Exness Minimum Deposit Review

The Exness Minimum Deposit amount required to register an Exness Professional live trading account is 200 USD. This minimum deposit amount required for Standard Account registration will depend on the payment system chosen.

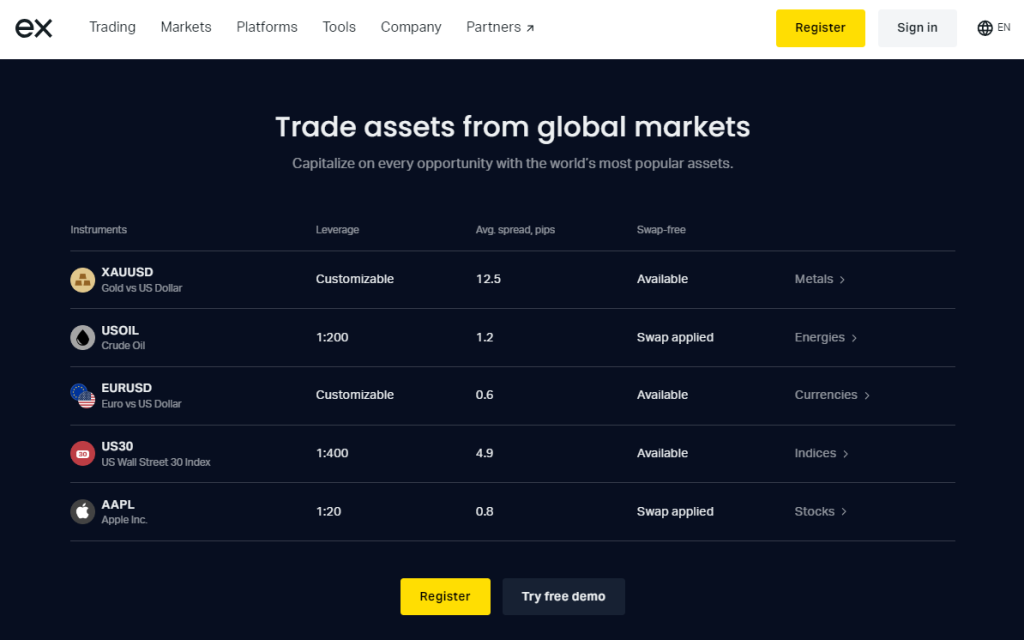

| 🔎 Account | 🚀 Open an Account | 🤝 Best Suits | 💴 Min. Deposit |

| 🥇 Standard | 👉 Click Here | All Traders | Depends on payment system |

| 🥈 Standard Cent | 👉 Click Here | Beginners | Depends on payment system |

| 🥉 Professional | 👉 Click Here | Professional | 500 USD |

| 🏅 Zero | 👉 Click Here | Professional | 500 USD |

| 🎖️ Raw Spread | 👉 Click Here | Professional | 500 USD |

| 🥇 Social Standard | 👉 Click Here | All Traders | 500 USD |

| 🥈 Social Pro | 👉 Click Here | Professional | 2000 USD |

Overview

Exness charges a minimum deposit amount of 10 USD. After thoroughly examining Exness, we were especially impressed by the accessible entry requirements.

For those new to trading or who prefer to start with a smaller investment, a minimum deposit of only 10 USD is a welcome opportunity. In addition to the wide variety of account funding options, this is a significant advantage.

Exness impresses with its extensive range of supported currencies, encompassing major ones such as USD, EUR, and GBP, as well as numerous local currencies. Traders worldwide can benefit greatly from this advantage, as it can significantly reduce conversion costs.

Exness offers a wide range of deposit methods to provide flexibility and convenience. They provide a range of payment methods, including bank transfers, credit/debit cards, and e-wallets. They have carefully considered how to streamline the process for their users.

Although the 10 USD minimum may seem appealing, it’s important to consider that specific account types or features may necessitate a higher initial deposit. Furthermore, it is important to note that deposit fees may differ based on the payment method you choose. Therefore, it is advisable to verify these fees in advance.

Overall, we believe Exness’ approach to deposits and its low minimum requirement makes it an attractive choice for traders at any level.

Regulation and Safety of Funds

| 🔎 Registered Entity | 🌎 Country of Registration | 📈 Registration Number | 📉 Regulatory Entity | 📊 Tier |

| 🥇 Exness (SC) Ltd. | Seychelles | 8423606-1 | FSA | 3 |

| 🥈 Exness B.V. | Saint Maarten | 148698(0) | CBCS | 3 |

| 🥉 Exness VG Limited | British Virgin Islands | 2032226 | FSC BVI | 3 |

| 🏅 Tortelo Limited | Mauritius | 176967 | FSC | 3 |

| 🎖️ Vlerizo (Pty) Ltd | South Africa | 51024 | FSCA | 2 |

| 🥇 Exness (CY) Ltd | Cyprus | HE 293057 | CySEC | 2 |

| 🥈 Exness (UK) Ltd | United Kingdom | 0886148 | FCA | 1 |

| 🥉 Tadenex Limited | Kenya | N/A | CMA | 2 |

Protection of Client Funds

| 🔎 Security Measure | 📌 Information |

| 🔒 Segregated Accounts | ✅Yes |

| 🔏 Compensation Fund Member | ✅ Yes, Financial Commission |

| 🔐 Compensation Amount | €20,000 per client |

| 🔓 SSL Certificate | ✅Yes |

| 🔒 2FA (Where Applicable) | ✅ Yes, Exness App |

| 🔏 Privacy Policy in Place | ✅Yes |

| 🔐 Risk Warning Provided | ✅Yes |

| 🔓 Negative Balance Protection | ✅Yes |

| 🔒 Guaranteed Stop-Loss Orders | ✅ Yes, above 1.2 pips |

Deposit Fees and Options

We were pleased that Exness does not charge any internal fees on deposits made into a trading account. Join us as we explore Exness’ payment methods and processing times for deposits, followed by a generalized step-by-step on depositing funds.

| 🔎 Payment Method | 🌎 Country | 💰 Currencies Accepted | ⏰ Processing Time |

| 💴 Bank Cards | All | Various | Instant – 24 hours |

| 💶 Skrill | All | Various | Instant – 24 hours |

| 💵 Neteller | All | Various | Instant – 24 hours |

| 💷 Perfect Money | All | Various | 30 minutes – 24 hours |

| 💴 SticPay | All | Multi-currency | Instant – 30 minutes |

| 💶 Cryptocurrency | All | USDT TRC20, USDC ERC20, USDT ERC20 | Instant – 1 day |

| 💵 BinancePay | All | Multi-currency | Instant – 30 minutes |

How to Make a Deposit with Exness

Bank WireTransfer:

Sign in to your Exness Personal Area.

- To deposit, click the Deposit option and select Bank Wire.

- Include your deposit amount and bank details.

- Follow the instructions to transfer money from your bank account to your Exness account.

Once the transfer is completed, the funds will be deposited to your Exness trading account within 24 hours.

Credit or Debit Card:

- Access your Exness Personal Area by logging in.

- Navigate to the “Deposit” section and select the option for “Credit/Debit Card.”

- Please provide your card information, enter the deposit amount, and proceed to complete the transaction.

Cryptocurrency:

- Gain access to your Exness Personal Area.

- Go to the “Deposit” section, then click “Cryptocurrency” to select the coin you want.

- Use the wallet address provided by Exness and transfer the desired amount from your wallet.

e-Wallets or Payment Gateways:

Access your Exness Personal Area by logging in.

- Go to the “Deposit” section and choose your preferred e-wallet provider, such as Skrill or Neteller.

- Please provide your e-wallet account information and the amount you wish to deposit.

Please follow the instructions provided to complete the authorization process on your e-wallet’s secure platform.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Exness supports instant deposits across payment methods | Some accounts have high minimum deposits |

| There are no fees associated with deposits | The 10 USD deposit might not be enough to start trading or cover margin requirements |

| Traders can choose from flexible payment options for deposits | Currency conversion fees might apply |

Faq

While the first deposit has a minimum, future deposits can be any amount as long as they match the minimum limit of the payment method used.

No. Exness covers most deposit fees. However, your payment provider may incur additional fees. Check their terms for further information.

Exness has no maximum deposit restriction. However, other payment systems may have their own.

Deposits are often quick; however, bank transfers could take 1-3 business days, depending on your bank.