GBP/USD – Forecast Summary

| GBP/USD Forecast: H2 2021 Price: $1.3100 – $1.4300 Price drivers: Downward Trendline Breakout, Bullish Engulfing Candles, MACD & RSI Crossover | GBP/USD Forecast: 1 Year Price: $1.4300 – $1.4710 Price drivers: Weaker Dollar Amid COVID-19-Based Stimulus, Descending Triangle Breakout, 50 EMA Crossover | GBP/USD Forecast: 3 Years Price: $1.3500 – $1.4300 Price drivers: Sluggish UK Economic Growth, Bearish Correction, Trendline Resistance, Overbought Indication |

Lately, there have been some solid bullish movements in the British Pound (GBP), which saw the GBP/USD pair soar from the 1.2800 area, to trade at 1.3900, with a growth spurt of 6.64% in the past six months. The Sterling has been trending higher against the US dollar in recent months, amid the successful Brexit trade deal between the UK and the European Union. The fresh strength in the Sterling could also be attributed to the massive distribution of coronavirus vaccines in the UK, which raised the expectations of a return to normal economic activity.

In 2020, the coronavirus pandemic caused an abrupt drop in the price of the GBP/USD, especially during the first quarter. The GBP/USD pair dropped to its lowest level since the financial crisis in 2009, when lockdowns were introduced to curb the spread of the virus, heavily affecting economic activities in the UK. However, in the second and third quarter of 2020, the price of the GBP/USD began to rise, amid a bullish correction and easing of lockdown restrictions in Great Britain. At the start of 2021, the GBP/USD pair moved higher when the UK finally took leave of the European Union, with a trade agreement in January, and became an independent nation once again. This saw the GBP/USD pair prices reach their highest level since May 2018, at 1.37586.

Recent Changes in the GBP/USD Price

| Period | Change ($) | Change (%) |

| 30 Days | +0.0283 | 2.07% |

| 6 Months | +72.46 | 66.86% |

| 1 Year | +114.73 | 173.54% |

GBP/USD Price Prediction for the Next 5 Years

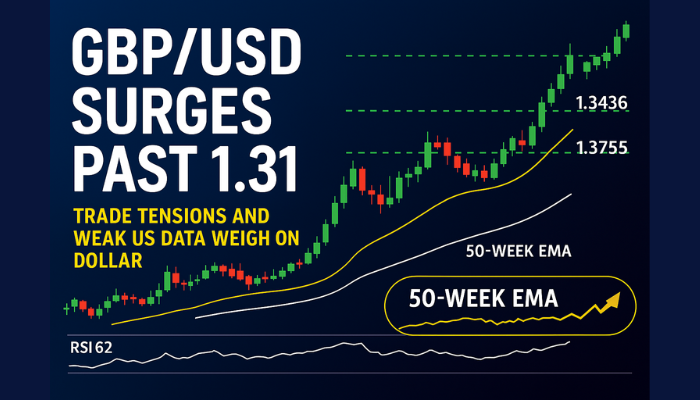

In the short-term, the technical indicators suggest the market remains consolidated as the relative strength index (RSI) has yet to confirm the break above the 1.3700 level against the US dollar. According to the Commerzbank from Germany, the analysts called the break of GBP/USD above 1.3700 level in January as a possible false break as it was premature and also because the RSI did not confirm the break higher yet. That is why the market suspects that the GBP/USD pair will consolidate further in the near term. Over the long-term, the Commerzbank forecasted that the GBP/USD pair was targeting the 2018 peak above 1.4377 level to reach in 2021. From the Citibank analysts, the forecast for the first quarter of 2021 has been made for GBP/USD to reach 1.3800 level and for the second quarter, the bank suggested a forecast for the currency pair GBP/USD to reach1.40 level over the long-term. The analysts of a UK high-street lender HSBC said that the outlook for British Pound was not promising in their view because of the broader underlying flow dynamics. They told clients of their commercial and investment banking unit that British Pound will struggle during 2021. Until now, the British Pound has had a mixed movement as the currency has gained about 0.70% against the Euro and about 0.18% against the US dollar. However, the Sterling has lost against the Norwegian Krone, New Zealand dollars, and Australian dollars. According to HSBC, the bullish hopes that were triggered due to the optimism after the signing of an agreement between the UK and the EU appeared to be rested because of the long-term underweight positioning. In short, HSBC maintained a view of the British Pound as an underperformer among the G10 currencies in 2021. Keeping the fundamentals and technicals in mind, the British economy seems to recover in upcoming years, however, the U.S. economy is also likely to be stabilized on the back of COVID19 liquidity injections, thus we can expect the GBP/USD pair to trade in a range of 1.3500 – 1.5000 during the next five years period, as nothing exceptional is expected here.

GBP/USD Factors Affecting the British Pound (GBP)

In the past four years, the primary driver of the British Pound has been the developments in Brexit negotiations with the European Union, and the impact of those negotiations on the UK economy. The British Pound was also affected by the fundamentals, which drove other factors, like Gross Domestic Product, industrial production, employment, interest rates, and inflation too.

Last year, the coronavirus pandemic had a massive impact on global economic performance. Then, after the fairly healthy recovery, the Sterling took some additional hits on the back of a more contagious strain of the coronavirus, which was identified in the UK during December 2020. The new variant of the COVID-19 virus resulted in a spike in the number of infections in the country, which forced the government to order another round of national lockdowns, which, in turn, disrupted the UK economy, and ultimately the British Pound, once again.

Coronavirus – Impact on British Pound:

No matter which economy or currency we are talking about, the deadly virus impacted on economic health and currency valuation. As we all know, COVID-19 originated in the city of Wuhan in China and reached the UK in late January 2020. Since then, the total number of coronavirus cases has reached 3,959,784, with a death toll of 112,798. The UK has been marked as the country with the fourth-highest death rate per hundred thousand residents throughout the world, and it is also the country with the highest number of coronavirus cases in all of Europe.

In March 2020, the country imposed a stay-at-home order that banned all non-essential travel and resulted in the closure of most gathering places. In the same month, the coronavirus pandemic-induced lockdowns sent the British Pound to its lowest level against the US dollar in 35 years. In October 2020, the UK faced many difficulties in controlling the pandemic, as a new, faster-spreading strain of the virus emerged, ultimately raising both the case count and the death toll. However, in December, the UK also became the first country to authorize and begin using the Pfizer-BioNTech coronavirus vaccine in a mass vaccination program that is still underway. Thanks to this massive vaccination program, the UK has started to recover, and this might continue to add strength to the British Pound in 2021.

Impact of Brexit on the British Pound:

It all started on June 23, 2016, when, in a referendum, most votes were in favor of the UK leaving the European Union. In March 2017, the President of the European Council, Donald Tusk, triggered Article 50, which started the 2-year countdown until the UK would formally leave the EU. Later, this came to be referred to as Brexit.

The UK was first expected to leave the European Union on March 29, 2019, but the vote in the House of Commons left the government with no choice but to seek permission from the EU to extend Article 50 and agree on a later Brexit date. Permission for extension rights was granted by 27 EU leaders just one day after the formal request by the UK PM of the time, Theresa May.

Prime Minister May then announced, in April 2019, that she would seek a further extension to the Article 50 process, as she wanted to work at reaching a deal with the opposition that would win the support of the MPs. At a European Council meeting on April 10, 2019, the UK and the EU agreed to an extension of the deadline until October 31, 2019. However, in October 2019, the PM failed to get approval from the House of Commons, resulting in another request to extend the Brexit process until January 31, 2020. The EU ambassadors granted this request on October 28, 2019. Meanwhile, Theresa May lost to Boris Johnson in the UK General Election of 2019, whereupon the newly elected Prime Minister promised to get Brexit finalized by the new deadline that had been set. On January 23, 2020, the withdrawal agreement, under the European Union Act of 2020, was granted Royal Assent, and on January 31, 2020, the UK finally left the EU and entered a one-year transition period.

The whole of 2020 was spent trying to secure a deal over the major sticking points of fisheries, a level-playing field, the Northern Ireland borders, and various other matters. However, in the final weeks of December, the UK and the EU finally reached a deal, after a long and challenging round of talks, which were hampered by the coronavirus and lockdowns. During this period, the Pound Sterling received a beating.

On December 31, 2020, the transition period came to an end, and the UK left the EU Single Market and Customs Union. Throughout the year, progress on Brexit negotiations kept driving the price of the British Pound, and once a final deal had been secured, the British Pound started to rise, and it has only been getting stronger against the US dollar ever since.

Impact of the Bank of England on the British Pound:

The Bank of England Governor Andrew Bailey announced an additional Quantitative Easing (QE) program in November 2020, amid the rising need to support the UK economy at a time that was dramatically affected by the pandemic. In March 2020, QE was at 645 billion British Pounds, which was expanded to 745 billion in June. The Quantitative Easing in the UK, by the Bank of England, has now reached 895 billion British Pounds. The rise in the QE resulted in a decrease in the value of the British Pound, and these QE measures weighed continuously on the GBP/USD currency pair throughout the year.

In March, the Bank of England also cut its rates in half, to 0.25%, and in November 2020, the Bank cut interest rates again, to the lowest level on record, at 0.10%. Interest rate cuts always impact a currency negatively, which means the British Pound was weak due to dovish moves by the Bank of England during 2020. Recently, the Bank of England has considered cutting interest rates to below zero. In its latest monetary policy meeting in February 2021, the BOE asked banks whether that would affect their ability to lend.

British Pound Fluctuations in 2020:

The Pound Sterling is considered to have been undervalued in recent years, as the uncertainty surrounding the impact of Brexit has limited the upside momentum in the currency and affected the trend of the GBP against other currencies. The Sterling started 2020 at 1.308 against the greenback, but due to coronavirus pandemic-induced lockdowns, the currency dropped to 1.163 in late March. This sell-off was driven across the financial markets, due to the increased safe-haven demand amid the rising fears of a pandemic crisis.

By late August, the British Pound had reached the 1.335 level, after the number of coronavirus cases in the country started to decrease during summer. The hopes for a Brexit deal between the UK and the EU before December 31, started to rise. Then, in late September, the British Pound dropped again, to 1.275, as the numbers of coronavirus cases began to rise again. Furthermore, the Brexit negotiations came up against a stalemate over fisheries and some other issues. At the end of the year, the British Pound reached 1.367, amid rising hopes for a Brexit deal and easing lockdown restrictions in the country. The Pound Sterling started 2021 in a range between 1.352 and 1.373, and now the question arises: Will the British Pound rise further in 2021? I think most of the movements depend upon how successful the vaccination program in the UK turns out to be. A faster rollout of vaccines suggests a quicker reopening of the economy, which will support the country’s GDP.

Current Bullish Sentiment Surrounding the GBP/USD:

The British Pound has retained its position as this year’s outperformer on the global currency market, amid the faded expectations for an interest rate cut by the Bank of England. On Thursday, the Bank of England declined to expand its Quantitative Easing program and to cut its interest rates, sending strong signals to the markets. As a result, the expectations of interest rate cuts dissipated, and the British Pound started to gain traction. So far in 2021, the Pound Sterling has recorded gains against all major G10 currencies. The outlook for the British Pound improved markedly with the successful Brexit negotiations and the removal of threats related to negative interest rates.

Some analysts believe that despite the top performance of the Sterling among the G10 currencies in 2021, the GBP/USD pair will decline, as the US dollar has also started to gain traction in the market, due to its safe-haven status and its broad-based popularity. A strong dollar could pull back gains in the GBP/USD and force a reversal in the bullish momentum of the pair in the coming weeks.

US Dollar Strength:

In recent weeks, the US dollar has seen massive buying, as investors have moved on from the weaker Euro. The single currency Euro has come under pressure because of the slow vaccine rollout in the Eurozone. This could mean that lockdowns will remain in place longer, with the UK and the US leaving the Euro economy behind.

Apart from the delay in terms of vaccines, the EU economy was already struggling compared to the US economy for several reasons: the number of cases of coronavirus in the USA was already coming down, the lockdown measures had almost been lifted in many areas, and hopes were high that the new Democratic government would soon inject a large amount of cash into the US economy.

Ethereum (ETH) Price Prediction For 2022: The $5,000 Level is the Next Target

Bitcoin (BTC) Price Prediction For 2022: BTC/USD Targeting $100,000

Technical Analysis, GBP/USD – Will the GBP/USD Bounce off the 50 SMA?

On the monthly time-frame, the technical indicators suggest a strong bullish bias for the GBP/USD pair. The Relative Strength Index (RSI) and the MACD have crossed the 50 level, suggesting strong odds of a buying trend in the Cable. The closing of a three-white soldiers pattern on the monthly time frame supports strong odds of continuation of the bullish trend.

At the moment, the GBP/USD pair is gaining support at the 1.3595 level and the closing of candles above this level could drive a buying trend in Sterling. On the higher side, the GBP/USD pair may continue trading bullishly until the 1.4025 and 1.4275 levels. The continuation of a bullish trend could extend buying until the 1.4393 level.

GBP/USD – Monthly Chart – Three White Soldiers

With the MACD crossing over the mid-level and closing histograms over 0, the bullish bias of the GBP/USD has gained further support. In the long term, the GBP/USD pair is likely to target a 2018 highs, over the 1.4377 mark in 2021. During the first quarter of 2021, the GBP/USD will probably reach 1.3800, and in the second quarter, the Cable may go after the 1.40 level.

GBP/USD – Weekly Chart – Breakout of the Descending Triangle Pattern

On the lower timeframe, the GBP/USD pair is testing the 50-period exponential moving average (EMA) level. The breakout below the 50 EMA level can extend a selling trend until the support area of 1.3574 and below this, the long-term support prevails at the 1.3206 level. However, the MACD indicates that the bulls are exhausted, and sellers may enter the market to secure market profits. The Cable could show corrections on the lower side, until 1.3565 and 1.3360, before exhibiting further buying trends in the market. Good luck!

Updated: Aug 24, 2021