Crypto Guide: What Are Crypto Trading Bots?

Last Update: September 9th, 2024

In the ever-evolving world of cryptocurrency, crypto trading bots have become an essential tool for maximizing profits and minimizing risks. Automated crypto trading bots allow traders to execute trades at the right time and at the optimal price, offering advantages such as customizability and ease of use for different market conditions, which is crucial in a market as volatile and fast-paced as the cryptocurrency market.

Whether you’re a beginner or an advanced trader, understanding how crypto trading bots work can help you make better trading decisions and automate the trading process to maximize your potential returns.

In this guide, we’ll explore the role of crypto trading bots, their evolution, and how they function in today’s complex and expanding cryptocurrency markets. We will also highlight key features, trading strategies, and the advantages of automated crypto trading.

Introduction to Crypto Trading Bots

Crypto trading bots are computer programs that use artificial intelligence and advanced algorithms to automate the buying and selling of cryptocurrencies. These bots simplify the trading process by leveraging real-time and historical market data to make informed trading decisions.

One of the key advantages of crypto trading bots is their ability to operate 24/7, allowing traders to take advantage of market opportunities even when they cannot actively monitor the market. By automating trades, these bots can help traders maximize their potential returns and minimize risks in the highly volatile crypto market.

The Evolution of Crypto Trading Bots

Early Days of Crypto and Automated Trading

The crypto market began with the introduction of Bitcoin in 2009, and in just over a decade, it has grown into a highly diverse ecosystem featuring thousands of cryptocurrencies. In parallel, the development of crypto trading bots followed closely behind. The first wave of crypto trading bots emerged soon after Bitcoin’s popularity took off, largely based on existing automated trading systems that had been successfully used in traditional financial markets like stocks, forex, and commodities.

By 2011, with the introduction of Litecoin and other alternative coins (altcoins), the need for automation became more apparent, as traders sought ways to capitalize on the market’s increasing volatility. Automated trading systems were quickly adapted to the crypto markets, and crypto bots began to evolve to match the unique demands of these new digital assets.

The Crypto Bot Boom of 2017 and Beyond

The real boom in crypto trading bots occurred in late 2017 during the historic bull run, when Bitcoin and other cryptocurrencies surged to all-time highs. During this period, the emergence of the crypto trading bot platform provided user-friendly automated trading solutions that catered to both beginners and experienced traders with features like customizable bots and no coding requirements. With cryptocurrency prices skyrocketing, crypto trading bots became even more necessary for traders seeking to manage large volumes of trades and capitalize on the extreme volatility of the crypto markets.

Since then, these bots have continued to evolve, leveraging advanced artificial intelligence (AI), machine learning, and sophisticated technical indicators to become a mainstay of modern crypto trading. Today, they are widely used across the globe by professional traders, institutions, and retail investors alike, enabling them to stay competitive in the highly dynamic cryptocurrency markets of 2024.

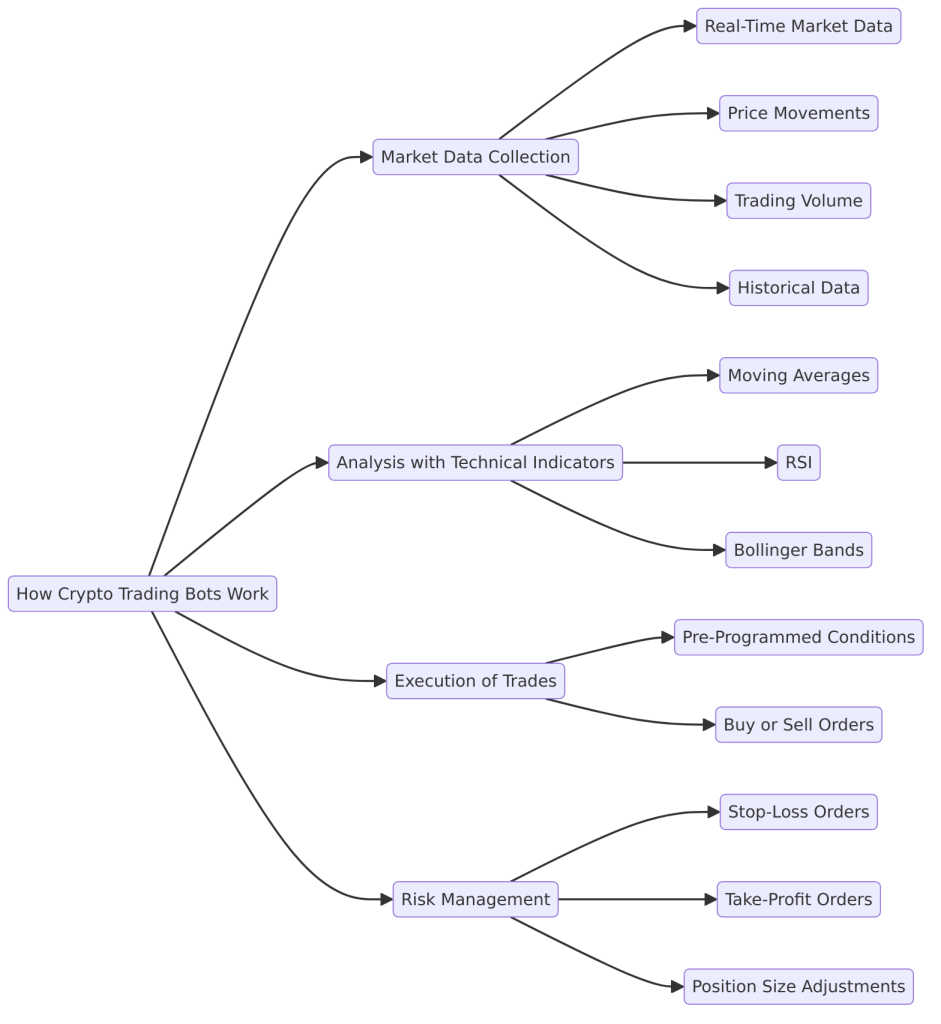

How Crypto Trading Bots Work

At their core, crypto trading bots are automated software programs designed to execute trades based on predefined rules and algorithms. These bots can perform tasks like market evaluation, technical analysis, and statistical calculations—all without requiring constant manual intervention. As a result, traders can participate in the market 24/7, even while they sleep, ensuring they don’t miss out on lucrative opportunities in the ever-active cryptocurrency markets.

Here’s a breakdown of how they function:

- Market Data Collection: The bot collects and analyzes vast amounts of real-time market data from various crypto exchanges, including price movements, trading volume, and historical data.

- Analysis with Technical Indicators: Using a combination of technical indicators such as moving averages, Relative Strength Index (RSI), or Bollinger Bands, the bot predicts future market movements, potential price trends and generate trading signals.

- Execution of Trades: Once the bot identifies a profitable opportunity, it automatically places buy or sell orders based on pre-programmed conditions, such as a certain price level being hit or a specific technical indicator triggering an action.

- Risk Management: Bots can be set up to automatically execute stop-loss and take-profit orders, as well as adjust position sizes according to market volatility, ensuring that trades are made within defined risk parameters.

By automating these processes, crypto bots make it easier for traders to manage their portfolios, even in highly volatile markets, without needing to be glued to their screens.

Automated Trading Strategies

Automated trading strategies are the backbone of crypto trading bots. These strategies are designed to execute trades based on predefined parameters, such as price movements, technical indicators, and market trends.

By automating the trading process, crypto trading bots can help traders save time and reduce emotional decision-making.

For instance, a bot can be programmed to buy a cryptocurrency when its price drops to a certain level and sell it when the price rises, ensuring that trades are executed consistently according to the strategy.

This automation allows traders to focus on refining their strategies rather than constantly monitoring the market.

Use of Algorithms and Technical Indicators

Crypto trading bots use sophisticated algorithms and technical indicators to analyze market data and make trading decisions. These algorithms can be based on various technical indicators, such as moving averages,

Bollinger Bands, and the Moving Average Convergence Divergence (MACD). By combining these indicators, crypto trading bots can identify trading opportunities and execute trades accordingly.

For example, a bot might use moving averages to determine the overall trend of a cryptocurrency and Bollinger Bands to identify potential entry and exit points.

This analytical approach helps ensure that trades are made based on data-driven insights rather than guesswork.

Integration With Crypto Exchanges

Crypto trading bots can be integrated with various crypto exchanges, allowing traders to execute trades on multiple platforms. This integration is typically done through APIs (Application Programming Interfaces), which enable the bot to access the exchange’s trading data and execute trades.

By integrating with multiple exchanges, crypto trading bots can provide traders with a wider range of trading opportunities and the ability to capitalize on price discrepancies across different platforms.

This seamless integration ensures that the bot can operate efficiently and effectively, maximizing the trader’s potential returns.

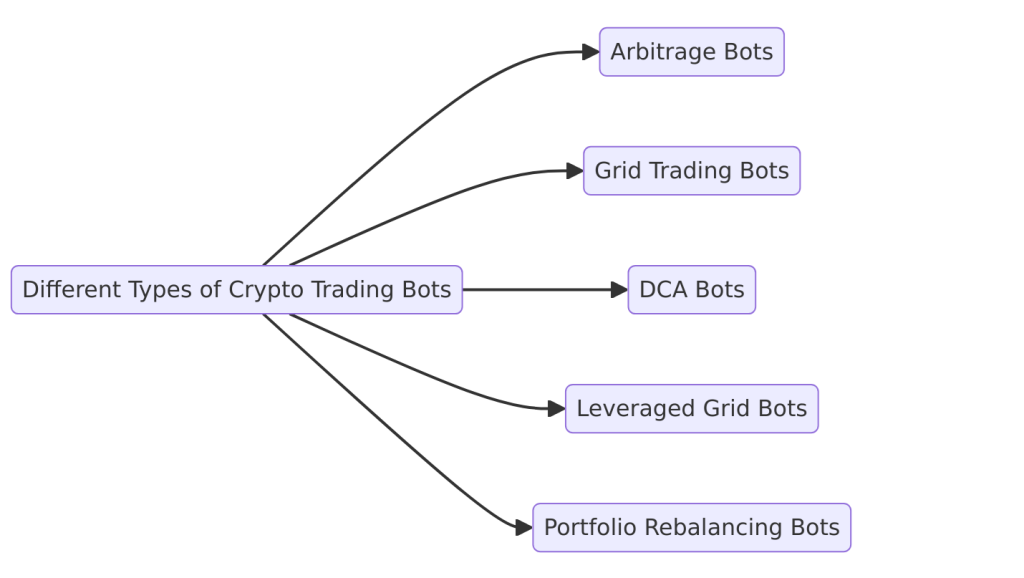

Different Types of Crypto Trading Bots

4.1 Arbitrage Bots

Arbitrage bots are one of the most popular types of crypto trading bots. These bots take advantage of price discrepancies across different crypto exchanges by simultaneously buying and selling the same asset on multiple platforms. Given that cryptocurrency prices can vary slightly from exchange to exchange, arbitrage bots can profit from these differences without being exposed to market risk.

For example, a bot might buy Bitcoin on one exchange where the price is lower and immediately sell it on another exchange where the price is higher, pocketing the difference as profit.

4.2 Grid Trading Bots

Grid trading bots are designed to execute the grid trading strategy, which involves placing a series of buy and sell orders at incremental price levels above and below a set price. This strategy is ideal for sideways markets where the price fluctuates within a predictable range. The bot continuously buys low and sells high within the grid, generating small profits from each trade.

4.3 Dollar-Cost Averaging (DCA) Bots

Dollar-cost averaging (DCA) is a common investment strategy where a fixed amount of money is invested in a cryptocurrency at regular intervals, regardless of its price. DCA bots automate this process by regularly buying small amounts of cryptocurrency over time, reducing the risk of investing a large sum when the market is at a peak.

4.4 Leveraged Grid Bots

For advanced traders, leveraged grid bots offer the opportunity to apply leverage to their grid trading strategy. By borrowing funds, traders can increase their exposure to price movements and potentially amplify profits. However, it’s important to note that this also increases the potential risk, so it’s best suited for traders with a high tolerance for risk.

4.5 Portfolio Rebalancing Bots

Portfolio rebalancing bots help traders maintain an optimal allocation of assets within their cryptocurrency portfolio. For instance, if one asset grows in value more than others, the bot will automatically sell a portion of the over-performing asset and reinvest in underperforming ones, ensuring that the portfolio remains balanced according to the trader’s preferences.

Cloud-based vs. server-based bots

Crypto trading bots can be either cloud-based or server-based, each offering distinct advantages. Cloud-based bots are hosted on remote servers and can be accessed through a web interface, making them convenient and requiring less maintenance. They are ideal for traders who prefer a hands-off approach and want their bots to run continuously without the need for constant monitoring. On the other hand, server-based bots are installed on a local computer and require the computer to be constantly running. While they may require more maintenance, server-based bots offer more control and customization options, making them suitable for traders who want to fine-tune their trading strategies.

Social trading and copy trading bots

Social trading and copy trading bots are a type of crypto trading bot that allows traders to follow and copy the trades of other successful traders. These bots can be integrated with social trading platforms, where traders can share their trading strategies and performance. By copying the trades of successful traders, novice traders can learn from their strategies and improve their own trading performance. This approach not only helps beginners gain confidence but also provides an opportunity to profit from the expertise of more experienced traders. Social trading and copy trading bots democratize access to advanced trading strategies, making it easier for everyone to participate in the crypto market.

Where to Get a Crypto Trading Bot

There are two main ways to obtain a crypto trading bot: you can either build one yourself or purchase a ready-made solution.

Build Your Own Crypto Trading Bot

If you’re an IT developer or have coding experience, you can create a custom bot tailored to your specific trading strategies.

- Custom Algorithms: Write algorithms based on technical indicators like price levels, pivot points, and moving averages.

- Strategy Flexibility: The bot can either execute trades automatically or generate buy/sell signals for you to act on.

- Platform Integration: After coding, the bot can be implemented on your chosen trading platform.

Purchase a Pre-Built Trading Bot

For non-developers, many platforms offer user-friendly tools for bot creation, making it accessible to all traders.

- Drag-and-Drop Interface: Easily build a bot without coding by selecting indicators such as moving averages, RSI, or Bollinger Bands.

- Pre-Set Bots: Choose from a variety of pre-built bots designed for specific strategies like arbitrage, grid trading, or market-making.

Key Considerations When Buying a Bot

- Cost: Many advanced bots come at a premium price, especially those offering highly profitable strategies.

- Track Record: Ensure the bot is reliable, with a proven history of good performance.

- Customer Support: Check if the platform offers strong customer support to help troubleshoot issues.

Security and API Access

When using a trading bot, you will need to authorize it to access your crypto exchange accounts via API keys.

- API Access: This allows the bot to place trades on your behalf.

- Security: Most platforms allow you to manage permissions and revoke access anytime, providing extra security.

Summary: Whether you choose to build your own bot or purchase a pre-built one, ensure that it aligns with your trading goals, risk tolerance, and technical skills.

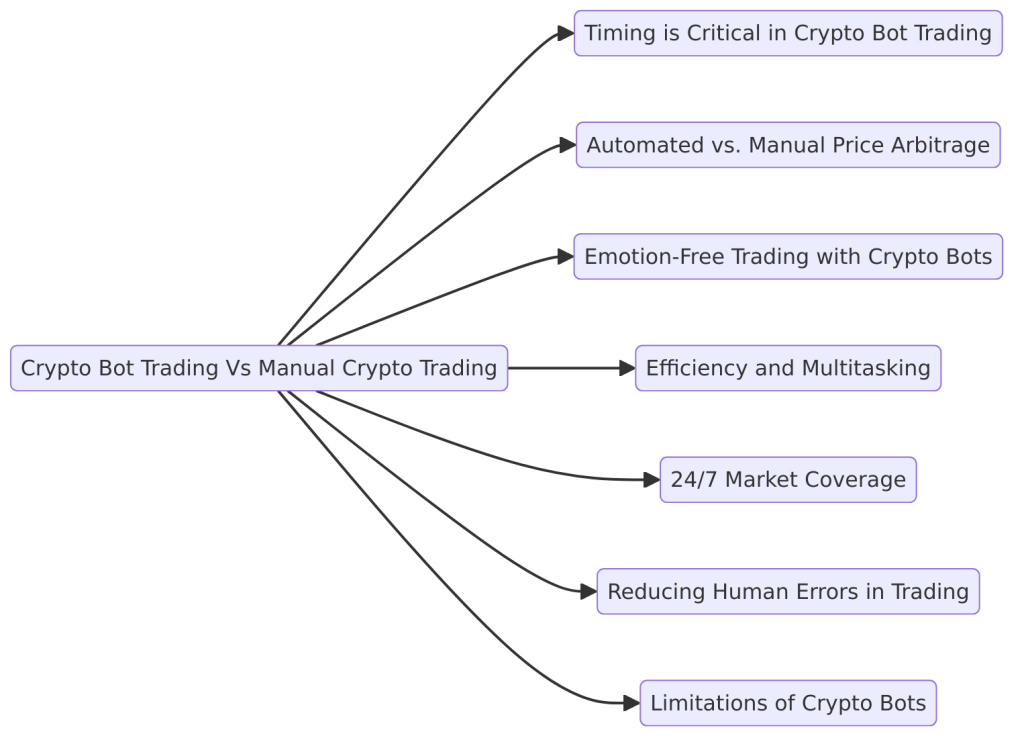

Crypto Bot Trading Vs Manual Crypto Trading

In the world of cryptocurrency trading, a fundamental debate has emerged: should traders rely on crypto trading bots to automate their strategies, or is manual trading still the superior approach? This discussion mirrors a longstanding debate in traditional financial markets, but with one crucial difference—cryptocurrencies are far more volatile than assets like stocks, forex, or even commodities like oil and gold.

This volatility makes the decision between automated and manual trading even more critical for both beginner traders and experienced traders. Let’s take a closer look at the key differences between crypto bot trading and manual crypto trading, highlighting the advantages and potential pitfalls of each.

Timing is Critical in Crypto Bot Trading

Speed and Precision in Execution

One of the most significant advantages of crypto trading bots is their ability to execute trades instantaneously, which is vital in the ever-volatile crypto markets. Timing is everything, and in a market where prices can move by several percentage points within seconds, bots have the upper hand. A crypto bot can scan the market, identify opportunities, and place trades at precisely the right moment, all within a fraction of a second.

In contrast, manual trading often suffers from delays. Even the most experienced trader might struggle to react quickly enough to capitalize on fast-moving market conditions. Many traders have missed out on potential profits by hesitating or failing to place trades in time, especially when trying to catch the “perfect” price. By the time a human can react, the market may have already shifted.

Automated vs. Manual Price Arbitrage

This speed is especially advantageous in arbitrage trading, where crypto bots can instantly exploit price differences across various crypto brokers. While a human trader may take several minutes to identify these discrepancies and place the trades, a bot can act immediately, maximizing profit before the opportunity disappears.

Emotion-Free Trading with Crypto Bots

The Pitfalls of Emotional Decision-Making in Manual Trading

Human emotions can be a trader’s worst enemy. Even seasoned traders can fall prey to fear, greed, or overconfidence, leading to impulsive decisions that deviate from their original strategy. The crypto market is particularly prone to triggering emotional responses due to its wild price swings. For example, a trader might panic sell during a market dip or hold onto a losing position for too long, hoping for a rebound.

Crypto bots, on the other hand, are immune to emotional interference. They execute trades based solely on data and pre-programmed rules. Whether the market is crashing or surging, the bot sticks to the strategy, ensuring that trades are made consistently according to preset conditions. This is especially useful during times of extreme volatility, where emotional traders might make rash decisions that lead to substantial losses.

Consistency in Execution

One of the major benefits of automated trading is its ability to stick to a plan without deviation. Crypto bots don’t suffer from hesitation or second-guessing. They simply execute the strategy they’ve been programmed to follow, whether that’s grid trading, dollar cost averaging, or arbitrage trading. This level of consistency is difficult to achieve in manual trading, where emotions and market noise can cloud judgment.

Efficiency and Multitasking: The Power of Automation

Managing Multiple Trades Simultaneously

Crypto bots excel in efficiency, especially when it comes to managing multiple trades and assets. In a market as fast-paced as cryptocurrency, keeping track of several positions at once is challenging for any manual trader. Each trade requires monitoring, adjusting, and precise timing to open or close positions at the right price. For human traders, this can be overwhelming—especially when dealing with multiple cryptocurrencies and various trading pairs across different exchanges.

In contrast, crypto trading bots can handle this effortlessly. They can multitask, monitoring multiple trades in real-time, executing transactions based on preset criteria, and making adjustments to positions without missing a beat. This increased efficiency often translates to more profitable trades and better overall portfolio management.

Scalable Strategies for Higher Profits

When trading manually, scaling up your strategy—such as trading across different cryptocurrencies or increasing the number of trades—becomes increasingly difficult. Human traders are limited by time and attention, making it impossible to optimize every trade in real-time.

With crypto bots, scaling is simple. A bot can manage hundreds of small trades across different cryptocurrencies, making it an ideal solution for those who trade in large volumes or want to apply strategies like grid trading across multiple assets. This scalability can lead to higher overall profits, especially in a market as dynamic as cryptocurrency.

24/7 Market Coverage: A Major Advantage for Bots

Around-the-Clock Trading

One of the most significant advantages of crypto trading bots is their ability to operate 24/7, offering constant market coverage. Unlike traditional financial markets, crypto markets never close. Prices fluctuate continuously, making it essential to have a system in place that can monitor and trade at any hour of the day or night.

For human traders, maintaining this level of vigilance is impossible. No one can monitor the markets non-stop. Even if you’re awake during peak trading hours, there’s always the possibility of missing significant price movements that occur while you’re asleep. This is where crypto bots shine. They can monitor the markets day and night, ensuring that no opportunity goes unnoticed.

Reducing Human Errors in Trading

Common Mistakes in Manual Trading

Human traders are prone to errors, whether it’s placing the wrong trade size, selecting the incorrect trading pair, or miscalculating entry and exit points. These errors can be costly, especially in the crypto markets, where precision is critical, and tiny mistakes can lead to significant losses.

For example, accidentally entering a trade for $50,000 instead of $5,000 in Bitcoin, or misplacing a decimal in Shiba Inu, can result in drastically different outcomes. Crypto bots eliminate these errors by executing trades based on pre-defined rules and conditions, ensuring that mistakes are minimized or avoided altogether.

Flawless Execution with the Right Algorithm

As long as the crypto bot is powered by a well-designed algorithm, it will make fewer, if any, mistakes. It will execute the strategy precisely as programmed, handling everything from buy and sell orders to risk management protocols. However, it’s crucial to regularly monitor and update the bot’s algorithm to keep pace with changing market conditions.

Continuous Monitoring and Adaptation

While crypto bots can execute strategies autonomously, they are not entirely maintenance-free. Market sentiment and conditions can shift rapidly, especially in the crypto space, where news, regulations, and macroeconomic factors can cause sharp market movements. The strategy that worked last week may not be as effective today.

As a result, even when using bots, traders need to keep a pulse on the market and regularly adjust their trading strategies. A bot that is not regularly updated may underperform or fail to adapt to changing market trends. Therefore, a balance between automation and human oversight is key to long-term success.

Limitations of Crypto Bots: Limited Cryptocurrencies and Missed Opportunities

Restriction to Specific Cryptocurrencies

Many crypto trading bots are designed to work with a limited number of cryptocurrencies, which can restrict a trader’s ability to diversify their portfolio. For example, a Bitcoin bot will only trade Bitcoin, and while this might be sufficient for some traders, others may want to capitalize on emerging altcoins like Cardano (ADA), Solana (SOL), or Polkadot (DOT).

Unfortunately, older bots may not support newer cryptocurrencies, leading to missed opportunities. In contrast, manual trading offers flexibility, allowing traders to quickly adapt to new cryptocurrencies as they emerge and take advantage of strong market rallies in newly launched tokens.

Best Crypto Bots Review

1. 3commas.io

3commas.io is one of the leading crypto trading platforms that enables users to automate their trading strategies using advanced bots. Launched in 2017, the platform is integrated with more than 23 crypto exchanges, providing a seamless trading experience for crypto traders of all levels. 3commas offers an easy-to-use interface with powerful features that can cater to both beginner traders and professional traders.

Key Features of 3commas:

- Customizable Bot Parameters: 3commas allows users to set up their own crypto trading bot parameters, making it easy to automate specific strategies based on market data and technical indicators.

- Financial Protection Algorithms: The platform offers advanced risk management features, such as stop-loss and take-profit functions, to minimize potential losses and lock in profits.

- TradingView Integration: For more advanced traders, 3commas integrates with TradingView, a popular platform for technical analysis and trading signals. This allows users to set up more sophisticated bots that respond to trading signals generated by TradingView’s tools.

- Supports 23 Crypto Exchanges: The platform is compatible with a wide variety of major crypto exchanges, including Binance, Coinbase Pro, Kraken, KuCoin, and more, giving users flexibility in where they choose to trade.

- Copy Trading and Portfolio Analysis: One standout feature is the ability to follow successful traders and copy their strategies. The copy trading function allows users to replicate the trades of more experienced traders, which is particularly beneficial for those new to the market. Additionally, users can analyze their portfolios across all exchanges in one place.

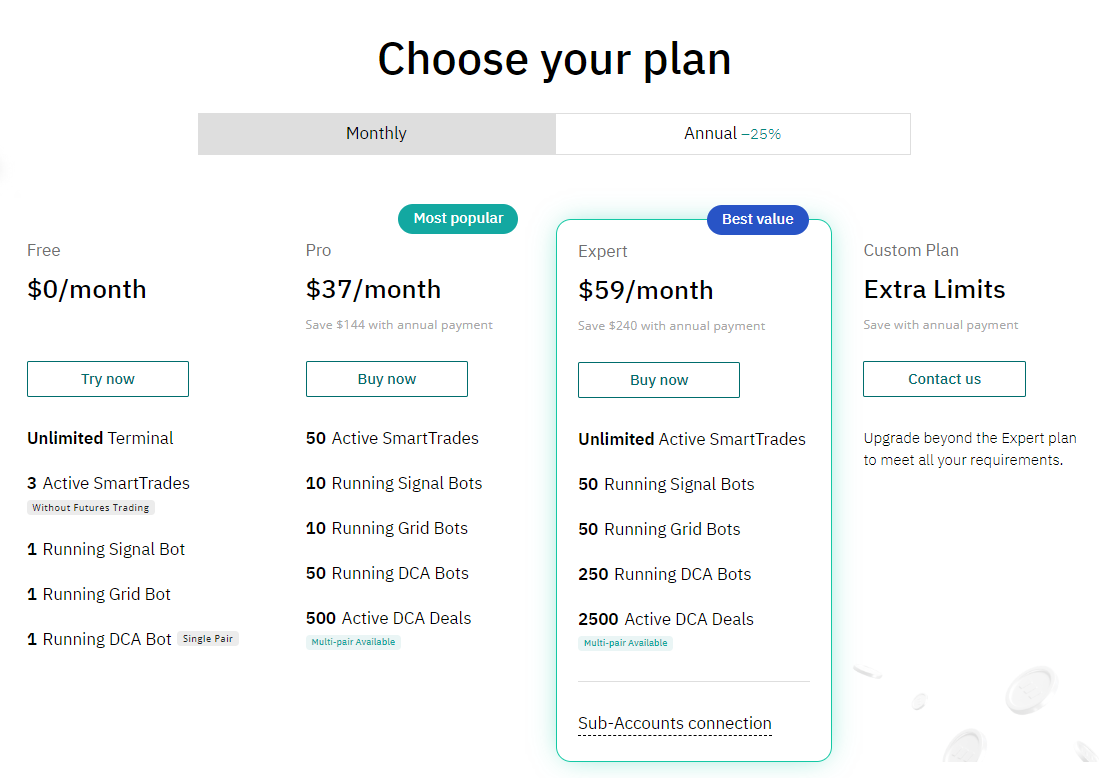

Pricing Plans:

3commas offers four subscription tiers:

- Free: Includes basic features like 3 active SmartTrades, 1 running bot for each type (Signal, Grid, DCA), ideal for beginners trying out the platform.

- Pro ($37/month): Provides 50 active SmartTrades, 10 running Signal Bots, Grid Bots, and DCA Bots, making it suitable for traders looking to expand their strategies.

- Expert ($59/month): Unlocks unlimited SmartTrades, 50 running Signal and Grid Bots, 250 DCA Bots, and 2500 active DCA deals, offering comprehensive tools for advanced traders.

- Custom Plan: For users needing higher limits or custom solutions, tailored to meet specific trading needs.

Pros:

- Flexible strategy customization.

- Comprehensive risk management options.

- Integration with TradingView for advanced charting and signals.

- Supports a wide range of exchanges.

- Copy trading for beginners.

Cons:

- TradingView is essential for advanced strategies, and without it, customization may feel limited.

- Subscription fees are required even for basic access to the platform.

2. Cryptohopper.com

Cryptohopper, launched in 2017, has quickly grown into one of the most popular and accessible crypto trading bot platforms. Its primary goal is to simplify crypto trading for all levels of traders, from beginners to professionals. With a mix of algorithmic and social trading features, Cryptohopper offers flexibility and sophistication for traders seeking automation and community-driven strategies.

Key Features of Cryptohopper:

- Algorithmic and Social Trading: Cryptohopper allows users to automate their strategies with algorithmic trading, using predefined rules and customizable indicators. It also supports social trading, enabling users to follow copy trading strategies or buy signals from other traders.

- Market Making Tools: Cryptohopper includes market-making features, where traders can place simultaneous buy and sell orders to profit from the spread. This is ideal for advanced traders looking to provide liquidity and capitalize on small price movements.

- Advanced Analysis Tools: The platform supports a variety of technical indicators like Bollinger Bands, Relative Strength Index (RSI), and moving averages, allowing traders to fine-tune their bots for better performance.

- Mobile App: Cryptohopper offers a comprehensive mobile app with push notifications and real-time trade alerts, making it easy for traders to manage their bots on the go. The app also includes robust security features.

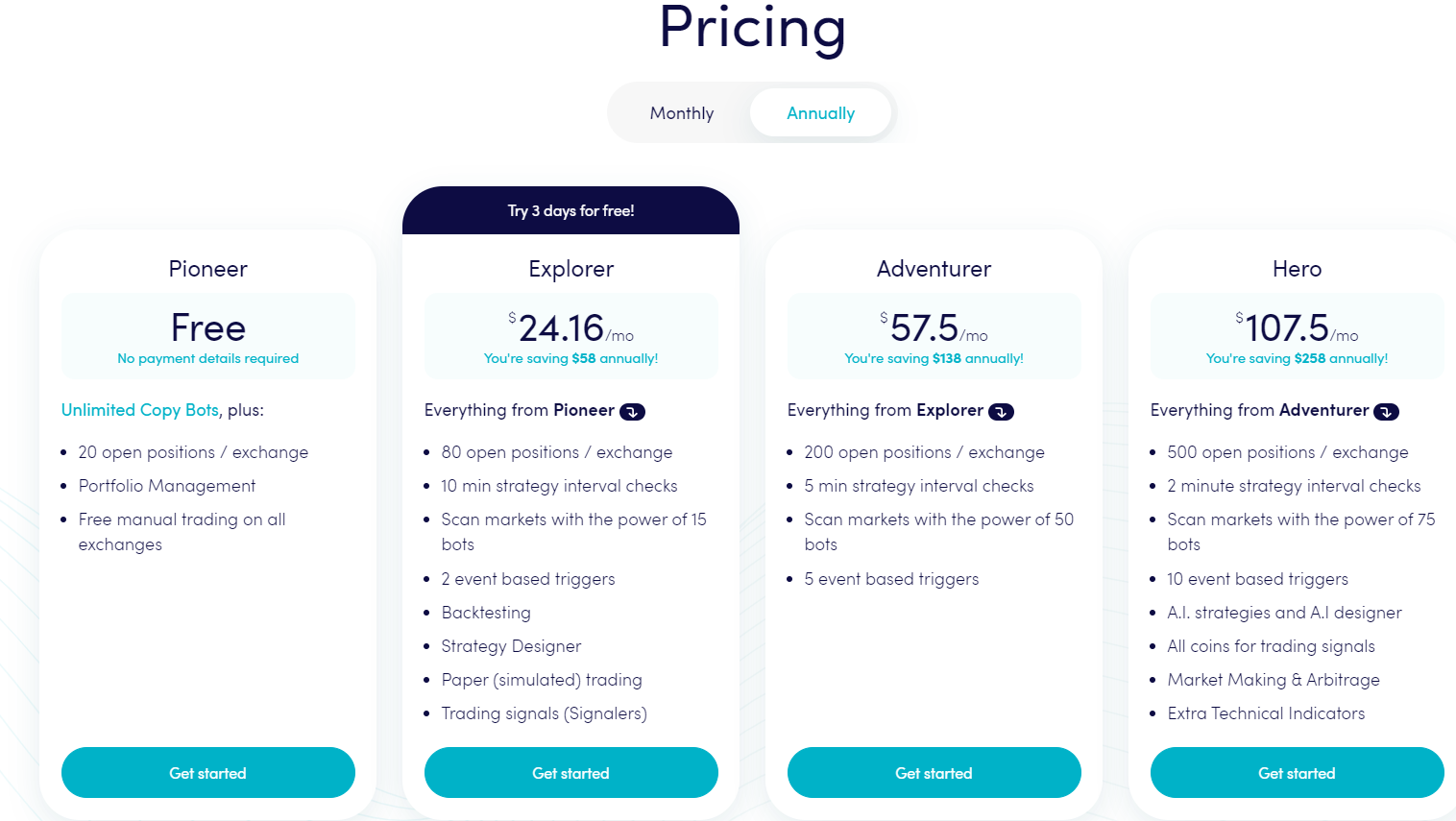

Pricing Plans:

- Pioneer (Free): Unlimited Copy Bots, 20 open positions per exchange, portfolio management, and free manual trading.

- Explorer ($24.16/month): Includes 80 open positions, 15 bots, and 10-minute strategy intervals.

- Adventurer ($57.5/month): 200 open positions, 50 bots, and 5-minute strategy intervals.

- Hero ($107.5/month): 500 open positions, 75 bots, 2-minute strategy intervals, AI strategies, and access to advanced tools like Market Making and Arbitrage.

Pros:

- Beginner-friendly interface with advanced tools for experienced traders.

- Supports market making, ideal for professionals.

- Strong social trading features, allowing users to share and follow strategies.

- Advanced customization with a wide range of technical indicators.

- Secure and easy-to-use mobile app with real-time alerts.

Cons:

- Some advanced features, like market making, require a higher level of expertise.

- Premium plans may be costly for beginners.

3commas vs. Cryptohopper: Which Platform is Best for You?

- 3commas is ideal for traders looking for flexibility and advanced customization, particularly with its TradingView integration and copy trading features, making it great for beginner traders who want to learn by following successful strategies.

- Cryptohopper, with its user-friendly interface and powerful built-in features like market making and algorithmic trading, is better suited for traders looking for an all-in-one solution that caters to both beginners and advanced traders. Its social trading features offer more variety in terms of strategy execution.

The Future of Crypto Trading Bots

As the cryptocurrency market continues to grow and evolve, so too will crypto trading bots. In 2024 and beyond, expect to see further integration of AI-powered bots, machine learning algorithms, and advanced predictive analytics. These innovations will enable bots to not only react to market conditions but also predict and adjust to future market trends.

Moreover, with the rise of decentralized finance (DeFi) and the increasing popularity of decentralized exchanges (DEXs), bots will play an even more significant role in automated trading within the decentralized ecosystem. Automated trading systems will continue to expand, offering greater flexibility and customization for traders of all levels.