The NZD/USD was on a steady bullish trend during the 2000s, apart from the crash during the 2008 global financial crisis, which sent everything tumbling lower, while safe havens, including the USD, surged higher. Compared to most commodities and risk currencies, the bullish momentum continued longer in this pair, extending until 2014, when the big reversal finally came, and the NZD/USD has been bearish since then. The technical indicators have been helping sellers during this decline, with the 50 monthly SMA providing resistance on pullbacks. Now, we have reached a decisive moment for this pair, as the price is trading just below the moving average that rejected the buyers at the first attempt. The strong decline in the USD of the last few months has also stalled, so buyers should pay attention now. If I was long on the NZD/USD from lower, with a long-term forex trade, I would lose most of my position, since the main trend is still bearish, and the pullback has run its course. In fact, we are looking at opening a long-term sell forex signal from here, since fundamentals don’t look too promising for this forex pair either.

Current NZD/USD Price: $

Recent Changes in the Ripple Price

| Period | Change ($) | Change % |

| 30 Days | +0.008 | +0.1% |

| 6 Months | +0.041 | +0.6% |

| 1 Year | +0.023 | +3.4% |

| 5 Years | +0.032 | +4.8% |

| Since 2000 | +0.41 | +61.7% |

The New Zealand Dollar (NZD) is prone to the shift in the risk sentiment in the financial markets. The Kiwi is a commodity currency, together with the CAD and the AUD, and commodities are heavily affected by the market sentiment, which makes them positively correlated to the sentiment, as well as to the commodity prices and the demand. The main commodities have been on a bearish trend for more than a decade, pulling the commodity Dollars down with them. The NZD/USD has been on a bearish trend since 2014, after it failed to push above the double top on the monthly chart, at 0.8850. The biggest decline came during 2014-15, when this pair lost almost 25 cents. The trade war between the US and China is also keeping the sentiment bearish for the NZD, since China is a major trade partner of New Zealand, and Q1 of this year was also pretty bearish. However, the sentiment has changed positively for this pair, as it began turning negative for the USD, and the [[NZD/USD]] has been bullish since March, although it might not last much longer, as we mentioned above. But, China, which is a major trading partner of Australia and New Zealand, has recuperated from the coronavirus lockdowns, so there is still some hope for buyers, although chances for a further continuation above the 50 SMA are slim, and gains will be very limited.

| NZD/USD Forecast: Q4 2020 | NZD/USD Forecast: 1 Year | NZD/USD Forecast: 3 Years |

| Price: $ 62 – $ 63 Price Drivers: Global Risk Sentiment, COVID-19 Measures in New Zealand, Technicals | Price: $ 63 – $ 65 Price Drivers: Market Sentiment, Post-US Elections, Global Economic Recovery, USD Correlation | Price: $ 55 – $ 60 Price Drivers: Fundamentals in New Zealand, Global Economy, Global Politics |

NZD/USD Live Chart

The New Zealand Dollar Price Prediction for the Next 5 Years

Here, we will see how the New Zealand Dollar has been performing during the last few decades and try to predict the future price action for the NZD/USD. The USD side of the coin is also important when analyzing this pair, and the sentiment surrounding the USD has been quite negative since March, but it is turning around now, as forex rates show, so from here on, fundamentals point up for the Buck, while for New Zealand, the fundamental situation is still blurry for now. The coronavirus situation has turned out to be positive for risk currencies and other assets in general, with central banks and governments throwing trillions into the global economy. But, the situation is shifting now, as the global economic rebound slows, and this is turning the risk sentiment negative in financial markets. So, the larger bearish trend is still on, and it will probably resume again, once the retrace higher is complete.

The Bullish Momentum From COVID-19 Seems to be Over for the NZD/USD

Risk assets, like commodities and stock markets, took a plunge during February and March, as the coronavirus broke out in Europe. The NZD followed stocks down, with the NZD/USD declining around 12 cents, as it is both a risk asset and a commodity currency. But, the crash stopped in March and risk assets turned bullish. This should have been a bearish period for stock markets and commodity currencies, but the governments and central banks around the globe threw what they had at the markets, and they borrowed billions to keep the economy afloat at first, and then to get it going again. Risk currencies benefited from this and they have been bullish since March, rather than bearish. Another major factor for this bullish momentum in the NZD/USD and most major currencies, has been the fact that the USD has been on a steady and rather rapid decline. The economic recovery from the coronavirus in China since March, has also helped the sentiment in financial markets, and particularly for the AUD and the NZD, as these countries are major exporters to China, as we will explain in the section below. But, all this is coming to an end. Parts of Australia are still under lockdown rules and Auckland in New Zealand also went into a 12-day lockdown in August, which is hurting the sentiment for these currencies. It seems like these two countries were late to join the game and they are getting out of it late too, which should increase the pressure for the AUD and the NZD, as we have seen in recent days. The climb has already stalled, and we have seen a pullback in the NZD/USD in September, which we will take a closer look in the technical analysis section. So, the strange bullish trend during these times of uncertainty due to the coronavirus seems to be coming to an end for this pair.

Fundamentals and RBNZ Policy

New Zealand is also a major exporter of raw materials, just like Australia. The main exports from New Zealand include fish and seafood, meat, dairy products, wood, commodities, wine, fruit, machinery etc. The demand for food is increasing constantly, as the world population grows, but the price of certain exports has been declining for some time, since 2011-12, as is the case with precious metals and certain commodities, and dairy product exports have been declining since 2013. But in recent years, the global dairy trade GDT Price Index has been trading within a range.

Source: Global Daily Trade

During the first months of the coronavirus crisis, the New Zealand economy responded well, despite the rest of the globe plunging into one of the deepest recessions ever. The pandemic was kept largely out of New Zealand, with low numbers compared to other countries, and the coronavirus measures were mild in Q2, so the economy didn’t go through as deep a contraction as was the case in other countries. Fundamentals in New Zealand have been much better than in the rest of the world since March. Employment declined by 0.4% in Q2 which is not much in such a scenario, while the unemployment rate increased to just 4.2%, which is great compared to the 12% -13% that we have seen in other countries. But, as the rest of the globe reopened, New Zealand and Australia tightened the restrictions, which is not helping the economy. Although, one positive factor is the fact that China has left the coronavirus slump behind, and is back to normal, even opening football stadiums in Wuhan again. However, the business confidence remains really low, with the New Zealand ANZ Business Confidence at -42 points in August and -26 points in September. Even after the confidence has turned positive, it will take time for the economy to get back to normal, as is evident in Europe.

NZD/USD Correlation

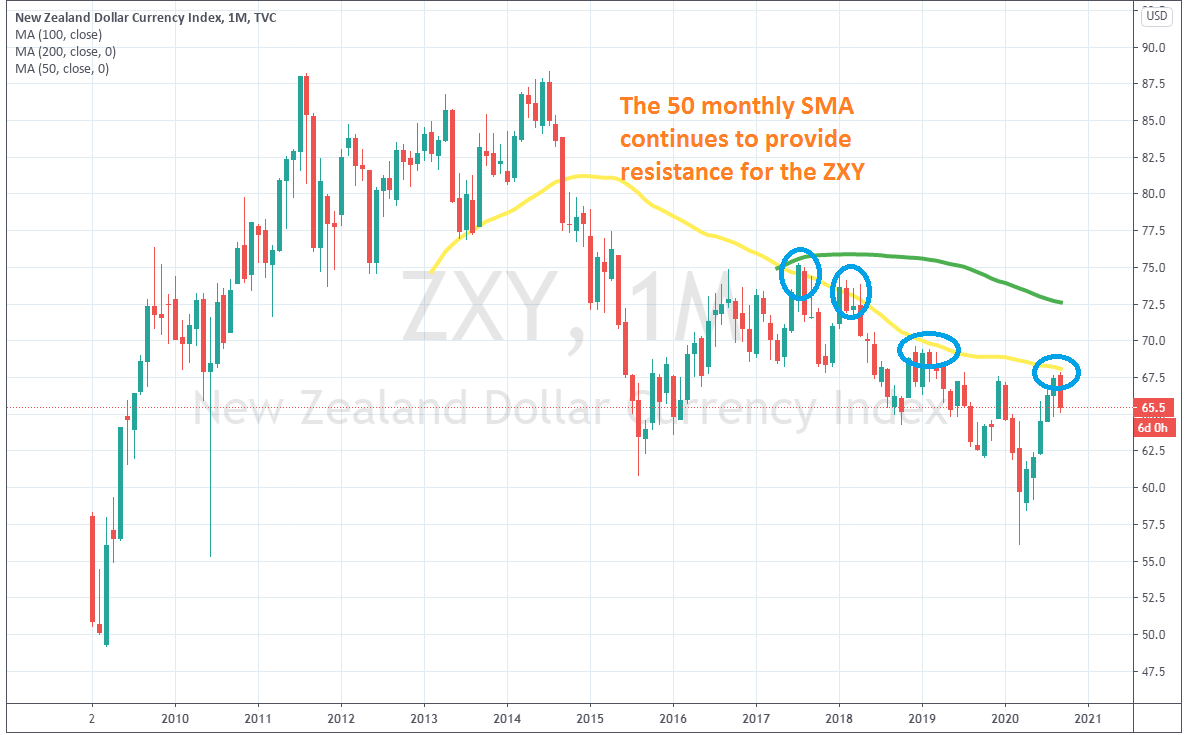

To see which of the two currencies is more correlated to the overall price in the NZD/USD, we must compare the NZD index ZXY and the USD index DXY. The USD index is negatively correlated, since the USD is quoted second in this currency pair, but even so, the correlation is not as strong as it is between the ZXY and the NZD/USD. The index from Tradingview doesn’t go too far back, but even from 2009, we can see that the correlation is stronger for this pair, than it is for the USD index. The 50 SMA (yellow) provided support for the ZXY and the NZD/USD once in 2013, and after it was broken, this moving average turned into resistance. The 50 SMA was pierced a couple of times in 2017-18, but then the price continued lower. After the crash in Q1 of this year, we have seen a reversal in both, but buyers have stalled right below the 50 SMA once again. For the DXY, the 50 SMA hasn’t been of much significance, while the 100 SMA is taking its place, so the correlation is not as strong with the NZD/USD as it is with the ZXY.

The 50 SMA is keeping the trend bearish for the NZD index

The USD index is bouncing off the 100 SMA

Technical Analysis – Is the Recent Surge for the NZD/USD Ending at the 50 SMA?

NZD/USD has remained on a bearish trend since 2014

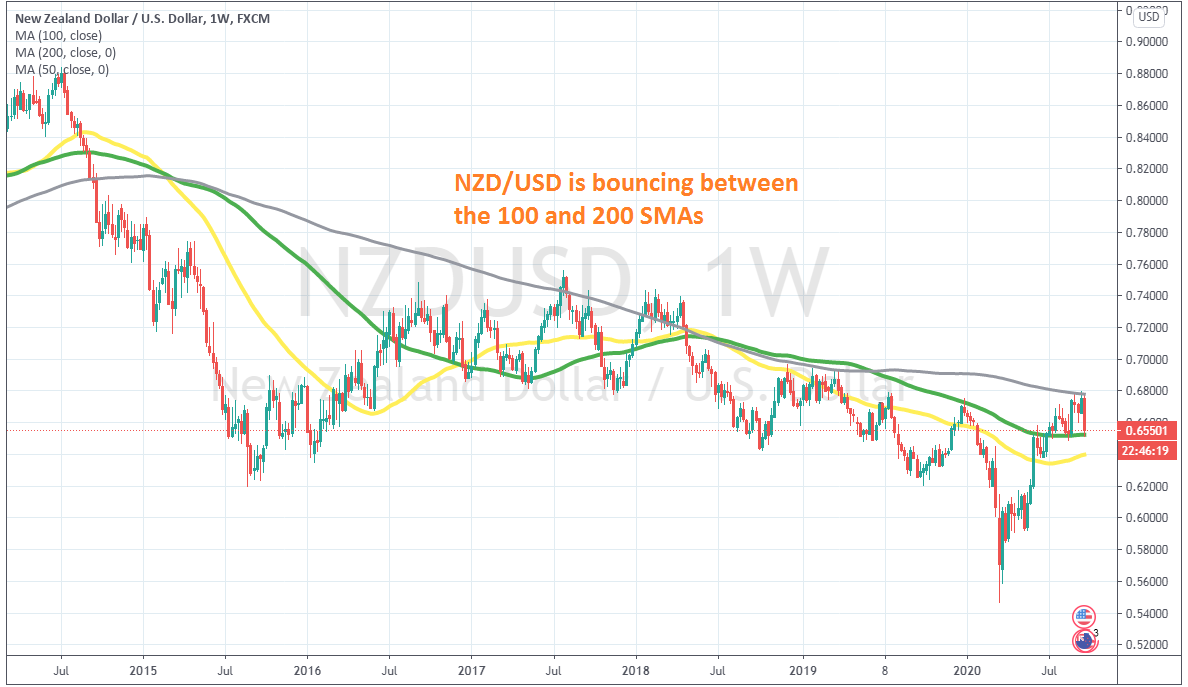

The NZD/USD chart looks pretty similar to the [[AUD/USD]] monthly chart, except that the price in AUD/USD is trading above the 50 SMA (yellow). The AUD/USD tumbled more than the NZD/USD during the coronavirus crash in February and March, but it has made a stronger climb, since reversing higher by the middle of March. The Kiwi on the other hand, hasn’t been able to push above the 50 SMA on the monthly chart. On September 1, this pair kissed the 50 SMA, which stands just below 0.68, but the moving average rejected the price downwards, where it has stayed since then. So, the NZD seems a tad weaker than the Aussie. Although, looking back at the history, we see that volatility is not a stranger to this pair. During the late 1990s, the NZD/USD was on a bearish trend, with the 20 monthly SMA (gray) providing resistance, but then the trend shifted in the 2000s, and moving averages turned from resistance into support, with the same MA holding the line during a pullback in 2004. The 50 SMA (yellow) took its place, as the trend slowed, with the 100 SMA (green) also reversing the price higher once, in 2010. We saw a deep pullback after the 2008 crisis, but the bullish momentum resumed again, and this pair formed a double top at 0.8850. After the second attempt to push above that level, the [[NZD/USD]] reversed back down in 2014, with the 50 SMA and the 100 SMA turning into resistance eventually. They have been keeping the price down, and buyers are once again failing to push above the 50 SMA now. The area around 0.68, where this MA stands, has been both support and resistance before, so it is adding strength to the 50 SMA. Besides that, the pullback is complete now, which points to this pair resuming the larger bearish trend.

The price is stuck between the 100 SMA and the resistance on the weekly chart

If we switch to the weekly time-frame chart, we see that the 100 SMA (green) has been the ultimate support and resistance here. It provided support during 2016-17, when the price moved above this level, then it turned into resistance until June this year. But buyers managed to push above the 100 SMA on this chart and it seems to have turned into support again. But, the resistance at 0.68 still remains, and a bearish reversing pattern is developing on the weekly chart, after the doji candlestick last week, below the resistance, and the bearish candlestick this week. We should see a reversal down now, but the 100 SMA will be the decisive indicator. If it gets broken, the larger bearish trend will be back on.