5 Best Forex Brokers in Bhutan

The 5 Best Forex Brokers in Bhutan – Rated and Reviewed. We have reviewed the top international Forex Brokers that accept Bhutanese Traders.

In this in-depth guide, you will learn:

- The Best Forex Brokers in Bhutan – a List

- Is Forex Legal and Profitable in Bhutan?

- The Best Forex Brokers in Bhutan for Beginners and Foreigners.

- Forex Brokers Trading per the Bhutan National Bank

and much, MUCH more!

5 Best Forex Brokers in Bhutan – a Comparison

| 🔎 Broker | 🚀 Open an Account | 🤝 Accepts Bhutanese Traders | 💶 Min. Deposit (BTN) |

| 🥇 Interactive Brokers | 👉 Click Here | ✅Yes | None |

| 🥈 XTB | 👉 Click Here | ✅Yes | None |

| 🥉 Oanda | 👉 Click Here | ✅Yes | None |

| 🏅 Admirals | 👉 Click Here | ✅Yes | 8339.09 BTN |

| 🎖️ IC Markets | 👉 Click Here | ✅Yes | 16'678.18 BTN |

5 Best Forex Brokers in Bhutan (2024)

- ☑️ Interactive Brokers – Overall, the Best Forex Broker accepting Bhutanese Traders.

- ☑️ XTB – Commission-free stocks and ETFs.

- ☑️ Oanda – Excellent Trading Platforms + Educational Resources.

- ☑️ Admirals – Straightforward account opening.

- ☑️ IC Markets – Low Forex commissions and tight spreads.

Interactive Brokers

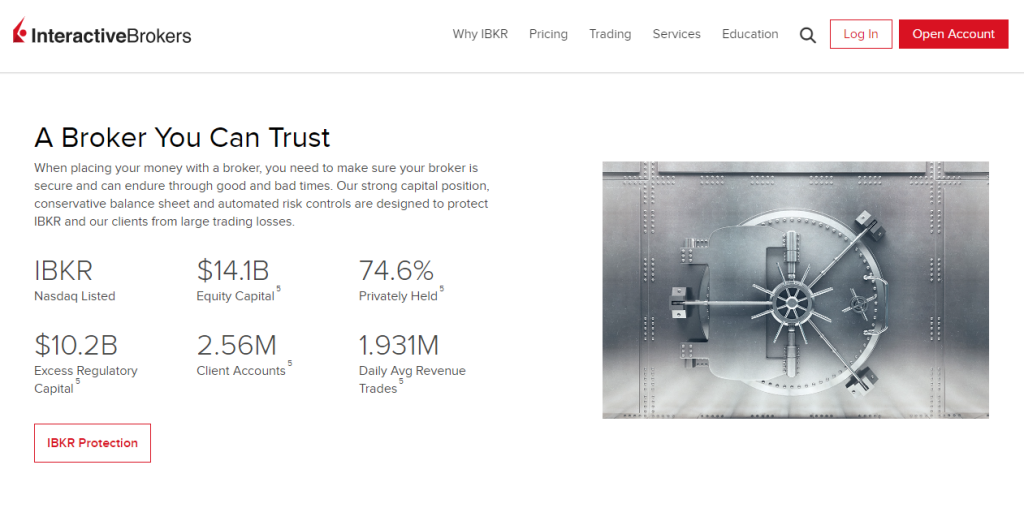

An advanced trading platform and a large selection of tradable securities make Interactive Brokers an excellent choice for active and advanced traders. Furthermore, the brokers’ proprietary trading platform for desktop, mobile, and web is partnered with two account types: IBKR Lite and IBKR Pro.

| 🔎 Broker | 🥇 Interactive Brokers |

| 💴 Min. Deposit | None |

| 💶 Inactivity Fee | None |

| 📈 Tradable Assets | Forex, Metals, Futures, ETFs |

| 🪙 Crypto Trading | ✅Yes |

| 📉 MT4 / MT5 | None |

| 📊 Proprietary Platforms | ✅Yes |

| 📲 Mobile App | ✅Yes |

| 🤝 Customer Support | 24/7 |

| ✏️ Education | ✅Yes |

| 📍 Account Types | IBKR Pro and Lite |

| 🚀Open an Account | 👉 Click Here |

Account Types

Interactive Brokers offer Multiple account types, including IBKR Lite and IBKR Pro. The IBKR Lite account offers the following notable features:

- Commission-free trading on US exchange-listed stocks and ETFs

- No Minimum Deposit or Inactivity Fee

- Competitive Interest Rates

Furthermore, IBKR Lite Clients are granted access to the client Portal, IBKR Mobile, and Trader Workstation (TWS). The Lite account caters to beginners, while the IBKR Pro account is designed for professional and active traders.

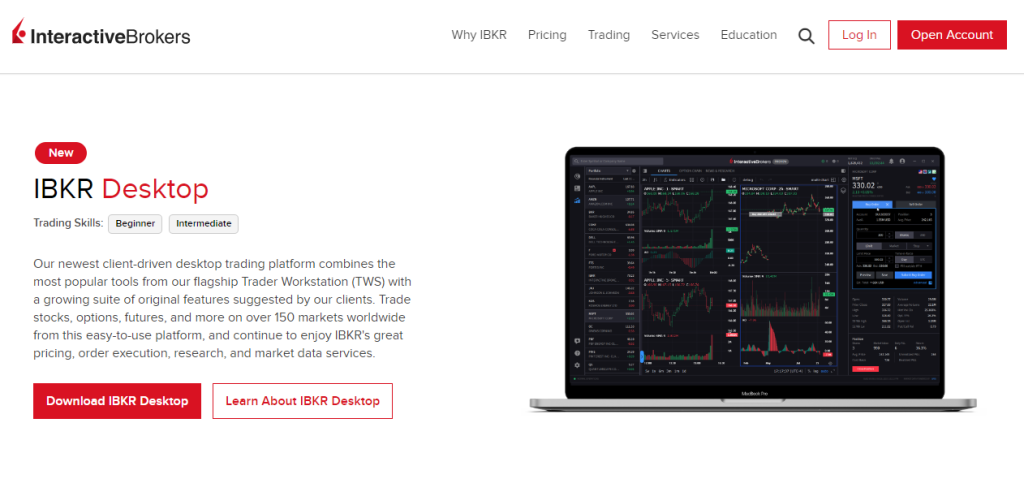

Trading Platforms

Traders can choose from a wide range of Trading Platforms across the web, desktop, and, mobile. IBKR Trading platforms include:

- Trader Workstation (TWS)

- IBKR Mobile

- GlobalTrader

Additionally, access will be granted to the Client Portal.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Low commissions and fees | Intimidating Platform |

| Excellent educational materials | Complex tiered pricing plans |

| Reliable trade execution | Lacking Customer Support |

Our Insights

Interactive Brokers’ advanced execution and strong trading platforms best suit active and advanced traders. Furthermore, Casual traders may find the IBKR Lite account attractive, but the overall offering can overwhelm them.

XTB

As one of the largest stock exchange-listed Forex and CFD Brokers in the world, XTB is an excellent Broker Choice for Bhutanese Traders.

| 🔎 Broker | 🥇 XTB |

| 📈 Regulation | FCA, ACPR, BaFin, DFSA, KNF, CNMV, FSCA, CySEC, IFSC |

| 📉 Social Media Platforms | Facebook YouTube |

| 📊 Trading Accounts | Standard Account Swap-free Account Islamic Account Professional Account |

| 💹 Trading Platform | xStation 5 xStation Mobile |

| 💴 Minimum Deposit | There is no specific minimum deposit required |

| 📌 Trading Assets | Forex Indices Commodities Stock CFDs ETF CFDs Cryptocurrencies |

| 💵 USD-based Account | ✅Yes |

| 💶 USD Deposits Allowed | ✅Yes |

| 🎁 Bonuses | ✅Yes |

| 📍 Minimum spread | From 0.5 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

| 🚀 Open an Account | 👉 Click Here |

Account Types

XTB offers three different account types; Standard, Pro, and Islamic. No Minimum Deposit is set.

Trading Platforms

A proprietary trading platform, xStation is available on the Web, Desktop, and Mobile. The Platform offers a simple and intuitive design.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Islamic Account | Inactivity fee |

| Free Deposit and Withdrawal | High conversion fee |

Our Insights

Cost-conscious traders consider XTB a Top Choice as it offers commission-free stocks and ETFs, free deposits/withdrawals, and does not require a set minimum deposit. However, Inactivity and High Conversion Fees apply.

OANDA

As a trusted and well-established global brand, OANDA is set apart for its low trading cost and trusted support. Top-tier authorities, including FCA and ASIC, regulate OANDA.

| 🔎 Broker | 🥇 OANDA |

| 💶 Minimum Deposit | None |

| 📌 Account Types | Standard, Elite Trader |

| 🆓 Demo Account | ✅Yes |

| 🎁 Bonus Offers | ✅Yes |

| ✏️ Education | ✅Yes |

| 📲 Mobile Trading | ✅Yes |

| 🖱️ Trading Platform | MetaTrader 4 |

| 🚀Open an Account | 👉 Click Here |

Account Types

OANDA offers multiple Account Types; Standard, Core, Premium, and Premium Core. The Standard account suits all traders, whereas the Premium Core suits high-volume traders. No minimum deposit is set.

Trading Platforms

Clients can choose to trade via MetaTrader 4, MetaTrader 5, or fxTrade for mobile. Notable features of fxTrade include:

- Customizable Interface

- Multi-Asset Product Suites

- One-Click Trading

Furthermore, MetaTrader is available on demo trading accounts.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Great trading platforms | Only FX and CFD available for most clients |

| Outstanding research tools | Lacking Customer Support |

| Low trading fees | Inactivity fee |

Our Insights

OANDA is considered to be a safe Forex Broker choice for Beginners in Bhutan. Top-tier authorities regulate it. However, bank transfers incur high withdrawal fees, and only forex, CFDs, and cryptocurrencies are offered.

Admirals

Admiral Markets or Admirals, as a well-established FSCA Regulated Forex Broker, holds all client funds in segregated accounts with negative balance protection offered. Furthermore, clients can trade or invest in 3,700+ trading instruments.

| 🔎Broker | 🥇Admirals |

| 💴Minimum Deposit | 25 USD |

| 🎉Established Year | 2001 |

| ⏰Support Hours | 24/5 |

| 💻Trading Platforms | MetaTrader 4, MetaTrader 5, Admirals App |

| 📈Account Types | Trade.MT4, Zero.MT4, Trade.MT5, Invest.MT5, Zero.MT5, Bets.MT5 |

| 🚀 Open an Account | 👉 Click Here |

Account Types

Multiple MetaTrader 4 and MetaTrader 5 Account types are offered, namely:

- Trade.MT5

- Zero.MT5

- Trade.MT4

- Zero.MT4

A 25 USD/BTN 8339.09 minimum deposit is required to register an account. Furthermore, an Islamic Swap-Free Option is offered on the Trade.MT5 Account.

Trading Platforms

Admirals offers a choice between the MetaTrader 4 and MetaTrader 5 Platforms. Additionally, the Admirals App is available for download on the Apple App Store, Google Play, and Huawei AppGallery.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Islamic Account | Inactivity fee |

| Free Deposit and Withdrawal | No 24/7 customer service |

Our Insights

In our opinion, Admirals is well-suited to beginners as it charges low forex CFD fees. However, Customer support is not available 24/7.

IC Markets

With 17 years of experience, IC Markets is a trusted and highly-regulated Forex Broker. IC Markets offers Competitive pricing, low average spreads, and multi-platform trading.

| 🔎 Broker | 🥇 IC Markets |

| 📌 Year Founded | 2007 |

| 👤 Amount of Active Traders | Over 1 million |

| 📍 Publicly Traded | None |

| 🛡️ Regulation | FSA (Seychelles) |

| 🌎 Country of Regulation | Seychelles |

| 🔃 Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| 🧾 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | None |

| 💴 Minor Account Currencies | Major and Minor |

| 💶 Minimum Deposit | 200 USD |

| ⚡ Average Deposit/Withdrawal Processing Time | Typically 1-2 business days |

| 💵 Fund Withdrawal Fee | Generally no fee |

| 🔖 Spreads From | From 0.0 pips |

| 💷 Commissions | Variable |

| 🪙 Number of Base Currencies Supported | 10+ |

| 💳 Swap Fees | ✅Yes |

| 🏷️ Leverage | Up to 1:500 |

| 🖇️ Margin Requirements | Varies |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| 🖥️ Order Execution Time | Milliseconds |

| 💻 VPS Hosting | ✅Yes |

| 📈 CFDs Total Offered | Extensive Range |

| 📉 CFD Stock Indices | Major global indices |

| 🍎 CFD Commodities | Oil, gold, etc. |

| 📊 CFD Shares | Major global stocks |

| 💴 Deposit Options | Bank transfer, credit/debit, e-wallets |

| 💶 Withdrawal Options | Bank transfer, credit/debit, e-wallets |

| 🖥️ Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader |

| 💻 OS Compatibility | Windows, macOS, iOS, Android |

| 🖱️ Forex Trading Tools | Advanced charting tools, etc. |

| 🥰 Live Chat Availability | ✅Yes |

| ☎️ Customer Support Contact Number | Varies by region |

| 💙 Social Media Platforms | Twitter, Facebook, LinkedIn, |

| 😎 Languages Supported | Multiple Languages |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | ✅Yes |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 Amount of Partners | Numerous global partners |

| 🫰🏻 IB Program | ✅Yes |

| ↪️ Do They Sponsor Any Notable Events or Teams | ✅Yes |

| ⭐ Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

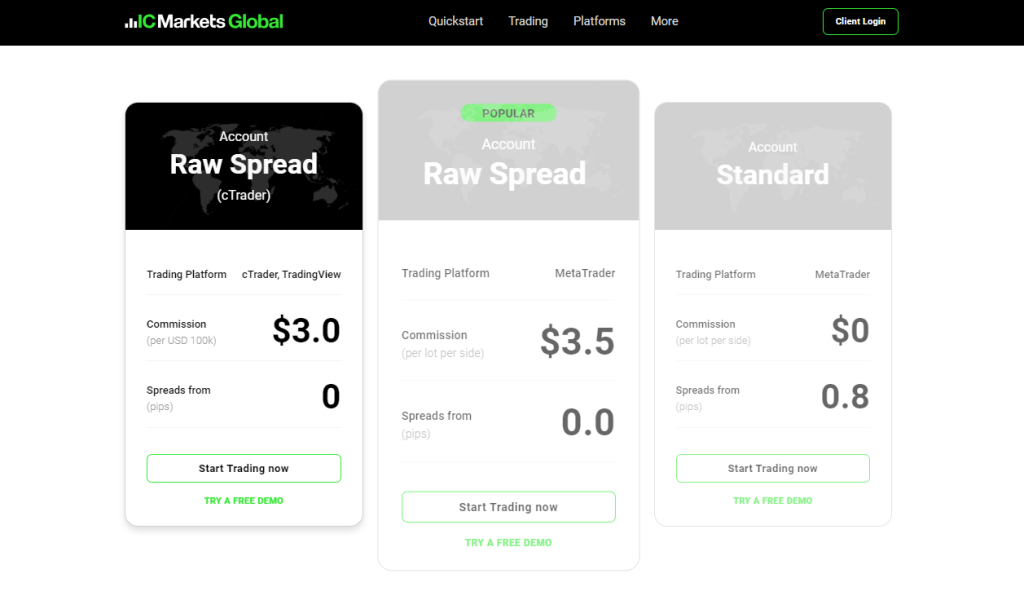

Account Types

IC Markets accounts include cTrader, Raw Spread, and Standard. All accounts require a 200 USD/BTN 16’678.18 minimum deposit on registration. Notable features on all accounts include:

- 61+ Currency Pairs

- 50% Stop Out Level

- Leverage up to 1:1000

- One Click Trading

Additionally, an Islamic Option can be requested.

Trading Platforms

The Raw Spread and Standard Accounts are partnered with the MetaTrader Suite, whereas the cTrader account offers access to cTrader and TradingView.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Low forex fees | Limited product selection |

| Easy and fast account opening | High financing rate for CFDs |

Our Insights

IC Markets is an impressive Forex Broker with low trading fees and tight spreads. However, the product selection is limited and the customer support is subpar.

In Conclusion

Traders rely on International Forex Brokers to effectively trade the Bhutanese Ngultrum as local entities are hard to find. Trading in Bhutan is legal, but not regulated by Local authorities. A trader should prioritize Safety and Security when considering trading in Bhutan.

Our Insights

In the process of reviewing the Best Forex Brokers that accept Bhutanese Traders, we found 5 excellent options. Each broker has its list of Benefits, ranging from trusted trading platforms to excellent customer support. Furthermore, finding the Best Forex Broker will depend on a trader’s individual trading needs.

You might also like:

Faq

Trading in Bhutan is legal, but not regulated by Local authorities.

Regulation, Trading Fees, and Customer Support should be considered.