The British Pound (GBP) has been really volatile in recent years, with all that’s been going on in the UK, and given the volatility of the USD this year, the GBP/USD has turned into one of the most volatile pairs in forex, with a range of 19 cents so far this year. Only the GBP/JPY has surpassed the volatility of the GBP/USD, with a range of 21 cents, but that pair includes the GBP as well, which means that the volatility in GBP pairs has been coming mainly from the GBP. The GBP/USD crashed lower in Q1 of 2020, as most forex majors did, but it has made quite a comeback since March, and seems pretty bullish right now, and there have been a number of successful forex signals during this time. But, will this bullish momentum continue, and if so for how long? Generally, there are many uncertainties in the financial markets at the moment, but the uncertainties are even higher for the GBP/USD, as it will also be affected by the Brexit process. So, let’s use this GBP/USD forecast to take a look into all the factors that are likely to affect the GBP in the near future.

Current GBP/USD Price: $

Recent Changes in the GBP/USD Price

| Period | Change ($) | Change % |

| 30 Days | +$ 0.027 | +2.0% |

| 6 Months | +$ 0.057 | +4.3% |

| 1 Year | +$ 0.124 | +9.3% |

| 5 Years | –$ 0.198 | –12.9% |

| Since 2000 | -$ 0.279 | -17.2% |

The GBP/USD has been on a bearish trend since September 2008, after having made a swift reversal during the Global Financial Crisis and crashing around 75 cents lower from the top. The highs have been getting lower for this pair, while the lows have been getting lower as well, showing that the sellers remain in control in the long run. Fundamentals have been on the opposite side of the GBP/USD, with the Brexit uncertainty weighing on the British Sterling, while the trade was between the US and China has been helping the USD, adding fuel to the bearish move, and sending this pair to 1.1410 in March this year, as the coronavirus epidemic spread in Europe and the UK. But since March, we have seen an increase of almost 20 cents, driven mostly by the reversal in the GBP index (BXY). But the uncertainty remains highly elevated for the GBP, for a number of reasons, and I see the upside limited for the GBP/USD. The technical charts point to some further gains, after the break of the 50 SMA on the monthly chart, but the climb is likely to end at some point. However, it might take several months for the reversal to come and the larger bearish trend to resume.

| GBP/USD Forecast Q4 2020: 1.40 | GBP/USD Forecast 1 Year: 1.25-26 | GBP/USD Forecast 3 Years: 0.55-0.60 |

| Price Drivers: Improved Risk Sentiment, Technical Analysis, Bearish USD Momentum | Price Drivers: Post US elections, Post Coronavirus, Economic Recovery, EU-UK Trade Deal? | Price Drivers: Fundamentals in UK, DXY Correlation, Global Sentiment, Post Brexit |

The GBP/USD Price Prediction for the Next Five Years

As with most countries around the globe, the global trade war has been weakening the growth of the UK economy in the last two years, which has also been denting the sentiment for risk currencies, such as the GBP. But, there is another reason for the decline in the GBP; the uncertainty resulting from the Brexit process after the “Leave” vote in 2016. On top of that, the GBP traders have to cope with the volatility arising from the COVID-19 pandemic, which sent all currencies diving lower against the USD, and then surging back up. Right now, the sentiment is positive and the GBP/USD is riding this wave, but nobody knows when the two major events affecting the GBP, namely the coronavirus and the Brexit, will come to an end, and this should keep the GBP bearish overall. But, in the last few months of 2020, we are likely to get an idea as to where GBP/USD might be heading next year, since the US elections and the end of the Brexit negotiations are scheduled in November-December.

How Will Brexit End?

Since the referendum, Brexit has been on a roller-coaster ride. Theresa May, who took over as Prime Minister after the Brexit vote in 2016, implemented the invocation of Article 50 in March 2017. However, she was unable to gain more support from the electorate during the June 2018 elections, but her successor Boris Johnson, who won by a clear majority, pushed forward with the Brexit, making it clear that the UK would be out, deal or no deal. The EU and the UK came to an agreement in terms of the withdrawal act, but they still need to ratify a trade deal before the end of 2020, otherwise the UK will end up paying tariffs for exports to the EU and vice-versa. The UK is much more affected by the EU exports, since it exports around £ 300 billion annually, which makes up 43% of all UK exports, while exports from the EU to the UK account for a much smaller portion. As of September 2020, there is still no clarity as to whether a deal will be ratified, particularly since the coronavirus has taken all the attention and the world is changing fast. But, in case of a trade deal, the GBP should rally for a few months, probably during Q1 and Q2 of 2021. So, in the case of a deal, the GBP/USD should turn bullish early in 2021, but that will also depend on the US elections, which will be held in November. If Donald Trump is reelected, that would mean the end of coronavirus restrictions in the US and the sentiment for the USD would turn massively bullish as a result, which in turn could cause the GBP/USD to end lower overall. But the trade deal should be a positive element for the GBP in the long run, especially against other currencies. Should the UK end up leaving the EU without a deal, it will add an additional burden, on top of the existing economic crisis, the negative sentiment resulting from coronavirus and various other factors, and the bearish trend will resume for the GBP. But we will have to keep an eye on the EU/UK negotiations in this regard, and trade accordingly.

COVID-19 and the Reopening Send the GBP/USD Higher

The coronavirus began spreading in the UK a little later than it did in other European countries, like Italy and Spain. Prime Minister Boris Johnson refused to enforce measures in the beginning, but after contracting the virus himself, he joined the majority of other countries, and put the country into lockdows, which sent the economy into a deep recession. The UK economy was already in trouble, due to the global economic slump in recent years, and as a result of Brexit. The GBP was on a bearish trend, but the decline picked up pace in the early stages of the COVID-19 pandemic, in February and March, from a high of 1.35 in December last year, to 1.14 by mid March, which was one of the biggest declines in major currencies. But, the situation has changed for the GBP since then, as it has for all risk assets, such as the stock markets. All governments have thrown whatever they can into the economy, to try to aid its recovery from one of the deepest and strangest recessions ever. This has helped both the risk sentiment and the GBP. The UK government has introduced several recovery packages worth around £ 400 billion, aided by the Bank of England (BOE), to carry out the operations, such as bond purchases, debt relief and business loans, and this has also played a part in helping during these times of crisis. The BOE has cut interest rates to 0.10%, while increasing the “Asset Purchase Facility” to £ 745 billion. The COVID-19 packages and the reopening of the global economy have had great effects on the British economy. Most sectors are at full steam now, and the momentum is underway for the UK, unlike in Europe where the economy has weakened after the strong jump in May and June. The UK core CPI (Consumer Price Index) inflation increased to 1.8%, the Manufacturing PMI increased to 55.3 points in August and Services surged to 60.1 points, which means a great pace of expansion. The money of the Brits is staying within the country this summer, due to travel restrictions, hence the surge in services. So, the UK economy still appears to be robust, recovering better than its European counterparts. That’s the reason why the uptrend in the EUR/GBP ended in July, while in August the currency pair retreated lower. The GBP/USD on the other hand, remains pretty bullish, after having claimed back all the losses since the start of the COVID-19 troubles.

BXY – GBP/USD Correlation

Comparing the monthly charts for the GBP index – the BXY, and the USD index – the DXY, the similarities with the GBP/USD monthly time-frame are greater for the GBP index. The index only shows the history until 2009, but even so, the picture in both is almost identical from then on. From 2010 until July 2014 the BXY was trading sideways, within a 200 point range between 148 and 168, while the GBP/USD was also trading within a 20 cent range, from 1.48 to 1.68. This was followed by a decline to 120 points in the DXY, while the GBP/USD fell to 1.20.

The first target for the BXY is at 140 points

The 50 SMA (yellow) was keeping the price in both charts down from 2015, but since December last year, the 50 SMA has lost importance as a resistance indicator, since the price has moved above it twice and has remained there, without looking back. In the DXY, it was the 100 SMA (green) which was providing resistance during the first half of last year, then it turned into support. However, the price has moved below that moving average for now, but it remains to be seen whether it will climb back above it. So, we must follow the GBP index more closely than the DXY, in order to trade the GBP/USD, since the BXY is very closely correlated to GBP/USD.

The bullish trend is in danger for the USD index

Technical Analysis – Will the GBP/USD Reach the 100 MA at 1.140?

The 50 SMA has been broken again

Looking at the monthly chart for the GBP/USD, we see that it looks similar to most commodities, such as oil and copper, and other risk assets. Until 2007, this pair was on a bullish trend, reaching record highs as it climbed above 2.10, but then it crashed, and it has been on a bearish trend overall, despite some decent pullbacks higher. The price formed a few doji candlesticks in 2009, after the big crash from the GFC, but moving averages turned into resistance on the monthly chart, and this pair has remained below them since. The 50 SMA has been providing resistance in recent years, as we mentioned above, but that moving average has been broken now, and the price is heading higher, as the DXY declines, so the monthly chart points to more bullish momentum until the 100 SMA (green) at 1.40.

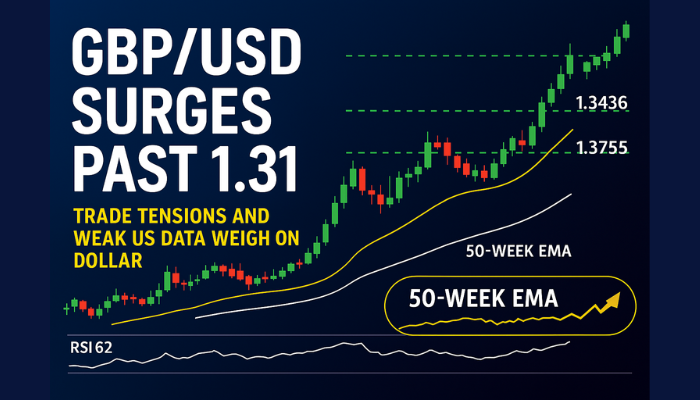

The upside is open on the weekly chart now

On the GBP/USD weekly chart, the picture looks quite bearish as well, from 2014, with the price remaining below moving averages from 2015, particularly the 200 SMA (gray), which has been providing decent resistance. But the price rose above that moving average in July, and it seems that the 20 SMA turned into support immediately. The price bounced higher in the last week of August, as the USD index resumed its decline. This also points to further gains for the GBP/USD, probably until the end of the year, when the US elections are over and Brexit is complete, probably without a trade deal, in which case the larger bearish trend will resume.