The Euro to British Pound exchange rate (EUR/GBP) is the eighth most popular currency pair in the financial market. Successful trading in the EUR/GBP pair depends upon paying close attention to the economic releases from the central banks of both the UK and the Eurozone. The European Central Bank (ECB) is responsible for the Euro, and the Bank of England is responsible for the British Pound.

As a currency, the British Pound is also known by the names Pound Sterling, Cable, Nicker and Quid. It is considered the 4th most traded currency globally, as it is the 4th most held reserve currency on the globe. The British Pound has the distinction of being the oldest currency in the world that is still in use. It is also one of the most frequently converted currencies. The history of the pound dates back to 760. It changed forms many times before reaching its current form – from the silver penny to Sterling Pound in 1158, to paper banknotes in 1694. The BOE was founded in 1695, as the world's very first central bank. In 1816, the British government adopted the gold standard that lifted the British economy in the world. However, after the First World War, the US dollar took over that position.

As for the Euro, as a currency, it is unique globally, as it represents multiple countries rather than just one nation. Almost 19 nations have adopted the Euro as their local currency; these countries are all part of the European Union and the Economic Monetary Union (EMU). The countries have formed a union, which is also known as the Eurozone. One of the problems with the Eurozone is that occasional disagreement flares up between different countries and their governments over a single issue, and during that time, the single currency Euro can become weak. However, the European Union (EU) is the biggest economic region globally, and the Euro is the second most traded currency in the financial market.

Let us remind you that the UK was previously also a member country of the European Union. However, it is currently under the transition period, in the process of leaving the Union. The transition period will end on 31st December 2020, and after that, the UK will officially become an independent nation once again. However, a trade deal has yet to be made between the UK and the European Union, and negotiations are underway to secure a Brexit trade deal before mid-October. The Brexit – which is the process of leaving the European Union – is still in progress, and has yet to be finalized. The UK left the EU on January 31, 2020, and entered into a transition period of one year, in order to secure a trade deal with the EU. This deal will set the rules and regulations between both nations, to be followed by the UK after its departure from the Eurozone. Several

issues have not been resolved yet, and they require consensus from both parties, but they are rapidly running out of time.

The Brexit is the most important factor that drives the EUR/GBP pair, as both economies will be highly affected after Britain finally departs from the EU.

Current EUR/GBP Price: $

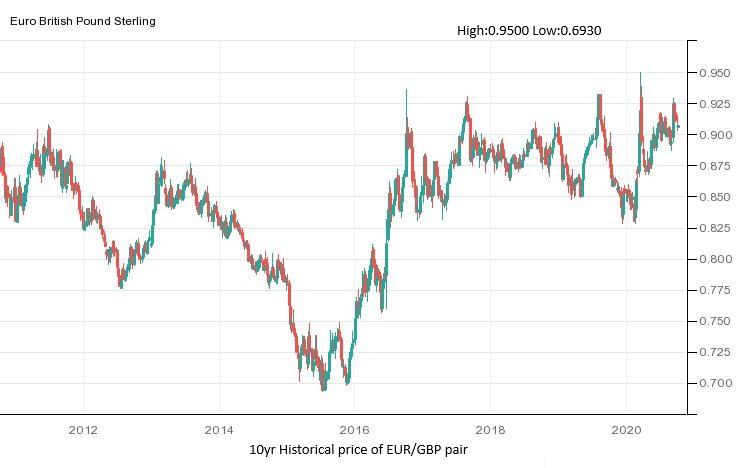

EUR/GBP– Historical Price Charts:

Historical Data Tables:

EUR/GBP Historical Price Data

| Date | Price | Open | High | Low | Change % |

|---|

Monthly Change

| Date | Price | Open | High | Low | Change % |

|---|

Factors impacting the EUR/GBP pair:

European Central Bank:

The ECB manages the Euro currency and takes decisions on interest rates and other monetary issues affecting it. The current President of the European Central Bank is Christine Lagarde. The ECB's current interest rates are set at -0.5%, having been reduced to this historic lowest level in order to support the European economy through this pandemic crisis.

The decisions and announcements made by the ECB, along with speeches by Christine Lagarde, are followed closely by the market traders, in order to find fresh clues about the movements of the EUR/GBP pair.

Bank of England:

The Central Bank of the United Kingdom is known as the Bank of England, and the current Governor of the Bank is Mark Caney. The Bank announces all the monetary policies and takes interest rate decisions. The current interest rate of the BoE is 0.75% on average, and it is low enough to provide support to the British economy through the Brexit process, and more recently, also through the coronavirus pandemic.

The interest rate decisions, announcements and comments by the governor of the Bank are closely followed by traders and investors in the GBP, and they have a direct impact on the EUR/GBP pair.

Brexit Progress:

During the referendum held in 2016, it was decided that the UK would leave the European Union, and the whole process of leaving became known as Brexit. On January 31, 2020, the UK officially left the European Union; however, Brexit has not yet ended, as the UK is still in a transition period until December 31, 2020. The transition period was provided to secure a post-Brexit trade deal between the EU and the UK. Currently, the parties have differences in many issues, including the creation of a level playing field, fisheries and Northern Ireland. As Brexit would directly affect both currencies in the EUR/GBP pair, the Brexit progress has a high impact on its movements. Any news related to developments in the Brexit deal affects the pair, either positively or negatively.

Economic Data:

Every month, various economic numbers are released, which are of major importance with regard to the price movements of the EUR/GBP. The major economic releases from both

economic zones include the GDP, CPI, Trade Balance, Retail Sales, PPI, HPI, PMI, Employment numbers and Unemployment Claims