Natural Gas – Forecast Summary

| Natural Gas Forecast: H1 2023 Price: $2.51 – $3.0 Price drivers: Summer Impact, Bearish Correction, Doji Patterns, Weekly Bearish Engulfing | Natural Gas Forecast: 1 Year Price: $3.45 Price drivers: Weaker Dollar Amid COVID-19-Based Stimulus, Descending Triangle Breakout, 50 EMA Crossover | Natural Gas Forecast: 3 Years Price: $4.45 Price drivers: Improved Economic Conditions, Weaker Dollar, Dovish Monetary Policies |

Lately, natural gas has encountered excellent movements, gaining +$ 0.28 in its prices, and reporting a surge of 10.76% in a time span of just one month. [[Natural Gas]] is currently trading at $ 2.70, bouncing off the June 2020 low of 1.529. The commodity has gained +$ 0.21, or 7.98%, over the past six months. The average price of natural gas at the national benchmark Henry Hub in Louisiana was $2.05 per million British thermal units (MMBtu) in 2020, which was the lowest average price of natural gas in decades.

At the start of 2023, the prices remained relatively low, because of the lower demand for natural gas for space heating during mild winter weather. Both natural gas production and consumption reduced during 2020, as the economy faced the crisis induced by the coronavirus pandemic, which resulted in low prices throughout the year. The prices were further lowered in March, during the spring, when responses to the coronavirus pandemic resulted in lockdowns of economic activities that drove the demand for natural gas down. In June, the Henry Hub price averaged $1.66/MMBtu, which was the lowest monthly price in decades. However, due to the decreased production of natural gas and increased exports of liquefied natural gas (LNG), the prices started to grow in the second half of the year, with an exceptional annual performance that saw natural gas soar by +$ 1.156, adding a total of 68.64% last year.

Recent Changes in the Natural Gas Price

| Period | Change ($) | Change (%) |

| 30 Days | +0.28 | 10.76% |

| 6 Months | +0.21 | 7.98% |

| 1 Year | +1.156 | 68.64% |

Natural Gas Price Prediction for the Next 5 Years

The global natural gas demand is expected to grow by 2.8% in 2021, which is slightly higher than the decline in 2020, but it enables a recovery towards the 2019 level. This forecast is far from the 7.5% annual change observed in 2010, after the financial crisis in 2009. This forecast by the EIA was released with two main warnings:

1 – Not all regions are affected equally by the recovery in the global gas market. The emerging markets will be considered the main drivers of demand growth in 2021 and upcoming years, while the mature markets will penetrate the effect of declined demand in 2020. The fast-growing markets, like Asia, Africa, South America, Central America and the Middle East, are anticipated to be the main drivers of demand growth in 2021. However, mature markets will probably see a more gradual recovery, while some might remain below their 2019 demand levels.

2 – The sectoral drivers of growth are all related to significant uncertainties. The increasing inter-fuel competition and slow growth in terms of the electricity demand are expected to affect the burning of gas in power generation, as gas prices recover from the low levels of 2020. Industrial gas consumption, especially for Asian export–driven industries, is strongly dependent on economic recovery, which is highly uncertain due to the coronavirus pandemic crisis. The cold temperatures have been supporting the rise in the residential demand for gas consumption; however, this is likely to drop in milder weather conditions.

Natural Gas Forecasts by the EIA in figures:

The estimated consumption of natural gas in the United States averaged 83.1 billion cubic feet per day (Bcf/d) in 2020, which was down by 2.5% from 2019. In 2021, the EIA, an organization administered by Linda Capuano, expects the US consumption of natural gas to decline by 2.8% or 2.3 Bcf/d, and in 2022, it is likely to decline by 2.1% or 1.7 Bcf/d.

The estimated US production of natural gas averaged 90.8 Bcf/d in 2020, which was down by 2.5% or 2.3 Bcf/d compared to 2019. The EIA expects natural gas production to decline again in 2021, to an annual average of 88.2 Bcf/d, and on a monthly basis, the average natural gas production will fall by 87.3 Bcf/d in March 2021.

The Henry Hub spot prices averaged $2.03/ MMBtu in December 2020. In the first quarter of 2021, the EIA expects a rise in the average spot price of natural gas, to $3.01/MMBtu. The rise in natural gas prices in 2021 has been attributed to relatively low natural gas production. In 2022, the EIA forecasts that the average spot price of natural gas will reach $3.27/MMBtu.

- The IMF anticipates that the Henry Hub price will surge to $2.65 per MMBtu in 2024.

- The World Bank extends a more optimistic forecast: $3.16 per MMBtu.

- The World Bank anticipates that the natural gas price is likely to increase to $4 per MMBtu by 2030.

That said, the technical side of natural gas is also optimistic, as it suggests a potential bullish bias on natural gas. Since the leading and lagging technical indicators, such as RSI, MACD and the series of EMA support a bullish trend, the natural gas price may surge to an immediate resistance level of 3.487 by the end of 2021. A bullish breakout at 3.48 could lead the natural gas price towards the 4.40 mark in the years ahead.

Factors Affecting Natural Gas

US Natural Gas Production – During 2020, the production of dry natural gas in the United States averaged 90.9 Bcf/d, which was 2.2 Bcf/d less than in 2019. The decline in production in 2020 broke the three-year growth streak of natural gas production in the United States. During the spring season, the number of rigs drilling for natural gas in the United States started to decline. In July, the count reached a record low of 68 natural gas rigs; the rig-count remained relatively low throughout 2020.

Hurricanes – The hurricanes and the changes in demand for natural gas in Europe and Asia affected LNG exports in the United States during the summer of 2020. However, at the end of 2020, the total exports of LNG showed expansion. The EIA estimated that the United States had exported 9.4Bcf/d in November 2020; this volume is equivalent to 10% of the US dry natural gas production in the same month.

Seasonal Demand – In 2021, the natural gas prices rallied in Europe and Asia, amid the rising winter demand that tightened supplies. However, the spikes in prices are not projected to last long, as the market fundamentals for 2021 look fragile. It is anticipated that the global gas demand will recover to its 2019 levels, but the uncertainties persist regarding the recovery route of fast-growing markets, compared to more mature regions. On the other hand, the sectoral demand is dependent on several risk factors, including the slow industrial rebound, fuel switching and milder weather.

The Coronavirus Pandemic and its Impact on Natural Gas – he largest decline in global gas consumption was driven by the exceptionally mild weather in the early months and the dramatic effects of the coronavirus pandemic, with a 4% y-o-y decline in global gas demand in the first half of the year. However, during the 3rd quarter of the year, a progressive recovery was seen as lockdown measures were eased, and the seasonal electricity requirements pushed the demand and raised the competitive gas prices.

In 2020, the global demand for natural gas saw its largest drop on record, falling by an estimated 2.5% or 100 billion cubic meters. This slowdown resulted in fuel switching, which lifted the gas demand for power generation, while the whole supply chain adjusted the demand variations and showed strong flexibility. The prices of natural gas experienced extreme volatility and historic low levels in 2020. The gas investment went on hold due to the coronavirus pandemic and a well-supplied market. In major gas-consuming markets, the clean gas policy and the gas market reforms started to gain momentum.

In 2020, the rise in LNG prices was triggered by the colder temperatures in December and the tightened gas supply. By the start of January, LNG prices more than tripled in Asia, reaching above USD 30/MBtu. The recent spike in gas prices reflected a combination of supply and demand factors, rather than the result of a single event.

The demand for LNG in northeast Asia increased by 10% y-o-y between mid-Dec 2020 and early January 2021 amid the colder-than-average winter temperatures around the globe, which was aggravated by the lower nuclear availability in Japan and the limits on the coal-fired generation in Korea. The surge in demand for LNG also increased the calls for more remote suppliers, resulting in higher prices. Longer voyages and the congestion in the Panama Canal pushed spot charter rates to record highs of more than $ 230,000 per day. However, these high prices are not expected to last beyond the short-term cold wave, as the fundamentals for 2021 remain weak.

Technical Analysis – Descending Triangle & MACD Crossover

On the technical front, the bulls are dominating the natural gas demand. Currently, natural gas is trading at the 2.79 level. Still, the leading technical indicator, the MACD (Moving average convergence divergence), has crossed over the mid-level (0 level), which exhibits a strong bullish trend in the natural gas price. Natural gas has closed a spinning top candle on a monthly time-frame, followed by two monthly sell candles, demonstrating that sellers are getting exhausted and the bulls might take over the market now.

Natural Gas – Monthly Time-frame – Descending Triangle Pattern

Furthermore, the lagging indicators, such as the 20, 50 and 200 periods EMA (Exponential Moving Averages) support a bullish trend, as natural gas prices have surged over all of these EMA levels. On the higher side, the monthly resistance remains at $ 3, $ 3.52 and $ 4.47. Conversely, the commodity may find support at the $ 2.70 level. If natural gas violates the support level of $ 2.70, we might see its prices falling toward the $ 1.60 area. If the demand for natural gas drops further, and manages to break below the $ 1.60 level, which is doubtful, the prices may dip until areas around $ 1.36 and $ 1.19.

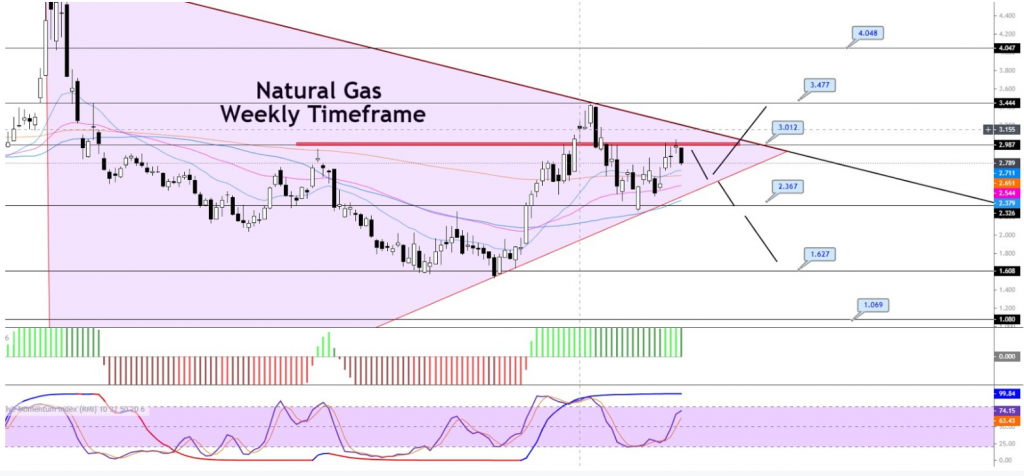

Natural Gas – Weekly Time-frame – Trendline & Doji Pattern

In the short run, natural gas may exhibit a slight bearish correction until the $ 2.33 area, which is extending by the most recent low of Dec 2020. However, the odds of continuation of the bullish trend will remain solid if the commodity fails to violate the support level of $ 2.33. According to the MACD and Stochastic indicators, natural gas has entered into the overbought zone, and exhausted bulls may start profit-taking before showing any further upward momentum in the market. On the weekly timeframe, natural gas prices have closed a Doji candle that suggests indecision among investors and typically drives correction, which is followed by a bullish trend. So here, it is followed by a 29.89% gain in natural gas prices, suggesting that the bulls need some rest now. That said, we can see a slight dip in natural gas prices until the 2.36 area, and then the odds of a bullish reversal will remain high. However, the violation of the 2.36 level could also lead the prices towards the 1.62 area. Good luck!