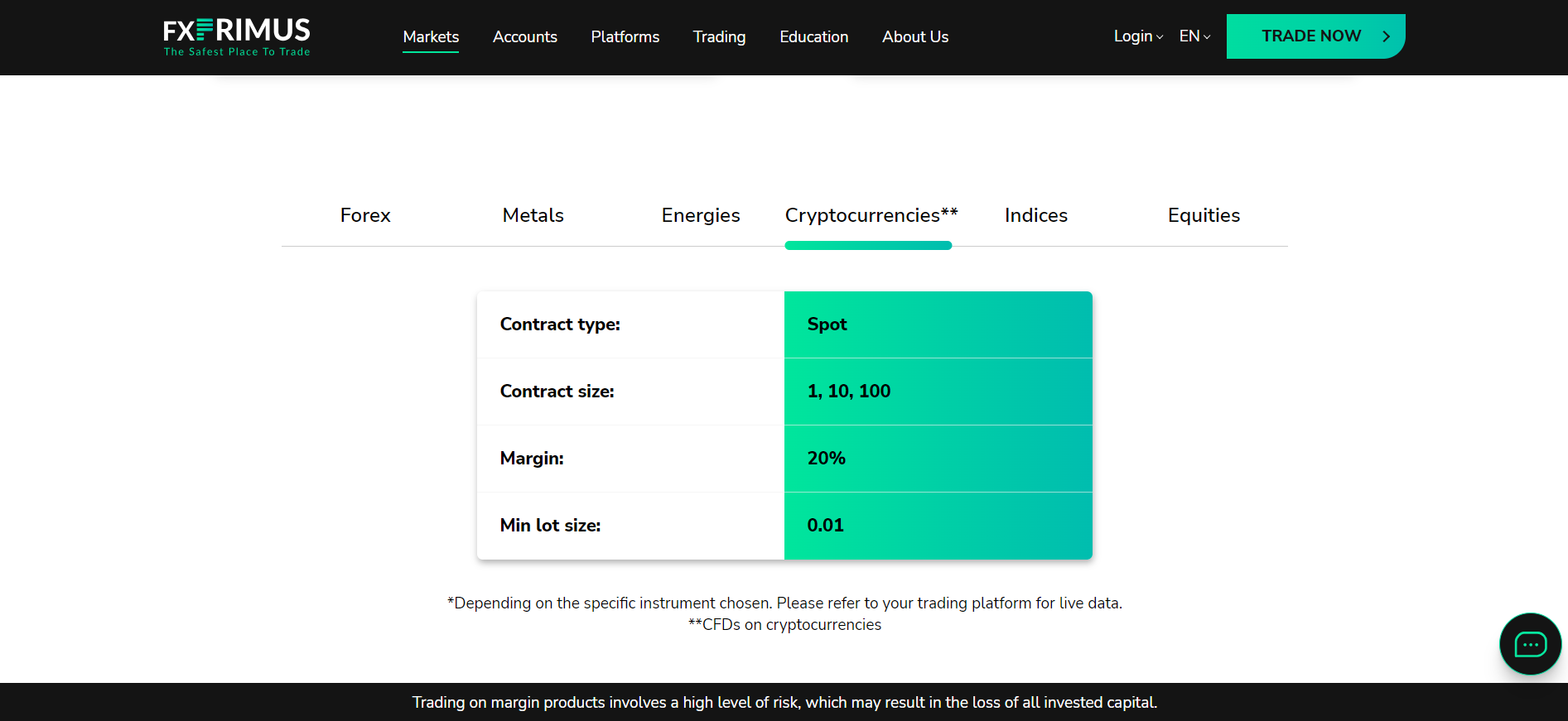

✅Cryptocurrencies – They offer four cryptocurrency choices, responding to the rising demand for digital assets and allowing traders to participate in this creative and unpredictable market.

Are precious metals trading options available with FXPRIMUS?

Yes, they allow traders to invest in precious metals such as gold and silver.

Can I trade energies like oil and gas with FXPRIMUS?

Yes, they allow trading in various energy commodities, including oil and natural gas.

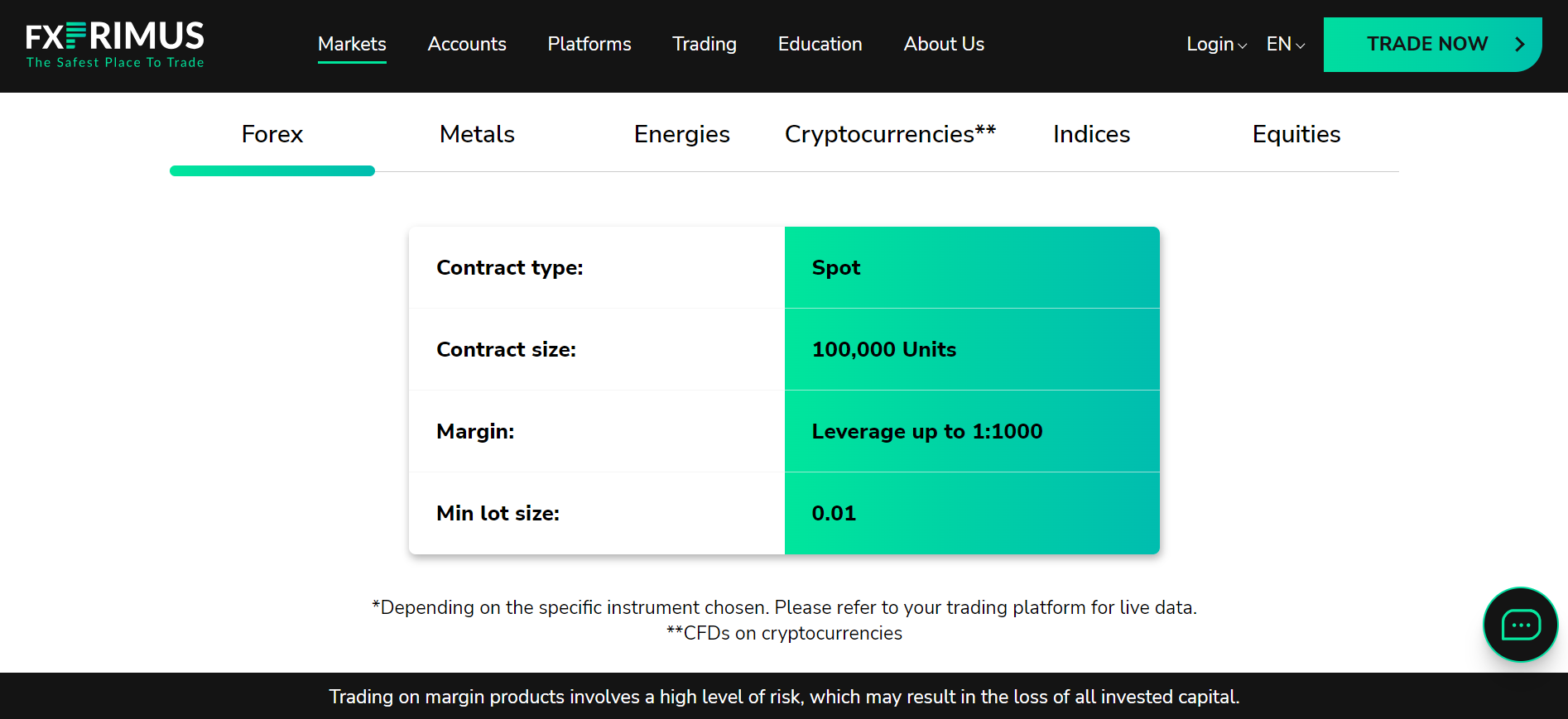

Leverage and Margin

This broker offers a range of leverage options tailored to different traders and account balances in line with its revised Risk Management Policy. The PrimusCLASSIC account has a maximum leverage of 1:1000 for traders up to $5,000, while the PrimusPRO account has a different structure.

Traders with equity between $5,000 and $50,000 can use leverage up to 1:500, while those between $20,001 and $50,000 can use leverage up to 1:200.

Leverage on bigger account balances decreases, with $50,000 to $100,000 qualifying for leverage up to 1:100 and $100,000 to $100,000 eligible for leverage up to 1:50.

The 1:1000 leverage option is not generally available on the PrimusPRO account but can be added on a case-by-case basis. This tiered leverage method demonstrates their commitment to risk reduction, ensuring that bigger account balances are handled with lower leverage to minimize risk.

How does leverage vary by account type at FXPRIMUS?

They provide varying leverage levels, with the PrimusPRO account allowing up to 1:500 and changes based on account equity.

How does FXPRIMUS protect against negative balance?

They provide negative balance protection, which means clients cannot lose more than their account balance.

Deposit & Withdrawal Options

| 🔍Payment Method | 🌎Country | 💴Currencies Accepted | ⏰Processing Time |

| 🏦Bank Wire | All | USD, EUR, SGD, GBP, PLN, HUF, ZAR, BRL | 2 – 5 days |

| ➡️Local Transfer | Malaysia, Indonesia, Vietnam, Thailand | MYR, IDR, VND, THB | 1 – 5 days |

| 💳Credit/Debit Card | All | USD, EUR, SGD, GBP, PLN, HUF | 5 minutes |

| 💸e-wallets | All | USD, EUR, SGD, GBP, PLN, HUF | 5 minutes |

Deposit Methods:

Bank Wire

✅Log onto your account and go to the “Funding” section.

✅Choose “Bank Wire Transfer” as your deposit option.

✅Select your selected currency and enter your desired deposit amount.

✅Examine the bank information supplied by the broker, including account name, number, and bank address.

✅Begin the deposit from your bank, ensuring all data match the broker’s information. Allow two to five business days for the funds to appear in your trading account.

Credit or Debit Card

✅Log in and visit the “Funding” area.

✅Choose “Credit/Debit Card” as your deposit method.

✅Enter your card information, including the card number, expiration date, and CVV code.

✅Select your desired deposit currency and amount.

✅Verify the transaction information and follow your bank’s security requirements. Funds are normally credited immediately after proper authorization.

Cryptocurrency Wallets

✅Access the “Funding” section and select “Cryptocurrency Deposit.”

✅Choose your desired cryptocurrency (such as Bitcoin or Ethereum).

✅You will obtain a wallet address that is unique to your deposit.

✅Transfer the necessary amount from your cryptocurrency wallet to the specified address. Processing times vary based on the coin used and network congestion.

e-Wallets or Payment Gateways

✅Navigate to the ‘Funding’ page in your dashboard

✅Choose your favorite e-wallet (e.g., Neteller, Skrill).

✅Enter your e-wallet credentials and confirm the transaction.

✅Select your deposit currency and amount.

✅Complete any extra verification procedures necessary by your e-wallet provider. Funds are normally credited immediately after successful processing.

Withdrawal Methods:

Bank Wire

✅Navigate to the “Funding” section and click “Withdrawal.”

✅Select “Bank Wire Transfer” as your withdrawal option.

✅Enter your bank account information, including name, number, and address.

✅Choose the withdrawal currency and amount.

✅Review the information and submit your request. Processing typically takes 2-5 working days, and the brokers pays all associated bank expenses.

Cryptocurrency Wallets

✅Access the “Funding” section and select “Cryptocurrency Withdrawal.”

✅Choose your desired cryptocurrency (such as Bitcoin or Ethereum).

✅You will obtain a wallet address that is unique to your withdrawal.

✅Make sure you select the same cryptocurrency you used to make your deposit.

✅Enter the withdrawal amount and your cryptocurrency wallet address.

✅Submit the request and allow time for processing according to your chosen crypto network.

e-Wallets or Payment Gateways

✅Access “Funding” and choose “Withdrawal.”

✅Choose your favorite e-wallet option.

✅Enter your e-wallet login information and select a withdrawal amount.

✅Complete any extra verification procedures necessary by your e-wallet provider. Withdrawals are normally handled within 24 hours; however, wait periods may differ based on the method used.

Can I deposit funds in currencies other than USD with FXPRIMUS?

Yes, they accept deposits in several currencies, including EUR, GBP, PLN, and others, making it accessible to traders worldwide.

What is the minimum withdrawal amount at FXPRIMUS?

The minimum withdrawal amount is decided on the withdrawal method, which can start as low as $5 for various methods.

Educational Resources

✅FXPRIMUS Academy serves as the focal location for all instructional resources.

✅It provides a wide range of resources for traders of various skill levels.

✅Beginners may have access to key materials such as basic terminology, chart interpretation, and risk management concepts via user-friendly video courses and informative articles.

✅For advanced traders, the Academy offers in-depth training on technical and fundamental analysis, algorithmic trading, advanced risk mitigation strategies, and webinars presented by industry professionals.

✅Interactive tools and simulations are offered for the practical application of information, with demo accounts that mimic current market situations.

✅Traders may keep updated by reading market insights and analysis, such as daily market updates, economic calendars, and expert comments.

✅The FXPRIMUS Academy also encourages community interaction, allowing traders to communicate, exchange ideas, and learn collectively, with dedicated customer support to provide a thorough learning experience.

Are there advanced trading strategies covered in FXPRIMUS’ educational resources?

Yes, sophisticated traders can learn about complicated trading methods and analytical techniques through seminars and in-depth tutorials.

Does FXPRIMUS offer demo accounts alongside educational resources?

Yes, they supplement its instructional offers with demo accounts, allowing traders to test techniques risk-free.

Pros & Cons

| ✅ Pros | ❌ Cons |

| FXPRIMUS is licensed and regulated by CySEC and VFSC | Credit/debit card withdrawals are not permitted owing to regulations |

| Provides narrow spreads on key currency pairings, especially on the ECN account | Does not provide promotions or incentives like other brokers, which may appeal to new traders |

| Multilingual support is offered by live chat, email, and phone | FXPRIMUS' FSCA regulation has expired |

| FXPRIMUS provides swap-free trading alternatives for Sharia-compliant clientele | Lack of comprehensive market analysis and research resources compared to competitors |

| There is basic educational material available to beginners, including a demo account | While educational resources exist, they are not as broad or user-friendly as other rivals' offerings |

| FXPRIMUS provides a selection of popular platforms, including MT4, MT5, and cTrader, to meet the diverse demands and preferences of its traders | Fewer selections than other prominent brokers, thereby limiting access for some clients |

| Multiple account types are available, each with its own set of features and minimal deposits, making it appropriate for traders of all levels | Some clients report problems with withdrawals, customer support, and platform performance |

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements.

Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all South African investors.

Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

| Broker | Review | Regulators | Min Deposit | Website | |

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | SVGFSA | USD 5 | Visit Broker >> |

Conclusion

In our experience, FXPRIMUS has established itself as a prominent forex and CFD broker, noted for its wide range of trading options and dedication to trader education and security.

Faq

No, FXPRIMUS presently does not provide deposit incentives or promotions.

Withdrawals from FXPRIMUS normally take 2 to 5 business days, depending on the withdrawal method chosen. The broker aims to handle requests quickly so clients can access their funds as soon as feasible.

FXPRIMUS provides Classic, Zero, and Pro accounts with different features and minimal deposits.

FXPRIMUS has a minimum investment of $15 to begin trading, making it possible for traders of all budgets to enter the forex and CFD markets.

Yes, FXPRIMUS is a secure broker, regulated by CySEC and VFSC, and uses various security measures to protect clients’ funds, such as segregated accounts and negative balance protection.

FXPRIMUS provides bank transfers, credit/debit cards (deposits only), e-wallets, and cryptocurrency wallets. However, the particular solutions accessible may differ based on your location.

FXPRIMUS lets clients trade a wide range of financial products, including currency pairs, stocks, precious metals, energy, indexes, and cryptocurrencies, giving sufficient options for diversification

FXPRIMUS provides MT4, MT5, and cTrader platforms to meet its traders’ diverse demands and preferences.

FXPRIMUS is based in Vanuatu and Cyprus, operating under stringent regulatory constraints and providing services to traders worldwide, focusing on security and transparency.