TRY stands for the Turkish currency, the new lira, which is now in its 2nd issue period. The Turkish lira is the national currency of Turkey. However, the new Turkish lira can be broken down into 100 new kurus coins, usually represented by the letters YTL. From a historical aspect, the Turkish new lira was first introduced in early 2005. It was equivalent to 1 million of the old Turkish lira. The government removed the six zeros from the value of the currency during revaluation in 2005. The 9th issue of the TRY was printed in 2009.

Let me explain the history of how the release of the Turkish lira as a currency was split into two periods. The first Turkish lira was in use during the period between 1923 and 2005 (it remained valid and in circulation until the end of 2005). At the same time, the 2nd Turkish lira period began in 2005. As a currency, the TRY has been pegged to the French franc and the British pound, as well as being both hard and soft-pegged to the US dollar, during its history. There is no longer an explicit peg, but Turkey actively intervenes in the currency markets and attempts to influence the value of the TRY.

History of the TRY (New Turkish Lira)

In response to the economic crisis in 2001, the Turkish lira started to lose value. State-owned businesses, such as telecommunications companies and oil refineries, were privatized, and the central bank ran a tight monetary policy, in an attempt to restrict spending and ensure that inflation did not destroy economic gains. Before these economic reforms took place, Turkey’s economy depended heavily on foreign aid, as approximately 80% of Turkey’s GDP was external debt.

Major Factors that Influence the USD/TRY Currency Pair

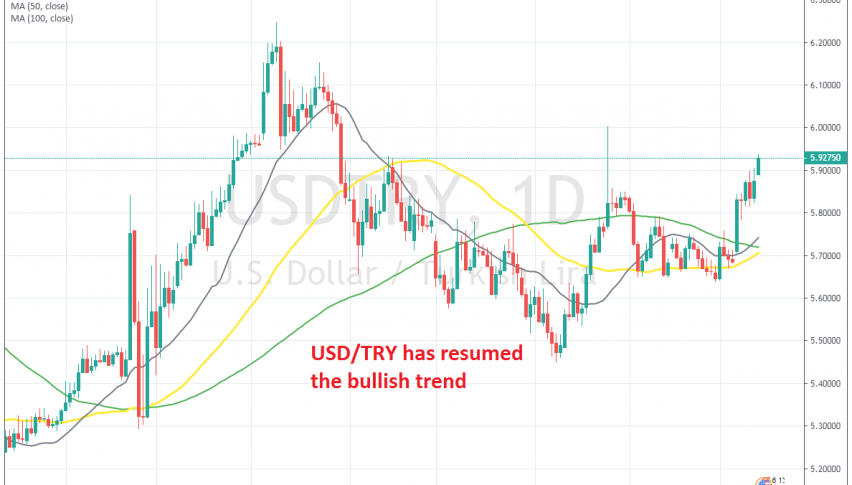

The USD/TRY currency pair is usually affected by factors that impact the value of the US dollar and the Turkish lira, in relation to each other and to other currencies. Therefore, the interest rate differential between the Central Bank of the Republic of Turkey and the Federal Reserve (Fed) has a significant influence on the value of these currencies compared to one another. It is worth recalling that the Turkish lira dropped by more than 20%, falling into record low territory, against the US dollar on August 10, 2018. However, the reason for this could be associated with economic and geopolitical problems. In addition to suffering from rapidly rising inflation and political pressure to keep interest rates low, the country faced a looming debt crisis that threatened to place further pressure on both the economy and the currency.

Current USD/TRY Price: $

Historical Data Table:

USD/TRY Historical Price Data

| Date | Price | Open | High | Low | Change % |

|---|

Monthly Change

| Date | Price | Open | High | Low | Change % |

|---|

Factors impacting the USD/TRY Prices:

The USD/TRY currency pair is affected by factors that determine the value of the US dollar and the Turkish Lira, compared to one another and to other currencies. Therefore, the interest rate differential between the Federal Reserve (Fed) and the Central Bank of the Republic of Turkey will affect the value of currencies compared to each other.

The CBRT and Interest Rates:

Determining the interest rate could be considered one of the CBRT’s most important tasks. Turkish monetary policy structure is designed to keep inflation low and stable. Thus, the artificially low-interest-rate environment has contributed to additional ongoing pressures on the Turkish Lira.

US-Turkey Relations:

The relationship between the United States and Turkey has been getting worse over recent years, which tends to undermine the Turkish economy and its currency.

Economic Data:

The economic data, such as the Consumer Price Index (CPI), Gross Domestic Product (GDP), Trade Balance, Retail Sales, Labour Force Survey (the Canadian unemployment statistic), and Industrial Price Index have a great influence on USD/TRY prices.

Potential Turkish Debt Crisis:

Turkey’s heavy burden of debt to other countries is evident in the extraordinarily large percentage of its debt that is denominated in foreign currencies. As the Turkish currency continues to undermine, this foreign debt becomes more difficult and expensive for Turkey to manage, further exacerbating the decline in the currency. Furthermore, Turkey’s remarkably large current account deficiency makes the country’s potential to fall into a severe debt crisis even higher. Let me point out that the Turkish loans amount to $ 265 billion, or less than 1% of the worldwide total, as per the Bank of International Settlements.

International Relationships:

Relations between countries tend to grow or undermine their economies. They increase the range of consumers reached geographically and demographically, through interactions such as imports and exports, but they also allow the economic fluctuations of other countries to affect their economy.