The USD/JPY is severely influenced by factors that affect the value of the US dollar and the Japanese yen. The interest rate differential between the Federal Reserve (FED) and the Bank of Japan (BOJ) affect the value of these currencies, compared to one another. For example, when the Federal Reserve makes any decision in open market activities, in order to strengthen the US dollar, the value of the USD/JPY currency pair could increase, due to the strengthening of the US dollar, compared with the Japanese yen. Overall, 2020 has predominantly driven choppy sessions, as the overall trading range has been 112.250 to 101.155. Take a look at the recent price changes in the USD/JPY currency pair.

Current USD/JPY Price: $

Recent Changes in the USD/JPY Price

| Period | Change (JPY) | Change % |

| 30 Days | -2.071 | -1.87% |

| 6 Months | -2.65 | -2.51% |

| 1 Year | -2.878 | -2.87% |

The USD/JPY prices consolidated within a sideways trading range, with a yearly high to low change of 9%, as traders seemed confused as to whether to buy USD or JPY, amid safe haven concerns, especially due to the COVID-19 pandemic. Let’s take a look at the USD/JPY price forecast for Q4 of 2020 and upcoming years.

| USD/JPY Forecast: Q4 2020 | USD/JPY Forecast: 1 Year | USD/JPY Forecast: 3 Years |

| Price: 100.171 Price drivers: Second wave of COVID-19, Increased safe haven appeal, Double top resistance, Fed’s dovish monetary policy, BOJ’s unchanged monetary policy. | Price: 108.535 – 110 Price drivers: COVID-19 recovery, Double top resistance, Bearish retracement in overbought USD/JPY. | Price: 94.50 Price drivers: Descending triangle breakout, Weaker US dollar, Bearish retracement in overbought USD/JPY. |

Common Factors That Impact USD/JPY Prices

As we know, the Japanese yen is a safe-haven currency, which means that investors seek refuge in the Japanese yen during times of market turmoil. On the flip side, the yen tends to weaken when the global economy stands strong and stock markets move higher. Before the recession years, this was evident where the Japanese yen slowly lost its value against the US dollar, as the global economy improved. There are a few common factors that impact the price determination of the USD/JPY pair. Let’s explore them one by one, to determine the USD/JPY price forecast.

Safe-Haven Demand – Investors Rushed to Safer Assets

As we have already mentioned, the Japanese yen is a safe-haven currency, therefore, traders prefer to invest their money in safe-haven assets instead of putting it in riskier assets. This year, the reason for the high safe-haven demand in the market could be associated with the coronavirus crisis. The coronavirus outbreak, which first raised its ugly head in China, has infected people in 188 countries and left a significant negative impact on the global economies in its wake, increasing the safe-haven demand in the market and underpinning the Japanese yen, which in turn has caused the USD/JPY pair’s bearish bias. The number of cases of COVID-19 around the world is closing in on 14.5 million, and more than 600,000 people have died so far, according to data released by Johns Hopkins University.

As a result, investors turned to safe-haven assets, like the Japanese yen, which negatively impacted the USD/JPY currency pair. This virus was also responsible for the “Stock Market Crash.” It is worth noting that the 2020 stock market crash, which started on

February 20, 2020, was global. On February 12, the Dow Jones Industrial Average, the NASDAQ Composite and the S&P 500 Index all finished at record highs (while the NASDAQ and S&P 500 reached subsequent record highs on February 19). From February 24 to 28, stock markets worldwide reported their largest one-week declines since the financial crisis of 2008. On March 9, most global markets reported severe declines. Eventually, investors rushed to park their investments in safer assets, such as the JPY and gold. As a result, trading in the USD/JPY has been slightly bearish throughout the year.

Geopolitical Tensions – Trade War Between China and the US

The reason for the high degree of uncertainty in the market can also be attributed to the long-lasting geopolitical tensions between the US and the rest of the global economies, like the European Union (EU), the UK and China. Any activity that intensifies the US-China trade war tends to boost the strength of the safe-haven Japanese yen. However, China and the US have fired fresh sanctions at one-another in the ongoing tussle, and this has strengthened the safe-haven Japanese yen, by weakening the equity market.

Japan and the US Macroeconomic Data

Another driver of USD/JPY prices could be associated with US economic data. The bullish trend in the Japanese yen is also bolstered by downbeat global economic data. Economic events, such as job reports, wage data, manufacturing data and retail sales, and broader-based data such as GDP growth, influence the Federal Reserve’s monetary policy decisions, which directly affect the market risk tone, and tend to provide support to the safe-haven assets.

As a result of the damage that has resulted from the COVID-19 pandemic, the weaker growth on the job market, rising unemployment figures, weak manufacturing data, decreased retail sales and weakened GDP growth, have all increased the safe-haven demand in the market, which tends to underpin the yen and push the currency pair toward the bearish track.

As a result, the abovementioned weaker growth in terms of jobs, rising unemployment, weak manufacturing data, decreased retail sales and weakened GDP growth combine to create a dovish Fed scenario on interest rates, pushing the USD/JPY prices lower. In April, prices for the precious metal, gold, surged over 1,600 pips, to place a high at around 1,746, in the wake of worse-than-expected US jobless claims, and even before that, the negatively correlated USD/JPY currency pair fell to 101.180, amid increased safe haven demand. In April, the number of Americans who applied for unemployment benefits rose by a record 6.6 million, bringing the latest jobless cases to 10 million, as the all-out struggle to reduce the spread of the coronavirus banged the economy. The USD/JPY prices thus slipped by over 5.7% in March, shortly after the economic downturn began.

US Dollar and FED Monetary policy (Negative Rate Cuts)

Although global investors do manage to run with the US dollar through periods of uncertainty, this type of movement was muted over the previous year, despite the trade war with China. They preferred to go with the USD/JPY. This year, the most significant impact on USD/JPY prices has been driven by the US monetary policy, which is controlled by the Federal Reserve. Interest rates impact significantly on bullion prices, due to the factor known as “opportunity cost.”

Opportunity cost is the idea of giving up a near-guaranteed gain in one investment to achieve a greater gain in another. According to the historical outlook, a strong positive correlation exists between US interest rates and USD/JPY prices. However, slight dips in the USD/JPY prices can be attributed to the low interest rates from all central banks across the world, especially the US Federal Reserve, which was driven down in order to curb the economic slowdown triggered by the lockdowns that were induced by the coronavirus pandemic.

The US Federal Reserve cut their interest rates from 1.75% to 1.25% in March, which drove sharp selling in the US dollar and triggered a bullish bias for the safe haven pair USD/JPY. Later, considering the massive outbreak of COVID-19, the Federal Reserve decided to cut the rate even further on March 16, from 1.25% to 0.25%, which has made the USD/JPY even more bearish this year. On the other hand, the Bank of Japan kept the interest rates unchanged, as they were already in negative territory.

USD/JPY Price Prediction for the Next 5 Years

Most traders mainly drive their predictions on the basis of one point. “Interest rates will rise, so the USD/JPY will gain support.” Well, there are few other factors that I think will impact the price of the USD/JPY this year:

1: The Japanese Yen will rally in a new weak dollar trend, and that’s the last thing Japan needs.

3: The Japanese Yen is still a safe haven.

4: The Japanese economy is somewhat resilient to external shocks, underpinning the JPY.

5: The BOJ is defenseless to stop a growing Japanese Yen.

6: Japan’s Government Pension Investment Fund stops its overseas investments.

7: The period of overactive BOJ intervention is over.

8: Capital managers purchase JGBs on an unhedged basis.

9: The CHF is also no longer an EU-specific safe haven strategy.

10: A sharp contraction in China, the greatest macro risk in the region.

Considering all these factors, the price of the USD/JPY could extend a bearish bias, to hit triple bottom support levels of 101.160 during the next 6 to 9 months.

Tug of War Between the US Dollar and the Japanese Yen

Despite these all supporting factors for the safe-haven Japanese yen, the currency pair has not dropped significantly during this uncertain period, as the broad-based US dollar has been taking safe-haven bids since the pandemic started. Thus, the broad-based US dollar long-lasting strength played a role as the major key factor that was capping any further downside in the USD/JPY currency pair. The long-lasting geopolitical tensions between the US and the rest of the global economies like the European Union (E.U.), the U.K., and China were also supporting the US dollar as a safe-haven asset.

Factors that drove Bearish Impact on US Dollar

1: Speculation on lower rates to undermine the US dollar

2: Federal Reserve expectations to doing more implies further US dollar weakness

3: Extra jobless benefits set to disappear

4: US Dollar to trade inversely to the number of new Covid-19 cases

5: Iran and China on the verge of a huge deal

6: Federal Budget deficit prints new record amount

7: Fed officials are increasingly doubtful about the sustainability of the US economic recovery which undermines the dollar

8: Fed-fueled debt crisis to worsen

9: Spike in US Covid-19 cases in contrast to Europe and China situation

10: Stimulus funds have been distributed without monitoring.

Technical Analysis – Can We Expect a Bearish Correction in USD/JPY?

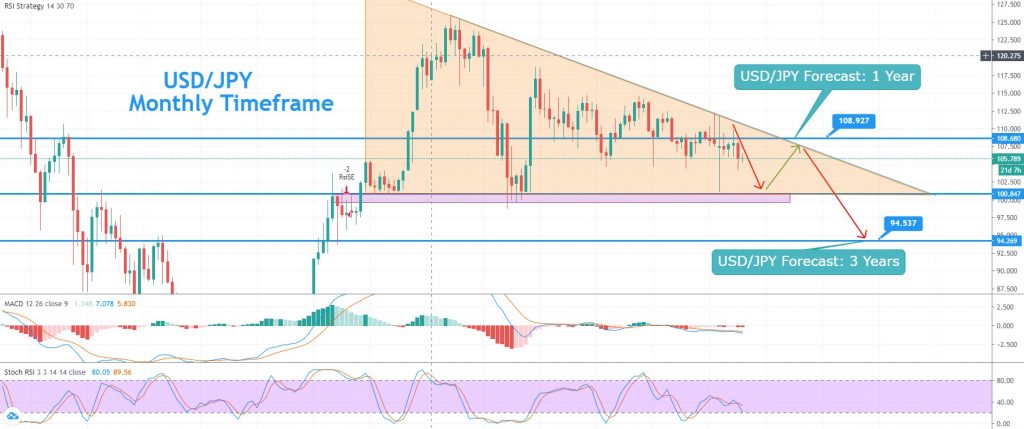

At the moment, the safe haven currency pair, USD/JPY, is trading at the 105.750 level, and the technical outlook for the pair suggests odds of a continuation of the selling trend, until the triple bottom support level of 101.162. In the monthly time frame, the USD/JPY pair has formed a descending triangle pattern, which is providing solid resistance at the 108.900, level and the recent bearish engulfing candles support a selling bias. Besides this, the leading indicators, such as MACD and RSI, are holding below 0 and 50 respectively, which demonstrates the bearish bias in the USD/JPY.

USD/JPY Descending Triangle Pattern, RSI, MACD and 50 EMA – all Suggest Selling

With regard to the yearly forecast, I’m not expecting any massive price action in the USD/JPY, especially considering the safe haven status of both currencies. However, the USD/JPY could bounce off, after testing the triple bottom support level of 101.160. Above the 101.160 trading level, the USD/JPY pair could soar until the 108.900 trading level, according to a yearly USD/JPY price forecast.

USD/JPY Yearly Forecast – Descending Triangle Pattern

USD/JPY 3 Year Forecast – Descending Triangle Pattern Breakout

We can expect USD/JPY prices to drop lower, after testing the resistance level of 108.920. The triangle patterns should break out on the lower side, therefore, the violation of the 100.850 support level could extend selling until the 94.500 level in coming years. The fluctuations in the USD/JPY currency pair have been insignificant since the beginning of 2020. The reason for this could be associated with the common supporting factor for both currencies, such as a safe-haven investment or aid packages from both central banks. Let me remind you: the broad-based US dollar was playing the role of a safe-haven asset, and became the key factor that helped to limit deeper losses for the currency pair, which were supported by the stronger safe-haven Japanese yen. Thus, we might see a continuation of the choppy sessions during the coming months and years.

Good luck!