10 Best Award-Winning Investment Performances

Successfully navigating the forex market demands a combination of skill, foresight, and a strong strategy.

This article explores the brokers and investment firms that have been recognized with prestigious awards for their exceptional investment performance, establishing them as frontrunners in the highly competitive field of finance. In this in-depth guide, you’ll learn about the following:

- What Is The “Best Investment Performance” Award?

- Who Are The Firms That Have Award-Winning Investment Performance?

- What are the Criteria for The “Best Investment Performance” Award?

- Our Conclusion on The Best Investment Performance

- Popular FAQs about The Best Investment Performance

And lots more…

So, if you’re ready to go “all in” with The Best Investment Performance…

Let’s dive right in…

What Is The “Best Investment Performance” Award?

From our experience, the “Best Investment Performance” Award is highly regarded in the forex and investment industry. It recognizes brokers and investment firms that have consistently shown exceptional skill in managing investments and delivering significant client returns.

This acknowledgment goes beyond just honoring past accomplishments; it highlights the recipient’s skill in navigating the complex and sometimes unpredictable world of forex trading with expertise, innovation, and a deep understanding of market dynamics.

Best Award-Winning Investment Performances – Comparison

| 👥 Firms | 📝 Investment Philosophy | 👉 Risk Management Practices | 🚀 Market Access | 💰Commission and Fees |

| 1. Vanguard | Long-term investing, diversification, minimizing costs | Diversification across asset classes and geographic regions | Access to both US and international markets | Competitive and low, with some funds featuring zero commissions when trading directly through Vanguard |

| 2. Fidelity Investments | Active management, research-driven approach to stock selection, and constructing portfolios | Comprehensive risk management strategies like diversification and robust research | Extensive access to domestic, international, and emerging markets | Competitive commission rates and fees |

| 3. IG | Provides traders access to a large range of markets, trading tools, etc., instead of a traditional investment philosophy | Various risk management tools like stop-loss orders, margin calls, etc. | Global financial markets, including forex, commodities, indices, stocks, etc. | Spreads, commissions, overnight financing charges |

| 4. BlackRock | Diversification, risk management, sustainable investing | With advanced risk management techniques, Aladdin technology platform assesses and manages risks | Extensive global access using ETFs and mutual funds that cover emerging and developed markets | Fees vary per product, but they are relatively low cost compared to other firms |

| 5. Rowe Price | Active management with a long-term perspective relying heavily on fundamental research and investment discipline | Rigorous risk assessment process | Covers a range of markets in the US and international | Fees reflect an active management approach with rates varying by fund and service |

| 6. Saxo Bank | Transparency, accessibility, broad range of trading and investment products | Offers various tools like Portfolio Protector | Access to more than 30 international markets | Competitive; zero-commission options offered |

| 7. CMC Markets | Provides robust trading platforms, extensive tools to help traders make informed decisions | Offers stop-loss orders, risk management tools, etc. | Access to a range of global markets | Competitive; low forex and spread betting fees |

| 8. Berkshire Hathaway | Long-term value investing | Financial stability, intrinsic value assessment in investment decisions | Global | Not applicable |

| 9. TD Ameritrade | A broad range of investment options; accommodates passive and active trading | Personalized advice and auto risk management tools | Wide; access to US and International markets | No commission fees for online stock, ETF, or options trades |

| 10. Interactive Brokers | Provides technological solutions to support various investing and trading strategies | Advanced tools like margin calculators and real-time monitoring | Access to over 135 global markets | Low costs and transparent pricing models |

10 Best Award-Winning Investment Performances (2024*)

- ☑️Vanguard – Overall Best Investment Performance

- ☑️Fidelity Investments – Offers Zero-expense Ratio Funds

- ☑️IG – Provides Tight Spreads and Low Commissions

- ☑️BlackRock – Diverse Options for Individual and Institutional Investors

- ☑️Rowe Price – Offers a Wide Range of Investment Options

- ☑️Saxo Bank – Offers Several User-Friendly Platforms

- ☑️CMC Markets – Provides Competitive Spreads on Instruments

- ☑️Berkshire Hathaway – Has Diverse Business Interests

- ☑️TD Ameritrade – Offers Extensive Range of Trading Tools

- ☑️Interactive Brokers – Offers Advanced Risk Management Tools

1. Vanguard

In our opinion, Vanguard is notable in the investment world for its innovative approach to low-cost investing. We highly value Vanguard’s distinctive structure as a client-owned firm, where the investors in its funds are the owners.

Vanguard’s mission to lower the cost of investing is driven by aligning its interests with those of its clients. Vanguard provides a wide selection of index funds and ETFs, serving the needs of both individual and institutional investors.

Their research and insights, shared through various content formats, are valuable for investors seeking to make informed decisions.

Overall, Vanguard’s dedication to maintaining low fees while upholding quality has established a standard in the industry, positioning it as a dependable and affordable option for many.

Why is Vanguard a Leading Firm for Investment Performance?

From our experience, Vanguard is particularly noteworthy for its investment results, mostly because of its innovative work in low-cost index fund investing.

For investors, this strategy has regularly produced very good long-term returns. We find that Vanguard’s client-owned structure—which emphasizes low costs and wide market access—is essential to matching investor interests.

Unique Features

🚀 Average Annual Return Index funds have historically offered competitive annual returns 📝 Expense Ratio Known for its low expense ratios 🔎 Asset Allocation Strategy Range of asset allocation strategies using target-date funds and LifeStrategy funds 💸 Performance of Managed Funds Index funds and ETFs consistently rank high in terms of long-term performance ✴️ Investment Philosophy Long-term investing, diversification, minimizing costs 💻 Risk Management Practices Diversification across asset classes and geographic regions 🔁 Customer Satisfaction Receives high marks for customer satisfaction, especially low fees and the range of funds 💳 Trading Platform Features Straightforward, suitable for buying and holding a range of mutual funds and ETFs 🤝 Range of Investment Products Wide range of investment products, including ETFs, bonds, stocks, mutual funds 🗣 Market Access Access to both US and international markets ✅ Research and Educational Resources Extensive research and educational resources 📉 Transparency Highly transparent, especially regarding fund expenses and investment strategies 🏦 Trading Technology Not as advanced as other platforms that accommodate active trading, perfect for efficient portfolio management and trading 🎉 Commission and Fees Competitive and low, with some funds featuring zero commissions when trading directly through Vanguard

Pros and Cons

✔️ Pros ❌ Cons There are low-cost funds with an average expense ratio of 0.09% Fixed asset allocation in some funds is not adaptable to changing market conditions There are various low-cost mutual funds and ETFs The platform isn’t optimized for active trading There is a unique investor-owned structure Slow account opening process Strong performance track record for index funds and ETFs

Our Insight

Vanguard is a good option for investors. They have innovative work in low-cost index fund investing, which is very good for long-term returns.

2. Fidelity Investments

While researching Fidelity Investments, we were impressed by the extensive range of services catering to various investment needs.

Fidelity provides personalized advice and investment solutions for a range of financial needs, from retirement planning to wealth management.

Fidelity’s impressive track record is highlighted by its early adoption of online trading platforms and ongoing exploration of emerging technologies through Fidelity Labs.

We found their Portfolio Advisory Services are exceptional, offering customized asset allocation and portfolio rebalancing. Fidelity’s dedication to data security and client education reinforces its reputation as a reliable and knowledgeable advisor in the financial industry.

Why is Fidelity Investments a Leading Firm for Investment Performance?

Through extensive research, we’ve seen that Fidelity Investments performs exceptionally well in investing. Its broad research capabilities and wide selection of fund offerings—which frequently beat benchmarks—are noteworthy and award-winning.

Unique Features

🚀 Average Annual Return Funds (including Fidelity 500 Index Fund) have competitive returns; performance varying by fund and strategy 📝 Expense Ratio Competitive expense ratios across mutual funds and ETFs 🔎 Asset Allocation Strategy Variety of asset options through target-date funds and managed accounts 💸 Performance of Managed Funds Actively managed funds like Fidelity Contrafund show strong performance ✴️ Investment Philosophy Active management, research-driven approach to stock selection, and constructing portfolios 💻 Risk Management Practices Comprehensive risk management strategies like diversification and robust research 🔁 Customer Satisfaction Highly regarded for customer support, research, and investment options 💳 Trading Platform Features Advanced platforms that feature robust tools for beginner and experienced traders 🤝 Range of Investment Products A broad range of products, including options, ETFs, stocks, mutual funds, bonds 🗣 Market Access Extensive access to domestic, international, and emerging markets ✅ Research and Educational Resources A wealth of research materials, educational content, and market analysis 📉 Transparency Highly transparent about fees, fund performance, and investment strategies 🏦 Trading Technology Highly rated, offers fast execution and advanced tools for trading and analysis 🎉 Commission and Fees Competitive commission rates and fees

Pros and Cons

✔️ Pros ❌ Cons Zero-expense ratio funds are available Lack of depth on portfolio analysis tools Strong order execution that can lead to better investment returns There are higher fees on some managed account options like robo-advisors Offers extensive research and educational resources There is no direct access to crypto assets There are no commissions charged on Options, ETFs, or Stocks

Our Insight

Fidelity provides personalized advice and investment solutions but lacks depth in portfolio analysis tools.

3. IG Group

IG Group has positioned itself as a frontrunner in online trading and investments, offering clients an extensive range of over 17,000 financial markets to explore.

We were intrigued by IG Group’s focus on optimizing operations to drive growth, as demonstrated by their strategic cost-saving initiatives.

Their dedication to utilizing technology and forming partnerships, like their collaboration with impact.com and Silverbean to strengthen their affiliate program, is commendable.

Overall, we believe that IG Group’s commitment to delivering swift and adaptable market access and its unwavering commitment to surpassing client expectations establishes it as a progressive force in the financial services industry.

Why is IG Group a Leading Firm for Investment Performance?

We find that IG Group leads in performance by providing sophisticated trading platforms and market access. Its attractiveness is, therefore, shared by both novice and seasoned traders.

Furthermore, IG Group’s emphasis on innovation and client education has helped it maintain its standing in the financial services industry.

Unique Features

🚀 Average Annual Return Not directly applicable; IG specializes in forex and CFD trading with returns depending on individual trading strategies 📝 Expense Ratio Not applicable due to the nature of Forex and CFD trading; costs are spread-based 🔎 Asset Allocation Strategy IG offers trading services instead of focussing on managed investment products 💸 Performance of Managed Funds Does not offer managed funds; performance tied to individual trading success ✴️ Investment Philosophy Provides traders access to a large range of markets, trading tools, etc., instead of a traditional investment philosophy 💻 Risk Management Practices Various risk management tools like stop-loss orders, margin calls, etc. 🔁 Customer Satisfaction Positive reviews from clients 💳 Trading Platform Features Robust trading platforms; advanced charting, analysis, and research tools 🤝 Range of Investment Products Over 17,000 instruments that can be traded 🗣 Market Access Global financial markets, including forex, commodities, indices, stocks, etc. ✅ Research and Educational Resources Comprehensive research and education 📉 Transparency Transparency in pricing, clear information on spreads, margins, and trading costs 🏦 Trading Technology Advanced trading technology ensures fast and reliable trade execution, real-time market data 🎉 Commission and Fees Spreads, commissions, overnight financing charges

Pros and Cons

✔️ Pros ❌ Cons There are tight spreads and low commissions across several instruments There are high forex and CFD fees Offers cutting-edge trading software Customer support can be slow at times There are several effective risk management tools offered Beginners might be overwhelmed by the platform’s complexity There are over 17,000 instruments that can be traded

Our Insight

IG is an excellent broker choice for both advisors and clients. They also collaborate with impact.com and Silverbean to strengthen their affiliate program.

4. BlackRock

While investigating BlackRock as an investment firm, we were extremely impressed by the comprehensive range of investment solutions and systematic investment approach offered by the firm, which is one of the world’s largest asset managers.

Furthermore, BlackRock’s dedication to sustainability and responsible investing is evident through its adherence to the EU Sustainable Finance Disclosure Regulation, which we greatly appreciate.

Their value assessment process, which we found thoroughly analyzes fund performance and pricing, showcases their commitment to providing value to investors.

In addition, the focus on technology and innovation at BlackRock, demonstrated through initiatives like BlackRock Systematic Investing, highlights their commitment to achieving investment excellence and agility in responding to evolving market conditions.

Why is BlackRock a Leading Firm for Investment Performance?

Our analysis of BlackRock’s investment performance leadership reveals that its size and wide selection of funds – including its iShares ETFs – drive it. We found that a wide client base is drawn to BlackRock by its strategic emphasis on technology and sustainable investing solutions.

Unique Features

🚀 Average Annual Return Varied returns from iShares ETFs and mutual funds according to market conditions and strategies 📝 Expense Ratio Competitive expense ratio across ETFs and mutual funds 🔎 Asset Allocation Strategy Diversified asset allocation solutions through strategic portfolio solutions, ETFs, target-date funds 💸 Performance of Managed Funds Strong track record of performance ✴️ Investment Philosophy Diversification, risk management, sustainable investing 💻 Risk Management Practices With advanced risk management techniques, Aladdin technology platform assesses and manages risks 🔁 Customer Satisfaction Positive feedback for the range of investment options and commitment to sustainable investment 💳 Trading Platform Features Does not have a trading platform, but ETFs can be accessed through several broker platforms 🤝 Range of Investment Products A comprehensive range of products, including ETFs, solutions for institutional investors, funds, etc. 🗣 Market Access Extensive global access using ETFs and mutual funds that cover emerging and developed markets ✅ Research and Educational Resources Robust research and insights through BlackRock Investment Institute 📉 Transparency High level of transparency in terms of sustainable investment practices, clear reporting of fund performance, etc. 🏦 Trading Technology State-of-the-art technology for investment management and analysis 🎉 Commission and Fees Fees vary per product, but they are relatively low cost compared to other firms

Pros and Cons

✔️ Pros ❌ Cons Largest investment manager globally with a range of investment opportunities and strategies Many complex investment strategies are less transparent There is a strong track record with ETFs Limited focus on alternative investments There is a strong focus on sustainable investing There are diverse options for individual and institutional investors

Our Insight

BlackRock has a wide range of investment solutions and systematic investment approach which is one of the world’s largest asset managers.

5. Rowe Price

Rowe Price sets itself apart with its active management approach and dedication to achieving long-term investment success for its clients.

We deeply appreciate T. Rowe Price’s meticulous research process and unwavering dedication to offering strategic investment guidance.

They offer a wide range of investment options to meet different needs, such as retirement planning, college savings, and general investing, to accommodate diverse investors.

Furthermore, T. Rowe Price’s commitment to client success is evident through its transparent fee structure and focus on investor education, establishing it as a reliable partner for individuals seeking guided investment strategies.

Why is T. Rowe Price a Leading Firm for Investment Performance?

We rank T. Rowe Price highly for its active management approach, which has continuously produced better fund performance than its competitors. The company provides investors with outstanding value through its thorough research and worldwide investment skills.

Unique Features

🚀 Average Annual Return Mutual funds exhibit strong performance; several funds consistently outperform respective benchmarks 📝 Expense Ratio It is not the lowest in the industry, but competitive 🔎 Asset Allocation Strategy Variety of allocation strategies through mutual funds and retirement solutions 💸 Performance of Managed Funds Actively managed funds are known for their history of strong performance due to deep research and experienced management teams ✴️ Investment Philosophy Active management with a long-term perspective relying heavily on fundamental research and investment discipline 💻 Risk Management Practices Rigorous risk assessment process 🔁 Customer Satisfaction High ratings for customer support and investment guidance 💳 Trading Platform Features Solid trading platform supporting mutual fund investments and basic trading needs 🤝 Range of Investment Products Wide range of investment products like bonds, stocks, mutual funds, etc. 🗣 Market Access Covers a range of markets in the US and international ✅ Research and Educational Resources Extensive research, detailed market insights, investment guidance, etc. 📉 Transparency High level of transparency in the investment process and fund performance 🏦 Trading Technology Robust technology but purely designed for long-term investing instead of high-frequency trading (HFT) 🎉 Commission and Fees Fees reflect an active management approach with rates varying by fund and service

Pros and Cons

✔️ Pros ❌ Cons Known for its robust active management strategy Weak trading platforms Offers decent research and analysis There is higher volatility attached to managed strategies There are automatic cash sweep accounts offered There is limited market access compared to rivals Professional advice is available

Our Insight

Rowe Price is a great choice for investors, they have an active management approach and provide investors with outstanding value through its thorough research.

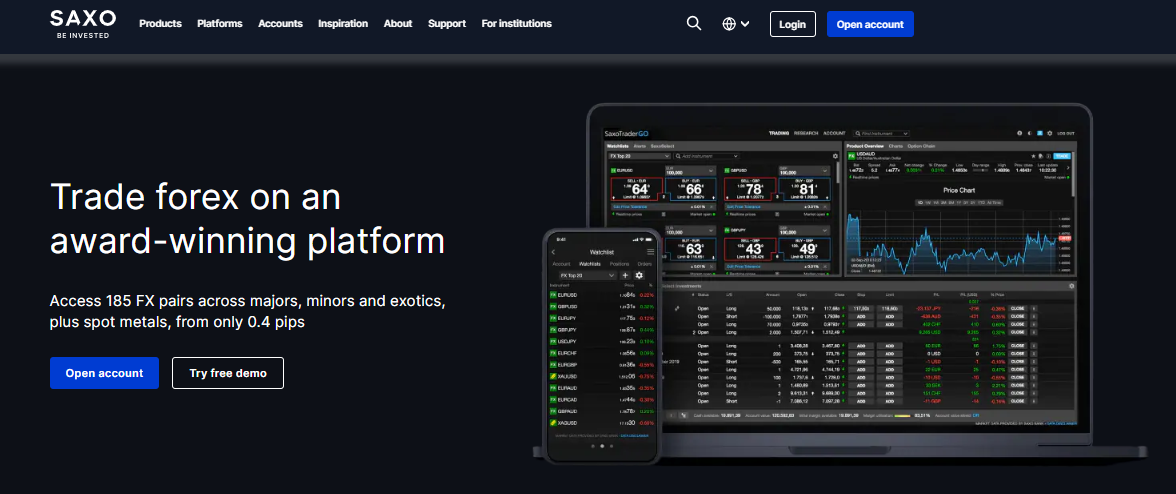

6. Saxo Bank

Saxo Bank has established a strong online trading and investment reputation, targeting a discerning clientele with their specialized services.

Our analysis found Saxo Bank’s strong suit in its wide range of trading platforms and investment products, encompassing forex, stocks, commodities, and options.

The bank’s proprietary trading platform, SaxoTraderGO, stood out to us for its intuitive interface and powerful features, catering to experienced traders and beginners.

In addition, we found that Saxo Bank’s dedication to offering access to global markets is a notable benefit, letting traders expand their portfolios across international borders.

However, we must mention that smaller or less experienced investors could face challenges due to the bank’s fee structure and higher account minimums.

Why is Saxo Bank a Leading Firm for Investment Performance?

From our experience with Saxo Bank, traders looking for strong trading tools and a large range of investment alternatives choose it for its user-friendly platforms and broad market access.

Unique Features

🚀 Average Annual Return Specifics not detailed: Saxo offers competitive returns on various products 📝 Expense Ratio Varies according to product and service 🔎 Asset Allocation Strategy Personalized asset allocation using SaxoWealthCare and other tools 💸 Performance of Managed Funds Actively managed funds are known for their history of strong performance due to deep research and experienced management teams ✴️ Investment Philosophy Transparency, accessibility, broad range of trading and investment products 💻 Risk Management Practices Offers various tools like Portfolio Protector 🔁 Customer Satisfaction Generally positive for platform usability and customer support 💳 Trading Platform Features Advanced trading platforms like SaxoTraderGO, SaxoTraderPRO, etc. 🤝 Range of Investment Products Extensive range including forex, bonds, stocks, ETFs, options, etc. 🗣 Market Access Access to more than 30 international markets ✅ Research and Educational Resources A wealth of resources like webinars, expert insights, etc. 📉 Transparency High; clear information on investment strategies, pricing, fees, etc. 🏦 Trading Technology Highly sophisticated 🎉 Commission and Fees Competitive; zero-commission options offered

Pros and Cons

✔️ Pros ❌ Cons Offers several user-friendly platforms across devices The fee structure and high account minimums pose several challenges for smaller investors There are over 71,000 instruments that can be traded The platform might be too complex for beginners Features advanced trading technology There is limited direct access to certain markets and investment types There are competitive commission rates

Our Insight

Saxo Bank offers strong trading tools and a large range of investment alternatives making them a great choice for al investors alike.

7. CMC Markets

CMC Markets is notable for its wide selection of tradable assets and ability to quickly adapt to market changes, making it well-suited for the fast-paced world of online trading.

Our investigation of CMC Markets reveals a highly dynamic trading environment, providing access to an extensive range of over 9,500 financial instruments. Furthermore, traders can engage in forex, indices, stocks, and commodities trading, all in one place.

The platform’s dedication to offering competitive spreads and a user-friendly interface enhances its appeal, especially to active traders who value efficiency and precision.

In addition, we also discovered that CMC Markets’ commitment to client success is evident through its investment in educational resources and trading support tools, making it a suitable choice for traders of all levels of expertise.

Why is CMC Markets a Leading Firm for Investment Performance?

Our assessment of CMC Markets shows how well it serves a variety of trading methods with a dynamic trading environment with competitive spreads and a complete platform that includes sophisticated charting and educational materials.

Unique Features

🚀 Average Annual Return Primarily offers trading services instead of managed funds 📝 Expense Ratio Not applicable for trading accounts 🔎 Asset Allocation Strategy Does not offer traditional asset management but provides tools for personal portfolio management 💸 Performance of Managed Funds Not applicable to CMC Markets ✴️ Investment Philosophy Provides robust trading platforms, extensive tools to help traders make informed decisions 💻 Risk Management Practices Offers stop-loss orders, risk management tools, etc. 🔁 Customer Satisfaction Known for its strong customer support and intuitive trading software 💳 Trading Platform Features Highly regarded for advanced charting, customizability, technical indicators, etc. 🤝 Range of Investment Products A broad range of products spread across forex, CFDs, spread betting, etc. 🗣 Market Access Access to a range of global markets ✅ Research and Educational Resources Comprehensive trading education and market analysis 📉 Transparency High; clear information about trading fees and platform features 🏦 Trading Technology Advanced, strong emphasis on providing robust trading technology 🎉 Commission and Fees Competitive; low forex and spread betting fees

Pros and Cons

✔️ Pros ❌ Cons There is a dynamic trading environment with access to various instruments The focus is more on CFDs, spread betting, and forex trading than on investment There are competitive spreads charged on instruments There is a limited product portfolio compared to full-service investment firms Broker is known for strong customer support Customer support experiences vary greatly There are advanced charting, technical indicators, and other tools offered to enhance the trading experience

Our Insight

CMC Markets is a good choice for beginner investors. They have a user-friendly platform and offer a variety of trading methods.

8. Berkshire Hathaway

Berkshire Hathaway, led by Warren Buffett, has always been associated with outstanding investment expertise. Our investigation into Berkshire shows a conglomerate that strategically purchases companies with robust economic moats and skilled management teams.

This approach has consistently delivered strong returns and established itself as a dominant force in the investment world.

Furthermore, Berkshire’s portfolio showcases investments in prominent companies across different sectors, highlighting its commitment to long-term value rather than immediate profits.

In addition, we found that the company’s financial stability is evident through its significant cash reserves and impressive earnings. This allows the company to confidently pursue substantial investments to fuel future growth and enhance shareholder value.

Why is Berkshire Hathaway a Leading Firm for Investment Performance?

Because of Warren Buffett’s value investing approach, Berkshire Hathaway’s investment success is legendary, according to our analysis. Buying premium businesses at fair prices is the main focus of this approach, which has produced strong returns time and again.

Unique Features

🚀 Average Annual Return Historically strong, significant long-term growth 📝 Expense Ratio Holding company, not a fund 🔎 Asset Allocation Strategy Focused on acquiring full ownership or majority stakes in companies with long-term prospects 💸 Performance of Managed Funds Not applicable ✴️ Investment Philosophy Long-term value investing 💻 Risk Management Practices Financial stability, intrinsic value assessment in investment decisions 🔁 Customer Satisfaction High considering its historical performance and reputation 💳 Trading Platform Features Not applicable 🤝 Range of Investment Products Conglomerates holding diverse business interest in several sectors 🗣 Market Access Global ✅ Research and Educational Resources Not applicable 📉 Transparency High transparency in reporting and shareholder communication 🏦 Trading Technology Not applicable 🎉 Commission and Fees Not applicable

Pros and Cons

✔️ Pros ❌ Cons Highly regarded because Warren Buffet leads it The structure could dilute the impact of successful investments Diverse business interests across several sectors There are limited direct investment opportunities for retail investors Strong historical growth with solid financial health Exposure to market volatility because of the significant focus on equity investment There are significant cash reserves that allow for large-scale investments and several growth opportunities

Our Insight

Berkshire Hathaway is a great choice for professional investors. They have investments in prominent companies across different sectors, showing their commitment to long-term value rather than immediate profits.

9. TD Ameritrade

TD Ameritrade is known for its extensive range of trading tools and educational resources, making it suitable for investors of all experience levels.

Our review of TD Ameritrade emphasizes its no-commission structure for stocks and ETFs, making it a compelling choice for traders who are mindful of costs.

In addition, the platform offers a wide range of technological features, such as the advanced thinkorswim trading platform, which provides traders with powerful analytical tools and real-time data to help them make well-informed decisions.

Furthermore, we also found that TD Ameritrade prioritizes educational enhancement by offering webinars, video tutorials, and articles to support continuous learning and skill development.

Why is TD Ameritrade a Leading Firm for Investment Performance?

Our investigation into TD Ameritrade indicated that its extensive trading tools and instructional materials are its main draws. These characteristics help a large variety of investing philosophies and levels of experience, enhancing investments’ success.

Unique Features

🚀 Average Annual Return Varies according to the investment choice 📝 Expense Ratio Competitive 🔎 Asset Allocation Strategy Range of portfolio management solutions 💸 Performance of Managed Funds Varies according to fund and market conditions ✴️ Investment Philosophy A broad range of investment options; accommodates passive and active trading 💻 Risk Management Practices Personalized advice and auto risk management tools 🔁 Customer Satisfaction Generally high; strong reviews for platform usability and customer support 💳 Trading Platform Features Comprehensive trading tools, advanced capabilities, educational resources 🤝 Range of Investment Products Extensive; spread across mutual funds, ETFs, stocks, bonds, etc. 🗣 Market Access Wide; access to US and International markets ✅ Research and Educational Resources Extensive resources like trading courses, real-time data, webinars, etc. 📉 Transparency High; clear fee structure and investment disclosures 🏦 Trading Technology Advanced but suitable for all traders 🎉 Commission and Fees No commission fees for online stock, ETF, or options trades

Pros and Cons

✔️ Pros ❌ Cons Offers comprehensive tools and educational resources The tools are not as advanced as those of other firms There are commission-free trades on options, ETFs, and stocks There are higher fees with managed portfolios Access to an extensive range of local and international markets The extensive features are too much for those who want simple trades Offers superior technology that is suitable for beginner and professional investors and traders

Our Insight

TD Ameritrade offers extensive trading tools and instructional materials that are great for all investors alike. Their platform also offers a wide range of technological features.

10. Interactive Brokers

Interactive Brokers is renowned for its wide market access and extremely competitive pricing, making it the top choice for dedicated traders.

Our analysis revealed that Interactive Brokers provides a wide range of investment opportunities, including stocks, options, futures, and forex, in various global markets.

The platform’s advanced trading technology and extensive risk management tools cater to the requirements of professional traders seeking optimal efficiency and rapid execution.

In addition, the pricing model of Interactive Brokers is highly advantageous for high-volume traders, allowing them to maximize their trading profitability by taking advantage of cost efficiencies.

Why is Interactive Brokers a Leading Firm for Investment Performance?

Our research into Interactive Brokers validates its stellar reputation for cutting-edge trading technologies and broad market access. This makes it ideal for sophisticated traders needing a variety of instruments and sophisticated risk management tools.

Unique Features

🚀 Average Annual Return Depends on individual trading success 📝 Expense Ratio Low; competitive pricing structure 🔎 Asset Allocation Strategy A wide range of investment strategies, including global asset allocation 💸 Performance of Managed Funds Managed funds with varying performance according to market conditions and the fund ✴️ Investment Philosophy Provides technological solutions to support various investing and trading strategies 💻 Risk Management Practices Advanced tools like margin calculators and real-time monitoring 🔁 Customer Satisfaction Highly rated for technical capabilities and the range of options 💳 Trading Platform Features Highly advanced; ideal for professionals 🤝 Range of Investment Products Very extensive across options, forex, bonds, futures, etc. 🗣 Market Access Access to over 135 global markets ✅ Research and Educational Resources A vast range of tools and educational materials 📉 Transparency High, detailed disclosures on trading conditions and fees 🏦 Trading Technology Ranked among the industry leaders with sophisticated tools and platforms 🎉 Commission and Fees Low costs and transparent pricing models

Pros and Cons

✔️ Pros ❌ Cons Offers superior trading technology and market access The complexity of the platform makes it daunting for new investors There is an extensive range of investment products There is limited direct access to niche markets There is exceptional global market access The customer support experiences vary greatly Offers advanced risk management tools

Our Insight

Interactive Brokers is ideal for sophisticated traders. They offer wide market access and extremely competitive pricing, they also provide a wide range of investment opportunities.

What are the Criteria for The “Best Investment Performance” Award?

The “Best Investment Performance” Award is a mark of distinction in the investment industry, given to the most outstanding performance by an individual or team.

In our experience, this prestigious honor transcends monetary achievement. It includes an all-encompassing assessment of an investment manager’s capacity to traverse the intricate realm of finance with strategic agility, innovation, and a substantial influence on the community.

Strategic Excellence and Innovation

Our research highlights the importance of displaying exceptional strategic insight to receive this recognition. Recipients are trailblazers whose inventive techniques raise the bar for investment returns; they are more than just market participants.

According to our research, the capacity to foresee changes, a thorough familiarity with market dynamics, and the quickness to adjust plans are essential characteristics of great leaders. These skills guarantee continued success even when markets are unpredictable.

Impact Beyond Investment

The award’s focus on “impact beyond investment” is something we’ve already mentioned. This criterion recognizes financial advisers who go above and beyond to benefit their clients and the community.

From what we can see, the award is given to sustainable practices that promote social welfare, increase economic growth, and create value beyond what is often expected from investments.

Demonstrated Investment Success

Our research shows that the award is based on demonstrated investment success. This includes both immediate profits and steady growth over time, demonstrating the manager’s capacity to give investors above-average returns again and time again.

The execution of the investment plan is subject to a thorough appraisal as part of our assessment, considering the dynamic nature of the market.

Conclusion

Our final thoughts on achieving the best investment performance convey a mix of appreciation and prudence.

The recognition, like the Global Forex Awards, showcases the highest level of achievement, emphasizing the significance of strategic innovation and risk management in navigating unpredictable markets.

Our Insight

Overall, the awards highlight the accomplishments of individuals. Still, they also serve as a reminder of the ever-changing and intricate nature of the markets, where great rewards often come with substantial risks.

Faq

You can work for companies with a proven track record of generating strong returns in various market scenarios. Examine the fund or portfolio’s previous performance and any financial regulatory disclosures.

You should check for regulatory actions or customer complaints against the firm. You can also investigate their reputation using internet reviews and industry publications.

Both have pros and cons. Larger organizations may have more stability and resources, although smaller firms can provide more customized services.

Investment brokers can charge commissions on trades, fixed management fees, or performance-based fees. Before deciding on a broker, make sure you completely grasp all associated expenses and compare them to other possibilities.

Not necessarily. Many firms and brokers have different minimum investment requirements, and some specialize in serving smaller investors or beginners.