Compound Price History

Compound (COMP/USD) traded at $64.64 on June 17, 2020, with a trading volume of over $175,000. The pair then spiked to $337.05 on June 21, 2021, with trading volumes reaching $5.23 million, in a 421% gain in just four days. COMP/USD then came under a bearish momentum at the start of November, moving from a high of $255 to close the month at $133. The bearish streak continued until October 2020, where COMP/USD moved from $126 on October 1, 2020, to close the month at a low of $108, shedding off 16% in a month.

COMP/USD gained bullish momentum at the start of November 2020, starting from a low of $95 to a high of $474 as of February 2021. The surge led to almost a 400% increase in three months. The pair then retraced slightly, reaching $360 on March 22, 2021. The subsequent bullish momentum pushed COMP/USD to an all-time high of over $900 as of May 10, 2021, but it could not hold steady. COMP/USD crashed to a low of $211 on June 21, 2021. The drop led to a loss of around 300% in one and a half months.

Recent Compound Price Changes

COMP/USD began the last quarter of 2021 trading in a consolidation pattern between $298 and $380, from October 1, 2022, to November 3. A bearish sentiment that affected the whole cryptocurrency industry took the pair to a low of $186 on December 12. The drop led to a loss of about 100% in two weeks. At the time of writing, COMP/USD was trading at $197 and looking to go lower.

COMP/USD Recent Price Changes

| Period | Change ($) | Change (%) |

| 1 Week | -3.88 | -1.98 |

| 1 Month | -113.9 | -58.26 |

| 3 Months | -206.11 | -105.50 |

| 6 Months | -84.43 | -43.29 |

| 1 Year | +39.46 | +20.23 |

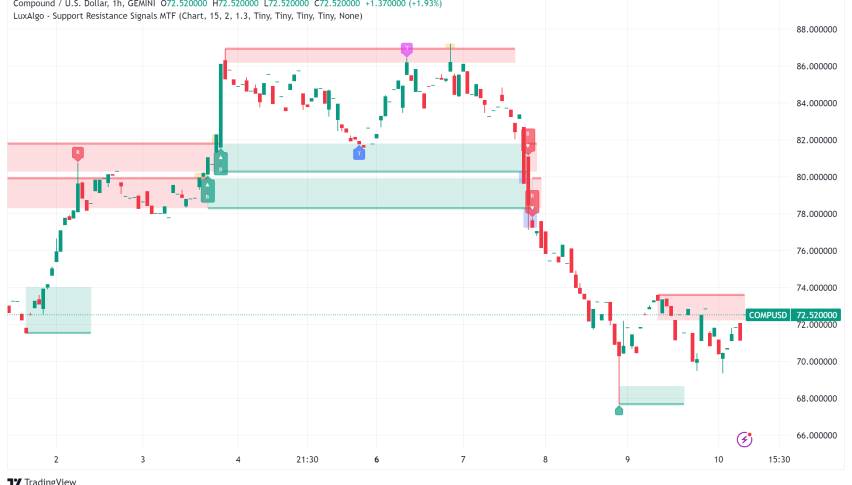

Compound Live Chart

Compound Price Forecast

| Compound Forecast: H1 2022 $200-$375 | Compound Forecast: H2 2022 $375-$650 | Compound Forecast 2 years $650-$1,000 |

Despite the current weakness, Compound will remain bullish in both the short term and the long term, based on its strong fundamental and technical analysis. We expect COMP/USD to trade between $200 and $375 in the first half of 2022. The pair could trade between $375 and $650 in the last half of 2022. For the two-year forecast, we expect that COMP/USD will reach up to $1,000.

What is Compound?

Compound is a decentralized Finance lending protocol built on the Ethereum blockchain that rewards users with interest for depositing their tokens in supported liquidity pools. The platform was launched in 2017, as a peer-to-peer DeFi platform. Compound matches lenders and borrowers and rewards the liquidity providers from the charged interest. The smart contracts in Compound set the borrowing terms, replacing the conventional documentation processes. Compound automates the matching and lending from a cryptocurrency liquidity pool.

COMP is the native token that powers Compound. There are 6,275,832 COMP tokens in circulation, from a maximum supply of 10,000,000. Compound currently ranks as the 83rd most valuable cryptocurrency, with a market capitalization of $1,171,855,157 and $9,958,087,674 in the total value locked. The COMP token, that is also used in governance, to enable users to vote on the advancement of the protocol. Compound leverages smart contracts that are incorporated in the cTokens. The protocol temporarily converts deposited funds into cTokens, and stakes them in a liquidity pool. The lending terms are incorporated in the compound protocol and cTokens.

The platform’s treasury fund allows users to earn an annual percentage rate on savings and fixed accounts. A user needs to lock more funds than the borrowed amount, as a collateral in the platform. The maximum loan to value ratio varies, depending on the collateral asset, and it can range between 50% and 75%. The interest rate paid also depends on the borrowed funds. The collateralized amount is automatically liquidated if it falls below a certain maintenance level. Compound was founded by Robert Leshner and Geoffrey Hayes in 2017.

Factors Driving Adoption

Decentralization

Centralized Finance is faced with many challenges, ranging from slow intermediary processes, to costly transaction settlements. The rate of returns in fixed deposit accounts offered by banks is minimal. On the flipside, decentralization is backed by cryptocurrency and blockchain technology. The process features immutable records with an aspect of anonymity and security. As decentralization gains traction, we could see growth in DeFi networks.

The Popularity of Liquidity Mining

Decentralized Finance has become an important aspect of blockchain technology. The field is aiming at democratizing financial services. The new craze in the sector, that could potentially create a robust financial infrastructure, could drive the price of COMP/USD to the upside. Use cases for the Compound protocol are where borrowers access extra funds to profit from arbitrage opportunities.

Community Governance

The use of the COMP token in governance could drive the growth of the Compound network. The governance aspect allows token holders to vote on increasing or reducing the release of tokens. The engagement of a community in Compound development could increase both adoption and the token price. As long as the price of COMP tokens continues to rise, users would be incentivized to borrow, lend and farm liquidity.

Total Value Locked

Compound’s total value locked is currently standing at $9,956,826,844, and growing progressively. A high TVL means that the project is gaining popularity, adoption and investor confidence. As the TVL in the Compound network continues to surge, the price of COMP will follow suit. DeFi has continued to attract institutional investors. Compound could benefit if the momentum is sustained.

Factors that could Hinder Growth

Sustainability

Liquidity mining protocols are striking a balance to provide a sustainable Annual Percentage Rate on interests from the fixed deposit. If Compound fails to sustain an attractive return for the providers of liquidity, there would be an outflow of funds. Also, if the rate proves to be unsustainable, then growth will be minimal.

Collateralization

Borrowers must provide collateral equal to the value of the borrowed asset or even more. This requirement excludes many users from accessing the service. Overcollateralization also makes the protocol less competitive than the traditional financial sector, which requires a lower amount of security.

Market Sustainability

As Decentralized Finance protocols attempt to attract users with incentives, competition could get stiff, and this might destabilize the sector. If the enthusiasm in the DeFi space on liquidity mining fades, Compound could experience negative growth. This would, in turn, affect the attractiveness of the COMP token. The DeFi market has witnessed accelerated growth in a very short time. Whether the growth would stand the test of time is a concern.

Network Security Threats

Compound uses systems that are prone to hacking and a risk of asset losses. Private keys are also a challenge to users, and if lost, the asset can never be retrieved. If Compound faces a security breach, investor confidence will be shaken, which could lead to asset outflows.

Regulation

Decentralized Finance continues to face regulatory hurdles as the sector expands. As the regulatory authorities in different jurisdictions update their policies, some laws could hinder the growth. Many networks that emerge, but become fraudulent somewhere along the line, could shake confidence among investors. Regulations that could adversely affect liquidity mining and staking would hinder the advancement of the compound network.

Ethereum (ETH) Price Prediction For 2022: The $5,000 Level is the Next Target

Bitcoin (BTC) Price Prediction For 2022: BTC/USD Targeting $100,000

Technical Analysis – COMP Heads for the Lows of 2020, as Key Levels Fail to Hold

COMP/USD has been on a roller coaster since the start of 2021. Despite hitting an all-time high of almost $920 in May 2021, in a bullish momentum that started at the beginning of the year, COMP/USD has largely been moving within narrow ranges. Any upsides in price have been met with steep corrections, making COMP/USD unable to replicate gains, but always maintaining previously established levels. Nonetheless, COMP/USD has now entered a bearish zone that has become a focal point for trading in 2022 and beyond. At the current price of $192, COMP/USD is trading at a 2021 low. The last time the crypto token was trading at the lowest point of 2021 was on June 22, when the value was around $200. Can the token recover the losses?

COMP/USD Breaks Below $220, Exposes Pair to 2020 Levels

After breaking the $306 key support, which held prices for the larger part of 2021, COMP/USD has proceeded down and breached the $220 level. From the weekly chart above, COMP/USD appears to be under pressure, after having touched the lows of 2021. The cryptocurrency also broke below $220, accelerating the ongoing weakness. Although we do not consider $220 as key support for the cryptocurrency, previous price action points to an event area, as the prices tested it in June, before rebounding. The level also held back prices when it remained below $200, before the bullish momentum that started in January 2020.

With COMP/USD now trading below the $220 level, we foresee a further drop to the lows of 2020. The bearish momentum is confirmed by the moving averages, which are currently above the price and offering resistance. Still, looking at the relative strength indicator, a reading of around 36 suggests that COMP/USD is approaching, but has not yet fully entered, the oversold zone. The indicators suggest that a further price drop is imminent, but a rebound in COMP/USD could potentially occur in early 2022.

COMP/USD – Key Levels to Watch

A break below $220 would expose COMP/USD to levels last witnessed in 2020. Although there is no clear support in sight, the area around $165 and $130 have acted as price action zones and could support prices. COMP/USD could rebound from those key levels in early 2022, setting the stage for a surge above $200, which we see as the possible base price that year. If these levels are successfully maintained, COMP/USD could surge above its previous ATH, over $900, surpassing our conservative forecast of $650 for the year.