5 Best Binary Options Brokers

5 Best Binary Options Brokers – Rated and Reviewed. We have explored and tested several prominent brokers to identify the 5 best.

In this in-depth guide you’ll learn:

- What is a binary options broker?

- Which binary options trading platform is overall the best?

- Trusted Binary Options Brokers list.

- Best Binary Brokers with a Low Minimum Deposit.

- Pros and cons of each broker

- Popular FAQs about binary options trading brokers

and much, MUCH more!

| 🔎 Broker | 🚀Open an Account | 💴 Minimum Deposit | 📌 Binary Options |

| 🥇 IQ Option | 👉 Click Here | 10 USD | ✅Yes |

| 🥈 eToro | 👉 Click Here | 50 USD | ✅Yes |

| 🥉 Capitalcore | 👉 Click Here | 10 USD | ✅Yes |

| 🏅 Interactive Brokers | 👉 Click Here | None | ✅Yes |

| 🎖️ Deriv | 👉 Click Here | 5 USD | ✅Yes |

IQ Option

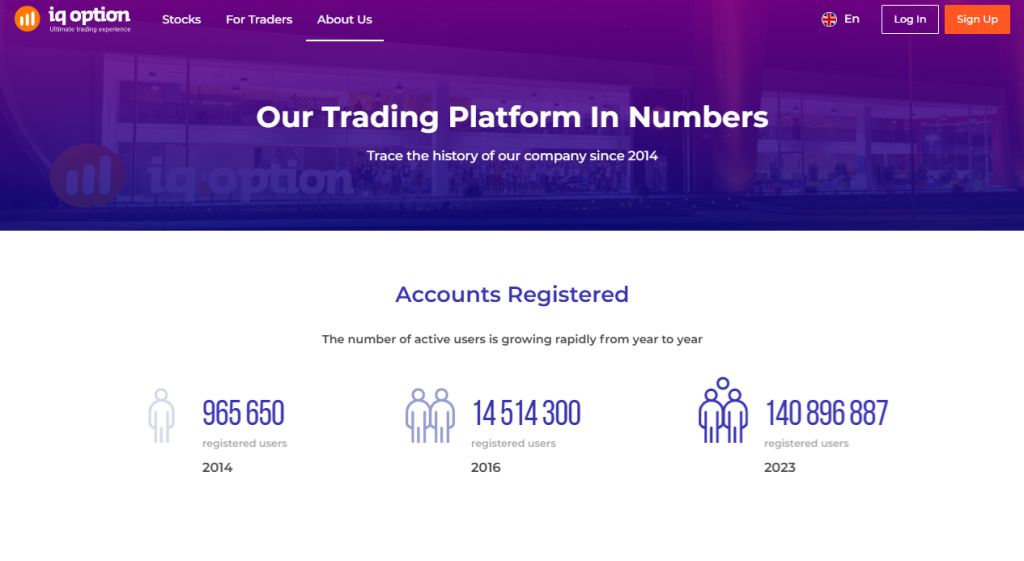

IQ Option is a globally recognized online trading platform that offers a wide range of trading instruments, including CFDs on stocks, forex, commodities, cryptocurrencies, ETFs, and indices. Founded in 2013, it has quickly grown into one of the fastest-growing brands in online trading, with over 40 million users worldwide.

The platform provides users with tools for technical analysis, real-time news feeds, customizable price alerts, and risk management features such as Stop Loss/Take Profit and Negative Balance Protection. With a low minimum deposit of $10, IQ Option is accessible to both beginners and experienced traders alike.

It also offers a free practice account with a $10,000 balance, allowing users to hone their skills before engaging in real trading.

| 🔎 Broker | 🥇 IQ Option |

| 📌 Year Founded | 2013 |

| 👤 Amount of Staff | 300 |

| 👥 Amount of Active Traders | 48 million+ |

| 📍 Publicly Traded | None |

| ⭐ Security | High |

| ↪️ Account Segregation | No |

| 🚨 Negative Balance Protection | ✅Yes |

| ⏹️ Investor Protection Schemes | No |

| ⏺️ Account Types and Features | Real VIP |

| 🅰️ Institutional Accounts | None |

| 🅱️ Managed Accounts | None |

| 💴 Minor Account Currencies | ✅Yes |

| 💶 Minimum Deposit | 10 USD |

| ⏰ Avg. Deposit Processing Time | Instant |

| ⏱️ Avg. Withdrawal Processing Time | 1-3 business days |

| 💵 Withdrawal Fee | None |

| 🔖 Spreads From | 0.1 pips |

| 💷 Commissions | None for forex, varies for other instruments |

| 💳 Number of Base Currencies | 14 |

| 💸 Swap Fees | Yes (depends on position) |

| 🏷️ Leverage | Up to 1:1000 |

| ⚙️ Margin Requirements | Varies by asset |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⌛ Order Execution Time | 1 ms |

| 🖱️ VPS Hosting | Available (Paid) |

| 📈 CFDs Total Offered | 300+ |

| 📉 CFD Stock Indices | ✅Yes |

| 🍏 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💹 Deposit Options | Credit Card, E-Wallets, Bank Transfer |

| 💱 Withdrawal Options | E-Wallets, Bank Transfer |

| 🖥️ Trading Platforms | Web, Mobile, Desktop |

| 💻 OS Compatibility | Windows, Mac, iOS, Android |

| 🤖 Forex Trading Tools | Technical analysis, indicators |

| 🥰 Customer Support | Responsive |

| 💌 Support Email | [email protected] |

| 🐦 Social Media | Facebook, Twitter, |

| 🗯️ Languages | Multiple |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | Tutorials, articles |

| 📒 Affiliate Program | ✅Yes |

| 📑 Amount of Partners | Varies |

| 🗃️ IB Program | ✅Yes |

| 🗄️ Sponsor Notable Events/Teams | Various |

| 📇 Rebate Program | ✅Yes |

| 😊 Suited to Beginners | ✅Yes |

| 😎 Suited to Professionals | ✅Yes |

| 🧐 Suited to Active Traders | ✅Yes |

| 🔢 Suited to Scalpers | ✅Yes |

| 🌞 Suited to Day Traders | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Low minimum deposit ($10) | High risk due to leverage |

| Free practice account ($10,000) | Limited cryptocurrency options |

| Wide range of trading instruments | Withdrawal fees may apply |

| Advanced risk management tools | Not available in all countries |

| Award-winning platform | No phone support for customer care |

Frequently Asked Questions

How can I start trading on IQ Option?

To start trading on IQ Option, simply register for an account, practice with a free $10,000 practice account, and then make a minimum deposit of $10 to begin real trading. The platform supports multiple payment methods for both deposits and withdrawals.

What assets can I trade on IQ Option?

IQ Option offers a variety of assets for trading, including CFDs on forex, stocks, commodities (gold, silver, oils), cryptocurrencies, ETFs, and indices. This allows users to diversify their trading portfolio.

Is IQ Option a safe platform to trade on?

Yes, IQ Option uses advanced security measures to protect your funds and personal data. The platform also provides risk management features such as Stop Loss and Take Profit to help manage potential losses. However, as with any investment, it is important to understand the risks involved in trading.

What are the fees and minimum deposit requirements?

The minimum deposit required to start trading on IQ Option is $10. There are no fees for deposits, but withdrawal fees may apply depending on the payment method you use. It’s always recommended to check the specific terms and conditions for withdrawals.

Our Insights

IQ Option is a highly versatile and user-friendly trading platform that caters to both beginners and advanced traders. Its low minimum deposit and wide range of tradable assets make it a popular choice for those looking to get into online trading. The platform’s educational resources, free practice account, and comprehensive risk management tools further enhance its appeal.

eToro

Founded in 2007, eToro is a well-established global online trading platform. It provides a broad selection of trading options, such as Forex, stocks, indices, commodities, cryptocurrencies, and ETFs. With a user base of over 27 million active traders, eToro is particularly known for its social trading and CopyTrading features, which allow users to mirror the trades of successful investors. The platform operates under strict regulation, holding licenses from top authorities like the FCA, ASIC, and CySEC. eToro is publicly listed on NASDAQ with the ticker “ETOR.”

eToro serves professionals, active traders, and beginners, offering various account types such as retail, professional, corporate, and Islamic accounts. It provides a seamless trading experience on web, mobile, and desktop platforms. While trades are commission-free, eToro charges spreads and swap fees, with leverage of up to 30:1 available for retail traders.

| 🔎 Broker Name | 🥇 eToro |

| 📌 Company Information | eToro Group Ltd. |

| 📍 Year Founded | 2007 |

| 👤 Amount of Staff | Over 1,000 employees |

| 👥 Amount of Active Traders | Over 27 million users (as of 2024) |

| 🗃️ Publicly Traded | Yes (Listed on the NASDAQ under the ticker symbol "ETOR") |

| 🛡️ Regulation and Security | Regulated by multiple authorities |

| ⭐ Regulation | FCA CySEC MFSA ADGM ASIC FSAS FinCEN |

| 🌎 Country of Regulation | UK Europe Malta Middle East Australia Seychelles USA |

| 1️⃣ Suited to Professionals | ✅Yes |

| 2️⃣ Suited to Active Traders | ✅Yes |

| 3️⃣ Suited to Beginners | ✅Yes |

| 🥰 Most Notable Benefit | Social trading and CopyTrading features (allows following experienced traders) |

| 🥺 Most Notable Disadvantage | Limited asset offerings compared to traditional brokers in some markets |

| ↪️ Account Segregation | Client funds are held in segregated accounts |

| 🪫 Negative Balance Protection | ✅Yes |

| 🔋 Investor Protection Schemes | In certain jurisdictions |

| 🅰️ Account Types | Retail Professional Corporate Islamic |

| 🅱️ Institutional Accounts | ✅Yes |

| 💴 Minor Account Currencies | USD EUR GBP AUD |

| 💶 Minimum Deposit | 200 USD |

| ⚙️ Trading Conditions | Standard spreads, leverage up to 30:1 for retail traders (varies by market) |

| ⏰ Average Deposit Processing Time | Instant or up to 1 business day |

| ⏱️ Average Withdrawal Processing Time | 1-3 business days |

| 💵 Fund Withdrawal Fee | No withdrawal fees (may depend on payment method) |

| 📈 Spreads from | From 1 pip (varies by asset) |

| 💷 Commissions | No commissions on trades; spreads apply |

| 💳 Number of Base Currencies | 8 main base currencies (USD, EUR, GBP, AUD, etc.) |

| 💰 Swap Fees | Yes, swap fees apply (overnight financing charges) |

| 📉 Leverage | Up to 30:1 for retail traders (varies by asset and jurisdiction) |

| 📊 Margin Requirements | Minimum 50% for standard positions (varies by asset) |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | Unlimited virtual trading balance |

| 📊 Order Execution Time | Market orders executed in seconds |

| 💹 Trading Instruments | Forex stocks indices commodities crypto ETFs |

| 🔢 Total CFDs Offered | 2,000+ CFDs on stocks, indices, commodities, ETFs, and more |

| 💱 CFD Stock Indices | Includes major indices like S&P 500, NASDAQ, etc. |

| 🌽 CFD Commodities | Gold Oil and others |

| 📑 CFD Shares | Shares of publicly traded companies available as CFDs |

| 💴 Deposit Options | Bank transfer debit/credit cards PayPal e-wallets |

| 💶 Withdrawal Options | Bank transfer PayPal debit/credit cards e-wallets |

| 🖱️ Trading Platforms and Tools | eToro Trading Platform (web, mobile, and desktop) |

| 💻 Trading Platforms | eToro proprietary platform |

| 🖥️ OS Compatibility | Web-based iOS Android |

| ⚙️ Forex Trading Tools | Charting Social Trading CopyTrading market analysis tools |

| ❤️ Customer Support | 24/7 support |

| 🗯️ Live Chat | ✅Yes |

| 💌 Support Email | Contact Request |

| ☎️ Contact Number | 1-888-271-8365 |

| 🐦 Social Media | Facebook YouTube |

| 🔊 Languages | English Spanish French German Italian Arabic Portuguese |

| 🎓 Education | Educational guides blog, and more |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 🫰🏻 Affiliate Program | ✅Yes |

| 🫶 Amount of Partners | Thousands of partners globally |

| 🤝 IB Program | ✅Yes |

| 💡 Acts as Sponsor | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Social trading and CopyTrading features. | Limited asset selection in some markets. |

| Easy-to-use platform for beginners. | Higher spreads compared to some competitors. |

| No commissions on trades. | Leverage limits vary by jurisdiction. |

| Regulated by top authorities (FCA, ASIC, etc.). | No VPS hosting available. |

| Offers demo account with unlimited balance. | Swap fees apply on certain positions. |

Frequently Asked Questions

What is eToro?

eToro is an online trading platform that offers access to global financial markets, including Forex, stocks, indices, commodities, crypto, and ETFs.

Is eToro regulated?

Yes, eToro is regulated by top-tier authorities, including the FCA, CySEC, and ASIC.

What is CopyTrading?

CopyTrading is a feature on eToro that lets users automatically copy the trades of experienced traders.

Can I trade cryptocurrencies on eToro?

Yes, eToro provides a range of cryptocurrencies for trading.

Our Insights

eToro is an excellent platform for both professionals and active traders, thanks to features like CopyTrading and a variety of account options, including professional and Islamic accounts. However, the limited asset selection in certain markets might be a drawback for more advanced investors.

Capitalcore

Capitalcore is a regulated online trading platform offering a wide range of trading instruments, including forex, stocks, crypto, and binary options. Traders can access high leverage of up to 1:2000, enjoy free VPS, and take advantage of a 40% deposit bonus.

The platform offers advanced technology to ensure smooth trading across multiple devices and operating systems, with a focus on customer support 24/7. With the option of a $100,000 demo account, Capitalcore provides tools for both beginners and experienced traders to thrive in a competitive trading environment.

| 🔎 Broker Name | 🥇 Capitalcore |

| 🛡️ Regulation | IFSA (International Financial Services Authority) |

| 1️⃣ Suits Professionals | ✅Yes |

| 2️⃣ Suits Active Traders | ✅Yes |

| 3️⃣ Suits Beginners | ✅Yes |

| 🥰 Most Notable Benefit | High leverage (up to 1:2000) and free VPS hosting |

| 🥺 Most Notable Disadvantage | Lack of detailed overall information, unclear founding year and staff details |

| 📌 Account Types | Classic Silver Gold VIP Demo |

| 💴 Account Currency | USD |

| 💶 Minimum Deposit | 10 USD |

| 💵 Deposit and Withdrawal | Visa Mastercard PerfectMoney PayPal Bitcoin |

| 📍 Instruments | Forex Metals Stocks Cruptos Futures Indices Binary Options |

| 🖱️ Trading Platforms | WebTrader |

| ⭐ Margin Trading | ✅Yes |

| 📈 Leverage | 1:2000 |

| 📉 Min. Trade | 0.01 Lots |

| 🎁 Bonus Offers | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| High leverage (up to 1:2000) | High leverage can be risky for inexperienced traders. |

| 24/7 customer support | Limited information about educational content. |

| Free VPS included with account | Only available in certain countries. |

| $100,000 demo account to practice | Trading fees may apply to some transactions. |

| Multi-platform support across devices | Some advanced tools may be difficult for beginners. |

Frequently Asked Questions

What trading instruments are available on Capitalcore?

Capitalcore offers forex pairs, cryptocurrencies, stocks, commodities, and indices. It also supports binary options trading.

What kind of bonus can I get when registering?

New users can receive up to a $2,500 tradable bonus on every deposit, plus a $100,000 demo account for free.

What are the platform’s leverage and regulations?

Capitalcore offers leverage up to 1:2000 and is regulated by the IFSA (International Financial Services Authority).

Can I trade on multiple devices?

Yes, Capitalcore supports multi-platform access, allowing you to trade seamlessly across any device, whether desktop or mobile.

Our Insights

Capitalcore is an excellent choice for traders of all levels, offering high leverage, diverse trading instruments, and a user-friendly platform. With 24/7 support, a robust bonus system, and a demo account, it provides an accessible and supportive environment for both new and experienced traders. However, prospective users should carefully assess the risks of high leverage before diving in.

Interactive Brokers

Interactive Brokers (IBKR) is a leading platform that provides professional traders with access to global financial markets. Serving clients in over 200 countries, IBKR offers trading opportunities on 150 international markets, covering stocks, options, futures, currencies, bonds, and funds.

With competitive pricing, low commissions, and no hidden fees such as ticket charges or account minimums, IBKR enables investors to maximize their returns. The platform is equipped with advanced trading tools, cutting-edge technology, and a wealth of educational resources to help traders at all levels make well-informed decisions.

IBKR’s strong financial stability and top-tier security features make it a reliable choice for traders around the world.

| 🔎 Broker | 🥇 Interactive Brokers |

| 📌 Year Founded | 1978 |

| 👤 Amount of Staff | Approximately 2,700 |

| 👥 Amount of Active Traders | Over 2 million active traders |

| 📍 Publicly Traded | NASDAQ - IBKR |

| 🧾 Regulation | Multiple |

| 🌎 Country of Regulation | USA (SEC, FINRA), UK (FCA), Australia (ASIC) |

| ↪️ Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| 🛡️ Investor Protection Schemes | SIPC |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | ✅Yes |

| 💴 Minor Account Currencies | 15+ |

| 💶 Minimum Deposit | None |

| ⚡ Average Deposit/Withdrawal Processing Time | 1-3 business days |

| 💵 Fund Withdrawal Fee | Typically free |

| 📈 Spreads From | Variable |

| 📉 Commissions | Variable |

| 📊 Number of Base Currencies Supported | 20+ |

| 💹 Swap Fees | ✅Yes |

| 💱 Leverage | Up to 1:40 (Retail Clients) |

| 📐 Margin Requirements | Varies |

| ☪️ Islamic Account | None |

| 🆓 Demo Account | ✅Yes |

| ⏰ Order Execution Time | Milliseconds |

| 🖱️ VPS Hosting | Free |

| 📈 CFDs - Total Offered | Thousands |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💴 Deposit Options | Bank wire, ACH, credit/debit |

| 💶 Withdrawal Options | Bank wire, ACH, credit/debit |

| 🖥️ Trading Platforms | Trader Workstation (TWS), IBKR Mobile, WebTrader |

| 💻 OS Compatibility | Windows, macOS, iOS, Android |

| 🖱️ Forex Trading Tools | Advanced charting, market scanners, etc. |

| 🥰 Live Chat Availability | ✅Yes |

| 💌 Customer Support Email Address | [email protected] |

| ☎️ Customer Support Contact Number | +1-877-442-2757 |

| 💙 Social Media Platforms | Facebook, Twitter, |

| 🔊 Languages Supported | English, Spanish, Chinese, Japanese |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | ✅Yes |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 Amount of Partners | Numerous |

| 🫰🏻 IB Program | ✅Yes |

| 📌 Do They Sponsor Any Notable Events or Teams | ✅Yes |

| 📍 Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Interactive Brokers offers a wide range of marketable assets and markets | A challenging platform with a steep learning curve |

| The Advanced Trader Workstation (TWS) platform is available to traders | During peak periods of activity, customer service may be less accessible |

| Competitive commission and margin rates | Low-balance accounts incur monthly inactivity penalties |

Frequently Asked Questions

What markets can I access with IBKR?

IBKR offers access to over 150 global markets, allowing clients to trade stocks, options, futures, currencies, bonds, and funds in more than 200 countries.

What are the commission rates for trading with IBKR?

IBKR offers professional pricing with commissions starting at USD 0 for US-listed stocks and ETFs. There are no additional ticket charges, spreads, or account minimums, ensuring cost-effective trading.

How can I fund my IBKR account?

IBKR allows account funding in 28 different currencies, making it convenient for clients to deposit and trade across global markets.

What educational resources does IBKR offer?

IBKR offers a variety of educational resources through its Traders’ Academy, including webinars, on-demand courses, podcasts, and blogs to help traders at all experience levels improve their skills and knowledge.

Our Verdict

Interactive Brokers is an ideal platform for professional traders and investors seeking a powerful, affordable solution with access to global markets. Its low-cost trading structure, comprehensive educational resources, and robust security features make it a top choice in the online brokerage industry.

Deriv

Deriv is a global leader in online trading, providing CFDs and other derivatives across various markets such as forex, stocks, indices, cryptocurrencies, commodities, and derived indices. Since its establishment 25 years ago, the company has aimed to offer an alternative to traditional brokers by removing high commissions and complex products.

With a dedication to delivering an exceptional trading experience, Deriv currently serves over 2.5 million users worldwide. The company is known for its transparency, reliability, and customer-focused approach, creating a trustworthy platform for traders of all skill levels.

As it celebrates its 25th anniversary, Deriv continues to innovate and evolve, solidifying its position as an industry leader. With a monthly trading turnover surpassing USD 15 trillion and over USD 46 million in monthly withdrawals, the company reflects its strong global presence and outstanding reputation.

| 🔎 Broker | 🥇 Deriv |

| 📌 Year Founded | 1999 |

| 👤 Amount of Staff | 500+ |

| 👥 Amount of Active Traders | 1 million+ |

| 🛡️ Regulation | MFSA LFSA BVI FSC Vanuatu FSC FMA FSC Mauritius SVG TFC |

| 🌎 Country of Regulation | Various |

| 1️⃣ Suited to Professionals | ✅Yes |

| 2️⃣ Suited to Active Traders | ✅Yes |

| 3️⃣ Suited to Beginners | ✅Yes |

| 🥰 Most Notable Benefit products | Diverse range of |

| 🥺 Most Notable Disadvantage | Limited customer support options |

| 🔂 Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| 🅰️ Investor Protection Schemes | ✅Yes |

| 🅱️ Institutional Accounts | ✅Yes |

| 🖇️ Managed Accounts | ✅Yes |

| 🪙 Minor Account Currencies | Multiple |

| 💰 Minimum Deposit | 5 USD |

| 💴 Trading Conditions | Flexible |

| ⏰ Average Deposit Processing Time | Instant |

| ⏱️ Average Withdrawal Processing Time | 1-3 days |

| 💶 Fund Withdrawal Fee | None |

| 💵 Spreads From | 0.0 pips |

| 💷 Commissions | Varies |

| 💳 Number of Base Currencies | 10+ |

| 💸 Swap Fees | ✅Yes |

| 🏧 Leverage | Up to 1:1000 |

| 🏦 Margin Requirements | Varies |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏲️ Order Execution Time | < 1 second |

| 🖱️ VPS Hosting | ✅Yes |

| 📈 Total CFDs Offered | 1000+ |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💴 Deposit Options | Credit/Debit Cards E-Wallets |

| 💶 Withdrawal Options | Bank Transfer E-Wallets |

| 🖥️ Trading Platforms | Deriv MT5 Deriv cTrader Deriv XOptions Deriv Trader Deriv Bot Deriv GO SmartTrader |

| 💻 OS Compatibility | Windows macOS Mobile |

| 🤖 Forex Trading Tools | ✅Yes |

| 🩷 Customer Support | Responsive |

| 😊 Live Chat | ✅Yes |

| 💌 Support Email | Varies by Region |

| ☎️ Support Contact Number | Varies by Region |

| 🐦 Social Media | Facebook, Twitter, LinkedIn |

| 🗯️ Languages | Multiple |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | Articles Tutorials |

| 📒 Affiliate Program | ✅Yes |

| 📑 Amount of Partners | 1000+ |

| 🗃️ IB Program | ✅Yes |

| 📇 Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Open Account |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Low commissions | May not suit advanced traders' needs. |

| User-friendly platform | Limited educational resources. |

| Wide range of trading instruments | Higher risk with leveraged products. |

| Transparent and reliable | Not available in all regions. |

| Strong global presence and reputation | Limited account types. |

Frequently Asked Questions

What makes Deriv different from other online brokers?

Deriv stands out by focusing on eliminating high commissions and offering an intuitive trading experience. It emphasizes transparency, fairness, and innovation while providing a wide variety of trading instruments, catering to both novice and experienced traders.

How many customers does Deriv serve?

Deriv serves over 2.5 million traders globally, offering a diverse range of financial products and services to a worldwide audience.

What markets can I trade?

Deriv offers CFDs and derivatives across several markets, including forex, stocks, indices, cryptocurrencies, commodities, and derived indices, giving traders access to a broad range of financial instruments.

What are Deriv’s core values?

Deriv’s core values include Integrity, Customer Focus, Competence, and Teamwork. These values guide the company’s actions and help foster a culture of transparency, fairness, and prioritizing customer service.

Our Insights

Deriv has established itself as a dominant player in the online trading industry, offering an innovative platform focused on low commissions, transparency, and customer-first solutions. With a 25-year legacy, millions of active users, and a commitment to excellence, Deriv continues to shape the future of trading for both beginners and seasoned traders alike.

What is Binary Options Trading?

Binary options trading is a type of financial trading where the outcome is either a fixed profit or a loss, depending on whether the price of an asset (such as stocks, forex, or commodities) reaches a certain level by a specific time. In essence, you are betting on the direction of the price movement (up or down) over a predetermined period.

Here’s how it works:

Prediction

The trader predicts whether the price of an asset will rise or fall by the time the option expires.

Strike Price

The price level at which the asset is traded when the option expires.

Expiration Time

Binary options typically have short expiration times, ranging from minutes to hours.

Payout

If the prediction is correct, the trader receives a fixed payout, which is often a percentage of the invested amount. If the prediction is wrong, the trader loses the invested amount.

Binary options are known for their simplicity, but they are highly speculative and risky, as they involve predicting price movements over short periods with little room for error. This makes them more suitable for experienced traders who understand the high risks involved.

In Conclusion

Binary options trading offers a straightforward way to trade financial assets by predicting price movements within a set time frame. While it can be highly profitable, the simplicity of the concept comes with significant risks, making it more suitable for experienced traders who can manage short-term market fluctuations effectively.

You might also like:

Faq

It’s a type of trading where you predict whether an asset’s price will rise or fall by a specific time.

You invest in an asset, predict its price direction, and receive a fixed payout if your prediction is correct by the expiration time.

It is highly speculative with a high potential for loss, as predictions need to be accurate within a short time frame.

Yes, but the profit potential comes with a high risk of losing your investment, especially for short-term trades.

It’s generally not recommended for beginners due to its speculative nature and the need for understanding short-term market movements.