Deriv Review

Deriv is a reputable and dependable broker, regulated by several trusted authorities. They offer leverage of up to 1:1,000 and pips starting at 0.5. The minimum deposit is as low as USD 5, and the broker boasts a high trust score of 85 out of 100.

🛡️Regulated and trusted by the MFSA, LFSA, BVI FSC, Vanuatu FSC, FMA, etc.

🛡️2708 new traders chose this broker in the last 90 days.

🛡️Available for global Traders.

| 🔎 Broker | 🥇 Deriv |

| 📌 Year Founded | 1999 |

| 👤 Amount of Staff | 500+ |

| 👥 Amount of Active Traders | 1 million+ |

| 🛡️ Regulation | MFSA LFSA BVI FSC Vanuatu FSC FMA FSC Mauritius SVG TFC |

| 🌎 Country of Regulation | Various |

| 1️⃣ Suited to Professionals | ✅Yes |

| 2️⃣ Suited to Active Traders | ✅Yes |

| 3️⃣ Suited to Beginners | ✅Yes |

| 🥰 Most Notable Benefit products | Diverse range of |

| 🥺 Most Notable Disadvantage | Limited customer support options |

| 🔂 Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| 🅰️ Investor Protection Schemes | ✅Yes |

| 🅱️ Institutional Accounts | ✅Yes |

| 🖇️ Managed Accounts | ✅Yes |

| 🪙 Minor Account Currencies | Multiple |

| 💰 Minimum Deposit | 5 USD |

| 💴 Trading Conditions | Flexible |

| ⏰ Average Deposit Processing Time | Instant |

| ⏱️ Average Withdrawal Processing Time | 1-3 days |

| 💶 Fund Withdrawal Fee | None |

| 💵 Spreads From | 0.0 pips |

| 💷 Commissions | Varies |

| 💳 Number of Base Currencies | 10+ |

| 💸 Swap Fees | ✅Yes |

| 🏧 Leverage | Up to 1:1000 |

| 🏦 Margin Requirements | Varies |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏲️ Order Execution Time | < 1 second |

| 🖱️ VPS Hosting | ✅Yes |

| 📈 Total CFDs Offered | 1000+ |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💴 Deposit Options | Credit/Debit Cards E-Wallets |

| 💶 Withdrawal Options | Bank Transfer E-Wallets |

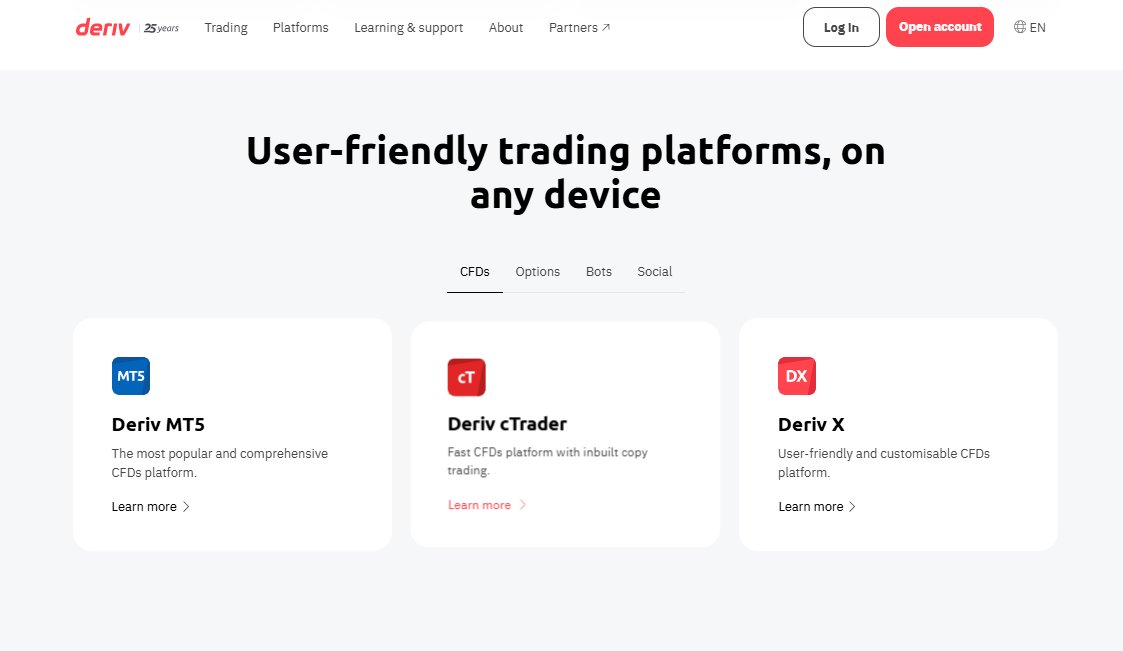

| 🖥️ Trading Platforms | Deriv MT5 Deriv cTrader Deriv XOptions Deriv Trader Deriv Bot Deriv GO SmartTrader |

| 💻 OS Compatibility | Windows macOS Mobile |

| 🤖 Forex Trading Tools | ✅Yes |

| 🩷 Customer Support | Responsive |

| 😊 Live Chat | ✅Yes |

| 💌 Support Email | Varies by Region |

| ☎️ Support Contact Number | Varies by Region |

| 🐦 Social Media | Facebook, Twitter, LinkedIn |

| 🗯️ Languages | Multiple |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | Articles Tutorials |

| 📒 Affiliate Program | ✅Yes |

| 📑 Amount of Partners | 1000+ |

| 🗃️ IB Program | ✅Yes |

| 📇 Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Open Account |

Overview

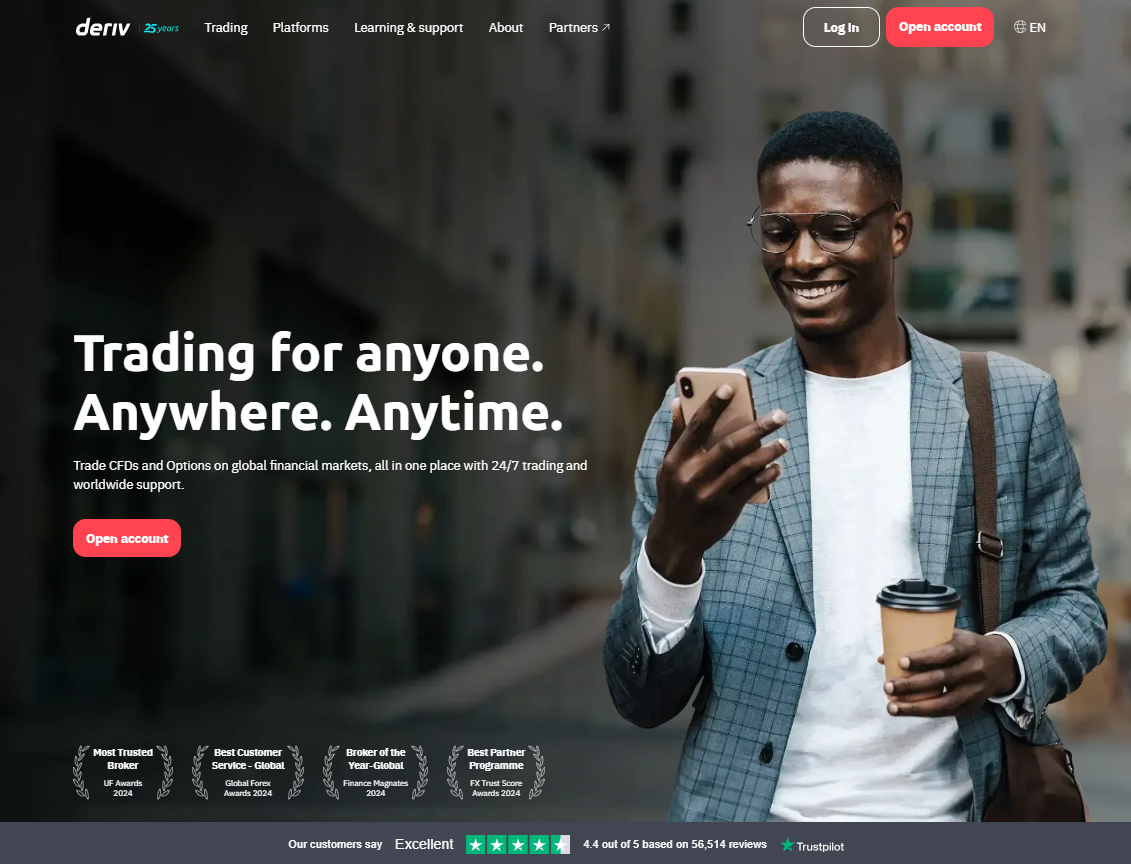

Deriv is a global leader in online trading, offering CFDs and other derivatives across a wide range of markets, including forex, stocks, indices, cryptocurrencies, commodities, and derived indices. Since its inception 25 years ago, the company has been focused on providing an alternative to traditional brokers by eliminating high commissions and cumbersome products.

With a commitment to delivering a top-tier trading experience, the broker serves over 2.5 million users worldwide. The company prides itself on being transparent, reliable, and customer-centric, creating a trusted platform for traders of all levels.

In celebration of its 25th anniversary, it continues to innovate and evolve, cementing its position as a leader in the industry. The company’s monthly trade turnover exceeds USD 15 trillion, with more than USD 46 million in withdrawals processed each month, reflecting its vast global presence and strong reputation.

Frequently Asked Questions

What makes Deriv different from other online brokers?

It stands out for its commitment to eliminating high commissions and offering a user-friendly trading experience. With an emphasis on transparency, fairness, and innovation, it provides a diverse range of trading instruments and a platform designed for both beginner and experienced traders.

How many customers does the Broker serve?

It currently serves over 2.5 million traders worldwide, offering a wide array of financial products and services to a global audience.

What markets can I trade?

The Broker offers CFDs and derivatives on a range of markets including forex, stocks & indices, cryptocurrencies, commodities, and derived indices, allowing traders to access a diverse set of financial instruments.

What are Deriv’s core values?

Deriv’s core values are Integrity, Customer Focus, Competence, and Teamwork. These principles guide the company’s decisions and help shape a culture of transparency, fairness, and customer-first service.

Our Insights

Deriv has proven itself as a leading force in the online trading industry, offering an innovative platform that focuses on low commissions, high transparency, and customer-centric solutions. With a 25-year history, millions of active users, and a commitment to excellence, Deriv continues to shape the future of trading for both novice and experienced traders alike.

Detailed Summary

| 🔎 Broker | 🥇 Deriv |

| 📌 Year Founded | 1999 |

| 👤 Amount of Staff | 500+ |

| 👥 Amount of Active Traders | 1 million+ |

| 🛡️ Regulation | MFSA LFSA BVI FSC Vanuatu FSC FMA FSC Mauritius SVG TFC |

| 🌎 Country of Regulation | Various |

| 1️⃣ Suited to Professionals | ✅Yes |

| 2️⃣ Suited to Active Traders | ✅Yes |

| 3️⃣ Suited to Beginners | ✅Yes |

| 🥰 Most Notable Benefit products | Diverse range of |

| 🥺 Most Notable Disadvantage | Limited customer support options |

| 🔂 Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| 🅰️ Investor Protection Schemes | ✅Yes |

| 🅱️ Institutional Accounts | ✅Yes |

| 🖇️ Managed Accounts | ✅Yes |

| 🪙 Minor Account Currencies | Multiple |

| 💰 Minimum Deposit | 5 USD |

| 💴 Trading Conditions | Flexible |

| ⏰ Average Deposit Processing Time | Instant |

| ⏱️ Average Withdrawal Processing Time | 1-3 days |

| 💶 Fund Withdrawal Fee | None |

| 💵 Spreads From | 0.0 pips |

| 💷 Commissions | Varies |

| 💳 Number of Base Currencies | 10+ |

| 💸 Swap Fees | ✅Yes |

| 🏧 Leverage | Up to 1:1000 |

| 🏦 Margin Requirements | Varies |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏲️ Order Execution Time | < 1 second |

| 🖱️ VPS Hosting | ✅Yes |

| 📈 Total CFDs Offered | 1000+ |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💴 Deposit Options | Credit/Debit Cards E-Wallets |

| 💶 Withdrawal Options | Bank Transfer E-Wallets |

| 🖥️ Trading Platforms | Deriv MT5 Deriv cTrader Deriv XOptions Deriv Trader Deriv Bot Deriv GO SmartTrader |

| 💻 OS Compatibility | Windows macOS Mobile |

| 🤖 Forex Trading Tools | ✅Yes |

| 🩷 Customer Support | Responsive |

| 😊 Live Chat | ✅Yes |

| 💌 Support Email | Varies by Region |

| ☎️ Support Contact Number | Varies by Region |

| 🐦 Social Media | Facebook, Twitter, LinkedIn |

| 🗯️ Languages | Multiple |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | Articles Tutorials |

| 📒 Affiliate Program | ✅Yes |

| 📑 Amount of Partners | 1000+ |

| 🗃️ IB Program | ✅Yes |

| 📇 Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Open Account |

Frequently Asked Questions

Does Deriv offer leverage, and what is the maximum leverage available?

Yes, Deriv offers leverage of up to 1:1000, enabling traders to control larger positions with a smaller investment. Margin requirements vary based on the asset and account type.

Is Deriv regulated?

Yes, Deriv is regulated by several authorities, including MFSA, LFSA, BVI FSC, and others, ensuring a secure and reliable trading environment.

What trading platforms does Deriv offer?

Deriv provides multiple trading platforms, including Deriv MT5, cTrader, Deriv XOptions, and more, to cater to different trader preferences.

Can I use Deriv on mobile devices?

Yes, Deriv’s platforms are compatible with both mobile devices and desktops, allowing for seamless trading on the go.

Our Insights

Deriv offers a competitive and comprehensive trading platform for both new and experienced traders. With low minimum deposits, high-leverage options, and a diverse range of trading instruments, it delivers an attractive package. However, its customer support could be improved. Overall, Deriv is a reliable choice for those looking for flexibility and security in their trading experience.

Advantages over Competitors

Deriv stands out in the online trading space due to its wide range of benefits compared to its competitors. It offers low minimum deposit requirements, flexible trading conditions, and access to high leverage up to 1:1000, making it accessible for traders of all levels. The platform provides a variety of account types, including managed and Islamic accounts, as well as multiple trading platforms to cater to diverse trading styles.

Deriv’s quick deposit and withdrawal processing times, along with educational resources, also add significant value. Additionally, its regulatory compliance across various jurisdictions ensures a high level of security and trustworthiness.

Frequently Asked Questions

What makes Deriv different from other brokers?

Deriv offers a unique combination of low minimum deposits, high leverage (up to 1:1000), and fast deposit/withdrawal processing times, which distinguishes it from many competitors. Its range of account types and platforms adds to its flexibility.

Does Deriv offer high-leverage options?

Yes, Deriv provides leverage of up to 1:1000, which allows traders to control larger positions with a smaller initial investment, a feature that sets it apart from many other brokers.

How quickly can I withdraw funds from Deriv?

Withdrawals from Deriv are processed within 1-3 days, which is faster than many other brokers in the industry.

Is Deriv regulated in multiple regions?

Yes, Deriv is regulated in several jurisdictions, including MFSA, LFSA, BVI FSC, and others, ensuring a high level of security and trustworthiness for its users.

Our Insights

Deriv’s advantages over competitors lie in its low deposit requirements, high-leverage options, diverse account types, and fast withdrawal processing. These features, combined with its regulatory oversight and range of trading platforms, make Deriv a strong choice for traders seeking flexibility and reliability in their trading experience.

Safety and Security

Deriv places a strong emphasis on security, regulation, and fair trading practices, ensuring that its users can trade with confidence. Since its founding in 1999, the company has adhered to high ethical standards, providing a secure environment for traders across the globe.

With regulatory licenses from multiple jurisdictions, including the Malta Financial Services Authority (MFSA), Labuan Financial Services Authority (LFSA), and the Vanuatu Financial Services Commission, Deriv operates in compliance with industry standards.

Additionally, the platform prioritizes the protection of user accounts through strong security measures, such as two-factor authentication, secure web browsing, and antivirus protection.

Deriv also offers tools for responsible trading, including self-exclusion options, trading limits, and risk management tools, ensuring a safe and fair trading environment for all its users.

Frequently Asked Questions

Is Deriv regulated?

Yes, Deriv is regulated by several authorities, including the MFSA, LFSA, BVI FSC, and others, ensuring a high level of legal and financial security for traders.

How does Deriv protect my account?

Deriv implements strong security measures such as two-factor authentication, secure web browsers, and antivirus protection to help keep your account safe from unauthorized access.

What measures does Deriv take to ensure fair trading?

Deriv follows ethical practices by complying with international regulations, conducting regular internal audits, and enforcing risk management protocols to ensure a fair and transparent trading environment.

Can I set limits on my trading activities?

Yes, Deriv allows you to set limits on your stake amount, losses, and trading session duration. You can also self-exclude from trading for a defined period if you wish to take a break.

Our Verdict

Deriv’s commitment to safety and security is evident through its regulatory compliance across multiple regions and its focus on protecting users through advanced security features. The platform also promotes fair trading practices and responsible trading with tools to manage limits and self-exclusion.

This makes Deriv a secure and reliable choice for traders seeking a protected and transparent trading environment.

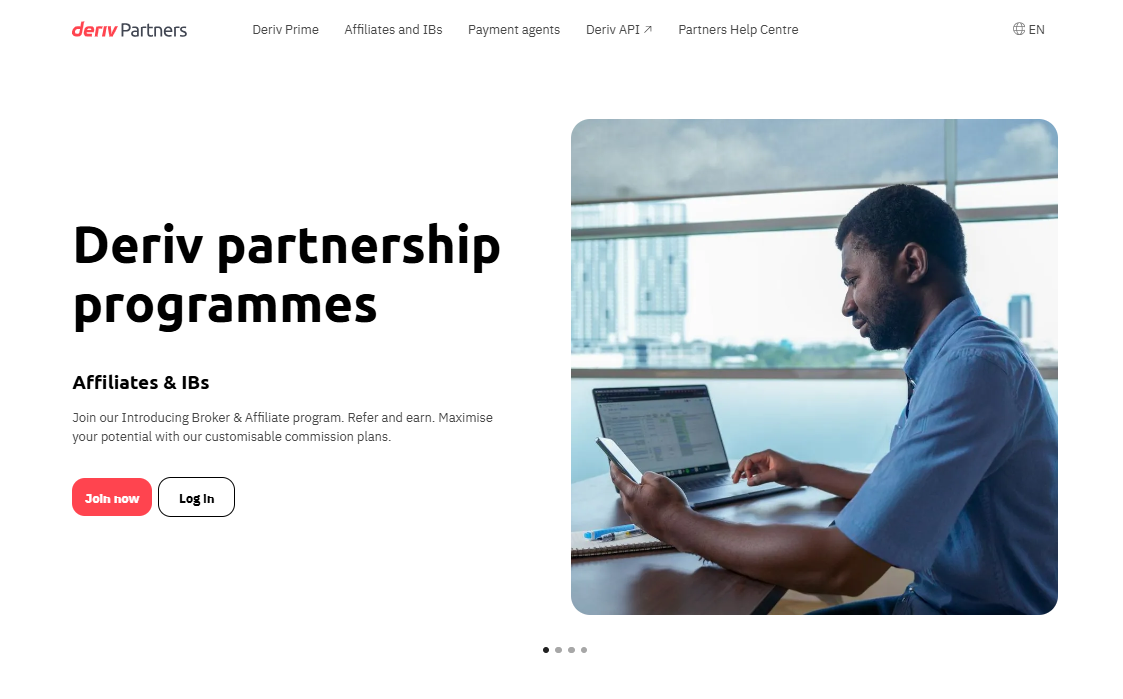

Partnership Options

Deriv offers a range of partnership programs designed to help individuals and businesses earn additional revenue and expand their client base. These programs, which include options for affiliates, introducing brokers, payment agents, and API partners, provide ample opportunities for collaboration and financial growth.

Whether you are a marketer looking to monetize your network or a business aiming to offer payment services to traders, Deriv’s partnership initiatives are designed to be rewarding, with no hidden fees or setup costs.

With expert support, promotional materials, and the backing of Deriv’s trusted reputation, partners can build strong and profitable relationships with the platform.

Frequently Asked Questions

How do I become a Deriv partner?

You can apply to become a Deriv partner by signing up for any of the available partnership programs, such as affiliate, IB (Introducing Broker), or payment agent programs. Simply email Deriv to apply and start expanding your business.

Are there any fees associated with joining Deriv’s partnership programs?

No, Deriv’s partnership programs are completely free to join. There are no hidden fees or charges, making it a cost-effective way to earn additional income.

What types of partnerships does Deriv offer?

Deriv offers several partnership opportunities, including affiliates, introducing brokers (IBs), payment agents, API partners, and Deriv Prime, each designed to suit different business models and monetization strategies.

What support does Deriv provide to its partners?

Deriv offers expert support through dedicated affiliate managers, who provide guidance, promotional materials, and educational resources to help you succeed in the partnership program.

Our Insights

Deriv’s partnership programs offer a great opportunity for businesses and individuals to grow their client base and generate income without the burden of fees or hidden costs. With expert support, flexible programs, and a solid reputation in the industry, Deriv makes it easy for partners to succeed. Whether you’re a marketer, payment agent, or API partner, joining Deriv’s network is a smart and profitable choice.

CFDs Trading

Trading Contracts for Difference (CFDs) on Deriv allows you to control larger positions with a smaller capital investment. With leverage of up to 1:1000, traders can go long or short across various markets, including Forex, Stocks, Commodities, and 24/7 Derived Indices. Deriv provides commission-free trading on popular platforms such as MT5, cTrader, and Deriv X, with tight spreads starting from 0 pips and negative balance protection to safeguard your funds.

Traders can access over 250 instruments and choose from different account types to suit their trading strategies. With an intuitive interface and advanced analytical tools, Deriv offers a supportive environment for both beginners and experienced traders.

Frequently Asked Questions

What are CFDs, and how do they work on Deriv?

CFDs are contracts that allow traders to speculate on the price movements of various assets without owning the underlying asset. On Deriv, you can trade CFDs with leverage, enabling you to manage larger positions with a smaller investment.

What leverage options does Deriv offer for CFD trading?

Deriv offers leverage of up to 1:1000, enabling traders to amplify their positions and maximize potential returns with lower capital investment.

Are there any fees for trading CFDs on Deriv?

Deriv offers commission-free CFD trading, allowing traders to benefit from tight spreads without additional fees or costs.

How many instruments can I trade as CFDs on Deriv?

Traders can access over 250 instruments across a variety of markets, including Forex, Stocks, Commodities, and Derived Indices when trading CFDs on Deriv.

Our Insights

Deriv’s CFD trading platform presents an attractive option for traders looking to leverage their capital effectively. With a wide range of instruments, high leverage, and a user-friendly interface, it supports both beginner and experienced traders, fostering a versatile environment for diverse trading strategies.

Options Trading

Options trading on Deriv enables you to diversify your portfolio with vanilla and exotic contracts across more than 50 assets while capping your risk at your initial investment.

With entry costs starting from just USD 0.35, traders can choose from various contract types, including Digital, Vanilla, and Turbo Options, which are tailored to different trading strategies. The platform also offers flexible payout options, allowing you to choose either fixed or variable returns depending on your market predictions.

Accessible through user-friendly platforms like Deriv Trader and Deriv GO, options trading offers a strategic way to engage with asset classes such as Forex, Derived Indices, Cryptocurrencies, and Commodities.

Frequently Asked Questions

What types of options contracts are available on Deriv?

Deriv offers various contract types, including Digital, Vanilla, and Turbo Options. These contracts cater to different trading strategies, allowing you to choose based on your preferences.

What is the minimum cost to start trading options on Deriv?

The minimum entry cost for options trading on Deriv is just USD 0.35, making it an accessible option for traders with varying budgets.

Can I trade options on different asset classes?

Yes, Deriv allows you to trade options across a wide range of asset classes, including Forex, Derived Indices, Cryptocurrencies, and Commodities.

What payout options are available for options trading?

Deriv provides flexible payout options, allowing you to select either fixed or variable returns depending on your market forecasts and trading strategy.

Our Insights

Deriv’s options trading platform offers a flexible and accessible way for traders to diversify their portfolios and manage risk. With low entry costs, various contract types, and user-friendly platforms, it is an excellent choice for both new and experienced traders seeking to engage in strategic trading.

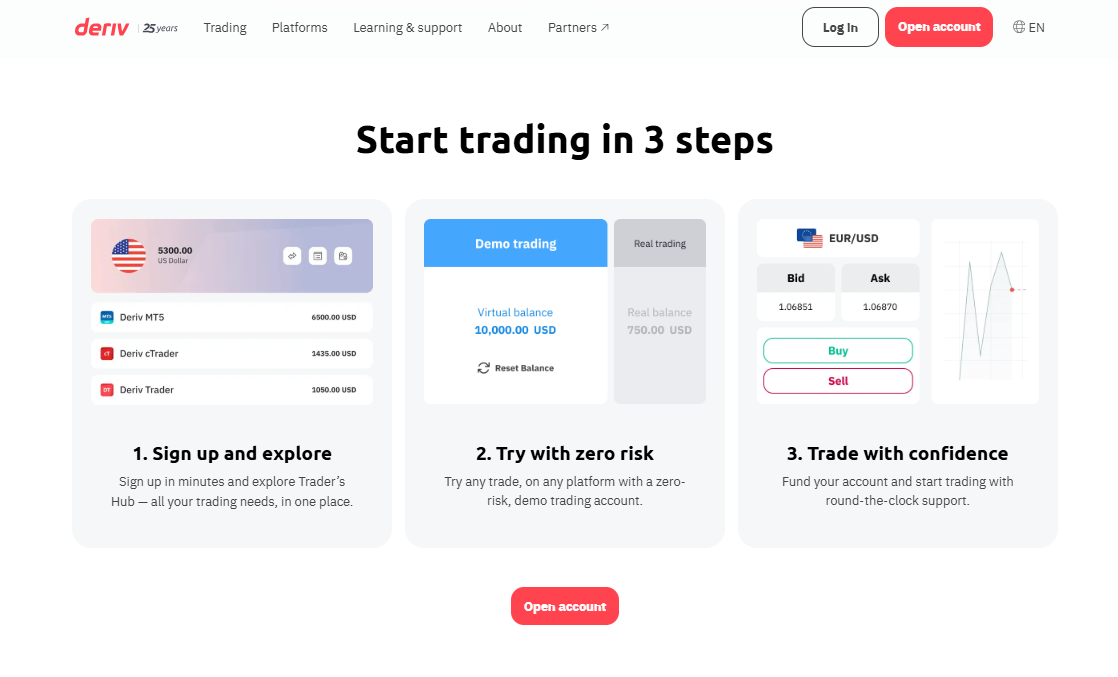

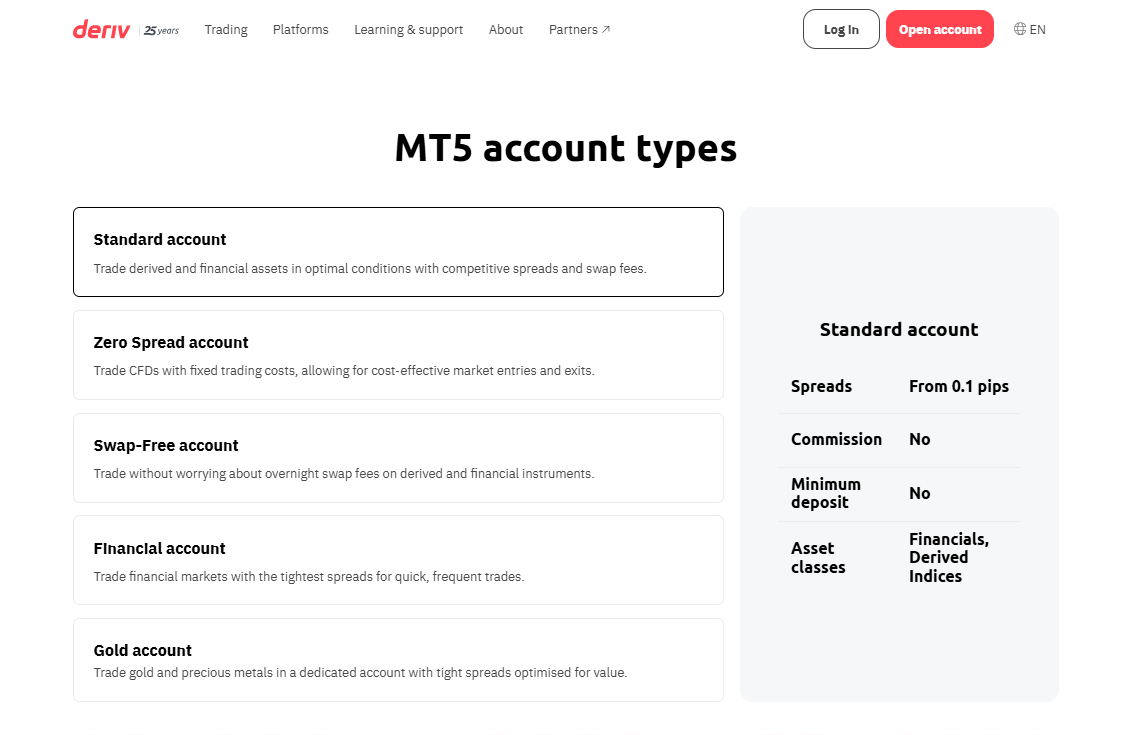

Minimum Deposit and Account Types

Deriv offers a flexible trading experience with various account types to suit the needs of different traders. The platform allows you to trade CFDs on Forex, Stocks, Cryptocurrencies, and more while providing access to advanced features such as swap-free trading, multiple indicators, and exclusive 24/7 Derived Indices.

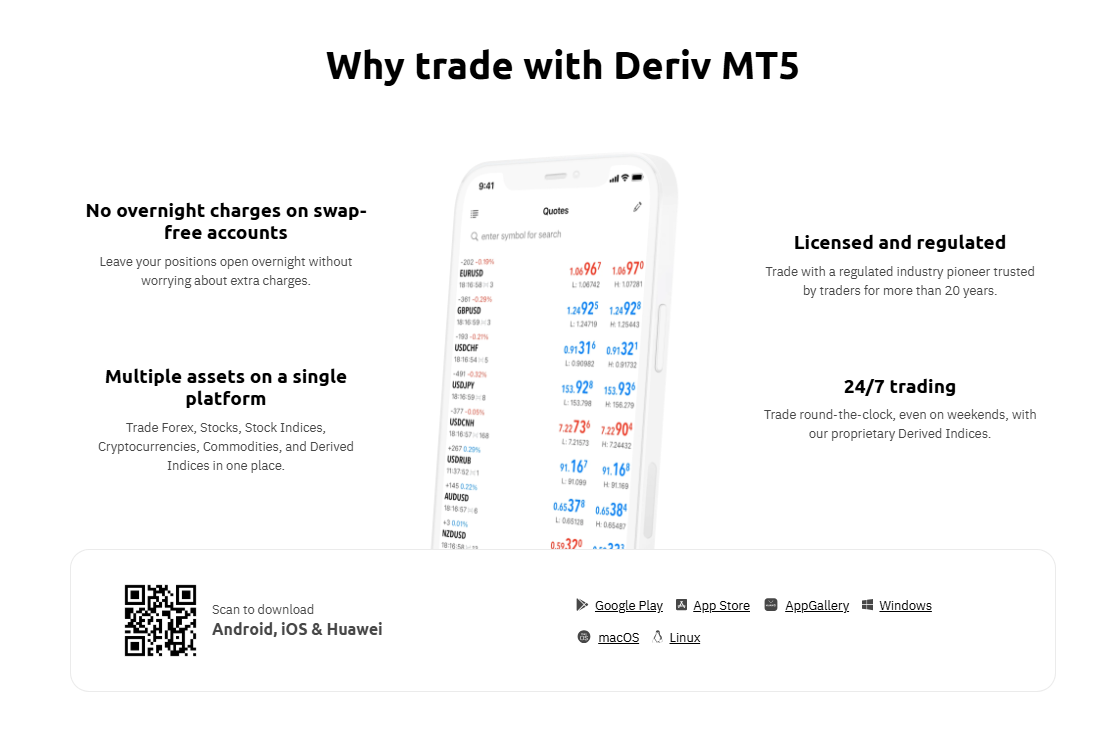

Deriv MT5, one of the platform’s key offerings, allows traders to manage their positions without incurring additional overnight charges and provides multiple assets in one place, making it an all-in-one solution for traders worldwide.

The minimum deposit required to start trading with Deriv is just 5 USD, making it accessible to a wide range of traders. This low entry barrier allows both beginners and experienced traders to participate without a heavy upfront investment.

Frequently Asked Questions

What is the minimum deposit required to start trading on Deriv?

To begin trading on Deriv, you only need to deposit a minimum of $5, providing a low-cost entry into the world of CFD trading.

Can I trade CFDs with no commission on Deriv?

Yes, Deriv offers commission-free trading on all assets, which helps you save on trading costs and make the most of your capital.

How does the Swap-Free account work on Deriv?

With a Swap-Free account, you can trade without worrying about overnight charges or swap fees on derived and financial instruments, making it ideal for traders who want to hold positions overnight without extra costs.

Is a demo account available on Deriv?

Yes, Deriv offers a demo account where you can practice trading with risk-free virtual funds. This is an excellent way to familiarize yourself with the platform and its features before committing real money.

Our Insights

Deriv provides a user-friendly trading environment with low minimum deposits starting at just $5. The variety of account types caters to traders of all levels, from beginners to professionals, offering flexibility in how trades are executed. With commission-free trading, multiple asset classes, and no overnight charges on certain accounts, Deriv stands out as an accessible and cost-effective platform for CFD trading.

Trading Platforms and Tools

Deriv offers a range of tailored trading platforms designed to suit various trading styles and preferences. MT5 allows traders to access a wide variety of assets, including Forex, Stocks, Cryptocurrencies, and Derived Indices, with commission-free trading and no overnight charges on swap-free accounts.

cTrader provides zero-commission trading with over 150 instruments and 60+ custom indicators, along with the added feature of copy trading. Deriv X delivers precision charting and 24/7 access to more than 200 assets, all while offering extensive customization options with technical indicators.

For options traders, Deriv Trader offers a minimum stake of just USD 0.35 and potential payouts of up to 200%. Deriv GO, the mobile platform, enables users to trade Multipliers and Options with effective risk management tools, starting from just $1.

Finally, Deriv Bot offers an automated trading experience with an intuitive drag-and-drop interface, allowing traders to create custom strategies without needing coding knowledge.

Frequently Asked Questions

What assets can I trade on Deriv MT5?

You can trade a wide range of assets on Deriv MT5, including Forex, Stocks, Cryptocurrencies, and Derived Indices.

Does Deriv cTrader charge commissions?

No, Deriv cTrader offers commission-free trading, helping you minimize costs and maximize returns.

What features does Deriv X offer for traders?

Deriv X provides precision charting, a wide array of technical indicators, and access to over 200 assets, with 24/7 trading availability.

How much can I start trading with Deriv Trader?

The minimum stake for options trading on Deriv Trader is just USD 0.35, making it accessible to traders with smaller budgets.

Our Insights

Deriv’s diverse range of platforms offers unique tools and features that cater to traders at all experience levels. From commission-free trading to automated strategies, Deriv provides a comprehensive and user-friendly environment, ensuring traders have the support they need to succeed.

Fees, Spreads, and Conclusions

Deriv offers a transparent and cost-effective trading environment with no hidden fees. Traders can enjoy commission-free trading on several platforms, including Deriv MT5 and Deriv cTrader. Spreads on assets such as Forex, Stocks, and Cryptocurrencies are competitive, with the Zero Spread account offering spreads as low as 0 pips.

Swap-free accounts are available, allowing traders to leave positions open overnight without incurring extra swap fees, particularly on Derived Indices and financial assets. While Deriv MT5 offers a wide range of assets with no commissions, other platforms like Deriv Trader feature low minimum stakes starting at just USD 0.35 for options trading, with potential payouts of up to 200%.

For automated traders, Deriv Bot provides the flexibility to implement custom strategies without the cost of additional fees or commissions. Overall, Deriv’s fee structure is designed to be straightforward and cost-efficient, appealing to both beginner and experienced traders.

Frequently Asked Questions

Does Deriv charge commissions on its trading platforms?

No, Deriv offers commission-free trading on several platforms, including Deriv MT5 and Deriv cTrader.

What spreads can I expect when trading on Deriv?

Spreads on Deriv are competitive, with Zero Spread accounts offering spreads as low as 0 pips.

Are there any fees for holding positions overnight in Deriv?

For traders using swap-free accounts, there are no overnight charges, allowing traders to leave positions open without worrying about additional fees.

How much can I start trading with on Deriv?

You can start trading on platforms like Deriv Trader with a minimum stake of just USD 0.35, making it accessible for traders with smaller budgets.

Our Insights

Deriv’s fee structure is both transparent and trader-friendly, with commission-free trading across multiple platforms, competitive spreads starting from 0 pips, and swap-free accounts for overnight positions. The platform’s low minimum stake and flexibility in account types make it suitable for traders of all experience levels.

Deposits and Withdrawals

Deriv offers a wide range of payment methods to ensure convenient and flexible account funding. These include credit/debit cards, online banking, e-wallets, cryptocurrencies, vouchers, and the Deriv P2P system. Traders can fund their accounts in USD, EUR, or AUD, with a minimum deposit of $10 and a maximum of $5,000.

Withdrawals are typically processed within one working day, while P2P transactions are completed in less than two hours. This diverse selection of payment options ensures that users can make quick and secure transactions tailored to their preferences.

Frequently Asked Questions

What payment methods does the Broker accept?

Deriv accepts a wide range of payment methods, including credit/debit cards, online banking, e-wallets, cryptocurrencies, vouchers, and P2P transactions.

What is the minimum deposit amount?

The minimum deposit is $10.

How long does it take to process withdrawals?

Withdrawals are processed within one working day.

How quickly are P2P transactions completed?

P2P transactions are typically completed in under two hours.

Our Insights

With a variety of payment methods and quick processing times, it provides a convenient, secure, and user-friendly experience for traders, ensuring that funding and withdrawals are hassle-free and efficient.

Customer Reviews

🥇 Great Trading Experience!

I’ve been trading with its Broker for over a year now, and I couldn’t be happier! The variety of platforms available makes it easy to find one that suits my style. I love the low spreads on the Standard Account, and the customer support has been responsive whenever I’ve had questions. Highly recommended! – Jessica

🥈 User-Friendly and Efficient

Deriv has simplified my trading journey. The deposit and withdrawal process is seamless, and I appreciate the range of payment options. The cTrader platform’s copy-trading feature is a game-changer for me. I’ve learned so much from replicating successful traders. Overall, a fantastic platform! – Michael

🥉 Flexible and Reliable

As a beginner, I found the educational resources invaluable. The demo account helped me practice without any risk, and now I’m confidently trading on live accounts. The Swap Free Account is perfect for my long-term strategy. I feel secure knowing my funds are in good hands. Great job! – Jones

References:

In Conclusion

Deriv has cemented its reputation as one of the most innovative and flexible online brokers in the industry, offering a comprehensive suite of trading products that cater to both beginners and professionals. With over 1 million active traders, a broad range of asset classes, and regulatory oversight from multiple jurisdictions, the Broker stands out for its commitment to providing a secure and user-friendly trading environment.

Faq

Yes, Deriv is well-suited for beginner traders. The platform offers educational resources, including forex courses, tutorials, and webinars, making it easier for newcomers to get started. Additionally, the demo account allows beginners to practice without risking real money.

The minimum deposit required to start trading on Deriv is just $5, making it accessible for traders with a small starting budget.

Deriv offers various account types, including individual accounts, institutional accounts, managed accounts, and Islamic accounts. This diversity allows traders of all levels to choose an account that best suits their needs.

Withdrawals from Deriv typically take between 1-3 days, depending on the withdrawal method. There are no fees for withdrawals, which is a benefit for traders.