7 Best Forex Brokers in Trinidad and Tobago

The 7 Best Forex Brokers in Trinidad and Tobago – Rated and Reviewed. We have listed the Best Forex Brokers accepting traders in Trinidad and Tobago.

in this in-depth guide, you will learn:

- The Best Forex Brokers in Trinidad and Tobago – a List

- Is Forex Trading Legal in Trinidad and Tobago

- How to Open a Brokerage Account in Trinidad and Tobago

- Low TTD Minimum Deposit Forex Brokers

- Leading MT4 and MT5 Forex Brokers

and much, MUCH more!

7 Best Forex Brokers in Trinidad and Tobago – a Comparison

| 🔎 Broker | 🚀Open an Account | 🤝 Accepts Local Traders | 💴 Min. Deposit |

| 🥇 Trade Nation | 👉 Click Here | ✅Yes | None |

| 🥈 TMGM | 👉 Click Here | ✅Yes | 677,16 |

| 🥉 Vantage | 👉 Click Here | ✅Yes | 338,58 |

| 🏅 Tickmill | 👉 Click Here | ✅Yes | 677,16 |

| 🎖️ IC Markets | 👉 Click Here | ✅Yes | 1354,32 |

| 🥇 Pepperstone | 👉 Click Here | ✅Yes | 903,20 |

| 🥈 IG | 👉 Click Here | ✅Yes | 338,58 |

7 Best Forex Brokers in Trinidad and Tobago (2024)

- ☑️ Trade Nation – Overall, the Best Forex Broker in Trinidad and Tobago

- ☑️ TMGM – The Best Forex Broker for Beginners and Casual Traders

- ☑️ Vantage – Best Online Trading Experience

- ☑️ Tickmill – Best Overall User Experience

- ☑️ IC Markets – The Best Mobile Trading Experience

- ☑️ Pepperstone – Popular Broker for Established Traders

- ☑️ IG – The Best Account Selection Offered

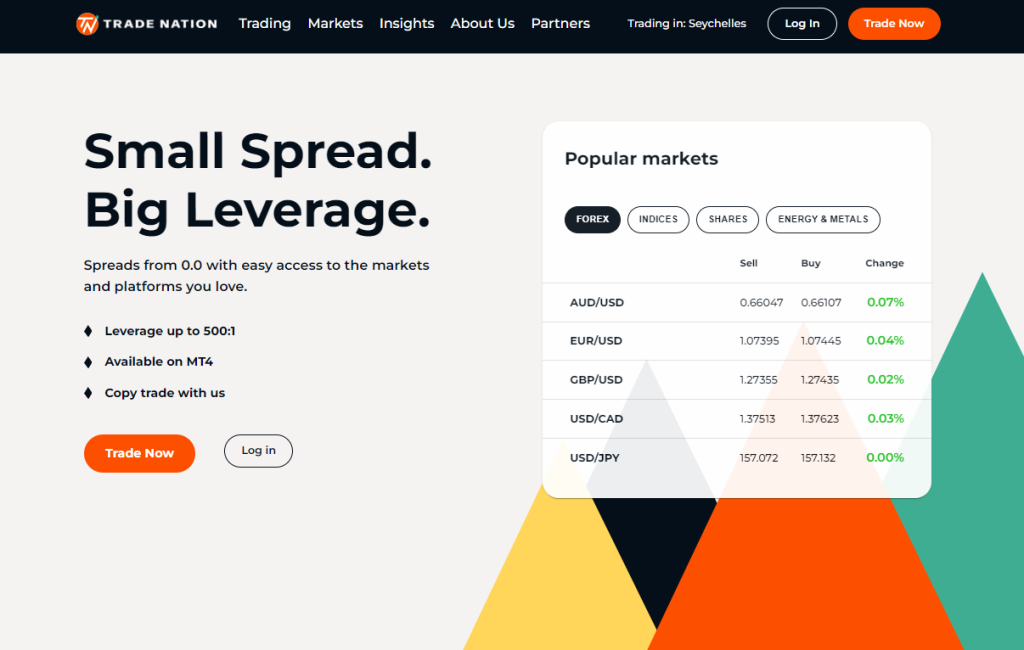

Trade Nation

Trade Nation is a leading Forex and CFD brokerage firm. Regulations by renowned and trusted agencies include the FCA, ASIC, FSCA, SCB, and, the FSA. Account Options available are:

- Low Leverage Account – Available in the European Union, the United Kingdom, and, Australia.

- High Leverage Account – Available in the Bahamas and South Africa

Moreover, a Demo Account is available. No Minimum Deposit is required. Supported Trading Platforms include MetaTrader 4 and a Proprietary Option. Notable factors and features include:

- 24/5 Customer Support

- Spreads from 0.3 Pips

- Leverage of up to 1:200

- Access to over 30 Currency Pairs

- Scalping and Hedging

Deposit Options accepted include Credit Cards, Debit Cards, Bank Wire Transfers, Skrill, and, Crypto Wallets. Trading instruments and Products include Forex, Indices, and, Commodities.

| 🔍 Broker | 🥇Trade Nation |

| 💵 Minimum Deposit | 0 USD |

| 4️⃣ Ease of use Rating | 4/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅Pros | ❌Cons |

| A good range of Forex pairings, indices, and commodities | Access to MT4 comes at a high cost |

| Provides Stop-Loss Orders | Direct asset ownership is not provided |

| Excellent Customer Support | The platform lacks advanced charting capabilities |

Our Insights

The Benefits of trading with Trade Nation include access to a wide range of Forex pairings, indices, and commodities.

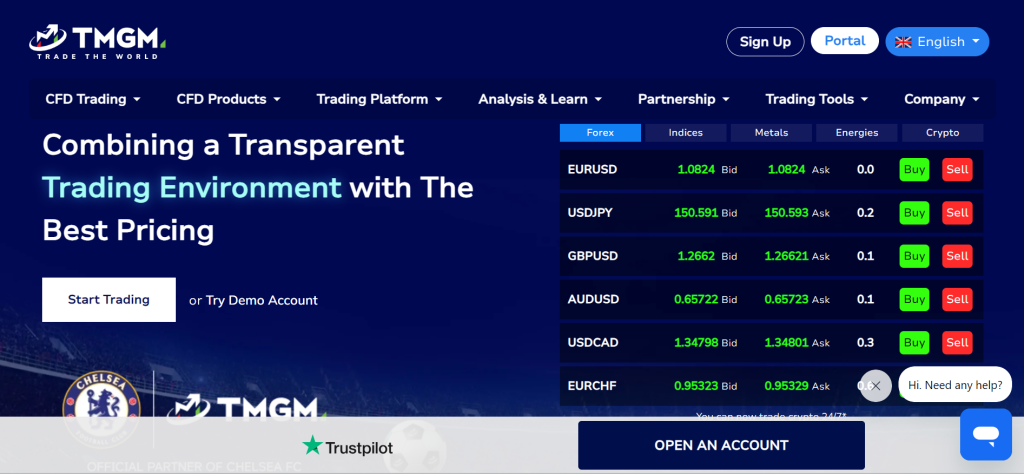

TMGM

TMGM is a popular and well-regulated Forex and CFD broker. License and Regulations include ASIC, FMA, and, the VFSC. Account Options include:

- Classic Account – Best Suited to Beginners and Casual Traders

- Edge Account – Ideal for Scalpers

- IRESS Standard Account – Ideal for Casual Traders

- IRESS Premium Account – Ideal for Experienced Traders and Investors

- IRESS Gold Account – Ideal for Professionals

Moreover, Islamic, Swap-Free, and Demo Trading are available. The Minimum Deposit is 100 USD. Supported Trading Platforms include MetaTrader 4, MetaTrader 5, IRESS, and, HUBx. Notable Factors and Features include:

- Multiple Base Currencies, including USD, EUR, and, GBP

- Spreads from 0.0 Pips

- Leverage of up to 1:1000

- Access to Over 70 Currency Pairs

- An Inactivity Fee is Charged

- Multilingual Customer Support

Trading instruments and Products include Forex, Metals, Shares, Energies, Crypto CFDs, and, Indices.

| 🔍 Broker | 🥇TMGM |

| 💵 Minimum Deposit | 100 USD |

| 4️⃣ Ease of use Rating | 4/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/7 |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Quick order execution + little slippage | Restricted Proprietary Platforms |

| MT4 and MT5 | Limited Demo Account |

Our Insights

The benefits of trading with TMGM include quick order execution, little slippage, and deals that are filled at the correct pricing.

Vantage

Vantage, previously known as Vantage FX and Vantage Markets, is a trusted Brokerage with a trust score of 89 out of 90. Regulations by acclaimed and trusted agencies include CIMA, VFSC, FSCA, and, ASIC. Account Options include:

- Standard STP Account – Ideal for Beginners and Casual traders

- Raw ECN Account – Ideal for Scalpers and Day traders

- Pro ECN Account – Ideal for Professional Traders

In addition, a Demo Account is available. Trading Platforms include:

- MetaTrader 4 and MetaTrader 5

- ProTrader

- Vantage Mobile App

- Vantage Copy Trading

- ZuluTrade

- DupliTrade

- MyFXBook Autotrader

Several Funding Options are available, including Credit Cards, Debit Cards, China UnionPay, Neteller, and, Skrill. Notable Factors and Features include:

- Refer a Friend Bonus

- Copy and Social Trading

- Multiple Base Currencies, including USD and AUD

- Spreads from 0.0 Pips

- Leverage of up to 1:500

Trading instruments and Products include Forex, indices, metals, soft commodities, energies, ETFs, share CFDs, bonds, and, crypto CFDs.

| 🔍 Broker | 🥇 Vantage Markets |

| 💵 Minimum Deposit | 50 USD |

| 4️⃣ Ease of use Rating | 4/5 |

| 🎁 Bonuses | ✅ Yes |

| ⏰ Support Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Narrow spreads on the ECN accounts | Some payment methods might incur withdrawal fees |

| Fast transaction execution while minimizing slippage in turbulent markets | Some services and product offers may be restricted by Location |

| Traders can use webinars, market analysis, and other instructional resources | Share CFD trading expenses may be higher than those of certain rivals |

Our Insights

The benefits of trading with Vantage include Narrow Spreads on ECN Accounts, Fast Transaction Execution, and, Trusted Customer Support.

Tickmill

Tickmill is a prominent Forex, CFD, and, Finacial Services Provider. License and Regulations include the Seychelles FSA, FCA, CySEC, Labuan FSA, and, the FSCA. Account Options are:

- Pro Account – Ideal for Professional Traders

- Classic Account – Suited to Beginners, Casual Traders, and Retail Investors

- VIP Account – Ideal for Scalpers and Day Traders

Trading Platforms supported include MetaTrader 4, MetaTrader 5, and, a Proprietary Mobile Platform. Notable Factors and Features include:

- Multiple Base Currencies, including USD and EUR

- Leverage of up to 1:500

- Spreads from 0.0 Pips

- No Inactivity Fee is Charged

- Scalping and Hedging

Trading instruments and Products include Forex, Stock indices, Energy indices, Precious metals, Bonds, Cryptocurrencies, Stocks, and, ETFs.

| 🔎 Broker | 🥇 Tickmill |

| 💴 Minimum Deposit | $100 |

| 💵 Inactivity Fee | None |

| 📈 Spreads | From 0.0 pips on the Pro and VIP Accounts |

| 📉 Leverage | 1:500 |

| 💶 Currency Pairs | 62, major, minor, and exotic pairs |

| 📊 Scalping | ✅Yes |

| 💹 Hedging | ✅Yes |

| 🖱️ Trading Platforms | MetaTrader 4, MetaTrader 5, Tickmill App |

| ⏰ Support Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| MetaTrader 4 and MetaTrader 5 | Limited range of instruments |

| Pro account with minimal commissions | Limited Trading Platforms |

Our Insights

The Benefits of Trading with Tickmill include Bonus Offers and Promotions, including a Trader of the Month Promotion, Tickmill’s NFP Machine, and, a 30 USD Welcome Account.

IC Markets

IC Markets is a globally recognized Forex and CFD Broker licensed and regulated by ASIC, CySEC, FSA, and, the SCB. Accounts available include:

- cTrader Account – Only available on the cTrader Platform

- Raw Spread Account – Ideal for Scalpers, Day traders, and, Active traders

- Standard Account – Ideal for Beginners and Casual traders

Supported Trading Platforms include MetaTrader 4, MetaTrader 5, cTrader, IC Social, Signal Start, and, ZuluTrade. Notable Factors and Features include:

- 24/7 Multilingual Customer Support

- Copy and Social Trading via Multiple Platforms

- Multiple Base Currencies, including AUD, USD, and, JPY

- Over 60 Currency Pairs

- Spreads from 0.0 Pips

- Scalping and Hedging are Offered

- The Standard Account is Commission Free

Trading instruments and Products include Forex, Commodities, Indices, Bonds, Cryptocurrencies, Stocks, and, Futures.

| 🔎 Broker | 🥇 IC Markets |

| 📌 Year Founded | 2007 |

| 👤 Amount of Active Traders | Over 1 million |

| 📍 Publicly Traded | None |

| 🛡️ Regulation | FSA (Seychelles) |

| 🌎 Country of Regulation | Seychelles |

| 🔃 Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| 🧾 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | None |

| 💴 Minor Account Currencies | Major and Minor |

| 💶 Minimum Deposit | 200 USD |

| ⚡ Average Deposit/Withdrawal Processing Time | Typically 1-2 business days |

| 💵 Fund Withdrawal Fee | Generally no fee |

| 🔖 Spreads From | From 0.0 pips |

| 💷 Commissions | Variable |

| 🪙 Number of Base Currencies Supported | 10+ |

| 💳 Swap Fees | ✅Yes |

| 🏷️ Leverage | Up to 1:500 |

| 🖇️ Margin Requirements | Varies |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| 🖥️ Order Execution Time | Milliseconds |

| 💻 VPS Hosting | ✅Yes |

| 📈 CFDs Total Offered | Extensive Range |

| 📉 CFD Stock Indices | Major global indices |

| 🍎 CFD Commodities | Oil, gold, etc. |

| 📊 CFD Shares | Major global stocks |

| 💴 Deposit Options | Bank transfer, credit/debit, e-wallets |

| 💶 Withdrawal Options | Bank transfer, credit/debit, e-wallets |

| 🖥️ Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader |

| 💻 OS Compatibility | Windows, macOS, iOS, Android |

| 🖱️ Forex Trading Tools | Advanced charting tools, etc. |

| 🥰 Live Chat Availability | ✅Yes |

| ☎️ Customer Support Contact Number | Varies by region |

| 💙 Social Media Platforms | Twitter, Facebook, LinkedIn, |

| 😎 Languages Supported | Multiple Languages |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | ✅Yes |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 Amount of Partners | Numerous global partners |

| 🫰🏻 IB Program | ✅Yes |

| ↪️ Do They Sponsor Any Notable Events or Teams | ✅Yes |

| ⭐ Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅Pros | ❌Cons |

| Affordable forex and CFD trading costs | High minimum deposit requirement |

| Comprehensive education and research | No investor protection for non-EU customers |

Our Insights

The Benefits of Trading with IC Markets include a Demo Account with an extremely high virtual balance.

Pepperstone

Pepperstone is a trustworthy and highly regulated Forex and CFD Broker. Regulations include ASIC, BaFin, CMA, CySEC, DFSA, FCA, and, the SCB. Account Options include:

- Standard Account – Suitable to all Traders of all Skill Levels

- Razor Account – Best Suited to Scalpers, Day Traders, and, Automatic Traders

Moreover, Islamic and Demo Trading are supported. The minimum deposit is AU$ 200. Supported Trading Platforms include TradingView, MetaTrader 4, MetaTrader 5, cTrader, and, Capitalise.ai. Notable Factors and Features include:

- Spreads from 0.0 Pips

- Leverage of up to 1:500

- 24/7 Customer Support

- USD and GBP Base Currencies

- Access to over 70 Currency Pairs

- TradingView Integration

Trading instruments and Products include Forex, commodities, indices, currency indices, cryptocurrencies, shares, and, ETFs.

| 🔎 Broker | 🥇 Pepperstone |

| 💴 Minimum Deposit | AU$200 |

| 📈 Account Types | Standard Account, Razor Account |

| 💵 Base Currencies | USD, GBP |

| 📉 Spreads | From 0.0 pips EUR/USD on the Razor Account |

| 📊 Leverage | 1:500 (Pro), 1:200 (Retail) |

| 💶 Currency Pairs | 70, minor, major, and exotic pairs |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Fully digital account opening | Mostly CFDs offered |

| Great customer service | Basic Trading Platforms |

Our Insights

The benefits of trading with Pepperstone include access to responsive, user-friendly, and, dedicated Customer Support.

IG

IG is a well-established and trusted Forex and CFD broker. License and Regulations include FCA, BaFin, CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, and, BMA. Accounts available are:

- CFD/DMA Trading Account – Available in All Regions

- Limited Risk Trading Account – Available in the EU

- Options Trading Account – Available in the EU

- Turbo24 Trading Account – Available in the EU

- Share Dealing Account – Available in Australia

- Spread Betting Account – Available in the United Kingdom

- Swap-Free Trading Account – Available in Dubai

Moreover, a Demo Account is available. Trading Platforms supported include MetaTrader 4, ProRealTime (PRT), L2 Dealer, and, FIX API. In addition, an IG Proprietary Mobile Platform is available. Notable factors and features include:

- Spreads from 0.1 Pips

- 24/7 Dedicated Customer Support

- Access to over 8- Currency Pairs

- Access to an Affiliate Program

Instruments available for trade include Forex, indices, share CFDs, commodities, cryptocurrencies, futures, options, bonds, ETFs, Digital 100s, and, interest rates.

| 🔎 Broker | 🥇 IG |

| 📌 Year Founded | 1974 |

| 👤 Amount of Staff | 2,000+ |

| 👥 Amount of Active Traders | 300,000+ |

| 📍 Publicly Traded | ✅Yes |

| 🛡️Regulation | FCA, ASIC, CFTC, NFA, BaFin |

| 🌎 Country of Regulation | UK, Australia, US, Germany |

| ↪️ Account Segregation | ✅Yes |

| ⭐ Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | None |

| 💴 Minor Account Currencies | USD, EUR, GBP |

| 💶 Minimum Deposit | $250 |

| ⏰ Average Deposit/Withdrawal Processing Time | 1-3 business days |

| 💷 Fund Withdrawal Fee | None |

| 📈 Spreads from | 0.6 pips |

| 📉 Commissions | None |

| 💰 Number of Base Currencies Supported | 5 |

| 📊 Swap Fees | Applicable |

| ⚙️ Leverage | Up to 1:30 (Retail) |

| 🔖 Margin Requirements | Varies by asset |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏲️ Order Execution Time | 0.1 seconds |

| 🖱️ VPS Hosting | ✅Yes |

| ✔️CFDs Total | 17,000+ |

| 📌 CFD Stock Indices | 80+ |

| 🍎 CFD Commodities | 30+ |

| 📍 CFD Shares | 12,000+ |

| 💴 Deposit Options | Bank Transfer, Credit/Debit Cards, PayPal, Skrill |

| 💶 Withdrawal Options | Bank Transfer, Credit/Debit Cards, PayPal, Skrill |

| 🖥️ Trading Platforms | MetaTrader 4, ProRealTime, L2 Dealer, IG Trading Platform |

| 💻 OS Compatibility | Windows, MacOS, Android, iOS |

| 📐 Forex Trading Tools | Economic calendar, Autochartist, Trading signals |

| 🥰 Live Chat Availability | ✅Yes |

| 💌 Customer Support Email | ✅Yes |

| ☎️ Customer Support Contact Number | ✅Yes |

| 💙 Social Media Platforms | Facebook, Twitter, LinkedIn |

| ✏️ Languages Supported | Multiple languages |

| 📔 Forex Course | ✅Yes |

| 📚 Webinars | ✅Yes |

| 📒 Educational Resources | Articles, Videos, Tutorials |

| 📑 Affiliate Program | ✅Yes |

| 🗃️ Amount of Partners | Not specified |

| 🗄️ IB Program | ✅Yes |

| 📇 Notable Events or Teams | ✅Yes |

| 🪙 Rebate Program | ✅Yes |

| 💴 Cent or Micro Accounts | None |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Access to over 17,000 instruments across markets | Limitations on customer support hours |

| Investing opportunities for high-volume traders | Inactivity fees apply |

| Several advanced Trading platforms | IG is not available in all regions |

Our Insights

The benefits of trading with IG include a strong regulatory framework, broad market access, and extensive training resources.

Is Forex Trading Legal in Trinidad and Tobago?

Forex Trading in Trinidad and Tobago is legal and available without restriction. Moreover, it is licensed and regulated by the Trinidad and Tobago Securities and Exchange Commission (TTSEC).

In Conclusion

Forex Trading in Trinidad and Tobago is extremely popular and highly regulated. Moreover, several International Forex Brokers accept Local Traders.

Our Insights

While reviewing the Best Forex Brokers that accept Traders in Trinidad and Tobago, we found 7 excellent options. Each broker has its list of Benefits, ranging from multiple account types to multilingual customer support. Finding the Best Forex Broker will depend on a trader’s individual trading needs.

You might also like:

Faq

Forex Trading in Trinidad and Tobago is legal and available without restriction.

The Trinidad and Tobago Securities and Exchange Commission (TTSEC).

The Trinidad and Tobago Dollar (TTD).

No minimum deposit is required.

TMGM offers 24/7 Customer Support.

Vantage supports Scalping and Hedging.

Tickmill supports MetaTrader 4 and MetaTrader 5.

The IC Markets minimum deposit is 200 USD.

Regulations include ASIC, BaFin, CMA, CySEC, DFSA, FCA, and, the SCB.

IG offers 24/7 Customer Support.