JustMarkets Review

JustMarkets is a trustworthy and highly regulated Forex Broker that offers access to an extensive selection of financial instruments and highly competitive trading conditions. JustMarkets has a trust score of 90 out of 99.

🛡️Regulated and trusted by FSA, CySec, FSCA, FSC

🛡️2000 new traders chose this broker in the last 90 days.

🛡️Available for global Traders.

| 🔎 Broker | 🥇 JustMarkets |

| 📌 Year Founded | 2010 |

| 📉 Publicly Traded (Listed Company) | None |

| ⭐ Regulation | FSA, CySec, FSCA, FSC |

| 🌎 Country of regulation | Belize |

| ⭐ Account Segregation | ✅Yes |

| 🚨 Negative balance protection | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | ✅Yes |

| 💴 Minor account currencies | Multiple |

| 💶 Minimum Deposit | 10 USD |

| ⭐ Average deposit/withdrawal processing time | 1-2 business days |

| 💵 Fund Withdrawal Fee | Varies based on method |

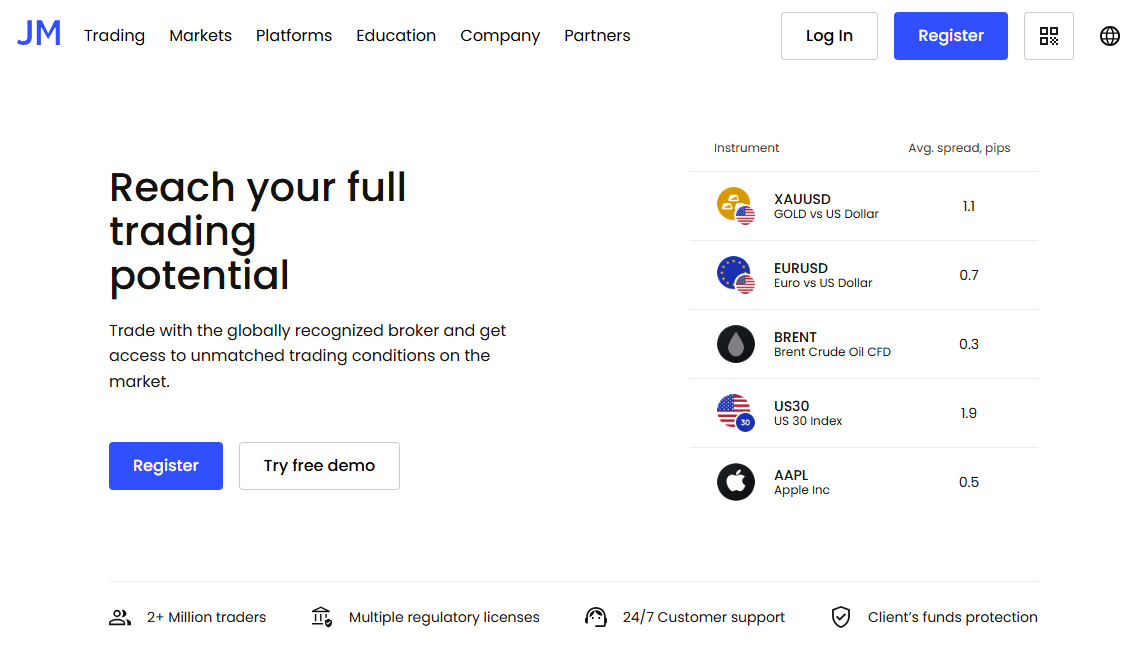

| 💹 Spreads from | 0.0 pips |

| 💷 Commissions | Depends on account type and trading volume |

| 7️⃣ Number of base currencies supported | 7 |

| 💳 Swap Fees | ✅Yes |

| 📈 Leverage | Up to 1:1000 |

| 📉 Margin requirements | Varies based on leverage and position size |

| ☪️ Islamic account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏲️ Order Execution Time | Fraction of a second to a few seconds |

| ⚙️ VPS Hosting | Available for clients |

| ⭐ CFDs Total | 500+ |

| 📈 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📉 CFD Shares | ✅Yes |

| ➡️ Deposit Options | Bank transfer, credit/debit cards, e-wallets |

| ↪️ Withdrawal Options | Bank transfer, credit/debit cards, e-wallets |

| 🖱️ Trading Platforms | MetaTrader 4, MetaTrader 5 |

| 💻 OS Compatibility | Windows, macOS, iOS, Android |

| 🖥️ Forex trading tools | Various built-in and third-party tools available |

| 🥰 Live chat availability | ✅Yes |

| 💌 Customer Support Email address | [email protected] |

| 🚀 Social media Platforms | Facebook, Twitter, Instagram, |

| 📔 Languages supported on FBS Website | Multiple languages |

| 📚 Forex course | ✅Yes |

| 📒 Webinars | ✅Yes |

| 📑 Educational Resources | ✅Yes |

| ⭐ Affiliate program | ✅Yes |

| 📉 IB Program | ✅Yes |

| 📊 Rebate program | ✅Yes |

| 💹 Does JustMarkets Accept US Traders | No |

| 🚀Open an Account | 👉 Click Here |

Overview

JustMarkets is a well-regarded online broker that grants access to global financial markets, with a commitment to helping traders reach their full potential. Focused on creating a user-friendly and transparent trading environment, JustMarkets offers competitive spreads, fast execution, and customer-focused services.

Trusted by millions of traders in over 160 countries, the company is known for its reliability, professionalism, and continuous commitment to improvement. Whether you are a beginner or an experienced trader, JustMarkets aims to provide a secure and rewarding trading experience.

Frequently Asked Questions

What makes JustMarkets stand out from other brokers?

JustMarkets distinguishes itself through its dedication to delivering high-quality service, reliability, and transparency. It offers excellent spreads and fast execution, supported by a skilled team with extensive experience. The company’s emphasis on earning customer trust and its focus on continuous learning set it apart in the competitive trading industry.

How secure is my personal and financial information with JustMarkets?

JustMarkets safeguards all client information using encryption technology, prioritizing privacy and protecting personal and financial details from unauthorized access. This ensures a secure and safe trading environment.

Can I start trading with JustMarkets if I’m a beginner?

Yes, JustMarkets provides a free demo account, allowing beginners to practice trading without risk. Additionally, their team of experts is always available to support traders at any experience level, ensuring a smooth and educational trading experience.

What is the company’s approach to customer service?

JustMarkets is highly customer-focused, offering dedicated support to assist traders. The company values long-term relationships and works to resolve issues while enhancing services based on customer feedback. Their goal is to provide a seamless and convenient trading experience for every client.

Our Insights

JustMarkets is a reliable, customer-oriented broker that offers competitive benefits for traders of all skill levels. With its commitment to security, professionalism, and innovation, JustMarkets ensures that traders can confidently engage with global financial markets, supported by the right tools and expertise.

Detailed Summary

| 🔎 Broker | 🥇 JustMarkets |

| 📌 Year Founded | 2010 |

| 📉 Publicly Traded (Listed Company) | None |

| ⭐ Regulation | FSA, CySec, FSCA, FSC |

| 🌎 Country of regulation | Belize |

| ⭐ Account Segregation | ✅Yes |

| 🚨 Negative balance protection | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | ✅Yes |

| 💴 Minor account currencies | Multiple |

| 💶 Minimum Deposit | 10 USD |

| ⭐ Average deposit/withdrawal processing time | 1-2 business days |

| 💵 Fund Withdrawal Fee | Varies based on method |

| 💹 Spreads from | 0.0 pips |

| 💷 Commissions | Depends on account type and trading volume |

| 7️⃣ Number of base currencies supported | 7 |

| 💳 Swap Fees | ✅Yes |

| 📈 Leverage | Up to 1:1000 |

| 📉 Margin requirements | Varies based on leverage and position size |

| ☪️ Islamic account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏲️ Order Execution Time | Fraction of a second to a few seconds |

| ⚙️ VPS Hosting | Available for clients |

| ⭐ CFDs Total | 500+ |

| 📈 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📉 CFD Shares | ✅Yes |

| ➡️ Deposit Options | Bank transfer, credit/debit cards, e-wallets |

| ↪️ Withdrawal Options | Bank transfer, credit/debit cards, e-wallets |

| 🖱️ Trading Platforms | MetaTrader 4, MetaTrader 5 |

| 💻 OS Compatibility | Windows, macOS, iOS, Android |

| 🖥️ Forex trading tools | Various built-in and third-party tools available |

| 🥰 Live chat availability | ✅Yes |

| 💌 Customer Support Email address | [email protected] |

| 🚀 Social media Platforms | Facebook, Twitter, Instagram, |

| 📔 Languages supported on FBS Website | Multiple languages |

| 📚 Forex course | ✅Yes |

| 📒 Webinars | ✅Yes |

| 📑 Educational Resources | ✅Yes |

| ⭐ Affiliate program | ✅Yes |

| 📉 IB Program | ✅Yes |

| 📊 Rebate program | ✅Yes |

| 💹 Does JustMarkets Accept US Traders | No |

| 🚀Open an Account | 👉 Click Here |

Frequently Asked Questions

Does JustMarkets offer Negative Balance Protection?

Yes, JustMarkets offers Negative Balance Protection along with Account Segregation.

Does JustMarkets offer Institutional and Managed Accounts?

Yes, JustMarkets provides both Institutional and Managed Accounts.

What is the minimum deposit required to open a JustMarkets Standard Account?

The minimum deposit required to open a JustMarkets Standard Account is $10.

Does JustMarkets support Demo and Swap-Free Trading?

Yes, JustMarkets offers access to Demo Accounts as well as Islamic, Swap-Free Accounts.

Our Insights

JustMarkets delivers a comprehensive and well-rounded trading experience. With strong regulatory oversight, a wide range of financial instruments, competitive trading conditions, and valuable educational resources, it is an excellent choice for traders of all experience levels.

Regulation and Security

JustMarkets ensures a secure and reliable trading environment for all clients through comprehensive regulatory oversight.

The company holds licenses from respected financial authorities, including the Seychelles Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), and the Financial Services Commission (FSC), maintaining the highest standards of security and transparency.

These regulations are in place to safeguard your financial security, providing you with the confidence to trade with peace of mind.

Frequently Asked Question

Is JustMarkets regulated?

Yes, JustMarkets is a fully regulated broker, holding licenses from prominent financial authorities such as the Seychelles Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), and the Financial Services Commission (FSC).

In which countries is JustMarkets regulated?

JustMarkets is regulated in several regions, including Seychelles, Cyprus, South Africa, and Mauritius, offering a strong global presence with solid regulatory backing.

What is the difference between a regulated broker and an unregulated broker?

A regulated broker complies with legal requirements set by financial authorities, offering protections such as secure funds and transparent trading practices. An unregulated broker, on the other hand, may lack these safeguards, presenting higher risks to your funds and trading experience.

How does JustMarkets ensure my financial security?

JustMarkets operates under the supervision of trusted financial regulators, ensuring transparency and safeguarding client funds. The company adheres to strict regulatory standards and provides a secure platform for all trading activities.

Our Insights

JustMarkets offers a highly secure and regulated trading environment, allowing clients to trade with confidence. With oversight from leading global financial authorities, the broker ensures a transparent and protected trading experience.

Whether you’re new to trading or an experienced investor, JustMarkets provides a safe space for managing your investments securely.

Bonus Offers and Promotions

JustMarkets offers an appealing 50% deposit bonus with no maximum limit on the amount you can receive. This promotion is available for deposits starting as low as $10, enabling traders to increase their trading capital. The larger your deposit, the greater the bonus, helping to enhance your trading potential and boost profits.

The bonus can be used as additional margin for trading, providing more flexibility in managing your trades. JustMarkets ensures a straightforward process to claim your bonus, with clear and transparent rules and conditions for a seamless experience.

Frequently Asked Questions

How do I claim the 50% deposit bonus?

To claim the bonus, go to the Deposit section in your account, select the “Get a bonus on deposit” option, and read and accept the bonus terms before making your deposit.

What is the minimum deposit required to qualify for the bonus?

The minimum deposit required to qualify for the 50% bonus is just $10.

Can I receive a bonus on multiple deposits?

There is no limit to the number of deposits you can make or the total bonus amount you can receive. However, the bonus is applied only to one-time deposits, not to multiple smaller deposits combined.

How long can I use the bonus?

The bonus is valid for 30 calendar days from the deposit date. After this period, the bonus will be canceled unless the necessary conditions for its use have been met.

Our Insights

The 50% deposit bonus offered by JustMarkets is a fantastic opportunity for traders to increase their trading capital. With no limits on the total bonus amount and a straightforward claiming process, this offer provides a valuable advantage for traders looking to enhance their trading potential.

Minimum Deposit and Account Types

JustMarkets provides six account types tailored to meet the needs of traders with varying experience levels and trading preferences: Standard, Pro, Raw Spread, Standard Cent, Demo, and Islamic accounts. The minimum deposit required varies by account type, starting as low as USD 10 for beginner-friendly accounts and up to USD 100 for more advanced trading accounts.

Traders can select the account that best aligns with their trading style and objectives, with options available for both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Frequently Asked Questions

How can I determine which account type is suitable for me?

Choose an account type based on your trading experience, goals, risk tolerance, and preferred instruments. The Standard Cent account is ideal for beginners, while Pro and Raw Spread accounts cater to more experienced traders seeking tighter spreads and faster execution.

Which JustMarkets Account suits all types of Trading Strategies?

The MT4 and MT5 Standard Accounts are versatile and suitable for all trading strategies, whether you’re a scalper, day trader, or swing trader.

Who is the Standard Cent Account best suited for?

The Standard Cent account is designed specifically for beginners who want to start trading with lower risk using micro-lots and pennies as the base currency.

What does the JustMarkets Pro Account offer?

The Pro account provides advanced trading conditions with lower spreads and no commissions, making it ideal for high-volume and experienced traders.

Our Insights

JustMarkets offers a diverse selection of account types, each catering to different trader needs. Whether you’re a beginner just starting with a low minimum deposit, or an experienced trader looking for tighter spreads and advanced features, JustMarkets has an account option for you.

The platform’s flexible account types and accessible minimum deposit requirements make it suitable for traders of all experience levels.

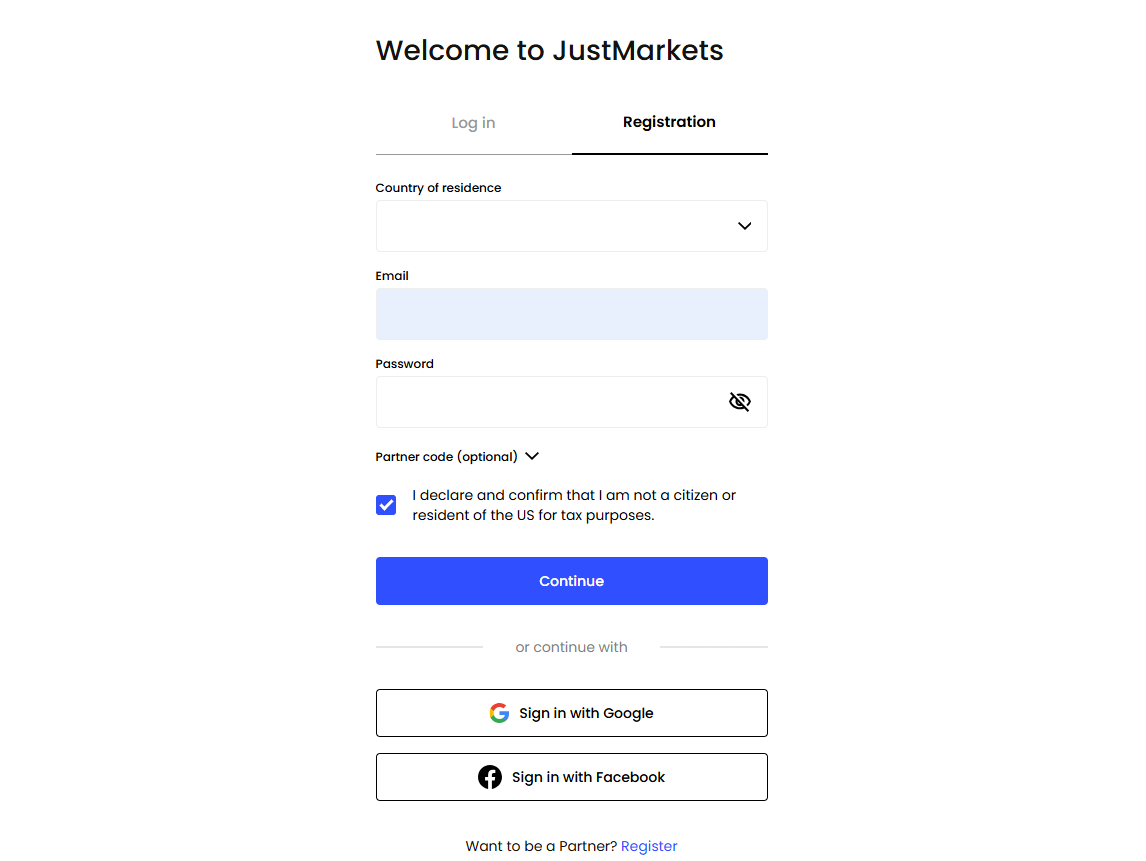

How to open a JustMarkets Account

The applicant will need to register to gain access to the “Back Office.” After registration, the applicant will be automatically redirected to the Back Office, where they can open their first account. Fill in your credentials and click on Create account.

JustMarkets offers the MetaTrader suite of trading platforms—MetaTrader 4 and MetaTrader 5 – on most smart devices.

Trading Platforms and Tools

JustMarkets offers two of the most popular trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). While both platforms come with robust trading features, MT5 stands out by supporting a wider range of assets, including stocks, commodities, and cryptocurrencies, in addition to forex and CFDs.

MT5 offers additional order types, timeframes, and technical indicators, making it a more versatile choice for traders seeking a broader set of trading tools. It also includes an economic calendar and advanced charting options, further enhancing the trading experience.

Both MT4 and MT5 support automated trading through Expert Advisors (EAs) and custom indicators.

Frequently Asked Questions

Which platforms does JustMarkets offer?

JustMarkets provides MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

What is the difference between MT4 and MT5?

MT5 offers more asset classes, order types, and technical tools compared to MT4.

Can I trade stocks on MT4?

No, MT4 supports only forex and CFDs. MT5 allows trading in stocks, commodities, and cryptocurrencies.

Does MT5 include an economic calendar?

Yes, MT5 features an integrated economic calendar, unlike MT4.

Our Insights

MT4 is ideal for traders who focus on forex and CFDs, providing all the essential tools. However, for those seeking to trade a wider array of assets, such as stocks and cryptocurrencies, MT5 offers greater versatility.

While both platforms offer powerful features, MT5 is the better option for traders who require advanced tools and multi-asset trading capabilities.

Markets Available for Trade

JustMarkets offers a diverse range of trading markets, enabling traders to explore a variety of asset classes. You can trade major, minor, and exotic forex pairs, including EUR/USD, GBP/USD, and USD/TRY. The broker also provides CFDs on global indices such as the S&P 500 and NASDAQ 100, along with stocks from prominent companies like Apple and Amazon.

For commodity traders, JustMarkets offers precious metals like gold and silver, energy assets such as crude oil and natural gas, and agricultural commodities like corn and wheat. Cryptocurrency traders can access popular coins like Bitcoin and Ethereum, as well as a selection of emerging altcoins.

Additionally, JustMarkets offers trading in ETFs, providing traders with exposure to different sectors and indices.

Frequently Asked Questions

What forex pairs can I trade on JustMarkets?

JustMarkets offers a range of forex pairs, including major, minor, and exotic pairs such as EUR/USD, GBP/USD, and USD/TRY.

Does JustMarkets offer cryptocurrency trading?

Yes, JustMarkets supports trading in major cryptocurrencies like Bitcoin and Ethereum, along with emerging altcoins.

Can I trade commodities on JustMarkets?

Yes, you can trade commodities including gold, silver, crude oil, and natural gas.

What types of indices are available?

JustMarkets provides CFDs on global indices, including the S&P 500, NASDAQ 100, and FTSE 100.

Our Insights

JustMarkets offers a diverse range of markets, making it an excellent choice for traders interested in forex, cryptocurrencies, commodities, and beyond. With access to a wide variety of asset classes, including stocks, indices, and ETFs, it provides a comprehensive trading experience for those seeking a well-rounded portfolio.

Fees, Spreads, and, Commissions

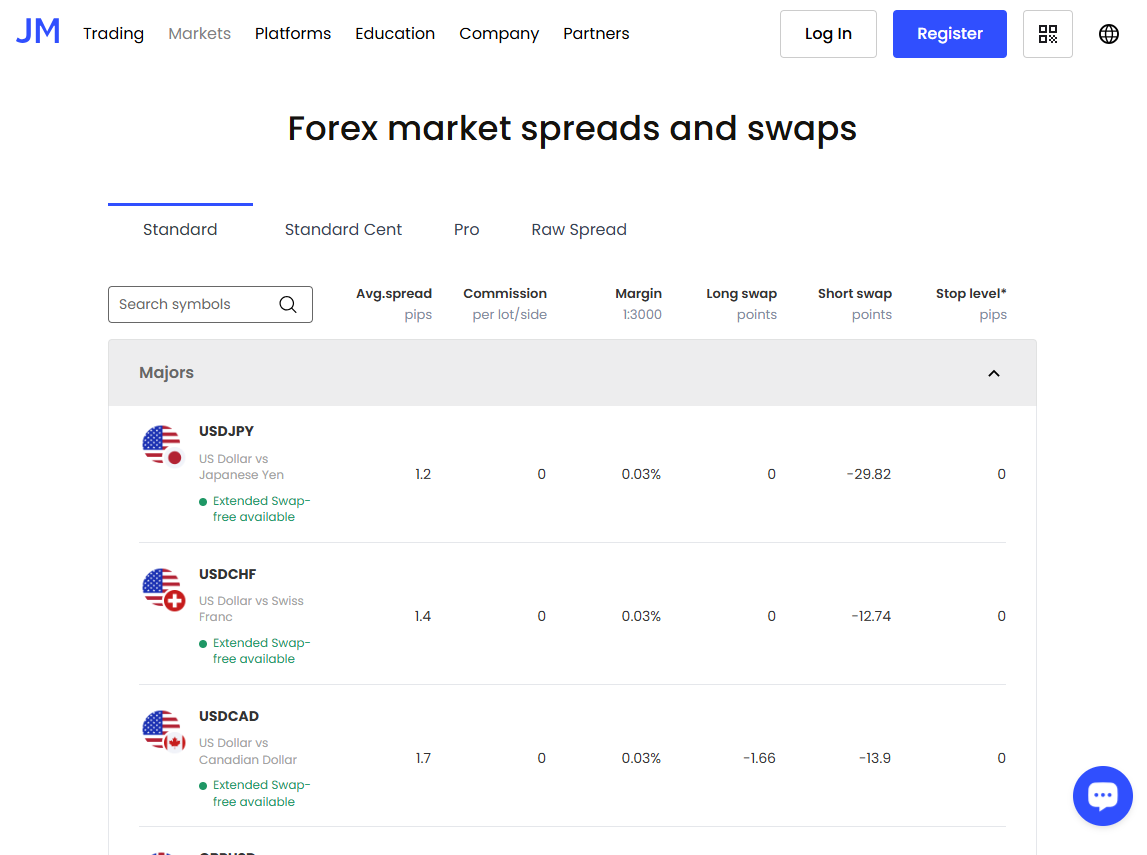

JustMarkets offers competitive fees, spreads, and commission structures across its various account types. Depending on the selected account, traders can benefit from tight spreads starting as low as 0 pips. Some accounts offer commission-free trading, while others, like the Raw Spread account, charge a commission on each trade.

The pricing structure is designed to accommodate both casual and high-frequency traders, ensuring flexibility and efficiency.

Frequently Asked Questions

What is the spread on JustMarkets accounts?

Spreads start from as low as 0 pips on the Raw Spread account, and from 0.3 pips on the Standard and Pro accounts, depending on market conditions.

Are there any commissions on trading?

There are no commissions on the Standard and Pro accounts, but the Raw Spread account charges a commission of $3 per side per lot traded.

How do JustMarkets fees compare to other brokers?

JustMarkets offers highly competitive fees, with tight spreads and low commissions, making it attractive for both beginner and professional traders.

Do JustMarkets accounts offer swap-free trading?

Yes, JustMarkets provides swap-free accounts for traders who adhere to Islamic finance principles, allowing interest-free trading.

Our Insights

JustMarkets offers competitive and transparent pricing, making it a strong choice for traders looking for low-cost trading options. With tight spreads, no commissions on several account types, and the option for swap-free trading, the platform provides flexibility and cost-effective conditions for both novice and experienced traders.

Deposit and Withdrawal

JustMarkets offers a variety of deposit and withdrawal methods, supporting multiple currencies for traders. Deposit options include popular methods such as MasterCard, Visa, Bitcoin, Skrill, Neteller, and more, with minimum deposit amounts starting at just USD 10. Most deposits are processed quickly, typically within 30 minutes.

Withdrawals can be made through several methods, including Visa, MasterCard, Bank Transfer, Skrill, and Bitcoin. Withdrawal processing times vary: e-wallets and card payments usually take 1-2 hours, while bank transfers may take between 1 and 6 banking days.

Frequently Asked Questions

What is the minimum deposit amount on JustMarkets?

The minimum deposit starts at USD 10 for most methods.

How long do withdrawals take?

Withdrawals typically take 1-2 hours for e-wallets and card payments, while bank transfers may take 1-6 banking days.

Can I deposit with Bitcoin?

Yes, Bitcoin is an accepted deposit method, with a minimum deposit of USD 30.

What withdrawal methods are available?

JustMarkets supports withdrawals via MasterCard, Visa, Skrill, Neteller, Bank Transfer, Bitcoin, and more.

Our Insights

JustMarkets provides a flexible and convenient range of deposit and withdrawal options, with fast processing times. The platform’s extensive selection of methods and quick turnaround for e-wallets and card payments enhance both accessibility and efficiency, ensuring a smooth and user-friendly trading experience.

Partnership Program

The JustMarkets Introducing Broker Program offers a great opportunity for partners to earn up to $25 per lot based on the trading activity of referred clients. With a flexible commission structure, partners can increase their earnings by referring clients who trade various instruments, including gold, as well as major, minor, and exotic currency pairs. The more clients you refer, the higher your earning potential.

This program provides daily payouts, an easy-to-use set of promotional tools, and real-time statistics to help you monitor your earnings. It’s designed to help you generate a steady income while giving your clients access to the full range of services offered by JustMarkets.

Frequently Asked Questions

How do I become a JustMarkets partner?

To become a partner, simply register for the Introducing Broker Program, and you’ll receive a unique referral link to share with potential clients.

What instruments do I earn commissions for?

Commissions are earned on a wide range of instruments, including gold, majors, minors, and exotics. You can earn up to $25 per lot depending on the instrument.

How often is the commission credited to my partner account?

Commissions are credited to your account daily, and withdrawals can be processed instantly through popular payment systems.

Where can I find promotional materials to attract clients?

JustMarkets provides a variety of promotional tools and materials in your Partner Area to help you attract clients and enhance your marketing efforts.

Our Insights

The Introducing Broker Program at JustMarkets is a fantastic opportunity for anyone looking to earn passive income by referring clients to a reputable global broker. With competitive commissions, fast payouts, and a variety of promotional tools, the program offers everything needed to succeed.

Whether you are an experienced marketer or new to the industry, JustMarkets provides the support and resources to help you start earning and grow your business.

Pros and Cons

| ✅ Pros | ❌ Cons |

| MAM accounts | US clients not accepted |

| Excellent Education | High Spreads |

| Low Minimum Deposit | Limited Regulation |

| High Leverage | Limited Investor Protection Schemes |

In Conclusion

JustMarkets stands out as a highly regulated broker that offers strong protection for traders’ funds and personal information. With licenses from top-tier financial authorities like CySEC, FSCA, and FSA, the broker operates under strict regulatory standards, ensuring transparency and security. The addition of negative balance protection and secure data storage adds further security for traders.

You might also like:

Faq

No, due to regional regulations, JustMarkets may not be available in certain countries. It’s best to check the platform’s availability in your country before registering.

Yes, JustMarkets is regulated by CySEC, which ensures compliance with the strict financial regulations that apply to all brokers operating within the European Union.

JustMarkets does not charge any fees for withdrawals, though fees may apply depending on the payment method you choose.

JustMarkets offers robust technical protections to prevent issues such as system failures. However, like any online platform, it’s important to ensure your personal account security is also maintained.