AvaFutures Review

The futures-focused AvaFutures is a young but powerful member of the AvaTrade family. Offering a broad range of features to improve trading efficiency and success, this platform is designed to fulfill the different demands of both rookie and experienced traders.

AvaFutures Review – Key Point Quick Overview

- ☑️User-Friendly Design and Accessibility

- ☑️Varied Futures Contracts

- ☑️Tools for Risk Management

- ☑️Educational resources

- ☑️Strong Security and Sound Regulations

- ☑️Trading Automation and Powerful Extras

- ☑️Customer Support

- ☑️Our Insights

- ☑️Frequently Asked Questions

User-Friendly Design and Accessibility

Because of its user-friendly layout, the AvaFutures platform is suitable for traders with varying degrees of expertise.

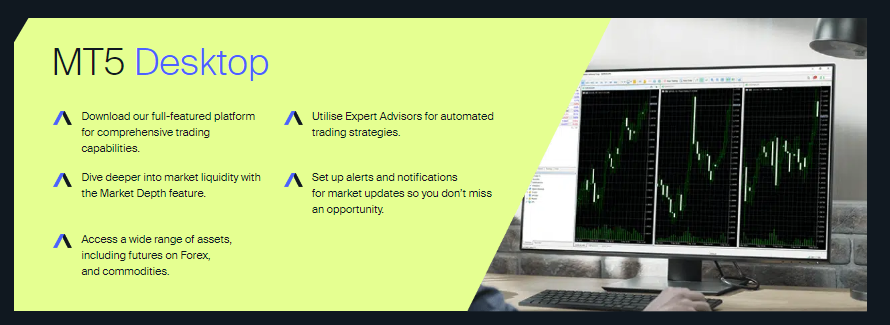

The intuitive design makes it easy to handle trading operations efficiently by providing quick access to market data and key trading tools. By incorporating MetaTrader 5 (MT5), the platform gains superior charting capabilities, transparency into market depth, and the ability to facilitate automated trading methods with the help of Expert Advisors, sometimes known as trading robots.

Varied Futures Contracts

An important asset of AvaFutures is the wide variety of futures contracts it offers. You can diversify your portfolio successfully with the platform’s access to global indexes, commodities, treasuries, and cryptocurrencies.

Although traders must exercise extreme caution when using high-leverage options, doing so allows them to build larger positions than their money would normally allow. Traders can maximize their profits even more with competitive spreads and minimal commission expenses.

| ▶️Feature | ⏩Description | 💹Benefit |

| Futures Contracts | Wide range of contracts | Meets diverse trading needs |

| Transaction Costs | Low spreads and commissions | Maximizes profitability |

| Leverage Options | High leverage available | Allows larger positions |

| Risk Management | Stop-loss, limit orders, margin calls | Helps manage potential losses |

| 👉Open Account | 👉Open Account | 👉Open Account |

Tools for Risk Management

Margin calls, stop-loss orders, and limit orders are just a few of the risk management tools available with AvaFutures. These methods are essential for minimizing losses, particularly in unpredictable markets. As a flexible platform that caters to various trading techniques, AvaFutures offers a large selection of contracts and keeps trader conditions favorable.

Educational resources

Understanding the need to provide traders with educational resources, AvaFutures provides a full range of tools for that purpose. Articles, videos, and lessons covering advanced trading subjects are all part of this.

In addition, the platform often has webinars where knowledgeable traders and analysts share their thoughts on trading methods and market trends. Traders who want to learn more and get better at trading will find these materials very helpful.

Strong Security and Sound Regulations

Reputable financial authorities oversee AvaFutures’ operations, guaranteeing the company’s adherence to best practices in corporate governance and its financial transparency.

To keep customer information and money safe, the platform uses robust security features including multi-factor authentication and encryption techniques. Traders can rest assured that their funds are safe and the platform functions fairly thanks to this regulatory structure.

Trading Automation and Powerful Extras

One of the best things about AvaFutures is that it allows automatic trading. To automate trading choices based on specified criteria, traders can use the MT5 platform to design trading robots or implement custom indicators.

As a result, less emotional decision-making is used and market monitoring is reduced to a minimum, freeing up your trading time. The use of technical indicators and different time frames in sophisticated charting tools allows for thorough market analysis and smart trading decisions.

🏆 10 Best Forex Brokers

🏆 10 Best Forex Brokers

| Broker | Review | Leverage | Min Deposit | Website | |

| 🥇 |  | Read Review | 1:400 | Minimum Deposit $100 |  |

| 🥈 |  | Read Review | 1:30 | Minimum Deposit $100 |  |

| 🥉 |  | Read Review | 1:1000 | Minimum Deposit $25 |  |

| 4 |  | Read Review | 1:500 | Minimum Deposit $0 |  |

| 5 |  | Read Review | 1:100 | Minimum Deposit $100 |  |

| 6 |  | Read Review | 1:2000 | Minimum Deposit $200 |  |

| 7 |  | Read Review | 1:1000 | Minimum Deposit $10 |  |

| 8 |  | Read Review | 1:Unlimited* | Minimum Deposit $10 |  |

| 9 |  | Read Review | 1:500 | Minimum Deposit $100 |  |

| 10 |  | Read Review | 1:3000 | Minimum Deposit $1 |  |

Customer Support

You can reach AvaFutures’s helpful customer service representatives by phone, email, or live chat. Traders can reach out to the platform’s support team whenever they have queries or concerns.

You can also find answers to frequently asked questions and in-depth descriptions of the platform’s capabilities in the support center and the FAQ area.

Conclusion

With its rich set of features and wealth of teaching materials, AvaFutures is a standout trading platform that can meet the needs of both novice and seasoned traders.

For traders hoping to maximize their trading performance in a constantly changing market, the platform’s support for several markets and automated trading techniques is a great fit. When it comes to futures trading, AvaFutures offers a full suite of tools for anyone looking to succeed.

Our Insights

From my research, AvaFutures, you will note that there is an insistence on sufficient educational resources as well as customer support which assists in deepening understanding among traders and refining their strategies.

Faq

AvaFutures is an online futures trading platform that allows users to trade various financial instruments, including forex, commodities, indices, and cryptocurrencies.

To create an account, visit the AvaFutures website, click on the “Sign Up” button, and follow the registration process by providing the required information and verifying your email address.

The minimum deposit requirement varies depending on the account type, but generally, it starts from $100.

AvaFutures offers access to a variety of futures markets, including indices, commodities, currencies, treasuries, cryptocurrencies, and metals.

Yes, AvaFutures is regulated by several financial authorities, ensuring compliance with industry standards and providing a secure trading environment.