The prices for the precious metal gold have been skyrocketing since the beginning of 2020. GOLD opened the year at 1,517, adding more than 2,800 pips to top the 1,800 price level. Forex traders are trading the risk-off market sentiment, which is mostly driven by the COVID19 pandemic at the moment. In this update, we are going to forecast gold prices not only for this year, but also for the upcoming years.

Current GOLD Price: $

Recent Changes in the Gold Price

| Period | Change ($) | Change % |

| 30 Days | +63.10 | +3.62% |

| 6 Months | +250.20 | +16.07% |

| 1 Year | +381.90 | +26.80% |

| 5 Years | +673.60 | +59.44% |

| Since 2000 | +1,519.10 | +527.83% |

Gold prices are on track for the 6th back-to-back weekly gain, for the first time in over a year. Nevertheless, the bullish momentum has stalled, with only spot prices in the previous week, and a marginal rise of 0.5%. In turn, this poses the question: with $ 1800 already having been breached, what can we expect next?

| Gold Forecast: Q4 2020 | Gold Forecast: 1 Year | Gold Forecast: 3 Years |

| Price: $ 1,896 Price drivers: Second wave of COVID19, double top resistance, Fed’s dovish monetary policy, boosted safe-haven appeal. | Price: $ 1,720 & $1,618 Price drivers: COVID19 recovery, double top resistance, bearish retracement in overbought gold. | Price: $ 2,160 Price drivers: COVID19 recovery, double top resistance, bearish retracement in overbought gold. |

Gold Live Chart

Common Factors That Impact Gold Prices

It has been a tough year for stocks, but on the contrary, it has been an exceptional year not just for physical gold but also for gold investors. As most of you know, the yellow metal is often used as a safe-haven asset, since the performance of the gold price often surges during periods of uncertainty. There are manifold factors involved in the determination of a bullish bias in gold. Let’s explore them one by one to determine gold price forecast.

- US Dollar & FED Monetary policy (Negative Rate Cuts):

Gold and the US dollar are negatively correlated nearly two-thirds of the time (when one advances, the other drops, and vice versa). While global investors do manage to run with the US dollar through periods of uncertainty, this type of movement was muted over the previous year, despite the trade war with China. They preferred to go with gold.

This year, the most significant impact on gold prices has been driven by the US monetary policy, which is controlled by the Federal Reserve. Interest rates impact bullion prices significantly, due to the factor known as “opportunity cost.” Opportunity cost is the idea of giving up a near-guaranteed gain in one investment to achieve a greater gain in another. According to the historical outlook, a strong negative correlation exists between interest rates and gold prices.

However, sharp gains in the gold prices can be attributed to the low interest rates from all central banks across the world, which were driven down in order to curb the economic slowdown triggered by the lockdowns that were induced by the coronavirus pandemic. The US Federal Reserve cut their interest rates from 1.75% to 1.25% in March, which drove sharp selling in the US dollar and triggered a bullish bias for the precious metal, gold. Later, considering the massive outbreak of COVID19, the Federal Reserve decided to cut the rate even further on March 16, from 1.25% to 0.25%, which has made gold even more bullish this year.

- Stock Market Crash

The recent 2020 crash on the US stock exchange wasn’t only limited to the US. Rather, it was a global stock market crash that began on February 20, 2020. On February 12, the Dow Jones Industrial Average, the NASDAQ Composite and the S&P 500 Index all finished at record highs (while the NASDAQ and S&P 500 reached subsequent record highs on February 19). From February 24 to 28, stock markets worldwide reported their largest one-week declines since the financial crisis of 2008. On March 9, most global markets reported severe declines, mainly triggered by the COVID-19 pandemic and an oil price war between Russia and the OPEC countries, led by Saudi Arabia. This became informally known as Black Monday. At the time, it was the worst drop in stocks since the Great Recession in 2008.

So, as a result, most investors were cautious, and turned to safe-haven investments like gold, because the yellow metal is known to be one of the safest investment options, as the odds of it losing its intrinsic value is almost non-existent. The precious metal prices may fluctuate, but they will never fall to zero. For this very reason, gold prices soar sharply during times of economic crisis or high levels of uncertainty. It is therefore undeniable that traders would rather resort to safer options than sticking to the ones that are sensitive to several economic and geopolitical factors.

The relationship between the gold prices and the stock markets is inverse. Mostly, the gold prices will drop when the stock markets are performing well and vice versa. Likewise, when the stock market collapses, the demand for gold increases, as more and more investors are looking at safer options.

- Economic Data & Gold

Another driver of gold prices could be associated with the US economic data. Economic figures, such as the labor market reports, wage data, manufacturing data, retail sales and the GDP growth all impact the US Central Bank’s Federal Reserve monetary policy decisions, and this affects gold prices directly. The COVID-19 pandemic has affected societies and economies at their core, resulting in increased poverty and inequalities on a global scale.

As a result, the weaker growth in terms of jobs, rising unemployment, weak manufacturing data, decreased retail sales and weakened GDP growth creates a dovish Fed scenario on interest rates, pushing the gold prices higher. In April, prices for the precious metal surged over 1,600 pips, to place a high at around 1,746, in the wake of worse-than-expected US jobless claims. In April, the number of Americans who applied for unemployment benefits rose by a record 6.6 million, bringing the latest jobless cases to 10 million, as the all-out struggle to reduce the spread of the coronavirus banged the economy. The gold prices thus soared by over 10% in April.

- COVID19 – Coronavirus Pandemic

The COVID19 outbreak, which was first identified in China, has infected people in 188 countries, and had a significant negative impact on the global economies, thus increasing the safe-haven demand in the market and sending the gold prices to record highs. According to data from the John Hopkins University, the number of COVID-19 patients around the globe is closing in on 14.5 million, and more than 600,000 people have died. A full quarter of the cases and close to a quarter of the deaths have been reported from the USA; in this country, the number of fatalities due to the pandemic US has just reached 140,000.

Since the beginning of the year, investors have turned to the safe-haven metal, and this sentiment has been sustained, due to fears of the second wave of the coronavirus. As a result, the global equity market often moves lower, while trading in safe havens, like the US Dollar and gold, is bullish.

- Geopolitical Tensions

The reason for the high degree of uncertainty in the market could also be attributed to the prolonged geopolitical tensions between the US and the rest of the global economies. These include the European Union (EU), the UK and China. Furthermore, any activity that intensifies the US-China war pushes gold prices to record highs. Meanwhile, China and the US have fired fresh sanctions at each other, in the ongoing conflict that has made gold futures climb to lifetime highs.

Gold – XAU/USD Price Prediction for the Next 5 Years

Before we begin, let us clear one thing: most price forecasts aren’t worth more than an umbrella in a hurricane, as there are several factors that need to be considered, so many ever-changing variables, that even the most intelligent forecast usually misses the mark.

However, most of the traders are mainly driving their predictions on the basis of one point. “Interest rates will rise, so gold will fall.” Well, there are few other factors that I think will impact the price of gold this year:

1: The US dollar

2: Investment demand

3: Central bank buying

4: Trading volumes on COMEX

5: Technical indicators

6: New supply from the mines

7: Future economic and monetary factors.

Considering all these factors, the price of gold will hit a record high in the next 6 to 9 months. “However, there is a 30% probability it will go above $ 2,000 in the next 3-5 months.”

- 2020 United States presidential Elections

The biggest political event of the Year 2020 will be the US presidential election on November 3. Let me remind you how good Mr. Trump has been for Wall Street in his term of office, thus far. At the moment, Trump is facing an impeachment inquiry, and chances are that he will win it. But for the election in November, he is far from winning, with polls being more inclined towards the Democratic contender, Joe Biden.

Donald Trump has been targeting China in all kinds of ways, as part of his election campaign, and this will be good for Wall Street. As mentioned above, stocks have a negative correlation to gold prices, and this means anything that is good for Wall Street is bad for gold and vice versa.

If Trump wins the upcoming elections in November, the chances are that US stocks will rally, and gold prices will plunge. However, if his competitor Joe Biden wins the election, then US stocks will suffer, and gold will presumably head higher.

- Inflation – CPI (Consumer Price Index)

Inflation is a surge in the price of goods and services, and a higher level of inflation levels tends to push gold prices higher, while lower inflation, or deflation, weighs on gold prices. Inflation is almost always a sign of economic growth and expansion. Whenever the economy is growing and expanding, the Federal Reserve tends to increase the money supply.

This expanded money supply weakens each existing banknote in circulation, making it more expensive to buy asset that are a recognized store of value, such as gold. This is why there is an increased monetary supply when quantitative easing programs and bond-buying programs are introduced, and gold prices become positive in response.

Recently, when the coronavirus pandemic affected the global economy so severely, all big economies introduced more quantitative easing and increased their bond-buying programs, which in turn increased the money supply and raised inflation, and ultimately, this helped the gold prices to edge higher.

- Currency Movements

Another strong influencer of the gold prices is the movement of currencies, specifically the US dollar, as the gold price is dollar-denominated. As we know, the US dollar has a negative correlation with gold prices, and whenever the US dollar becomes strong, mainly because of the growing US economy, gold prices suffer. On the contrary, whenever the US dollar falls, it tends to push gold prices higher, as other currencies and commodities rise in value.

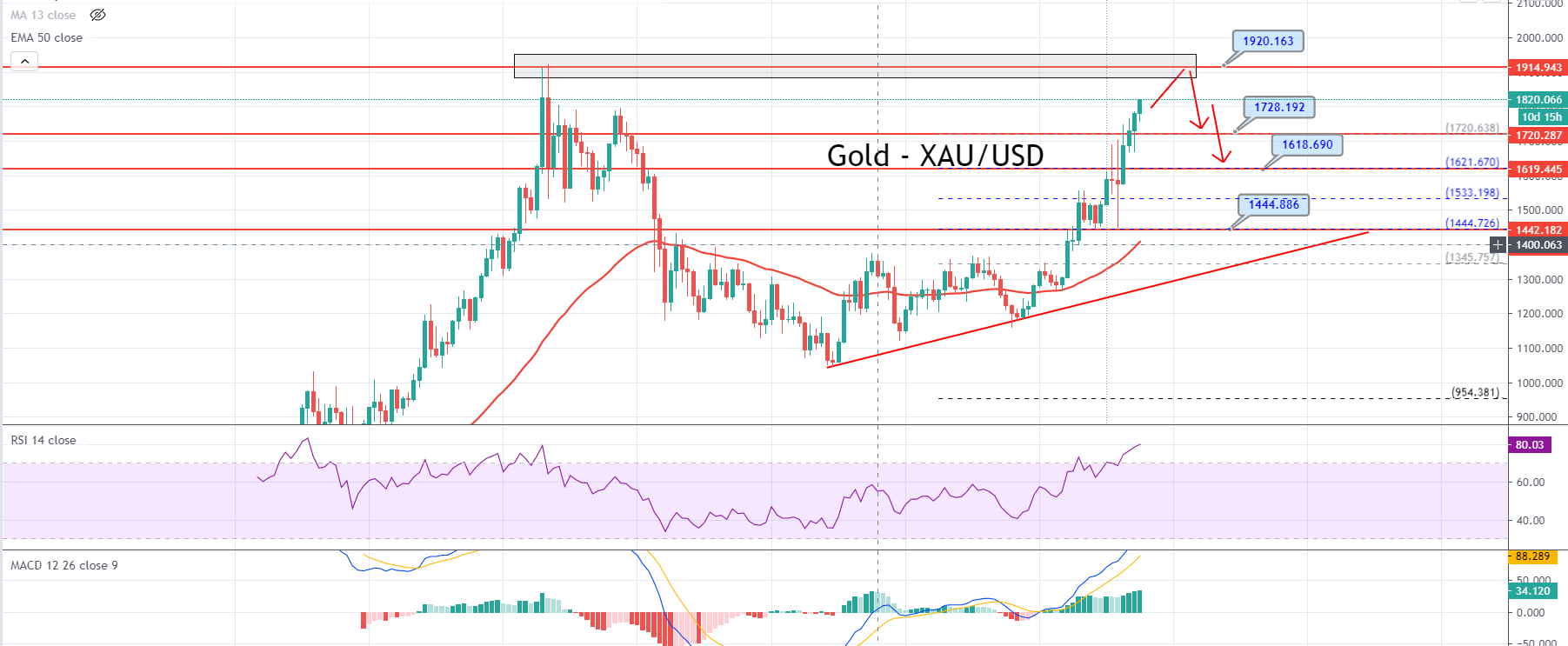

Technical Analysis – Can We Expect a Bearish Correction in Gold – XAU/USD?

Speaking about the technical side of the market, gold is trading with a solid bullish bias, having soared to the 1,806 level. In the monthly time-frame, the precious metal has formed the candlestick pattern “Three White Soldiers”, which suggests the odds of a continuation of the bullish trend. Besides this, the leading indicators, such as MACD and RSI, are holding above 0, and 50 respectively, which demonstrates the bullish bias in gold.

XAU/USD Three White Soldiers, RSI, MACD, and 50 EMA – All Suggest Buying

On the monthly chart, the 0-periods Exponential Moving Average suggests a strong bullish bias, but at the same time, it also suggests solid chances of a bearish correction, as it’s value stays at the 1,408 level, which is far away from the current market price of 1,808.

Speaking about gold price prediction, we can expect gold prices to continue their bullish trading, to form a double top resistance level at 1,916. Below the 1,916 level, the overbought precious metal, gold, could take a breather and trigger a bearish retracement until the 1,729 level, which marks the 23.6% Fibonacci level. Below this, the next support could be found around a 38.2% Fibonacci level of 1,630. Conversely, the bullish breakout on the 1,916 level could drive bullish bias until the 2,160 level, perhaps, during the year ahead. Let’s brace for the second half of the year and keep a closer eye on the fundamental side of the market.

Good luck!