The Euro has been on a bearish trend against the US Dollar since 2008, and many analysts have predicted parity for the EUR/USD, at 1:1 or lower, many times since 2015, when this pair was headed that was, as the USD was surging higher, while the troubles in the EU were/are never ending. Although, this pair has resisted parity, since coming up from below 1:1 in the first couple of years after the Euro was introduced, in 2001-02. After the weakness in 2014-16, we saw a rebound from 1.03, which took the price more than 20 cent higher during 2017. But the bearish trend resumed again, until early this year when it reversed higher again from 1.0650, after forming a few bullish reversing candlesticks on the monthly chart. The coronavirus situation has helped to improve the sentiment surrounding the Euro, but both the fundamentals and the technical analysis point to a bearish reversal in this pair soon, since it failed to hold above 1.20 in August. Instead, the EUR/USD reversed pretty quickly from there, which suggests strong selling pressure up there, and I wouldn’t be surprised, since Europe and the US are diverging fundamentally, although we will take a deeper look at all factors affecting this pair in this EUR/USD forecast.

Current EUR/USD Price: $

Recent Changes in the EUR/USD Price

| Period | Change ($) | Change % |

| 30 Days | +$ 0.008 | +0.6% |

| 6 Months | +$ 0.104 | +8.8% |

| 1 Year | +$ 0.085 | +7.2% |

| 5 Years | –$ 0.043 | –3.6% |

| Since 2000 | +$ 0.184 | +15.5% |

The Euro was a brave undertaking by the EU from the beginning, and at first it went downstream against the USD, with the EUR/USD falling to levels of 0.82 to 0.83, but as the decade went by, the Euro gained confidence and EUR/USD was bullish until 2008, reaching 1.60, also due to the decline in the USD index. But, the 2008 crisis exposed the weaknesses in the Eurozone, with the Greek debt crisis, the Italian debt and later political events in the country, followed by the Brexit and now the fallout from Covid-19. The Euro survived the Greek crisis well, but there are other issues still going on, which will hurt the Euro, especially if Italy heads towards a Brexit scenario, which would be detrimental to the Euro. It’s true that the EUR/USD has benefited during the COVID months, but the gains have largely been at the expense of the USD, and now the situation is shifting, which means that the recent pullback to 1.20 should be over and the larger downtrend is likely to resume soon.

| EUR/USD Forecast Q4 2020: 1.14-1.15 | EUR/USD Forecast 1 Year: 1.06-1.07 | EUR/USD Forecast 3 Years: 1:1? |

| Price Drivers: Covid-19 Restrictions in Europe, Technicals, USDX correlation | Price Drivers: EU Economic Recovery, Brexit, Post US elections, Market Sentiment | Price Drivers: Fundamentals, Politics in Europe, USD |

The EUR/USD Price Prediction for the Next 5 Years

The Covid-19 situation has been positive for the EUR/USD, mainly due to the decline in the USD, but that’s coming to an end now, as the technical analysis below, in the EUR/USD forecast, shows. According to the technical analysis, this pair will head for 1.15 and probably 1.10 by the end of 2020 or the beginning of 2021, and the fundamental analysis supports this scenario too. The odds of a successful Brexit decline with every day that passes, as we head towards the deadline at the end of the year, the Italian situation remains an issue which will bite pretty soon, sending the Euro tumbling. The economic recovery from the shut-down is also cooling off fast, so the future doesn’t look too bright for the Euro.

Is This the End of the COVID-19 Push for the EUR/USD?

The EUR/USD reacted pretty well to the spread of the coronavirus in Europe. The pandemic first exploded in Italy, and soon after that, in Spain, towards the end of February, and the Euro turned bullish rather than bearish. That lasted until March 10, despite the virus spreading all over Europe, and countries beginning to lock down one after another. The situation in Europe seemed really bad, with the EU leaving the hardest hit countries to fend for themselves at the worst time, but the EUR/USD rallied up to 1.15, nevertheless. However, the virus spread all over the world and panic set in, with traders turning to the USD as a global reserve currency. That was the reason for the reversal of the EUR/USD from 1.15 on March 10, which lasted until March 20, when traders realized the world wasn’t going to end, and the market turned totally against the USD, as the massively long USD orders were unwinding from the initial panic, and then the sentiment turned massively bearish for the USD, and thus bullish for the EUR/USD, which climbed above 1.20 briefly, until September 1. The Euro also had a part to play in this bullish trend, with the EU introducing a number of programs to help the Eurozone economy, to the tune of EUR 2,364.3 billion. On top of the EUR 540 billion for jobs/workers, businesses and member states, EU leaders agreed on another package in the amount of EUR 1,824.3 billion on July 21, which combines the Multiannual Financial Framework (MFF) and an extraordinary recovery effort, Next Generation EU (NGEU). The aim of the package is to help rebuild the EU after the COVID-19 pandemic, and it will support investment in the green and digital transitions, but on the other hand, all countries have introduced extraordinary measures as well.

Fundamentals and the ECB

The European Central Bank (ECB) was caught unprepared at first, when the coronavirus pandemic broke out. But they acted fast, with the initial EUR 750 billion package, which was increased to EUR 1,350 billion, as a Pandemic Emergency Purchase Program (PEPP). It aims to lower borrowing costs and increase lending in the Euro area. This ECB program aims at helping European citizens, businesses and governments get access to funds they may need in these difficult times. The PEPP program comes on top of the asset purchase programs that were in place previously. ECB rates are also at record lows, with Refinancing Rates at 0.0%, Deposit Rates at -0.50% and the Marginal Lending Facility at 0.25%. They have promised to take further monetary-easing steps in the future, if the Eurozone economy weakens further or falls into contraction again. However, it depends on how the situation goes in Europe, in terms of the virus and politics. The Eurozone economy started to rebound nicely initially, as the sentiment improved after the reopening, which helped the EUR/USD. But the rebound wasn’t as strong as the decline, so there was no V-shaped recovery, and in recent weeks, the data has shown that the rebound has slowed, with certain sectors remaining in contraction. If there are more coronavirus restrictions due to a second wave, as has been suggested, the economic programs from the EU and the ECB won’t help the situation.

Brexit And Other Political Issues in the EU

Brexit is an old story now, although it is not over yet. The UK is still in the process of negotiating with the EU, before leaving the block. While she was in office, Theresa May failed to get a Brexit deal passed by the British Parliament, while Boris Johnson succeeded in the second attempt, after taking care of the Irish border issue. But, a Brexit deal means nothing without a trade deal between the EU and the UK. Both sides are still negotiating for a trade deal, but with the coronavirus and the economic slump from the lockdowns taking center stage, Brexit has been in the shadows. The signs are not very positive, so the odds of a trade deal are around 50-50. If they don’t reach a deal, the Brexit agreement takes the UK out of the EU with no deal, which will mean tariffs on both sides. Although this will not be as detrimental for the Eurozone economy as it will be for the UK, such a scenario would definitely be negative for the Euro. Besides that, the whole coronavirus situation is not favourable for EU politics. Protests have erupted in major European countries, and many old coats in politics will be replaced by new politicians. Mateo Salvini poses a threat to the Euro if he comes back into power in Italy, which is very likely. He is not very fond of the EU either, and an Ital-exit party has been formed, similar to the Brexit in the UK, which will probably side with Salvini in the next elections. This is all negative for the Euro, so I don’t see any positive events for the Euro from the European political scene.

EXY – EUR/USD Correlation

Looking at the Euro index EXY chart, as far back as it goes, to around 2007, it seems pretty similar to the EUR/USD chart. This is also partly because the USD accounts for a large portion of the weight in the basket of currencies in which the Euro is weighed. During the 2000s, the EXY index was on a bullish trend, as was the EUR/USD. But it reversed just above 160 points during the 2008 financial crisis. The EXY was very volatile, making some major declines, followed by swift reversals higher. In 2014, we saw it crash lower, after the previous ECB president, Mario Draghi, said that they would do whatever it takes to help the economy of the Eurozone. This index fell below the moving averages, and it has remained there since. The 100 SMA in particular has turned into the ultimate support for the EXY on the monthly time-frame chart. This moving average provided resistance in early 2018, after the pullback from the lows, and it seems like it is also providing resistance right now. We will expand on that further in the technical section below. The DXY index on the other hand, despite being negatively correlated, is not as spot on with the EUR/USD as the EXY. The 100 SMA is providing support for the DXY now, but the price reversed way up in 2018. So, the USD index is not as closely correlated to the EUR/USD as the Euro index, but it is still worth watching if you are trading the EUR/USD in the long term.

The Euro index continues the downtrend

The 100 SMA hasn’t acted as support for the USD index previously

Technical Analysis – Is the 100 SMA Turning the EUR/USD Bearish Again

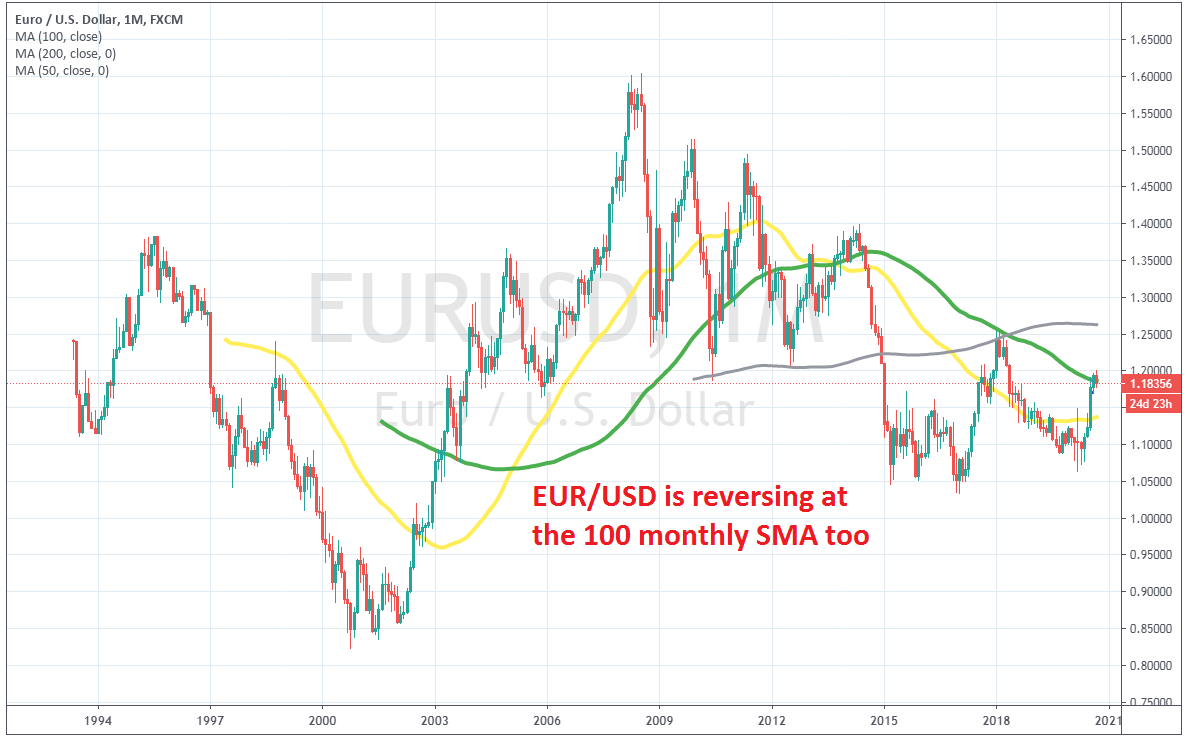

The precursor of the Euro, before it was introduced, was the ECU; that’s the reason why the chart history goes further back than 2000. The ECU was on a bearish trend from 1995, so the Euro started life on the back foot at 1.00, and fell further until January 2003, when it made the big reversal at 0.82 – 0.83. Buyers ran into the 50 SMA (yellow) on the monthly chart, which turned from resistance into support, it was eventually broken, and the EUR/USD had pushed higher, to 1.60, by 2008. During the bullish trend, moving averages turned into support, with first the 100 SMA (green), and then the 50 SMA taking its place, as the trend picked up pace.

But the 2008 financial crisis reversed this pair lower, sending the Euro crashing against the USD, as was the case with most risk currencies. The 50 SMA was broken, which was a sign that moving averages had lost importance, as both the support and the trend were changing. The 200 SMA (gray) held as support a couple of times, once in 2010 and once in 2012, but that was eventually broken as the USD progressed higher, and those moving averages turned into support. A base formed at 1.0330 and the EUR/USD reversed higher, but that proved to be just a retrace, which ended at the 1.2550s, where the 100 and 200 SMAs provided resistance. The sellers gave up and the price turned bearish again, with the 50 SMA pushing the price down as it declined. However, after the lockdown months and a few reversing candlesticks, such as dojis and hammers, the situation improved for this pair, and it has been bullish since then. The 50 SMA has been broken but the 100 SMA is standing as resistance, despite the price moving above it for some time. It now seems like this will be another retrace that is coming to an end, and buyers are showing great weakness at the moment, as the price reversed quite quickly from above 1.20. But, I suppose that 1.20 was the target for the buyers. The big level was obviously pierced, which appeared to be stop hunting, which is usually the case for these big levels. Although, as we mentioned, the reversal was quick, which points to a larger bearish reversal to 1.15 first after the support at 1.17 is broken, then 1.10 and maybe lower, if there is a clear winner in the US elections.