6 Best Forex Brokers in Saudi Arabia

The 6 best Forex brokers in Saudi Arabia revealed. We have explored and tested several prominent brokers to identify the 6 best.

In this in-depth guide you’ll learn:

- What is a Forex broker in Saudi Arabia?

- Best Forex Trading Platform.

- Is Forex Trading Legal in Saudi Arabia?

- Pros and cons of each broker.

- Popular FAQs about the best Forex brokers in Saudi Arabia.

And lots more…

So, if you are ready to go “all in” with the 6 best Forex brokers in Saudi Arabia…

Let us dive right in…

🏆 10 Best Forex Brokers

What is a Forex broker in Saudi Arabia?

A Forex broker accepting Saudi Arabian traders offers a platform for buying and selling currencies, adhering to Islamic finance principles. Compliant with Saudi regulations, it provides access to global markets, competitive spreads, secure transactions, and localized support in Arabic. Empowering traders with tools for informed decision-making and seamless trading experiences.

6 Best Forex Brokers in Saudi Arabia

- ☑️Interactive Brokers – Award Winning Platform.

- ☑️XTB – Best Multi-asset Market in 2024.

- ☑️AvaTrade – Great for beginners and copy trading.

- ☑️ Pepperstone – Great ECN execution on the MT4 platform.

- ☑️FP Markets – Best mobile trading platform in Saudi Arabia.

- ☑️IC Markets – Low FX commission and tight spreads.

Best Forex Brokers in Saudi Arabia

| 🔎 Broker | 👉 Open Account | 💶 Min. Deposit ($) | 📊 Forex broker | 📈 Minimum Spread |

| Interactive Brokers | 👉 Open Account | There is no specific minimum deposit required | ✅ | From 0.0 pips |

| XTB | 👉 Open Account | There is no specific minimum deposit required | ✅ | From 0.5 pips |

| AvaTrade | 👉 Open Account | SAR375.03 or $100 | ✅ | From 0.0 pips |

| Pepperstone | 👉 Open Account | SAR 501.053 or AU$200 | ✅ | From 0.0 pips |

| FP Markets | 👉 Open Account | SAR375.03 or $100 | ✅ | From 0.0 pips |

| IC Markets | 👉 Open Account | SAR750.09 in $200 | ✅ | From 0.0 pips |

6 Best Forex Brokers in Saudi Arabia

Interactive Brokers

Overview

Interactive Brokers is a global brokerage renowned for its advanced trading platform and comprehensive range of financial instruments, including forex, stocks, options, and futures.

Specifically tailored for traders in Saudi Arabia, it offers Sharia-compliant accounts, adhering to Islamic finance principles. Traders can access a diverse array of markets, including the Tadawul, with competitive pricing and low commissions.

The platform provides advanced trading tools, such as algorithmic trading options and customizable analytics, empowering traders to execute strategies efficiently. With robust security measures and regulatory compliance, it ensures the safety of traders’ funds and personal information.

Moreover, Interactive Brokers offers extensive educational resources, including webinars and tutorials, catering to both novice and experienced traders.

With multilingual support and localized services, it facilitates a seamless trading experience for Saudi Arabian investors, enabling them to capitalize on global market opportunities while adhering to their cultural and regulatory requirements.

Unique Features

| Feature | Information |

| ⚖️ Regulation | SEC, CFTC, FCA |

| 💻 Account Types | Individual, Joint, Trust, IRA. Non-Professional Advisor. Family Office. Advisor. Advisor Client (including Non-Professional Advisor and Family Office) Broker Client. EmployeeTrack. |

| 💵 Minimum Spread | From 0.0 pips |

| 💸 Minimum Deposit | There is no specific minimum deposit required |

| 📱 Platforms Supported | IBKR |

| 📈 Range of Markets | Global stocks, options, futures, currencies, cryptocurrencies |

| 📊 Demo Account | Yes |

| ✴️ Social Trading Offered | Facebook YouTube |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Interactive Brokers gives traders access to a variety of global markets, including stocks, bonds, futures, currencies, and options, allowing them to diversify their portfolios across multiple asset classes. | Advanced trading platforms and tools can be challenging for new traders to comprehend and use effectively. |

| Interactive Brokers' trading platforms, including Trader Workstation (TWS) and IBKR Mobile, offer traders extensive tools for analysis and execution. | Despite their low costs, Interactive Brokers' fee structures can be confusing for some traders due to the different charges assessed for numerous services and account types. |

| Interactive Brokers offers simple pricing structures and fair commission rates to active traders, particularly those with large volume, which may result in lower overall trading costs. | Certain account types at Interactive Brokers have minimum balance restrictions that are greater than those at other brokers, making it more difficult for traders with lesser account balances to access the platform. |

| Interactive Brokers provides traders with a wealth of research and analytical materials, such as market commentary, technical analysis, fundamental data, and research papers, to help them make informed investing decisions. | Although Interactive Brokers provides customer care by phone, email, and live chat, some traders may find the service less personalized or attentive than that of smaller brokers. In comparison to other brokers, Interactive Brokers may offer less tutorials and educational resources, prompting newbie traders to seek additional assistance and educational materials. |

| Portfolio margining, risk-based margining, and real-time margin computations are among the risk management capabilities offered by Interactive Brokers to assist traders in better managing and mitigating risk. |

Trust Score

Interactive Brokers has a trust score of 95%

XTB

Overview

XTB is a leading brokerage offering cutting-edge trading solutions for Saudi Arabian traders. With a focus on transparency and innovation, XTB provides access to a wide range of financial instruments, including forex, indices, commodities, and cryptocurrencies.

One of XTB’s standout features for traders in Saudi Arabia is its adherence to Islamic finance principles, offering Sharia-compliant accounts. This ensures that traders can participate in the financial markets while remaining compliant with their religious beliefs.

XTB’s platform is renowned for its user-friendly interface and advanced trading tools, empowering traders to execute their strategies effectively. Additionally, the broker offers competitive pricing, tight spreads, and reliable execution, allowing traders to capitalize on market opportunities with confidence.

With dedicated customer support in Arabic and localized services, XTB ensures that Saudi Arabian traders receive the assistance they need for a seamless trading experience.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FCA, ACPR, BaFin, DFSA, KNF, CNMV, FSCA, CySEC, IFSC |

| 💻 Account Types | Standard Account Swap-free Account Islamic Account Professional Account |

| 💵 Minimum Spread | From 0.5 pips |

| 💸 Minimum Deposit | There is no specific minimum deposit required |

| 📱 Platforms Supported | xStation 5 xStation Mobile |

| 📈 Range of Markets | Forex Indices Commodities Stock CFDs ETF CFDs Cryptocurrencies |

| 📊 Demo Account | Yes |

| ✴️ Social Trading Offered | Facebook YouTube |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| XTB, known for technological innovation, provides an easy-to-use platform with enhanced charting capabilities and extensive market research. | The price structure needs to be thoroughly examined because it contains a variety of fees, such as spreads and overnight funding, which traders may find confusing. |

| The broker is committed to transparency and openness with its traders. | Even with a straightforward design, individual traders may experience a learning curve, particularly when using more sophisticated features and tools. |

| XTB provides traders with a wide choice of financial products, including commodities, indexes, and primary and exotic currency pairs. | If XTB does not have physical locations around the world, it may be more difficult to assist traders in need in person. |

| Support developed with dealers' needs in mind allows for effective communication and support in their local language. | |

| XTB focuses on education, giving traders the tools and market knowledge, they need to better their trading abilities and comprehension. |

Trust Score

XTB has a trust score of 95%

AvaTrade

Overview

AvaTrade is a trusted brokerage catering to Saudi Arabian traders with a diverse selection of assets, including forex, stocks, indices, commodities, and cryptocurrencies.

Recognizing the importance of education, AvaTrade provides extensive learning resources tailored to the Saudi market, including webinars, tutorials, and market analysis in Arabic.

For trading platforms, AvaTrade offers a variety of options, including the popular MetaTrader 4 and AvaTradeGO platforms, accessible via desktop, web, and mobile devices.

AvaTrade’s spreads are competitive, allowing traders to access global markets with minimal costs and favorable trading conditions.

Moreover, AvaTrade prioritizes the needs of Saudi traders by offering localized support in Arabic, ensuring efficient communication and assistance.

With a commitment to transparency and regulatory compliance, AvaTrade provides a secure trading environment for Saudi Arabian traders to navigate the financial markets confidently and capitalize on opportunities while staying informed and supported.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA |

| 💻 Account Types | Retail Account, Professional Account |

| 💵 Minimum Spread | From 0.0 pips |

| 💸 Minimum Deposit | SAR375.03 or $100 |

| 📱 Platforms Supported | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 📈 Range of Markets | Forex Stocks Commodities Cryptocurrencies Treasuries Bonds Indices Exchange-Traded Funds (ETFs) Options Contracts for Difference (CFDs) Precious Metals |

| 📊 Demo Account | Yes |

| ✴️ Social Trading Offered | Instagram YouTube |

👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade's extensive trading instruments, which include cryptocurrencies, equities, commodities, indices, and currency pairs, enable investors to build diverse portfolios. | Higher spreads than other brokers, according to some users, may influence trading expenses, particularly for regular traders. |

| AvaTrade's interface with ZuluTrade allows customers access to social trading, allowing them to replicate and follow the trading strategies of successful traders. | For some traders, AvaTrade's research and analysis capabilities might seem a little bit limited in comparison to other platforms, which could make it more difficult to conduct in-depth market study. |

| The platform offers unique features like as AvaTradeGo for convenient mobile trading, AvaSocial for social trading, and AvaProtect for advanced charting and technical analysis. | The sophisticated features and capabilities on the site could be too much for inexperienced traders to properly utilise, necessitating a learning curve. |

| Customers can trade in a safe and trusted environment with AvaTrade because it is regulated by several reputable institutions, including the Financial Services Commission of the British Virgin Islands and the Central Bank of Ireland. | Although AvaTrade provides customer care, there is a possibility that certain customers may become frustrated due to variations in the calibre and promptness of their assistance. |

| AvaTrade offers several instructional products to help traders expand their skills and expertise, including webinars, tutorials, and market analysis. | AvaTrade withdrawal processes have occasionally been reported to be delayed or complicated, which may be problematic for individuals who need quick access to their money. |

Trust Score

AvaTrade has a high trust score of 96%

Pepperstone

Overview

Pepperstone is a trusted brokerage catering to Saudi Arabian traders with a strong commitment to regulatory compliance.

Regulated by the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC), Pepperstone offers a secure trading environment that meets international standards.

Saudi traders benefit from responsive customer support in Arabic, ensuring prompt assistance and effective communication. Account security is paramount, with Pepperstone implementing robust measures such as encryption and segregated client funds, providing peace of mind to traders.

Pepperstone boasts a wide range of tradable assets, including forex, commodities, indices, and cryptocurrencies, allowing Saudi traders to diversify their portfolios.

With competitive spreads and lightning-fast execution, Pepperstone enables traders to seize opportunities in global markets with efficiency and confidence, all while adhering to the highest standards of security and regulatory compliance.

Unique Features

| Feature | Information |

| ⚖️ Regulation | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 💻 Account Types | Standard Account Razor Account Professional Account Demo Account Islamic Account |

| 💵 Minimum Spread | From 0.0 pips |

| 💸 Minimum Deposit | SAR 501.053 or AU$200 |

| 📱 Platforms Supported | MetaTrader 4 MetaTrader 5 cTrader TradingView Myfxbook Duplitrade |

| 📈 Range of Markets | Forex Indices Shares Commodities Cryptocurrencies Futures Options |

| 📊 Demo Account | Yes |

| ✴️ Social Trading Offered | LinkedIn YouTube |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Regulated by reputable authorities such as the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC), ensuring a secure trading environment. | While Pepperstone offers some educational materials, it may not provide as extensive resources compared to other brokers. |

| Offers a diverse selection of assets including forex, commodities, indices, and cryptocurrencies, enabling traders to build diversified portfolios. | Traders may find the research and analysis tools offered by Pepperstone to be less comprehensive compared to some other brokers. |

| Provides competitive spreads, allowing traders to access markets with minimal costs and favourable trading conditions. | While Pepperstone offers customer support in Arabic, some localized services may be limited compared to brokers specifically targeting the Saudi Arabian market. |

| Utilizes advanced trading platforms and tools, including MetaTrader 4 and cTrader, offering sophisticated trading features and analysis. | While Pepperstone may offer Islamic finance-compliant accounts, the availability and features of these accounts may not be as robust as some other brokers catering specifically to Islamic finance principles. |

| Offers multilingual customer support, including assistance in Arabic, ensuring prompt and effective communication. |

Trust Score

Pepperstone has a high trust score of 92%

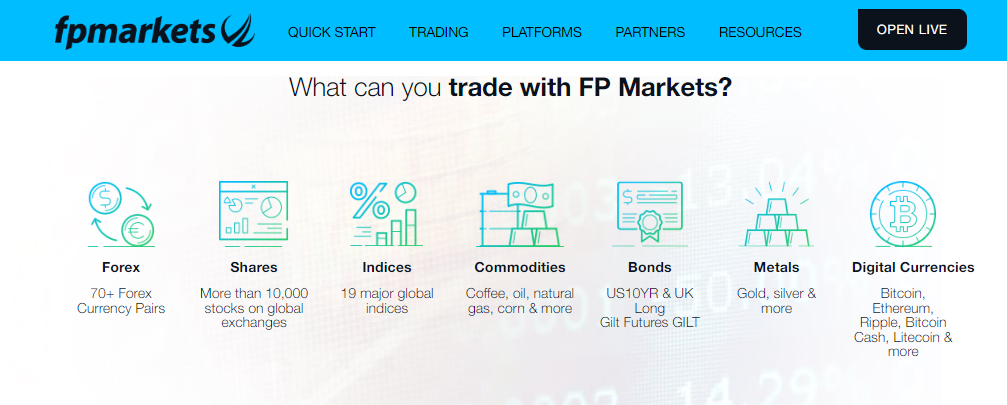

FP Markets

Overview

FP Markets is a reputable brokerage ideal for Saudi Arabian traders, offering various account types to suit individual preferences, including Standard, Raw ECN, and Islamic accounts compliant with Sharia principles.

Traders benefit from a wide array of tradable assets such as forex, commodities, indices, and cryptocurrencies, providing ample opportunities for portfolio diversification.

With competitive spreads starting from 0.0 pips, FP Markets ensures cost-effective trading. The broker offers advanced trading platforms including MetaTrader 4 and MetaTrader 5, renowned for their intuitive interface and powerful analytical tools, catering to traders of all skill levels.

Additionally, FP Markets provides localized customer support in Arabic, ensuring efficient communication and assistance.

With a commitment to regulatory compliance and account security, FP Markets offers Saudi traders a reliable and transparent trading environment to capitalize on global market opportunities.

Unique Features

| Feature | Information |

| ⚖️ Regulation | ASIC, CySEC, FSCA, FSA, FSC |

| 💻 Account Types | MT4/5 Standard Account, an MT4/5 Raw Account, an MT4/5 Islamic Standard Account, and an MT 4/5 Islamic Raw Account |

| 💵 Minimum Spread | From 0.0 pips |

| 💸 Minimum Deposit | SAR375.03 or $100 |

| 📱 Platforms Supported | MetaTrader 4 MetaTrader 5 IRESS cTrader FP Markets App |

| 📈 Range of Markets | Forex Shares Metals Commodities Indices Cryptocurrencies Bonds ETFs |

| 📊 Demo Account | Yes |

| ✴️ Social Trading Offered | LinkedIn YouTube |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The innovative technology architecture of FP Markets benefits traders. | Due to FP Markets' worldwide focus, not all local payment options may receive as much attention. |

| Traders can get complete customer support from a team of dedicated and qualified employees. | Even while FP Markets provides a diverse choice of items, some traders may be more interested in local or niche markets. |

| Traders can trade with a broker who is regulated by several international bodies, including the FSCA, CySEC, ASIC, FSA, and FSC. | FP Markets calculates withdrawal costs for various payment modes. |

| FP Markets offers several account types to meet the various needs and trading preferences of its traders. | |

| Trading platforms include MetaTrader 4, cTrader, IRESS, and MetaTrader 5 offer advanced analytical and charting features. | |

| The wide global market network of FP Markets enables traders to tailor their trading strategies to numerous asset classes. | |

| FP Markets continues to offer low commission policies and competitive spreads. |

Trust Score

FP Markets has a high trust score of 87%

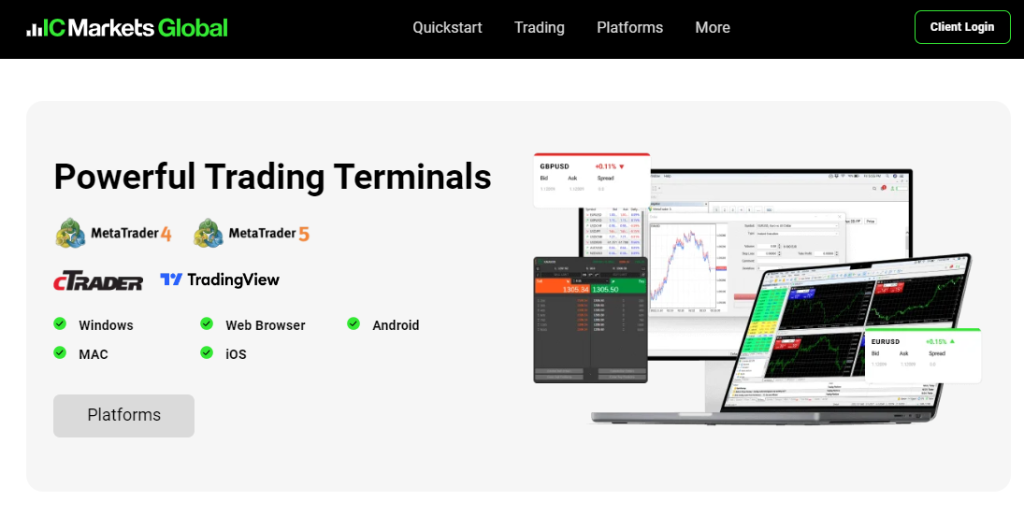

IC Markets

Overview

IC Markets offers a seamless trading experience with cutting-edge platforms like MetaTrader 4, MetaTrader 5, and cTrader, ensuring access to global markets with advanced tools and features.

The registration process is straightforward, adhering to regulatory standards while prioritizing efficiency and security.

For Saudi traders, IC Markets facilitates convenient deposit and withdrawal options, including bank transfers and popular e-wallets, ensuring flexibility and ease of transactions.

With competitive spreads starting from 0.0 pips and low commissions, IC Markets provides cost-effective trading conditions, enabling traders to optimize their profitability.

IC Markets offers various account options to suit different trading styles and preferences, including Standard, Raw Spread, and Islamic accounts compliant with Sharia principles.

With dedicated customer support in Arabic and a commitment to regulatory compliance, IC Markets ensures Saudi traders have the necessary resources and assistance to navigate the financial markets effectively.

Unique Features

| Feature | Information |

| ⚖️ Regulation | ASIC, CySEC, FSA, SCB |

| 💻 Account Types | cTrader Account, Raw Spread Account, Standard Account. |

| 💵 Minimum Spread | From 0.0 pips |

| 💸 Minimum Deposit | SAR750.09 in $200 |

| 📱 Platforms Supported | MetaTrader 4 MetaTrader 5 cTrader IC Social Signal Start ZuluTrade |

| 📈 Range of Markets | Forex Commodities Indices Bonds Cryptocurrencies Stocks Futures |

| 📊 Demo Account | Yes |

| ✴️ Social Trading Offered | LinkedIn YouTube |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IC Markets supports social trading platforms like ZuluTrade and IC Social. | Compared to other brokers, the $200 minimum deposit is much higher. |

| The stringent regulatory framework that IC Markets has implemented, which is regulated by bodies such as ASIC and CySEC, ensures a safe trading environment. | New traders may be turned off by the large tool selection and complex trading strategies. |

| IC Markets offers Islamic accounts to traders who, because to religious beliefs, prefer swap-free accounts. | |

| The high leverage allows traders to increase the size of their positions in transactions (up to 1:1000). | |

| IC Markets offers transparent fee schedules and trading conditions. | |

| IC Markets' multiple liquidity source arrangements allow for competitive pricing. | |

| IC Markets offers protection against negative balances during times of market weakness. |

Trust Score

IC Markets has a high trust score of 87%

Conclusion

Overall, selecting the best Forex broker in Saudi Arabia requires careful consideration of factors such as regulatory compliance, asset selection, trading platforms, and customer support. By prioritizing transparency, security, and tailored services, traders can confidently navigate the financial markets and capitalize on opportunities effectively.

Faq

Forex trading in Saudi Arabia is overseen by the Capital Market Authority (CMA), which regulates and supervises financial markets, including Forex brokers, to ensure compliance with local laws and regulations.

Yes, many Forex brokers in Saudi Arabia offer Islamic or swap-free accounts, adhering to Sharia principles by eliminating interest charges on overnight positions, making them suitable for Muslim traders.

You can verify a Forex broker’s regulatory status by checking with the Capital Market Authority (CMA) in Saudi Arabia. Additionally, researching online reviews and forums can provide insights into a broker’s reputation and reliability.

Forex markets operate 24 hours a day, five days a week. In Saudi Arabia, trading hours typically align with major global financial centers such as London, New York, and Tokyo, with peak activity during overlapping sessions.

While there are no specific restrictions, Saudi Arabian residents may need to consider local regulations regarding foreign exchange transactions and ensure compliance with tax laws. Additionally, it is essential to choose brokers offering convenient and secure deposit and withdrawal options for Saudi traders.

Yes, Forex Trading is Legal in Saudi Arabia.