Have you been keeping tabs on gold (XAU/USD chart) lately? It’s been on quite the journey since the beginning of 2023, with an increase of 133.47 USD/t oz. or 7.32% according to those who keep tabs on trading with a contract for difference (CFD).

XAU/USD Historical Data and Information

Gold is the world’s oldest mode of exchange. With its bright and glossy appearance, gold is not only visually attractive! It also has exceptional uses. Gold is regarded both as a long-term investment and as a short-term hedge in times of uncertainty or nervousness in the markets. Gold prices therefore usually display enhanced volatility during times of political or economic uncertainty, as this increases the investor demand for the precious metal, due to its global acceptability. Many economic factors influence the trading price of gold, including interest rates, inflation, the supply and demand of the yellow metal, the value of the US dollar and large gold transactions by central banks.

Current GOLD Price: $

Smilar Pairs

XAU/EUR, XAU/XAG

XAU/EUR

XAU/XAG

Historical Data Table:

XAU/USD Historical Price Data

| Date | Price | Open | High | Low | Change % |

|---|

Monthly Change

| Date | Price | Open | High | Low | Change % |

|---|

Why Look at Historical Gold Prices?

There are manifold factors involved in the determination of a bullish bias in gold. Let’s explore them one by one, in order to forecast the gold price.

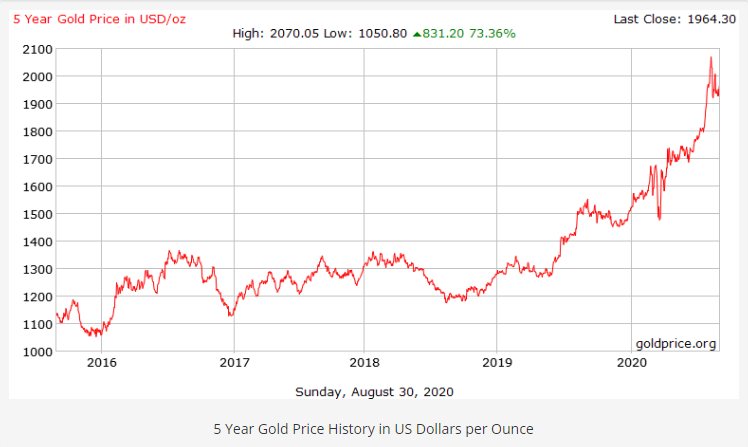

US Dollar and FED Monetary Policy (Negative Rate Cuts): – Gold and the US dollar are negatively correlated nearly two-thirds of the time (when one advances, the other drops, and vice versa). While global investors do manage to run with the US dollar through periods of uncertainty, this type of movement was muted over the previous year, despite the trade war with China. They preferred to go with gold. The US Federal Reserve cut their interest rates from 1.75% to 1.25% in March, which drove sharp selling in the US dollar and triggered a bullish bias for the precious metal, gold. Later, considering the massive outbreak of COVID-19, the Federal Reserve decided to cut the rate even further on March 16, from 1.25% to 0.25%, which has made gold even more bullish this year.

Stock Market Crash – The recent 2020 crash on the US stock exchange wasn’t only limited to the US. Rather, it was a global stock market crash that began on February 20, 2020. On February 12, the Dow Jones Industrial Average, the NASDAQ Composite, and the S&P 500 Index all finished at record highs (while the NASDAQ and S&P 500 reached subsequent record highs on February 19). From February 24 to 28, stock markets worldwide reported their largest one-week decline since the financial crisis of 2008. The relationship between the gold prices and the stock markets is inverse. Mostly, the gold prices will drop when the stock markets are performing well and vice versa. Likewise, when the stock market collapses, the demand for gold increases, as more and more investors are looking at safer options.

The Coronavirus Pandemic – The COVID-19 outbreak, which was first identified in China, has infected people in 188 countries, and it has had a significant negative impact on the global economies, thus increasing the safe-haven demand in the market, and sending the gold prices to record highs. Since the beginning of the year, investors have turned to the safe-haven metal, and this sentiment has been sustained, due to fears of the second wave of the coronavirus. As a result of such situations, the global equity market often moves lower, while trading in safe havens, like the US dollar and gold, becomes bullish.

Geopolitical Tensions – China and the US have fired fresh sanctions at each other, in the ongoing conflict that has made gold futures climb to all-time highs.