How to Trade Binance Futures? A Beginner’s Guide

Futures contracts give investors exposure to several cryptocurrencies without having to own the underlying asset. The concept shares similarities with stock indices and derivative contracts, which allow traders to take risks on the future value of the asset. Take note that a futures contract derives its value from the asset it represents, these could be Bitcoin or Ethereum. However, when the futures contract reaches its expiry date, the contract is settled in cash instead of the actual digital asset. A unique feature of crypto futures trading is investor protection against hostile market conditions. Investors have the opportunity to sell high and buy low so as to profit from the price difference – this method is called short-selling. This means an investor can trade in either direction of the underlying asset’s price. In this article, we will guide you on how to trade crypto futures on the world’s biggest crypto exchange, Binance.

Binance crypto futures are actively traded 24/7. The exchange offers its crypto futures contract on its derivative platform. Futures contracts are highly risky, and investors are at times prudent to heavy losses. This is because derivatives are associated with high price volatility, and therefore investors should practice how to manage their risks. Meanwhile, it is the volatility of crypto that traders love. The promise that the price will fluctuate at any given time means a lot to crypto investors. Once they have done their research and adequate technical analysis, they trade in the hopes that price movements will occur in their favour. The most important thing about Binance Futures is that traders only take risks on price fluctuations without having to hold the underlying asset. Here is an example of a futures contract in its simplest form:

Jennifer entered a long futures position when bitcoin traded at $35,000. Luke entered a short position at the very time that Jennifer opened her position. When prices began moving upwards, both Jennifer and Luke settled their positions at bitcoin’s price of $40,000. In this case, Luke’s trade was losing while Jennifer’s trade was winning. Therefore, Luke had to pay the exchange deficit loss of $5000, derived from ($40,000 – $35,000). Jennifer on the other hand gets a profit of $5,000 from the Binance exchange.

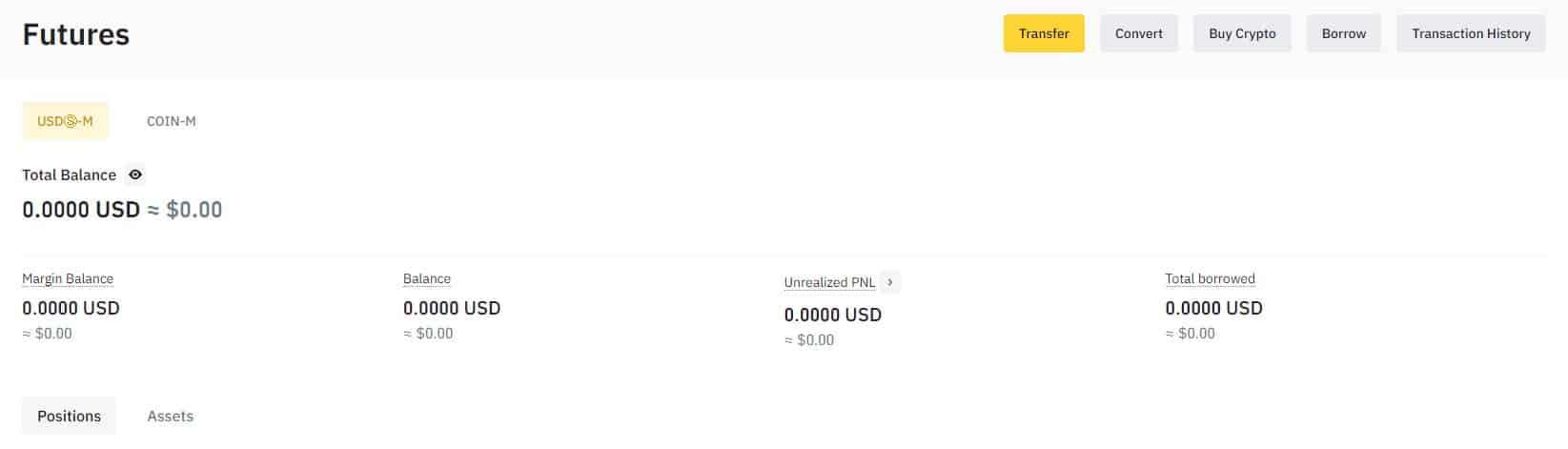

The first step to trading Binance Futures is creating a user account on Binance Exchange. Account registration is an easy step as long as you have your identity information. This is because Binance abides by strict KYC and AML requirements, hence you must go through identity verification. Check through our other Binance guides to learn how to create an account and deposit crypto in your Binance wallet. Thereafter on creating your account and loading funds, transfer the funds from your spot/funding wallet to the futures trading wallet. Do this by hovering over the navigation menu and clicking wallet. You will see the following interface:

Now select either of the two derivative contracts that Binance Futures offers: Coin-M or USDⓈ-M. This means you are trading on either a USD-denominated or crypto-denominated futures platform. Binance created this feature to help traders gain exposure to both crypto and stablecoins when trading cryptocurrency derivatives.

- USDⓈ-M: On the expiry of the contract, Binance exchange settles the futures contract in stablecoins. This means the trader marks their profits or losses in stablecoins such as BUSD and USDT.

- Coin-M: Translates to crypto-denominated. On the expiry of the contract, Binance settles the futures contract in cryptocurrency. This means that traders mark their profits or losses in crypto. The Binance Derivatives platform margins Coin-M futures contracts in Bitcoin. This is because it is the base currency you are going to use.

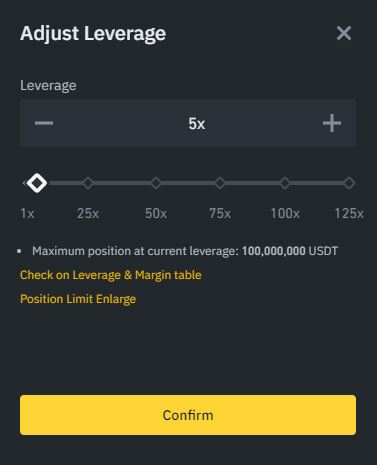

The next step is now understanding leverage because you will need to enhance your futures trading. Binance allows traders to place up to 125X leverage on some pairs. For our example, we are using BTC/USDT – which is among the pairs you can leverage 125x. Setting up your leverage is easy. Locate the order box on the above screenshot, and above it you see the leverage button. Once clicked, you will go to the following page shown below with an adjustable bar for the different leverage levels available:

At this point, note the higher the leverage, the higher the risk. In fact, inexperienced traders are highly discouraged from performing leverage on their trades. Additionally, even experienced traders are advised against leveraging above 5x. Besides, even the 5x leverage does carry a huge risk of losing your capital investment. The best thing, in this case, is only investing only what you can afford to lose.

With your leverage set, determine whether it should be cross-margin or isolated margin. Click the button to the right of the leverage adjustment bar to choose your type of leverage.

- Isolated margin – The isolated margin means your leverage is limited to the amount you allocated for each trade. Therefore, only your entered position gets liquidated when the margin ratio hits 100%. The liquidation does not affect the balance on the rest of your account.

- Cross margin – cross margin leverage positions share a common asset balance. Therefore, your entire futures account balance gets liquidated in case the margin ratio hits 100%. This holds also for margins you entered for other futures positions.

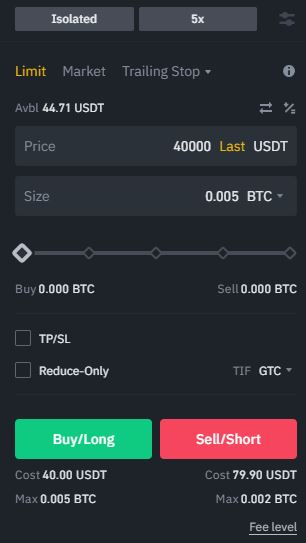

In this guide, we go with isolated margins to reduce the risk on our futures contracts wallet.If you have understood the above sections, it’s time to move on and learn how to interact with the order box. There are 4 types of orders you can place on the Binance platform:

- Stop-Limit/Market Order

- Limit Order

- Market Order

- Trailing Stop Order

Market Order

This is the most popular and basic order type for purchasing cryptocurrencies at the spot price.

You execute a limit order by entering the quantity of your order. Remember, that the margin you need is 5X less than the actual value of your bitcoin order.

Limit order

Limit orders are for traders who want to buy a cryptocurrency at its specific price.

Here is what the limit order box looks like

On the size button, input the value of the bitcoins you wish to purchase. In our example, we have our target price at $40,000, and 0.005 bitcoins. When the price of bitcoin reaches $40,000, we set an order to buy, also called long. In this trade, we will use leverage of 5x. Once you hit the Buy/Long button, the futures contract opens your first position.

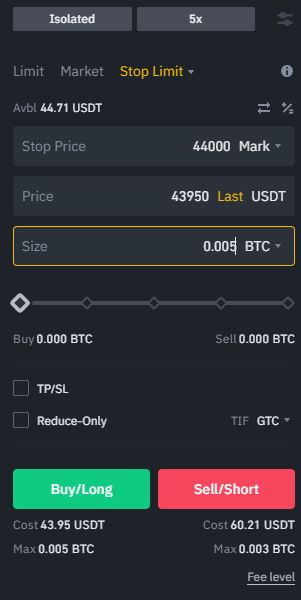

Stop-Limit Order

Traders mostly prefer the stop-loss order since it supports a take-profit mechanism. The stop price denotes the price at which your stop-limit order changes into a regular limit order. The order would change into a market order had the trader used a stop-market order. You will also see a price tab on the stop-loss order which denotes the price at which you want to buy the crypto.

Using it as a stop-loss requires that you place a stop price. Once the order reaches the stop price, the contract triggers the execution of the limit order at the set price

Traders execute a limit order when buying an asset at a specific price. The process is to first set the price at which you intend to buy or sell the asset.

For this trade, the contract will trigger a limit order when the price of Bitcoin falls to $44,000. If in case, the trader longs at the current $46,000 price, they will need to place a sell/short position. Conversely, traders can close the position once they have already set up all the levels.

However, to use the stop-limit order as a take-profit mechanism, we advise traders to take advantage of the stop-market order. Therefore, if for instance, bitcoin reaches $48,000, the order will be executed and the position will close at a profit.

Trailing Stop Order

A trailing stop order allows traders to lock profits or even limit their losses as the trade continues to move in each direction. A trader can therefore use the trailing stop to pre-set an order at a particular percentage from the market price whenever the market swings. A trailing spot is a move advanced type of order but restricted to only experienced traders.

Once the trader opens a position, they are able to monitor the status of the trade. There is a view bar beneath the price chart of the trade where you can observe the performance of the position. When you want to close the position, you can either close the position at the most suitable available spot price; or close the limit at the specified price where you wanted to close the position.

Conclusion

Derivatives trading is suitable for speculating on the future price of cryptocurrencies. With proper skills, knowledge and experience, futures trading can be lucrative. What traders need to do is evaluate the market and craft a solid risk management plan. At the moment, the Binance Futures platform is the most liquid derivatives exchange in the cryptocurrency market. Users enjoy tight bid/offer spreads to protect them from careless risks. Furthermore, a wide variety of trading pairs are available, all of which have big trading volumes.

Binance Futures Frequently Asked Questions

Is the Binance Futures Exchange platform secure?

Binance exchange is among the most secure digital currencies exchange in the world. While no exchange is completely cybercrime-proof, Binance’s security team is doing a splendid job. Besides, the exchange has an emergency fund worth billions of dollars to refund its users in case of a hack. Additionally, the exchange follows a strict KYC process to protect user funds.

How reliable is the Binance support team?

Binance encourages its users to reach out to customer support if they ever face a problem. Be it login problems, or a withdrawal/deposit error. The exchange’s customer support is reliable and comprises a highly experienced international support staff.

What cryptocurrencies does the Binance Futures platform support?

Binance Futures provides a diverse range of crypto trading pairs. Here is a list: