10 Best Forex Brokers with Crypto Deposits

The 10 Best Forex Brokers with Crypto Deposits – Rated and Reviewed. We have taken the time to research several brokers to find the 10 Best that accept crypto deposits.

In this in-depth guide, you’ll learn:

- The Best Forex Brokers Accepting Crypto Deposits – a List.

- Forex Brokers that accept Crypto deposits and withdrawals.

- Can I deposit Bitcoin in my Forex Account?

- Can I Fund my Forex Account with Bitcoin?

and much, MUCH more!

10 Best Forex Brokers with Crypto Deposits – a Comparison

| 🔎 Forex Broker | 🪙 Coin Deposits | 💴 Min. Deposits (BTC) | 🚀 Open an Account |

| 🥇 FreshForex | ✅Yes | None | 👉 Click Here |

| 🥈 BDSwiss | ✅Yes | 0.00013935 BTC | 👉 Click Here |

| 🥉 Octa | ✅Yes | 0.00034832 BTC | 👉 Click Here |

| 🏅 AAAFx | ✅Yes | 0.00069664 BTC | 👉 Click Here |

| 🎖️ PrimeXBT | ✅Yes | 0.001 BTC | 👉 Click Here |

| 🥇 JustMarkets | ✅Yes | 0.00001393 BTC | 👉 Click Here |

| 🥈 EightCap | ✅Yes | 0.00139369 BTC | 👉 Click Here |

| 🥉 CMTrading | ✅Yes | 0.00139369 BTC | 👉 Click Here |

| 🏅 FP Markets | ✅Yes | 0.000970 BTC | 👉 Click Here |

| 🎖️ XBTFX | ✅Yes | 0.00013935 BTC | 👉 Click Here |

10 Best Forex Brokers with Crypto Deposits (2024)

- ☑️ FreshForex – Overall, the Best Forex Broker accepting Crypto Deposits

- ☑️ BDSwiss – Best MT4 Broker

- ☑️ Octa – Best Forex Broker for Beginners

- ☑️ AAAFx – Trade Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple.

- ☑️ PrimeXBT – Best Online Trading Experience

- ☑️ JustMarkets – Low Spreads and High Leverage

- ☑️ EightCap – Excellent Account Offerings

- ☑️ CMTrading – Low Minimum Deposit

- ☑️ FP Markets – Wide Selection of withdrawal and deposit Options

- ☑️ XBTFX – Excellent all-round offering

FreshForex

As a trusted and well-established Forex Broker, FreshForex is based in Saint Vincent and the Grenadines. It allows traders to fund trading accounts in various methods, including LTC, ETH, BTC, and BCH.

The processing time on these deposits might vary, but they are typically processed instantly, depending on network speed and connection.

| 🔎 Broker | 🥇 FreshForex |

| 📈 Regulation | None |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏰ Non-expiring Demo | None |

| ⏱️ Demo Duration | 30 days |

| 💰 Coin Deposit | ✅Yes |

| 🪙 Coin Withdrawal | ✅Yes |

| ⏲️ Minimum Deposit Time | Instant |

| ⌚ Instant Deposits Offered | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Traders can use several cryptocurrencies to fund their FreshForex Accounts | FreshForex is not regulated |

| FreshForex does not charge deposit fees on cryptocurrencies | Blockchain fees might apply to crypto deposits |

BDSwiss

Firstly, BDSwiss is a well-regulated broker that does not impose internal fees on deposits, allowing traders to save costs.

It offers a safe trading environment and ensures that all payment portals are secure and protected. Traders can expect client fund segregation, where BDSwiss separates client deposits and funds from its operational capital.

| 🔎 Broker | 🥇 BDSwiss |

| 📈 Regulation | CySEC, FSC, BaFIN, FSA |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏰ Non-expiring Demo | None |

| ⏱️ Demo Duration | 30 days |

| 💰 Coin Deposit | ✅Yes |

| 🪙 Coin Withdrawal | ✅Yes |

| ⏲️ Minimum Deposit Time | Instant |

| ⌚ Instant Deposits Offered | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| BDSwiss offers free deposits across payment methods | Blockchain fees might apply |

| Traders can choose from several popular crypto coins for deposits | Beginners might find the range of payment options intimidating |

Octa

Octafx, or Octa, is a popular broker that has been operating since 2011. Octa offers market-leading trading conditions across account types, with tight spreads and zero commission fees. Traders registering an account with Octa can choose from several flexible deposit methods.

With a choice between several popular coins, traders can easily fund their Octa Account to start trading various markets. In addition, Octa is well-regulated by three entities and follows stringent rules about fund segregation.

| 🔎 Broker | 🥇 Octa |

| 📈 Regulation | CySEC, SVG FSA, FSCA |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏰ Non-expiring Demo | None |

| ⏱️ Demo Duration | 30 days |

| 💰 Coin Deposits | ✅Yes |

| 🪙 Coin Withdrawal | ✅Yes |

| ⏲️ Minimum Deposit Time | Instant – 3 hours |

| ⌚ Instant Deposits Offered | ✅Yes |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Octa is regulated in three regions | Offers fewer crypto coins that can be used to fund accounts |

| The broker has established itself as a trustworthy broker | Crypto deposits can take up to 3 hours |

AAAFx

Firstly, AAAFx is a forex and CFD broker in Greece and South Africa. It is known for its versatile deposit and withdrawal methods. AAAFx does not charge internal fees and offers up to 5% reimbursement when traders face deposit fees.

Furthermore, AAAFx supports top coins that can be used for account funding, allowing traders to use their native wallets without needing to obtain another.

| 🔎 Broker | 🥇 AAAFx |

| 📈 Regulation | FSCA, HCMC |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏰ Non-expiring Demo | None |

| ⏱️ Demo Duration | 30 days |

| 💰 Coin Deposit | ✅Yes |

| 🪙 Coin Withdrawal | ✅Yes |

| ⏲️ Minimum Deposit Time | Instant |

| ⌚ Instant Deposits Offered | 2 – 3 days |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Deposits and withdrawals are free with AAAFx | There are limited crypto coins offered for deposits |

| Instant deposits are available with AAAFx | Traders incur deposit fees |

PrimeXBT

This is a broker that focuses on providing fast, reliable deposits to traders. PrimeXBT does not charge any deposit fees, but blockchain fees might apply, which are the responsibility of traders.

Furthermore, with PrimeXBT, traders can register a standard account and the broker offers a demo trading contest, which is extremely rare.

| 🔎 Broker | 🥇 PrimeXBT |

| 📈 Regulation | None, registered in Seychelles and Marshall Islands |

| ☪️ Islamic Account | None |

| 🆓 Demo Account | ✅Yes |

| ⏰ Non-expiring Demo | None |

| ⏱️ Demo Duration | Depends on the contest terms |

| 💰 Coin Deposit | ✅Yes |

| 🪙 Coin Withdrawal | ✅Yes |

| ⏲️ Minimum Deposit Time | Instant |

| ⌚ Instant Deposits Offered | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| PrimeXBT emphasizes crypto trading, offering traders tailormade solutions | PrimeXBT is not regulated |

| Traders can deposit funds in several crypto-coins | There are limited deposit methods offered |

| There are no internal deposit fees | There are limited non-crypto trading options |

JustMarkets

A popular option for traders who want versatile trading accounts, JustMarkets offers competitive trading conditions and access to quick and easy deposits. JustMarkets offers transparent schedules, powerful trading platforms, and a range of tradable instruments.

It is well-regulated in four regions and guarantees client fund security. JustMarkets keeps all client funds in segregated accounts and provides several security features on the website.

| 🔎 Broker | 🥇 JustMarkets |

| 📈 Regulation | FSA, CySEC, FSCA, FSC |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏰ Non-expiring Demo | None |

| ⏱️ Demo Duration | 30 days |

| 💰 Coin Deposit | ✅Yes |

| 🪙 Coin Withdrawal | ✅Yes |

| ⏲️ Minimum Deposit Time | 5 minutes |

| ⌚ Instant Deposits Offered | Near-instant |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| JustMarkets guarantees fast processing time across all deposit methods | JustMarkets’ range of deposit options might be overwhelming to beginners |

| Traders can choose from several cryptocurrencies for their deposits | Blockchain fees could apply |

Eightcap

Operational since 2009, Eightcap is a reliable trading partner for forex and CFD. Furthermore, Eightcap uses robust and modern technologies to offer traders the best trading experience.

In addition to this, Eightcap supports deposits in several coins that can be used to fund a trading account. Eightcap also ensures that all client funds are kept segregated from its operating capital.

| 🔎 Broker | 🥇 Eightcap |

| 📈 Regulation | CySEC, SCB, ASIC, FCA |

| ☪️ Islamic Account | None |

| 🆓 Demo Account | ✅Yes |

| ⏰ Non-expiring Demo | None |

| ⏱️ Demo Duration | 30 days |

| 💰 Coin Deposit | ✅Yes |

| 🪙 Coin Withdrawal | ✅Yes |

| ⏲️ Minimum Deposit Time | Instant |

| ⌚ Instant Deposits Offered | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Eightcap is well-regulated and has built a good reputation | Eightcap offers limited account base currencies, and crypto is not featured |

| Eightcap offers multilingual support if traders ever struggle with deposits | Blockchain fees might apply to Eightcap’s crypto deposits |

CMTrading

First, CMTrading is one of the best brokers and offers competitive trading conditions. CMTrading allows traders to use LTC, ETH, and BTC to fund their Bronze, Silver, Gold, or Premium Accounts.

| 🔎 Broker | 🥇 CMTrading |

| 📈 Regulation | FSA, FSCA |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏰ Non-expiring Demo | ✅Yes |

| ⏱️ Demo Duration | Unlimited |

| 💰 Coin Deposit | ✅Yes |

| 🪙 Coin Withdrawal | ✅Yes |

| ⏲️ Minimum Deposit Time | Instant |

| ⌚ Instant Deposits Offered | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Traders can use instant deposits with CMTrading | Blockchain fees could apply |

| CMTrading offers competitive trading conditions | Deposit fees are charged on cryptocurrencies |

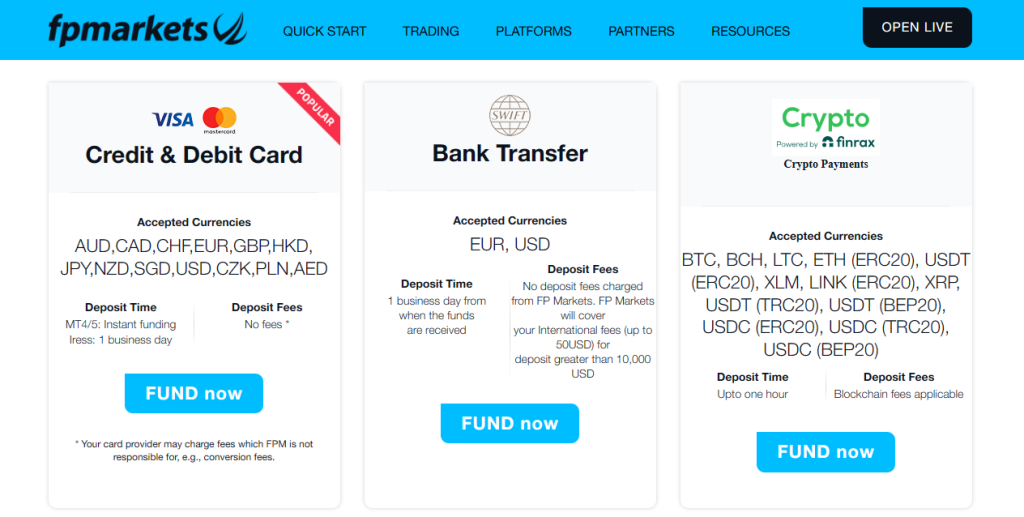

FP Markets

As a well-established broker, FP Markets provides traders access to over 10,000 financial instruments. Furthermore, FP Markets also allows traders to fund their trading accounts using BTC, ADA, PAX, ZEC, ETH, and several other coins.

It guarantees short processing times and keeps all client funds segregated from its operational capital.

| 🔎 Broker | 🥇 FP Markets |

| 📈 Regulation | ASIC, CySEC, FSCA, FSA, FSC |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏰ Non-expiring Demo | If the demo account remains active |

| ⏱️ Demo Duration | 30 days if it becomes inactive |

| 💰 Coin Deposit | ✅Yes |

| 🪙 Coin Withdrawal | ✅Yes |

| ⏲️ Minimum Deposit Time | 1 hour |

| ⌚ Instant Deposits Offered | None |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Traders can trust FP Markets with their deposits | Blockchain fees might apply |

| There are several crypto coins available as deposit currencies | There are limited crypto instruments available for trading |

XBTFX

The broker offers a wide range of assets and traders can deposit using BTC, LTC, DOGE, ETH, XRP, USDT, and USDC. Traders are not subject to deposit fees with XBTF, but blockchain fees might apply depending on the blockchain.

| 🔎 Broker | 🥇 XBTFX |

| 📈 Regulation | None |

| ☪️ Islamic Account | On ECN only |

| 🆓 Demo Account | ✅Yes |

| ⏰ Non-expiring Demo | ✅Yes |

| ⏱️ Demo Duration | Unlimited |

| 💰 Coin Deposit | ✅Yes |

| 🪙 Coin Withdrawal | ✅Yes |

| ⏲️ Minimum Deposit Time | Same-day |

| ⌚ Instant Deposits Offered | None |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Deposit and withdraw using crypto | XBTFX is not regulated |

| Low minimum deposit of 10 USD | There are limited deposit methods |

| Low and competitive commissions | XBTFX offers limited crypto coins for deposits |

| cTrader, MT4, and MT5 | There are no instant deposits on crypto |

Why do Forex Brokers offer Crypto Deposits?

There is a new wave of forex traders who are tech-savvy and who want more diversified investment avenues in modern financial markets. Because there is a growing appetite for decentralized money, forex brokers are integrating these payment options into their platforms.

This allows brokers and traders to leverage the transaction speed, decentralization, and overall reduction in transaction costs. Apart from their transactional benefits, these types of deposits show traders that brokers are committed to advancing technologically.

It also shows that brokers are aligning their goals with traders’ needs regarding transaction privacy.

How to Choose The Right Forex Broker for Crypto Deposits

Regulatory Compliance and Credibility

Before selecting a forex broker to trade financial markets, especially one offering these types of deposits, you must evaluate the broker’s regulatory compliance and credibility.

Confidence is crucial in online trading. Therefore, choosing a broker registered with and licensed by reputable entities provides traders with safety and guarantees fairness.

Choosing a regulated broker is not only about guaranteeing that client funds are safe, but it also offers dispute resolution when there are issues between a broker and their clients.

Traders can easily evaluate a broker’s regulation and credibility by checking their licenses on the websites of regulatory entities, reading reviews, and asking about them online.

Evaluating Withdrawal and Deposit Terms

You must understand the broker’s unique terms before making crypto deposits. You must understand which digital coins are accepted, what the transaction speeds are, and whether there are any associated costs.

Luckily, many brokers provide instant deposits with cheap charges, making them appealing to traders who prioritize efficiency and low expenses.

Furthermore, traders must consider the withdrawal procedure since having easy access to funds is vital. Therefore, a broker who offers simple, quick withdrawals with clear rules demonstrates a user-centric strategy that prioritizes your convenience and financial autonomy.

Consider the Trading Features and Support

The trading platform is your entry point into the trading markets. Therefore, its features and support system are essential components to help you achieve trading success.

Traders must look for solutions that provide powerful analytical capabilities, real-time data, and user-friendly interfaces.

Overall, regardless of Whether you are an experienced trader or just getting started, these features can have a major influence on your ability to make educated judgments.

Furthermore, a broker that provides extensive client support, such as instructional materials and prompt help, demonstrates a dedication to your trading performance and overall pleasure.

Risks and Considerations of Crypto Deposits

Market Volatility and its Impact

The decentralized finance markets are inherently volatile, which can add another risk element when traders deposit funds via coins.

The value of decentralized money can change dramatically over short periods, influencing the real amount of your investment when it is converted and available in the trading account.

Therefore, market volatility necessitates a careful approach. Traders must remain informed about market developments and attempt to time their deposits to prevent negative effects on their trading money.

Security Concerns and Protecting Your Assets

One of the most important things when dealing with decentralized money is safeguarding your funds and mitigating risks. As it is digital, it is vulnerable to cyber theft and fraud.

Consider brokers who offer advanced encryption security, cold wallets, and 2FA.

In Conclusion

According to our research, while most brokers still prefer offering conventional deposit payment methods, many others have started offering coins as an option. This move demonstrates a progressive intersection between the typical forex markets and digital currencies.

In our experience, these deposits open avenues for diversification and offer traders more flexibility with their deposits.

You might also like:

Frequently Asked Questions

Can I use Bitcoin to fund my Forex trading account?

Yes, some forex brokers currently accept multiple coin options as deposits.

What are the benefits of using this method for forex deposits?

Compared to other ways, such as bank transfers or credit cards, these types of deposits can provide faster processing times, reduced transaction costs, and enhanced anonymity.

Can I withdraw my forex profits in Coins?

Yes, if a broker accepts these deposits, they typically accept and support similar withdrawals.