BDSwiss Review

BDSwiss is a reliable and secure broker offering competitive spreads and educational resources. It manages an average monthly trading volume of $84 billion and boasts a strong trust score of 74/100. The FSA, FSC, FSCA, and MISA fully regulate the broker.

🛡️Regulated and trusted by FSC, FSA, FSCA, MISA

🛡️2000 new traders chose this broker in the last 90 days.

🛡️Available for global Traders.

| 🔎 Broker | 🥇 BDSwiss |

| 📌 Year Founded | 2012 |

| 👤 Amount of Staff | Over 200 |

| 👥 Amount of Active Traders | Over 1,000,000 |

| 📍 Publicly Traded | None |

| 📈 Regulation | FSA, FSC, FSCA, MISA, SCA |

| 📉 Country of Regulation | Cyprus, Seychelles, Germany |

| 📊 Account Segregation | ✅Yes |

| 💹 Negative Balance Protection | ✅Yes |

| 💱 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | ✅Yes |

| 💴 Minor Account Currencies | 10+ |

| 💶 Minimum Deposit | $100 |

| ⏰ Average Deposit/Withdrawal Processing Time | 1-3 business days |

| 💵 Fund Withdrawal Fee | Varies by method |

| ➡️ Spreads From | 0.0 pips (for Raw account) |

| 💷 Commissions | Varies by account type |

| 💰 Number of Base Currencies Supported | 20+ |

| 🔃 Swap Fees | ✅Yes |

| 📑 Leverage | Up to 1:500 |

| ▶️ Margin Requirements | Varies by instrument and leverage |

| ☪️ Islamic Account (Swap-Free) | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏱️ Order Execution Time | 0.1 - 0.3 seconds |

| 🔖 VPS Hosting | Yes (for clients meeting criteria) |

| 1️⃣ CFDs - Total Offered | 250+ |

| 2️⃣ CFD Stock Indices | 15+ |

| 3️⃣ CFD Commodities | 10+ |

| 4️⃣ CFD Shares | 100+ |

| 💴 Deposit Options | Bank Transfer, Credit/Debit Cards, E-wallets |

| 💶 Withdrawal Options | Bank Transfer, Credit/Debit Cards, E-wallets |

| 💻 Trading Platforms | MT4, MT5, BDSwiss Mobile App, BDSwiss WebTrader |

| 🖥️ OS Compatibility | Windows, macOS, iOS, Android |

| ⚙️ Forex Trading Tools | Economic Calendar, Trading Signals |

| 🥰 Live Chat Availability | ✅Yes |

| 💌 Customer Support Email Address | [email protected] |

| ☎️ Customer Support Contact Number | +44 203 695 4343 |

| ⭐ Social Media Platforms | Facebook, Twitter, |

| 🏷️ Languages Supported on Website | 20+ |

| 📔 Forex Course | ✅Yes |

| 📚 Webinars | ✅Yes |

| 📒 Educational Resources | Articles, webinars, tutorials |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 IB Program | ✅Yes |

| 🏆 Do They Sponsor Any Notable Events or Teams | ✅Yes |

| ❤️ Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Overview

BDSwiss, founded in 2012, is a highly regarded online broker with over 1 million active traders. The broker operates under the FSA, FSC, FSCA, and MISA regulations, ensuring a safe and secure trading environment. Offering competitive spreads starting from 0.0 pips, a wide range of account types, and educational resources like courses and webinars, BDSwiss caters to both beginner and advanced traders.

With an impressive leverage of up to 1:500 and support for over 250 CFDs, BDSwiss is a strong choice for those seeking a reliable trading platform.

Frequently Asked Questions

Can I open an Islamic (swap-free) account with BDSwiss?

Yes, BDSwiss offers Islamic accounts.

What is the maximum leverage available on BDSwiss?

BDSwiss offers leverage up to 1:500.

Does BDSwiss charge a withdrawal fee?

Withdrawal fees vary depending on the method chosen.

What trading platforms does BDSwiss offer?

BDSwiss supports MT4, MT5, the BDSwiss Mobile App, and BDSwiss WebTrader.

Our Insights

BDSwiss provides robust customer support, educational tools, and flexible account options. Whether you’re interested in retail or institutional trading, their platform accommodates various needs, ensuring an efficient and secure trading environment.

Detailed Summary

| 🔎 Broker | 🥇 BDSwiss |

| 📌 Year Founded | 2012 |

| 👤 Amount of Staff | Over 200 |

| 👥 Amount of Active Traders | Over 1,000,000 |

| 📍 Publicly Traded | None |

| 📈 Regulation | FSA, FSC, FSCA, MISA, SCA |

| 📉 Country of Regulation | Cyprus, Seychelles, Germany |

| 📊 Account Segregation | ✅Yes |

| 💹 Negative Balance Protection | ✅Yes |

| 💱 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | ✅Yes |

| 💴 Minor Account Currencies | 10+ |

| 💶 Minimum Deposit | $100 |

| ⏰ Average Deposit/Withdrawal Processing Time | 1-3 business days |

| 💵 Fund Withdrawal Fee | Varies by method |

| ➡️ Spreads From | 0.0 pips (for Raw account) |

| 💷 Commissions | Varies by account type |

| 💰 Number of Base Currencies Supported | 20+ |

| 🔃 Swap Fees | ✅Yes |

| 📑 Leverage | Up to 1:500 |

| ▶️ Margin Requirements | Varies by instrument and leverage |

| ☪️ Islamic Account (Swap-Free) | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏱️ Order Execution Time | 0.1 - 0.3 seconds |

| 🔖 VPS Hosting | Yes (for clients meeting criteria) |

| 1️⃣ CFDs - Total Offered | 250+ |

| 2️⃣ CFD Stock Indices | 15+ |

| 3️⃣ CFD Commodities | 10+ |

| 4️⃣ CFD Shares | 100+ |

| 💴 Deposit Options | Bank Transfer, Credit/Debit Cards, E-wallets |

| 💶 Withdrawal Options | Bank Transfer, Credit/Debit Cards, E-wallets |

| 💻 Trading Platforms | MT4, MT5, BDSwiss Mobile App, BDSwiss WebTrader |

| 🖥️ OS Compatibility | Windows, macOS, iOS, Android |

| ⚙️ Forex Trading Tools | Economic Calendar, Trading Signals |

| 🥰 Live Chat Availability | ✅Yes |

| 💌 Customer Support Email Address | [email protected] |

| ☎️ Customer Support Contact Number | +44 203 695 4343 |

| ⭐ Social Media Platforms | Facebook, Twitter, |

| 🏷️ Languages Supported on Website | 20+ |

| 📔 Forex Course | ✅Yes |

| 📚 Webinars | ✅Yes |

| 📒 Educational Resources | Articles, webinars, tutorials |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 IB Program | ✅Yes |

| 🏆 Do They Sponsor Any Notable Events or Teams | ✅Yes |

| ❤️ Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Frequently Asked Questions

Is BDSwiss publicly traded?

No, BDSwiss is not publicly traded.

Where is BDSwiss regulated?

BDSwiss is regulated in Cyprus, Seychelles, Germany, and other regions by authorities such as the FSA, FSC, FSCA, MISA, and SCA.

What is the minimum deposit required to open an account with BDSwiss?

The minimum deposit is $100.

Does BDSwiss offer negative balance protection?

Yes, BDSwiss provides negative balance protection.

Our Insights

BDSwiss is a reliable broker for both beginners and advanced traders. With over 250 CFDs and competitive spreads starting from 0.0 pips, it offers a comprehensive trading experience. The broker is well-regulated and provides a wealth of educational resources to support traders’ growth.

Safety and Security

BDSwiss, a leading financial institution since 2012, has grown to serve over 1.7 million clients globally with a monthly trading volume exceeding $84 billion. The broker is regulated in multiple jurisdictions, including Seychelles (FSA), Mauritius (FSC), the UAE (SCA), and other regions. Furthermore, BDSwiss ensures a safe and transparent trading environment with client fund protection, segregation of accounts, and high-level regulatory oversight.

Frequently Asked Questions

Is BDSwiss regulated?

Yes, BDSwiss is regulated by the FSA (Seychelles), FSC (Mauritius), MISA, and SCA (UAE).

How does BDSwiss protect client funds?

BDSwiss uses account segregation to ensure client funds are kept separate from the company’s operating funds, providing an added layer of protection.

What security measures are in place for online trading?

BDSwiss employs industry-standard encryption and security protocols to safeguard client data and transactions.

Can BDSwiss be trusted with my personal information?

Yes, BDSwiss adheres to strict data protection standards and complies with regulatory requirements to ensure your personal information remains secure.

Our Insights

BDSwiss provides a highly secure trading environment, with strong regulatory oversight from respected authorities like the FSA, FSC, MISA, and SCA. The broker’s commitment to account segregation and data protection ensures that client funds and information are handled with the utmost care. Traders can feel confident in BDSwiss’ transparent and secure operations.

Partnership Options

BDSwiss offers a highly competitive Partnership Program that has attracted over 20,000 affiliates and introducing brokers (IBs) worldwide. With a global reach in over 180 countries, the program features flexible commission structures, free marketing materials, personalized support, and high conversion rates.

In addition, Partners can benefit from competitive remuneration, cutting-edge tools, and opportunities for significant payouts, with up to $2.7 million in partner payouts monthly.

Frequently Asked Questions

What types of partnerships does BDSwiss offer?

BDSwiss offers Affiliate and Introducing Broker (IB) partnership programs, each with competitive commission structures.

Are there any setup fees to join the BDSwiss Partnership Program?

No, there are no setup fees required to join the BDSwiss Partnership Program.

What support does BDSwiss provide to its partners?

BDSwiss provides personalized support, free marketing materials, educational content, and advanced reporting tools to help partners succeed.

How much can I earn as a partner?

Partners can earn competitive commissions with customizable plans, benefiting from an average conversion rate of 36% and monthly payouts totaling $2.7 million.

Our Insights

BDSwiss offers a robust and lucrative partnership program with excellent earning potential. With a wide range of tools, educational resources, and flexible commission structures, partners are set up for success. Moreover, the broker’s global presence and high conversion rates make it a compelling choice for anyone looking to monetize their influence or network in the financial industry.

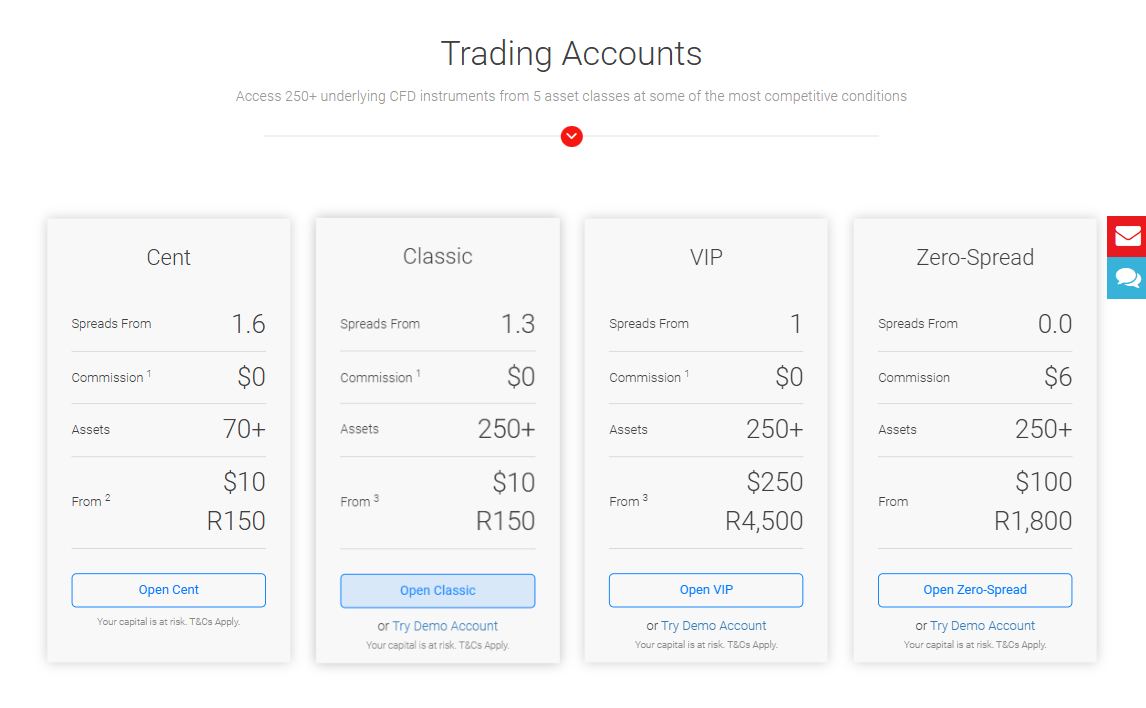

Minimum Deposit and Account Types

BDSwiss offers a variety of account types to suit different trading preferences and experience levels. The Cent, Classic, VIP, and Zero-Spread accounts all provide access to 250+ CFDs across various asset classes. Account minimum deposit requirements range from $10 for the Cent account to $250 for the VIP account.

Furthermmore, traders can enjoy flexible leverage options, from 1:400 to 1:2000, depending on the account type, along with dynamic leverage that adjusts based on position size.

Frequently Asked Questions

What is the minimum deposit for each account type at BDSwiss?

The Cent account requires a minimum deposit of $10, the Classic account $10, the VIP account $250, and the Zero-Spread account $100.

What is dynamic leverage, and how does it work?

Dynamic leverage adjusts automatically based on the size of your open positions, offering more flexibility in risk management.

Which account type is best for beginners?

The Cent account is ideal for beginners, as it has a low minimum deposit and provides access to a variety of assets with competitive spreads.

Are there any specific benefits to the VIP account?

The VIP account provides additional benefits such as a personal account manager, VIP access to trading tools, and priority support, with a minimum deposit of $250.

Our Insights

BDSwiss offers a range of account types tailored to traders with different needs, from beginners to more experienced traders. With low minimum deposit requirements and dynamic leverage, traders can easily find an account type that suits their trading style. The VIP account adds extra perks for those seeking more personalized service and advanced trading tools.

Trading Platforms and Tools

BDSwiss offers a variety of advanced trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary WebTrader and Mobile App. These platforms are designed to cater to both beginners and experienced traders, providing sophisticated tools, real-time market quotes, and automated trading options. MT5, for example, supports over 80 technical indicators, while BDSwiss WebTrader features exclusive trend analysis tools.

In addition, the mobile app allows trading on the go, with real-time quotes, interactive charts, and 24/7 access to cryptocurrency pairs.

Frequently Asked Questions

What platforms does BDSwiss offer for trading?

BDSwiss offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, and a Mobile App for both iOS and Android.

What are the key features of the MT5 platform?

MT5 offers over 80 technical indicators, automated trading with Expert Advisors, multi-language support, and the ability to overlay analytical studies.

Can I trade on BDSwiss using a mobile app?

Yes, the BDSwiss Mobile App allows you to trade CFDs, monitor market activity, and manage deposits and withdrawals while on the go.

What is the BDSwiss WebTrader, and how is it different from other platforms?

BDSwiss WebTrader is an in-house developed platform that works directly in browsers, providing easy access to trading without the need for downloads. It includes exclusive tools like Trend Analysis and integrates seamlessly with MT4.

Our Insights

BDSwiss provides a comprehensive suite of platforms and tools suitable for traders of all levels. The advanced features on MT5 and WebTrader, along with the flexible mobile app, ensure that traders can access the market from anywhere and use powerful tools to enhance their strategies. Whether you’re trading on desktop or mobile, BDSwiss delivers an intuitive, feature-rich trading environment.

Markets Available for Trade

BDSwiss offers access to over 250 CFD instruments across five major asset classes: Forex, Stocks, Indices, Commodities, and Cryptocurrencies. Traders can access these markets via a range of platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), BDSwiss WebTrader, and the Mobile App.

Moreover, with highly competitive spreads and dynamic leverage options, BDSwiss provides a diverse and flexible trading environment for investors interested in both traditional and emerging financial markets.

Frequently Asked Questions

What types of markets can I trade on BDSwiss?

BDSwiss offers CFDs on Forex, Stocks, Indices, Commodities, and Cryptocurrencies, providing a diverse range of trading opportunities.

How many instruments are available for trade on BDSwiss?

BDSwiss offers over 250 CFD instruments across the five asset classes mentioned above.

Can I trade cryptocurrency pairs on BDSwiss?

Yes, BDSwiss offers 24/7 trading on a wide variety of cryptocurrency pairs, including popular assets like Bitcoin, Ethereum, and Litecoin.

What are the trading conditions for these markets?

BDSwiss offers competitive spreads starting from 0.0 pips (for Zero-Spread accounts) and provides dynamic leverage, allowing flexibility in trading across various asset classes.

Our Insights

BDSwiss provides an extensive selection of markets for traders, from major Forex pairs to a wide range of commodities and cryptocurrencies. The variety of available instruments, coupled with competitive spreads and leverage options, makes it an appealing choice for traders looking to diversify their portfolios across global markets.

Whether you’re focused on traditional assets or new-age cryptocurrencies, BDSwiss has you covered.

Fees, Spreads, and Commissions

BDSwiss offers competitive spreads starting from 1.6 pips for the Cent account and as low as 0.0 pips for the Zero-Spread account. There are no commissions on forex, crypto, and commodity pairs across all account types. However, for other CFDs, such as indices and shares, commissions vary based on the account type, with commissions starting at $2 for indices and 0.15% for shares. In addition, BDSwiss also provides zero fees on deposits and credit card withdrawals.

Frequently Asked Questions

What are the spreads on BDSwiss accounts?

Spreads range from 1.6 pips on the Cent account to 0.0 pips on the Zero-Spread account.

Does BDSwiss charge commissions on all instruments?

No, BDSwiss does not charge commissions on forex, crypto, and commodity pairs, but fixed commissions apply to indices and shares.

Are there any fees on deposits and withdrawals?

There are no fees on deposits or credit card withdrawals up to $2,000, ensuring a cost-effective experience for traders.

How do the commissions vary across different account types?

The Cent, Classic, and VIP accounts charge no commissions on forex pairs, but the Zero-Spread account charges a $6 commission on all pairs and commodities, along with commissions on indices and shares.

Our Insights

BDSwiss provides competitive spreads and transparent fee structures across its account types. While forex, crypto, and commodity traders benefit from no commission fees, traders focusing on indices and shares may incur commissions. Overall, BDSwiss offers attractive trading conditions, especially for those seeking tight spreads and no deposit/withdrawal fees.

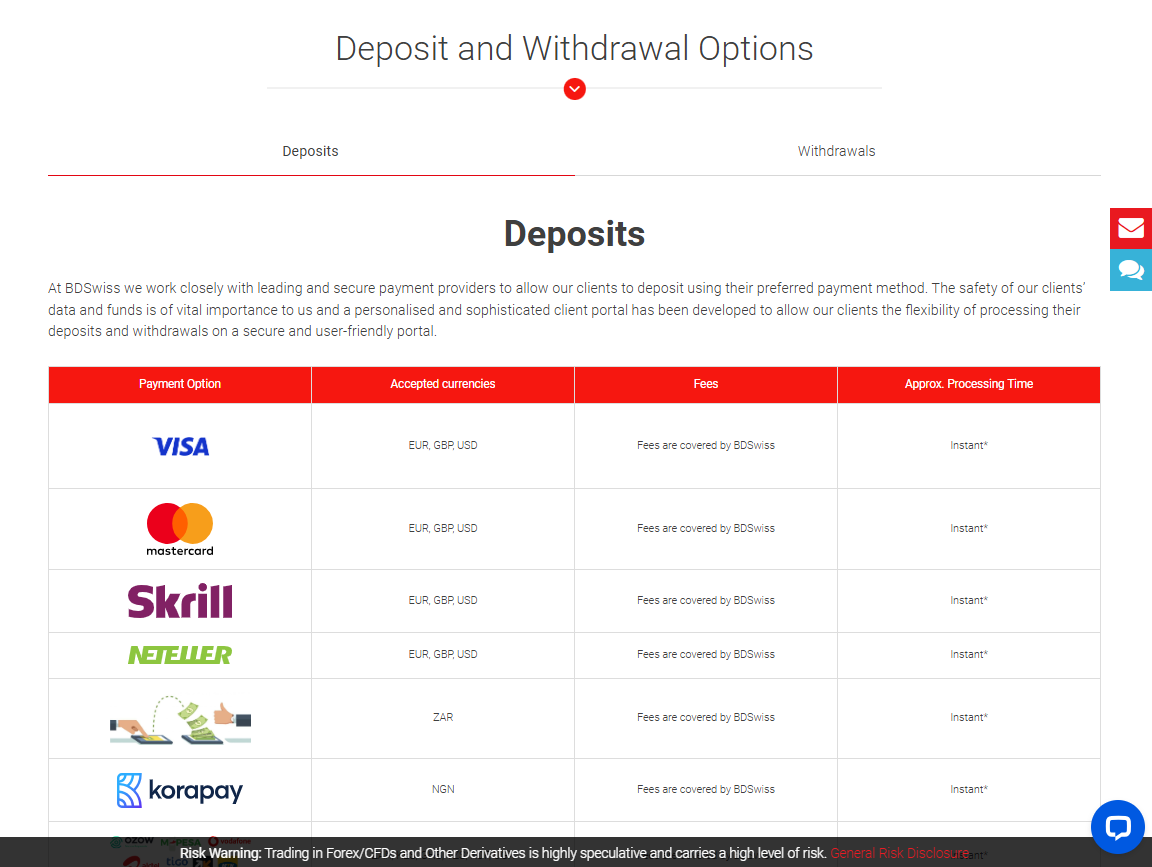

Deposit and Withdrawal

BDSwiss offers a wide range of secure deposit and withdrawal options for clients, including popular payment methods such as Visa, Mastercard, Skrill, Neteller, and various local payment systems like MPESA and PayPal. Deposits are processed instantly for most methods, while withdrawals are typically processed within 24 hours.

In addition, BDSwiss covers all receiving costs, and clients are advised to use the same method for withdrawals as for deposits. To ensure security and compliance, withdrawals are subject to full account verification.

Frequently Asked Questions

What deposit methods are available at BDSwiss?

BDSwiss supports various deposit options including Visa, Mastercard, Skrill, Neteller, PayPal, and cryptocurrencies like Bitcoin, Ethereum, and others. Local payment systems such as MPESA and GCash are also available.

Are there any fees for depositing or withdrawing funds?

BDSwiss covers all deposit and receiving costs for most payment methods. However, there may be additional exchange or banking fees imposed by your payment provider.

How long do withdrawals take?

Most withdrawals are processed within 24 hours. The time it takes for the funds to reach your account depends on the withdrawal method and your bank’s processing time.

Can I withdraw funds using a different payment method than the one I used for depositing?

Generally, withdrawals must be processed using the same method as the original deposit for security reasons. However, some exceptions may apply depending on the method used.

Our Insights

BDSwiss offers a highly flexible and secure range of payment methods for both deposits and withdrawals, with most transactions processed instantly. The platform’s commitment to covering receiving costs and ensuring fast processing times enhances the overall user experience.

Additionally, BDSwiss’s stringent KYC requirements provide added security for clients. Whether you’re a new or experienced trader, the ease and speed of BDSwiss’s payment options are a definite advantage.

Customer Reviews

🥇 Great Trading Experience.

I’ve been trading with BDSwiss for over a year, and I couldn’t be happier. The platform is easy to use, and the educational resources helped me improve my skills. The spreads are competitive, and the customer support is top-notch! – Alex

🥈 Reliable Broker with Excellent Support.

BDSwiss is a fantastic broker! I appreciate their fast execution times and the wide variety of trading instruments. The customer service is always quick to respond, and I love the range of educational tools available to help me stay informed. – Angela

🥉 Solid Choice for Traders.

I switched to BDSwiss after trying a few other brokers, and I’m glad I did. The leverage options are great, and the platform is stable. The demo account was a perfect way to get started, and now I feel confident in my trading. – Mark

Pros and Cons

| ✅ Pros | ❌ Cons |

| Regulated by multiple authorities | Withdrawal fees may apply |

| Competitive spreads from 0.0 pips | Limited public trading information |

| Leverage up to 1:500 | Not publicly traded |

| Over 250 CFDs available | Swap fees for certain accounts |

References:

In Conclusion

BDSwiss stands out as a trusted and secure broker in the forex and CFD markets. With a wide range of account types, impressive leverage options, and a solid regulatory framework, it offers an excellent platform for traders worldwide. The broker’s dedication to customer support and educational resources makes it an ideal choice for both newcomers and seasoned traders.

Faq

Yes, BDSwiss offers both an affiliate and an IB program.

Bank transfers, Credit/Debit Cards, and E-wallets are available.

Yes, BDSwiss offers articles, webinars, and trading tutorials.

Deposits and withdrawals typically take 1-3 business days.

Yes, BDSwiss offers a demo account.

BDSwiss is actually a very unreliable broker when it comes to withdrawals you won’t get your money back!

Thank you for your review!