FinecoBank Review

- FinecoBank Review – 13 key points quick overview:

- Overview

- At a Glance

- FinecoBank Account Types

- How To Open a FinecoBank Demo Account

- FinecoBank Deposit & Withdrawal

- Trading Instruments and Products

- FinecoBank Trading Platforms and Software

- Spreads and Fees

- Leverage and Margin

- Educational Resources

- Pros & Cons

- Security Measures

- 🏆 10 Best Forex Brokers

- Conclusion

Overall, FinecoBank is considered a low risk, with an overall Trust Score of 92 out of 100. FinecoBank is licensed by two Tier-1 Regulators (highly trusted), zero Tier-2 Regulators (trusted), zero Tier-3 Regulators (average risk), and zero Tier-4 Regulators (high risk).

FinecoBank Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️FinecoBank Account Types

- ☑️How to Open A FinecoBank Account

- ☑️FinecoBank Deposit & Withdrawal Options

- ☑️Trading Instruments & Products

- ☑️FinecoBank Trading Platforms and Software

- ☑️Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

FinecoBank, founded in 1982 in Italy, has become a leading player in online finance since 1999, when it introduced its online retail trading service. This commitment to innovation has led to its reputation and membership in the FTSE MIB. Furthermore, FinecoBank’s focus on client-centric services has earned it a strong reputation with over a million clients in Italy.

This focus on client service translates into the bank’s strength: integrating banking, investment, and trading products into a user-friendly, technologically sophisticated platform. Today, FinecoBank is one of Europe’s largest financial institutions, with recent expansion into the UK market.

Can I use FinecoBank services outside of Italy and the UK?

Yes, FinecoBank’s services are offered to customers in several countries.

How does FinecoBank support financial education?

FinecoBank provides various training services, including live trading events, webinars, and a video library.

At a Glance

| 🗓 Established Year | 1999 |

| ⚖️ Regulation and Licenses | CONSOB, FCA |

| 🪪 Ease of Use Rating | 3/5 |

| 📞 Support Hours | 24/5 |

| 💻 Trading Platforms | FinecoX, PowerDesk, Web Trading and Investing, Fineco App |

| 🛍 Account Types | Multi-currency Account |

| 🤝 Base Currencies | 20+ |

| 📊 Spreads | From 0.8 pips pip EUR/USD |

| 📈 Leverage | 1:30 (retail), 1:100 (professional) |

| 💸 Currency Pairs | 50+; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 0 USD |

| 🚫 Inactivity Fee | None |

| 🗣 Website Languages | English |

| 💰 Fees and Commissions | Spreads from 0.8 pips, commissions from $0 |

| ✅ Affiliate Program | No |

| 🏦 Banned Countries | Australia, Canada, China, Germany, Hong Kong, India, Japan, Malaysia, Netherlands, Singapore, United Arab Emirates, United States |

| ✔️ Scalping | No |

| 📉 Hedging | No |

| 🎉 Trading Instruments | Forex, shares, indices, commodity CFDs |

| 🎖 Open an Account | 👉 Open Account |

FinecoBank Account Types

| Multi-currency Account | |

| ✅ Availability | All |

| 🛍 Markets | All |

| 💸 Commissions | From $0 |

| 💻 Platforms | FinecoX, PowerDesk, WebTrading and Investing, Fineco App |

| 📊 Trade Size | From 0.01 lots |

| 📈 Leverage | 1:30 (retail), 1:100 (professional) |

| 💰 Minimum Deposit | 0 USD |

| 🎖 Open an Account | 👉 Open Account |

Multi-Currency Account

FinecoBank’s multi-currency account is a popular choice for traders interested in forex and CFDs. It allows users to trade over 20 foreign currencies, simplifying the trading process and saving on conversion costs.

The account also enables direct trading of FX and CFDs using their preferred base currency, allowing market opportunities without additional adjustments. FinecoBank offers reasonable spreads on key currency pairs and clear pricing for CFD trading.

Additionally, the account integrates seamlessly with banking and financial options, allowing traders to manage funds, transfer funds across accounts, and use holdings in other asset classes as collateral. This comprehensive service provides a user-friendly platform for traders.

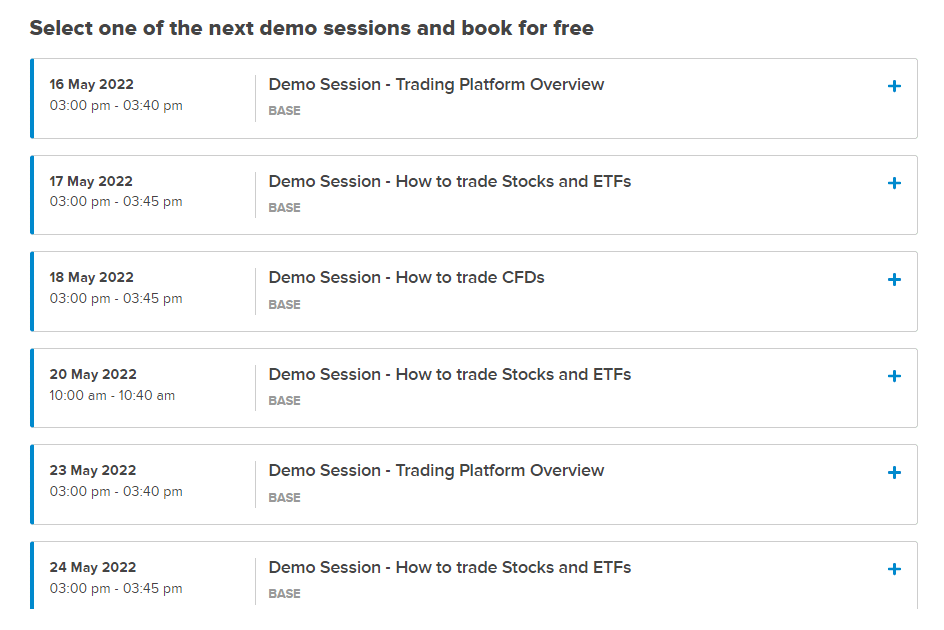

Demo Account

FinecoBank offers a comprehensive trading experience through its demo account, which allows users to access a wide range of information and knowledge about various financial products on the platform.

Users can schedule a session with a specialist to learn about the complexities of trading various asset classes and the platform’s trading tools.

The demo session also allows users to ask questions and seek clarification on the platform’s various products and services.

The broker demo account is flexible, allowing users to participate whenever they prefer, demonstrating its commitment to meeting users’ diverse needs and ensuring a smooth exploration of its trading platform.

Are there any limits on the number of transactions I may enter using FinecoBank’s account types?

No, FinecoBank account types do not limit the number of transactions.

Does FinecoBank provide customized accounts for professional traders?

Yes, FinecoBank provides professional accounts with increased leverage and extra features designed to meet the demands of experienced traders who qualify for professional status.

How To Open a FinecoBank Demo Account

Opening a demo account with Fineco Bank will consist of the following simple steps:

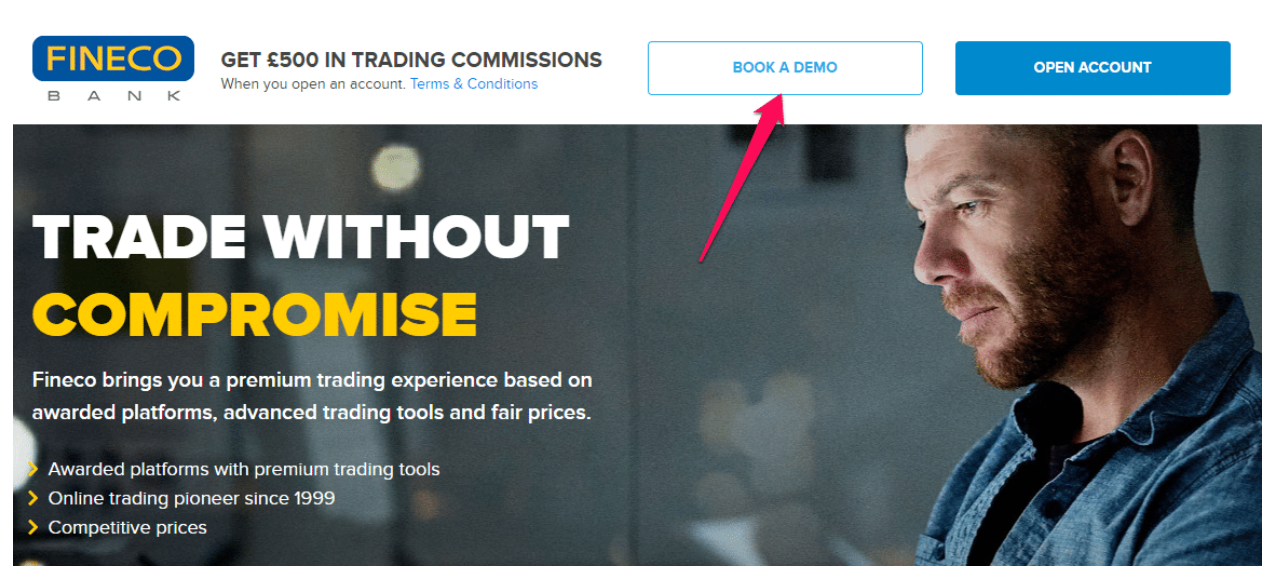

Step 1 – Navigate to the Fineco Bank website and click “Book a demo”

Navigate to the demo registration area on the Fineco Bank website. This can be accessed by clicking on the Book a Demo button at the top of the landing page

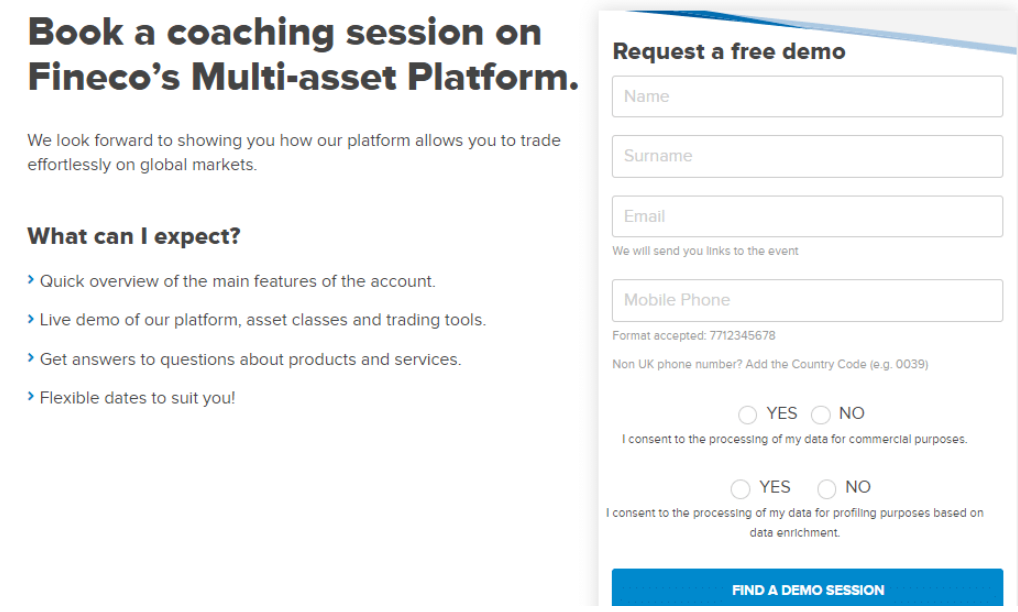

Step 2 – Fill out the Fineco Bank demo registration form

Fill out the short online registration form to request a free demo. You will need to provide your name, email address, and contact number

Step 3 – Select a Fineco Bank demo session.

Specify your area of interest when booking a demo session, whether it be trading, investment, or both. Also, specify your preferred trading instruments. You can choose from CFDs, stocks, funds, ETFs, and more. Accept the terms of the demo coaching session and Submit your request

FinecoBank Deposit & Withdrawal

| 💳 Payment Method | 🏛 Country | ⚖️ Currencies Accepted | ⏰ Processing Time |

| Bank Transfer | All | Multi-currency | 1 – 5 days |

| Credit/Debit Card | All | Multi-currency | 1 day |

| SEPA | All | Multi-currency | 1 – 3 days |

Deposit Methods:

Bank Wire

✅Log into your FinecoBank account and navigate to the “Deposits” section. You will see their bank account details (IBAN, SWIFT/BIC code) and particular instructions.

✅Go to your particular bank’s website or a branch. Make a bank transfer to the FinecoBank account, inputting the required information and the amount you want to deposit.

✅You must provide any reference numbers supplied by FinecoBank to ensure that your deposit is accurately allocated.

Credit or Debit Card

✅Within your FinecoBank account, go to the “Deposits” area.

✅Provide your card number, expiry date, CVV security code, and deposit amount.

✅Follow the on-screen steps to complete the transaction. Card deposits are frequently handled promptly.

SEPA

✅Make sure your bank account is SEPA-zone compatible (European).

✅Within your FinecoBank account, go to “Deposits” and look for the SEPA Direct Debit option. Follow the steps to set up the mandate that links your external bank account.

✅Once the mandate is established, you can make SEPA deposits straight from your FinecoBank account.

Withdrawal Methods:

Bank Wire

✅Navigate to the “Withdrawals” section of your FinecoBank account.

✅Enter your external bank details (account name, IBAN, and SWIFT/BIC).

✅Specify the amount you want to withdraw and complete any needed verification processes.

✅Process withdrawal: Please review the facts and submit your withdrawal request.

Credit or Debit Cards

✅FinecoBank may only accept withdrawals from cards that were previously used for deposits. Verify eligibility with their assistance.

✅Locate the Withdrawal Section: Go to your account’s “Withdrawals” section.

✅Select the card on which you wish to receive funds and enter the withdrawal amount.

✅Use the on-screen instructions to complete the withdrawal.

Are there any fees for deposits at FinecoBank?

Furthermore, FinecoBank does not impose deposit fees and accepts various payment options.

Does FinecoBank accept cryptocurrency deposits and withdrawals?

No, FinecoBank does not presently accept cryptocurrency deposits or withdrawals.

Trading Instruments and Products

FinecoBank offers the following trading instruments and products:

Moreover, FinecoBank offers 50 currency pairings in Forex trading, with no fees, narrow spreads on EUR/USD, and a margin of 3.5%. Traders can access trading tools across platforms like the website, PowerDesk, and mobile app.

Additionally, FinecoBank offers CFDs on numerous UK and international equities in the Shares market, with a 0% fee on FTSE100, US, and EU share CFDs, real-time stock prices, and a 0.06% markup per side on FTSE250 equity CFDs.

Furthermore, FinecoBank allows clients to trade key indices in the Indices market with spreads as low as 0.4 pips for the S&P 500 and 0.6 pips for the Nasdaq 100 and FTSE 100, including Dax 30, CAC 40, and EURO STOXX 50. Additionally, the bank provides CFDs on commodities like gold, crude oil, natural gas, platinum, palladium, and silver, with two forms: “super” (size and tick value like regular futures contracts) and “standard” (smaller margins).

Does FinecoBank support fractional share trading?

Yes, FinecoBank provides fractional share trading.

Does FinecoBank give access to initial public offerings (IPOs)?

No, FinecoBank does not give access to IPOs.

FinecoBank Trading Platforms and Software

FinecoX

Moreover, FinecoX is a revolutionary platform offering innovation, simplicity, and customization.

It offers quick execution, professional tools, and flexibility for various trading styles. Additionally, with access to 26 global stock exchanges and over 20,000 financial assets, it provides instant confirmations and transparent conditions without installation, making it a top choice for traders seeking a new trading era.

PowerDesk

Fineco’s PowerDesk, named ‘Best Trading Platform’ at the London Trader Show, is a professional-grade platform designed for aggressive traders and investors.

It offers live pricing, real-time market data, and extensive charting capabilities, allowing traders to respond quickly to market opportunities across various financial instruments in over 20 currencies. PowerDesk is available at home or on the go.

Web Trading and Investing

Fineco’s online trading and investment platform has a straightforward interface that is appropriate for beginner and expert traders.

This platform’s elegant and easy-to-navigate interface gives traders access to various financial markets, including funds, bonds, and ETFs, allowing them to explore new possibilities easily.

Fineco App

Fineco’s premium app offers mobile traders on-the-go trading and investment capabilities, including live P&L updates, customizable charting, and streaming quotations.

This pocket-sized solution allows traders to stay connected to their portfolios, access real-time pricing, and execute transactions, ensuring uninterrupted market connection.

Is FinecoBank’s desktop trading platform available for download?

Yes, FinecoBank offers PowerDesk, a professional-grade desktop trading platform that includes comprehensive charting tools and real-time market data for experienced traders.

Is there any difference in functionality between FinecoBank’s online and desktop trading platforms?

No, FinecoBank’s web-based and desktop trading platforms have identical functionality.

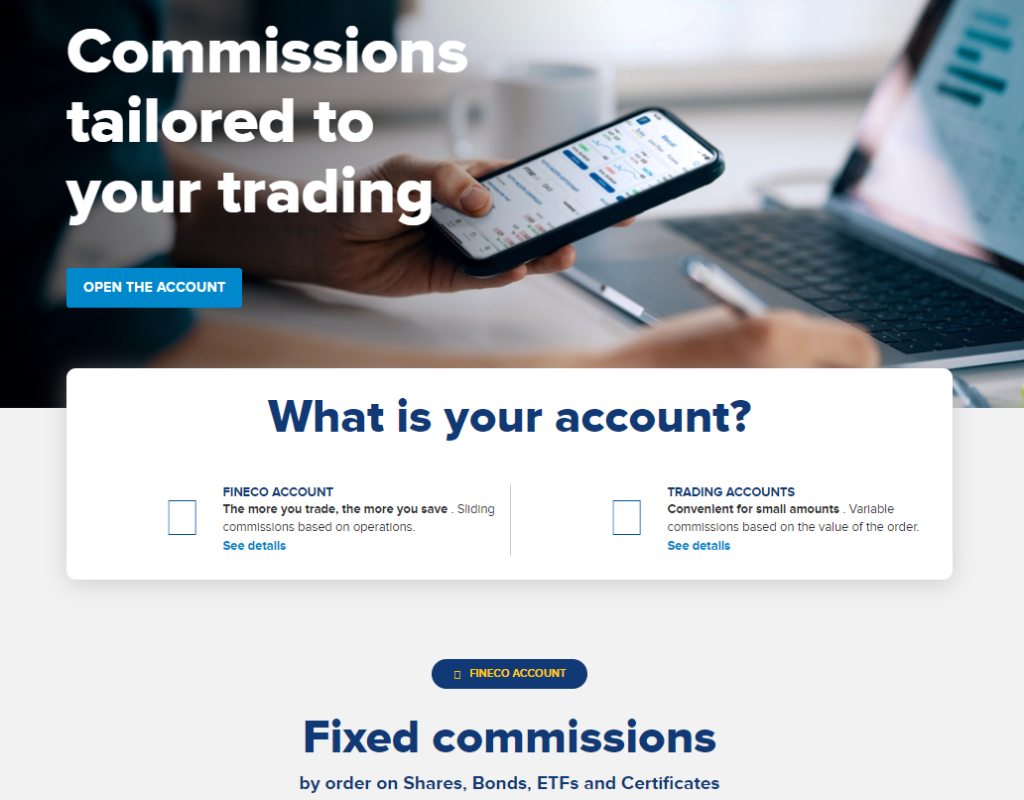

Spreads and Fees

Spreads

FinecoBank offers competitive Forex spreads starting at 0.8 points on EUR/USD pairings, providing low costs for traders. The bank emphasizes the lack of commissions, allowing traders to fully profit from small spreads.

This technique suits both beginners and experts, allowing them to optimize trading efficiency while keeping expenses low.

Commissions

FinecoBank Commissions offers a zero-commission policy on FTSE100, US, and EU share CFDs, making it an attractive option for traders looking to participate in stocks without significant fees.

This strategy streamlines trading costs and improves the trading experience, making it attractive for volume traders and allowing easy earnings evaluation.

Overnight Fees

Additionally, FinecoBank charges overnight fees for positions that remain open for over one trading day, based on the Euro Interbank Offered Rate (Euribor) plus or minus a markup. This price structure is transparent and closely related to market conditions, allowing traders only to be charged for the actual expenses of holding a position overnight. This demonstrates FinecoBank’s commitment to providing equitable trading conditions.

Deposit and Withdrawal Fees

Moreover, FinecoBank offers low deposit and withdrawal fees, sometimes with free options, demonstrating its commitment to cost-effective banking solutions. This strategy enhances trading experiences and strengthens the bank’s reputation as a customer-friendly organization prioritizing value for money, ensuring traders and investors can transfer funds without extra fees.

Inactivity Fees

Furthermore, FinecoBank’s trader-friendly policy allows customers to keep their accounts without incurring costs for inactivity. This policy supports casual traders and those taking a vacation from the markets by allowing them to resume trading without incurring financial penalties.

Currency Conversion Fees

Moreover, FinecoBank offers a cost-effective currency conversion fee for traders in multiple currencies, offering real-time conversion and a spread-only pricing model. Additionally, this efficient approach reduces costs associated with currency translation, making international trade operations more efficient. Furthermore, the lower spread prices for larger transactions make it a desirable feature for high-volume traders.

Does FinecoBank give spread reductions for high-volume traders?

Yes, FinecoBank offers spread reductions to high-volume traders while also providing competitive pricing and cost-saving possibilities to active traders.

Does FinecoBank provide charge exemptions for certain trading activities?

Yes, FinecoBank may give charge exemptions or reductions for certain trading activity or account types.

Leverage and Margin

Furthermore, FinecoBank offers a flexible approach to leverage and margin needs, catering to various trading styles across asset classes. Additionally, they specialize in highly leveraged Contracts for Difference (CFDs) on currencies, indices, commodities, and equities.

Experienced traders can use leverage of up to 100:1, allowing them to manage larger positions with minimal investment. Moreover, FinecoBank uses intraday and multiday margining for CFDs, with intraday margin requirements lower for traders who plan to terminate all positions on the same trading day and greater for overnight holdings. Additionally, margin calls are used to monitor traders’ holdings and prevent excessive losses. This risk management method ensures that traders have sufficient capital to back their bets and reduces the possibility of substantial losses.

Does FinecoBank have margin requirements for trading?

Yes, FinecoBank applies margin restrictions for CFD trading, which vary based on the asset class and market conditions.

How does FinecoBank compute the margin needs for overnight positions?

FinecoBank determines margin requirements for overnight holdings using established formulae and market conditions, reflecting the possible risk of holding positions overnight while guaranteeing enough capitalization to cover any losses.

Educational Resources

FinecoBank offers the following educational resources:

Moreover, FinecoBank offers Live Trading Events and free events for traders to enhance their skills, gain practical trading experience, and gain insights into financial markets. Additionally, FinecoBank offers free online webinars for traders to enhance their trading and investment knowledge from the comfort of their homes or workplaces. Furthermore, FinecoBank has created the Video Library, a collection of informative films offering expert recommendations on financial products, trading tactics, and investment strategies aimed at novice and experienced traders.

Can I get FinecoBank’s educational materials on demand?

Yes, FinecoBank’s training tools, such as webinars and the video collection, are accessible on demand, enabling customers to study at their own speed.

Does FinecoBank provide customers with individualized educational support?

Yes, the broker offers specialized educational assistance in one-on-one meetings with professionals.

Pros & Cons

| ✔️ Pros | ❌ Cons |

| FinecoBank provides a diverse selection of trading assets | While fundamental trading costs are reasonable, the overall charge schedule might be complicated, including fees for inactivity or platform features |

| FinecoBank is authorized by trustworthy agencies and has implemented security measures to secure customer funds | The platform and services may seem less user-friendly than other options |

| Traders can utilize webinars, market news, and instructional resources to help them improve their skills | FinecoBank's key services are largely offered in Italy and the United Kingdom |

| The brokerage charges minimal costs and spreads on popular assets | Traders used to MT4 or MT5 will have to adjust to FinecoBank's customized PowerDesk |

| FinecoBank can manage tax declarations for Italian customers, streamlining the taxation procedure | Compared to industry leaders, FinecoBank's research and market analysis techniques may be deemed rudimentary |

| FinecoBank offers customer support in many languages, increasing accessibility | While a demo account is available, it may have restricted capability or longevity compared to certain rivals |

| FinecoBank effectively combines banking, trading, and investment services into a single platform to simplify your financial management | |

| Their PowerDesk platform is well-designed, has extensive charting capabilities, and caters to experienced traders |

Security Measures

Furthermore, the broker prioritizes customer data and transaction security through robust safeguards to prevent unauthorized access and maintain financial integrity. Additionally, they prioritize information security to protect trader interests and business systems reliability. Fineco’s app offers extensive security measures for cryptocurrency transactions, including cold storage, to minimize hacking risks. These measures align with industry standards and legal regulations, demonstrating their commitment to maintaining customer trust and confidence through strong security standards.

What steps does FinecoBank take to prevent fraudulent activity?

The broker has modern fraud detection technologies and regularly monitors account activity to prevent fraud.

How does FinecoBank protect customer data?

FinecoBank uses encryption technologies and strong data privacy regulations to protect customer data from unwanted access while maintaining the confidentiality and integrity of critical information.

🏆 10 Best Forex Brokers

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $0 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

Conclusion

In our experience, the broker also portrays itself as a strong alternative for FX and CFD trading. Offering a wide selection of trading assets and competitive pricing, they aim to be a comprehensive solution for traders. Furthermore, the combination of banking and trading services on a single platform simplifies financial management for traders, creating a more streamlined experience. However, although it has reliable regulation and security procedures, some might find its fee structure complicated, perhaps leading to unanticipated charges. Furthermore, some users might find the platform less straightforward than industry-leading competitors.

Faq

The broker offers competitive commissions and spreads, particularly to aggressive traders and those concentrating on large markets.

The broker normally processes withdrawals between 1 and 5 days, depending on the withdrawal method and the destination bank’s processing periods.

The broker offers a multi-currency account that combines banking, trading, and investment services.

The broker’s minimum deposit requirement is $0.

Yes, they provide a well-rated mobile app for iOS and Android smartphones. It enables you to trade, manage your portfolio, and access banking services while on the road.

Yes, they are regarded as a safe broker since trustworthy authorities license it and employ strong security measures to protect client funds and data.

The broker provides traders access to various trading instruments, including forex, shares, indices, and commodities CFDs.

The broker was created in Italy in 1982 and has since grown into several European nations, including the United Kingdom, consolidating its position as a notable financial institution.

Yes, the broker is regulated by respectable financial agencies such as the Bank of Italy and the Financial Conduct Authority (FCA) of the UK.