How to trade Binance Options? Beginner’s Guide

Binance is a really diverse exchange when it comes to providing a wide variety of investment products. If you are looking for more ways to diversify your trading business, you can opt for Binance savings, staking, spot trading, Binance DEX and margin trading. Furthermore, you could go the derivatives path and begin trading Binance Options or Futures. In this article, we will guide you through the step-by-step process of trading options on the Binance Exchange.

We will take a brief look at what Binance options contracts are and how they function.

What are options contracts?

Options contracts are classified as derivative products. These products give traders the right to either buy or sell an asset at a particular specified price. However, the contract does not come with an obligation to trade the asset. It’s a matter of the trader’s decision.

The opportunity to either buy or sell an options contract depends on the trader’s type of contract. Once a trader sets out the contract, the goal is to trade the contract within the specified timeframe before the date of expiry of the contract.

When a trader is buying an options contract, they are speculating on the price going in a given direction. Binance offers two major types of options contracts: Put options and Call options. For a call option, the trader expects the price to rise. While for a put option, the trader is expecting the price to drop

In other words, a call option gives traders the right but not the obligation, to buy the said asset at a particular specified price. A put option gives traders the right, but not the obligation, to sell the underlying asset at a particular specified price.

Binance lets you trade what is called American Options. This means that you can exercise your option any time before the expiration date.

Another popular style of options contracts is called European Options. These can only be exercised on the same day of expiry, or within a short timeframe of the expiration date.

What are options contracts used for?

Options may be used for speculation but more typically they’re used for hedging, a risk management strategy. When traders or investors are hedging, they are trying to protect their investment from events that could have a negative impact on it.

In the cryptocurrency markets, options can be useful for miners to hedge their cryptocurrency holdings. How does that work? Well, for example, they can buy put options. This way, if the value of their holdings goes down, they’ll still profit from their put options and mitigate some of their losses.

Now you have a brief understanding of what options contracts are. However, they can be very complicated to use. Be sure to understand the implications of your actions before you jump into trading them. It could be worth starting with smaller amounts to test out the waters.

An important thing to note before you start is that your options trading activity is tied to your Binance Futures account. This means that what you do with options contracts may affect your open futures positions. Take extra care when trading options to avoid unintended consequences to your futures positions.

Please note that there’s no order book on Binance Options. If you buy an option, it will remain valid until you either exercise it any time before the expiry date or when the option expires.

Let’s go through some of the most fundamental concepts you’ll need to understand before trading:

- Premium – This is what you’ll pay to buy the options contract. It’s deducted from your Binance Futures Wallet Balance.

- Expiry Date – The duration of time until the option expires. You can choose between 10-minute, 30-minute, 1-hour, 8-hour, and 1-day options. So, if you buy a 30-minute option, you’ll have a 30-minute window to exercise it. If it expires, you’ll only lose the Premium you paid.

- Strike Price – The price at which you’ve bought the option.

- Close Price – The price at which you’ve exercised the option. This is also known as the Settlement Price.

How to trade options contracts on the Binance Web Desktop

Trading Binance Options

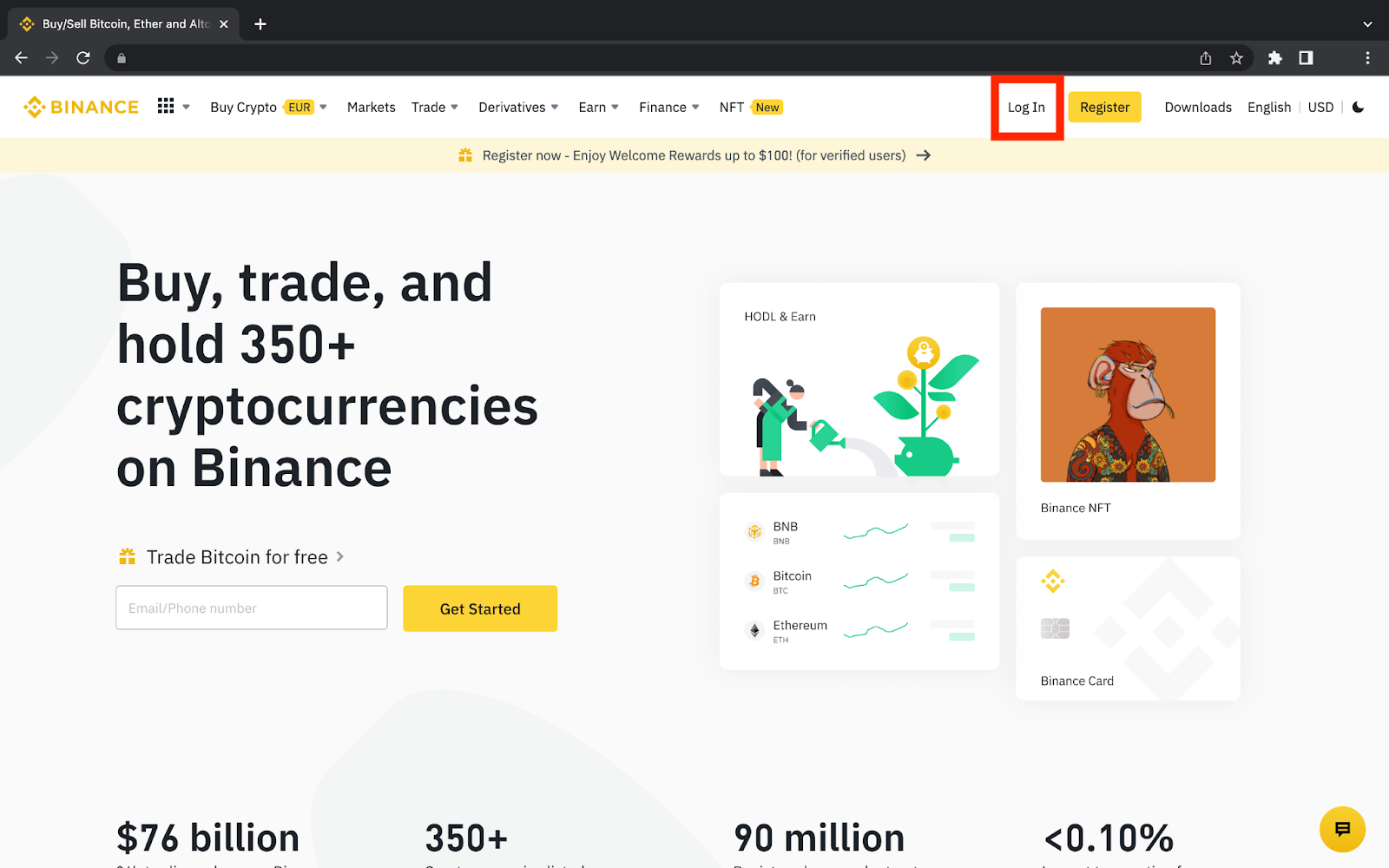

Step 1 – Go to Binance and click [Login], or [Register] if you don’t have an account yet.

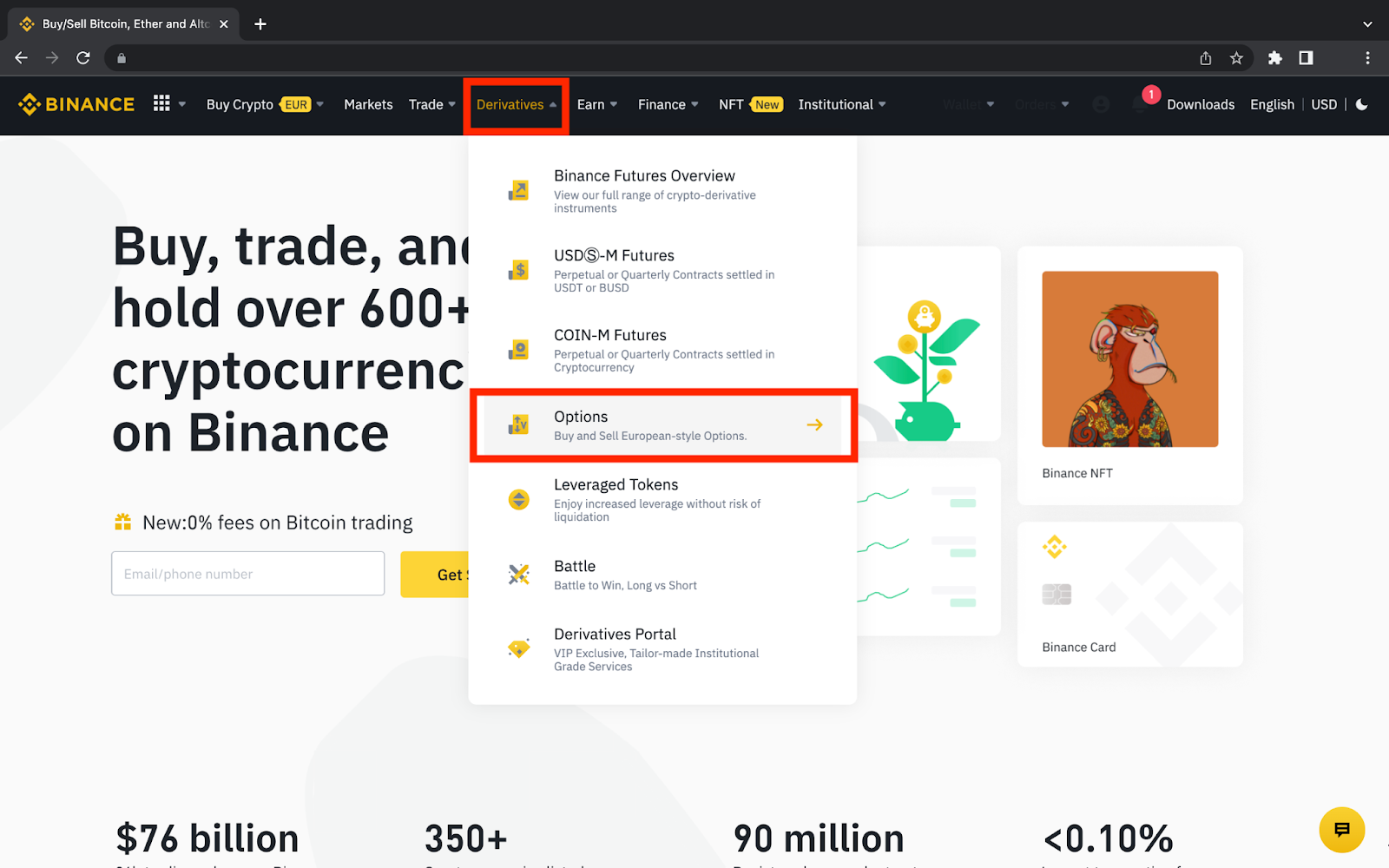

Step 2 – Once logged in, click [Derivatives] – [Options].

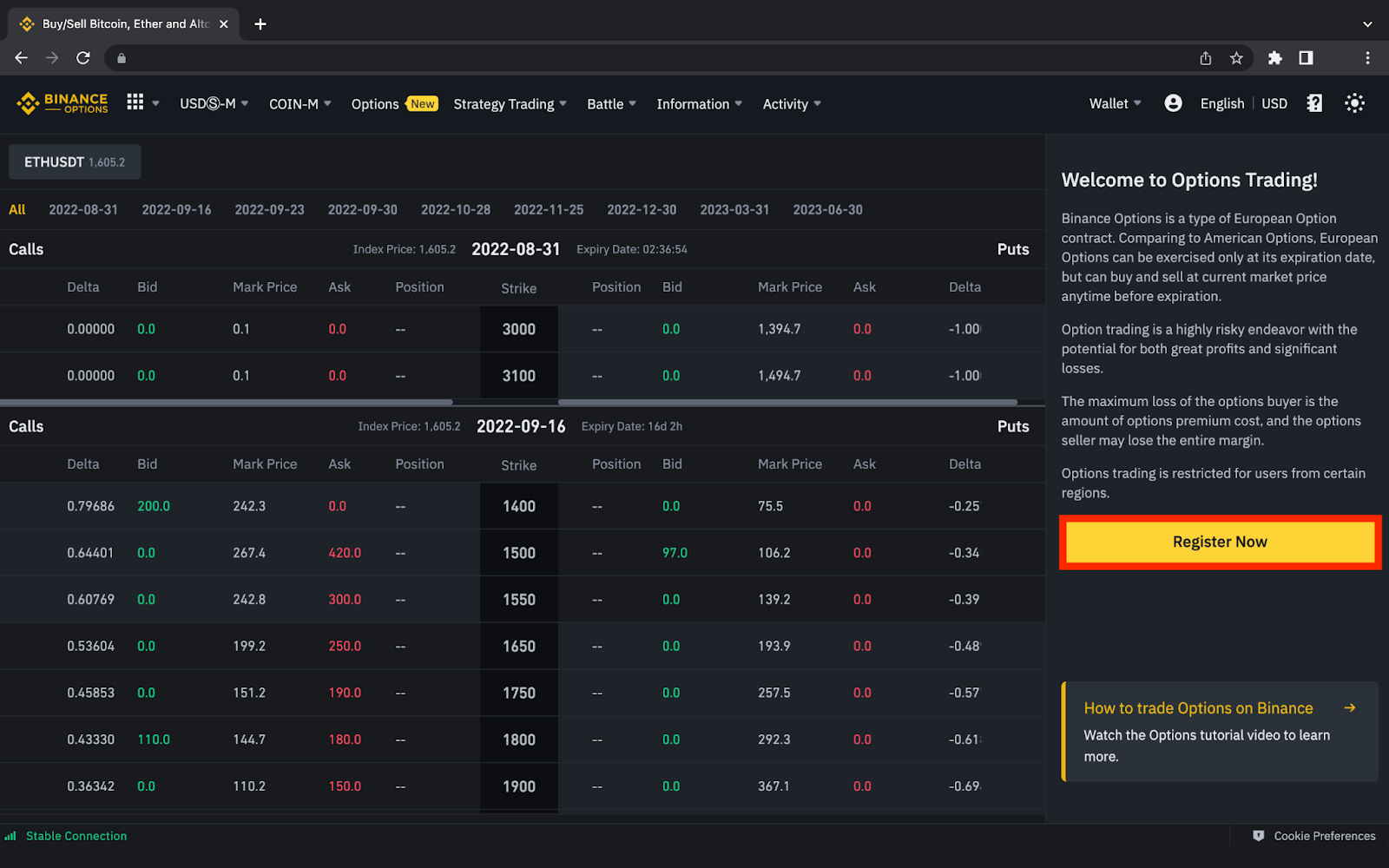

Step 3 – Click [Register Now] to open a Binance Options account.

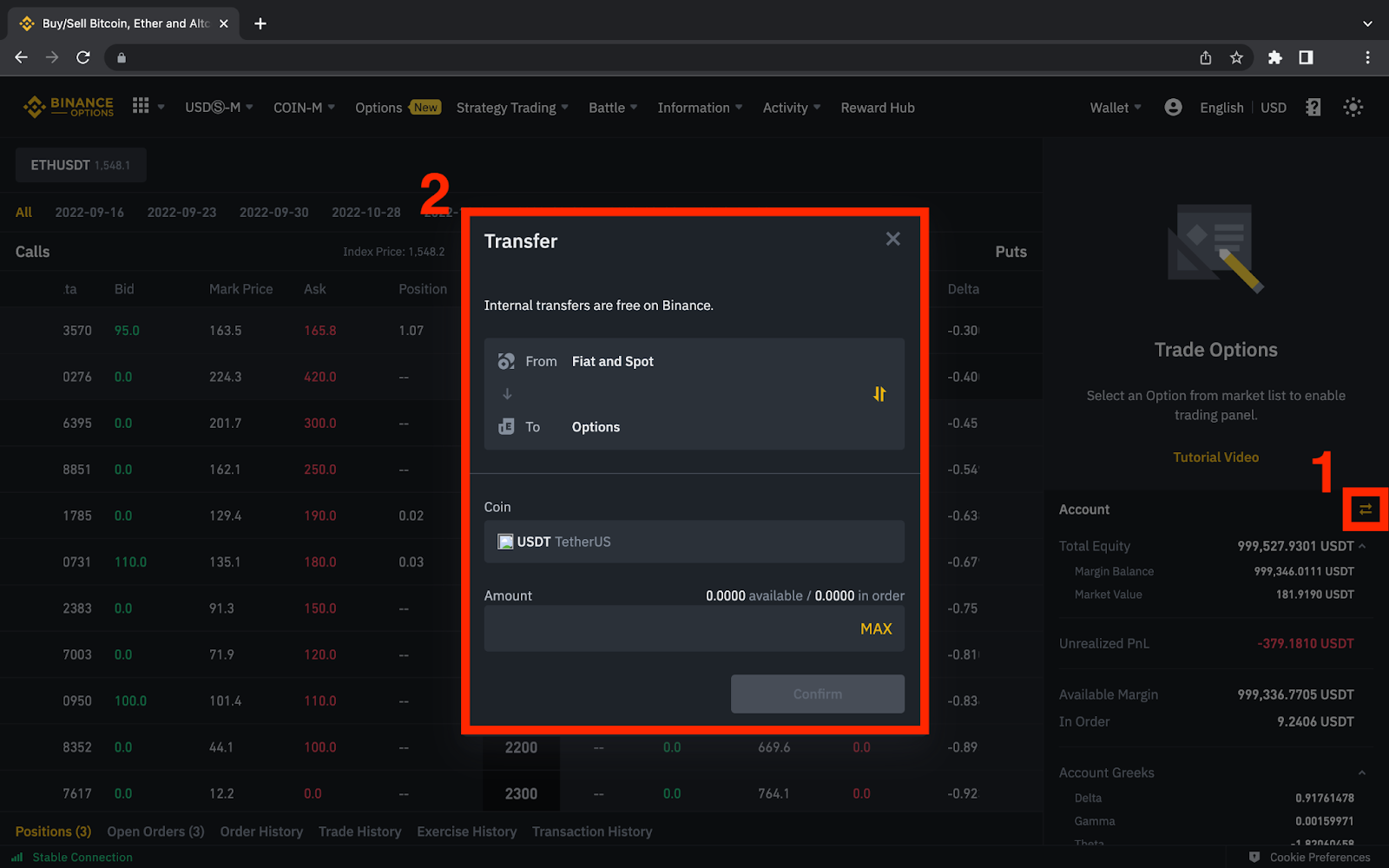

Step 4 – Click [Transfer] to add funds to your Options Wallet.

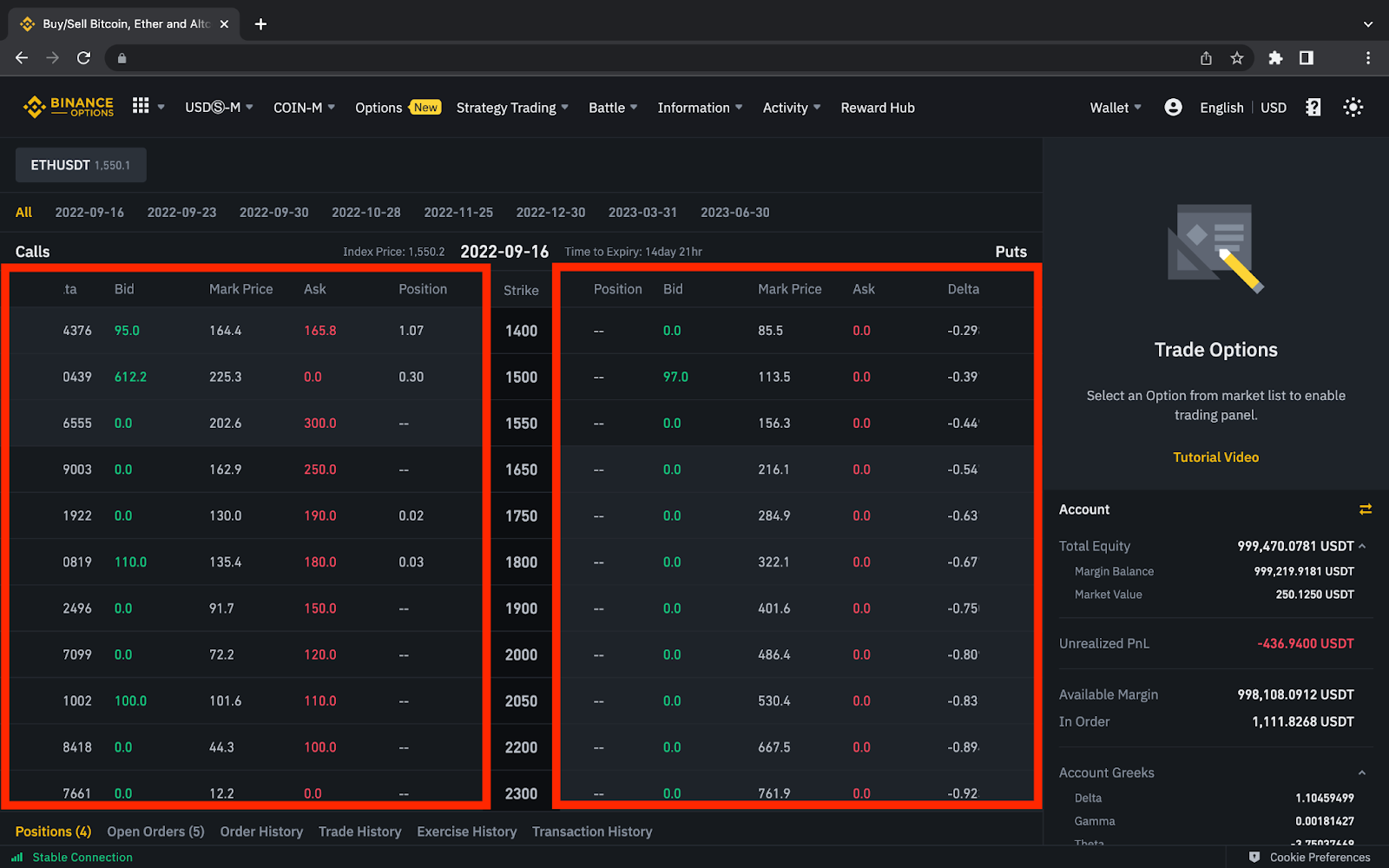

Step 5 – Choose between the different [Call] and [Put] Options available to open a position. Note that Call Options give the holder the right, but not the obligation, to buy the underlying asset at an agreed-upon date and time, while Put Options give the right to sell the underlying asset.

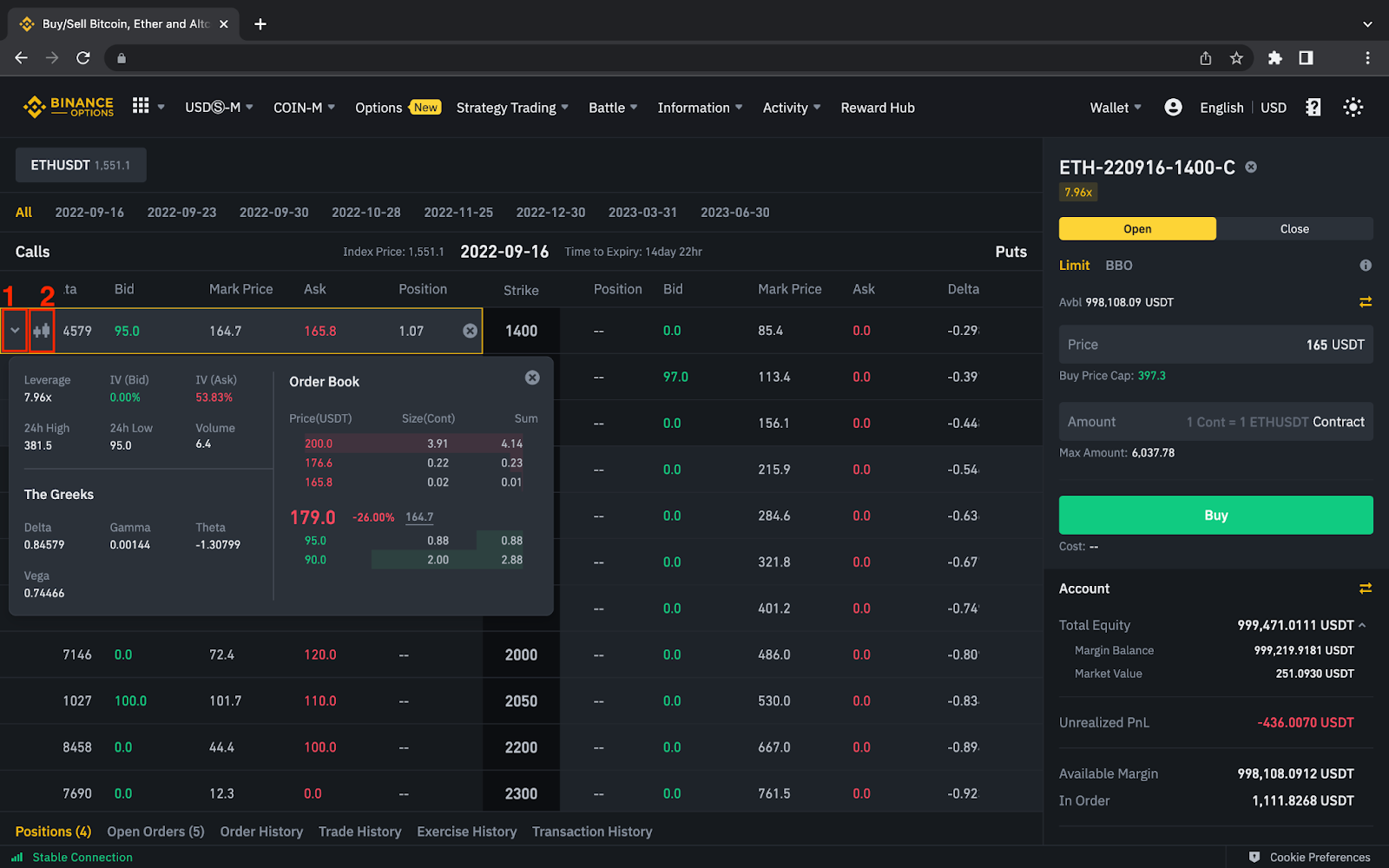

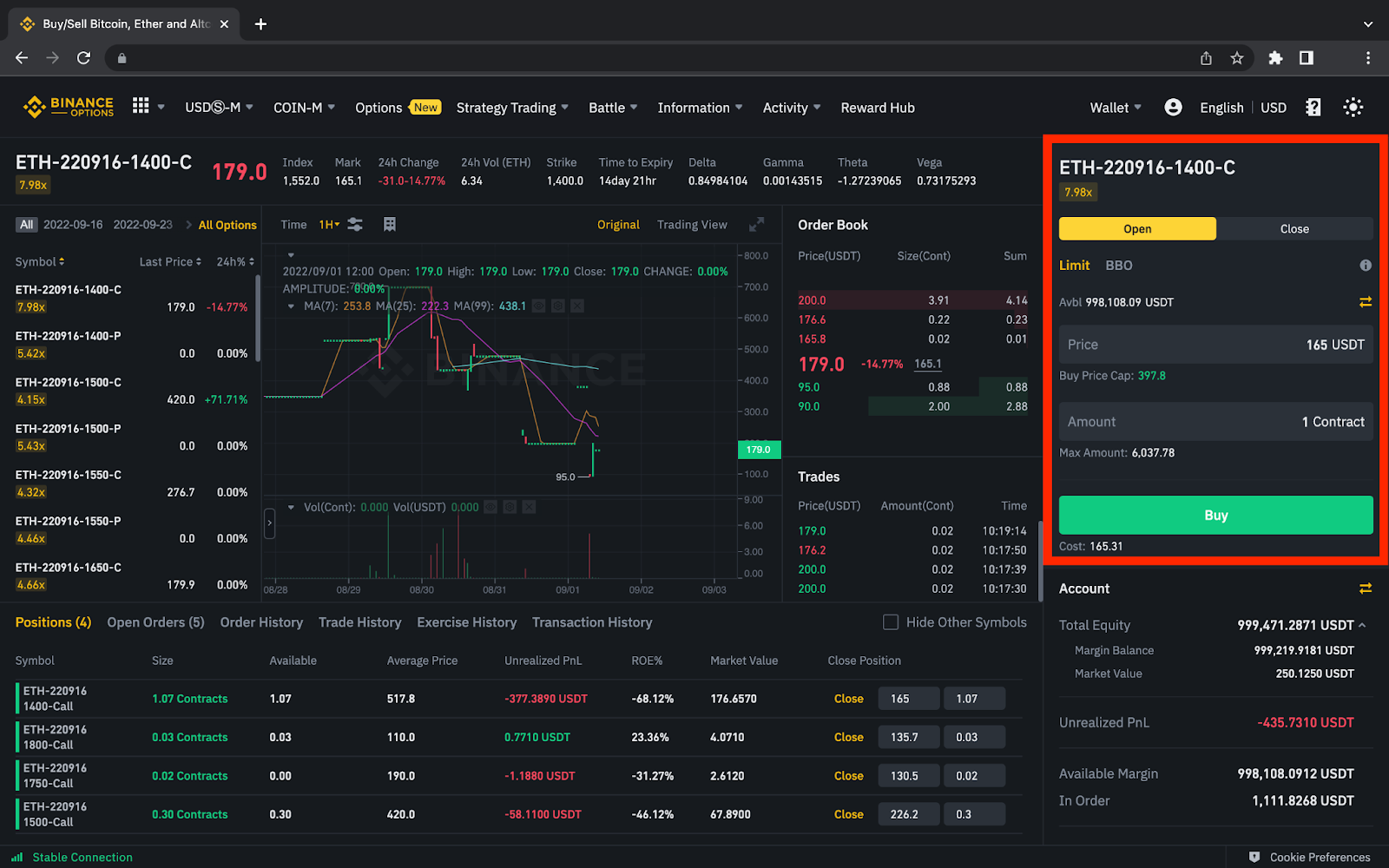

Step 6 – Once you have selected a Call or Put Option, the [Trading Panel] will be enabled. You can also click on the arrow to check for more market details or click on the candlestick symbol to switch the trading interface.

Step 7 – Select [Order Type], input [Price] and [Amount], and click [Buy] to open a position.

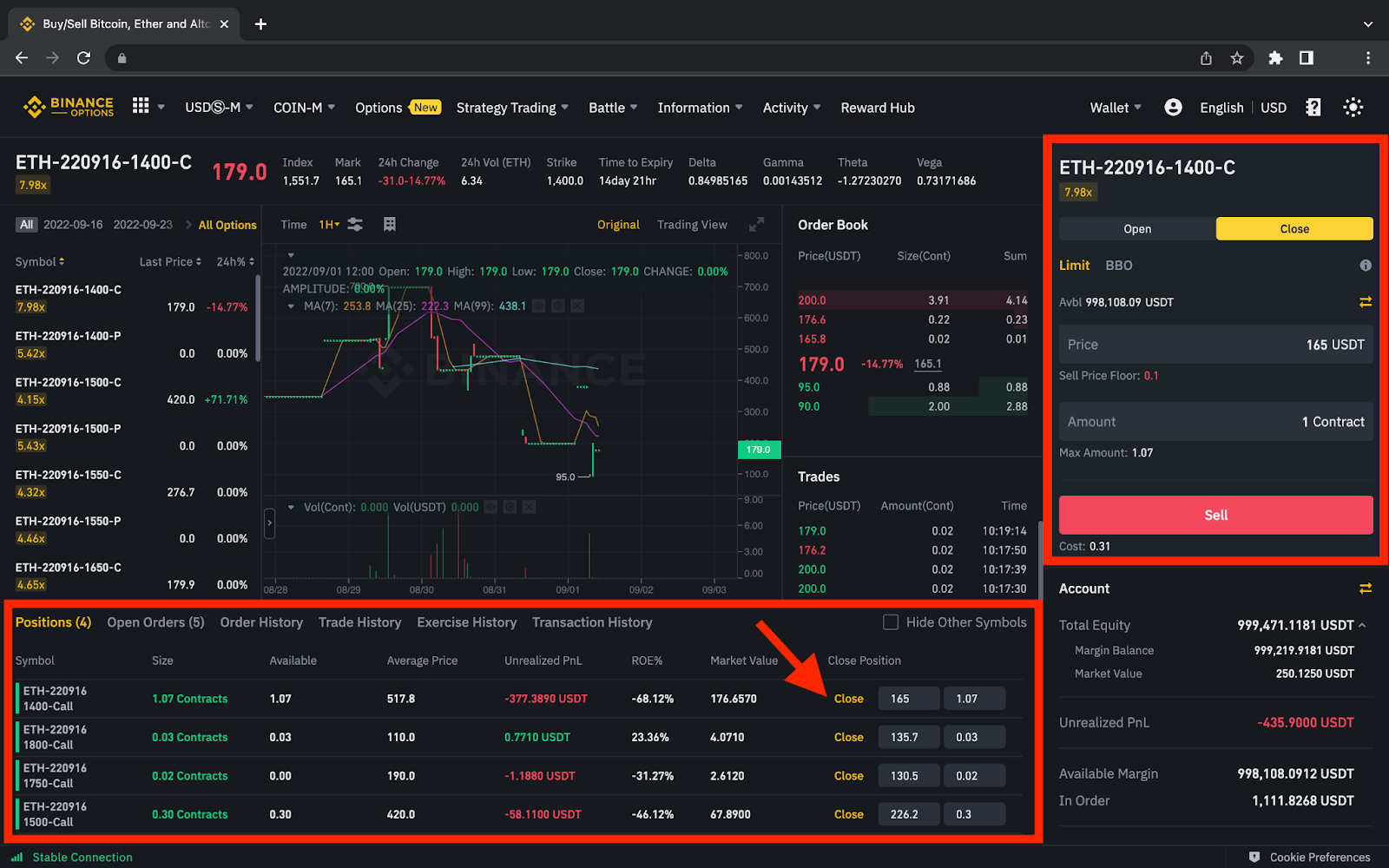

Step 8 – To close the position, you have the choice to:

- Hold until expiration;

- Switch to the [Close] mode in the Trading Panel, select [Order Type], input [Price] and [Amount], and click [Sell];

- Or click [Close] directly under [Positions].

How to trade options contracts on the Binance mobile app

1. Download the Binance app

If you haven’t already, download the Binance mobile app from this page. Options trading is available for both iOS and Android.

Log in to your Binance account in the app. If you don’t have an account, register and create one in minutes.

2. Activate your Futures account

Your Binance Options account is tied to your Binance Futures account. So, if you don’t have a Futures account, activate it, and you’re ready to trade options!

3. Start trading options contracts

Navigate to the Trades tab, and click on Options at the top.

Make sure you have funds in your Futures Wallet. If you don’t, click on the arrow icon on the top right to transfer funds from your Exchange Wallet to your Futures Wallet.

You can choose between options with 10-minute, 30-minute, 1-hour, 8-hour, and 1-day expiry. Select which one you’d like to buy. In this example, we’re going to buy a 1-hour call option, so we expect the price to go up within the next hour.

Next, specify the contract size in the Quantity field.

Note that you’re defining it in the underlying asset of the contract which, in this case, is BTC. However, you’ll pay the Premium in USDT.

When you are ready, click on Buy Call.

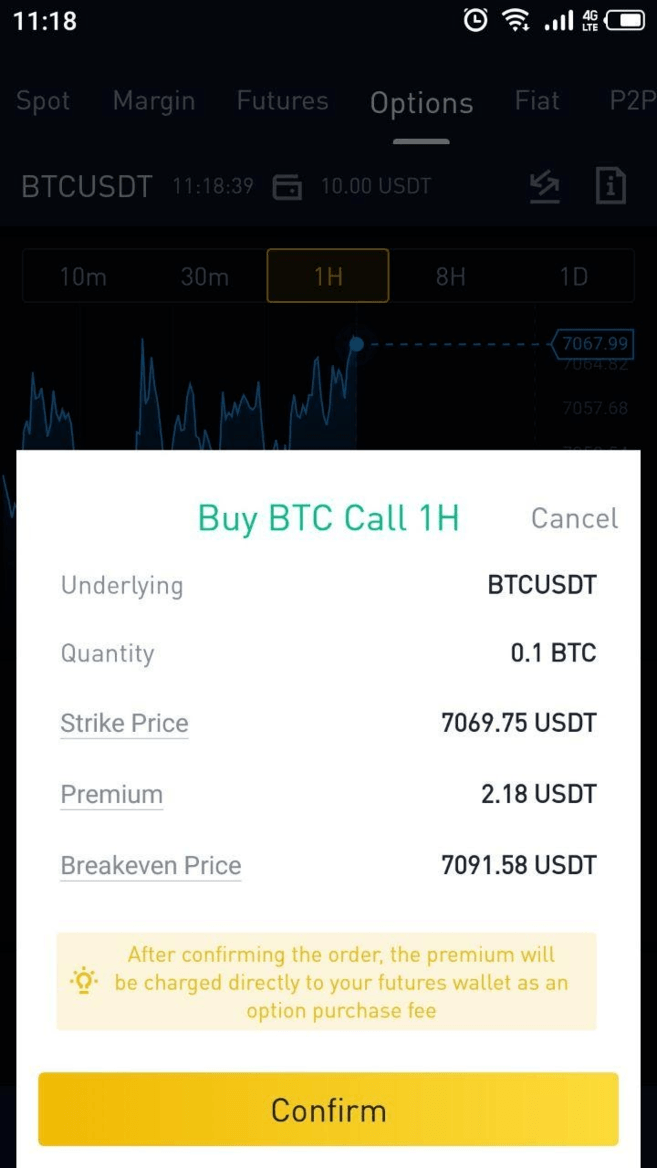

Next, you will see a confirmation window. If everything looks good, click on Confirm.

So, what’s happening here? We’re buying a 1-hour call option for BTCUSDT with a quantity of 0.1 BTC at the price of 7069.75. The 2.18 USDT Premium is going to be deducted from our Futures wallet. If the price of Bitcoin goes up to 7091.58, we’ll break even.

4. Monitoring and closing positions

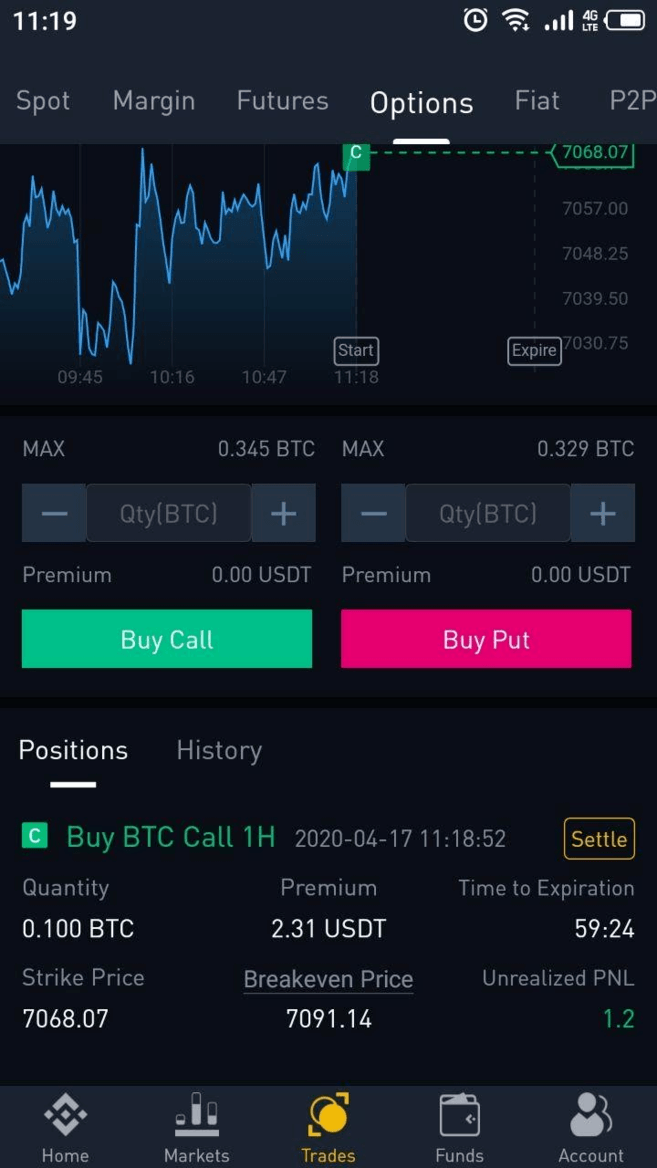

You can monitor your open positions under the Positions tab. Amongst what we’ve discussed earlier, you can check how much time you’ve got left until the option expires, and a current estimation of your unrealized PnL (profit and loss).

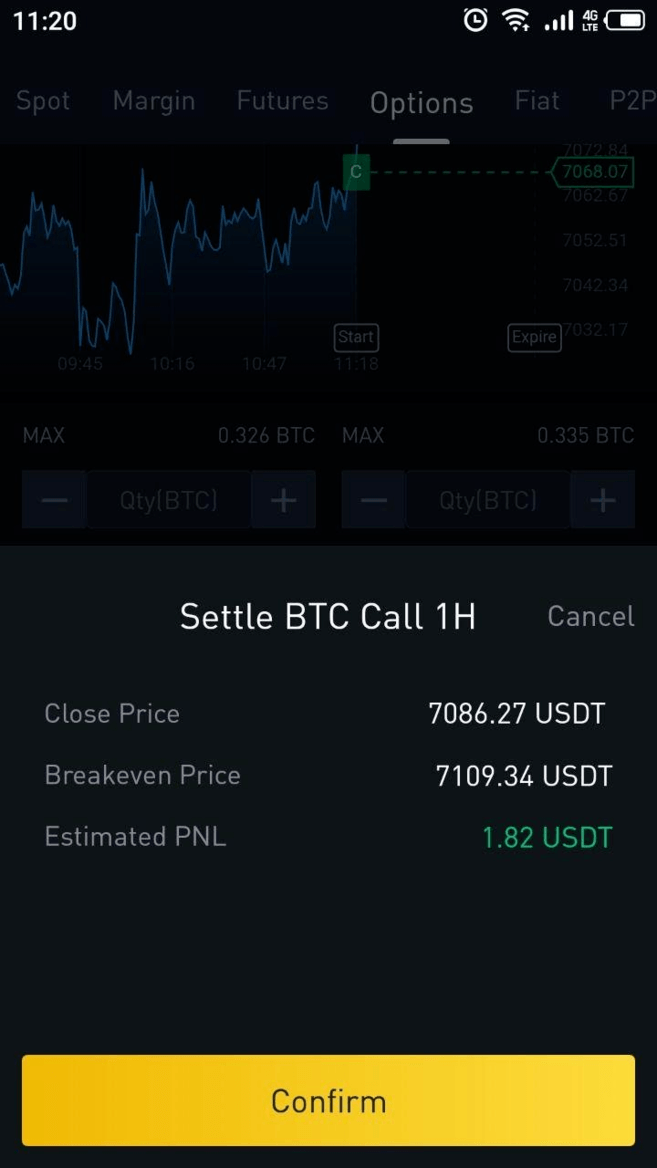

If you’d like to close the position (exercise the option), click on Settle on the right side of the Positions tab.

The option will be exercised once you click on Confirm.

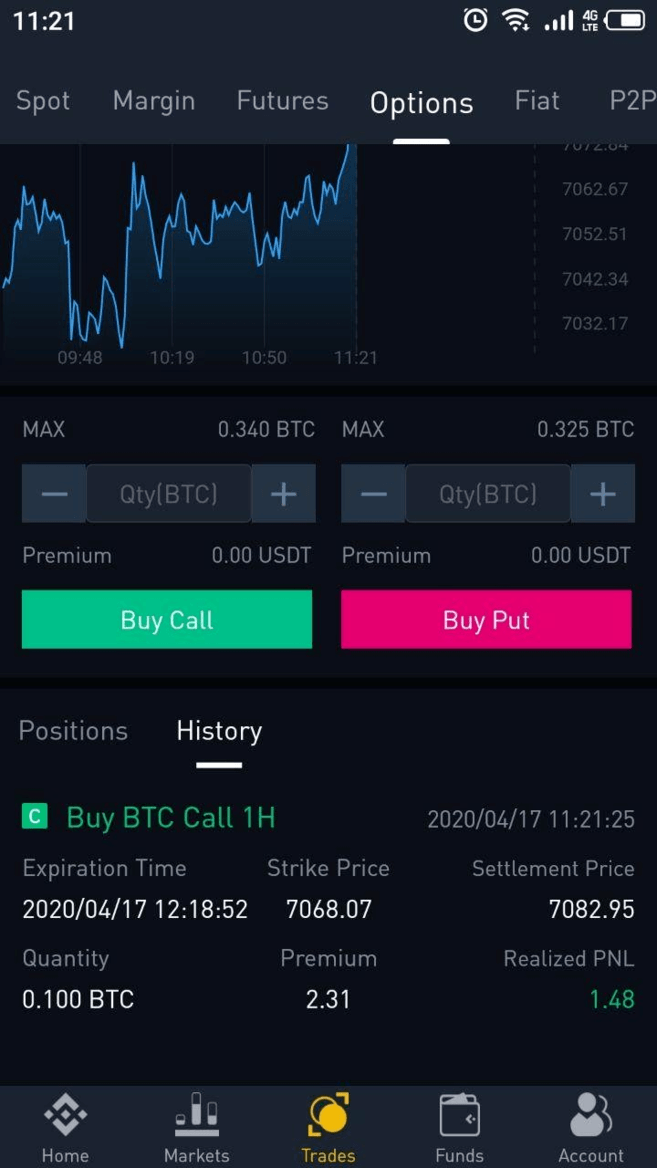

You can check your previous options trades under the History tab.

Conclusion

Options enable traders to trade assets of their choice in the future, regardless of the current market price. The difference between Options contracts and Futures contracts is that Option traders have the choice to execute the contract. Despite being a highly speculative form of trading, Binance Options are crucial when abiding by a strict risk management plan, such as when hedging. However, inexperienced traders are advised to be more cautious and learn the inner workings before trading options.