6 Best Forex Brokers in Singapore

The 6 successful Forex brokers in Singapore revealed. We have explored and tested several prominent brokers trading on a regulated platform to identify the 6 best. Brokers can be seen on social media like Reddit and Instagram.

In this in-depth guide you’ll learn:

- What is a Forex broker in Singapore?

- Who are the best brokers in the currency market?

- Pros and cons of each broker.

- Popular FAQs of the best currency market brokers in Singapore.

- Is currency trading legal and taxable in Singapore?

And lots more…

So, if you’re ready to go “all in” with the 6 best Forex brokers in Singapore…

Let’s dive right in…

🏆 10 Best Forex Brokers

6 Best Forex Brokers in Singapore (2024*)

- ☑️Saxo Bank – Overall Best Forex Broker in Singapore.

- ☑️Interactive Brokers – Gives Diverse global opportunities.

- ☑️Oanda – Instant execution of orders.

- ☑️Plus500 – user-friendly platform.

- ☑️AvaTrade – Voted number one Forex Broker.

- ☑️FP Markets – Low-cost structure enhances profitability.

What is a Forex broker for traders in Singapore?

Forex brokers welcoming traders from Singapore present a wide array of trading options with competitive spreads and user-friendly platforms adhering to local regulations. They prioritize safety with secure deposit methods and educational support, alongside multilingual customer service, ensuring a seamless trading experience in the dynamic forex market. Forex trading is legal and taxable in Singapore provided they trade with a legal regulated broker.

The 6 Best Forex Brokers in Singapore

| 👥Broker | 👉 Open Account | 💰Minimum Deposit | ⚖️Regulation | 💻Platform |

| Saxo Bank | 👉 Open Account | $2000 | FINMA, FSA, FCA, MAS, ASIC, JFSA | SaxoInvestor, SaxoTraderGo, SaxoTraderPro |

| Interactive Brokers | 👉 Open Account | No specific minimum deposit required. | SEC, CFTC, FCA | IBKR |

| Oanda | 👉 Open Account | No specific minimum deposit required. | ASIC, FSCA | MT4, MT5, IRESS |

| Plus500 | 👉 Open Account | COP 391,864.00 to USD100 | CySEC, FCA, MAS, FSA, ASIC, FMA, FSCA | WebTrader |

| AvaTrade | 👉 Open Account | $100 | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| FP Markets | 👉 Open Account | AU$100 | ASIC, CySEC, FSCA, FCA and FSA | MetaTrader 4 MetaTrader 5 cTrader IRESS FP Markets App |

Saxo Bank

Saxo Bank stands out as an excellent choice for multi-asset traders in Singapore due to its comprehensive range of trading instruments and global market access. With Saxo Bank, traders can access a diverse selection of assets including forex, stocks, options, futures, and bonds, all from a single platform.

This allows Singaporean traders to build diversified portfolios and capitalize on opportunities across various markets without the need for multiple accounts or platforms.

Saxo Bank provides competitive pricing and efficient execution, ensuring that traders can enter and exit positions with minimal slippage. The platform also offers advanced trading tools and analysis resources, empowering multi-asset traders to make informed decisions and optimize their trading strategies.

Their regulatory compliance and a strong reputation for reliability and security make it a trusted partner for traders in Singapore seeking a robust and versatile trading solution across multiple asset classes.

Unique Features

| 🔍Feature | 👁️🗨️ Information |

| 📝 Regulation | FINMA, FSA, FCA, MAS, ASIC, JFSA |

| 📱 Social Media Platforms | LinkedIn, Twitter, Facebook, YouTube |

| 🔎 Trading Accounts | Classic, Platinum and VIP |

| 💻 Trading Platforms | SaxoInvestor, SaxoTraderGo, SaxoTraderPro |

| 💸 Minimum Deposit | $2000 |

| 🔁 Trading Assets | Forex, commodities, CFDs, bonds, ETFs, Stocks, Mutual Funds, Crypto ETPs options |

| SGD-based Account? | ❌No |

| SGD Deposits Allowed? | ✔️ Yes |

| 💰 Bonuses for traders? | ❌No |

| 📊 Minimum spread | From 0.9 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ❌No |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Saxo Bank excels in providing a diverse range of assets, including forex, stocks, bonds, and commodities. | The platform may be overwhelming for novice traders due to its advanced features and tools. |

| The platform offers sophisticated tools for in-depth market analysis, catering to experienced traders. | Compared to some competitors, Saxo Bank's fees may be relatively higher, impacting cost-effectiveness. |

| Saxo Bank provides extensive access to global financial markets, allowing diverse investment opportunities. | The sophisticated platform might have a steeper learning curve, requiring time to master for some users. |

| Experienced traders benefit from tailored support and research resources, enhancing decision-making capabilities. | |

| Saxo Bank incorporates cutting-edge technology for seamless and efficient trading experiences. |

Saxo Bank has a high trust score of 96%

Interactive Brokers

Interactive Brokers is an excellent option for day traders in Singapore due to its low commissions, fast execution, and advanced trading tools. With competitive pricing and access to multiple markets worldwide, day traders can capitalize on short-term price movements efficiently.

Their robust trading platform offers customizable charts, real-time data, and sophisticated order types, empowering day traders to make quick and informed decisions.

Additionally, its comprehensive range of products including stocks, options, futures, and forex provides ample opportunities for day traders to diversify their strategies and capture profit potential in various market conditions.

Interactive Brokers’ strong regulatory compliance and reputation for reliability ensure a secure trading environment for day traders in Singapore, instilling confidence and trust in their trading activities.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | SEC, CFTC, FCA |

| ⚖️ MAS Regulation? | ❌ No |

| 📲 Social Media Platforms | LinkedIn YouTube |

| 💻 Trading Accounts | Individual, Joint, Trust, IRA, Non-Professional Advisor, Family Office, Advisor, Advisor Client (including Non-Professional Advisor and Family Office), Broker Client, EmployeeTrack |

| 📊 Trading Platforms | IBKR |

| 💰 Minimum Deposit | No specific minimum deposit required. |

| 📉 Trading Assets | Global Stocks, options, futures, currencies, cryptocurrencies |

| SGD-based Account? | ✔️ Yes |

| SGD Deposits Allowed? | ❌ No |

| ➕ Bonuses for traders? | ✔️Yes (except for US traders, as per US regulation) |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ❌ No |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Interactive Brokers gives traders access to a variety of global markets, including stocks, bonds, futures, currencies, and options, allowing them to diversify their portfolios across multiple asset classes. | Trading platforms and tools can be challenging for new traders to comprehend and use effectively. |

| Interactive Brokers' trading platforms, including Trader Workstation (TWS) and IBKR Mobile, offer traders extensive tools for analysis and execution. | Despite their low costs, Interactive Brokers' fee structures can be confusing for some traders due to the different charges assessed for various services and account types. |

| Interactive Brokers offers simple pricing structures and fair commission rates to active traders, particularly those with large volume, which may result in lower overall trading costs. | Certain account types at Interactive Brokers have minimum balance restrictions that are greater than those at other brokers, making it more difficult for traders with lesser account balances to access the platform. |

| Interactive Brokers provides traders with a wealth of research and analytical materials, such as market commentary, technical analysis, fundamental data, and research papers, to help them make informed investing decisions. | Although Interactive Brokers provides customer care by phone, email, and live chat, some traders may find the service less personalized or attentive than that of smaller brokers. |

| Portfolio margining, risk-based margining, and real-time margin computations are among the risk management capabilities offered by Interactive Brokers to assist traders in better managing and mitigating risk. | In comparison to other brokers, Interactive Brokers may offer less tutorials and educational resources, prompting newbie traders to seek additional assistance and educational materials |

Trust Score

Interactive Brokers has a trust score of 95%

Oanda

They emerge as an optimal choice for risk-averse traders in Singapore owing to several key attributes with flexible position sizing options and risk management tools too enable traders to tailor their positions according to their risk tolerance levels.

Their negative balance protection feature shields traders from potentially catastrophic losses by ensuring that their account balances cannot fall below zero. The platform’s user-friendly interface and educational resources empower traders to make informed decisions, further mitigating risk.

Oanda’s adherence to regulatory standards and its reputation for reliability instill confidence in risk-averse traders, providing them with peace of mind as they navigate the forex markets.

By offering a combination of risk management features, educational support, and regulatory compliance, Oanda facilitates a secure trading environment conducive to the cautious strategies favoured by risk-averse traders in Singapore.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA, CFTC |

| MAS regulation? | ✔️ Yes |

| 📲 Social Media Platforms | LinkedIn YouTube |

| 💻 Trading Accounts | Standard Account, Core Account, Swap-Free Account, Demo Account |

| 📊 Trading Platforms | Oanda Platform, MetaTrader 4, TradingView |

| 💰 Minimum Deposit | No specific minimum deposit required. |

| 📉 Trading Assets | Index CFD's, Forex, Metals, Commodity CFD's, Bonds CFD's, Precious Metals, Real-Time Rates |

| SGD-based Account? | ✔️ Yes |

| SGD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️Yes (except for US traders, as per US regulation) |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✅Pros | ❌Cons |

| OANDA is known for its strong regulatory structure, which is overseen by top-tier entities like as the FCA and CFTC, enhancing its credibility and dependability | OANDA has a restricted product selection, principally focused on Forex and CFDs |

| The platform has an advanced trading interface, extensive charting capabilities, and a user-friendly design that is appropriate for both novice and expert traders | The broker's account structure and price tiers can be complex and perplexing to inexperienced traders |

| OANDA offers a wide range of research tools and resources, such as market analysis and economic calendars | While OANDA offers complex tools, beginners may struggle to master these functions |

| There is no minimum deposit requirement, making it accessible to traders of all levels, and its spreads are competitive. | Some users have noticed slippage and latency concerns during periods of strong market volatility |

| OANDA's customer service is well-regarded, with helpful and experienced support staff |

Trust Score

Oanda has a trust score of 91%

Plus500

Plus500 presents an ideal solution for technology-oriented traders in Singapore due to its advanced trading platform and emphasis on technological innovation.

The platform offers a user-friendly interface coupled with cutting-edge features such as advanced charting tools, real-time market data, and customizable trading parameters, catering to traders who prioritize sophisticated technology in their trading endeavors.

Plus500’s robust API solutions enable seamless integration with algorithmic trading strategies and third-party platforms, facilitating automated trading for technologically savvy traders. Furthermore, Plus500‘s mobile trading app provides flexibility and convenience, allowing traders to stay connected to the markets and execute trades on the go using their preferred devices.

With its focus on technological excellence and innovation, Plus500 is well-aligned with the preferences and requirements of technology-oriented traders in Singapore, offering a competitive edge in navigating the dynamic financial markets.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️Regulation | CySEC, FCA, MAS, FSA, ASIC, FMA, FSCA |

| ⚖️MAS regulation? | ✔️Yes |

| 📱 Social Media Platforms | Facebook, Twitter, Telegram, Instagram, YouTube, LinkedIn |

| 🔎 Trading Accounts | Retail trading account |

| 💻 Trading Platforms | WebTrader |

| 💸 Minimum Deposit | COP 391,864.00 to USD100 |

| 🔁 Trading Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| SGD-based Account? | ❌No |

| SGD Deposits Allowed? | ❌No |

| 💰 Bonuses for traders? | ✔️Yes |

| 📊 Minimum spread | From 0.0 pips |

| ✔️ Demo Account | ✔️Yes |

| ✔️ Islamic Account | ✔️Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Intuitive and user-friendly trading platform. | Limited research and analysis tools compared to some competitors. |

| Wide range of tradable assets including Forex, stocks, commodities, cryptocurrencies, and indices. | Inactivity fees may apply to dormant accounts. |

| No commission on trades, with fees incorporated into spreads. | Withdrawal processing times can be slow. |

| Access to a free and unlimited demo account. | Limited customization options for trading interface. |

| Competitive spreads on major assets. | Availability of certain assets may be restricted in specific regions. |

Trust Score

Plus500 has a trust score of 85%

AvaTrade

This broker stands out as an excellent choice for algorithmic traders in Singapore due to several key factors. AvaTrade provides robust support for algorithmic trading through its advanced API solutions, allowing algorithmic traders to seamlessly integrate their trading systems and strategies with AvaTrade’s platform.

They offer a wide range of trading instruments across various asset classes, including forex, stocks, indices, commodities, and cryptocurrencies, providing ample opportunities for algorithmic trading strategies.

Their advanced trading tools, customizable trading parameters, and real-time market data empower algorithmic traders to execute their strategies effectively and efficiently.

AvaTrade’s regulatory compliance and reputation for reliability ensure a secure trading environment for algorithmic traders in Singapore, fostering trust and confidence in their trading activities.

Overall, AvaTrade’s comprehensive support for algorithmic trading, combined with its extensive market coverage and regulatory adherence, makes it a compelling choice for algorithmic traders in Singapore.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA |

| ⚖️ MAS regulation? | ✔️ Yes |

| 📲 Social Media Platforms | Instagram You Tube |

| 💻 Trading Accounts | Retail Account, Professional Account |

| 📊 Trading Platforms | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 💰 Minimum Deposit | $100 |

| 📉 Trading Assets | Forex Stocks Commodities Cryptocurrencies Treasuries Bonds Indices Exchange-Traded Funds (ETFs) Options Contracts for Difference (CFDs) Precious Metals |

| SGD -based Account? | ❌ No |

| SGD Deposits Allowed? | ❌ No |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes (Dubai) |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade provides free deposit and withdrawal alternatives, as well as useful research tools | The product selection is limited, with a concentration on CFDs, Forex, and cryptocurrency |

| They offer a wide choice of trading platforms to suit a variety of trading preferences | Higher inactivity costs than other brokers |

| SharpTrader offers high-quality educational resources | The forex fees are minimal, but the CFD trading fees are high |

| Multiple authorities regulate it effectively, ensuring a secure trading environment | AvaTrade’s trading costs may not be the most budget-friendly for all traders |

| AvaTrade provides free deposit and withdrawal alternatives, as well as useful research tools | The inactivity cost is charged periodically and is expensive |

Trust Score

AvaTrade has a high trust score of 96%

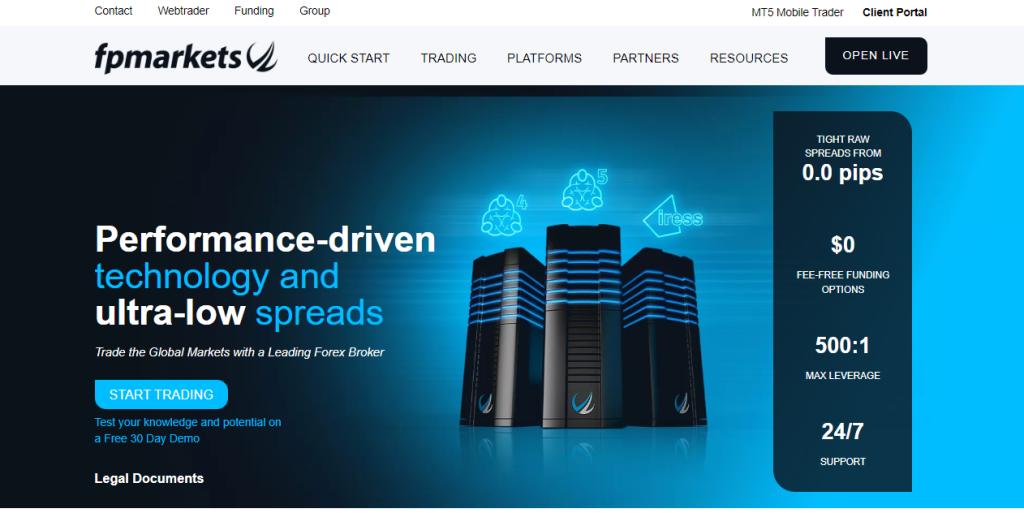

FP Markets

FP Markets emerges as an ideal choice for institutional traders in Singapore due to its comprehensive institutional-grade offerings and commitment to providing sophisticated trading solutions.

They offer prime brokerage services tailored to meet the needs of institutional clients, providing access to deep liquidity pools and competitive pricing. Additionally, the platform’s advanced trading infrastructure ensures fast execution and reliable order routing, essential for executing large volume trades efficiently.

FP Markets’ regulatory compliance and adherence to strict industry standards instill confidence in institutional traders, assuring a secure trading environment. The platform’s dedicated institutional support team provides personalized assistance and guidance, catering to the unique requirements of institutional clients.

Overall, FP Markets’ combination of institutional-grade services, technological prowess, regulatory adherence, and client-centric approach make it a compelling choice for institutional traders seeking a reliable and comprehensive trading partner in Singapore.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | ASIC, CySEC, FSCA, FCA and FSA |

| ⚖️ MAS Regulation? | ❌ No |

| 📲 Social Media Platforms | LinkedIn You Tube |

| 💻 Trading Accounts | MT4/5 Standard Account, an MT4/5 Raw Account, an MT4/5 Islamic Standard Account, and an MT 4/5 Islamic Raw Account |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader IRESS FP Markets App |

| 💰 Minimum Deposit | AU$100 |

| 📉 Trading Assets | Forex Shares Indices Commodities Cryptocurrencies Bonds ETFs |

| SGD - based Account? | ✔️ Yes |

| SGD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ❌ No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The cutting-edge technology architecture of FP Markets is advantageous to traders. | Owing to FP Markets' global orientation, support for certain local payment methods could be limited. |

| Traders can take advantage of comprehensive customer support provided by a skilled and committed crew. | Although FP Markets offers a wide range of products, certain traders may be interested in local or specialist markets that they do not offer. |

| Traders have the option of trading with a broker who is subject to regulation by a variety of international regulatory bodies, including the FSA, FSC, ASIC, FSCA, and CySEC. | Withdrawal fees are assessed by FP Markets for a number of payment options. |

| For traders who wish to advance their trading expertise, FP Markets provides a whole educational package. | |

| In order to accommodate traders' diverse demands and trading preferences, FP Markets offers a range of account kinds. | |

| Traders can use platforms like MetaTrader 4, cTrader, IRESS, and MetaTrader 5 to get access to sophisticated charting and analytical tools. | |

| Traders can diversify their trading methods across asset classes by having access to a large range of global markets through FP Markets. | |

| FP Markets keeps its minimum commission arrangements and competitive spreads in place. |

Trust Score

FP Markets has a high trust score of 87%

Conclusion

Our Final Thoughts on the 6 Best Forex Brokers in Singapore. Overall, selecting the best Forex broker in Singapore entails considering various factors such as regulatory compliance, trading platform features, customer support, and trading costs.

By carefully evaluating these aspects and aligning them with individual trading needs, traders can make informed decisions to optimize their trading experience in Singapore’s dynamic Forex market.

Frequently Asked Questions

What types of accounts do Forex brokers in Singapore offer?

Forex brokers typically offer various types of accounts such as standard, mini, and VIP accounts, each with different minimum deposit requirements and trading conditions.

Can I trade other financial instruments besides Forex with Singaporean Forex brokers?

Yes, many Forex brokers in Singapore also offer trading opportunities

In other financial instruments such as stocks, indices, commodities, and cryptocurrencies.

What are the typical trading costs associated with Forex trading in Singapore?

Trading costs may include spreads, commissions, overnight financing fees (swap rates), and other fees. It’s essential to compare these costs when choosing a broker.

Is leverage available when trading Forex in Singapore?

Yes, leverage is commonly offered by Forex brokers in Singapore, allowing traders to amplify their trading positions. However, it’s crucial to understand the risks associated with leverage.

Can I get customer support in my native language?

Many Forex brokers provide multilingual customer support to assist traders in their preferred languages, including English, Mandarin, Malay, and others.

Follow us on social media Twitter.