XTB Review

- Overview

- Detailed Summary

- Safety and Security

- Minimum Deposit and Account Types

- How To Open an XTB Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Which Markets Can You Trade with XTB?

- Leverage and Margin

- Deposit and Withdrawal Options

- Educational Resources

- Customer Reviews

- Pros and Cons

- In Conclusion

XTB is a trusted and reputable broker recognized for its intuitive platform and extensive trading tools, boasting a trust score of 95 out of 99.

🛡️Regulated and trusted by the FCA, KNF, CySEC, and FSC

🛡️2900 new traders chose this broker in the last 90 days.

🛡️Available for global Traders.

| 🔍 Broker | 🥇 XTB |

| 📌 Year Founded | 2002 |

| 👤 Amount of Staff | Approximately 2,000 |

| 👥 Amount of Active Traders | Over 500,000 |

| 📍 Publicly Traded | Warsaw Stock Exchange |

| 📈 Regulation | FCA, KNF, IFSC, CySEC |

| 🌎 Country of Regulation | UK (FCA), Poland (KNF) |

| 📉 Account Segregation | ✅Yes |

| 📊 Negative Balance Protection | ✅Yes |

| 💹 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | None |

| 💰 Minor Account Currencies | Major, Minor |

| 💴 Minimum Deposit | Varies by account type |

| ⚡ Average Deposit/Withdrawal Processing Time | 1-3 business days |

| 💶 Fund Withdrawal Fee | None |

| 📐 Spreads From | From 0.1 pips |

| 💶 Commissions | Variable |

| 💵 Number of Base Currencies Supported | 30+ |

| 💷 Swap Fees | ✅Yes |

| 🔖 Leverage | Up to 1:500 |

| 🏷️ Margin Requirements | Varies |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| 🖇️ Order Execution Time Seconds | Milliseconds - |

| 🖥️ VPS Hosting | Select accounts |

| 📈 CFDs Total | Over 2,000 |

| 📉 CFD Stock Indices | Major global indices |

| 🍎 CFD Commodities | Oil, gold, etc. |

| 📊 CFD Shares | ✅Yes |

| 💴 Deposit Options | Bank transfer, credit/debit, e-wallets, etc. |

| 💶 Withdrawal Options | Bank transfer, credit/debit, e-wallets, etc. |

| 🖱️ Trading Platforms | xStation 5 |

| ⭐ OS Compatibility | Windows, macOS, iOS, Android |

| ⚙️ Forex Trading Tools | Charting tools, technical analysis |

| 🥰 Live Chat Availability | ✅Yes |

| ☎️ Customer Support Contact Number | Varies by region |

| 💙 Social Media Platforms | Twitter, Facebook, LinkedIn, |

| 🚩 Languages Supported | Multiple languages |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | Articles, tutorials, etc. |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 Amount of Partners | Numerous global partners |

| 🫰🏻 IB Program | ✅Yes |

| 🔖 Notable Events or Teams | ✅Yes |

| 🏷️ Rebate Program | ✅Yes |

| 🚀 Open an Account | 👉 Click Here |

Overview

XTB is a leading global brokerage firm dedicated to providing diverse investment solutions. With over 20 years of experience in the financial markets, the company offers a range of services through its innovative app, allowing clients to trade, invest, and save effortlessly.

XTB prides itself on its cutting-edge technology, strong customer support, and an emphasis on responsible investing. As of 2024, the company has gained the trust of over 1 million customers worldwide and is regulated by top-tier authorities like the FCA, CySEC, and KNF.

XTB’s commitment to providing high-quality services and education is reflected in its industry accolades and its global presence across 12 countries.

Frequently Asked Questions

What is XTB?

XTB is a global brokerage firm that provides trading, investing, and saving solutions through its proprietary platform.

How many countries is XTB active in?

XTB operates in over 12 countries across three continents.

Is XTB regulated?

Yes, XTB is regulated by authorities like the FCA, CySEC, KNF, and DFSA.

How long has XTB been in business?

XTB has over 20 years of experience in the financial markets.

Our Insights

XTB stands out as a reliable broker; moreover, it offers a robust trading platform, extensive asset selection, and exceptional support, making it an excellent choice for both new and experienced investors. Consequently, traders can feel confident in XTB for their trading needs.

Detailed Summary

| 🔍 Broker | 🥇 XTB |

| 📌 Year Founded | 2002 |

| 👤 Amount of Staff | Approximately 2,000 |

| 👥 Amount of Active Traders | Over 500,000 |

| 📍 Publicly Traded | Warsaw Stock Exchange |

| 📈 Regulation | FCA, KNF, IFSC, CySEC |

| 🌎 Country of Regulation | UK (FCA), Poland (KNF) |

| 📉 Account Segregation | ✅Yes |

| 📊 Negative Balance Protection | ✅Yes |

| 💹 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | None |

| 💰 Minor Account Currencies | Major, Minor |

| 💴 Minimum Deposit | Varies by account type |

| ⚡ Average Deposit/Withdrawal Processing Time | 1-3 business days |

| 💶 Fund Withdrawal Fee | None |

| 📐 Spreads From | From 0.1 pips |

| 💶 Commissions | Variable |

| 💵 Number of Base Currencies Supported | 30+ |

| 💷 Swap Fees | ✅Yes |

| 🔖 Leverage | Up to 1:500 |

| 🏷️ Margin Requirements | Varies |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| 🖇️ Order Execution Time Seconds | Milliseconds - |

| 🖥️ VPS Hosting | Select accounts |

| 📈 CFDs Total | Over 2,000 |

| 📉 CFD Stock Indices | Major global indices |

| 🍎 CFD Commodities | Oil, gold, etc. |

| 📊 CFD Shares | ✅Yes |

| 💴 Deposit Options | Bank transfer, credit/debit, e-wallets, etc. |

| 💶 Withdrawal Options | Bank transfer, credit/debit, e-wallets, etc. |

| 🖱️ Trading Platforms | xStation 5 |

| ⭐ OS Compatibility | Windows, macOS, iOS, Android |

| ⚙️ Forex Trading Tools | Charting tools, technical analysis |

| 🥰 Live Chat Availability | ✅Yes |

| ☎️ Customer Support Contact Number | Varies by region |

| 💙 Social Media Platforms | Twitter, Facebook, LinkedIn, |

| 🚩 Languages Supported | Multiple languages |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | Articles, tutorials, etc. |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 Amount of Partners | Numerous global partners |

| 🫰🏻 IB Program | ✅Yes |

| 🔖 Notable Events or Teams | ✅Yes |

| 🏷️ Rebate Program | ✅Yes |

| 🚀 Open an Account | 👉 Click Here |

Frequently Asked Questions

What services does XTB offer?

XTB offers trading in CFDs, investing in stocks and ETFs, and saving through investment plans.

How secure is XTB?

XTB uses two-factor authentication (2FA) to ensure secure logins.

Does XTB have a mobile app?

Yes, XTB provides a mobile app for trading, investing, and managing savings.

Can I trade stocks and ETFs with XTB?

Yes, XTB gives access to stocks and ETFs listed on major global exchanges.

Our Insights

With nearly 20 years of experience, XTB has established itself as a trusted broker, serving a global community of over 500,000 traders.

Additionally, it offers a wide range of trading instruments, high leverage, and robust client protections, including negative balance protection. As a result, traders can enjoy a secure and versatile trading environment.

Safety and Security

XTB is committed to ensuring the safety and security of its clients’ investments and personal data. With over 20 years of experience, the company adheres to strict regulatory standards from top-tier financial authorities, including the FCA, CySEC, and KNF. XTB uses advanced security measures such as two-factor authentication (2FA) for account protection.

Their robust cybersecurity protocols, alongside a focus on responsible investing, help create a secure and trustworthy platform for investors worldwide.

Frequently Asked Questions

Is XTB a secure platform for trading and investing?

Yes, XTB employs advanced security measures, including two-factor authentication (2FA), to ensure the safety of your account and personal information.

Is XTB regulated?

Yes, XTB is regulated by reputable financial authorities such as the FCA (UK), CySEC (Cyprus), and KNF (Poland), ensuring compliance with global standards.

How does XTB protect my data?

XTB uses the latest cybersecurity technologies to safeguard your personal and financial data, providing a secure trading environment.

Does XTB offer any protection against fraud?

Yes, XTB has strong fraud prevention systems in place and complies with strict regulatory requirements to protect clients from potential risks.

Our Insights

XTB prioritizes the safety and security of its clients, ensuring a secure trading experience through robust regulatory oversight and advanced technology. The implementation of two-factor authentication and adherence to global financial standards provides users with peace of mind when using the platform for trading, investing, and saving.

Minimum Deposit and Account Types

XTB offers a flexible approach to account types, catering to traders and investors of all experience levels. One of the standout features of XTB is the lack of a minimum deposit requirement, allowing anyone to get started regardless of their budget.

The platform provides free account opening and maintenance for active clients, which makes it accessible to all. Additionally, XTB offers a variety of account types, including the option for swap-free accounts for specific products and periods, accommodating a wide range of trading preferences.

Frequently Asked Questions

Is there a minimum deposit required to open an account with XTB?

No, XTB does not require a minimum deposit to open an account.

Are there fees for maintaining an account?

No, XTB offers free account opening and maintenance for all active clients, regardless of account balance.

Can I get a swap-free account with XTB?

Yes, XTB provides swap-free accounts for specific products and periods. Not all products are eligible for swap-free options, so refer to the specification table for full details.

What are the available account types at XTB?

XTB offers various account types, including standard accounts and options for swap-free accounts, designed to meet the diverse needs of its clients.

Our Insights

XTB’s no-minimum deposit policy and free account maintenance make it an attractive option for traders at all levels. With flexible account types, including the option for swap-free accounts, XTB provides a personalized and accessible experience for users looking to trade, invest, or save.

How To Open an XTB Account

To register an XTB Account, the following steps can be followed:

1. Step 1: Visit the official website and select “Open Account” or “Create Account.” Enter your personal information, including name, email, country, and phone number, and create a password.

2. Step 2: Choose the account type that fits your trading goals, such as live or demo accounts. Verify your identity by submitting a government-issued ID and a utility bill or bank statement.

3. Step 3: Complete the application by reviewing your information, agreeing to the terms, and submitting.

Wait for approval, which you’ll receive via email or your dashboard. Once approved, fund your account. After funding, you can start trading on the platform.

Trading Platforms and Software

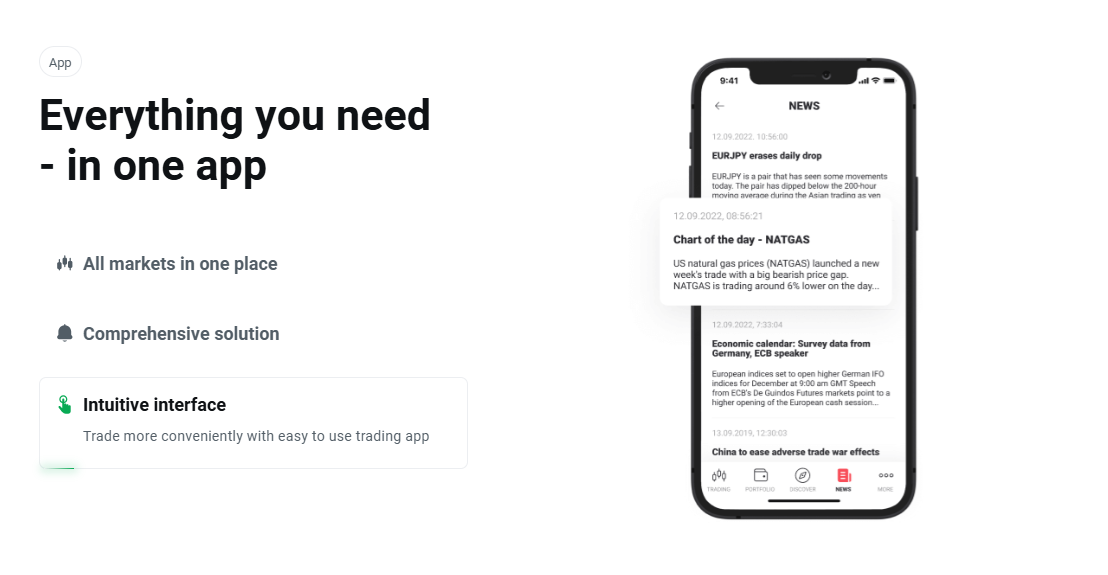

XTB offers a powerful, modern, and intuitive trading platform designed to help you navigate the financial markets with ease. The platform provides access to over 6,000 instruments, including stocks, ETFs, and CFDs, all in one place.

It features user-friendly tools such as position management options, investment calculators, and market sentiment indicators. The platform is accessible on desktop, iOS, and Android devices, giving you the flexibility to invest anywhere, anytime.

With daily market news, an extensive knowledge base, and the ability to create personalized Investment Plans, XTB ensures that both novice and experienced investors can manage their investments seamlessly.

Frequently Asked Questions

What instruments can I trade on XTB’s platform?

XTB provides access to over 6,000 instruments, including stocks, ETFs, and CFDs, giving you a wide range of trading options.

Is XTB’s trading platform easy to use?

Yes, the platform is designed to be user-friendly with an intuitive interface, making it easy for both beginners and experienced traders to navigate.

Can I use XTB’s platform on mobile devices?

Yes, the platform is available on both desktop and mobile devices (iOS and Android), offering flexibility to trade on the go.

What tools are available to help me manage my investments?

XTB offers tools like Stop Loss, Take Profit, Pending Orders, an Investment Calculator, and market sentiment analysis to help you manage your investments effectively.

Our Insights

XTB’s trading platform stands out for its ease of use, comprehensive features, and multi-device compatibility. Whether you’re looking to trade a wide range of instruments, manage positions efficiently, or access educational resources, the platform provides everything needed to succeed in the financial markets.

With intuitive tools and real-time market data, XTB offers a seamless and flexible trading experience for investors of all levels.

Fees, Spreads, and, Commissions

XTB strives for transparency in its fee structure, providing clear and competitive pricing. Deposits are free, though some payment providers may charge additional fees. There are no account opening or maintenance fees for active clients, and withdrawals are free for amounts over 50 USD.

XTB offers commission-free trading on stocks and ETFs for a monthly turnover of up to 100,000 EUR. For larger transactions, a small commission of 0.2% (minimum 10 EUR) applies. XTB’s competitive spreads and various instruments ensure a cost-effective trading experience for its clients.

Frequently Asked Questions

Are there any fees for opening or maintaining an account with XTB?

No, opening and maintaining an account is free for all active clients, regardless of the account balance.

What fees are involved with deposits?

XTB does not charge deposit fees, although payment providers may charge additional fees, depending on the method used.

Is there a commission for trading stocks and ETFs?

XTB offers commission-free trading on stocks and ETFs for a monthly turnover of up to 100,000 EUR. For higher turnovers, a 0.2% commission applies, with a minimum of 10 EUR.

Are withdrawals free with XTB?

Yes, withdrawals are free for amounts over 50 USD.

Our Insights

XTB’s fee structure is clear and competitive, with no account maintenance fees and free deposits and withdrawals (above 50 USD). The platform’s commission-free trading for stocks and ETFs, combined with low spreads and transparent pricing, ensures a cost-efficient trading experience for users.

Which Markets Can You Trade with XTB?

XTB offers a wide range of trading instruments, including:

- Forex: Diverse currency pairs with competitive spreads from 0.5 pips and leverage up to 1:500.

- Indices: Access to global indices, enabling trading on entire sectors without selecting individual stocks.

- Commodities: Trade various commodities like gold, silver, oil, and agricultural products for portfolio diversification.

- Stock CFDs: Over 3,900 stock CFDs are available, allowing trading on major markets without owning the underlying assets.

- ETF CFDs: CFDs for ETFs provide exposure to baskets of assets, offering a cost-effective way to diversify.

Additionally, XTB supports trading in major cryptocurrencies like Bitcoin and Ethereum, allowing speculation in a volatile market.

Frequently Asked Questions

What types of forex pairs does XTB offer?

XTB provides a diverse range of currency pairs, including major, minor, and exotic pairs, with spreads starting at 0.5 pips.

Can I trade commodities with XTB?

Yes, XTB allows trading in various commodities, including precious metals like gold and silver, as well as energy and agricultural products.

How many stock CFDs are available at XTB?

XTB offers over 3,900 stock CFDs, allowing traders to access shares from major global markets without owning the underlying assets.

Does XTB support cryptocurrency trading?

Yes, XTB supports trading of major cryptocurrencies, including Bitcoin and Ethereum, enabling speculation in this dynamic market.

Our Insights

XTB provides a comprehensive range of trading instruments, including forex, indices, commodities, stock CFDs, ETF CFDs, and cryptocurrencies. This diverse selection allows traders to explore various markets and strategies, catering to novice and experienced investors seeking flexibility and opportunities in their trading activities.

Leverage and Margin

XTB offers a flexible leverage system that allows traders to increase their market exposure beyond their initial investment. For example, with leverage of 30:1, a $2,000 investment can control a position worth $60,000. Leverage ratios vary depending on the asset type and the trader’s experience. For instance, lower leverage ratios are recommended for beginners, while more experienced traders can access leverage of up to 1:500 on certain products.

Margin requirements dictate the capital needed to maintain leveraged positions. If the account balance falls below the required margin, a margin call may be triggered, and the trader risks having positions closed to prevent further losses.

Frequently Asked Questions

What is the maximum leverage offered by XTB?

XTB offers leverage up to a maximum of 1:500, depending on the asset type.

How does leverage increase my market exposure?

Leverage allows traders to control a larger position than their initial investment, increasing potential earnings but also risks.

What are the margin requirements?

Margin requirements specify the capital needed to open and maintain a leveraged position, ensuring traders have sufficient funds in their accounts.

What happens if my account balance falls below the required margin?

If your account balance falls below the required margin, a margin call may be issued, which could lead to the closure of your positions.

Our Insights

XTB’s flexible leverage options enable traders to amplify their market exposure, with a maximum of 1:500 available for experienced users.

Deposit and Withdrawal Options

XTB offers a variety of deposit and withdrawal options to ensure seamless transactions for its clients. Traders can easily fund their accounts using bank wire transfers, credit or debit cards, and popular e-wallets.

XTB will convert funds at the current exchange rate when necessary. Additionally, XTB does not accept cryptocurrency deposits; only fiat currencies like USD, EUR, or GBP are permitted.

Frequently Asked Questions

What deposit methods are available at XTB?

XTB offers several deposit methods, including bank wire transfers, credit/debit cards, and e-wallets.

Are there any fees for deposits and withdrawals?

XTB does not charge fees for deposits or withdrawals, making transactions cost-effective for traders.

Can I withdraw funds to my credit or debit card?

Yes, you can withdraw funds to your credit or debit card; however, the amount may be limited to the previous deposits made with that card. Therefore, it’s important to consider this when planning your withdrawals.

Does XTB accept cryptocurrency for deposits?

No, XTB currently does not accept cryptocurrency deposits; only fiat currencies like USD, EUR, or GBP are allowed.

Our Insights

XTB offers a variety of convenient deposit and withdrawal options, including bank wire transfers, credit/debit cards, and e-wallets, allowing traders to manage their funds easily. Furthermore, with no transaction fees and straightforward processes, clients can efficiently deposit and withdraw funds.

Educational Resources

XTB provides valuable educational resources, including:

- Articles: These publications offer insights into financial markets, trading strategies, and economic concepts, helping traders stay informed and expand their knowledge.

- Guides: Comprehensive trading tutorials deliver step-by-step instructions and detailed analysis for organized learning on specific trading topics.

Frequently Asked Questions

What types of educational resources does XTB offer?

XTB offers articles and comprehensive guides that cover financial markets, trading strategies, and economic concepts.

Are the articles suitable for beginners?

Yes, the articles provide insights that are beneficial for traders of all levels, including beginners looking to expand their knowledge.

What can I expect from the trading guides?

The trading guides offer step-by-step tutorials and in-depth analysis of specific trading topics, making them a valuable learning tool.

Is there a cost for accessing the educational resources?

No, XTB’s educational resources are free for all clients, allowing easy access to valuable trading knowledge.

Our Insights

XTB offers a robust selection of educational resources, including informative articles and comprehensive guides. Moreover, materials are designed to enhance traders’ knowledge and skills.

Customer Reviews

🥇 A Seamless Trading Experience.

I’ve been using XTB for a few months now, and I couldn’t be happier. The platform is incredibly easy to navigate, even for someone like me who’s new to trading. I love the variety of assets available, and the real-time market data and daily news keep me well informed. The mobile app is just as smooth as the desktop version, so I can trade on the go. Highly recommend XTB to anyone looking to get into the markets! – Michael

🥈 Outstanding Customer Service and Support!

As an experienced trader, I’ve used many platforms, but none have matched XTB’s customer service. The support team is always quick to respond and very helpful, whether it’s a technical issue or a question about a trade. I also appreciate their educational resources—they’ve helped me refine my strategy. XTB truly cares about its clients, and it shows in the level of service they provide. – James

🥉 Impressive Range of Tools and Features.

XTB’s platform has everything I need to succeed. The variety of tools, such as the Investment Plans and the position management features, allows me to control my investments with ease. I especially love the market sentiment indicators and the investment calculator—these tools help me make informed decisions. Whether you’re a beginner or an experienced trader, XTB has all the features you need for a smooth and profitable trading experience. – Emily

Pros and Cons

| ✅ Pros | ❌ Cons |

| For selected clients and within trade volume restrictions, XTB provides commission-free trading on genuine stocks and ETFs, resulting in considerable cost savings | Some features of XTB's pricing structure might be confusing, especially for certain sorts of deals |

| XTB is licensed by renowned financial institutions such as the UK's FCA | The depth of research and market analysis materials may be greater in English than in other languages |

| XTB delivers in-depth market research, news updates, and a variety of technical indicators to help traders make educated decisions | XTB charges an inactivity fee on dormant accounts, prompting traders to either trade often or terminate their accounts to avoid these fees |

| XTB provides narrow spreads on main currency pairs and other popular assets, reducing trading expenses | The cryptocurrency CFD selection at XTB is smaller than that of certain specialized crypto exchanges |

| Traders have access to a wide range of financial products, including Forex, indices, commodities, stocks, ETFs, and even cryptocurrencies | While XTB provides customer assistance, there have been varied comments about its quickness and general helpfulness |

References:

In Conclusion

XTB, founded in 2002 and publicly traded on the Warsaw Stock Exchange, is a leading broker with over 500,000 active traders. In addition, it is regulated by major authorities like the FCA and KNF, and XTB prioritizes client security through account segregation and negative balance protection. Moreover, with its user-friendly xStation 5 platform and extensive educational resources, XTB effectively supports traders of all levels.

Faq

You can easily open an account through their website or app by completing a registration form.

XTB charges fees on certain services, but it offers competitive pricing and often runs promotions, such as zero-commission investing.

XTB offers an extensive library of educational materials, including articles and videos.

Yes, XTB adheres to strict regulatory standards and employs advanced cybersecurity measures.

XTB provides customer support in 18 languages via email, chat, and phone.